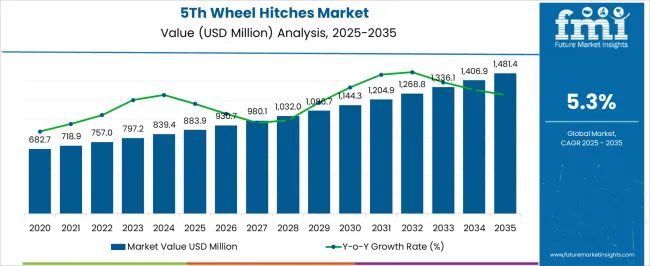

The 5th wheel hitches market is projected to grow from USD 883.9 million in 2025 to USD 1,481.4 million by 2035, registering a compound annual growth rate (CAGR) of 5.3%. This expansion reflects a consistent upward trajectory in both consumer adoption and commercial utilization, driven by increasing preferences for recreational vehicles, long-haul transportation efficiency, and towing safety enhancements.

The market demonstrates a strong growth pattern, with incremental yearly gains observed across the forecast period. Starting from USD 682.7 million in 2020, values advanced steadily through USD 718.9 million in 2021, USD 757.0 million in 2022, USD 797.2 million in 2023, USD 839.4 million in 2024, and reached the base value of USD 883.9 million in 2025. Beyond this point, growth continues at a similar cadence, moving to USD 930.7 million in 2026 and progressively reaching USD 980.1 million, USD 1,032.0 million, USD 1,086.7 million, and USD 1,144.3 million in subsequent years.

By 2030, the market crosses USD 1,204.9 million, climbing to USD 1,268.8 million, USD 1,336.1 million, and USD 1,406.9 million, before achieving USD 1,481.4 million in 2035. The steady compound absolute growth underscores the increasing reliance on high-quality towing solutions, improved hitch engineering, and widespread adoption across recreational and commercial transport sectors.

| Metric | Value |

|---|---|

| 5Th Wheel Hitches Market Estimated Value in (2025 E) | USD 883.9 million |

| 5Th Wheel Hitches Market Forecast Value in (2035 F) | USD 1481.4 million |

| Forecast CAGR (2025 to 2035) | 5.3% |

The 5th wheel hitches market occupies a distinct segment across multiple parent domains, with shares influenced by towing adoption and vehicle integration. Within the recreational vehicle (RV) accessories market, 5th wheel hitches account for nearly 18 to 20%, as they are essential for travel trailers and motorhomes, providing stability and safety during long-distance towing. In the trailer and towing equipment market, their share is about 12 to 14%, reflecting their role alongside ball hitches, gooseneck hitches, and couplers for heavy-duty towing requirements.

The automotive aftermarket components market shows a smaller portion, with 5th wheel hitches representing roughly 8 to 9%, driven by retrofitting, replacement, and custom installation in trucks and SUVs. Within the commercial and fleet vehicle accessories market, their contribution stands at 6 to 7%, primarily used in utility trailers, construction equipment transport, and cargo mobility, where robust towing solutions are required. In the light and medium-duty truck components market, 5th wheel hitches hold about 10 to 11%, integrated with chassis and suspension systems to ensure towing performance and vehicle safety.

The market is experiencing strong demand growth, supported by the rising adoption of recreational vehicles, heavy-duty trailers, and commercial transport solutions. Market expansion is being shaped by technological advancements in hitch design, which have enhanced safety, ease of installation, and compatibility with a wider range of towing vehicles. The increasing preference for long-distance travel and outdoor leisure activities has driven demand from both personal and commercial users.

Additionally, infrastructure improvements, growth in the RV rental industry, and heightened safety regulations for towing systems are influencing product innovation and purchase decisions. The shift towards user-friendly, durable, and maintenance-efficient hitch systems has also encouraged replacement demand in established markets.

As consumer awareness regarding towing safety and operational efficiency grows, the market is expected to continue its upward trajectory. Strategic product launches, customization options, and integration of advanced materials are further anticipated to strengthen market penetration across diverse towing applications.

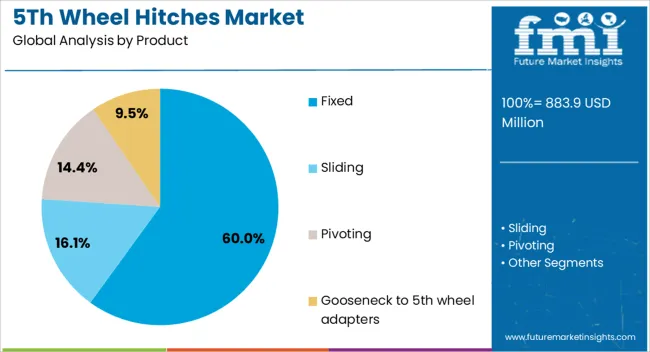

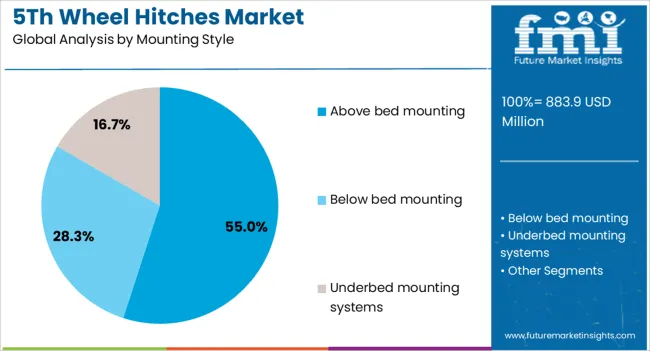

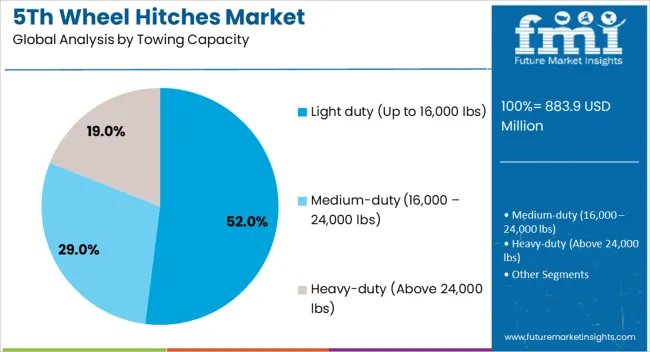

The 5th wheel hitches market is segmented by product, mounting style, towing capacity, application, end use, sales channel, and geographic regions. By product, 5th wheel hitches market is divided into Fixed, Sliding, Pivoting, and Gooseneck to 5th wheel adapters. In terms of mounting style, 5th wheel hitches market is classified into Above bed mounting, Below bed mounting, and Underbed mounting systems. Based on towing capacity, 5th wheel hitches market is segmented into Light duty (Up to 16,000 lbs), Medium-duty (16,000 – 24,000 lbs), and Heavy-duty (Above 24,000 lbs). By application, 5th wheel hitches market is segmented into Recreational vehicles (RVs), Commercial trailers, Agricultural trailers, and Construction equipment transport.

By end use, 5th wheel hitches market is segmented into Individual consumers, Logistics & transportation companies, Construction & infrastructure firms, and Agriculture sector. By sales channel, 5th wheel hitches market is segmented into OEM (Original equipment manufacturer) and Aftermarket. Regionally, the 5th wheel hitches industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The fixed product segment is projected to hold 60% of the 5th Wheel Hitches market revenue share in 2025, making it the leading product category. This dominance is being driven by the segment’s robust structural design, which offers long-term durability and reliability under heavy towing loads. Fixed hitches provide consistent towing stability, which is valued in both commercial and personal applications where safety and predictable performance are critical.

The relatively lower maintenance requirements and cost efficiency of fixed designs have supported their preference among fleet operators and individual consumers. Their compatibility with a wide range of towing setups, coupled with straightforward installation processes, has further enhanced their market position.

Growing awareness of towing safety standards has reinforced adoption, as fixed hitches often exceed baseline requirements. These factors, along with the increasing prevalence of heavy trailer use in freight, agriculture, and recreational travel, are contributing to the sustained leadership of the fixed product segment.

The above bed mounting style segment is expected to account for 55% of the 5th Wheel Hitches market revenue share in 2025, positioning it as the leading mounting style. This preference is attributed to its ease of installation, broad compatibility with existing truck bed configurations, and cost-effectiveness compared to alternative mounting solutions. Above bed systems enable straightforward connection and disconnection of the trailer, making them highly practical for users who frequently switch between towing and standard vehicle use.

The segment’s adoption has been bolstered by its proven safety performance, as it maintains strong structural integrity during operation. Additionally, the availability of aftermarket kits and accessories for above bed systems has facilitated customization, meeting a wide range of user requirements.

The flexibility to retrofit these systems into older vehicles has also expanded their appeal. Combined with their balance of performance, affordability, and ease of use, above-bed mounting styles continue to dominate user preference in this market.

The light duty towing capacity segment, defined as up to 16,000 lbs, is anticipated to hold 52% of the 5th Wheel Hitches market revenue share in 2025, making it the dominant capacity range. Its market leadership has been supported by the increasing use of mid-size and half-ton pickup trucks for towing purposes, which are well-matched to light duty hitch systems.

This capacity range meets the requirements of a large portion of recreational and small commercial users, including those towing RVs, small livestock trailers, and utility trailers. The lighter weight design of these hitches often results in improved fuel efficiency and reduced strain on the towing vehicle, which appeals to cost-conscious consumers.

Their ease of handling during installation and operation further drives adoption. As vehicle manufacturers continue to expand the towing capabilities of consumer-grade trucks, the light-duty segment is positioned to retain its strong market share by aligning performance with the needs of a broad user base.

Fifth wheel hitches are being adopted for stable towing across recreational, commercial, and agricultural segments, supported by factory prep beds, dealer installs, and training content that eases first use. Constraints center on weight, payload trade offs, installation time, and the added complexity of short bed solutions, with supply variability adding planning risk. Upside appears in lighter modular designs, quick engagement features, damping elements, and bundled accessories that raise confidence and reduce coupling errors. Clear trends include stronger safety signaling, better coatings, regional parts hubs, and digital fitment tools. Providers delivering verified performance and fast support are positioned to win.

Adoption is being propelled by growth in recreational towing, commercial hauling, and specialty transport where stable articulation and high pin weight capacity are required. Recreational trailers, toy haulers, and horse trailers are being paired with pickup trucks prepared at the factory for bed mounting, which simplifies dealer fitment and shortens delivery time. Construction and agriculture fleets value smooth pivoting heads, cushioned pin boxes, and tighter tolerances that limit chucking under variable loads. Quick hookup, repeatable latch feedback, and clear sight lines are being requested to reduce coupling errors. OEM companies promote factory prep packages that accept drop in hitches without bed drilling, encouraging buyers to select approved systems during vehicle purchase. E commerce channels expand reach with fitment guides, video walkthroughs, and bundled wiring kits, reinforcing confidence for first time users. As towing activity diversifies, fifth wheel layouts are being favored for stability, control, and predictable highway manners.

Barriers persist around total installed cost, payload impact, and installation complexity on mixed truck fleets. Heavy assemblies reduce available cargo capacity and can shift axle balance if selection is not precise for trailer geometry. Short bed pickups often require sliding mechanisms or offset solutions, which add weight, height, and moving parts that demand maintenance. Drilling through bed structures, routing harnesses, and confirming torque specifications extend install time and raise labor exposure for small shops. Noise, rattle, and premature wear occur when bed deflection, rail alignment, or pin height are not tuned to the trailer. Confusion between gooseneck and fifth wheel interfaces leads to mismatched hardware and returns. Insurance, liability, and warranty terms require clear documentation, which smaller resellers may not provide consistently. Steel and casting availability, coating capacity, and long lead times on specialty fasteners keep inventories tight, pushing buyers to plan well ahead of seasonal peaks.

Market direction points to stronger emphasis on verified coupling, corrosion defense, and channel diversification. Positive lock indicators, secondary latches, and clearer jaw geometry are being prioritized to reduce drop risk during tight maneuvers. Materials are shifting toward optimized castings, formed plate structures, and improved coatings that resist abrasion, road chemicals, and winter conditions. Height adjustability with indexed settings and repeatable torque targets shortens setup variance between technicians. Online configurators that combine truck trims, bed lengths, and trailer parameters are being adopted to minimize misorders. Regional warehousing for rails, brackets, and sliders reduces lead time during peak towing seasons. Refurbishment and inspection programs for used units are gaining attention among budget buyers. Training content for dealers and rental operators is expanding, with checklists for coupling, breakaway testing, and periodic fastener audits. Vendors offering documented fitment, responsive parts support, and proven coating performance gain preferred status.

Clear opportunity exists in lighter, modular hitches designed for factory prep puck systems and underbed rails that preserve a clean bed when the unit is removed. Quick release handles, guided jaws, and high visibility engagement indicators reduce miscoupling risk and build user confidence. Integrated damping elements, torsion heads, and poly bushings are being specified to limit fore aft chucking and vertical shock, which improves comfort in long distance hauling. Short bed friendly packages with low profile sliders or rotating pin solutions expand the addressable base without major compromises. Accessory ecosystems such as lockable pins, bed cameras, torque tools, and plug and play harnesses create margin and simplify the upsell journey. Dealer programs that bundle hitch, install, and first service attract novice owners. Fleet and rental yard conversions support standardized hardware across trucks and trailers, improving training and reducing downtime when equipment is rotated between duty cycles.

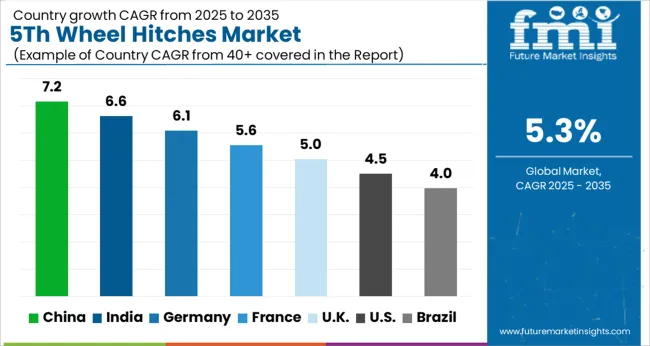

| Country | CAGR |

|---|---|

| China | 7.2% |

| India | 6.6% |

| Germany | 6.1% |

| France | 5.6% |

| UK | 5.0% |

| USA | 4.5% |

| Brazil | 4.0% |

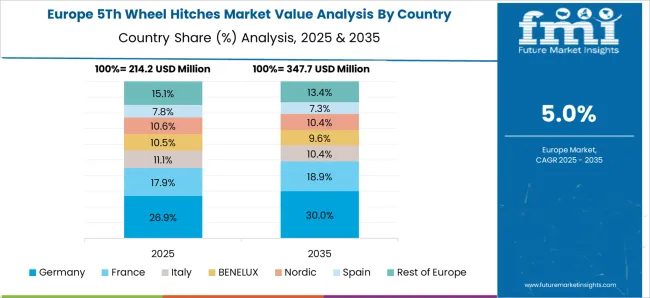

The 5th wheel hitches market is projected to grow globally at a CAGR of 5.3% from 2025 to 2035. China leads with 7.2%, followed by India at 6.6% and France at 5.6%, while the UK grows at 5.0% and the USA posts 4.5%. China and India show strong growth premiums of +1.9% and +1.3% above baseline, driven by heavy-duty truck production, expanding logistics networks, and rising RV adoption. France benefits from European safety standards and recreational vehicle usage, while the UK records steady growth through fleet and leisure applications. The USA maintains high-value demand with pickup trucks and RVs dominating market uptake. The analysis includes over 40+ countries, with the leading markets detailed below.

The 5th wheel hitches market in China is projected to expand at a CAGR of 7.2% from 2025 to 2035, representing the fastest growth among the profiled countries. Rising commercial vehicle production, particularly in heavy-duty trucks and logistics fleets, is fueling significant demand. Domestic manufacturers are increasingly adopting high-strength steel and modular designs to cater to both freight and recreational towing segments. Technological upgrades, such as adjustable coupling systems and weight-distribution enhancements, are being integrated to improve safety and vehicle handling. Strong infrastructure development and government policies promoting domestic manufacturing are further supporting market expansion. The increasing popularity of RVs and recreational trailers is also driving adoption among leisure consumers.

The 5th wheel hitches market in India is expected to grow at a CAGR of 6.6% between 2025 and 2035. Market growth is supported by rising logistics and commercial vehicle activity across Tier-1 and Tier-2 cities. Adoption in pickup trucks and trailers is increasing, particularly in small and mid-sized enterprises. Domestic suppliers dominate the sector, though collaborations with global manufacturers are enhancing product quality and feature sets. Consumer awareness regarding towing safety and vehicle stability is increasing demand for advanced hitch systems. Expanding road networks and rural-to-urban transportation requirements are also contributing to steady growth.

The 5th wheel hitches market in France is projected to grow at a CAGR of 5.6% from 2025 to 2035. Growth is driven by recreational vehicle usage and commercial trailer operations. European safety standards are influencing design, with features such as automatic locking, load-sensing couplers, and corrosion-resistant coatings gaining traction. Domestic suppliers collaborate with Tier-1 automotive manufacturers to produce high-quality hitches compatible with premium trucks and RVs. The market is also supported by aftermarket sales for replacement and upgrades, particularly for leisure vehicles.

The 5th wheel hitches market in the UK is forecast to grow at a CAGR of 5.0% between 2025 and 2035. The market benefits from strong commercial fleet activity and recreational trailer usage. Import dependence is notable, though domestic production of specialized hitches for high-end vehicles is growing. Safety-focused design features, including anti-sway and locking mechanisms, are increasingly adopted in both commercial and recreational segments. The trend of lightweight yet durable hitches aligns with modern vehicle towing requirements and supports expanding consumer interest.

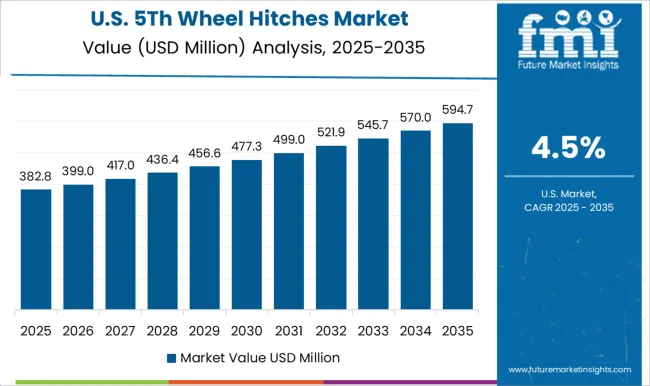

The 5th wheel hitches market in the United States is expected to grow at a CAGR of 4.5% from 2025 to 2035. Growth is anchored in the popularity of pickup trucks, heavy-duty trailers, and recreational vehicles. Domestic manufacturers focus on durable, high-strength materials, while imported products provide cost-effective solutions for mid-range vehicles. Aftermarket and replacement sales remain significant, as users frequently upgrade to advanced coupling and weight-distribution systems. Increasing RV travel and leisure towing are further driving adoption, while safety standards ensure continuous product innovation.

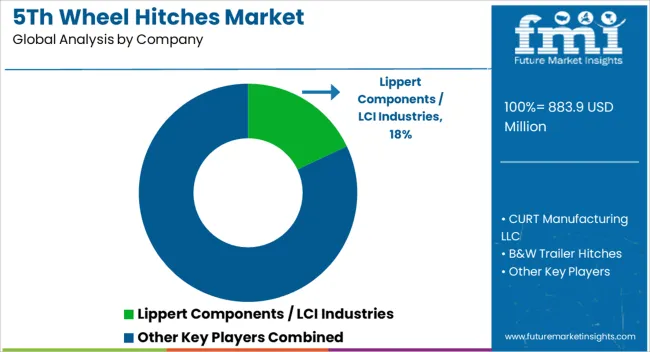

Competition in the 5th wheel hitches sector has been shaped by mechanical design, towing capacity, installation flexibility, and safety features, with manufacturers focusing on both recreational and commercial vehicle segments. Lippert Components / LCI Industries has established a prominent position by providing versatile hitch systems that combine integrated shock absorption, simplified installation mechanisms, and compatibility across a wide range of RV models. CURT Manufacturing LLC has concentrated on heavy-duty hitches designed for robust towing, offering adjustable jaws, corrosion-resistant coatings, and precision-engineered locking mechanisms that enhance reliability and performance. B&W Trailer Hitches has leveraged innovative kingpin designs, quick-release systems, and modular mounting options to cater to both consumer and commercial applications, ensuring safety and convenience. Demco has emphasized user-friendly designs, stability under load, and low-maintenance solutions suitable for long-haul operations as well as recreational towing, reinforcing its appeal among a broad customer base. Andersen / Blue Ox has strengthened competitiveness through lightweight yet durable hitches, modular components, and intuitive installation systems tailored to diverse trailers and truck models. PullRite / Pulliam Enterprises has differentiated itself with high-capacity hitches that feature self-aligning jaws, anti-sway technology, and precision manufacturing standards, enhancing towing safety and handling.

| Item | Value |

|---|---|

| Quantitative Units | USD 883.9 Million |

| Product | Fixed, Sliding, Pivoting, and Gooseneck to 5th wheel adapters |

| Mounting Style | Above bed mounting, Below bed mounting, and Underbed mounting systems |

| Towing Capacity | Light duty (Up to 16,000 lbs), Medium-duty (16,000 – 24,000 lbs), and Heavy-duty (Above 24,000 lbs) |

| Application | Recreational vehicles (RVs), Commercial trailers, Agricultural trailers, and Construction equipment transport |

| End Use | Individual consumers, Logistics & transportation companies, Construction & infrastructure firms, and Agriculture sector |

| Sales Channel | OEM (Original equipment manufacturer) and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Lippert Components / LCI Industries, CURT Manufacturing LLC, B&W Trailer Hitches, Demco, Andersen / Blue Ox, PullRite / Pulliam Enterprises, Reese / Horizon Global, and Others |

| Additional Attributes | Dollar sales by product type, including fixed, sliding, and integrated pin box hitches, and by mounting type, covering bed-mounted, rail-mounted, and custom solutions. End-use sales span recreational RV towing, commercial transport, and specialty trailers. Demand is driven by rising RV adoption, long-distance travel, and commercial hauling needs. North America leads in adoption, while Europe and Asia Pacific show gradual growth supported by trailer compatibility improvements and aftermarket infrastructure. |

The global 5th wheel hitches market is estimated to be valued at USD 883.9 million in 2025.

The market size for the 5th wheel hitches market is projected to reach USD 1,481.4 million by 2035.

The 5th wheel hitches market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in 5th wheel hitches market are fixed, _standard fixed, _heavy-duty fixed, sliding, _manual sliding, _automatic sliding, pivoting, _single pivot, _multi-axis pivot and gooseneck to 5th wheel adapters.

In terms of mounting style, above bed mounting segment to command 55.0% share in the 5th wheel hitches market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wheeled Bins Market Size and Share Forecast Outlook 2025 to 2035

Wheel Loader Scales Market Size and Share Forecast Outlook 2025 to 2035

Wheel Excavator Market Size and Share Forecast Outlook 2025 to 2035

Wheel Loader Market Size and Share Forecast Outlook 2025 to 2035

Wheel Balancing Market Size and Share Forecast Outlook 2025 to 2035

Wheel Aligner Equipment Market Size and Share Forecast Outlook 2025 to 2035

Wheel Tractor Scrapers Market Size and Share Forecast Outlook 2025 to 2035

Wheeled Insulated Cooler Market Trends - Growth & Demand Forecast 2025 to 2035

Competitive Breakdown of Wheeled Bin Providers

Germany Wheeled Bin Industry Analysis – Growth & Outlook 2024-2034

Wheelchair Market Analysis – Size, Share & Forecast 2024-2034

Wheel studs Market

3-Wheel Sit-Down Counterbalance Forklift Market Size and Share Forecast Outlook 2025 to 2035

4-Wheel Sit-Down Counterbalance Forklift Market Size and Share Forecast Outlook 2025 to 2035

4-Wheel Mobility Scooters Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Competitive Overview of 4-Wheeled Container Companies

4-Wheeled Container Market Trends – Size, Demand & Forecast 2024-2034

Flywheel Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Two-Wheeler Lubricants Market Size and Share Forecast Outlook 2025 to 2035

Two Wheeler Anti-lock Braking System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA