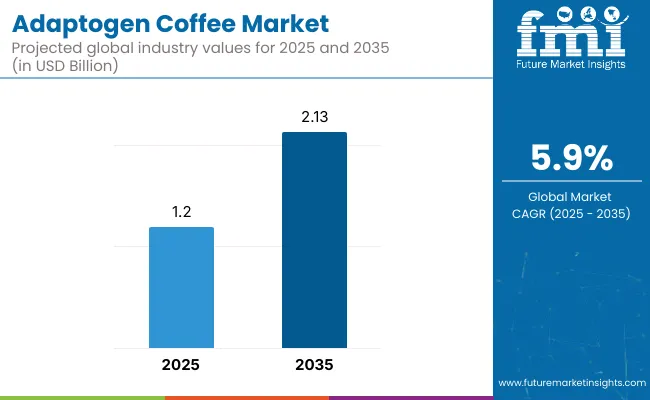

A steady transformation in global wellness preferences has been shaping the adaptogen coffee market, with value sales projected to reach USD 2.13 billion by 2035, up from USD 1.20 billion in 2025. This growth reflects a decade-long increase of USD 931.8 million, representing a near 2X expansion over the ten-year period. A compound annual growth rate (CAGR) of 5.9% has been forecasted, driven by rising consumer awareness around mental clarity, stress reduction, and natural energy boosters areas in which adaptogen-infused formulations have gained significant traction.

| Metric | Value |

|---|---|

| Adaptogen Coffee Market Estimated Value in (2025E) | USD 1.20 billion |

| Adaptogen Coffee Market Forecast Value in (2035F) | USD 2.13 billion |

| Forecast CAGR (2025 to 2035) | 5.9% |

In the initial five-year period (2025-2030), the market is expected to climb from USD 1.20 billion to USD 1.59 billion, adding approximately USD 396.2 million, which constitutes 42.5% of the decade’s total growth. This early momentum is being shaped by the surging popularity of instant adaptogen mixes and powdered formats, particularly in North America and parts of Europe, where busy urban lifestyles have aligned with the convenience of these offerings. Early adoption has also been enabled by a wellness-first retail environment and robust digital marketing by DTC (Direct-to-Consumer) brands.

The latter half of the decade (2030-2035) is projected to generate an even higher contribution of USD 535.6 million, accounting for 57.5% of the total ten-year expansion. This growth acceleration is expected to be fueled by expanding penetration across Asia-Pacific and Latin America, rising mainstream retail shelf space, and a shift toward personalized adaptogen blends targeting cognition, immunity, and metabolic health. These shifts are likely to increase category maturity and diversify the consumer base.

From 2020 to 2024, the Adaptogen Coffee Market expanded from a niche wellness segment into a structured functional beverage category, growing from approximately USD 670 million to USD 1.20 billion. This growth was led by powdered formulations, which dominated over 40% of the value share during this period. Major players such as Four Sigmatic, Mud\Wtr, and Ryze Superfoods captured early mindshare by leveraging DTC models, influencer ecosystems, and nootropic-based positioning.

During this phase, product innovation centered on mushroom adaptogens like lion’s mane and reishi, while caffeine alternatives gained traction among mental wellness-conscious consumers. Brand loyalty and subscription retention became critical competitive levers, as service-based models contributed over 25% of revenue by 2024 reflecting a strategic shift from single-use to recurring wellness solutions.

In 2025, the market is projected to reach USD 1.20 billion, with further expansion expected as software-enhanced personalization tools, AI-driven wellness platforms, and stackable nutrition formats redefine consumption. Legacy leaders are adapting by integrating bioavailability science, digital biomarkers, and habit-tracking functionalities, while newer entrants are gaining share through precision dosing, flavor innovation, and clinical storytelling. Competitive advantage is shifting from ingredient sourcing alone to ecosystem integration, consumer feedback loops, and subscription-based retention models.

Growth in the adaptogen coffee market is being propelled by a confluence of health, lifestyle, and functional nutrition trends. Rising consumer anxiety, fatigue, and burnout levels have been increasingly addressed through natural cognitive enhancers among which adaptogens have gained strong credibility.

As wellness-centric routines have been mainstreamed, adaptogen-infused beverages have been favored over synthetic stimulants, owing to their holistic appeal. Demand has been especially reinforced by digital wellness influencers and functional food brands, where adaptogens such as ashwagandha, reishi, and lion’s mane are positioned as daily stress-support rituals.

Convenience-led formats, particularly instant powders and pre-mixed sachets, have enabled faster consumer onboarding, while flavor innovations have helped normalize adaptogen consumption within coffee routines. Additionally, the shift toward caffeine moderation and clean-label preferences has supported adaptogen coffee adoption. Future growth is expected to be driven by personalized formulations, bioavailability-enhanced extracts, and broader retail access particularly in North America, Western Europe, and increasingly, Asia-Pacific wellness channels.

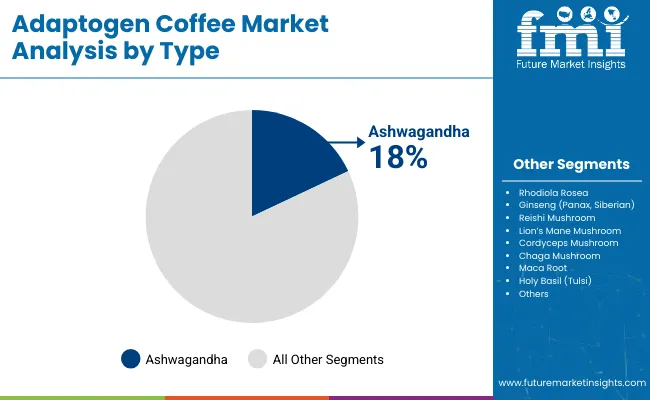

The adaptogen coffee market has been segmented by adaptogen type, coffee base, and product format, each contributing uniquely to category growth and consumer engagement. By adaptogen type, ingredients such as ashwagandha, lion’s mane, and reishi mushroom have been emphasized for their wellness functionality and increasing clinical validation.

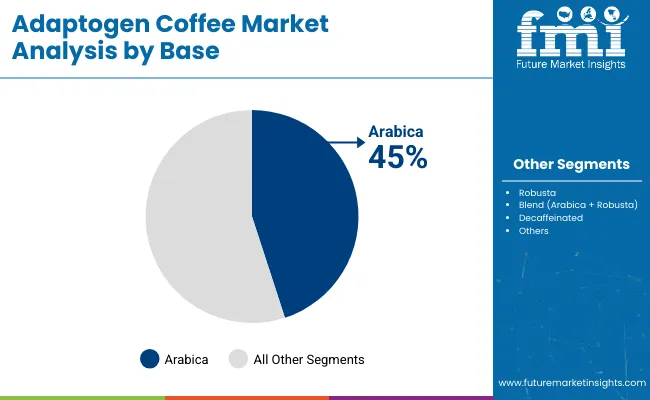

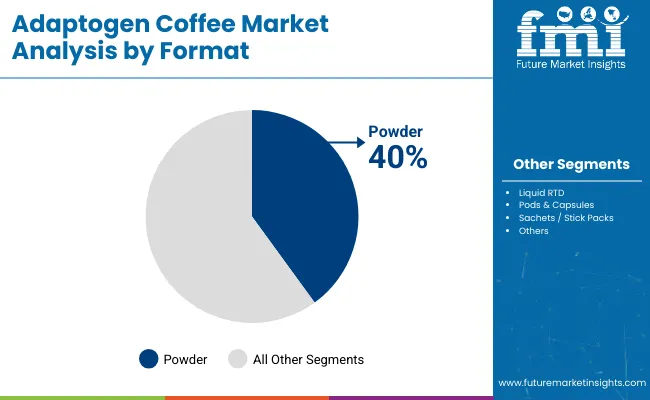

Coffee base differentiation highlights preferences between arabica, robusta, and hybrid blends, with flavor, caffeine content, and bean sourcing practices influencing demand. Format-wise, powders, RTD liquids, and capsules address evolving lifestyle habits, with convenience and dosage precision acting as key purchase drivers. Each of these segments reflects shifting consumer behavior, ingredient innovation, and branding strategies that are expected to evolve through 2035 in response to wellness personalization, digital commerce, and clean-label positioning.

| Segment | 2025 Share% |

|---|---|

| Ashwagandha | 18% |

| Rhodiola Rosea | 8% |

| Ginseng (Panax, Siberian) | 12% |

| Reishi Mushroom | 10% |

| Lion’s Mane Mushroom | 10% |

| Cordyceps Mushroom | 8% |

| Chaga Mushroom | 7% |

| Maca Root | 7% |

| Holy Basil (Tulsi) | 5% |

| Others (Schisandra, Astragalus, etc.) | 15% |

Ashwagandha is projected to lead the adaptogen type segment with an 18% market share in 2025. This dominance is being driven by widespread recognition of its stress-reducing, mood-enhancing, and cortisol-lowering benefits. The ingredient has been prominently positioned across functional food brands and integrative health platforms, gaining endorsement from wellness experts and lifestyle influencers.

Its deep cultural roots in Ayurvedic traditions have been adapted into modern functional coffee systems. The continued expansion of clinical studies on ashwagandha’s efficacy is expected to strengthen consumer trust and broaden its inclusion across blends. The "Others" segment comprising less mainstream adaptogens like Schisandra, Astragalus, and Licorice root will collectively hold 15%, catering to niche demands and premium health-focused brands exploring differentiation.

| Segment | 2025 Share% |

|---|---|

| Arabica | 45% |

| Robusta | 20% |

| Blend (Arabica + Robusta) | 25% |

| Decaffeinated | 10% |

The Arabica coffee base segment is forecasted to capture 45% of the market in 2025, reinforcing its reputation as the preferred option for premium taste and lower bitterness. Demand for Arabica-based adaptogen coffee has been reinforced by specialty coffee culture and health-conscious consumers seeking smooth profiles with natural ingredients.

The rise in single-origin and sustainably sourced Arabica has further enhanced its appeal. Meanwhile, blended bases are expected to contribute 25%, balancing cost and flavor. These blends are increasingly used by mid-range and mass-market adaptogen coffee brands to achieve taste balance and functional density. Growth in these bases is being influenced by transparency in sourcing and the promotion of antioxidant and metabolic benefits.

| Format | 2025 Share% |

|---|---|

| Powder | 40% |

| Liquid RTD | 25% |

| Pods & Capsules | 20% |

| Sachets / Stick Packs | 15% |

The powder format segment is projected to dominate with 40% share in 2025. Powdered adaptogen coffee has been favored for its longer shelf life, ease of formulation, and suitability for both hot and cold preparations. Brands offering powders often appeal to consumers seeking flexibility in dosing and cost-effective daily rituals.

The rising prevalence of subscription models and sustainable packaging formats has also accelerated powdered product adoption. RTD (Ready-to-Drink) liquids are forecasted to hold 25%, driven by convenience and on-the-go wellness consumption. These RTDs are increasingly positioned in functional beverage aisles and online wellness marketplaces. Pods and sachets, although smaller in share, are expected to witness future growth through retail expansion and smart appliance integration.

While health-conscious consumers have actively embraced adaptogen coffee for its stress-reducing and cognitive benefits, market growth is being tested by formulation complexity, regulatory ambiguities, and rising procurement costs for bioactive botanicals all unfolding alongside innovation in format and personalization.

Evolution of Functional Stacking in Wellness Beverages

Formulation strategies in the adaptogen coffee segment have shifted toward functional stacking, where multiple bioactive compounds including nootropics, prebiotics, and adaptogens are layered within a single product. This evolution has enabled companies to position adaptogen coffee not merely as a mood enhancer but as a multitasking wellness beverage addressing immunity, gut health, and metabolic balance simultaneously.

As a result, higher product differentiation is being observed, particularly in North America and Europe, where consumers expect outcome-specific solutions. This has empowered mid-size DTC brands to capture niche health segments using layered claims backed by clinical evidence. The competitive narrative is moving from “calm and focus” to “precision-formulated routines,” reinforcing adaptogen coffee’s value in broader functional beverage portfolios.

Integration of AI-Based Ingredient Mapping for Personalized Blends

Advanced AI algorithms are increasingly being integrated by premium adaptogen coffee brands to create customized blends based on biomarker data, lifestyle inputs, and cognitive profiles. These platforms map ingredient interactions, optimize dosages, and forecast tolerability, enabling users to design routines aligned with their circadian and metabolic rhythms.

This tech-enabled personalization is being treated as a market differentiator, especially for subscription-based business models targeting urban professionals and wellness enthusiasts. The convergence of adaptogenic science, behavioral data, and AI-driven interfaces is expected to redefine consumer engagement shifting product discovery from shelf to algorithm-led digital experience.

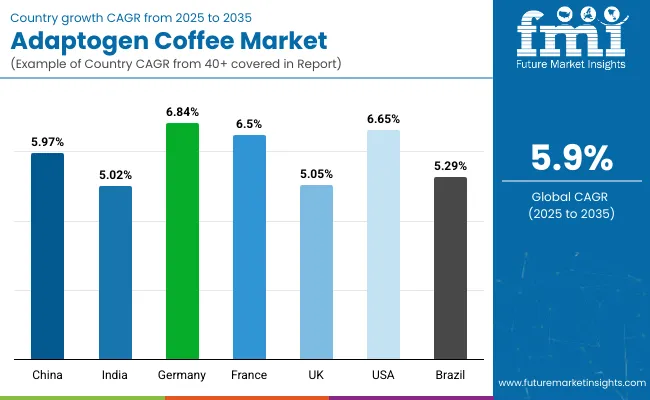

| Countries | CAGR |

|---|---|

| China | 5.97% |

| India | 5.02% |

| Germany | 6.84% |

| France | 6.50% |

| UK | 5.05% |

| USA | 6.65% |

| Brazil | 5.29% |

Pronounced disparities in growth dynamics have been observed across major countries in the adaptogen coffee market, with expansion shaped by regional wellness culture, ingredient sourcing ecosystems, and the digital maturity of functional beverage retailing. The Asia-Pacific region has emerged as a key growth hub, led by China at a projected CAGR of 5.97% and India at 5.02%.

In China, adaptogen coffee consumption is being strengthened by increasing urbanization, the rise of performance-focused consumers, and localized adoption of traditional herbs like cordyceps and reishi in coffee formats.

Digital wellness platforms and e-commerce ecosystems are facilitating rapid category penetration through influencer-led campaigns and DTC subscription models. In India, growth is being supported by a resurgence of Ayurveda-inspired dietary choices, rising disposable income among health-conscious millennials, and increased domestic formulation of ashwagandha-based coffee alternatives.

Europe continues to demonstrate robust momentum, led by Germany at 6.84%, France at 6.50%, and the UK at 5.05%, where consumers are drawn to clean-label, nootropic-rich, and caffeine-moderated beverages. Regulatory clarity around botanical ingredients and a strong base of specialty retailers have aided faster market scaling.

Meanwhile, the USA is forecasted to grow at 6.65%, reflecting steady alignment of adaptogen coffee with productivity, mental health, and biohacking trends. Growth in North America is increasingly shaped by branded storytelling, experiential packaging, and innovations in mushroom-based formats.

| Year | USA Adaptogen Coffee Market (USD Billion) |

|---|---|

| 2025 | 287.6 |

| 2026 | 302.2 |

| 2027 | 317.7 |

| 2028 | 338.6 |

| 2029 | 358.8 |

| 2030 | 380.8 |

| 2031 | 406.5 |

| 2032 | 427.7 |

| 2033 | 455.8 |

| 2034 | 487.2 |

| 2035 | 520.2 |

The Adaptogen Coffee Market in the United States is projected to grow at a CAGR of 6.1% between 2025 and 2035, driven by rising consumer preference for cognitive performance, stress support, and functional nutrition. As consumer health routines become more personalized and prevention-focused, adaptogen coffee has been increasingly positioned as a premium upgrade to conventional caffeine consumption. This shift has been reinforced by the popularity of clean-label, mushroom-infused, and nootropic coffee blends within health-conscious urban segments.

Adoption across diverse consumer groups is expected to continue, particularly among knowledge workers, fitness enthusiasts, and wellness-focused millennials. Growth is further enabled by DTC channels, AI-enabled personalization engines, and subscription-based bundling of adaptogen coffee with other nutraceuticals.

The United Kingdom Adaptogen Coffee Market is anticipated to register consistent growth at a CAGR of 5.05% between 2025 and 2035. Demand has been supported by a rising shift toward caffeine moderation, increased awareness around mental well-being, and growing consumer interest in holistic functional beverages. Adaptogen coffee is being adopted as a lifestyle choice among young professionals, wellness communities, and consumers seeking stress-relief alternatives during work-from-home or hybrid routines.

Premium blends featuring lion’s mane, rhodiola, and reishi are gaining shelf space across specialty retailers, particularly in London, Manchester, and Bristol. Sustainability narratives and ethical sourcing have also influenced brand selection, especially among climate-conscious UK consumers.

The Adaptogen Coffee Market in India is projected to grow at a CAGR of 5.02% from 2025 to 2035, driven by evolving wellness priorities, growing disposable income, and a resurgence in Ayurveda-based dietary patterns. The functional beverage space is being reshaped by urban consumers seeking natural stress relief and cognitive enhancement in their daily routines.

Ashwagandha-based coffee blends have gained strong momentum, supported by cultural familiarity and increasing domestic production. Local brands are leveraging storytelling around ancient traditions, while global brands are entering Tier I and Tier II cities with modern packaging and taste profiles. Expansion across e-commerce platforms and wellness-focused cafés is enhancing market reach.

The Adaptogen Coffee Market in China is projected to expand at a CAGR of 5.97% between 2025 and 2035, driven by the rapid fusion of traditional herbal knowledge and modern functional beverage trends. Growing consumer awareness of holistic health, combined with increased urban stress and fatigue levels, has positioned adaptogen coffee as a lifestyle-forward remedy aligned with TCM (Traditional Chinese Medicine) values.

Consumption is expected to rise in metropolitan areas such as Shanghai, Shenzhen, and Beijing, where health-conscious consumers are integrating adaptogens like cordyceps, reishi, and ginseng into daily routines. Digitally native brands are playing a pivotal role, leveraging influencer-led campaigns and online retail to promote adaptogen coffee as a premium wellness habit.

| Countries | 2025 |

|---|---|

| UK | 20.52% |

| Germany | 20.03% |

| Italy | 11.09% |

| France | 14.90% |

| Spain | 11.78% |

| BENELUX | 6.76% |

| Nordic | 5.10% |

| Rest of Europe | 10% |

| Countries | 2035 |

|---|---|

| UK | 20.06% |

| Germany | 20.35% |

| Italy | 10.56% |

| France | 13.05% |

| Spain | 9.47% |

| BENELUX | 5.83% |

| Nordic | 5.62% |

| Rest of Europe | 15% |

Germany’s adaptogen coffee market is forecasted to grow at a robust CAGR of 6.84% from 2025 to 2035, positioning it as one of the fastest-growing markets in Europe. Strong emphasis on mental well-being, sustainability, and clean-label formulations is shaping purchasing behavior across the German wellness consumer base. The adoption of adaptogen coffee has been facilitated by the country’s mature organic food culture and highly informed health-conscious population.

Products containing reishi, cordyceps, and lion’s mane have seen rising interest within both vegan and flexitarian communities. Specialty health stores and organic retailers (e.g., Alnatura, Bio Company) are expanding listings for adaptogen coffee brands. Growth is also being driven by collaborations between nutrition startups and naturopaths for evidence-backed formulations.

| Component Segment | Market Value Share, 2025 |

|---|---|

| Segment | 15% |

| Segment | 12% |

The Adaptogen Coffee Market in Japan is projected to reach USD 23.5 million in 2025, driven by surging demand for stress-reducing and brain-boosting functional beverages. Among key ingredients, ashwagandha holds the highest share at 15%, followed closely by lion’s mane mushroom and reishi mushroom, both at 12%. This distribution signals a strong preference for cognitive support and adaptogenic stress relief, reflecting Japan’s aging population and increasingly health-aware younger consumers.

The rising popularity of lion’s mane mushroom, projected to grow at a CAGR of 9.9%, underscores the local market’s orientation toward neuroprotection, memory enhancement, and mental clarity. Concurrently, reishi and cordyceps mushrooms are gaining traction as immunity-supportive and vitality-boosting ingredients, particularly in premium RTD and powdered formats.

Brand innovation has been focused on flavor masking, minimalist packaging, and localized education campaigns, which have enhanced market penetration in urban wellness circles and digital retail platforms. Japanese consumers’ trust in ingredient quality and clinical validation has been accelerating the adoption of adaptogen coffee, particularly through organic and pharmacist-recommended brands.

| South Korea Coffee Type | 2025 Share% |

|---|---|

| Ground Coffee with Adaptogens | 25% |

| Instant Coffee with Adaptogens | 30% |

| Coffee Pods / Capsules with Adaptogens | 15% |

| Ready to Drink (RTD) Adaptogen Coffee | 20% |

| Cold Brew Adaptogen Coffee | 10% |

The Adaptogen Coffee Market in South Korea is projected to reach 20.13 million in 2025, fueled by heightened consumer interest in cognitive function, immunity, and anti-fatigue solutions within everyday routines. In 2025, instant adaptogen coffee is expected to lead with a 30% market share, followed by ground coffee with adaptogens at 25%. This dominance of instant formats reflects South Korea’s entrenched instant coffee culture, where convenience, portability, and multi-serve sachets are favored across workspaces and households.

Strong double-digit CAGR growth in RTD (10.4%) and cold brew (10.0%) segments suggests a shift toward premium and lifestyle-centric offering among urban youth and wellness-focused consumers. These formats have gained popularity through convenience store chains, specialty cafés, and K-beauty lifestyle influencers, positioning adaptogen coffee as both a performance enhancer and a wellness indulgence.

Product formulation has been increasingly influenced by local flavor preferences and adaptogen-herb pairings that resonate with traditional Korean medicine (e.g., ginseng, jujube). High digital literacy and smartphone commerce have accelerated DTC subscriptions and app-based customization of coffee routines.

| Company | Global Value Share 2025 |

|---|---|

| Four Sigmatic | 12% |

| Others | 88% |

The Adaptogen Coffee Market is moderately fragmented, with a competitive mix of global disruptors, wellness-driven startups, and herbal specialists shaping category evolution. Leading brands such as Four Sigmatic, Mud\Wtr, and Ryze Superfoods have captured significant market share by combining adaptogenic functionality with lifestyle branding and clean-label positioning.

Their strategies have increasingly focused on mushroom-based coffee alternatives, DTC subscription models, and influencer-driven content ecosystems. Strong community engagement and educational storytelling have enabled these brands to dominate digital-first channels and premium health retail spaces.

Mid-sized innovators like Rasa, Renude, and Peak State Coffee have been gaining traction through formulation diversity and mindfulness-centered branding. These companies have positioned adaptogen coffee not just as a beverage, but as a ritual linked to emotional wellness and energy balance. Hybrid blends featuring ashwagandha, lion’s mane, and cacao are being promoted for morning clarity and afternoon calm.

Specialist players including Om Mushroom Superfood, La Republica Coffee, and Wooden Spoon Herbs have focused on deep adaptogen sourcing, organic certifications, and ingredient traceability. Regional appeal, practitioner alliances, and botanical credibility have reinforced their niche market presence.

Competitive differentiation is being redefined around bioavailability-enhanced formulations, personalized wellness pathways, and functional stacking with nootropics, probiotics, and collagen. As consumer expectations evolve, success will depend on the ability to merge scientific credibility with brand storytelling across omnichannel platforms.

Key Developments in Adaptogen Coffee Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1.20 Billion |

| Ingredient Type | Ashwagandha, Reishi Mushroom, Lion’s Mane Mushroom, Cordyceps, Ginseng, Chaga, Rhodiola Rosea, Holy Basil, Maca, Others |

| Coffee Base | Arabica, Robusta, Blend (Arabica + Robusta), Decaffeinated |

| Product Format | Powder, Liquid RTD, Coffee Pods & Capsules, Sachets / Stick Packs |

| Sales Channel | Direct-to-Consumer (DTC), Online Retail, Health & Nutrition Stores, Pharmacies, Supermarkets/Hypermarkets |

| Application | Stress Reduction, Cognitive Enhancement, Immunity Boost, Mood Support, Energy, Focus & Productivity |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Korea |

| Key Companies Profiled | Four Sigmatic, Rasa, Mud \ Wtr, Ryze Superfoods, Renude, Peak State Coffee, Everyday Dose, La Republica, Om Mushroom Superfood, Wooden Spoon Herbs |

The global Adaptogen Coffee Market is estimated to be valued at USD 1.20 billion in 2025.

The market size for the Adaptogen Coffee Market is projected to reach approximately USD 2.13 billion by 2035.

The Adaptogen Coffee Market is expected to grow at a CAGR of 5.9% between 2025 and 2035, nearly doubling in value over the decade.

The key product formats in the Adaptogen Coffee Market include powder, liquid RTD, pods & capsules, and sachets/stick packs, catering to convenience, portability, and functional efficacy.

In terms of format, the powder segment is projected to command the highest share—approximately 40%—of the Adaptogen Coffee Market in 2025, driven by flexibility, shelf life, and subscription-based adoption.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Adaptogenic Beverages Market Size and Share Forecast Outlook 2025 to 2035

Adaptogen Drink Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Adaptogens Market – Growth, Demand & Herbal Wellness Trends

Coffee Cherry Market Forecast and Outlook 2025 to 2035

Coffee Filter Paper Market Size and Share Forecast Outlook 2025 to 2035

Coffee Roaster Machine Market Analysis - Size, Share, and Forecast 2025 to 2035

Coffee Beauty Products Market Size and Share Forecast Outlook 2025 to 2035

Coffee Processing Machine Market Size and Share Forecast Outlook 2025 to 2035

Coffee Creamer Market Analysis by Form, Nature, Category, Application and Sales Channel Through 2025 to 2035

Coffee Grounds Market Analysis - Size, Share, and Forecast 2025 to 2035

Coffee Concentrate Market - Size, Share, and Forecast Outlook 2025 to 2035

Coffee Grounds for Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Coffee Bottles Market Insights & Industry Trends 2025 to 2035

Coffee Pouch Market Growth - Demand & Forecast 2025 to 2035

Coffee Bags Market Demand & Forecast Analysis 2025 to 2035

Coffee Gummy Market Analysis by sales channel, application and region Through 2025 to 2035

Coffee Syrup Market Analysis by Product type, Application, End User and Packaging Through 2025 to 2035

Coffee Capsules Market Analysis - Growth & Forecast 2025 to 2035

Coffee Bean Grind Machine Market Trends - Growth & Forecast 2025 to 2035

Coffee Extract Market Analysis by Nature, Product, End Use, Formulation, and Region through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA