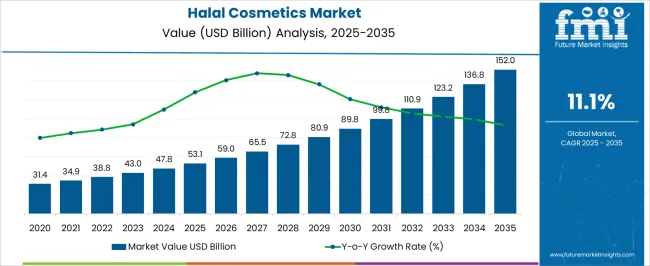

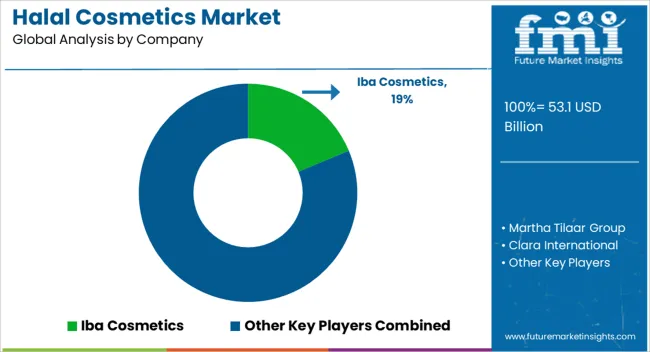

The Halal Cosmetics Market is estimated to be valued at USD 53.1 billion in 2025 and is projected to reach USD 152.0 billion by 2035, registering a compound annual growth rate (CAGR) of 11.1% over the forecast period.

| Metric | Value |

|---|---|

| Halal Cosmetics Market Estimated Value in (2025 E) | USD 53.1 billion |

| Halal Cosmetics Market Forecast Value in (2035 F) | USD 152.0 billion |

| Forecast CAGR (2025 to 2035) | 11.1% |

The halal cosmetics market is experiencing strong momentum as consumer awareness around ethical beauty, sustainability, and ingredient transparency continues to rise. Demand is being shaped by the growing Muslim population, combined with broader global interest in clean label and cruelty free formulations.

Brands are increasingly investing in certified halal ingredients, product innovation, and compliance with international halal standards to build consumer trust and credibility. Regulatory frameworks and certification bodies are reinforcing market adoption by ensuring consistency and quality in halal cosmetic formulations.

Additionally, rising disposable incomes and evolving grooming preferences across both male and female demographics are fueling wider product acceptance. The outlook remains favorable, with future opportunities concentrated in digital retail expansion, product diversification, and brand positioning strategies that combine ethical, sustainable, and culturally inclusive values.

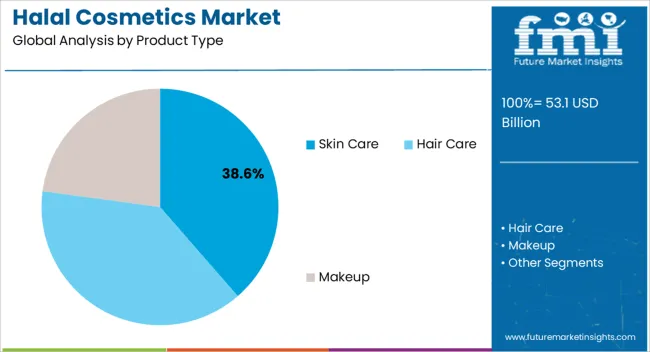

The skin care segment is projected to account for 38.60% of total revenue by 2025 within the product type category, positioning it as the leading segment. This is attributed to rising consumer demand for chemical free, natural, and certified halal skin care solutions that align with wellness and ethical values.

Growing awareness regarding skin health, preventive care, and anti aging has fueled adoption in this category. Increased investment by cosmetic companies in halal certified moisturizers, cleansers, and sunscreens has further strengthened its growth.

As consumers continue to prioritize authenticity and safety in cosmetic formulations, skin care is expected to maintain its leadership position within the halal cosmetics market.

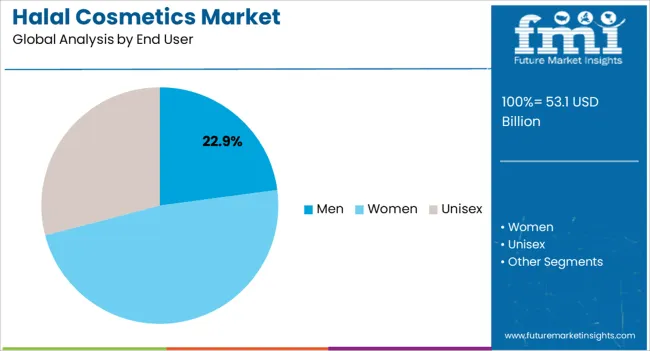

The men segment is expected to contribute 22.90% of total revenue by 2025 under the end user category, establishing itself as a fast growing segment. This growth is being supported by changing grooming habits among men, increasing acceptance of personal care products, and rising awareness regarding halal certified grooming essentials.

Shifting cultural perceptions toward male self care and the introduction of specialized halal product lines tailored to men’s needs are further accelerating growth.

As male consumers increasingly seek authenticity, safety, and ethical values in grooming products, the men segment is emerging as a critical growth driver in the halal cosmetics market.

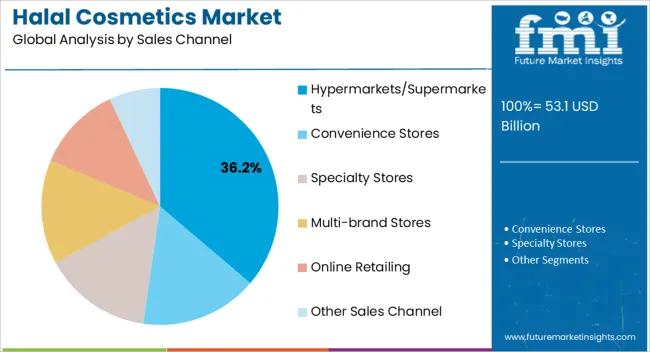

The hypermarkets and supermarkets segment is anticipated to represent 36.20% of the total market revenue by 2025 under the sales channel category, making it the dominant distribution channel. This growth is attributed to the availability of a wide product range, consumer preference for one stop shopping, and the opportunity for product visibility through retail merchandising.

Enhanced shelf presence and the ability to provide halal certified products alongside mainstream offerings have further strengthened adoption in this channel. Additionally, competitive pricing strategies and promotions within hypermarkets and supermarkets have driven strong consumer traction.

As halal cosmetics continue to gain mainstream acceptance, this sales channel will remain the leading contributor to market distribution.

| Attributes | Details |

|---|---|

| Market CAGR (2020 to 2025) | 9.2% |

| Market Share (2020) | USD 26.87 billion |

| Market Share (2025) | USD 38.21 billion |

From 2020 to 2025, the halal cosmetics sector experienced significant growth, driven by increasing consumer awareness, expanding Muslim population, and demand for ethical beauty products. Companies expanded their product portfolios, invested in R&D, and capitalized on digital marketing and e-commerce platforms.

Looking ahead from 2025 to 2035, the market is expected to continue its upward trajectory. Key trends include product innovation, collaboration with Islamic organizations, regulatory harmonization, market expansion in non-Muslim-majority regions, and a focus on sustainability. Digital marketing, partnerships, and eco-friendly practices are vital for reaching consumers and ensuring market competitiveness.

Halal skin care products are expected to dominate the halal cosmetics industry during the forecast period, driven by their widespread acceptance and high demand. They hold a significant share in terms of both volume and value. Additionally, the rising demand for sustainable, organic, vegan, and natural products has further fueled the popularity of halal skin care products. This trend is expected to continue, indicating the strong position of halal skin care products in the market.

Both men and women prioritize halal skin care products as an essential part of their daily routines, contributing to the market's growth. Halal cosmetics have gained significant interest among millennials, who are increasingly seeking sustainable, organic, vegan, and natural products. The acceptance of halal cosmetics is a global trend, with demand across all demographics, indicating a promising future for the market.

In the halal cosmetics Industry, there is a growing presence of startups and innovative firms that are introducing halal-certified cosmetics and makeup products, compliant with Islamic law. These companies are actively managing halal labeling and certification processes to cater to ingredient-conscious consumers.

To ensure their products are truly halal, they are utilizing halal ingredients and adopting halal packaging practices. A notable example is Amara Cosmetics, a halal-certified company that produces cosmetics approved by the Islamic Food and Nutrition Council of America (IFANCA). Their products are manufactured and packaged in California, adhering to Islamic law guidelines.

Halal Cosmetics Manufacturers Focusing on Brand Building for High Market Share

Key players in the halal cosmetics industry are employing a variety of techniques in order to thrive in a highly competitive climate. Companies are concentrating on innovations and advances to stay ahead of consumer demands, in order to build brand names and thrive in a competitive climate.

Halal cosmetics market players are also focused on merger and acquisition strategies in order to maximize their business operations and increase their in-house expertise. Companies are also actively participating in strategic alliances and partnerships to achieve a competitive edge through expanded corporate reach and services. Aside from them, new launches continue to be in high demand.

Recent Developments in the Market include:

Key players

The global halal cosmetics market is estimated to be valued at USD 53.1 billion in 2025.

The market size for the halal cosmetics market is projected to reach USD 152.0 billion by 2035.

The halal cosmetics market is expected to grow at a 11.1% CAGR between 2025 and 2035.

The key product types in halal cosmetics market are skin care, _creams & lotions, _face cleanser, _others, hair care, _shampoo, _conditioner, _hair oil, _others, makeup, _facial products, _eye products, _lip products, _nail products, body care, _soaps, _shower gels, _lotions, _others and fragrance.

In terms of end user, men segment to command 22.9% share in the halal cosmetics market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Halal Ingredient Market Analysis - Size, Growth, and Forecast 2025 to 2035

Halal Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cosmetics ODM Market Analysis – Size, Trends & Forecast 2025-2035

Halal Nutraceuticals and Vaccines Market Growth - Trends & Forecast 2025 to 2035

Analysis and Growth Projections for Halal Cheese Market

Market Share Breakdown of Halal Tourism Services

Halal Tourism Market Analysis by Tour Type, Tourist Type, Tourist Demography, Age Group, and by Booking Channel - Forecast for 2025 to 2035

UK Halal Tourism Market Analysis – Growth, Applications & Outlook 2025-2035

Pet Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

United States Halal Tourism Market Outlook – Trends, Demand & Forecast 2025–2035

Nutricosmetics Market Analysis - Growth, Trends & Forecast 2025 to 2035

Market Share Breakdown of Nutricosmetics Manufacturers

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Cosmetics ODM Market Analysis - Size, Share & Trends 2025 to 2035

Vegan Cosmetics Market Analysis - Trends, Growth & Forecast 2025 to 2035

Colour Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Tinted Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Organic Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Premium Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Natural Cosmetics Market - Size, Share, and Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA