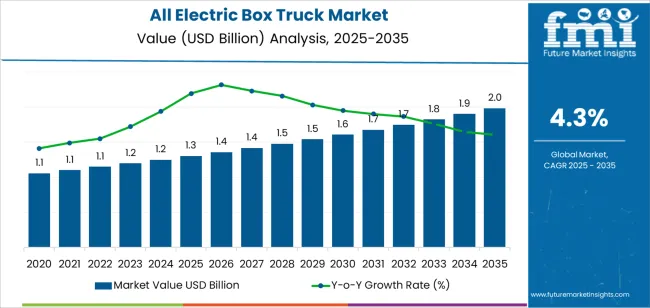

The all-electric box truck market is valued at USD 1.3 billion in 2025 and is expected to reach USD 2.0 billion by 2035, growing at a CAGR of 4.3%. Market growth is supported by the global shift toward zero-emission transportation, increasing adoption of electric commercial vehicles for urban logistics, and strengthening regulatory frameworks promoting decarbonization in freight operations. Expanding last-mile delivery networks and fleet electrification initiatives across e-commerce, retail, and municipal sectors continue to drive steady demand for electric box trucks.

Medium-duty (Class 6–7) trucks represent the leading market segment due to their balance between payload capacity, operational range, and energy efficiency. These vehicles are widely used in logistics, distribution, and public utility operations where lower noise, reduced maintenance, and improved total cost of ownership provide economic and environmental benefits. Advancements in lithium-ion battery technology, charging infrastructure, and thermal management systems are improving operational viability and range reliability.

Asia Pacific leads global market expansion, driven by manufacturing scale, policy incentives, and rapid urban logistics growth in China and India. Europe and North America maintain steady demand through commercial fleet electrification programs and carbon reduction mandates. Key companies include BYD, Hyundai, Ford, Daimler, Volvo Group, Renault, and Sany, focusing on battery innovation, vehicle efficiency, and integration of connected fleet management systems.

Peak-to-trough analysis indicates moderate cyclical variation influenced by supply chain adjustments, fleet electrification targets, and battery cost trends. Between 2025 and 2028, the market will reach an early growth peak as logistics operators and urban delivery fleets accelerate adoption to meet emission compliance standards and operational cost reduction goals. This phase will be supported by government incentives and expanding charging infrastructure.

A mild trough is anticipated between 2029 and 2031 as the market faces cost pressures from raw materials and slower subsidy rollbacks in mature regions. During this period, fleet replacement cycles and charging standardization efforts will temporarily moderate new procurement. Post-2031, a renewed growth phase is expected as advancements in battery energy density and range performance enhance operational efficiency. The overall peak-to-trough pattern reflects a steady, technology-driven market cycle characterized by short correction intervals and maintained long-term adoption, supported by policy continuity, fleet modernization, and the logistics sector’s transition toward zero-emission transportation systems.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 1.3 billion |

| Market Forecast Value (2035) | USD 2.0 billion |

| Forecast CAGR (2025-2035) | 4.3% |

The all-electric box truck market is expanding as fleet operators in logistics, delivery and urban services seek zero-emission alternatives to diesel vehicles. Advances in battery technology, powertrain integration and vehicle design make electric box trucks increasingly viable for short-haul and return-to-base operations where predictable routes and centralized charging reduce range anxiety. Regulatory frameworks and corporate ecofriendly goals promote fleet electrification efforts, pushing the adoption of electric box trucks across major markets.

The growth of e-commerce and last-mile delivery demands versatile medium-duty vehicles capable of navigating urban environments quietly and cleanly, which suits the electric box truck use case. Nonetheless, adoption faces constraints from higher upfront purchase price compared with conventional models, limited public-charging infrastructure tailored to commercial vehicles and the requirement for specialized fleet charging and maintenance systems.

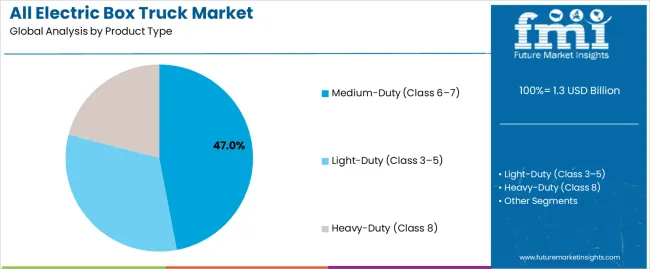

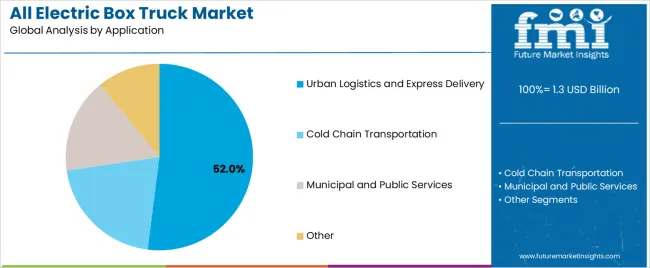

The all electric box truck market is segmented by product type and application. By product type, the market is divided into light-duty (Class 3–5), medium-duty (Class 6–7), and heavy-duty (Class 8) trucks. Based on application, it is categorized into urban logistics and express delivery, cold chain transportation, municipal and public services, and others. Regionally, the market is divided into Asia Pacific, Europe, North America, and other key regions.

The medium-duty (Class 6–7) segment holds the leading position in the all electric box truck market, representing an estimated 47.0% of total market share in 2025. Medium-duty electric box trucks are increasingly used for regional logistics, urban freight movement, and short- to mid-range delivery operations. They offer optimal load capacity and range balance, making them suitable for diverse fleet operations under evolving emission regulations.

The segment’s dominance is supported by growing demand from logistics companies, e-commerce providers, and municipal service operators aiming to reduce operational emissions and comply with zero-emission vehicle mandates. Medium-duty electric trucks typically provide ranges between 150 and 300 kilometers per charge, supported by rapid charging capabilities and modular battery configurations. The light-duty (Class 3–5) segment, estimated at 36.0%, is gaining adoption in last-mile delivery and parcel logistics. The heavy-duty (Class 8) category, accounting for approximately 17.0%, serves long-haul transport and high-capacity freight, constrained by infrastructure and battery weight limitations.

Key factors supporting the medium-duty segment include:

The urban logistics and express delivery segment accounts for approximately 52.0% of the all electric box truck market in 2025. This leadership reflects the increasing electrification of city logistics driven by e-commerce growth, urban air quality initiatives, and fleet operators’ shift toward ecofriendly last-mile delivery. Electric box trucks in this category offer reduced operating costs, quiet operation, and compliance with city-level emission restrictions.

The cold chain transportation segment follows with an estimated 24.0% market share, supported by the development of temperature-controlled electric box trucks integrating battery-powered refrigeration systems for perishable goods transport. The municipal and public services segment represents around 16.0%, encompassing waste collection, utility maintenance, and urban facility services. The others category, including rental fleets and specialized applications, holds the remaining 8.0%.

Primary dynamics driving demand from the urban logistics and express delivery segment include:

The all-electric box truck market is propelled by the rapid expansion of e-commerce, last-mile delivery volumes and urban freight operations that favour zero-emission vehicles. Municipal low-emission zones and corporate ecofriendly commitments drive fleet operators to switch to electric box trucks to comply with regulations and reduce carbon footprint. Electric drivetrains in box trucks offer lower operating and maintenance costs compared with conventional diesel variants, particularly in short-haul and return-to-base duty cycles, making electrification increasingly financially attractive to fleet owners.

Electric box trucks currently carry a higher purchase price than their diesel counterparts due to battery costs and specialised powertrain components. Lack of dedicated charging infrastructure near depots and commercial hubs can complicate operations and prolong downtime, which makes fleet transition harder in certain regions. The limited driving range of many electric box truck models, especially under load and in cyclical stop-start routes, may not meet the demands of all duty cycles, reducing replacement rates of conventional vehicles in deeper-haul or mixed-use scenarios.

Manufacturers are developing modular and swappable battery systems for electric box trucks to enable shorter turnaround times and flexibility across duty cycles, reducing fleet deployment risk. Rapid urbanisation and infrastructure investment in Asia-Pacific and Latin America are opening significant opportunities for electric box trucks as fleets modernise in emerging markets. Integration with telematics, route-optimisation software and vehicle-to-grid (V2G) capability is becoming standard, enabling fleet operators to monitor battery health, energy consumption and asset usage more effectively, thereby reinforcing the value-proposition of electric box trucks.

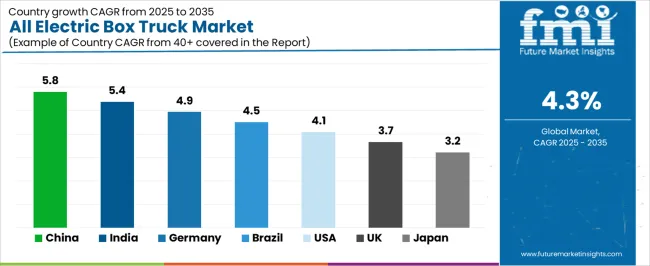

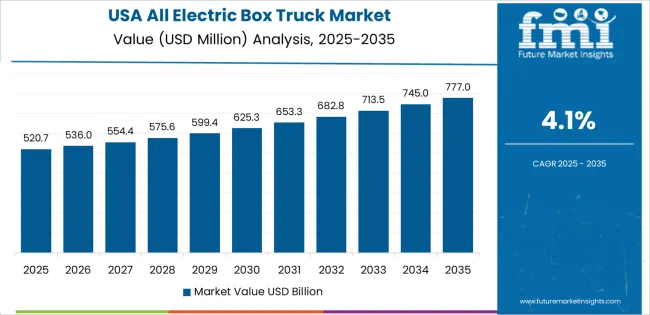

The global all-electric box truck market is expanding steadily through 2035, driven by zero-emission logistics mandates, urban delivery electrification, and advancements in battery and charging infrastructure. China leads with a 5.8% CAGR, followed by India at 5.4%, reflecting government-led fleet electrification and last-mile delivery modernization. Germany grows at 4.9%, supported by stringent emission regulations and logistics automation. Brazil records 4.5%, driven by ecofriendly transport adoption in industrial corridors. The United States grows at 4.1%, emphasizing corporate fleet transitions and clean mobility incentives, while the United Kingdom (3.7%) and Japan (3.2%) maintain moderate growth through technological refinement and urban logistics initiatives.

| Country | CAGR (%) |

|---|---|

| China | 5.8 |

| India | 5.4 |

| Germany | 4.9 |

| Brazil | 4.5 |

| USA | 4.1 |

| UK | 3.7 |

| Japan | 3.2 |

China’s all-electric box truck market grows at 5.8% CAGR, driven by national emission-reduction targets and rapid electrification of commercial transport fleets. The New Energy Vehicle (NEV) Industry Development Plan supports production subsidies, charging infrastructure expansion, and localized battery supply chains. Manufacturers are producing medium and heavy-duty box trucks optimized for urban logistics and intercity freight. Battery-swapping systems are being deployed to enhance operational uptime. The integration of lithium iron phosphate (LFP) battery packs and vehicle-to-grid (V2G) technology improves fleet efficiency and grid flexibility.

Key Market Factors:

India’s market grows at 5.4% CAGR, supported by policy initiatives for e-mobility, fleet electrification, and local manufacturing. The FAME-II Scheme (Faster Adoption and Manufacturing of Electric Vehicles) promotes electric commercial vehicle adoption through subsidies and infrastructure support. Domestic OEMs are launching light and medium-duty box trucks suited for urban and regional logistics. Battery technology advancements, including thermal management improvements, enhance vehicle reliability in high-temperature conditions. Public-private partnerships are expanding charging networks across major freight corridors.

Market Development Factors:

Germany’s market grows at 4.9% CAGR, supported by national emissions goals, logistics digitization, and innovation in electric mobility. The Climate Action Program 2030 and National Hydrogen Strategy encourage decarbonization in freight transport. European truck manufacturers are expanding all-electric model portfolios for urban and medium-distance logistics. Integration with digital fleet management systems improves route efficiency and charging scheduling. Government incentives under Klimaschutzprogramm and the European Green Deal promote adoption in commercial fleets. Charging infrastructure expansion across autobahn and logistics hubs strengthens long-term growth.

Key Market Characteristics:

Brazil’s market grows at 4.5% CAGR, driven by logistics modernization, renewable energy integration, and fleet electrification projects. Government-led programs encourage local assembly of electric trucks through tax incentives and industrial partnerships. The RenovaBio policy framework aligns fuel transition goals with electric vehicle adoption in logistics fleets. Manufacturers are developing mid-capacity electric box trucks optimized for urban deliveries and regional freight. Partnerships between utilities and logistics companies support fleet charging and renewable power integration.

Market Development Factors:

The United States grows at 4.1% CAGR, supported by federal incentives, corporate ecofriendly programs, and technological innovation. The Inflation Reduction Act (IRA) and Clean Trucks Plan provide funding for electric commercial vehicle procurement and charging infrastructure. Major logistics operators are electrifying short-haul delivery fleets to meet emission-reduction targets. Battery range improvements and DC fast-charging deployment enhance operational viability. Domestic manufacturers are developing Class 4–7 electric box trucks integrating telematics and predictive maintenance systems.

Key Market Factors:

The United Kingdom’s market grows at 3.7% CAGR, supported by decarbonization targets, clean transport policy, and urban logistics transformation. The Road to Zero Strategy and Zero Emission Vehicle (ZEV) Mandate promote electric vehicle adoption across commercial fleets. Manufacturers are introducing lightweight electric box trucks for last-mile and medium-range logistics. Expansion of urban low-emission zones (LEZs) drives replacement of diesel fleets. Public and private infrastructure partnerships are developing rapid charging stations along key delivery routes.

Market Development Factors:

Japan’s market grows at 3.2% CAGR, supported by government-led emission reduction targets and ongoing innovation in electric drivetrain systems. The Green Growth Strategy through Achieving Carbon Neutrality by 2050 encourages adoption of low-emission commercial vehicles. Domestic truck manufacturers are developing compact electric models tailored for urban freight and retail delivery. Advancements in solid-state batteries and regenerative braking technologies enhance range and energy efficiency. Coordination with municipalities supports charging station deployment and logistics route electrification.

Key Market Characteristics:

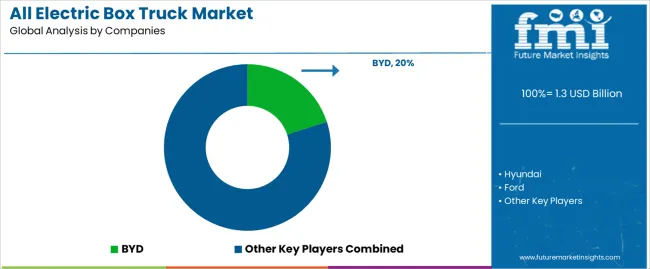

The all-electric box truck market is moderately consolidated, with around a dozen established automakers and commercial vehicle manufacturers competing in logistics, urban delivery, and regional transport applications. BYD leads the market with an estimated 20.0% global share, supported by its vertically integrated electric drivetrain production, large-scale battery manufacturing, and proven reliability in medium-duty electric commercial vehicles. Its leadership is reinforced by strong adoption in Asia, Europe, and Latin America, where fleet electrification policies are accelerating demand.

Ford, Hyundai, and Daimler follow as major competitors, leveraging global distribution networks and advanced e-mobility platforms. Their competitive advantage lies in modular chassis design, long-range battery systems, and integration with telematics for fleet optimization. Volvo Group and Renault maintain strong positions in Europe through established relationships with logistics operators and compliance with regional emission standards.

Chinese manufacturers such as Sany, JMEV, XCMG, Dongfeng Motor Group, and SUNLONG BUS drive production scalability and cost efficiency, serving both domestic and export markets. These firms emphasize durable battery packs, flexible vehicle configurations, and strong aftersales service networks. Reach targets North American fleets through lightweight, urban-focused models optimized for short-haul delivery operations.

Competition in this market centers on battery capacity, range efficiency, and total cost of ownership, with increasing emphasis on charging infrastructure compatibility and energy management software. Growth is driven by logistics electrification initiatives, stricter emission regulations, and advances in lithium-iron phosphate (LFP) and solid-state battery technologies supporting longer operating cycles and reduced maintenance costs.

| Items | Values |

|---|---|

| Quantitative Units | USD billion |

| Product Type | Light-Duty (Class 3–5), Medium-Duty (Class 6–7), Heavy-Duty (Class 8) |

| Application | Urban Logistics and Express Delivery, Cold Chain Transportation, Municipal and Public Services, Other |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Countries Covered | India, China, USA, Germany, South Korea, Japan, Italy, and 40+ countries |

| Key Companies Profiled | Hyundai, Ford, Daimler, Volvo Group, Renault, BYD, Sany, Reach, JMEV, XCMG, Dongfeng Motor Group, SUNLONG BUS |

| Additional Attributes | Dollar sales by product type and application categories; regional adoption trends across Asia Pacific, Europe, and North America; competitive landscape of electric commercial vehicle manufacturers; advancements in battery efficiency and charging infrastructure for electric box trucks; integration with ecofriendly logistics, last-mile delivery, and fleet electrification initiatives. |

The global all electric box truck market is estimated to be valued at USD 1.3 billion in 2025.

The market size for the all electric box truck market is projected to reach USD 2.0 billion by 2035.

The all electric box truck market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in all electric box truck market are medium-duty (class 6–7), light-duty (class 3–5) and heavy-duty (class 8).

In terms of application, urban logistics and express delivery segment to command 52.0% share in the all electric box truck market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Allergy Diagnostic Market Forecast and Outlook 2025 to 2035

Allergy Tester Market Size and Share Forecast Outlook 2025 to 2035

Allyl Chloride Market Size and Share Forecast Outlook 2025 to 2035

All-in-One LC Adapters Market Size and Share Forecast Outlook 2025 to 2035

All-In-One Under Sink Water Purifier Market Size and Share Forecast Outlook 2025 to 2035

Allergy Immunotherapy Market Analysis - Size, Share & Forecast 2025 to 2035

Allergen-Free Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

All Flash Array Market Size and Share Forecast Outlook 2025 to 2035

Allura Red AC Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Allantoin Extract for Skincare Products Market Analysis – Trends, Growth & Forecast 2025 to 2035

Allogeneic T Cell Therapies Market - Trends, Growth & Forecast 2025 to 2035

Allen Key Market Growth - Trends & Forecast 2025 to 2035

Market Share Breakdown of Allergy Immunotherapy Providers

Allergy Treatment Market Analysis - Demand & Forecast 2024 to 2034

Allulose Market Analysis – Size, Trends & Growth 2024 to 2034

Allyl Heptanoate Market

Allyl Caproate Market

All-Natural Flavors System Market

All-Terrain Vehicle Market

All Electric Multipurpose Goods Vehicle Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA