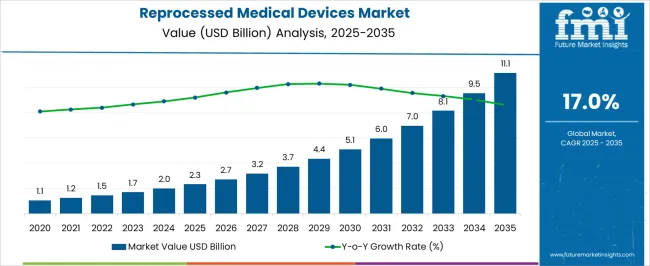

The Reprocessed Medical Devices Market is estimated to be valued at USD 2.3 billion in 2025 and is projected to reach USD 11.1 billion by 2035, registering a compound annual growth rate (CAGR) of 17.0% over the forecast period.

| Metric | Value |

|---|---|

| Reprocessed Medical Devices Market Estimated Value in (2025 E) | USD 2.3 billion |

| Reprocessed Medical Devices Market Forecast Value in (2035 F) | USD 11.1 billion |

| Forecast CAGR (2025 to 2035) | 17.0% |

The Reprocessed Medical Devices market is experiencing robust growth, driven by the increasing need to reduce healthcare costs while maintaining high standards of patient care. Rising demand for sustainable medical practices, coupled with budgetary constraints in hospitals and healthcare facilities, has accelerated the adoption of reprocessed devices. These devices, which are sterilized and refurbished for safe reuse, offer significant cost advantages without compromising quality or compliance.

Growth is further supported by advancements in sterilization techniques, quality control processes, and regulatory frameworks that ensure safety and efficacy. Hospitals and healthcare providers are increasingly integrating reprocessed devices into surgical and diagnostic workflows, optimizing operational efficiency and reducing environmental impact.

The market is also benefiting from growing awareness among clinicians and procurement teams regarding the economic and ecological advantages of device reprocessing As healthcare systems focus on sustainable resource utilization, regulatory compliance, and cost containment, the Reprocessed Medical Devices market is expected to sustain long-term expansion, supported by continued technological innovation and widespread adoption in clinical settings.

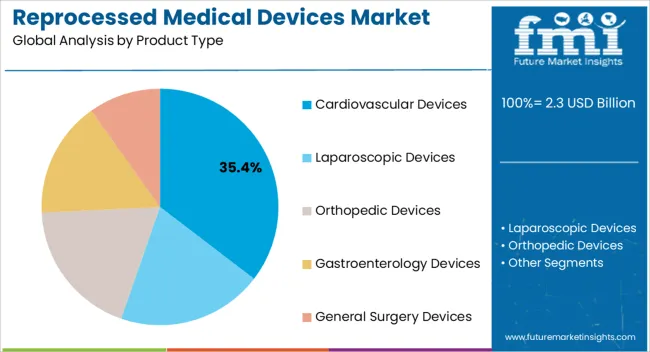

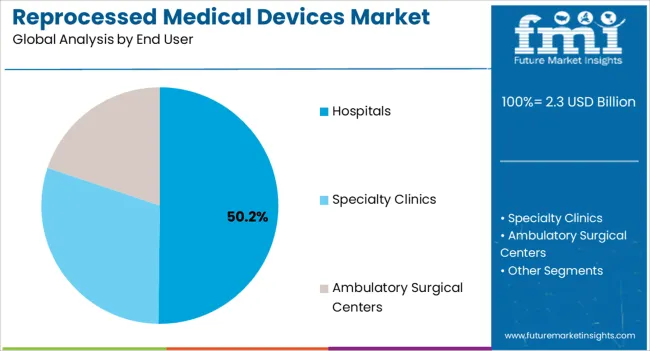

The reprocessed medical devices market is segmented by product type, end user, and geographic regions. By product type, reprocessed medical devices market is divided into Cardiovascular Devices, Laparoscopic Devices, Orthopedic Devices, Gastroenterology Devices, and General Surgery Devices. In terms of end user, reprocessed medical devices market is classified into Hospitals, Specialty Clinics, and Ambulatory Surgical Centers. Regionally, the reprocessed medical devices industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The cardiovascular devices segment is projected to hold 35.4% of the market revenue in 2025, establishing it as the leading product type. Growth in this segment is being driven by the high utilization of cardiovascular instruments in surgeries, interventional procedures, and diagnostic applications, combined with the cost savings achieved through reprocessing. Advanced sterilization and refurbishment processes ensure that device performance and patient safety are not compromised, increasing acceptance among hospitals and healthcare providers.

The segment benefits from rising cardiovascular disease prevalence and the growing number of procedures performed globally, which create a consistent demand for reprocessed devices. Hospitals prefer reprocessed cardiovascular instruments due to their ability to reduce operational expenses while maintaining quality standards.

Continuous improvements in regulatory oversight, quality assurance, and device tracking have further strengthened market confidence As cost efficiency and sustainability remain priorities for healthcare facilities, the cardiovascular devices segment is expected to maintain its leadership, supported by ongoing adoption and technological innovation in reprocessing methods.

The hospitals segment is anticipated to account for 50.2% of the market revenue in 2025, making it the leading end-user category. Growth is being driven by hospitals’ need to manage operational costs effectively while ensuring patient safety and compliance with medical regulations. Reprocessed medical devices allow hospitals to achieve significant cost savings, particularly for high-volume and expensive devices such as cardiovascular, orthopedic, and surgical instruments.

The integration of reprocessing programs enables hospitals to optimize device utilization, reduce procurement expenses, and improve inventory management. Adoption is further supported by advancements in sterilization, quality control, and device tracking technologies, ensuring safety, reliability, and regulatory adherence.

Hospitals are increasingly recognizing the sustainability benefits of device reprocessing, which reduces medical waste and promotes environmental responsibility As healthcare facilities continue to balance budget constraints with patient care quality, the hospitals segment is expected to remain the largest revenue contributor, driven by ongoing implementation of reprocessing strategies and technological improvements in device refurbishment and monitoring.

Reprocessed medical devices are those devices are those devices that are refurbished and put to reuse again. The reprocessing of medical devices involves disinfection, cleaning, remanufacturing, testing, sterilization, packaging and labelling of the devices in order to put to service again.

The reprocessing of any medical device must follow a validated process which renders it fit for use. In order to reprocess the device factors like the efficacy, life cycle, potential risk to the patient and components used to manufacture the device are taken into consideration. With the increasing healthcare cost and high price of medical devices then demand for reprocessed medical devices is expected to witness high growth over the forecast period.

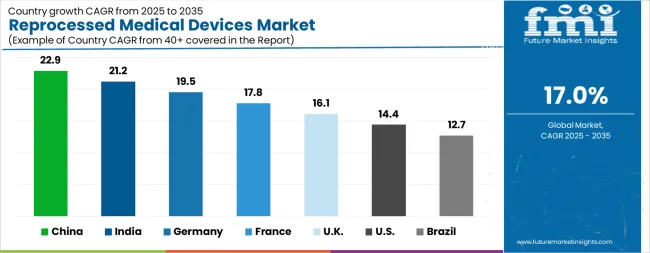

| Country | CAGR |

|---|---|

| China | 22.9% |

| India | 21.2% |

| Germany | 19.5% |

| France | 17.8% |

| UK | 16.1% |

| USA | 14.4% |

| Brazil | 12.7% |

The Reprocessed Medical Devices Market is expected to register a CAGR of 17.0% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 22.9%, followed by India at 21.2%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 12.7%, yet still underscores a broadly positive trajectory for the global Reprocessed Medical Devices Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 19.5%. The USA Reprocessed Medical Devices Market is estimated to be valued at USD 834.5 million in 2025 and is anticipated to reach a valuation of USD 3.2 billion by 2035. Sales are projected to rise at a CAGR of 14.4% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 111.9 million and USD 63.3 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.3 Billion |

| Product Type | Cardiovascular Devices, Laparoscopic Devices, Orthopedic Devices, Gastroenterology Devices, and General Surgery Devices |

| End User | Hospitals, Specialty Clinics, and Ambulatory Surgical Centers |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

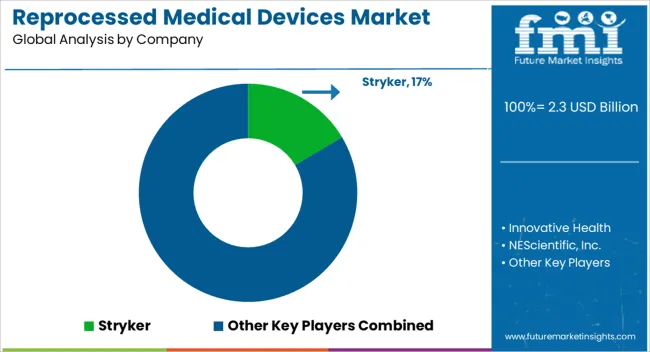

| Key Companies Profiled | Stryker, Innovative Health, NEScientific, Inc., Medline Industries, LP., Arjo, Cardinal Health, SureTek Medical, Soma Tech Intl, Johnson & Johnson MedTech, and GE Healthcare |

The global reprocessed medical devices market is estimated to be valued at USD 2.3 billion in 2025.

The market size for the reprocessed medical devices market is projected to reach USD 11.1 billion by 2035.

The reprocessed medical devices market is expected to grow at a 17.0% CAGR between 2025 and 2035.

The key product types in reprocessed medical devices market are cardiovascular devices, laparoscopic devices, orthopedic devices, gastroenterology devices and general surgery devices.

In terms of end user, hospitals segment to command 50.2% share in the reprocessed medical devices market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA