The adaptogen drink market is experiencing steady growth, driven by rising consumer demand for natural, functional beverages that support overall wellness. With increasing awareness of the stress-relieving, immune-boosting, and energizing benefits of adaptogens, the demand for drinks containing these ingredients is growing rapidly.

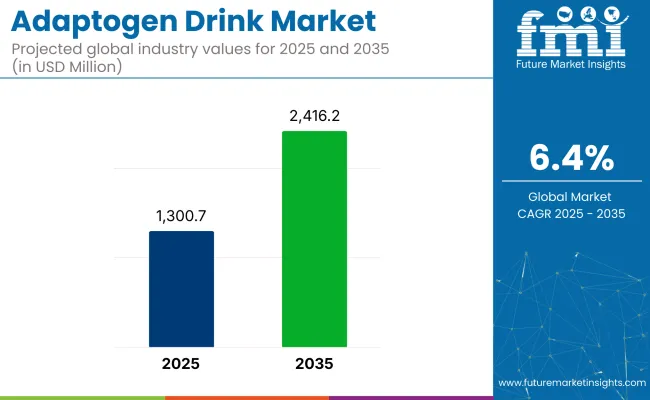

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 1,300.7 million |

| Projected Market Size in 2035 | USD 2,416.2 million |

| CAGR (2025 to 2035) | 6.4% |

Blended adaptogens and mushrooms are particularly popular due to their versatility and health benefits. The use of adaptogens in ready-to-drink (RTD) beverages is also gaining traction, as consumers shift towards convenient health products. Growth is being seen in North America, Europe, and Asia, especially in markets like India, where adaptogen-based products are becoming a part of mainstream wellness trends.

In a 2024 interview with LA Times, Nikita Walia, CEO of BLANK, highlighted the appeal of adaptogen drinks, stating, “For those folks, the possibility of a physical effect tends to be enticing. ‘So you’re telling me I can drink this nightcap and it will help me feel relaxed, but I won’t be intoxicated?’ Yep!” This emphasizes the growing consumer interest in adaptogens as a natural alternative for relaxation without the effects of alcohol.

The adaptogen drink market represents a small but growing segment within its parent markets. In the functional beverages market, it holds approximately 3-5%, driven by increasing consumer interest in drinks that offer health benefits like stress reduction and enhanced energy. Within the herbal supplements market, adaptogen drinks contribute around 1-2%, as they are often marketed alongside other herbal wellness products.

In the natural and organic products market, its share is about 2-3%, reflecting the demand for clean-label, plant-based solutions. In the health and wellness market, the share is approximately 4-6%, driven by the trend toward holistic well-being. Within the functional foods market, adaptogen drinks account for about 2-4%, as they blend nutritional benefits with functional health properties, particularly for mental and physical performance.

The adaptogen drink market is expected to continue its expansion with the rising consumer trend for healthier, functional beverages, and the increasing shift towards plant-based and natural wellness products.

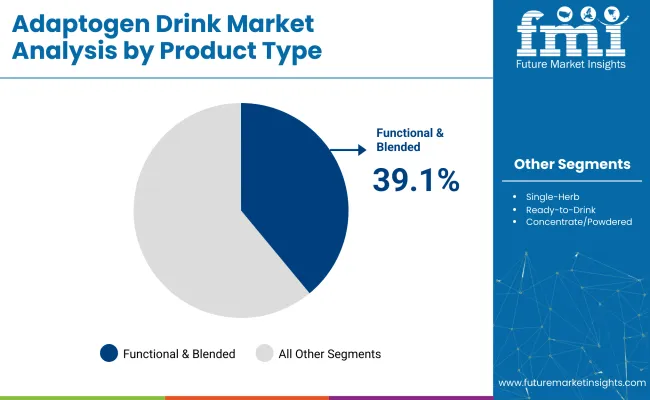

The adaptogen drink market has been segmented by product type into single-herb adaptogens, blended adaptogens, functional adaptogens, ready-to-drink adaptogens, and concentrate/powdered adaptogens.

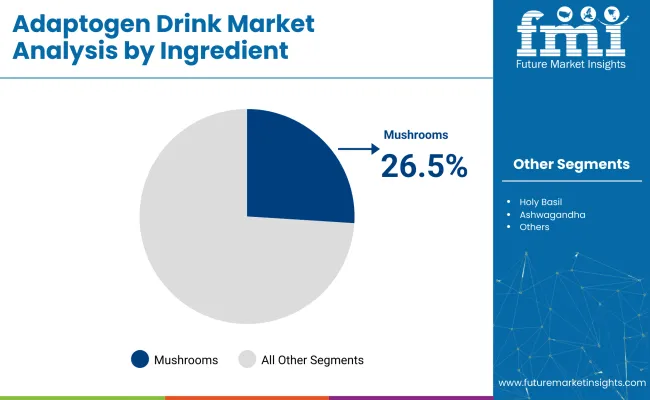

By ingredients into holy basil, ashwagandha, lavender, mushrooms, and maca; by sales channel into store-based retailing including modern trade, hospital pharmacies, retail pharmacies, and drug stores, and online pharmacies; by region into North America, Latin America, Eastern Europe, Western Europe, East Asia, South Asia & Pacific, Central Asia, Balkan and Baltic countries, Russia & Belarus, and Middle East & Africa.

The functional & blended adaptogensegment is projected to dominate the Adaptogen Drink market, capturing 39.1% of the market share in 2025. This category includes beverages that combine multiple adaptogens to enhance the overall health benefits, providing consumers with drinks that offer improved energy levels, reduced stress, and immune support.

The growing consumer preference for multifunctional wellness products is driving the demand for blended adaptogen drinks. These drinks are particularly popular among consumers seeking holistic wellness solutions that can be easily incorporated into their daily routines. With the increasing demand for natural alternatives to energy drinks and sugary sodas, this segment is expected to continue growing.

The mushrooms segment is expected to account for 26.5% of the Adaptogen Drink market in 2025. Mushrooms, particularly varieties like reishi, lion’s mane, and cordyceps, are increasingly being used in adaptogen beverages due to their cognitive-enhancing, stress-reducing, and immune-boosting properties.

As consumers become more aware of the health benefits of functional mushrooms, their popularity in the adaptogen drink market is growing. This segment is especially strong in regions with a high focus on natural and plant-based health solutions. Mushrooms are often used in blended adaptogen drinks for their ability to complement other adaptogenic ingredients like ashwagandha and holy basil.

Store-based retailing is projected to capture 50% of the adaptogen drink market share in 2025. This includes sales through modern trade, specialty retailers, and drugstores, offering consumers the opportunity to directly purchase adaptogen drinks.

The preference for physical retail outlets is driven by the tactile experience, where consumers can engage with product displays, ask questions, and sample products before making purchases. Additionally, the growing presence of health food stores and organic retailers supports the popularity of adaptogen drinks. However, online retailing is steadily gaining traction, offering convenience and direct-to-consumer options for health-conscious individuals.

The adaptogen drink market is fueled by growing consumer interest in wellness beverages and functional drinks. However, challenges like regulatory hurdles and consumer skepticism about the effectiveness of adaptogens may restrict market expansion.

Rising Consumer Demand for Wellness and Functional Beverages

The adaptogen drink market is experiencing significant growth, driven by a rising consumer shift toward health-focused products. With increasing emphasis on both physical and mental well-being, functional beverages offering benefits such as stress relief, improved energy, and enhanced immunity are becoming more popular. Adaptogen drinks, incorporating natural ingredients like ashwagandha, holy basil, and various mushrooms, are particularly in demand due to their perceived wellness benefits.

This trend is further fueled by the growing popularity of plant-based and organic alternatives, as consumers seek healthier options compared to sugary sodas and traditional energy drinks. The market for adaptogen-infused beverages is poised to continue thriving due to this demand for natural, functional solutions.

Regulatory Hurdles and Consumer Skepticism

Despite strong growth potential, the Adaptogen Drink market faces significant challenges, primarily related to regulatory hurdles and consumer skepticism surrounding the efficacy of adaptogens. In regions like the USA and Europe, these products often face regulatory scrutiny regarding health claims and approval for inclusion in food and beverages.

While the market continues to expand, many consumers remain unconvinced about the actual benefits of adaptogens, as scientific evidence supporting their health claims is still developing. This ongoing uncertainty could slow adoption rates, particularly in conservative regions with stringent health product regulations. As these factors persist, they may impede the rapid growth of the adaptogen drink market.

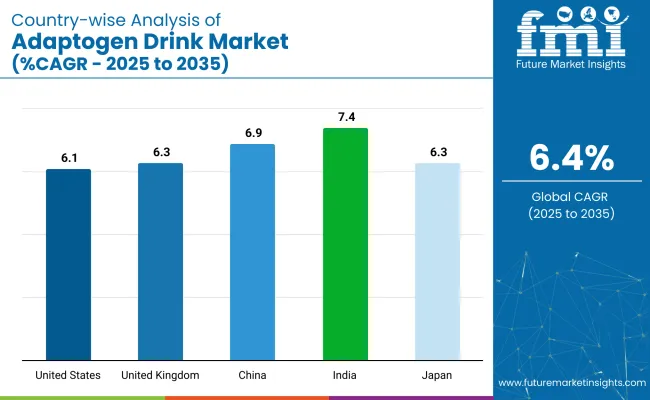

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 6.1% |

| United Kingdom | 6.3% |

| China | 6.9% |

| India | 7.4% |

| Japan | 6.3% |

The adaptogen drink market is expanding globally at a CAGR of 6.4% through 2035, with BRICS and ASEAN regions outperforming traditional OECD markets. India leads all countries with a CAGR of 7.4%, driven by an expanding middle class and growing demand for functional beverages in urban centers.

China, at 6.9%, is experiencing rapid growth due to consumer trust in herbal ingredients and a well-established tea culture transitioning into adaptogen-infused formats. Among OECD countries, Germany (6.6%) and Japan (6.3%) are seeing rising interest in functional drinks aimed at mental clarity and aging health, respectively.

The USA market, growing at 6.1%, remains a key contributor, especially as wellness trends shape beverage innovation. Japan also aligns with ASEAN+6 dynamics, contributing to regional growth momentum. Overall, the shift in demand from traditional markets to BRICS and ASEAN economies indicates a structural reorientation in the global adaptogen drink landscape.

The United States adaptogen drink market is projected to grow at a CAGR of 6.1% over the forecast period as per FMI 2025. Domestic transportation costs 14.2% below the global average have supported favorable margins as per USD A Report 2025 though compliance with FDA ingredient disclosure regulations raises per unit costs by USD 0.12 as per FDA 2025.

Online sales of functional beverages increased by 370 basis points between 2022 and 2024 reflecting a structural shift toward e commerce. Consumer behavior in the United States has also shifted with 73% of Americans preferring beverages with clean label formulations in 2024 as per IFIC Survey 2025. This aligns with strong retail expansion and product innovation in health focused beverage categories.

Demand for adaptogen drink in the United Kingdom is set to grow at a CAGR of 6.3% from 2025 to 2035 as per FMI 2025. Margin benefits are supported by proximity based sourcing from EU suppliers saving up to 11.6% on logistics versus Asia based sourcing as per DEFRA 2025.

However post Brexit compliance costs averaging USD 0.15 per product for phytosanitary clearances have negatively impacted profitability as per UK Food Standards Agency 2025. A 410 basis point increase in online health product sales between 2021 and 2024 indicates significant retail transformation as per Ofcom 2025. Consumer data shows 69% of UK adults actively seek botanical based beverages for stress and energy management as per Soil Association 2025.

China adaptogen drink market is projected to reach USD 628.9 million in 2025 increasing to USD 1201.4 million by 2035 growing at a CAGR of 6.9% as per FMI 2025. Cost efficiency is achieved through local herb cultivation offering a raw material advantage of 17.5% compared to imported adaptogens as per China MOA 2025.

However GMP certification costs for functional beverages add USD 0.09 per unit acting as a margin drag as per CFDA 2025. Online beverage sales surged by 520 basis points from 2021 to 2024 reflecting consumer trust in digital channels as per Alibaba Group Report 2025. According to the China Nutrition Society 81% of urban adults prefer natural beverages for fatigue reduction and mood improvement as per CNS 2025.

Sales of adaptogen drinksin India is expected to grow at a CAGR of 7.4% as per FMI 2025. Sourcing advantages provide up to 20.1% lower ingredient costs due to domestic production of ashwagandhatulsi and other adaptogens as per Ministry of AYUSH 2025. On the downside labor and bottling inefficiencies raise packaging costs by USD 0.06 per bottle as per FSSAI 2025.

A 440 basis point rise in online health product sales between 2021 and 2024 reflects rapid retail digitalization. 76% of Indian consumers surveyed reported switching to natural wellness beverages post pandemic as per FSSAI Survey 2025 validating strong consumer alignment with adaptogen based drinks.

Demand for adaptogen drink in Japan is likely to grow at a CAGR of 6.3% as per FMI 2025. Favorable domestic production of functional food bases has lowered input costs by 13.2% compared to import heavy peers as per MAFF 2025.

However strict food labelling laws enforced by the Consumer Affairs Agency raise compliance costs by USD 0.11 per product as per CAA Japan 2025. Functional beverage e commerce penetration expanded by 480 basis points between 2021 and 2024 indicating a growing digital shift. A national survey found that 78% of consumers over age 35 prefer drinks promoting mental clarity and calm as per Japan Health Promotion Foundation 2025.

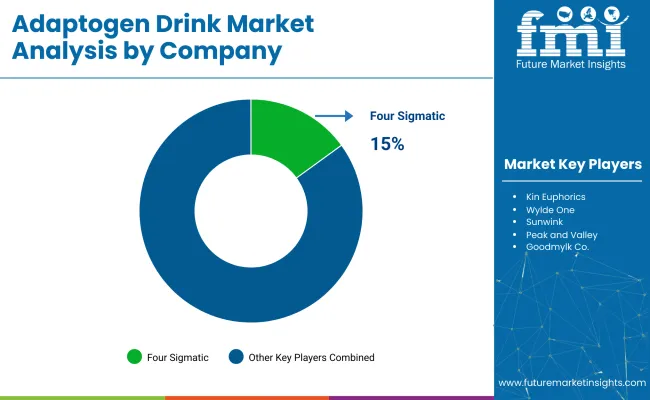

The global adaptogen drink market features a competitive landscape with dominant players, key players, and emerging players. Dominant players such as Four Sigmatic, Kin Euphorics, and RASA lead the market with extensive product portfolios, strong R&D capabilities, and robust distribution networks across health and wellness, food, and beverage sectors. Key players including REBBL, Wylde One, and Sunwink offer specialized formulations tailored to specific applications and regional markets. Emerging players, such as Peak and Valley, Goodmylk Co., and Moon Juice, focus on innovative formulations and premium offerings, expanding their presence in the global market.

| Report Attributes | Details |

|---|---|

| Estimated Industry Size (2025E) | USD 1300.7 million |

| Projected Industry Value (2035F) | USD 2416.2 million |

| Value-based CAGR (2025 to 2035) | 6.4% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value and million units for volume |

| Product Type Segmentation | Single-herb Adaptogens , Blended Adaptogens , Functional Adaptogens , Ready-to-drink (RTD) Adaptogens , Concentrate/Powdered Adaptogens |

| Ingredients Segmentation | Holy Basil, Ashwagandha , Lavender, Mushrooms, Maca |

| Sales Channel Segmentation | Store-based Retailing (Modern Trade, Hospital Pharmacies, Retail Pharmacies, Drug Stores), Online Pharmacies |

| Regions Covered | North America, Latin America, Eastern Europe, Western Europe, East Asia, South Asia & Pacific, Central Asia, Balkan and Baltic Countries, Russia & Belarus, Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, Australia, New Zealand, GCC Countries, South Afric a |

| Key Players Influencing the Market | REBBL, RASA, Four Sigmatic, Kin Euphorics , Wylde One, Sunwink , Peak and Valley, Goodmylk Co., Moon Juice, OM Mushrooms |

| Additional Attributes | Dollar sales by product type, ingredient, and sales channel, rising demand for functional and wellness-focused drinks, increasing popularity of adaptogenic herbs, growing trend of plant-based and functional beverages, regional differences in adaptogen consumption patterns. |

The market is segmented into Single-Herb Adaptogens, Blended Adaptogens, Functional Adaptogens, Ready-to-Drink (RTD) Adaptogens, and Concentrate/Powdered Adaptogens.

The market is segmented into Holy Basil, Ashwagandha, Lavender, Mushrooms, and Maca.

The market is segmented into Store-Based Retailing (including modern trade, hospital pharmacies, retail pharmacies, and drug stores), and Online Pharmacies.

Industry analysis has been carried out in North America, Latin America, Eastern Europe, Western Europe, East Asia, South Asia & Pacific, Central Asia, Balkan and Baltic Countries, Russia & Belarus, and Middle East & Africa.

The global market size is estimated to be USD 1,300.7 million in 2025 and USD 2,416.2 million by 2035.

The expected CAGR is 6.4% from 2025 to 2035.

The Functional & Blended Adaptogen product type holds the largest market share at 39.1% in 2025.

Four Sigmatic is the leading company in the market, holding a 15% market share.

The projected CAGR for India is 7.4% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Adaptogen Coffee Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Adaptogenic Beverages Market Size and Share Forecast Outlook 2025 to 2035

Adaptogens Market – Growth, Demand & Herbal Wellness Trends

Drinkable Yogurt Market Size and Share Forecast Outlook 2025 to 2035

Drinking Fountain Market Size and Share Forecast Outlook 2025 to 2035

Drink Carrier Poly Bags Market Size and Share Forecast Outlook 2025 to 2035

Drink Cans Market Insights - Growth & Trends 2025 to 2035

Leading Providers & Market Share in Drink Carrier Poly Bags

Drinkware Accessories Market

Oat Drink Market Analysis - Size, Share & Forecast 2025 to 2035

Soft Drinks Packaging Market Size and Share Forecast Outlook 2025 to 2035

Soft Drinks Concentrates Market Trends - Growth & Forecast

Analysis and Growth Projections for Detox Drink market

Vegan Drink Mixes Market Analysis by Type, Source, Sale Channel, Flavor, Application and Region through 2035

Squash Drink Market Size and Share Forecast Outlook 2025 to 2035

Beauty Drinks Market Size and Share Forecast Outlook 2025 to 2035

Sports Drink Industry Analysis in USA - Size and Share Forecast Outlook 2025 to 2035

Almond Drink Market Analysis - Size, Share, and Forecast 2025 to 2035

Sports Drink Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Energy Drink Market Outlook – Growth, Demand & Forecast 2024 to 2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA