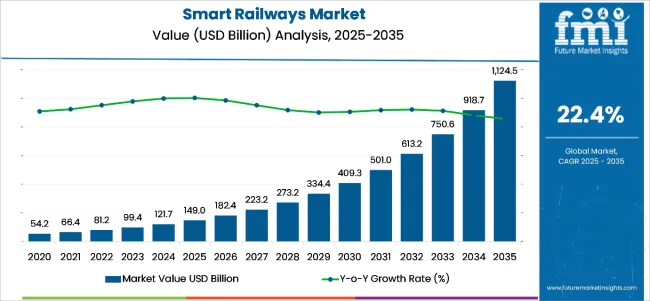

The global smart railways market is poised for remarkable growth during the forecast period of 2025 to 2035. The market is valued at USD 149 billion in 2025 and is projected to reach USD 1,124.5 billion by 2035, reflecting a CAGR of 22.4%. This surge can be attributed to the increasing emphasis on digitalizing railway operations, integrating technologies such as IoT, big data, artificial intelligence, and cloud computing to enhance operational efficiency, safety, and overall customer experience.

The deployment of smart railway systems is transforming traditional railways by offering advanced features such as real-time tracking, predictive maintenance, energy-efficient rail networks, and autonomous signaling. These advancements have been instrumental in meeting the rising global demand for modern, safe, and cost-effective rail transportation solutions.

The smart railways industry is being heavily shaped by growing investments in railway infrastructure modernization by both governments and private stakeholders worldwide. Various national and regional authorities are actively investing in automation, real-time data analytics, and AI-powered systems to improve the sustainability, safety, and reliability of rail networks.

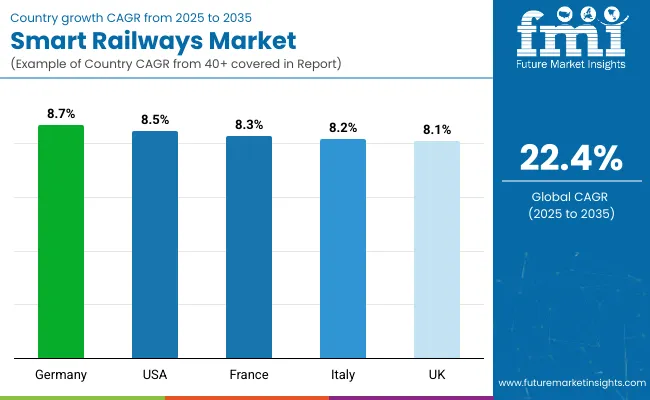

Countries such as China, South Korea, and Germany are leading this trend with significant CAGR figures, driven by government-backed initiatives for smart mobility and urban infrastructure. Moreover, the incorporation of digital ticketing and automated fare collection systems is streamlining passenger management, reducing operational costs, and enhancing the overall commuter experience. The evolution of high-speed rail networks and the expansion of metro systems in urban areas are also acting as catalysts, fostering the adoption of smart rail technologies at a rapid pace.

One of the most influential driving factors of the market is the rising importance of predictive maintenance and asset management in railway operations. The integration of IoT-enabled sensors and AI-driven analytics platforms is allowing railway operators to monitor train components, track conditions, and signaling systems in real-time. This capability reduces downtime, prevents accidents, and ensures efficient scheduling of maintenance tasks.

Additionally, the growing focus on passenger safety, with the deployment of AI-powered surveillance systems and facial recognition technologies, is fueling market demand. Global players like Siemens Mobility, Alstom, Hitachi Rail, Bombardier Transportation, Thales Group, and Huawei Technologies are actively investing in product innovation and technological advancements to capture market share, contributing significantly to the robust expansion of the smart railways market over the forecast period.

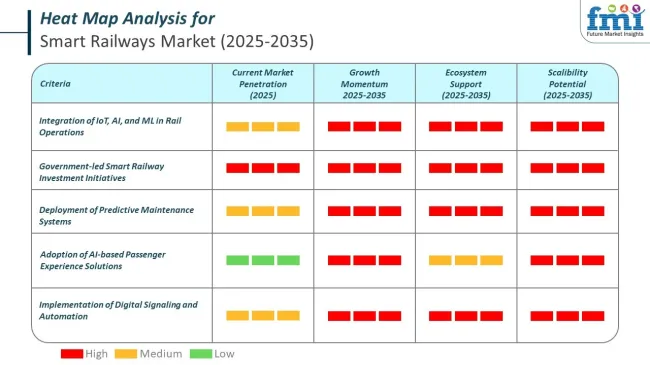

Significant advancements in the smart railways market are being driven by increased deployment of AI, IoT, and ML technologies across infrastructure, rolling stock, and operational systems. These technologies are enabling predictive maintenance, real-time monitoring, and enhanced passenger experiences. Countries like China, Germany, and Japan are leading adoption, supported by national smart mobility initiatives and digitization policies.

Governments are actively investing in intelligent transportation projects, including European Rail Traffic Management System (ERTMS) upgrades and India’s Smart Railway Station Development Program. Rail operators such as Deutsche Bahn, SNCF, Indian Railways, and CRRC are collaborating with tech firms to integrate automation, AI-driven safety protocols, and edge-based IoT devices across rail assets.

Governments across major economies are accelerating investments in smart railway infrastructure to improve safety, efficiency, and connectivity. These initiatives are part of broader national plans focused on sustainable mobility, digital transformation, and smart city integration. Public funding, public-private partnerships (PPPs), and infrastructure modernization programs are driving these capital flows into AI, IoT, and ML-based railway systems.

In Asia, Europe, and North America, central governments and transport ministries are prioritizing smart signaling, predictive maintenance, automation, and multimodal digital integration. Funds are being allocated toward command centers, IoT-enabled monitoring, and AI-powered scheduling systems.

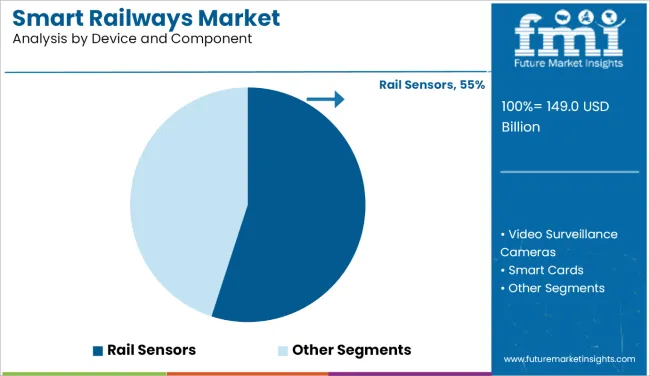

The smart railways market is segmented based on device and component, service, system, and region. By device and component, the market includes rail sensors, video surveillance cameras, smart cards, networking & connectivity devices (such as routers, wi-fi, switches, etc.), and others (including multimedia displays). In terms of service, the market covers professional services, cloud services, and integration services.

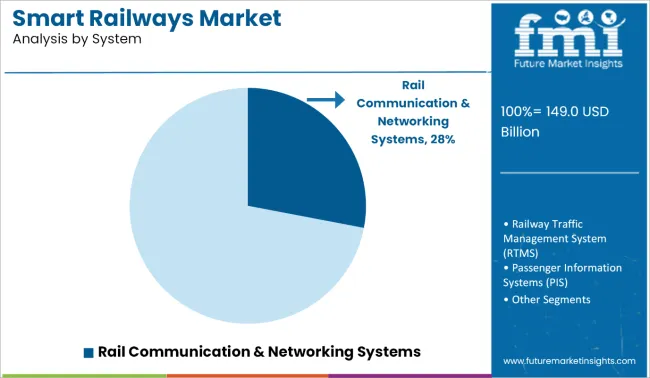

By system, the segmentation comprises passenger information systems (PIS), railway traffic management system (RTMS), advanced security management systems (ASMS), smart ticketing systems (STS), rail operations management systems, rail communication & networking systems, and others (such as rail analytics systems and freight information systems). Regionally, the market is divided into North America, Latin America, Europe, East Asia, South Asia & Pacific, and the Middle East & Africa (MEA).

Rail sensors hold the dominant position in the smart railways market, accounting for the largest share of approximately 55% in 2025. These sensors play a critical role in enabling predictive maintenance, real-time monitoring, and enhancing railway safety and operational efficiency. Integrated with IoT technology, rail sensors are widely used to detect track anomalies, monitor train speed, and analyze various mechanical parameters like vibration, temperature, and acoustic patterns.

Such functionalities help in preventing derailments, optimizing maintenance schedules, and reducing overall downtime. Leading market players such as Siemens Mobility, Alstom, and Hitachi Rail are deploying advanced sensor-based solutions, enabling operators to perform condition-based maintenance and asset monitoring with precision.

These smart rail sensors are instrumental in ensuring the reliability of high-speed trains and metro systems, especially in regions emphasizing transportation infrastructure modernization. Deutsche Bahn, for example, has successfully implemented AI-powered sensor networks to anticipate track and equipment failures, significantly minimizing service interruptions.

The proliferation of smart city projects and the rising demand for safe, efficient, and sustainable urban mobility solutions are expected to further drive the adoption of rail sensors across global markets. As the demand for real-time asset performance data continues to grow, rail sensors will remain at the forefront of technological innovations shaping the future of railway transportation.

| Device and Component | Share (2025) |

|---|---|

| Rail Sensors | 55% |

On the basis of system, the rail communications & networking systems segment accounts for 28% share. Smart rail communications & networking systems are popular because they enhance the safety, efficiency, and reliability of modern railway operations.

These systems enable real-time communication between trains, control centers, and station infrastructure, allowing for better traffic management, faster response to emergencies, and improved scheduling.

They support technologies like automated train control, predictive maintenance, and passenger information systems, which contribute to smoother operations and better customer experience. Smart networking also enables high-speed data transmission, essential for monitoring systems, CCTV, and Wi-Fi services onboard. As railways modernize to meet growing transportation demands and improve service quality, smart communication systems have become essential for building intelligent, connected, and future-ready rail networks.

| System | CAGR (2025 to 2035) |

|---|---|

| Railway Traffic Management System | 28% |

The industry is changing through the process of integrating automation, AI, IoT-based monitoring, and real-time data analytics, enhancing the safety and efficiency of rail operations. Urban transit and high-speed transit systems emphasize automated train control, optimum propulsion systems, and real-time passenger information systems to facilitate travel.

Freight railways emphasize predictive maintenance, tracking of cargo, and automated scheduling to streamline logistics and minimize delay. Railway infrastructure management is also moving toward more IoT sensors, AI-based track monitoring, and digital signaling systems to enhance operational safety and minimize maintenance expenses.

Passenger services are combining contactless ticketing, smart station solutions, and AI-powered customer service to enhance the travel experience. Moreover, cybersecurity functions are becoming mandatory with digitalization growing throughout railway networks. The trend towards sustainable rail transport is also driving investment in electrification, hydrogen trains, and energy-efficient rolling stock.

| Company | Contract Value (USD Million) |

|---|---|

| Siemens Mobility | Approximately USD 85 - USD 95 |

| Alstom | Approximately USD 75 - USD 85 |

| Hitachi Rail | Approximately USD 65 - USD 75 |

| Thales | Approximately USD 55 - USD 65 |

| Kawasaki Heavy Industries | Approximately USD 70 - USD 80 |

During 2024 and the first half of 2025, the industry kept advancing, driven by the need for greater operational efficiency, safety and customer experience through digitalization. Landmark contracts have also been awarded to large industry players Siemens Mobility, Alstom, Hitachi Rail, Thales and Kawasaki Heavy Industries, which reflect the focus on blending smart technologies with rail operations, defining the way forward for safer, more efficient and cleaner modes of transport.

The industry is flourishing, with robots, IoT, and AI technologies significantly improving efficiency, safety, and passenger comfort. Automation is yet not a universal herald. For instance, rail transport and some components of the railway are still in use despite reducing their percentage in the global technology industry. Railways infrastructure and operations are suffering from supply chain disruptions like semiconductor shortages and dependence on specialized equipment.

The geopolitical tensions, trade limitations, and raw material price fluctuations are among the other factors that add to industry uncertainties. On the other hand, the previous issues of the suppliers' inability to meet the deadlines, increased costs of materials, and the need to have local production, turned out to be real crises.

As a result, it is crucial for the company to perform the tasks efficiently. Therefore, these are the main five actions we have implemented to protect our operations and minimize service disruptions. The rapid growth of artificial intelligence, big data, and predictive maintenance develops the possibility of invalidation.

Enterprises should mainly build kit solutions that are interchangeable and include ongoing R&D in order to remain competitive and adjust to changing norms and client expectations. Cybersecurity is also one of the major issues as smart railways working with a lot of interconnected networks and cloud-based control systems.

Cybernetic attack, data leakage, and unauthorized admission that could lead to operations disruptions as well as indirect passenger safety endangerment are concerned. Executing AI-based security protocols, organizing robust encryption as well as conducting regular software updates are the essentials to protecting our infrastructure and data integrity.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 8.5% |

| UK | 8.1% |

| France | 8.3% |

| Germany | 8.7% |

| hItaly | 8.2% |

| South Korea | 8.9% |

| Japan | 8.3% |

| China | 9.1% |

| Australia | 7.9% |

| New Zealand | 7.6% |

The USA smart railways industry is transforming at a very fast pace with enormous investments in railway automation, predictive maintenance through AI, and top-of-the-line signaling. Constructing high-speed rail and integrating smart railways are the federal plans to make it more efficient and sustainable. Siemens Mobility, Alstom, and Wabtec are leading the charge with AI-driven traffic control and cloud predictive analytics to reduce journey delays and enhance passengers' experiences.

Adopting AI-based scheduling and condition monitoring by IoT is reshaping rail operations. Autonomous trains, real-time traffic management, and AI-based asset management are the most crucial areas of work for the Federal Railroad Administration (FRA) to make railway operations safer and more reliable. Greater emphasis on carbon-neutral railway networks also aligns with the global sustainability platform and is long-term industry growth.

UK smart railway is booming amidst government-sponsored schemes of modernization and digitalized signaling. The Department for Transport (DfT) is in charge of AI-based traffic management, real-time passenger information systems, and cloud-based ticketing. Decarbonization initiatives are bringing electric trains as well as hydrogen trains more onboard earlier, cutting fuel dependence on fossils.

Industry pioneers like Hitachi Rail, Network Rail, and Thales Group are pushing 5G-capable railway communications, AI traffic congestion management, and intelligent rolling stock planning into the mainstream. Contactless payment, automated timetables, and condition-based maintenance are boosting efficiency and passenger satisfaction. Integrated smart stations with greater connectivity and security are improving the rail network.

Smart rail development in France is spearheading massive investment in high-speed rail and artificial intelligence-based rail infrastructure. AI-based predictive maintenance and asset monitoring are the government's priorities to achieve operational performance and passenger safety. French railways are also making their infrastructure digital with smart sensors, autonomous control systems, and AI-based maintenance technology.

Companies like Alstom, Thales, and SNCF are also investing heavily in AI-based signaling, automatic control of trains, and cloud mobility platforms. The system is more efficient, and there are fewer delays with energy-saving trains and real-time monitoring. The country's goal of carbon neutrality for rail transport perfectly aligns with EU-level sustainability objectives, driving long-term industry growth.

Germany has high growth in the industry, driven by digitalization and AI-driven safety features initiatives. Route optimization based on AI, real-time observation, and next-generation cyber security are of interest to the government. Germany's emphasis on sustainable mobility is driving energy-efficient trains and networked rail.

Technology innovators in the rail industry, like Siemens Mobility, Deutsche Bahn, and Stadler Rail, are concentrating on predictive maintenance, autonomous train control, and cloud-based railway management. AI-enabled scheduling, smart ticketing, and IoT-enabled railway monitoring are enhancing efficiency. Studies on autonomous train operation and integration with 5G-enabled platforms are leading Germany's smart rail network.

Italy is developing smart rail technology, and investment in automation with the help of AI, high-speed rail, and electronic ticketing is on the rise. The government is especially keen on modernizing railway infrastructure with AI-based traffic management and predictive analytics to reduce accidents and increase efficiency. Its carbon emission battle is forcing the transition towards electrification and hydrogen fuel for rail transport.

Innovators like Trenitalia, Hitachi Rail Italy, and Ansaldo STS are leading the way with autonomous train operation, cloud management of the railway, and real-time traffic congestion monitoring. IoT-based maintenance and demand forecasting with AI are maximizing operations. Increasing investments in smart stations and frictionless mobility by Italy are transforming passenger experience.

The smart railway market in South Korea is growing at a high growth rate, fueled by high-speed rail modernization, AI-based automation, and 5G-based rail communication. The government is encouraging AI-based traffic control, cloud-based asset tracking, and real-time train location tracking to enhance efficiency and safety.

Leading firms like Hyundai Rotem, Samsung SDS, and SK Telecom are investing in smart railway infrastructure, predictive maintenance using AI, and automated ticketing. South Korea's focus on digitalization and the development of smart stations is also fueling industry growth. AI-driven train operation and real-time analytics are making railway efficiency easier.

Japan is at the forefront of the smart railway revolution with cutting-edge automation, AI-based train control, and high-speed rail technology. The government is creating AI-based predictive maintenance, real-time monitoring, and smart signaling to ensure improved safety and efficiency. Autonomous trains and 5G-based rail communication are transforming the industry.

Industry players like JR East, Hitachi Rail, and Kawasaki Heavy Industries are spearheading AI-powered scheduling, cloud ticketing, and autonomous train operations. The intersection of next-gen railway mobility platforms and cyber security is fueling the industry growth. Japan's leadership in high-speed rail technology gives it the lead position in worldwide smart railway innovation.

The Chinese smart railway market is growing fast with AI-based automation investment by the government, high-speed rail network extension, and real-time monitoring. China is focusing on AI-based asset management, predictive maintenance, and inter-operable rail.

These leaders are investing in cloud computing railway operations, 5G-based communication, and smart signaling. Congestion control, automatic fare collection, and real-time monitoring with artificial intelligence-based solutions are enhancing efficiency. China's carbon-neutral transportation push and digital railway transformation program are fueling industry growth.

Australia is upgrading its rail network with AI-driven automation, intelligent ticketing, and predictive maintenance. High-speed rail, cloud operation of rail, and real-time passenger information systems are being prioritized by the government.

Downer Group, Alstom, and Siemens Mobility are leading innovations in AI-driven railway safety, automated timetabling, and IoT-based condition monitoring. Green mobility investment and smart railway connectivity in Australia are transforming the transport sector.

New Zealand's smart railways industry is expanding steadily, with investments in AI-based maintenance, automated ticketing, and real-time train monitoring. The government is focusing on digital transformation and green rail transport.

KiwiRail, Transdev, and Thales are driving the use of AI-based predictive analytics, cloud-based asset management, and smart signaling. 5G communication and IoT-based monitoring are making railways efficient and safe.

The industry is witnessing a series of rapid transformations by the governments and transportation authorities due to the digitalization that they prefer to adopt for the prorating efficiency, safety, and convenience of passengers. The rise of IoT, AI-powered predictive maintenance, and real-time analytics is changing the face of railway systems by reducing delays and improving network reliability.

The industry is dominated by more established railway technology suppliers, telecom giants, and infrastructure disrupters Siemens Mobility, Alstom, Hitachi Rail, and Bombardier Transportation, for example. These companies incorporate automation, cloud-based monitoring, and energy-efficient rail solutions into their performance. Newcomers are trying to find a niche contributing to cutting-edge areas, including advanced systems cybersecurity, advanced high-speed rail connectivity for transporting vehicles, and AI-based management of traffic.

Some of the key drivers for the growth of the industry include technological advancements in autonomous train operations, the introduction of smart ticketing and passenger information systems, and regulatory initiatives for sustainable rail infrastructure. To help preserve their competitive position, companies are increasing spending on predictive analytics, electrification, and digital signaling.

Cost pressures, supply chain resilience, and changing consumer expectations around seamless, technology-enabled transportation are also driving change in the industry. Companies globally should focus on technology differentiation, compliance with safety regulations, and providing integrated smart mobility solutions to drive adoption and expansion into new markets to facilitate sustained growth.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 149 billion |

| Projected Market Size (2035) | USD 1,124.5 billion |

| CAGR (2025 to 2035) | 22.4% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billion/Volume in kilotons |

| By Device and Component | Rail Sensors, Video Surveillance Cameras, Smart Cards, Networking & Connectivity Devices (Router, Wi-Fi, Switches, etc.), Others (Multimedia Displays) |

| By Service | Professional Services, Cloud Services, Integration Services |

| By System | Passenger Information Systems (PIS), Railway Traffic Management System (RTMS), Advanced Security Management Systems (ASMS), Smart Ticketing Systems (STS), Rail Operations Management Systems, Rail Communication & Networking Systems, Others (Rail Analytics Systems and Freight Information Systems) |

| Regions Covered | North America, Latin America, Europe Smart, East Asia, South Asia & Pacific, Middle East & Africa (MEA) |

| Countries Covered | United States, Japan, Germany, India, United Kingdom, France, Italy, Brazil, Canada, South Korea, Australia, Spain, Netherlands, Saudi Arabia, Switzerland |

| Key Players | Siemens Mobility, Alstom, Hitachi Rail, Bombardier Transportation, Thales Group, General Electric (GE), Cisco Systems, Huawei Technologies, ABB Group, Indra Sistemas |

| Additional Attributes | Dollar sales by value, market share analysis by region, country-wise analysis |

| Customization and Pricing | Available upon request |

By device and component, the industry includes rail sensors, video surveillance cameras, smart cards, networking & connectivity devices (such as routers, Wi-Fi, and switches), and other components like multimedia displays, with networking & connectivity devices leading due to the growing demand for seamless railway communication systems.

By service, the industry is categorized into professional services, cloud services, and integration services, with cloud services dominating due to the increasing need for scalable data storage and real-time railway analytics.

By system, the industry includes Passenger Information Systems (PIS), Railway Traffic Management Systems (RTMS), Advanced Security Management Systems (ASMS), Smart Ticketing Systems (STS), rail operations management systems, rail communication & networking systems, and others, with Passenger Information Systems (PIS) leading due to the rising demand for real-time travel updates.

By region, the industry spans North America, Latin America, Europe, East Asia, South Asia & Pacific, and the Middle East & Africa (MEA), with Europe leading due to strong investments in smart railway infrastructure and digital transformation initiatives.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Device and Component, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Service, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by System , 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Device and Component, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Service, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by System , 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Device and Component, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Service, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by System , 2018 to 2033

Table 13: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Europe Market Value (US$ Million) Forecast by Device and Component, 2018 to 2033

Table 15: Europe Market Value (US$ Million) Forecast by Service, 2018 to 2033

Table 16: Europe Market Value (US$ Million) Forecast by System , 2018 to 2033

Table 17: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: South Asia Market Value (US$ Million) Forecast by Device and Component, 2018 to 2033

Table 19: South Asia Market Value (US$ Million) Forecast by Service, 2018 to 2033

Table 20: South Asia Market Value (US$ Million) Forecast by System , 2018 to 2033

Table 21: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: East Asia Market Value (US$ Million) Forecast by Device and Component, 2018 to 2033

Table 23: East Asia Market Value (US$ Million) Forecast by Service, 2018 to 2033

Table 24: East Asia Market Value (US$ Million) Forecast by System , 2018 to 2033

Table 25: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Oceania Market Value (US$ Million) Forecast by Device and Component, 2018 to 2033

Table 27: Oceania Market Value (US$ Million) Forecast by Service, 2018 to 2033

Table 28: Oceania Market Value (US$ Million) Forecast by System , 2018 to 2033

Table 29: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: MEA Market Value (US$ Million) Forecast by Device and Component, 2018 to 2033

Table 31: MEA Market Value (US$ Million) Forecast by Service, 2018 to 2033

Table 32: MEA Market Value (US$ Million) Forecast by System , 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Device and Component, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Service, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by System , 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Device and Component, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Device and Component, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Device and Component, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Service, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Service, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Service, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by System , 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by System , 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by System , 2023 to 2033

Figure 17: Global Market Attractiveness by Device and Component, 2023 to 2033

Figure 18: Global Market Attractiveness by Service, 2023 to 2033

Figure 19: Global Market Attractiveness by System , 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Device and Component, 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Service, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by System , 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Device and Component, 2018 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Device and Component, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Device and Component, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Service, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Service, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Service, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by System , 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by System , 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by System , 2023 to 2033

Figure 37: North America Market Attractiveness by Device and Component, 2023 to 2033

Figure 38: North America Market Attractiveness by Service, 2023 to 2033

Figure 39: North America Market Attractiveness by System , 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by Device and Component, 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Service, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by System , 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Device and Component, 2018 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Device and Component, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Device and Component, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Service, 2018 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Service, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Service, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by System , 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by System , 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by System , 2023 to 2033

Figure 57: Latin America Market Attractiveness by Device and Component, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Service, 2023 to 2033

Figure 59: Latin America Market Attractiveness by System , 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Europe Market Value (US$ Million) by Device and Component, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) by Service, 2023 to 2033

Figure 63: Europe Market Value (US$ Million) by System , 2023 to 2033

Figure 64: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 66: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Europe Market Value (US$ Million) Analysis by Device and Component, 2018 to 2033

Figure 69: Europe Market Value Share (%) and BPS Analysis by Device and Component, 2023 to 2033

Figure 70: Europe Market Y-o-Y Growth (%) Projections by Device and Component, 2023 to 2033

Figure 71: Europe Market Value (US$ Million) Analysis by Service, 2018 to 2033

Figure 72: Europe Market Value Share (%) and BPS Analysis by Service, 2023 to 2033

Figure 73: Europe Market Y-o-Y Growth (%) Projections by Service, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) Analysis by System , 2018 to 2033

Figure 75: Europe Market Value Share (%) and BPS Analysis by System , 2023 to 2033

Figure 76: Europe Market Y-o-Y Growth (%) Projections by System , 2023 to 2033

Figure 77: Europe Market Attractiveness by Device and Component, 2023 to 2033

Figure 78: Europe Market Attractiveness by Service, 2023 to 2033

Figure 79: Europe Market Attractiveness by System , 2023 to 2033

Figure 80: Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: South Asia Market Value (US$ Million) by Device and Component, 2023 to 2033

Figure 82: South Asia Market Value (US$ Million) by Service, 2023 to 2033

Figure 83: South Asia Market Value (US$ Million) by System , 2023 to 2033

Figure 84: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 86: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: South Asia Market Value (US$ Million) Analysis by Device and Component, 2018 to 2033

Figure 89: South Asia Market Value Share (%) and BPS Analysis by Device and Component, 2023 to 2033

Figure 90: South Asia Market Y-o-Y Growth (%) Projections by Device and Component, 2023 to 2033

Figure 91: South Asia Market Value (US$ Million) Analysis by Service, 2018 to 2033

Figure 92: South Asia Market Value Share (%) and BPS Analysis by Service, 2023 to 2033

Figure 93: South Asia Market Y-o-Y Growth (%) Projections by Service, 2023 to 2033

Figure 94: South Asia Market Value (US$ Million) Analysis by System , 2018 to 2033

Figure 95: South Asia Market Value Share (%) and BPS Analysis by System , 2023 to 2033

Figure 96: South Asia Market Y-o-Y Growth (%) Projections by System , 2023 to 2033

Figure 97: South Asia Market Attractiveness by Device and Component, 2023 to 2033

Figure 98: South Asia Market Attractiveness by Service, 2023 to 2033

Figure 99: South Asia Market Attractiveness by System , 2023 to 2033

Figure 100: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 101: East Asia Market Value (US$ Million) by Device and Component, 2023 to 2033

Figure 102: East Asia Market Value (US$ Million) by Service, 2023 to 2033

Figure 103: East Asia Market Value (US$ Million) by System , 2023 to 2033

Figure 104: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 106: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: East Asia Market Value (US$ Million) Analysis by Device and Component, 2018 to 2033

Figure 109: East Asia Market Value Share (%) and BPS Analysis by Device and Component, 2023 to 2033

Figure 110: East Asia Market Y-o-Y Growth (%) Projections by Device and Component, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) Analysis by Service, 2018 to 2033

Figure 112: East Asia Market Value Share (%) and BPS Analysis by Service, 2023 to 2033

Figure 113: East Asia Market Y-o-Y Growth (%) Projections by Service, 2023 to 2033

Figure 114: East Asia Market Value (US$ Million) Analysis by System , 2018 to 2033

Figure 115: East Asia Market Value Share (%) and BPS Analysis by System , 2023 to 2033

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by System , 2023 to 2033

Figure 117: East Asia Market Attractiveness by Device and Component, 2023 to 2033

Figure 118: East Asia Market Attractiveness by Service, 2023 to 2033

Figure 119: East Asia Market Attractiveness by System , 2023 to 2033

Figure 120: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 121: Oceania Market Value (US$ Million) by Device and Component, 2023 to 2033

Figure 122: Oceania Market Value (US$ Million) by Service, 2023 to 2033

Figure 123: Oceania Market Value (US$ Million) by System , 2023 to 2033

Figure 124: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: Oceania Market Value (US$ Million) Analysis by Device and Component, 2018 to 2033

Figure 129: Oceania Market Value Share (%) and BPS Analysis by Device and Component, 2023 to 2033

Figure 130: Oceania Market Y-o-Y Growth (%) Projections by Device and Component, 2023 to 2033

Figure 131: Oceania Market Value (US$ Million) Analysis by Service, 2018 to 2033

Figure 132: Oceania Market Value Share (%) and BPS Analysis by Service, 2023 to 2033

Figure 133: Oceania Market Y-o-Y Growth (%) Projections by Service, 2023 to 2033

Figure 134: Oceania Market Value (US$ Million) Analysis by System , 2018 to 2033

Figure 135: Oceania Market Value Share (%) and BPS Analysis by System , 2023 to 2033

Figure 136: Oceania Market Y-o-Y Growth (%) Projections by System , 2023 to 2033

Figure 137: Oceania Market Attractiveness by Device and Component, 2023 to 2033

Figure 138: Oceania Market Attractiveness by Service, 2023 to 2033

Figure 139: Oceania Market Attractiveness by System , 2023 to 2033

Figure 140: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 141: MEA Market Value (US$ Million) by Device and Component, 2023 to 2033

Figure 142: MEA Market Value (US$ Million) by Service, 2023 to 2033

Figure 143: MEA Market Value (US$ Million) by System , 2023 to 2033

Figure 144: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 145: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 146: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 147: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 148: MEA Market Value (US$ Million) Analysis by Device and Component, 2018 to 2033

Figure 149: MEA Market Value Share (%) and BPS Analysis by Device and Component, 2023 to 2033

Figure 150: MEA Market Y-o-Y Growth (%) Projections by Device and Component, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) Analysis by Service, 2018 to 2033

Figure 152: MEA Market Value Share (%) and BPS Analysis by Service, 2023 to 2033

Figure 153: MEA Market Y-o-Y Growth (%) Projections by Service, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) Analysis by System , 2018 to 2033

Figure 155: MEA Market Value Share (%) and BPS Analysis by System , 2023 to 2033

Figure 156: MEA Market Y-o-Y Growth (%) Projections by System , 2023 to 2033

Figure 157: MEA Market Attractiveness by Device and Component, 2023 to 2033

Figure 158: MEA Market Attractiveness by Service, 2023 to 2033

Figure 159: MEA Market Attractiveness by System , 2023 to 2033

Figure 160: MEA Market Attractiveness by Country, 2023 to 2033

The industry is expected to generate USD 149 billion in revenue by 2025.

The industry is projected to reach USD 1,124.5 billion by 2035, growing at a CAGR of 22.4%.

Key players include Siemens Mobility, Alstom, Hitachi Rail, Bombardier Transportation, Thales Group, General Electric (GE), Cisco Systems, Huawei Technologies, ABB Group, and Indra Sistemas.

Europe and Asia-Pacific, driven by rapid urbanization, government initiatives for railway modernization, and the adoption of AI and big data in rail management.

Railway traffic management systems dominate due to their role in enhancing operational efficiency, safety, and real-time monitoring of rail networks.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.