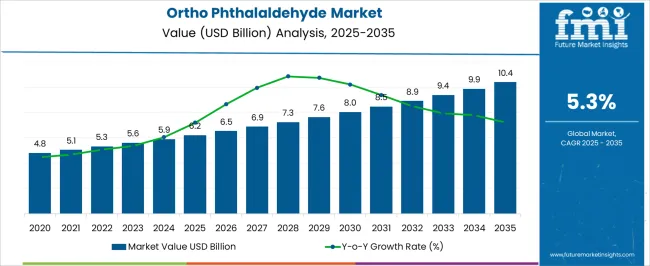

The ortho phthalaldehyde market is estimated to be valued at USD 6.2 billion in 2025 and is projected to reach USD 10.4 billion by 2035, registering a compound annual growth rate (CAGR) of 5.3% over the forecast period.

The ortho phthalaldehyde market, valued at USD 6.2 billion in 2025 and projected to reach USD 10.4 billion by 2035 with a CAGR of 5.3%, is significantly influenced by regulatory frameworks governing chemical safety, occupational exposure, and environmental compliance. Ortho Phthalaldehyde, widely used as a high-level disinfectant in healthcare and laboratory settings, is subject to stringent regulations regarding permissible exposure limits, handling protocols, and disposal procedures. Regulatory oversight by agencies such as the USA Environmental Protection Agency, European Chemicals Agency, and comparable regional bodies shapes production practices, storage standards, and product labeling, directly impacting market dynamics.

Compliance costs constitute a substantial portion of operational expenditure, influencing both manufacturing and distribution strategies. Facilities are required to implement safety controls, monitoring systems, and reporting mechanisms to align with local and international standards. These measures increase the initial cost of production but simultaneously enhance market acceptance and reliability, enabling manufacturers to sustain growth while mitigating potential legal and environmental liabilities.

The growth trajectory from USD 6.2 billion to USD 10.4 billion over the forecast period reflects the balancing effect of regulatory requirements, where adherence promotes broader adoption in healthcare, laboratory, and sterilization applications. As regulatory scrutiny continues to evolve, companies demonstrating robust compliance capabilities are likely to secure a competitive advantage, ensuring sustained revenue growth and resilience against policy-driven market disruptions.

| Metric | Value |

|---|---|

| Ortho Phthalaldehyde Market Estimated Value in (2025 E) | USD 6.2 billion |

| Ortho Phthalaldehyde Market Forecast Value in (2035 F) | USD 10.4 billion |

| Forecast CAGR (2025 to 2035) | 5.3% |

The ortho phthalaldehyde market represents a specialized part of the global chemical industry, valued for its effectiveness as a disinfectant and intermediate compound. Within the hospital disinfectants and sterilization chemicals sector, it holds nearly 4.6%, emphasizing its growing use in endoscopy and medical device reprocessing. In the broader biocidal chemicals market, it accounts for 3.9%, reflecting its acceptance as a high-level disinfectant alternative to glutaraldehyde. Across the specialty chemicals industry, its contribution is about 2.8%, underlining its relevance in controlled applications requiring stability and efficacy.

In the medical hygiene chemicals space, it secures 3.3%, supported by stricter infection control regulations. Within the industrial disinfectants category, its share stands at 2.5%, highlighting its adoption in pharmaceutical and laboratory environments. Recent developments in this market focus on safety, regulatory compliance, and formulation advancements. Manufacturers are investing in low-residue OPA solutions to minimize occupational hazards and ensure compatibility with sensitive medical instruments.

Research into extending shelf life and stability under different storage conditions is gaining attention. Digital compliance tracking systems are being paired with OPA-based disinfectants to record sterilization cycles and meet regulatory audits. Efforts to reduce environmental toxicity through improved wastewater neutralization methods are also evident. The market players are developing single-use, premeasured OPA formulations to simplify handling and reduce human error. These innovations reflect how regulatory adherence, safety, and operational efficiency are guiding the future of the market.

The ortho phthalaldehyde market is experiencing robust growth driven by its expanding use in high level disinfection processes, particularly within the healthcare sector. The compound’s effectiveness at low concentrations, rapid action against a broad spectrum of microorganisms, and compatibility with medical instruments sensitive to heat have contributed to its rising demand.

Stricter infection control protocols in hospitals and clinics, coupled with regulatory emphasis on patient safety, are increasing adoption. Advancements in formulation stability and packaging have enhanced ease of handling and storage, further supporting market penetration.

Beyond medical disinfection, ortho phthalaldehyde is gaining attention in laboratory and industrial sanitation applications, contributing to market diversification. The overall outlook remains strong, with growing healthcare infrastructure and heightened awareness of infection prevention fueling sustained demand.

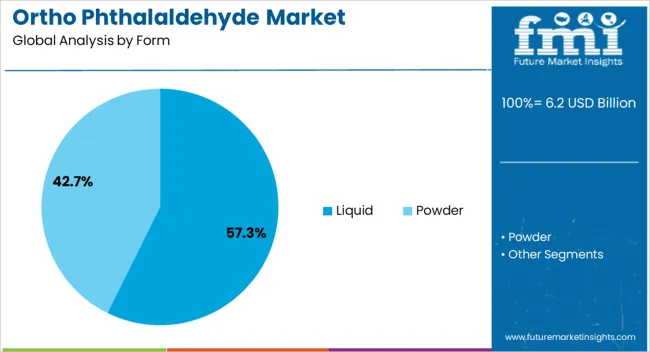

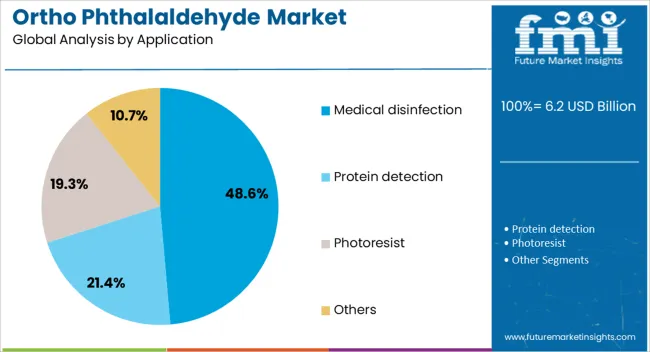

The ortho phthalaldehyde market is segmented by form, purity, application, and geographic regions. By form, ortho phthalaldehyde market is divided into liquid and powder. In terms of purity, ortho phthalaldehyde market is classified into ≥99%. Based on application, ortho phthalaldehyde market is segmented into medical disinfection, protein detection, photoresist, and others. Regionally, the ortho phthalaldehyde industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The liquid form segment is projected to account for 57.3% of the total market revenue by 2025, making it the leading form category. Its dominance is linked to ease of application, consistent concentration, and suitability for automated endoscope reprocessors and manual disinfection procedures.

The liquid form allows for even distribution, optimal surface contact, and rapid antimicrobial action, which are critical in clinical settings.

Furthermore, the established supply chain for liquid disinfectants and their ready to use formulations has reinforced their market share.

The ≥99% purity segment is expected to contribute 62.5% of total revenue by 2025, positioning it as the most prominent purity grade. This high purity level ensures maximum antimicrobial efficacy, reduced residue risk, and compliance with stringent medical sanitation standards.

It is preferred for critical healthcare applications where performance reliability is non negotiable.

The ability to maintain consistent quality across batches has strengthened trust among medical device manufacturers and healthcare providers.

The medical disinfection segment is projected to hold 48.6% of the total market revenue by 2025, making it the dominant application category. This is driven by the rising need for sterilization of complex medical devices and instruments that cannot withstand high temperature processes.

Ortho phthalaldehyde’s superior material compatibility, low odor, and reduced irritation potential compared to alternatives have increased its adoption in hospitals and diagnostic centers.

Growing surgical procedure volumes and heightened awareness of healthcare associated infection risks further reinforce its position as the leading application in the market.

The market has gained recognition due to its increasing applications in healthcare, pharmaceuticals, and chemical processing. This compound has been widely used as a disinfectant in endoscopy and other medical procedures because of its strong antimicrobial properties. Growth has been influenced by rising concerns over infection control, technological improvements in sterilization practices, and stricter compliance requirements across medical facilities. The demand has been strengthened by its application as a chemical intermediate in various industrial processes. The market has been shaped by regulatory dynamics, ongoing research in biocidal formulations, and expansion of healthcare infrastructure across developed and emerging economies.

The healthcare industry has remained the dominant consumer of ortho phthalaldehyde, particularly in infection prevention and disinfection. Its superior efficacy against a wide range of microorganisms, including bacteria, mycobacteria, and viruses, has made it a reliable choice in high level disinfection of medical instruments. Endoscopy procedures have driven significant adoption, as safe and effective sterilization is mandatory for reusable devices. Growing hospital admissions, surgical procedures, and regulatory pressure to reduce hospital acquired infections have further contributed to higher consumption. Medical centers and diagnostic laboratories have been expanding their reliance on ortho phthalaldehyde due to its shorter disinfection cycle compared to glutaraldehyde, positioning it as a preferred chemical for modern healthcare environments.

The ortho phthalaldehyde market has been strongly influenced by regulatory frameworks governing the use of disinfectants in healthcare. Authorities across different regions have implemented stringent safety and environmental standards, which have shaped the adoption of biocidal chemicals. The shift toward less toxic and more environmentally acceptable alternatives have placed ortho phthalaldehyde in focus due to its effectiveness and relatively safer handling profile. Compliance with standards set by organizations such as the US Environmental Protection Agency and European Chemical Agency has been essential for manufacturers and end users. While stringent regulations have posed challenges in terms of formulation approval, they have also ensured higher product quality and performance, thereby reinforcing market stability.

Beyond healthcare, ortho phthalaldehyde has found growing usage in industrial and research activities. It has been employed as a chemical intermediate in synthesis processes and in laboratory settings for analytical applications. Industries requiring antimicrobial agents for specialized functions have explored its potential for surface treatment and preservation. Research institutions have studied its broader biochemical applications, thereby extending the scope of demand. Its use in fluorescence detection and protein assays has provided additional market opportunities. These diversified applications have insulated the market from heavy dependence on the healthcare sector alone, contributing to a more stable demand outlook and creating new avenues for manufacturers and distributors.

Despite its benefits, the market has faced limitations due to cost concerns and safety considerations. Ortho phthalaldehyde is more expensive compared to some traditional disinfectants, which has restricted its adoption in price sensitive healthcare facilities and low income regions. Additionally, potential risks of respiratory irritation and allergic reactions among healthcare workers have raised concerns, necessitating proper ventilation and safety protocols during use. The disposal of ortho phthalaldehyde has also been subject to strict environmental guidelines, creating compliance costs for users. These challenges have slowed market penetration in certain segments. Addressing cost competitiveness and ensuring occupational safety remain critical factors for wider adoption across global markets.

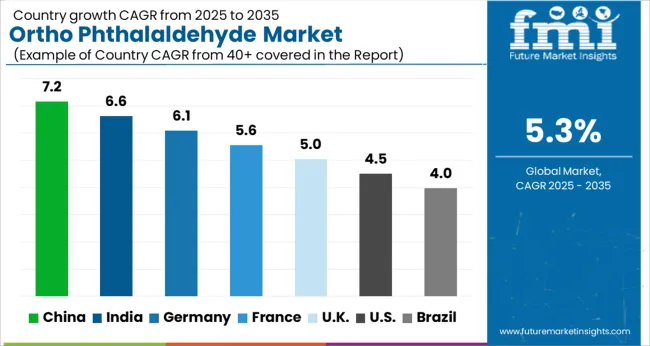

| Country | CAGR |

|---|---|

| China | 7.2% |

| India | 6.6% |

| Germany | 6.1% |

| France | 5.6% |

| UK | 5.0% |

| USA | 4.5% |

| Brazil | 4.0% |

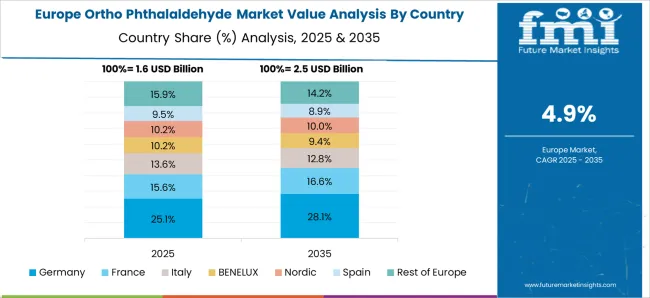

The market is anticipated to expand at a CAGR of 5.3% from 2025 to 2035, driven by increasing demand in medical disinfection, sterilization processes, and industrial cleaning applications. India recorded 6.6%, supported by growth in healthcare facilities and chemical manufacturing capacity. Germany reached 6.1%, reflecting adoption in advanced medical sterilization and industrial hygiene practices. China led with 7.2%, fueled by high production capabilities and rising hospital infrastructure. The United Kingdom achieved 5.0%, driven by steady healthcare sector investments, while the United States posted 4.5%, reflecting ongoing modernization in sterilization technologies. Collectively, these nations represent key regions driving production, technological advancement, and market expansion for Ortho Phthalaldehyde. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to grow at a CAGR of 7.2%, supported by increasing applications in disinfectants, pharmaceuticals, and chemical intermediates. Rising demand from healthcare facilities for effective sterilization solutions has reinforced market expansion. Domestic producers are strengthening production capacities to meet both domestic and export requirements, while imports continue to support specialized grades. Growth is also favored by strong investments in chemical manufacturing clusters and expanding pharmaceutical production capabilities.

India is forecast to expand at a CAGR of 6.6%, driven by the expanding pharmaceutical sector, rising healthcare investments, and growing use in sterilization processes. Domestic chemical manufacturers are gradually entering the OPA production segment, while imports from China and Europe continue to fill high purity demand. Rising awareness of hospital infection control has further accelerated demand. Expansion in generic drug production has also created additional requirements for OPA as a chemical intermediate.

Germany is expected to grow at a CAGR of 6.1%, supported by strong demand in pharmaceutical manufacturing, biotechnology, and medical sterilization. Domestic producers focus on high purity grades suited for stringent European standards. Adoption in laboratory sterilization processes has reinforced market opportunities, while exports to other EU nations remain a critical growth contributor. Continuous innovation in healthcare sterilization products has positioned Germany as a reliable market for specialty OPA products.

The United Kingdom is projected to record a CAGR of 5.0%, with demand influenced by adoption in healthcare sterilization systems, pharmaceutical research, and specialty chemical industries. Imports dominate the supply landscape, primarily sourced from Germany, China, and the United States. Increasing investments in healthcare infrastructure have created steady growth in demand for high quality sterilization agents. Regulatory compliance and stringent hospital hygiene requirements continue to shape procurement trends across the country.

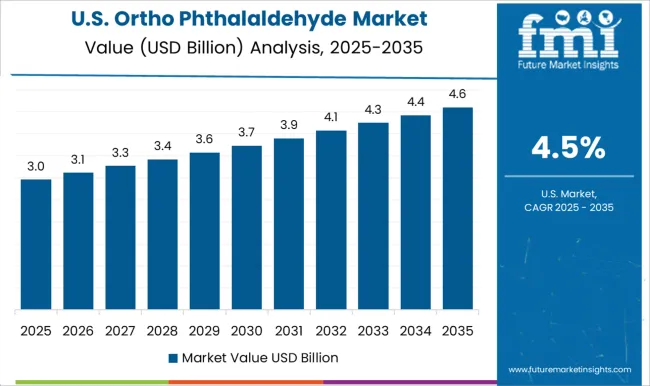

The United States market is forecast to grow at a CAGR of 4.5%, supported by expanding use in healthcare sterilization, medical device cleaning, and pharmaceutical intermediates. Domestic manufacturers focus on producing high quality grades that comply with FDA and EPA standards. Growth is also shaped by rising hospital investments in infection control systems and steady demand from research laboratories. Imports play a secondary role, with North America maintaining a strong domestic production base for OPA.

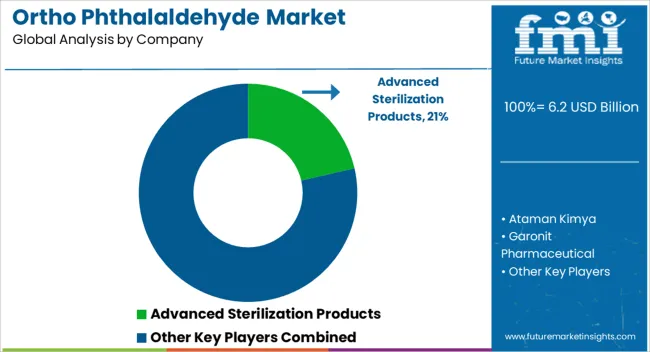

The market is characterized by a blend of global chemical manufacturers, specialized sterilization solution providers, and regional suppliers focusing on healthcare and laboratory applications. Advanced Sterilization Products leads through its established presence in medical sterilization systems, strong regulatory compliance, and integrated solutions for end-users in hospitals and clinics. Sigma-Aldrich and MP Biomedicals leverage their extensive distribution networks, research-grade product portfolios, and trusted reputations among laboratories and pharmaceutical companies.

Regional and specialty players such as Ataman Kimya, Garonit Pharmaceutical, Lircon, MedPurest, RX Chemicals, TCI America, and Voda Chemicals compete by providing cost-effective solutions, localized technical support, and tailored formulations for specific industrial or medical requirements. The market is increasingly shaped by the demand for high-purity OPA, safe handling protocols, and products meeting stringent biocompatibility and regulatory standards.

Companies that emphasize quality assurance, consistent supply, and compliance with global healthcare regulations maintain a strategic advantage. Innovation in scalable production methods, environmental sustainability, and integration with automated sterilization systems is expected to further influence competitive positioning and market share.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.2 billion |

| Form | Liquid and Powder |

| Purity | ≥99% |

| Application | Medical disinfection, Protein detection, Photoresist, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Advanced Sterilization Products, Ataman Kimya, Garonit Pharmaceutical, Lircon, MedPurest, MP Biomedicals, RX Chemicals, Sigma-Aldrich, TCI America, and Voda Chemicals |

| Additional Attributes | Dollar sales by product type and application, demand dynamics across healthcare, pharmaceutical, and laboratory disinfection sectors, regional trends in high-level disinfectant adoption, innovation in formulation stability, biocidal efficacy, and safety, environmental impact of chemical production and disposal, and emerging use cases in medical device sterilization, endoscope cleaning, and infection control solutions. |

The global ortho phthalaldehyde market is estimated to be valued at USD 6.2 billion in 2025.

The market size for the ortho phthalaldehyde market is projected to reach USD 10.4 billion by 2035.

The ortho phthalaldehyde market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in ortho phthalaldehyde market are liquid and powder.

In terms of purity, ≥99% segment to command 62.5% share in the ortho phthalaldehyde market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Orthopedic Braces and Support Market Forecast and Outlook 2025 to 2035

Orthopedic Power Tools Market Size and Share Forecast Outlook 2025 to 2035

Orthokeratology Market Size and Share Forecast Outlook 2025 to 2035

Orthopedic Contract Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

Orthopedic Digit Implants Market Size and Share Forecast Outlook 2025 to 2035

Orthopedic Prosthetic Device Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Orthodontic Wax Market Size and Share Forecast Outlook 2025 to 2035

Orthopedic Splints Market Size and Share Forecast Outlook 2025 to 2035

Orthopedic Software Market Size and Share Forecast Outlook 2025 to 2035

Orthotic Devices, Casts and Splints Market Size and Share Forecast Outlook 2025 to 2035

Orthopedic Navigation Systems Market Analysis – Trends, Growth & Forecast 2025 to 2035

Orthopedic Trauma Device Market Trends - Size, Share & Forecast 2025 to 2035

Orthobiologics Market is segmented by Product Type and End User from 2025 to 2035

Orthopaedic Imaging Equipment Market Report – Growth & Forecast 2025-2035

Orthopedic Insole Market Analysis – Size & Industry Trends 2025–2035

Orthopaedic Bone Cement and Casting Material Market Growth – Trends & Forecast 2025 to 2035

Ortho-Xylene Market Growth - Trends & Forecast 2025 to 2035

Ortho Phthalic Aldehyde Market Growth - Trends & Forecast 2025 to 2035

Orthopedic Shoes Market Growth – Trends & Forecast 2025 to 2035

Orthopedic Oncology Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA