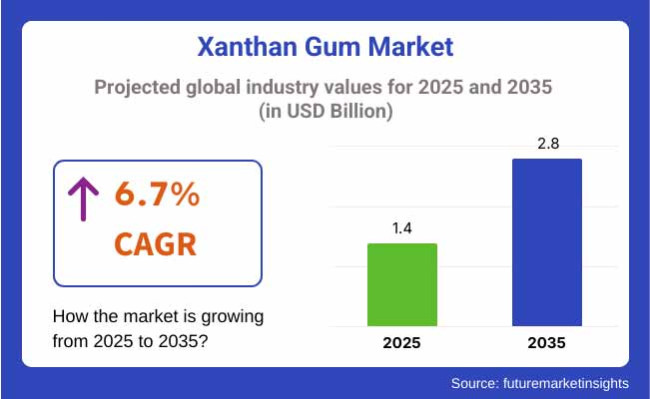

The xanthan gum market is estimated at USD 1.4 billion in 2025. With expanding applications across food, pharmaceutical, and industrial sectors, the industry is projected to grow at a steady CAGR of 6.7% during the forecast period, reaching USD 2.8 billion by 2035.

The industry is characterized by a steady growth rate that is mainly due to its extended use as a thickening, stabilizing, and emulsifying agent in the food, pharmaceutical, and cosmetics industries. With the extensive use in food and beverages, it is also found in pharmaceuticals and personal care products. At the same time, its multifunctional advantages continue to make this gum a significantly used material in various applications.

The prominent driving force of the industry is the increasing demand for gluten-free and clean-label products. A menu of health concerns drives consumers toward healthier options, which indirectly makes a pivotal ingredient in gluten-free baking and low-fat formulations. Furthermore, incorporating it in the preparation of sauces, dressings, and dairy products not only improves the products the sensory quality but also brings stability, which nudges the industry growth.

The industry encounters difficulties even if it expands. The price shift of raw materials like corn sugar, which is the main ingredient for xanthan, has an impact on production costs, limiting the gain in industry accessibility at times. The existence of alternative hydrocolloids like guar gum and carrageenan is a further factor of rivalry and affects producers/companies ' purchasing choices as well.

Increased markets and new technology are the spaces where it will have a great economic impact. The demand in the industry for starting new vegan and plant-based offerings in restaurants has seen a corresponding rise as a stabilizer in the production of milk alternatives.

The latest developments in the industry stand at the forefront of production process innovation in the quest for higher efficiencies and sustainability. Obviously, the transformation toward the usage of more bio-based and natural ingredients in food and personal care maintains the rise in consumption. Even though various industries are exploring the usage of xanthan gum for different purposes, a steady rise in trading in all corners of the globe is predicted.

The industryis increasing steadily with its extensive usage in food, pharmaceuticals, and industrial applications. High-quality product and raw material sourcing are the priorities for manufacturers, who ensure that xanthan gum is of strict food-grade and industrial quality.

Distributors target supply reliability and cost effectiveness to provide a continuous supply to manufacturers and retailers. Under volatile raw material prices, distributors aim to minimize procurement costs and keep prices competitive.

End users of the product value functionality, price, and ease of use. In food, the product is most valued for its stabilizing and thickening properties, and in pharmaceuticals and cosmetics, for texture and consistency enhancement. With growing demand across various industries, the industrykeeps expanding with innovation and shifting customer requirements.

The below table gives an overview of the change in CAGR over six months of the base year (2024) and current year (2025) for the industry. This analysis uncovers the critical fluctuations of performance and shows the pattern of revenue realization-giving stakeholders a clearer sight on the annual growth trajectory. H1 is short for the first six months of the year, from January to June. H2, the latter half of the year, the months of July through December.

| Particular | Value CAGR |

|---|---|

| H1 | 5.9% (2024 to 2034) |

| H2 | 6.3% (2024 to 2034) |

| H1 | 6.5% (2025 to 2035) |

| H2 | 6.7% (2025 to 2035) |

In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 5.9%, followed by a higher growth rate of 6.3% in the second half (H2) of the same decade. Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to increase to 6.5% in the first half and remain considerably high at 6.7% in the second half. In the first half (H1) the sector witnessed an increase of 60 BPS while in the second half (H2), the business witnessed an increase of 40 BPS.

The industry experienced continuous growth between 2020 and 2024 due to the growing use in food & beverages, pharmaceuticals, and personal care products. The increasing need for gluten-free and plant-based food options led to xanthan gum as a primary component in bakery foods, sauces, and dairy products. Large food manufacturers such as Nestlé and Unilever added it to their products for texture and shelf life enhancement.

Moreover, sustainability initiatives resulted in a greater focus on bio-based and non-GMO product to support clean-label demands. In the future from 2025 to 2035, the industry is likely to grow even more due to innovation in biotechnology-driven production and growing regulatory endorsement of natural hydrocolloids. Growing popularity of low-calorie and sugar-free foodstuffs will fuel its use in functional foods, particularly in protein shakes, fiber-fortified snacks, and sugar substitutes.

Technological advances in fermentation will enhance the efficiency of extraction, cutting costs and increasing its industrial applications. In personal care, its application in natural cosmetics will increase as companies target plant-based emulsifiers and stabilizers. In addition, the growing use of vegan and halal-certified food ingredients in the Asia-Pacific and Middle East markets will further drive industry growth.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Increased adoption of gluten-free and plant-based foods. | Increased use in ethical food, pharma, and oil & gas applications. |

| Higher adoption of low-calorie and sugar-free food. | Halal-tested and plant-based application. |

| Bio-based and non-GMO development. | Improved emulsifying properties in milk alternatives. |

| Improved fermentation from biotech at lower manufacturing costs. | Clean-label fermentation-derived hydrocolloids. |

| Used in food, personal care, and pharma. | Key ingredient in oil drilling mud. |

| Growing application in sugar reduction, plant-based milk, and meat substitutes. | There is a growing need for environmentally friendly extraction methods. |

| Growing organic and biodegradable products. | Non-GMO and clean-label certification is a necessity. |

| Increased regulation on synthetic stabilizers, boosting industry potential. | Very high demand in North America and Europe. |

| Rising interest in the Asia-Pacific food processing industry. | Increasing penetration in the Middle East and Latin America, with further halal and kosher certifications. |

The industry is subjected to various threats, including risks related to the availability of raw materials, industry competition, price volatility, regulatory barriers, and shifting consumer preferences. Being a common food additive and industrial stabilizer, the industry's growth is subject to the trends of the food, pharmaceutical, and personal care sectors.

Price competition in the industry becomes an additional risk. The industry is dominated by a few manufacturers, where price reduction strategies among vendors can lead to reduced profits. Along with this, the availability of substitute hydrocolloids like guar gum and modified starches impacts the industry position, especially as firms attempt to come up with cost-effective alternatives.

Shifting consumer behavior and the focus on health are also significant drivers of the dynamics of the industry. While it has been fairly extensively used in gluten-free and vegan products, certain consumers have a negative perception of synthetic additives. The growing desire for natural, clean-label ingredients could be a driver for manufacturers to innovate or reformulate their products in an attempt to maintain consumer trust.

To handle these risks effectively, companies need to identify the sources of raw materials, engage in research & development for recyclable applications, tighten compliance strategies, and adapt to consumer behavior. If they can address these challenges right from the go, they will be very likely to win the contest and remain in the industry in a changing environment.

Quality Advantages and Regulatory Acceptance Drive Food Grade Dominance

| Segment | Value Share (2025) |

|---|---|

| Food Grade (By Grade) | 58.9% |

In 2025, the major share of the industry will rely on the food grade segment with a maximum contribution of 58.9%, while the Industrial Grade segment will only contribute 30% to this industry.The Demand for food-grade xanthan Gum in North America has soared over time as consumers have shifted towards gluten-free and plant-based diets. CP Kelco has launched new formulation versions of food-grade options as a leading producer to meet the demand of the developing markets for dairy-free and gluten-free products. Since consumers are opting for healthy products, it is now crucial for stabilizing plant-based beverages, sauces, and dairy alternatives. In Europe, trends in consuming raw materials that are natural and cleanly labeled contribute to other factors attributed to the increase in demand for food-grade xanthan.

Innovation into formulations targeted at plant-based and organic food products is being pursued by companies in the industry, like DuPont and Fufeng Group. They are doing this to capitalize on what has been shaping up as a higher trend toward the structure of clean and sustainable ingredients in the industry. Tesco and Carrefour are some of the major retailers with a growing hefty share of plant-based products in their offering, further driving up demand for ready-to-eat meals and sauces.

Meanwhile, Asia, especially China, is home to what has become an enormous injection by Meihua Group into producing industrial-grade products, mainly for oil and gas applications such as hydraulic fracturing. In India, Tate & Lyle has launched the products for use in cosmetics and pharmaceuticals, which have found favour among local markets owing to an increasing demand for natural and functional ingredients in these industries.

Stability, Performance, and Formulation Versatility Drive Dry Form Dominance

| Segment | Value Share (2025) |

|---|---|

| Dry (By Form) | 82.3% |

In 2025, the industry is expected to be primarily driven by the Dry segment, which will hold a dominant 82.3% industry share, while the Liquid segment will account for 17.7%.

In North America, companies such as CP Kelco and Fufeng Group, with innovations in dry xanthan gum, are cornering the industry. For instance, CP Kelco sells high-grade dry xanthan gum, which is extensively used in producing gluten-free foods, and it performs stabilization and thickening functions in sauces, dressings, and bakery goods. Dry xanthan gum has gained strong preference due to the mounting consumer demand for clean-label gluten-free products. The dry form offers an extended shelf-life and reduces costs for food manufacturers in North America; hence, it has become their better option. In Europe, ongoing trends toward sustainability and plant-based products have further added to the movement of demand toward dry form.

Companies such as Kerry Group have engaged in plant-based production, which undoubtedly attracts eco-conscious and health-conscious consumers. The use of the same in plant-based meat alternatives and dairy-free products is exponentially increasing.In Asia, particularly in China, the drying of it can be supplied chiefly by Meihua Group to meet increasing demand in industries like pharmaceuticals, where a stable dry form most appropriately suits drug delivery systems.

The dry segment is also rapidly growing in India due to rising applications in processed foods and beverages. Dry segment continues to dominate the industry due to its broad application area and user-friendliness in handling and storage. In contrast, the liquid form will persist as a niche segment serving specialized uses in fast-hydrated and instant-dissolution industries.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.9% |

| UK | 6 % |

| France | 5.7% |

| Germany | 6.2% |

| Italy | 5.5% |

| South Korea | 7.1% |

| Japan | 6.8% |

| China | 8.4% |

| Australia | 6.3% |

| New Zealand | 6.5% |

The USA industry is increasing gradually with the extensive use of the ingredient in food, pharma, and industrial applications. The nation's robust processed food industry continues to be the key driver, with companies such as Cargill and CP Kelco constantly evolving stabilizer technology across different food segments. Increasing consumer demand for clean-label foods also further accelerated reformulation activity, with naturally occurring stabilizers replacing artificial additives.

The pharmaceutical industry also fuels industry growth, with the product being a common additive in oral and topical medications needing viscomodification. Usage in oil drilling operations also keeps industrial demand at bay, supporting the stability of the industry through the forecasting period.

Demand in the UK is spurred by robust demand within the food and personal care industries. The country's food producers are encouraged by high food safety standards and consumers' demand for natural ingredients to produce it as a natural substitute for artificial stabilizers. Increasing consumer demand for gluten-free and vegan food, stimulated by bakeries and producers of dairy alternatives relying on it for shelf life and texture stabilization, is also driving industry penetration.

Furthermore, additional xanthan gum is utilized as a gelling agent for the pharmaceuticals and cosmetics industries in drug syrups, gels, and lotions. The UK's robust research and development infrastructure ensures ongoing product development, further enhancing its role in applications.

Growth in the French industry is derived from its internationally renowned food industry and a very high focus on the creation of natural products. French producers like to have additive-free, quality products, and therefore, it is an ideal stabilizer in soups, sauces, and organic food. Increased focus on sustainable agriculture has also encouraged local processing and, therefore, decreased imports.

In addition to the food sector, it finds applications in the pharmaceutical and personal care sectors due to its non-toxicity and biodegradability. The increasing demand for natural-derived cosmetic products, especially in premium skincare, has increased the use in emulsions and serums, further solidifying its industry foundation.

The German industry is based on the country's advanced engineering capability and the advanced food technology industry. With a clean-label orientation at its center, German producers apply xanthan gum to a broad variety of food applications to enhance texture and stability and EU regulatory compliance in rigorous form. Industrial uses in coatings, adhesives, and chemical applications are also substantial, with specialty chemicals enjoying strong demand in the German industry.

Additionally, the country's research on bio-based products such as natural personal care products and eco-friendly manufacturing has made xanthan gum a top ingredient for nature-positioned beauty products. Due to increased investments in bio-based products, Italy's industry will remain steady during the forecast period.

Italy's industry is driven primarily by Italy's robust food culture and stringent food quality regulations. The nation's food sector uses it in large volumes to add stability and texture to classic frozen desserts, dressings, and sauces. Demand from expanding markets for gluten-free and vegetable food is also spurring adoption, especially in premium baked foods and pasta.

Outside the food industry, Italy's enormous pharmaceutical industry uses xanthan gum in oral drug preparation to improve suspension characteristics. Besides, the cosmetic industry has seen increased usage, whereby Italian cosmetic companies produce into natural hair and skin care products because of its viscosities.

The developed food, drug, and personal care markets drive the South Korean industry. The fast growth of the processed food industry, especially convenience foods and instant foods, requires stabilizers such as xanthan gum to ensure consistency. South Korea's high-tech cosmetics industry, which makes high-tech products, is highly dependent upon xanthan gum as an ingredient of creams, masks, and gels for the skin due to its being an emulsifier and a stabilizer.

The South Korean pharmaceutical industry also employs it in controlled-release drug formulations due to its biocompatible and non-toxic properties. Due to the investment in bio-based ingredients, the South Korean industry will establish itself strongly.

Japan's industry is dominated by a well-established food processing and pharmaceutical sector. Growing demand for food products with enhanced shelf life has spurred increased use of ready-to-use foods, sauces, and soft drinks. Its applications as a stabilizer and thickener are aimed at ensuring the use by the country's leading pharmaceutical sector in ophthalmic uses, syrups, and drug combinations meant for oral use.

Besides this, the reputation of Japan as a nation that delivers high-quality personal care ingredients has fueled demand in top-of-the-range skincare and haircare products. As functional foods and nutraceuticals progress further, the industry in Japan will grow consistently over the following decade.

China's industry demonstrates exceptional growth, driven by its massive industrial sector. The manufacturing production sectors of the country, i.e., petroleum, textile, and chemical processing, depend due to its rheological properties to obtain maximum production efficiency. China is also a leading world manufacturer and exporter by companies such as Fufeng Group and Deosen Biochemical for export overseas.

The food industry is also a major source of push, with local and foreign producers using it to provide stability and texture to food products. Chinese demand for high-quality, shelf-stable food in the country's growing retail industry also drives the industry forward.

The Australian industry supports natural and clean-label food demand. The country's food and drinks industry is buoyed by xanthan gum as a functional stabilizer in plant milk, sauces, and gluten-free bread. Personal care and cosmetics companies also purchase it, and Aussie companies have now started incorporating it into their natural skincare products.

The agricultural industry has even begun to investigate its possible uses as a conditioner for crops, and fresh applications continue to spread. With increased consumer pressure for natural and plant-based products, the Australian industry will grow modestly.

New Zealand's industry is dominated by its dairy and processed food sectors. Its high-food industry, which is export-led, demands good quality stabilizers to ensure consistency in the product when there is export shipping, thus the demand for it as an ingredient in products. Increased demand for allergen-free, vegetable-based food also drives demand, especially for replacement dairy and bakery applications.

New Zealand's personal care industry also highlights in organic and green cosmetics and skin care. New Zealand's emphasis on sustainability drives nature, and it also prefers the clean-label and biodegradable nature of xanthan gum, guaranteeing continued industry expansion.

The industry has intense competition marked by continuous innovations and strategic positioning within different applications across the industry. Major global suppliers compete with young producers from regions blessed with a raw material advantage and emerging manufacturing capabilities. Product performance is the key parameter here, underlying all competitive aspects. Consistency, purity, and specific functional properties directly drive customer acceptance of xanthan in technical applications.

Changing manufacturing technology can import significant positioning along the supply chain: advanced fermentation processes, along with purification systems and quality control for finished products, allow suppliers to foster differentiation to considerable effect. Companies employing advanced production technology are assured of much better consistency, which is simply impossible to achieve for producers resorting to less controlled manufacturing. R&D is a considerable leverage on the competition: companies developing specialized grades address challenges in fresh applications and offer differentiation beyond standard commodity xanthan.

Supply-chain integration is regarded as a competitive advantage, with companies controlling the sources of the raw materials for production and distribution so that they are able to maintain stability across industry fluctuations while keeping their cost structures optimized. Digital capabilities have become increasingly important competitive tools through which manufacturers will deliver online formulation assistance and predictive performance modeling, together with remote technical support, all aimed at enriching the customer experience throughout the product development process, albeit through the limitation of physical services.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Cargill, Incorporated | 19% |

| CP Kelco | 17% |

| Deosen Biochemical Ltd. | 12% |

| Archer Daniels Midland Company | 10% |

| DuPont | 9% |

| Other Key Players | 33% |

| Company Name | Key Offerings/Activities |

|---|---|

| Cargill, Incorporated | Produces high-quality xanthan gum with advanced fermentation processes, catering to diverse industries. |

| CP Kelco | Offers a wide range of xanthan gum solutions with a focus on consistent quality and technical support for multiple industries. |

| Deosen Biochemical Ltd. | Known for its competitively priced, high-purity xanthan gum, offering solutions for both food and industrial applications. |

| Archer Daniels Midland Company | Provides xanthan gum with superior performance in various applications, emphasizing consistency and custom formulations. |

| DuPont | Develops specialized xanthan gum grades with advanced performance characteristics for niche applications. |

Key Company Insights

Cargill, Incorporated (19%)

Cargill is a leading player in the industry, offering advanced fermentation processes to deliver high-quality products. Their strong global presence and focus on innovation keep them at the forefront of the industry.

CP Kelco (17%)

CP Kelco is a major supplier, known for its technical expertise and consistent product quality. Their focus on customer support and tailored formulations makes them a go-to supplier for industries requiring high-performance solutions.

Deosen Biochemical Ltd. (12%)

Deosen is an emerging player in the industry, offering cost-effective products with high purity. Their ability to provide customized solutions for food and industrial applications has allowed them to capture a significant portion of the industry.

Archer Daniels Midland Company (10%)

ADM maintains a competitive position with a strong focus on custom formulations. Their integrated supply chain ensures cost-effectiveness and product consistency across various industries.

DuPont (9%)

DuPont is focusing on developing specialized grades with unique functional properties. Their research-driven approach to creating tailored solutions has positioned them as a key player in the premium segment of the industry.

Other Key Players (33% Combined)

By function, the industry is segmented into thickener, stabilizer, fat replacer, and others.

By form, the industry is categorized into dry and liquid.

By application, the industry is divided into food & beverages, oil & gas, pharmaceuticals, personal care, and others.

By grade, the industry is categorized into food grade, industrial grade, and pharmaceutical grade.

By region, the industry is segmented into North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia and Belarus, Balkan & Baltic Countries, and the Middle East & Africa.

The market is expected to reach USD 1.4 billion in 2025.

The market is projected to grow to USD 2.8 billion by 2035.

China is expected to experience significant growth with an 8.4% CAGR during the forecast period.

The dry segment is one of the most popular categories in the market.

Leading companies include Cargill, Incorporated, CP Kelco, Deosen Biochemical Ltd., Archer Daniels Midland Company, DuPont, Fufeng Group, Hebei Xinhe Biochemical Co., Jungbunzlauer Suisse AG, Unionchem Co., Ltd., and Solvay S.A.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Form, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by End-use, 2018 to 2033

Table 7: North America Market Value (US$ Millions) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Millions) Forecast by Form, 2018 to 2033

Table 10: North America Market Volume (MT) Forecast by Form, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by End-use, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 16: Latin America Market Volume (MT) Forecast by Form, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 18: Latin America Market Volume (MT) Forecast by End-use, 2018 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 21: Europe Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 22: Europe Market Volume (MT) Forecast by Form, 2018 to 2033

Table 23: Europe Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 24: Europe Market Volume (MT) Forecast by End-use, 2018 to 2033

Table 25: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: East Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 27: East Asia Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 28: East Asia Market Volume (MT) Forecast by Form, 2018 to 2033

Table 29: East Asia Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 30: East Asia Market Volume (MT) Forecast by End-use, 2018 to 2033

Table 31: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 33: South Asia Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 34: South Asia Market Volume (MT) Forecast by Form, 2018 to 2033

Table 35: South Asia Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 36: South Asia Market Volume (MT) Forecast by End-use, 2018 to 2033

Table 37: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: Oceania Market Volume (MT) Forecast by Country, 2018-2033

Table 39: Oceania Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 40: Oceania Market Volume (MT) Forecast by Form, 2018 to 2033

Table 41: Oceania Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 42: Oceania Market Volume (MT) Forecast by End-use, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (MT) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 46: Middle East and Africa Market Volume (MT) Forecast by Form, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 48: Middle East and Africa Market Volume (MT) Forecast by End-use, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Form, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End-use, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 9: Global Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 13: Global Market Volume (MT) Analysis by End-use, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 16: Global Market Attractiveness by Form, 2023 to 2033

Figure 17: Global Market Attractiveness by End-use, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Form, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by End-use, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 27: North America Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 31: North America Market Volume (MT) Analysis by End-use, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 34: North America Market Attractiveness by Form, 2023 to 2033

Figure 35: North America Market Attractiveness by End-use, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Form, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by End-use, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 45: Latin America Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 49: Latin America Market Volume (MT) Analysis by End-use, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Form, 2023 to 2033

Figure 53: Latin America Market Attractiveness by End-use, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Europe Market Value (US$ Million) by Form, 2023 to 2033

Figure 56: Europe Market Value (US$ Million) by End-use, 2023 to 2033

Figure 57: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 60: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 63: Europe Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 64: Europe Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 65: Europe Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 66: Europe Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 67: Europe Market Volume (MT) Analysis by End-use, 2018 to 2033

Figure 68: Europe Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 69: Europe Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 70: Europe Market Attractiveness by Form, 2023 to 2033

Figure 71: Europe Market Attractiveness by End-use, 2023 to 2033

Figure 72: Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: East Asia Market Value (US$ Million) by Form, 2023 to 2033

Figure 74: East Asia Market Value (US$ Million) by End-use, 2023 to 2033

Figure 75: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: East Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 78: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: East Asia Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 81: East Asia Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 82: East Asia Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 83: East Asia Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 84: East Asia Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 85: East Asia Market Volume (MT) Analysis by End-use, 2018 to 2033

Figure 86: East Asia Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 87: East Asia Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 88: East Asia Market Attractiveness by Form, 2023 to 2033

Figure 89: East Asia Market Attractiveness by End-use, 2023 to 2033

Figure 90: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia Market Value (US$ Million) by Form, 2023 to 2033

Figure 92: South Asia Market Value (US$ Million) by End-use, 2023 to 2033

Figure 93: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 96: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 99: South Asia Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 100: South Asia Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 101: South Asia Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 102: South Asia Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 103: South Asia Market Volume (MT) Analysis by End-use, 2018 to 2033

Figure 104: South Asia Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 105: South Asia Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 106: South Asia Market Attractiveness by Form, 2023 to 2033

Figure 107: South Asia Market Attractiveness by End-use, 2023 to 2033

Figure 108: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 109: Oceania Market Value (US$ Million) by Form, 2023 to 2033

Figure 110: Oceania Market Value (US$ Million) by End-use, 2023 to 2033

Figure 111: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: Oceania Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 114: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: Oceania Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 117: Oceania Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 118: Oceania Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 119: Oceania Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 120: Oceania Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 121: Oceania Market Volume (MT) Analysis by End-use, 2018 to 2033

Figure 122: Oceania Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 123: Oceania Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 124: Oceania Market Attractiveness by Form, 2023 to 2033

Figure 125: Oceania Market Attractiveness by End-use, 2023 to 2033

Figure 126: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Form, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Millions) by End-use, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (MT) Analysis by End-use, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Form, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by End-use, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Gummed Tape Market Size and Share Forecast Outlook 2025 to 2035

Gummy Supplements Market Size and Share Forecast Outlook 2025 to 2035

Gum Arabic Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Gummy Market Analysis by Product, Ingredient, End-Use, Distribution Channel, and Region - Forecast through 2025 to 2035

Gum Turpentine Oil Market Growth - Trends & Forecast 2025 to 2035

Gum Hydrocolloid Market Analysis by Product Type, Source, and Region through 2035

Key Companies & Market Share in the Gummed Tape Sector

Evaluating Gum Fiber Market Share & Provider Insights

Gum Rosin Market Size & Demand Analysis 2024-2034

Gum Content Tester Market

CBD Gummies Market Analysis - Size, Share and Forecast Outlook 2025 to 2035

Pre-Gummed Labels Market Growth - Demand & Forecast 2025 to 2035

Guar Gum for Construction Market Size and Share Forecast Outlook 2025 to 2035

Tara Gum Market Size and Share Forecast Outlook 2025 to 2035

Guar Gum Market Growth & Demand Forecast 2024-2034

Sleep Gummy Market Analysis by Primary Ingredient, Customer Orientation, Pack Size and Product Claim Through 2035

Paper Gummed Tape Market Growth - Demand & Forecast 2025 to 2035

CoQ10 Gummies Market Analysis by Source, Distribution Channels, and Key Regions Through 2035

Ester Gums Market Growth – Trends & Forecast 2025 to 2035

Dammar Gum Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA