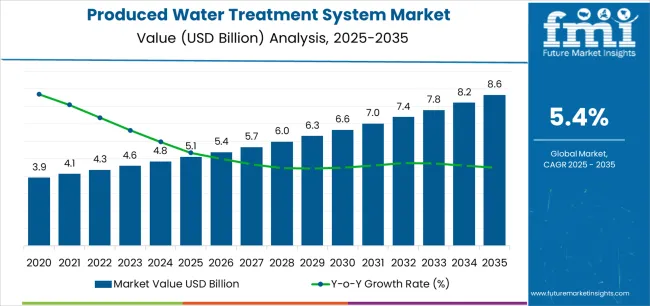

The Produced Water Treatment System Market is estimated to be valued at USD 5.1 billion in 2025 and is projected to reach USD 8.6 billion by 2035, registering a compound annual growth rate (CAGR) of 5.4% over the forecast period.

The produced water treatment system market is expanding steadily, driven by rising oil and gas production activities and increasing regulatory emphasis on environmental protection. Growing concerns over water scarcity and disposal costs are encouraging industries to adopt efficient treatment solutions. Current market dynamics highlight a shift toward sustainable water management practices and the deployment of advanced treatment technologies to meet discharge and reuse standards.

Manufacturers are focusing on modular and scalable system designs that enhance operational flexibility and minimize maintenance costs. The future outlook is defined by technological advancements in filtration, separation, and membrane systems, which are improving efficiency and reducing the environmental footprint of operations.

Growth rationale is supported by expanding upstream and midstream activities, investments in treatment infrastructure, and policy-driven initiatives promoting water reuse These factors collectively position the produced water treatment system market for sustained growth and broader adoption across industrial and energy sectors.

| Metric | Value |

|---|---|

| Produced Water Treatment System Market Estimated Value in (2025 E) | USD 5.1 billion |

| Produced Water Treatment System Market Forecast Value in (2035 F) | USD 8.6 billion |

| Forecast CAGR (2025 to 2035) | 5.4% |

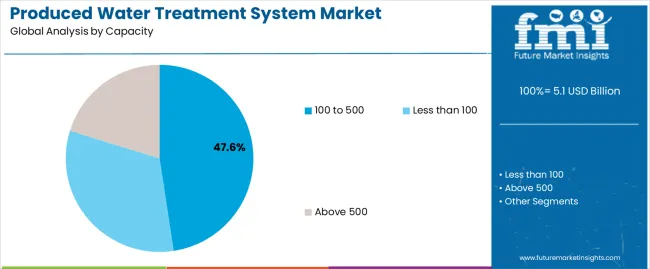

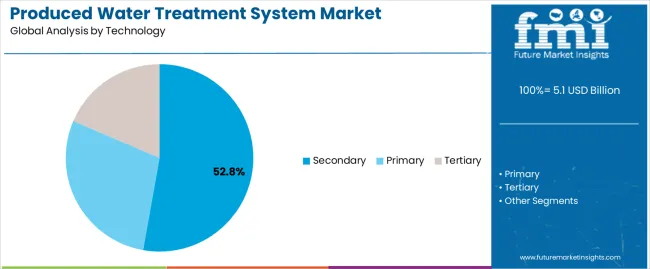

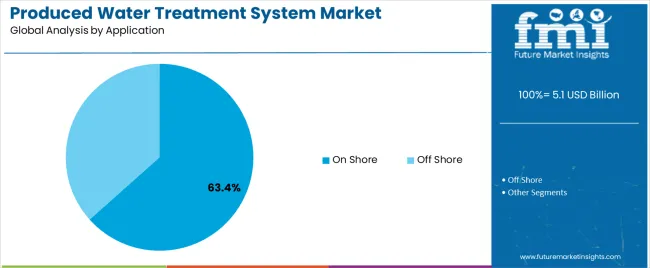

The market is segmented by Capacity, Technology, and Application and region. By Capacity, the market is divided into 100 to 500, Less than 100, and Above 500. In terms of Technology, the market is classified into Secondary, Primary, and Tertiary. Based on Application, the market is segmented into On Shore and Off Shore. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 100 to 500 segment, accounting for 47.60% of the capacity category, has been leading due to its suitability for medium-scale operations where balanced capacity and cost efficiency are essential. This segment serves a wide range of oilfield and industrial applications, where flexibility and reliability are critical.

Adoption has been supported by the ability of these systems to handle variable water quality and flow rates without compromising performance. Manufacturers have focused on optimizing energy use and integrating automation to improve process control and reduce operating costs.

Increased deployment in both onshore and offshore facilities has reinforced the segment’s position The segment’s dominance is expected to continue as producers prioritize adaptable and efficient treatment solutions that ensure compliance with stringent discharge regulations while maintaining operational continuity.

The secondary technology segment, holding 52.80% of the technology category, has established dominance through its effectiveness in removing suspended solids, oil residues, and dissolved contaminants from produced water. Adoption has been driven by its operational reliability, moderate cost, and compatibility with existing infrastructure.

Secondary treatment systems, including biological and chemical processes, provide consistent performance across diverse water conditions. Continuous innovation aimed at improving separation efficiency and reducing chemical consumption has further enhanced market appeal.

The segment benefits from growing preference for solutions that balance treatment depth and cost-effectiveness As regulatory frameworks tighten, demand for secondary treatment systems is expected to remain strong, supported by technological upgrades that enhance throughput and reduce environmental impact.

The on shore segment, representing 63.40% of the application category, has been leading the market due to the concentration of oil and gas production facilities and the relative ease of implementing treatment infrastructure in land-based operations. Onshore projects typically involve large volumes of produced water, driving consistent demand for advanced treatment systems.

Cost advantages in installation and maintenance compared to offshore setups have further reinforced this segment’s position. Increasing investments in shale and conventional oilfields, particularly in North America, the Middle East, and Asia Pacific, are supporting steady expansion.

Enhanced regulatory oversight on water discharge and reuse is prompting operators to adopt efficient onshore treatment solutions With the continued focus on sustainable resource management, the onshore segment is projected to maintain its leading share over the forecast period.

The global demand for the produced water treatment system market was estimated to reach a valuation of nearly USD 3.9 billion in 2020, according to a report from Future Market Insights. From 2020 to 2025, the produced water treatment system market witnessed significant growth, registering a CAGR of 4.83%.

| Historical CAGR 2020 to 2025 | 4.83% |

|---|---|

| Forecast CAGR 2025 to 2035 | 5.72% |

The market for produced water treatment system is expected to grow in the future due to these factors:

Demand is driven by the Growth of the Oil Sector, Water Shortages, and Environmental Laws

Significant quantities of wastewater are produced by the growing oil and gas sector, which makes efficient treatment necessary to comply with environmental laws and lower the risk of contamination. This drives the industrial demand for produced water treatment system.

Industry demand for produced water treatment system solutions is driven by growing worries about pollution and water shortages. Sustainable water management techniques are sought to reduce environmental impact and guarantee long term water security.

The need for efficiently produced water treatment system solutions is being driven by growing regulatory pressure and public awareness of environmental conservation and water quality, as well as the significance of sustainable practices in industrial operations.

Managing diverse water Compositions and Addressing Emerging Contaminants to Restrict Market Growth

Addressing the complexity and variety of produced water compositions is one of the market's biggest challenges. This entails controlling the reuse or disposal of treated water as well as making sure that new pollutants, such micro plastics and medications, are effectively handled.

For companies functioning in this dynamic market, additional hurdles include cost concerns, regulatory compliance, and the requirement for constant innovation.

This section focuses on providing detailed analysis of two particular market segments for the produced water treatment system, the dominant capacity and the significant technology. The two main segments discussed below are the 100 to 500 unit capacity and secondary technology.

| Capacity | 100 to 500 Thousand Barrels per Day |

|---|---|

| Market Share in 2025 | 56.70% |

In 2025, the produced water treatment system software segment is likely to gain a market share of 56.70%. The produced water treatment system market is seeing a surge in demand for units with capacities between 100 and 500 because of their adaptability and fit for medium sized industrial operations.

This system is becoming more and more popular as a workable solution for a variety of applications because it strikes a balance between efficiency and cost effectiveness, meeting the demands of enterprises with modest wastewater volumes.

Scalability and flexibility are offered by the 100 to 500 unit capacity range, which enables enterprises to modify their treatment infrastructure in response to fluctuating production demands while preserving peak performance and economic viability.

| Technology | Secondary |

|---|---|

| Market Share in 2025 | 39.30% |

In 2025, the secondary technology segment is anticipated to acquire 39.3% market share. Secondary produced water treatment system methods are expected to gain popularity due to their efficiency in tackling leftover impurities following primary treatment procedures.

The need for all encompassing treatment solutions to guarantee water quality and safety is growing as laws get stricter and environmental issues worsen. Secondary technologies are becoming more and more popular in the produced water treatment system market because they provide an extra layer of treatment to satisfy these changing needs.

This section will go into detail on the produced water treatment system markets in a few key countries, including the United States, the United Kingdom, China, Japan and Australia.

This part will focus on the key factors that are driving up demand in these countries for the produced water treatment system.

| Countries | CAGR from 2025 to 2035 |

|---|---|

| The United States | 4.60% |

| The United Kingdom | 4.80% |

| China | 7.70% |

| Japan | 6.30% |

| Australia | 6.90% |

The United States produced water treatment system ecosystem is anticipated to gain a CAGR of 4.60% through 2035.

Factors that are bolstering the growth are:

The produced water treatment system market in the United Kingdom is expected to expand with a 4.80% CAGR through 2035.

The factors pushing the growth are:

The produced water treatment system ecosystem in China is anticipated to develop with a 7.70% CAGR from 2025 to 2035.

The drivers behind this growth are:

The produced water treatment system industry in Japan is anticipated to reach a 6.30% CAGR from 2025 to 2035.

The drivers propelling growth forward are:

The produced water treatment system ecosystem in Australia is likely to evolve with a 6.90% CAGR during the forecast period.

The factors bolstering the growth are:

Leading businesses in the produced water treatment system market are investing in advanced technology to increase treatment efficiency while reducing environmental effect. To efficiently remove impurities from produced water, they are using novel treatment techniques such as membrane filtration, electrocoagulation, and advanced oxidation.

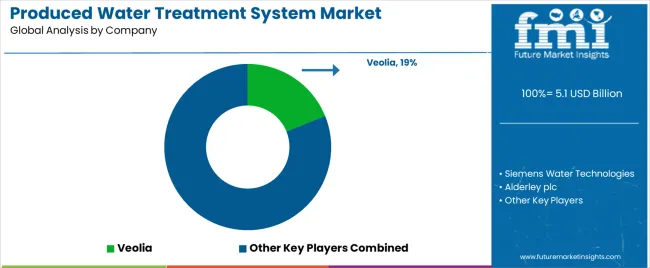

These companies are extending their global reach by means of tactical procurements and collaborations, all the while prioritizing research and development to enhance treatment methodologies and tackle novel obstacles in the realm of managed produced water. Leaders in the sector continue to prioritize achieving environmental goals and adhering to regulatory norms. The key players in this market include:

Significant advancements in the produced water treatment system market are being made by key market participants, and their offerings include:

In 2025, SIEMENS and ACCIONA extended their agreement to become partners in the water business. With the renewal of this contract, ACCIONA continues to demonstrate its unwavering dedication to the most innovative engineering tools and technologies, positioning it as a major player in the deployment and implementation of integrated automation systems that offer extensive expertise in process programming techniques.

This highlights the most recent project on which the two firms collaborated: the wastewater treatment plants Madinah 3, Buraydah 2, and Tabuk 2, which have a combined capacity of 440,000 m3/day and are intended to serve 2.1 million people.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 5.72% from 2025 to 2035 |

| Market value in 2025 | USD 4.82 billion |

| Market value in 2035 | USD 8.41 billion |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered |

Capacity, Technology, Application, Region |

| Regions Covered |

North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; The Middle East & Africa |

| Countries Profiled |

The United States, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Spain, Italy, Poland, Russia, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC Countries, South Africa, Israel |

| Key Companies Profiled |

Siemens Water Technologies; Alderley plc; Frames; Aker Solutions; Aquatech; Schlumberger; FMC Technologies; Veolia; Cetco; Ecosphere; Thermoenergy |

| Customization Scope | Available on Request |

The global produced water treatment system market is estimated to be valued at USD 5.1 billion in 2025.

The market size for the produced water treatment system market is projected to reach USD 8.6 billion by 2035.

The produced water treatment system market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in produced water treatment system market are 100 to 500, less than 100 and above 500.

In terms of technology, secondary segment to command 52.8% share in the produced water treatment system market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Waterless Bathing Solution Market Size and Share Forecast Outlook 2025 to 2035

Waterborne UV Curable Resin Market Size and Share Forecast Outlook 2025 to 2035

Water Adventure Tourism Market Forecast and Outlook 2025 to 2035

Water Packaging Market Forecast and Outlook 2025 to 2035

Water Soluble Bag Market Size and Share Forecast Outlook 2025 to 2035

Water Leak Sensors Market Size and Share Forecast Outlook 2025 to 2035

Water-soluble Packaging Market Size and Share Forecast Outlook 2025 to 2035

Water Underfloor Heating Thermostat Market Size and Share Forecast Outlook 2025 to 2035

Water Activity Meter Market Size and Share Forecast Outlook 2025 to 2035

Water Leakage Tester Market Size and Share Forecast Outlook 2025 to 2035

Waterstops Market Size and Share Forecast Outlook 2025 to 2035

Water-miscible Metalworking Oil Market Size and Share Forecast Outlook 2025 to 2035

Waterborne Polyurethane Dispersions Market Size and Share Forecast Outlook 2025 to 2035

Water Surface Conditioning Equipment Market Size and Share Forecast Outlook 2025 to 2035

Water-based Inks Market Size and Share Forecast Outlook 2025 to 2035

Water Cooled Transformer Market Size and Share Forecast Outlook 2025 to 2035

Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Waterborne Coatings Market Size and Share Forecast Outlook 2025 to 2035

Waterway Transportation Software Market Size and Share Forecast Outlook 2025 to 2035

Waterless Cosmetics Powders Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA