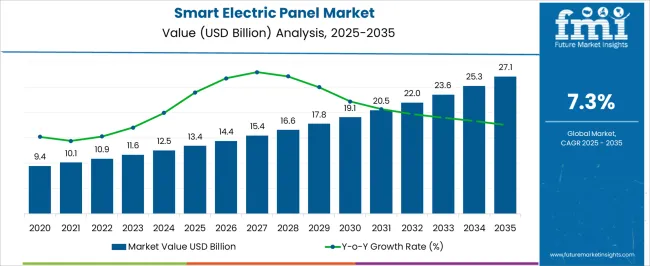

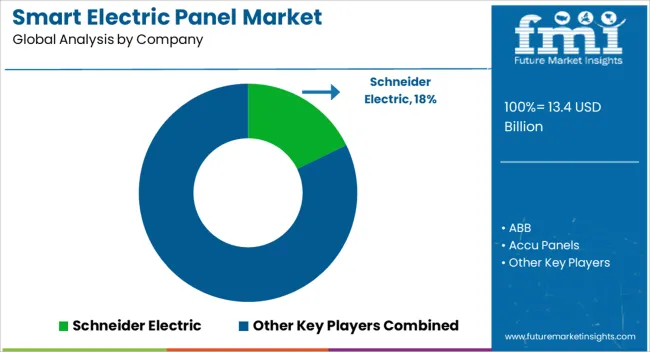

The Smart Electric Panel Market is estimated to be valued at USD 13.4 billion in 2025 and is projected to reach USD 27.1 billion by 2035, registering a compound annual growth rate (CAGR) of 7.3% over the forecast period. During this initial phase, annual growth increments range between USD 0.6 billion and USD 0.9 billion, indicating rising adoption driven by the demand for enhanced electrical distribution and safety features.

From 2025 to 2035, the market growth accelerates further, nearly doubling in value from USD 13.4 billion to USD 27.1 billion. Year-on-year increases gradually rise, with yearly gains ranging from USD 1.0 billion in the earlier years to about USD 1.8 billion toward the end of the decade. This consistent growth reflects expanding use of smart panels in residential, commercial, and industrial sectors, driven by needs for energy efficiency, load management, and integration with emerging electrical systems. The upward trend highlights the market’s growing significance in modern power infrastructure over the coming decade.

| Metric | Value |

|---|---|

| Smart Electric Panel Market Estimated Value in (2025 E) | USD 13.4 billion |

| Smart Electric Panel Market Forecast Value in (2035 F) | USD 27.1 billion |

| Forecast CAGR (2025 to 2035) | 7.3% |

The smart electric panel market is expanding rapidly, supported by global energy optimization efforts, advancements in home automation, and the growing need for real-time power monitoring. Electrification of infrastructure, integration of distributed energy resources, and emphasis on grid stability have elevated demand for intelligent load management solutions.

Governments and utilities are increasingly encouraging the adoption of energy-efficient components through mandates and incentives, while residential and commercial users are seeking greater control over consumption. Investments in IoT-enabled devices and interoperability frameworks have improved integration with renewable sources, backup systems, and EV chargers.

Future market development is expected to be driven by retrofit demand, especially in aging infrastructure and smart building upgrades, along with increased production of modular panels tailored for regional voltage standards.

The smart electric panel market is segmented by component, phase, technology, application, sales channel, and geographic regions. The smart electric panel market is divided into Hardware, Software, and Services. In terms of the phase, the smart electric panel market is classified into single-phase and three-phase. The smart electric panel market is segmented by technology into Wired and Wireless. The smart electric panel market is segmented into Residential, Commercial, and Industrial. The sales channel of the smart electric panel market is segmented into Online, Dealer, and Retail. Regionally, the smart electric panel industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

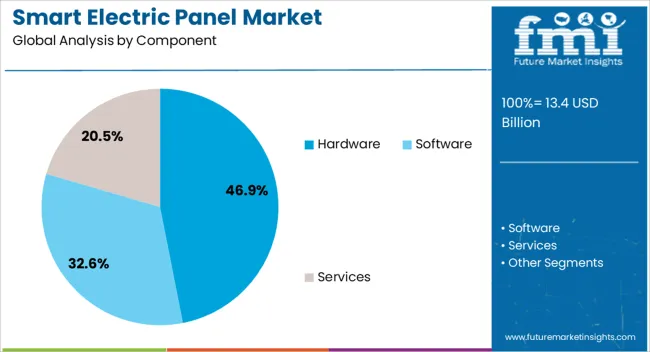

Hardware is projected to account for 46.90% of the total revenue in the smart electric panel market by 2025, making it the leading component category. This dominance is attributed to the tangible demand for sensors, controllers, breakers, and embedded processors that form the physical backbone of panel functionality.

As smart panels evolve to offer predictive diagnostics and load balancing, precision-engineered hardware is required to ensure operational integrity. The rise of intelligent circuit designs and compact form factors has reinforced demand in both residential and industrial installations.

Further, increased investments in domestic hardware manufacturing and advanced materials have improved product availability and lifecycle reliability, driving higher procurement volumes.

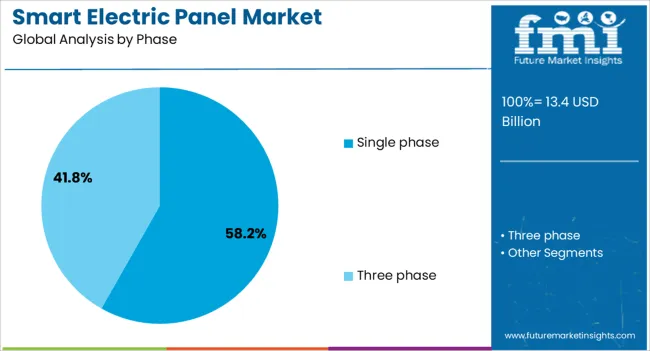

Single-phase smart electric panels are expected to contribute 58.20% of total market revenue in 2025, positioning this segment at the forefront by phase type. The segment’s leadership stems from widespread deployment across residential and small commercial spaces, where energy loads are comparatively lower but increasingly digitized.

Single-phase panels offer cost-efficient integration of monitoring modules and smart breakers, supporting functions like appliance-level control and solar inverter compatibility. The growing trend of smart home adoption, along with renovation activities in suburban and tier-II regions, has sustained demand for single-phase units.

Ease of installation, compatibility with distributed energy systems, and reduced space requirements further enhance their suitability in volume-driven markets.

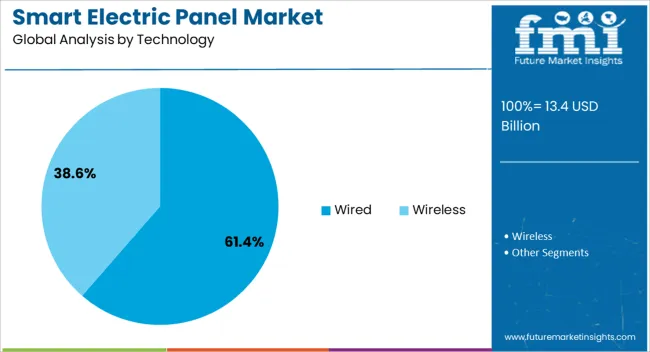

Wired technology is forecast to capture 61.40% of the smart electric panel market’s revenue share in 2025, making it the leading technology type. This segment’s strength is supported by superior transmission reliability, lower latency, and robust data security critical factors in power-sensitive applications.

Wired connections enable stable two-way communication with home energy management systems, load controllers, and utility platforms. The technology’s dominance is also reinforced by its compatibility with legacy systems, allowing partial upgrades without full panel replacement.

Industrial and commercial facilities, where uninterrupted monitoring and control are essential, continue to favor wired panels for safety and compliance. With rising cybersecurity regulations and edge-processing integration, wired smart panels offer a dependable foundation for scalable, long-term infrastructure planning.

The smart electric panel market is expanding as smart homes, buildings, and industrial facilities seek more efficient energy management and enhanced safety. These panels integrate digital technologies to monitor electrical usage, detect faults, and enable remote control, supporting energy conservation and predictive maintenance. Increasing electricity demand and regulatory pushes for smart grid adoption further drive growth. However, adoption is tempered by high upfront costs and technical integration challenges. Innovation in communication protocols and user-friendly interfaces continues to improve accessibility, making smart electric panels essential components of modern electrical infrastructure.

Growing emphasis on reducing energy consumption and optimizing electrical systems is propelling demand for smart electric panels. These panels provide real-time monitoring of electrical loads and enable users to manage power distribution intelligently, helping reduce waste and lower utility bills. Governments promoting energy-efficient infrastructure and building codes support market expansion. Moreover, smart panels facilitate integration with renewable energy sources and electric vehicles, enhancing grid flexibility. Energy management capabilities appeal to commercial and residential users alike, encouraging upgrades to traditional electrical panels and fostering more sustainable energy practices.

Despite clear benefits, widespread adoption of smart electric panels faces hurdles related to installation complexity and upfront investment. Integrating smart panels into existing electrical systems often requires technical expertise and may involve significant retrofitting costs. Additionally, the cost of advanced sensors, communication modules, and software platforms can be prohibitive, especially for small-scale users or in developing markets. Concerns about compatibility with legacy infrastructure and data security also slow adoption. To overcome these barriers, manufacturers are focusing on modular designs, plug-and-play solutions, and scalable pricing models that lower entry thresholds while maintaining advanced functionalities.

Recent innovations in communication technologies, such as IoT connectivity and wireless protocols, have significantly enhanced smart electric panels’ capabilities. Features like remote monitoring, fault detection, and automated alerts enable proactive maintenance and improve safety by quickly identifying electrical faults before they cause damage. Integration with smart meters and home automation systems provides comprehensive energy management solutions. Cloud-based analytics and mobile apps allow users to track consumption trends and control panels remotely, enhancing user convenience. Continuous R&D efforts are improving sensor accuracy and expanding panel features, positioning smart electric panels as critical enablers of intelligent energy ecosystems.

The global push towards smart grid deployment and modernization of electrical infrastructure is a key growth driver for the smart electric panel market. Utilities increasingly incorporate smart panels to enhance grid reliability, manage load balancing, and enable distributed energy resource integration. Infrastructure upgrades in emerging economies present significant opportunities, as governments seek to improve energy access and efficiency. Partnerships between panel manufacturers, utilities, and technology providers facilitate tailored solutions that meet regional requirements. As urbanization and electrification accelerate worldwide, smart electric panels are poised to play a vital role in transforming energy management and distribution.

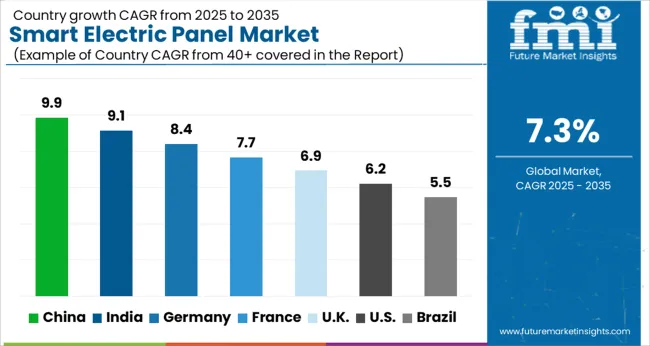

The global smart electric panel market is growing at a 7.3% CAGR, driven by rising demand for energy-efficient electrical distribution and smart grid technologies. China leads with 9.9% growth, supported by large-scale infrastructure development and adoption of smart technologies. India follows at 9.1%, fueled by increasing urbanization and modernization of electrical networks. Germany records 8.4% growth, reflecting stringent energy regulations and technological innovation. The United Kingdom grows at 6.9%, driven by investments in smart building solutions. The United States, a mature market, shows 6.2% growth, shaped by regulatory standards and integration with renewable energy systems. These countries collectively influence market trends through advancements in automation, safety features, and digital connectivity. This report includes insights on 40+ countries; the top countries are shown here for reference.

China smart electric panel market is advancing at a robust 9.9% CAGR as urbanization and industrial automation accelerate demand for advanced electrical infrastructure. The shift toward smart grids and energy-efficient systems fuels adoption of intelligent electric panels that offer remote monitoring, fault detection, and energy management. Compared to Western markets, China benefits from large-scale government investments in renewable energy integration and digital transformation projects. Industrial sectors such as manufacturing and construction are rapidly deploying smart panels to improve safety and reduce downtime. Growing residential demand for home automation and energy management systems also supports market expansion. Local manufacturers are innovating with cost-effective and customizable solutions to meet diverse customer needs. This dynamic environment positions China as a key driver in the global smart electric panel market landscape.

India smart electric panel market is growing at a strong 9.1% CAGR, propelled by expanding urban infrastructure and rising industrial automation. Government initiatives such as smart city programs and renewable energy targets boost deployment of smart electric panels capable of advanced monitoring and control. Compared to China, India’s market is marked by increasing private sector participation and investment in electrical modernization. Sectors like power generation, real estate, and manufacturing are key consumers of smart panels for energy optimization and safety enhancement. The rising focus on energy conservation and regulatory compliance encourages adoption of intelligent panels with remote diagnostics and load management. Increasing awareness among end-users about cost savings and operational efficiency further supports growth. Market players are focusing on tailored solutions that address local conditions and affordability.

Germany smart electric panel market is progressing at an 8.4% CAGR, supported by strong industrial automation and energy transition efforts. Germany’s commitment to Energiewende and reduction of carbon emissions drives adoption of smart panels for grid modernization and integration of renewable energy sources. Compared to Asian markets, Germany emphasizes high-quality standards and interoperability in smart panel solutions. Industrial facilities leverage intelligent panels for real-time monitoring, predictive maintenance, and improved energy efficiency. Residential adoption is also increasing with smart home technologies gaining popularity. Regulatory frameworks promote smart metering and energy management systems, facilitating broader market penetration. Collaboration between electrical equipment manufacturers and software providers enhances innovation in smart panel functionalities. Overall, Germany maintains a steady market with balanced growth across industrial and residential segments.

United Kingdom smart electric panel market is expanding at a 6.9% CAGR, driven by rising investments in energy efficiency and smart infrastructure upgrades. The UK government’s clean energy policies encourage adoption of smart panels that support renewable energy integration and grid resilience. Compared to Germany, the UK market shows faster growth in residential and commercial segments focused on energy management and demand response. Industrial users seek advanced electric panels to improve operational reliability and reduce energy costs. The rise of electric vehicles and distributed energy resources increases demand for intelligent load management. Digital solutions enabling remote monitoring and fault detection enhance system reliability. Market growth is supported by collaborations between utility companies, manufacturers, and technology providers focused on smart grid initiatives.

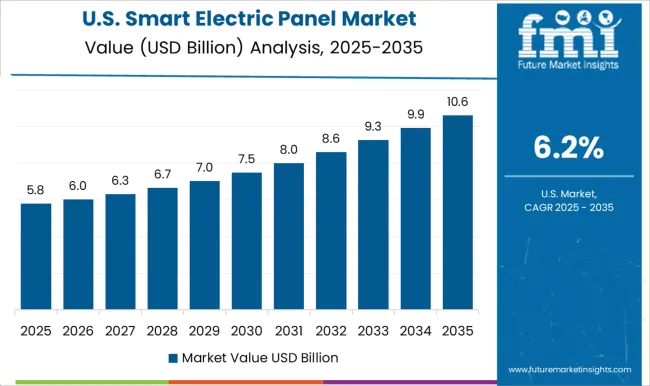

United States smart electric panel market is growing at a 6.2% CAGR, propelled by rapid technological innovation and focus on energy optimization. USA industries are investing in smart panels for enhanced monitoring, automation, and fault detection to improve safety and operational efficiency. Compared to European markets, the USA has a strong emphasis on integrating smart electric panels with IoT and cloud-based platforms for real-time data analytics. Residential adoption is increasing as smart homes and energy management systems gain popularity. Utility companies implement smart panels to support grid modernization and renewable integration. Regulatory incentives for energy efficiency and sustainability further encourage market growth. The presence of established manufacturers and startups fosters continuous innovation, positioning the USA as a competitive market in smart electric panel technology.

The smart electric panel market is undergoing significant transformation as demand for energy-efficient, connected, and intelligent electrical distribution systems surges globally. Schneider Electric and Siemens are at the forefront, leveraging their extensive expertise in automation and digital energy management to provide advanced smart panels that integrate seamlessly with building management systems.

ABB and Eaton also hold strong market positions, offering scalable solutions with robust safety features and real-time energy monitoring, catering to industrial, commercial, and residential sectors. Emerging players such as EcoFlow Technology and SPAN are innovating rapidly, focusing on residential smart panels designed for seamless integration with renewable energy sources like solar power and home energy storage systems.

Companies like Chint Group and Havells India are capitalizing on growing demand in Asia, providing cost-effective smart panel solutions tailored for regional markets. Meanwhile, Honeywell International, Emerson Electric, and Rockwell Automation leverage their broad automation portfolios to enhance smart panel functionality through IoT connectivity and predictive analytics. The competitive landscape also includes companies like Legrand, Leviton Manufacturing, and General Electric, which offer a blend of traditional electrical equipment expertise and new smart technologies.

Accu Panels and Qmerit Electrification focus on niche customization and installation services, adding value through tailored smart panel solutions. This dynamic ecosystem reflects a convergence of established industrial giants and innovative disruptors driving the market toward more intelligent, sustainable, and user-centric electrical distribution systems.

Manufacturers are focusing on developing customizable and scalable smart electric panels that can adapt to the specific needs of residential, commercial, and industrial sectors. For example, modular designs allow businesses and homeowners to add additional circuits, breakers, or energy monitoring modules as needed, providing a flexible solution for growing energy requirements. These modular systems also allow for easier upgrades and expansions, ensuring the panel can meet evolving needs.

| Item | Value |

|---|---|

| Quantitative Units | USD 13.4 Billion |

| Component | Hardware, Software, and Services |

| Phase | Single phase and Three phase |

| Technology | Wired and Wireless |

| Application | Residential, Commercial, and Industrial |

| Sales Channel | Online, Dealer, and Retail |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Schneider Electric, ABB, Accu Panels, Chint Group, Eaton, EcoFlow Technology, Emerson Electric, General Electric, Hager Group, Havells India, Honeywell International, Legrand, Leviton Manufacturing, Lumin, Qmerit Electrification, Rockwell Automation, Siemens, and SPAN |

| Additional Attributes | Dollar sales in the Smart Electric Panel Market vary by type (residential, commercial, industrial), application (energy management, load monitoring, safety), component (hardware, software, services), and region (North America, Europe, Asia-Pacific). Growth is driven by rising smart grid adoption, energy efficiency regulations, and increasing demand for automated electrical systems. |

The global smart electric panel market is estimated to be valued at USD 13.4 billion in 2025.

The market size for the smart electric panel market is projected to reach USD 27.1 billion by 2035.

The smart electric panel market is expected to grow at a 7.3% CAGR between 2025 and 2035.

The key product types in smart electric panel market are hardware, software and services.

In terms of phase, single phase segment to command 58.2% share in the smart electric panel market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Smart Electric Meter Market Analysis – Size, Trends & Forecast 2025 to 2035

RF Smart Electric Meter Market Size and Share Forecast Outlook 2025 to 2035

Electrical Sub Panels Market Size and Share Forecast Outlook 2025 to 2035

Residential RF Smart Electric Meter Market Size and Share Forecast Outlook 2025 to 2035

Smart Meeting Pod Market Size and Share Forecast Outlook 2025 to 2035

Smart Electrogastrogram Recorder Market Size and Share Forecast Outlook 2025 to 2035

Smart Aerial Work Robots Market Size and Share Forecast Outlook 2025 to 2035

Smart Bladder Scanner Market Size and Share Forecast Outlook 2025 to 2035

Smart School Bus Platform Market Size and Share Forecast Outlook 2025 to 2035

Smart Home Wireless Smoke Detector Market Size and Share Forecast Outlook 2025 to 2035

Smart Bus Platform Market Size and Share Forecast Outlook 2025 to 2035

Smart Vision Processing Chips Market Size and Share Forecast Outlook 2025 to 2035

Smart Touch Screen Scale Market Size and Share Forecast Outlook 2025 to 2035

Electric Aircraft Onboard Sensors Market Size and Share Forecast Outlook 2025 to 2035

Smart Magnetic Drive Conveyor System Market Size and Share Forecast Outlook 2025 to 2035

Smart Wheelchair market Size and Share Forecast Outlook 2025 to 2035

Smart Mining Technologies Market Size and Share Forecast Outlook 2025 to 2035

Electrical Label Market Size and Share Forecast Outlook 2025 to 2035

Electric Round Sprinklers Market Size and Share Forecast Outlook 2025 to 2035

Electric Cloth Cutting Scissors Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA