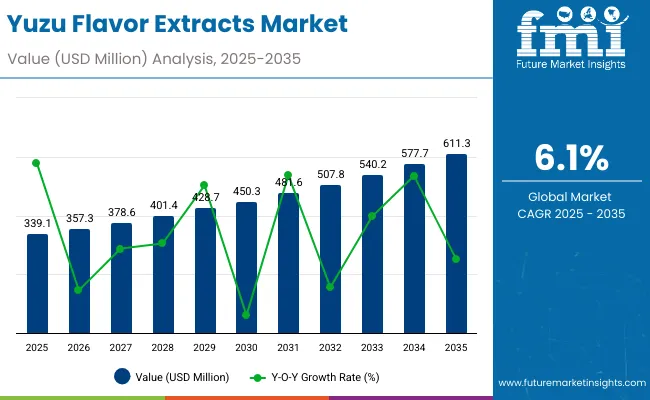

A valuation of USD 339.1Million has been projected for the Yuzu Flavor Extracts Market in 2025, which is anticipated to advance steadily to USD 611,3 Million by 2035. This represents an incremental gain of over USD 272 Million across the decade, reflecting an average annual growth rate of 6.1%.

| Metric | Value |

|---|---|

| Yuzu Flavor Extracts Market Estimated Value in (2025E) | USD 339.1 Million |

| Yuzu Flavor Extracts Market Forecast Value in (2035F) | USD 611.3 Million |

| CAGR 2025 to 2035 | 6.1% |

The trajectory highlights how consumer preference for authentic citrus-based flavors and clean-label positioning is expected to reinforce natural yuzu adoption, while broader application penetration across beverages, confectionery, nutraceuticals, and cosmetics ensures market stability.

During the first five-year phase from 2025 to 2030, the market is forecast to grow from USD 339.1 Million to USD 450.3 Million, capturing nearly USD 111 Million in added value, which accounts for close to 41% of total decade expansion. This period is expected to be defined by steady innovation in ready-to-drink beverages, dairy products, and bakery formulations, with rising demand for natural extracts supporting faster replacement of synthetic flavor alternatives. The segment outlook indicates that water-soluble and powdered solutions will continue to be favored for their processing efficiency and extended shelf stability.

The second half of the forecast period from 2030 to 2035 is projected to contribute nearly USD 161 Million, equivalent to almost 59% of the entire decade’s expansion. This stronger pace of adoption is anticipated as global manufacturers scale premium citrus portfolios, supported by clean-label claims and regulatory approvals. Rising penetration in cosmetics, aromatherapy, and functional nutrition is expected to further accelerate growth, positioning yuzu extracts as a mainstream flavor solution across industries by 2035.

From 2020 to 2024, the Yuzu Flavor Extracts Market was expanded from a niche, regional specialty into a globally recognized flavor category, driven by rising premium food and beverage adoption. During this period, natural extract suppliers captured the majority share, supported by consumer preference for authenticity, while synthetic alternatives were positioned as cost-efficient substitutes. Global leaders such as Givaudan, Symrise, and Kerry Group were observed to strengthen their sourcing networks in Japan and Korea to secure raw material resilience.

By 2025, the Yuzu Flavor Extracts Market is forecasted to reach USD 339.1 Million, with momentum shifting toward functional and health-driven applications. Between 2025 and 2035, digital traceability, sustainable farming, and clean-label compliance are projected to reshape sourcing and procurement strategies. Leading companies are anticipated to pivot toward hybrid portfolios combining natural purity with lab-engineered consistency, while regional specialists are expected to leverage cultural authenticity as differentiation. Ecosystem strength, innovation in solubility formats, and recurring partnerships with F&B giants are expected to define long-term competitive advantage.

The expansion of the Yuzu Flavor Extracts Market is being driven by shifting consumer preferences toward natural, authentic, and clean-label ingredients. Rising awareness of functional health benefits associated with citrus compounds is expected to sustain momentum, particularly as nutraceutical and wellness categories adopt exotic flavor solutions. Demand has also been reinforced by the premiumization of beverages, where yuzu’s distinctive aromatic and acidic profile has been positioned as a differentiator in low-alcohol, ready-to-drink, and craft formulations.

Growing adoption in bakery, dairy, and confectionery applications is being supported by the stability of powdered and water-soluble formats, which are projected to deliver consistent performance across diverse manufacturing lines. Cosmetics and aromatherapy industries are expected to strengthen usage as consumer demand for Asian-inspired botanicals increases. Supply chain investments by leading global flavor houses are ensuring reliability and scale, which further encourages adoption by multinational food and beverage companies. As brand strategies align with authenticity and differentiation, the market for yuzu extracts is anticipated to remain on a strong growth trajectory throughout the forecast horizon.

The Yuzu Flavor Extracts Market has been segmented based on source, form, and solubility, each of which reflects the diverse applications and evolving consumer preferences driving adoption. These categories highlight how the market is being shaped by clean-label demand, processing efficiencies, and expanding end-use applications across food, beverages, and wellness.

| Component Segment | Market Value Share, 2025 |

|---|---|

| Natural Yuzu Extracts | 62% |

| Synthetic Yuzu Flavor | 38% |

The source segment is expected to be dominated by natural yuzu extracts, which are projected to hold a 62% share in 2025, supported by a CAGR of 6.8% over the forecast period. Rising consumer inclination toward clean-label, non-GMO, and authentic flavor ingredients is driving this momentum. Food and beverage manufacturers are prioritizing natural extracts to strengthen product positioning in premium categories. Synthetic flavors retain a presence due to cost efficiency, but slower adoption is anticipated compared to natural counterparts. Continuous regulatory support and consumer awareness are expected to reinforce the leadership of natural yuzu extracts throughout the decade.

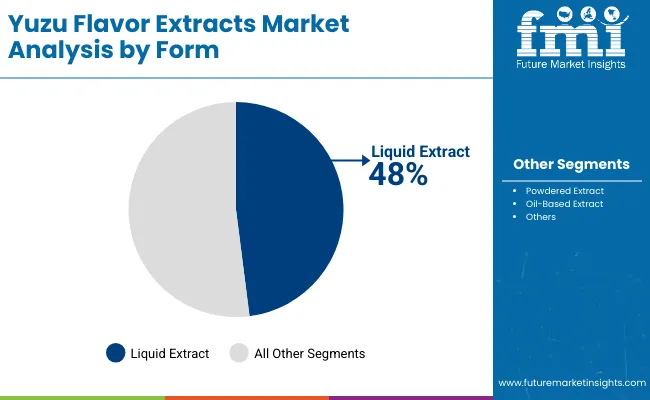

| Range Segment | Market Value Share, 2025 |

|---|---|

| Liquid Extract | 48% |

| Powdered Extract | 32% |

| Oil-Based Extract | 20% |

Liquid extracts are anticipated to account for 48% of the market in 2025, expanding at a CAGR of 6.5%. Their ease of incorporation into beverages and dairy formulations is expected to sustain strong demand. Powdered extracts, recording the highest CAGR of 6.9%, are gaining traction due to their stability, portability, and extended shelf life, particularly in nutraceuticals and bakery. Oil-based extracts are expected to retain niche appeal, largely in fragrance and specialty applications. Segmental dynamics suggest powdered formats will increasingly complement liquid extracts in functional food and supplement categories, ensuring balanced market growth.

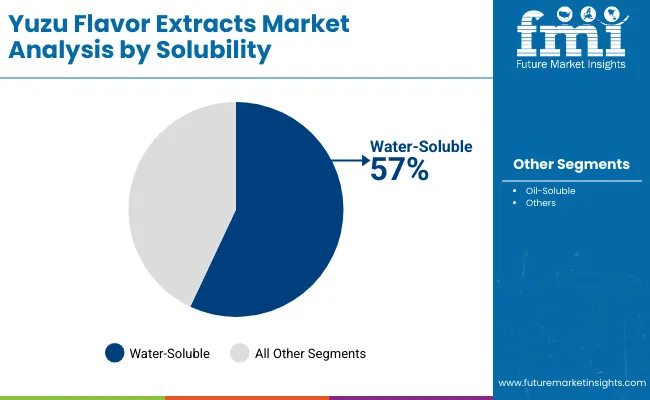

| Laser triangulation technology | Market Value Share, 2025 |

|---|---|

| Water-Soluble | 57% |

| Oil-Soluble | 43% |

Water-soluble extracts are projected to dominate with a 57% share in 2025 and a CAGR of 6.7%. Their superior blending capabilities make them the preferred choice for large-scale beverage, dairy, and functional product formulations. Growing investment in solubility-enhancing technologies is likely to expand adoption further. Oil-soluble extracts, holding a 43% share, remain important in niche areas such as cosmetics, perfumes, and oil-based condiments. Their performance in high-fat matrices ensures continued relevance, though growth will trail water-soluble counterparts. Overall, demand for water-soluble formats is expected to accelerate as manufacturing efficiency and product versatility remain critical drivers.

Global growth in the Yuzu Flavor Extracts Market is being influenced by multiple structural forces. Unique demand accelerators, emerging challenges, and transformative trends are reshaping how the category is positioned across industries and geographies.

Expansion of Premium and Functional Beverages

The market is being strengthened by the rising infusion of yuzu extracts in premium and functional beverages. These products are not only positioned as indulgent but also perceived as naturally energizing, refreshing, and culturally distinctive. Beverage innovators are actively reformulating around exotic citrus notes to address shifting consumer expectations of authenticity and wellness. Yuzu’s aromatic complexity enables brands to differentiate within saturated categories like sparkling waters, kombucha, and low-alcohol cocktails. The adaptability of water-soluble formats further supports large-scale beverage line integration. This dynamic is expected to intensify as beverage portfolios become key vehicles for clean-label and health-oriented consumer narratives, positioning yuzu extracts as an indispensable flavoring solution.

Integration of Yuzu Extracts in Beauty and Wellness

A growing trend has been observed in the infusion of yuzu extracts into cosmetics, skincare, and aromatherapy solutions. Positioned as both fragrant and functional, yuzu is increasingly utilized for its antioxidant potential and refreshing sensory appeal. Global beauty brands are investing in natural citrus-based formulations to reinforce transparency and align with consumer aspirations for plant-derived solutions. Beyond topical applications, yuzu extracts are being explored for mood-enhancing and aromatherapeutic benefits, linking personal care with holistic wellness. This trend is projected to gain momentum as cross-industry innovation blurs the lines between flavor, fragrance, and nutraceutical markets, expanding yuzu’s relevance beyond food and beverages into lifestyle-driven wellness ecosystems.

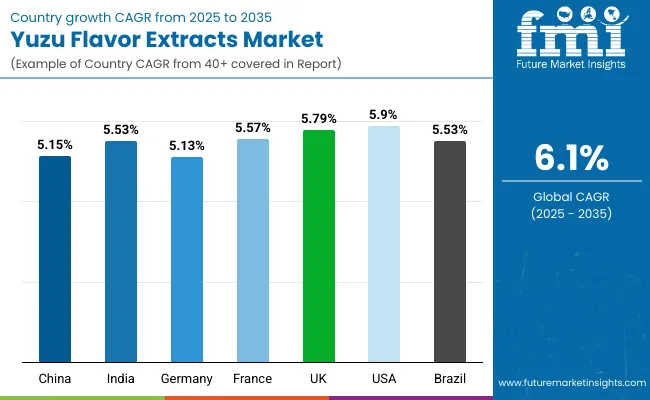

| Countries | CAGR |

|---|---|

| China | 5.15% |

| India | 5.53% |

| Germany | 5.13% |

| France | 5.57% |

| UK | 5.79% |

| USA | 6.83% |

| Brazil | 5.53% |

The Yuzu Flavor Extracts Market demonstrates distinct country-level growth patterns shaped by cultural preferences, regulatory frameworks, and industry adoption rates. The United States is anticipated to expand the fastest at a CAGR of 6.83% during 2025-2035, supported by strong demand for premium citrus-based flavors in beverages, functional foods, and wellness products. The country’s established consumer preference for authentic, exotic profiles is expected to reinforce adoption across both B2B and B2C channels.

In Europe, the United Kingdom, France, and Germany collectively sustain robust momentum with CAGRs of 5.79%, 5.57%, and 5.13% respectively. Demand here is being influenced by stringent clean-label regulations, the growth of artisanal food and drink markets, and the integration of natural citrus extracts in luxury personal care products. The UK leads regional expansion, reflecting its openness to global flavor experimentation.

China and India are forecast to deliver consistent mid-level growth, with CAGRs of 5.15% and 5.53%. China’s adoption is guided by modern beverage innovation and increased interest in functional ingredients, while India is anticipated to benefit from expanding nutraceutical and wellness segments. Brazil, also at 5.53% CAGR, is expected to contribute steady gains as natural citrus extracts resonate with local consumer preferences in confectionery and soft drinks. Together, these country dynamics illustrate a geographically diversified expansion path for yuzu extracts globally.

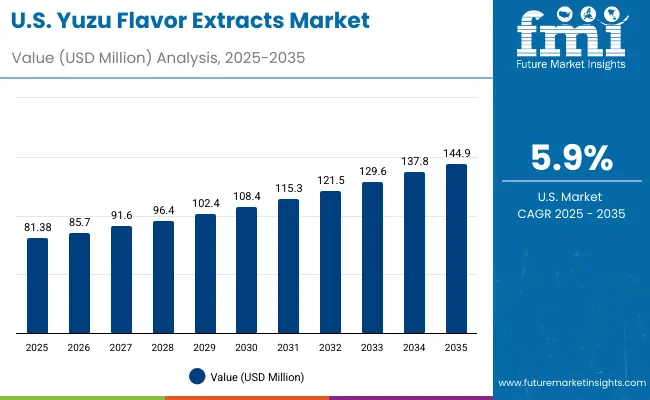

| Year | Yuzu Flavor Extracts Market (USD Million) |

|---|---|

| 2025 | 81.38 |

| 2026 | 85.7 |

| 2027 | 91.6 |

| 2028 | 96.4 |

| 2029 | 102.4 |

| 2030 | 108.4 |

| 2031 | 115.3 |

| 2032 | 121.5 |

| 2033 | 129.6 |

| 2034 | 137.8 |

| 2035 | 144.9 |

The Yuzu Flavor Extracts Market in the United States is anticipated to expand from USD 81.38 Million in 2025 to USD 144.9 Million by 2035, recording a CAGR of 5.9%. Growth in this market is being underpinned by sustained investment in premium beverage innovation, with yuzu increasingly incorporated into low-alcohol drinks, sparkling waters, and functional beverages. Adoption in dairy and confectionery categories is also intensifying, driven by consumer demand for clean-label citrus flavors that deliver authenticity and freshness.

Cosmetics and personal care manufacturers are integrating yuzu extracts into formulations to align with the natural beauty trend, enhancing diversification of demand beyond food and beverage. E-commerce platforms and specialty retailers are expanding access to niche citrus-based offerings, reinforcing B2C opportunities. Water-soluble formats are particularly favored in the USA due to their compatibility with large-scale production and processing efficiency.

The Yuzu Flavor Extracts Market in the UK is projected to expand at a CAGR of 5.79% from 2025 to 2035. Growth is expected to be anchored by the nation’s openness to global culinary experimentation and strong consumer preference for authentic, natural flavors. Premium beverages, particularly craft mixers and low-alcohol options, are anticipated to drive adoption, supported by the versatility of water-soluble formats in high-throughput production. Bakery and confectionery segments are integrating yuzu extracts as niche citrus notes gain popularity in gourmet and artisanal lines. Additionally, personal care brands are incorporating exotic botanicals into formulations to appeal to clean beauty consumers. Regulatory emphasis on transparency and non-GMO sourcing is also expected to encourage natural extract usage, positioning the UK as a leading European growth hub.

The Yuzu Flavor Extracts Market in India is expected to grow at a CAGR of 5.53% between 2025 and 2035. Growth momentum is being driven by the rapid expansion of functional foods and nutraceuticals, where yuzu’s perceived wellness attributes are valued by health-conscious consumers. The integration of exotic citrus flavors into premium beverages and fortified products is also expected to rise, especially within the urban millennial demographic. Powdered extract formats are anticipated to find strong demand due to their stability in hot climates and compatibility with local dry-mix applications. Furthermore, growing investments by multinational flavor houses in India are likely to expand awareness and accessibility of yuzu extracts. Increasing adoption in aromatherapy and skincare is also projected, supported by India’s affinity for botanicals and natural wellness traditions.

The Yuzu Flavor Extracts Market in China is forecast to record a CAGR of 5.15% from 2025 to 2035. Expansion is expected to be supported by the strong growth of modern beverage categories, particularly functional teas, RTD beverages, and health-focused infusions. Urban consumers are increasingly demanding unique and authentic flavor profiles, creating opportunities for natural citrus extracts. While beverages lead demand, bakery and confectionery sectors are also anticipated to integrate yuzu extracts to diversify premium offerings. In personal care, the rising popularity of natural ingredients has encouraged incorporation of citrus extracts into skincare and fragrance formulations. Partnerships between international flavor houses and Chinese beverage brands are expected to accelerate market penetration. The gradual premiumization of consumer goods in China provides a favorable environment for yuzu extract adoption across industries.

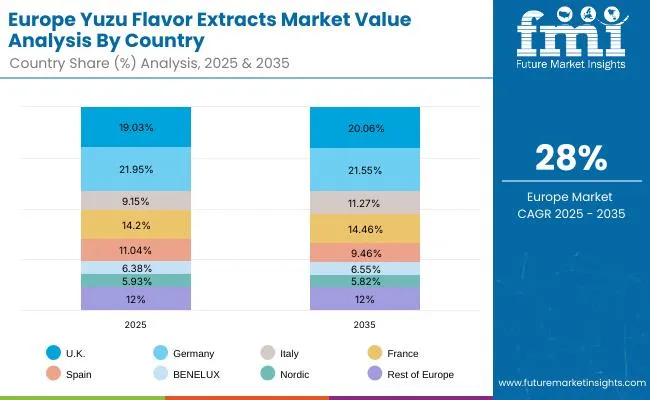

| Countries | 2025 |

|---|---|

| UK | 19.03% |

| Germany | 21.95% |

| Italy | 9.15% |

| France | 14.20% |

| Spain | 11.04% |

| BENELUX | 6.38% |

| Nordic | 5.93% |

| Rest of Europe | 12% |

| Countries | 2035 |

|---|---|

| UK | 20.06% |

| Germany | 21.55% |

| Italy | 11.27% |

| France | 14.46% |

| Spain | 9.46% |

| BENELUX | 5.55% |

| Nordic | 5.82% |

| Rest of Europe | 12% |

The Yuzu Flavor Extracts Market in Germany is projected to expand at a CAGR of 5.13% through 2035. This moderate but steady growth reflects Germany’s emphasis on product safety, compliance, and clean-label formulations. Demand for yuzu extracts is expected to be concentrated in beverages, where low-alcohol drinks, premium juices, and functional beverages continue to grow. The bakery and dairy sectors are also expected to integrate yuzu extracts into innovative formulations catering to evolving consumer tastes. Powdered and water-soluble formats are particularly relevant in Germany, given their ability to meet regulatory and production standards. Beyond food and beverages, the country’s cosmetics sector is experimenting with citrus extracts to align with consumer demand for sustainable, plant-based solutions. Market growth is anticipated to be reinforced by Germany’s leadership in quality assurance and sustainability-driven procurement practices.

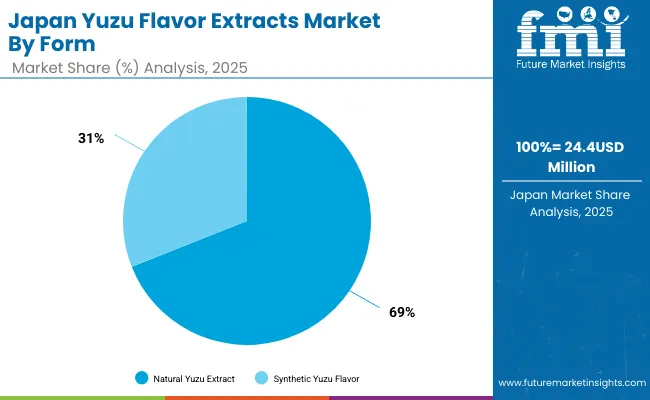

| Component Segment | Market Value Share, 2025 |

|---|---|

| Liquid Extract | 50% |

| Powdered Extract | 30% |

| Oil-Based Extract | 20% |

The Yuzu Flavor Extracts Market in Japan is projected at USD 24.4 Million in 2025, accounting for the largest share within East Asia’s regional consumption. Liquid extracts are anticipated to dominate with 50% share, reflecting their heavy usage in beverages, dairy, and traditional sauces. Powdered extracts, at 30% share, are expected to post the fastest CAGR of 6.8%, supported by growing demand in dry-mix beverages, bakery, and nutraceutical products. Oil-based extracts will represent 20% share, sustaining growth in cosmetics, perfumes, and aromatherapy segments, though expansion remains moderate at 6.1%.

Japan’s market outlook reflects its dual role as a domestic consumption hub and a global trendsetter. The country’s culinary heritage strongly anchors liquid extract adoption, while its innovation-driven food and wellness industries ensure rapid growth of powdered formats. Oil-based extracts continue to find demand in high-value personal care and fragrance applications, reinforcing Japan’s diversified adoption structure. Collaborations between domestic producers and global flavor houses are expected to amplify scale and innovation, making Japan a critical node for global yuzu extract trends.

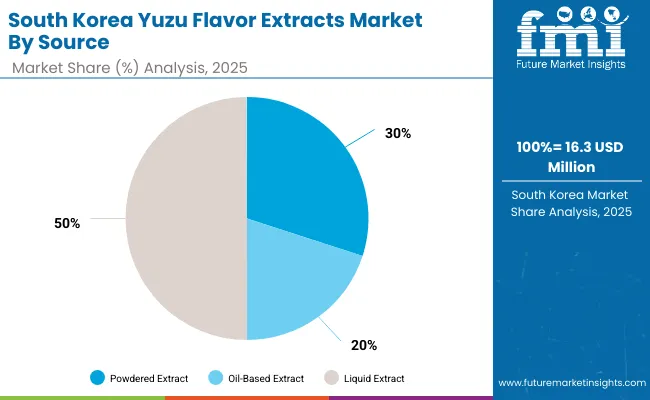

| Range Segment | Market Value Share, 2025 |

|---|---|

| Natural Yuzu Extracts | 69% |

| Synthetic Yuzu Flavor | 31% |

The Yuzu Flavor Extracts Market in South Korea is estimated at USD 16.3 Million in 2025. This value has been derived from the global 2025 total multiplied by East Asia’s 12% regional share and then allocated 40% to South Korea within East Asia. Natural formats are expected to lead with a 69% share and a faster CAGR trajectory (about 6.8%), reflecting strong alignment with clean-label preferences and wellness-forward product launches. Synthetic flavors, at 31%, are projected to maintain niche roles where cost or formulation constraints persist, growing at roughly 5.8%.

Adoption is anticipated to be reinforced by premium beverage innovation, café culture, and convenience retail, where citrus-forward RTD teas, sparkling drinks, and mixers are being expanded. Extensions into K-beauty, aromatherapy, and functional skincare are expected to broaden demand beyond food and beverages. Collaboration between domestic brands and global flavor houses is likely to accelerate application development, with water-soluble systems enabling line efficiency for high-throughput plants.

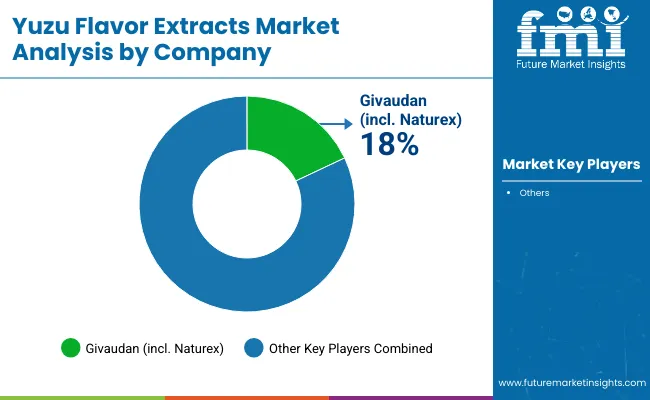

| Company | Global Value Share 2025 |

|---|---|

| Givaudan (incl. Naturex) | 18% |

| Others (All Remaining Players) | 82% |

The Yuzu Flavor Extracts Market is moderately fragmented, with global leaders, mid-sized innovators, and niche specialists competing across food, beverage, and wellness applications. Global flavor leaders such as Givaudan (incl. Naturex), Kerry Group (Taste & Nutrition), Symrise AG, Takasago International Corporation, and T. Hasegawa Co., Ltd. command significant presence, leveraging proprietary extraction technologies, deep citrus portfolios, and global distribution networks. Their strategies are centered on sustainability, traceable sourcing, and clean-label innovation to meet rising regulatory and consumer standards across North America (30% share) and Europe (28%), which remain dominant regions for premium citrus-based flavoring.

Established mid-sized innovators, particularly in Asia-Pacific, are capitalizing on regional familiarity with yuzu and tailoring solutions for fast-growing beverage, bakery, and nutraceutical categories. Their strength lies in agility, cost efficiency, and faster innovation cycles, which allow them to partner effectively with emerging consumer brands in South Asia & Pacific (25%) and East Asia (12%).

Specialist providers continue to focus on niche markets, such as aromatherapy, cosmetics, and artisanal food applications, where authenticity and cultural relevance drive adoption. These players differentiate through artisanal sourcing and small-batch production, catering to lifestyle and wellness-driven consumers.

Competitive differentiation is shifting toward ecosystem-based solutions that combine extract quality with technical application support, sustainability credentials, and co-development programs. Strategic collaborations with beverage and personal care brands are expected to further consolidate leadership positions among global majors.

Key Developments in Yuzu Flavor Extracts Market

| Item | Value |

|---|---|

| Market size (2025) | USD 339.1 Million |

| Market size (2035) | USD 611.3 Million |

| CAGR (2025 to 2035) | 6.1% |

| Segmentation - by source | Natural Yuzu Extracts, Synthetic Yuzu Flavor |

| Segmentation - by form | Liquid Extract, Powdered Extract, Oil-Based Extract |

| Segmentation - by solubility | Water-Soluble, Oil-Soluble |

| Regional distribution | North America, Europe, South Asia & Pacific, East Asia, Latin America, Middle East & Africa |

| Country CAGRs (202 to 2035) | USA, UK, France, Germany, China, India, Brazil |

The global Yuzu Flavor Extracts Market is estimated to be valued at USD 339.1 Million in 2025.

The market size for the Yuzu Flavor Extracts Market is projected to reach USD 611.3 Million by 2035.

The Yuzu Flavor Extracts Market is expected to grow at a CAGR of 6.1% between 2025 and 2035.

The key product types in the Yuzu Flavor Extracts Market are Liquid Extracts, Powdered Extracts, and Oil-Based Extracts.

In terms of solubility, the Water-Soluble segment is projected to play a leading role in 2025, supported by strong adoption in beverages and dairy applications.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.