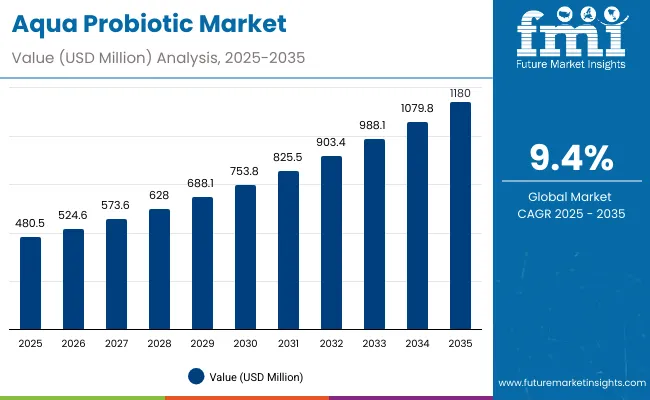

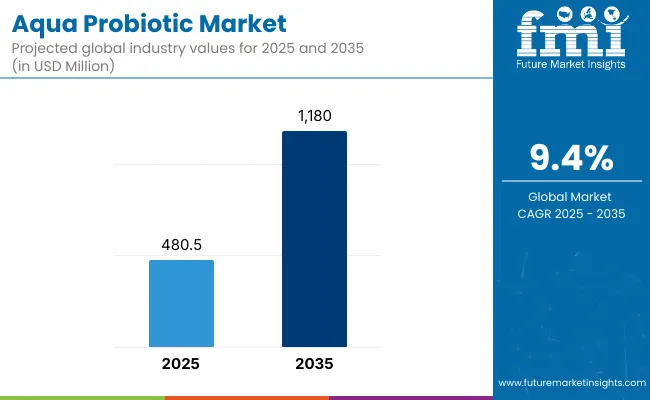

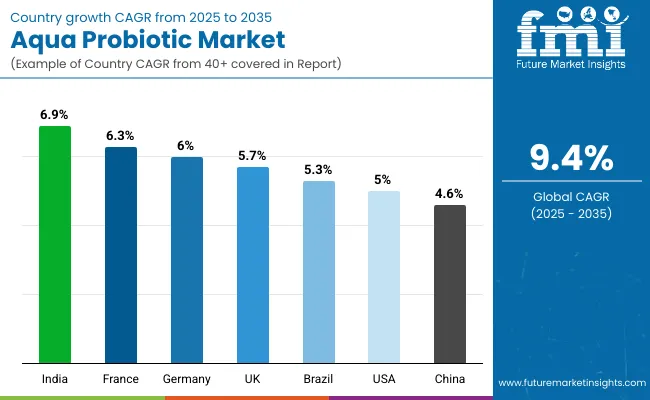

The global Aqua Probiotic Market has been projected to be valued at USD 480.5 million in 2025 and is anticipated to reach approximately USD 1,180.0 million by 2035. A cumulative gain of USD 264.9 million is expected over the forecast decade, signaling a 9.4% CAGR during the forecast period. The overall trajectory underscores the sector’s transition from niche adoption toward mainstream integration within aquaculture practices.

Aqua Probiotic Market Key Takeaways

| Metric | Value |

|---|---|

| Aqua Probiotic Estimated Value in (2025E) | USD 480.5 million |

| Aqua Probiotic Forecast Value in (2035F) | USD 1,180.0 million |

| Forecast CAGR (2025 to 2035) | 9.4% |

During the initial five years from 2025 to 2030, the market is anticipated to expand from USD 480.5 million to over USD 753.8 million, adding USD 273.3 million, which represents close to 39% of the decade’s total increase. This stage is likely to be defined by the steady adoption of probiotics as preventive health solutions, where disease management and feed efficiency are prioritized. Early emphasis is expected on strengthening microbial balance in aquatic environments, driven by growing concerns regarding antibiotic reduction and regulatory encouragement.

The second half of the forecast period, spanning 2030 to 2035, is forecasted to deliver the strongest acceleration, with market size expected to rise from USD 753.8 million to USD 1,180.0 million. This phase is anticipated to contribute nearly 61% of the decade’s overall expansion. Rapid intensification of aquaculture in Asia-Pacific, coupled with growing demand for species-specific formulations and performance-validated solutions, is projected to propel growth. Market momentum is expected to be reinforced by digital aquaculture innovations, integrated health monitoring systems, and strategic collaborations, ensuring probiotics become central to sustainable aquaculture practices.

From 2020 to 2024, the Aqua Probiotic Market expanded steadily, driven by rising demand for sustainable aquaculture and antibiotic-free solutions. During this period, adoption was dominated by fish and shrimp farming applications, which accounted for the majority of consumption. Competitive differentiation was shaped by microbial strain diversity, performance validation, and adaptability to species-specific needs.

Looking ahead, demand is expected to accelerate as advanced digital aquaculture systems, strain-specific probiotics, and sustainable farming practices redefine growth strategies. Market leaders are projected to pivot toward hybrid models that integrate probiotics with digital monitoring, predictive analytics, and eco-friendly aquafeed formulations, ensuring both compliance and long-term productivity.

The growth of the Aqua Probiotic Market is being propelled by the increasing demand for sustainable aquaculture practices, where health management and environmental stability are prioritized. Probiotics are being positioned as essential tools for reducing reliance on antibiotics, improving feed conversion efficiency, and strengthening the immune systems of aquatic species. This transition is being reinforced by regulatory encouragement, as governments and industry stakeholders advocate preventive measures over reactive treatments.

Expansion is being accelerated by heightened awareness of disease outbreaks in aquaculture ponds and hatcheries, where preventive probiotic usage is being viewed as cost-effective and reliable. Market adoption is being further stimulated by advancements in microbial strain development, enabling the delivery of more targeted, species-specific solutions that optimize gut health and water quality. Increasing investment in R&D and collaboration between feed manufacturers and biotechnology firms are also shaping innovation pipelines.

Digital aquaculture technologies, including real-time monitoring systems, are expected to further integrate probiotics into broader health management frameworks. Growing seafood consumption worldwide is driving farms to intensify production, thereby elevating the importance of probiotics in ensuring higher survival rates and sustainable yields. With sustainability becoming a central driver, probiotics are projected to remain at the forefront of next-generation aquaculture solutions.

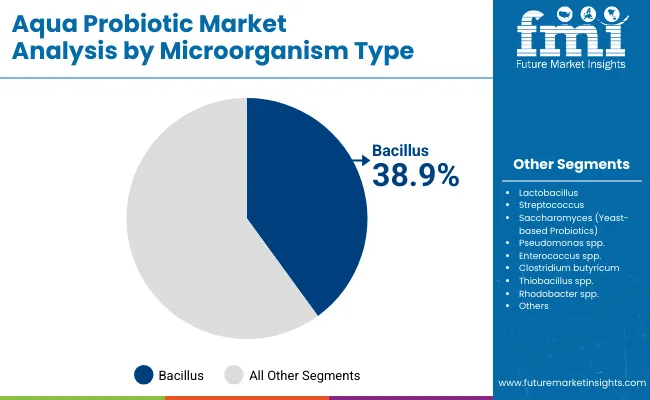

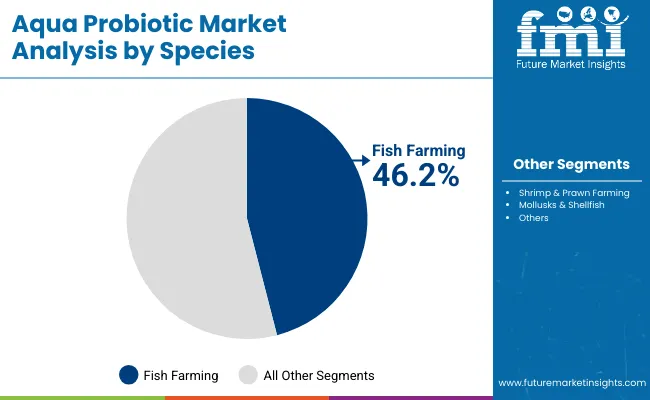

The Aqua Probiotic Market is segmented by microorganism type, species, form, application, distribution channel, and region, each shaping adoption patterns and growth opportunities. Microorganism-based classification highlights strains such as Bacillus, Lactobacillus, and yeast-based probiotics, which are being integrated into aquaculture systems for enhanced disease resistance and gut health optimization. Species-level segmentation encompasses fish farming, shrimp and prawn farming, mollusks, and other aquatic species, reflecting the diverse applications of probiotics in global aquaculture.

Form segmentation covers powder, liquid, and granules, which represent different modes of administration and farmer preferences. These segments are being influenced by evolving production technologies, intensification of aquaculture, and rising regulatory pressures for sustainable farming. Demand patterns across these categories are expected to be shaped by efficiency in disease prevention, cost-effectiveness of formulations, and adaptability to local farming practices. Collectively, these segmental dynamics are anticipated to define the future trajectory of probiotic adoption in aquaculture.

| Microorganism Type Segment | Market Value Share, 2025 |

|---|---|

| Bacillus | 38.9% |

| Saccharomyces (yeast-based probiotics) | 11.4% |

Bacillus is expected to dominate the microorganism type segment with a 38.9% market share in 2025, supported by its robustness, spore-forming ability, and proven effectiveness in water quality enhancement. Its resilience in varying environmental conditions has made it the preferred strain for aquaculture operators aiming to reduce disease outbreaks and stabilize pond ecosystems. Lactobacillus also represents a strong contributor due to its role in improving digestive efficiency and immune modulation in aquatic species. Emerging strains such as Enterococcus and Rhodobacter are projected to gain momentum as specialized solutions targeting niche applications. With advanced strain development and targeted research, microorganism diversity is anticipated to expand further, reinforcing the reliance on probiotics as a sustainable aquaculture solution.

| Species | 2025 Share% |

|---|---|

| Fish (salmon, tilapia, carp, catfish, etc.) | 46.2% |

| Shrimp & Prawn | 36.8% |

| Mollusks & Shellfish (oysters, mussels, clams) | 9.4% |

Fish farming is forecasted to lead the species segment with 46.2% share in 2025, driven by the global demand for salmon, tilapia, carp, and catfish. Rising protein consumption and expansion of intensive aquaculture systems are reinforcing the role of probiotics in ensuring higher survival rates and improved feed efficiency for these species. Shrimp and prawn farming represent the second-largest share, supported by high-value export markets and increasing susceptibility of crustaceans to disease outbreaks. Mollusks and ornamental species are emerging niches where probiotics are being applied for stress resistance and enhanced growth rates. The segmental distribution reflects a clear emphasis on high-demand species, where probiotics are being positioned as integral to long-term industry sustainability and profitability.

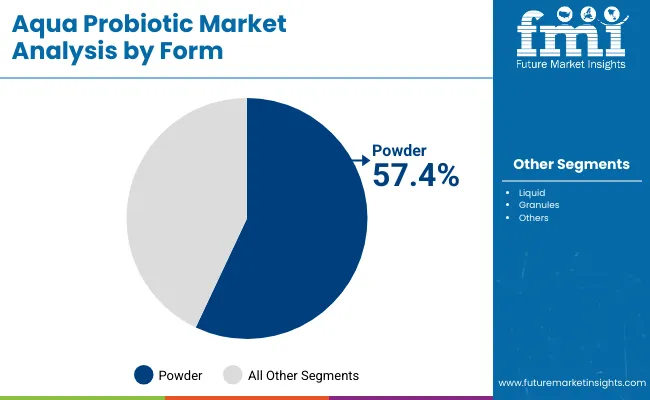

| Form | 2025 Share% |

|---|---|

| Powder | 57.4% |

| Liquid | 28.4% |

| Granules | 14.2% |

Powder is projected to lead the form segment with 57.4% share in 2025, primarily due to its ease of storage, stability, and compatibility with aquafeed formulations. The cost-efficiency of powdered probiotics has encouraged their widespread adoption among both large-scale farms and smaller operators. Liquid probiotics, while holding a smaller share, are increasingly utilized in hatcheries and water treatment applications where rapid dispersibility is required. Granules are also gaining traction in regions where slow-release formulations are valued for consistent probiotic availability. As manufacturing technologies advance, improvements in shelf-life, strain survivability, and targeted release mechanisms are expected to strengthen each format’s role. However, powdered forms are anticipated to maintain dominance, driven by farmer preference, logistical efficiency, and broad-spectrum applicability across aquaculture systems.

The Aqua Probiotic Market is advancing steadily as sustainability imperatives reshape aquaculture practices. Rising concerns over antibiotic resistance and disease outbreaks are driving demand for probiotic solutions, while innovation trends are positioning the market for long-term expansion.

Shift toward Antibiotic-Free Aquaculture

The global aquaculture industry is increasingly being shaped by regulatory restrictions and consumer preferences that discourage antibiotic use. Probiotics are being adopted as natural alternatives that promote gut health, enhance immunity, and improve feed efficiency in fish and shrimp. As seafood buyers demand safer, residue-free products, probiotics are being positioned as essential tools for ensuring compliance and market acceptance. The driver is expected to remain central as sustainability pressures intensify.

Integration with Digital Aquaculture Systems

Probiotics are no longer being viewed in isolation but are increasingly integrated into digital aquaculture frameworks. Real-time water monitoring, AI-driven health assessment, and precision feeding technologies are being combined with probiotics to optimize disease prevention and water quality management. This convergence of biotechnology with digital platforms is anticipated to create highly adaptive, data-driven probiotic applications, ensuring improved productivity and long-term resilience for aquaculture operators.

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 4.6% |

| India | 6.9% |

| Germany | 6.0% |

| France | 6.3% |

| UK | 5.7% |

| USA | 5.0% |

| Brazil | 5.3% |

The Aqua Probiotic Market is demonstrating varied growth trajectories across key countries, reflecting differences in aquaculture intensity, regulatory frameworks, and technology adoption. China is projected to expand at a CAGR of 4.6% from 2025 to 2035, driven by its dominant role in global aquaculture production and government-backed initiatives emphasizing sustainable practices. India is anticipated to outpace regional peers with a 6.9% CAGR, supported by rapid intensification of shrimp farming and expanding export demand for residue-free seafood.

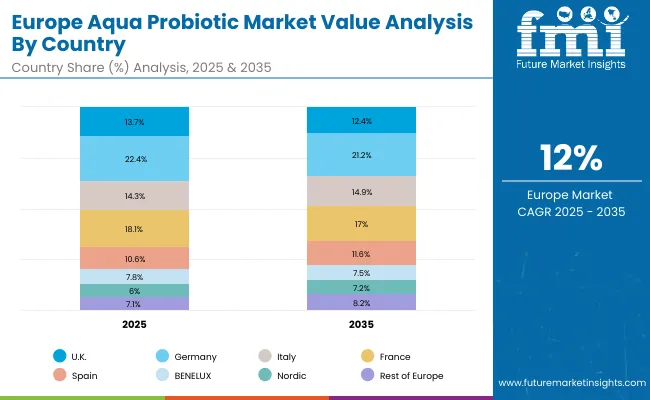

In Europe, steady adoption is being observed, with Germany forecasted at 6.0%, France at 6.3%, and the UK at 5.7%. This growth is being reinforced by stringent food safety standards, consumer preference for antibiotic-free products, and R&D collaborations between feed manufacturers and biotech firms. European nations are expected to remain critical innovation hubs, advancing species-specific probiotic solutions.

The United States is projected to grow at 5.0%, reflecting moderate expansion influenced by established aquaculture infrastructure and increasing integration of digital monitoring systems with probiotic applications. Brazil, with a CAGR of 5.3%, is expected to gain momentum from investments in tilapia farming and the regional transition toward sustainable aquafeed. Collectively, these markets highlight a globally diversified expansion path, where local conditions are shaping adoption speed and market positioning.

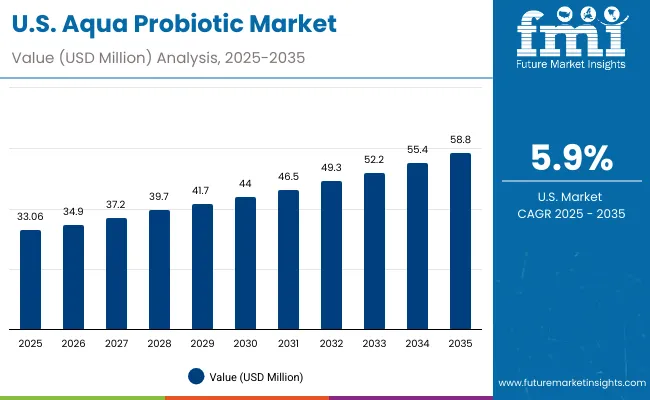

| Year | USA Aqua Probiotic Market (USD Million) |

|---|---|

| 2025 | 33.06 |

| 2026 | 34.9 |

| 2027 | 37.2 |

| 2028 | 39.7 |

| 2029 | 41.7 |

| 2030 | 44.0 |

| 2031 | 46.5 |

| 2032 | 49.3 |

| 2033 | 52.2 |

| 2034 | 55.4 |

| 2035 | 58.8 |

The Aqua Probiotic Market in the United States is projected to expand from USD 33.06 million in 2025 to USD 58.8 million by 2035, reflecting steady annual growth at a CAGR of 5.0%. This trajectory is being shaped by the growing emphasis on antibiotic-free aquaculture, with probiotics being adopted as critical tools for improving fish and shrimp health, enhancing immunity, and stabilizing pond ecosystems.

The Aqua Probiotic Market in the United Kingdom is forecasted to expand at a CAGR of 5.7% from 2025 to 2035, supported by strong regulatory enforcement and consumer preference for antibiotic-free seafood. Probiotics are being increasingly integrated into salmon aquaculture, which dominates the UK’s production base. Sustainability has been prioritized across aquaculture systems, and probiotics are being positioned as critical tools for maintaining fish health and enhancing survival rates. Market growth is also expected to be reinforced by digital aquaculture adoption, where probiotics are combined with water-quality monitoring and feed optimization solutions. R&D collaborations with European biotech firms are anticipated to deliver more strain-specific products aligned with the UK’s compliance-driven framework.

The Aqua Probiotic Market in India is projected to achieve the fastest growth globally, advancing at a CAGR of 6.9% during 2025-2035. The expansion is being propelled by shrimp farming, which contributes significantly to India’s aquaculture exports. Probiotic adoption is being reinforced by compliance requirements for residue-free seafood, which remain essential for sustaining exports to North America, Europe, and East Asia. Local feed manufacturers are actively integrating probiotics into pelleted and extruded feed, creating a stronger domestic supply chain. At the same time, smaller farms are increasingly adopting probiotics as cost-efficient alternatives to antibiotics. The government’s support for sustainable aquaculture practices and global buyer pressure are expected to further elevate India’s position as a growth engine in the aqua probiotics market.

The Aqua Probiotic Market in China is expected to grow at a CAGR of 4.6% through 2035, maintaining its role as the largest global aquaculture base. Expansion is being driven by the intensification of carp and tilapia farming, which remain highly sensitive to disease outbreaks in high-density systems. Probiotics are being adopted to stabilize water quality, improve feed conversion, and reduce reliance on antibiotics. Supportive government policies promoting sustainable aquaculture practices are expected to reinforce integration. Domestic biotechnology companies are expanding cost-competitive formulations, making probiotics more accessible for small and medium farms. With the rising focus on food safety and productivity, probiotics are forecasted to become essential to China’s aquaculture strategy, ensuring stable yields across a growing seafood supply chain.

| Countries | 2025 |

|---|---|

| UK | 13.7% |

| Germany | 22.4% |

| Italy | 14.3% |

| France | 18.1% |

| Spain | 10.6% |

| BENELUX | 7.8% |

| Nordic | 6.0% |

| Rest of Europe | 7.1% |

| Countries | 2035 |

|---|---|

| UK | 12.4% |

| Germany | 21.2% |

| Italy | 14.9% |

| France | 17.0% |

| Spain | 11.6% |

| BENELUX | 7.5% |

| Nordic | 7.2% |

| Rest of Europe | 8.2% |

The Aqua Probiotic Market in Germany is projected to expand at a CAGR of 6.0% from 2025 to 2035, supported by strong sustainability regulations and advanced aquaculture practices. Probiotics are being widely applied in trout and salmon farming, where feed efficiency and disease prevention remain top priorities. German aquaculture is strongly influenced by consumer demand for antibiotic-free seafood and environmental policies aligned with EU sustainability frameworks. Research collaborations with European biotech firms are expected to drive innovation in strain-specific probiotics with improved survivability and performance validation. With traceability and compliance becoming central to the industry, probiotics are being positioned as essential solutions to ensure both productivity and sustainability. This trajectory reflects Germany’s role as a leader in sustainable aquaculture innovation within Europe.

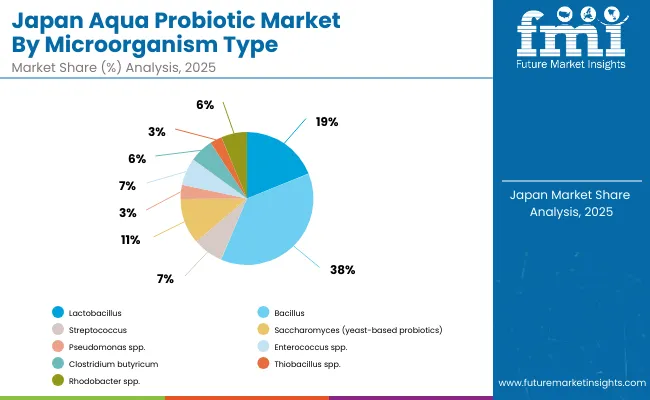

| Microorganism Type | Market Value Share, 2025 |

|---|---|

| Lactobacillus | 18.9% |

| Bacillus | 37.5% |

| Streptococcus | 7.4% |

| Saccharomyces (yeast-based probiotics) | 11.1% |

| Pseudomonas spp. | 3.4% |

| Enterococcus spp. | 6.7% |

| Clostridium butyricum | 5.8% |

| Thiobacillus spp. | 2.9% |

| Rhodobacter spp. | 6.3% |

The Aqua Probiotic Market in Japan is projected to record steady growth from 2025 to 2035, supported by regulatory emphasis on sustainable aquaculture and consumer preference for safe, antibiotic-free seafood. Bacillus dominates the microorganism segment with 37.5% share in 2025, reflecting its widespread application in pond stability and water-quality management. Lactobacillus follows at 18.9%, favored for its gut-health benefits in fish and shrimp. Emerging strains such as Rhodobacter (6.3%) and Clostridium butyricum (5.8%) are expected to record faster growth, driven by rising demand for strain-specific performance solutions.

This outlook highlights Japan’s transition toward advanced probiotic formulations tailored to intensive aquaculture practices. High-value species, coupled with strict food-safety standards, are reinforcing adoption. With increasing R&D in microbial biotechnology, Japan is anticipated to strengthen its role as a premium market where innovation, sustainability, and compliance shape competitive positioning.

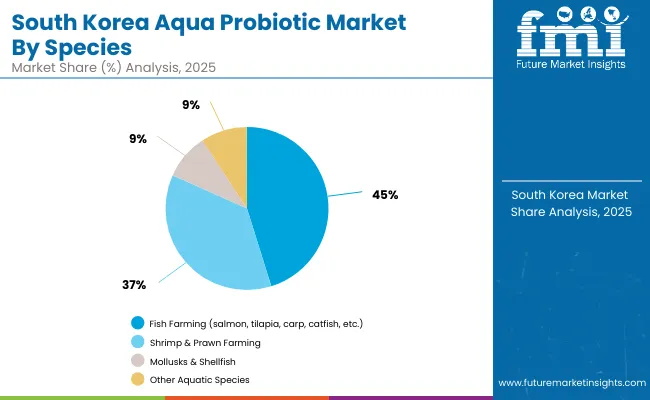

| Species | Market Value Share, 2025 |

|---|---|

| Fish Farming (salmon, tilapia, carp, catfish, etc.) | 45.2% |

| Shrimp & Prawn Farming | 36.5% |

| Mollusks & Shellfish (oysters, mussels, clams) | 9.1% |

| Other Aquatic Species (ornamental fish, eels, etc.) | 9.2% |

The Aqua Probiotic Market in South Korea is forecasted to expand strongly through 2035, supported by a rising focus on sustainable seafood production and premium aquaculture practices. Fish farming is expected to dominate with a 45.2% share in 2025, led by salmon and carp farming, where probiotics are being integrated to improve feed efficiency and resilience against disease outbreaks. Shrimp and prawn farming, contributing 36.5%, is anticipated to show rapid adoption as consumer demand for high-value crustaceans grows domestically and for export.

Mollusks (9.1%) and other aquatic species such as eels and ornamental fish (9.2%) are emerging segments, with adoption supported by the country’s diversification into specialty aquaculture. Probiotics are being positioned as essential tools in these sectors to enhance survival rates, improve water quality, and align with eco-friendly aquaculture mandates. With strong government emphasis on food safety and R&D investments in advanced formulations, South Korea is projected to become a regional leader in specialized probiotic applications.

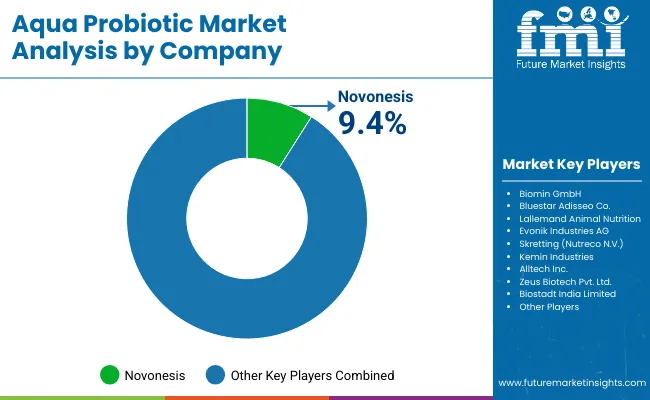

| Company | Global Value Share 2025 |

|---|---|

| Novonesis | 9.4% |

| Others | 90 .5% |

The Aqua Probiotic Market is moderately fragmented, with global leaders, established mid-sized innovators, and niche-focused specialists competing across aquaculture health and nutrition solutions. Global biotechnology and feed leaders such as Novonesis, Evonik Industries AG, and Bluestar Adisseo Co. are holding significant positions through advanced microbial strain portfolios, global distribution networks, and strong integration with aquafeed systems. Their strategies are being directed toward R&D collaborations, species-specific formulations, and sustainable production methods to address regulatory and environmental pressures.

Mid-sized innovators such as Biomin GmbH (DSM-Firmenich brand), Lallemand Animal Nutrition, and Skretting (Nutreco N.V.) are focusing on targeted health solutions, combining probiotics with prebiotics and functional feed additives. These players are expanding adoption through partnerships with fish and shrimp farms, where performance validation and traceability are critical to competitiveness.

Specialist companies including Kemin Industries, Alltech Inc., Zeus Biotech Pvt. Ltd., and Biostadt India Limited are driving growth in regional markets with cost-efficient, application-specific probiotics. Their strength lies in offering localized solutions, farmer education, and direct sales networks, making them particularly effective in emerging aquaculture hubs.

Competitive differentiation is shifting toward innovation in strain diversity, proof of efficacy, and integration with digital aquaculture systems. As compliance and sustainability pressures intensify, future competition is expected to be defined by ecosystem-based solutions that deliver both productivity and regulatory alignment.

Key Developments in Aqua Probiotic Market

| Item | Value |

|---|---|

| Quantitative Units | USD 480.5 million |

| Microorganism Type | Lactobacillus, Bacillus, Streptococcus, Saccharomyces, Pseudomonas spp., Enterococcus spp., Clostridium butyricum, Thiobacillus spp., Rhodobacter spp. |

| Form | Powder, Liquid, Granules |

| Application | Water Treatment, Feed Additives, Health Supplements |

| Species | Fish Farming (salmon, tilapia, carp, catfish), Shrimp & Prawn Farming, Mollusks & Shellfish (oysters, mussels, clams), Other Aquatic Species (ornamental fish, eels) |

| Distribution Channel | Direct B2B Sales, Veterinary & Specialty Stores, Online Platforms |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Novonesis, Biomin GmbH, Bluestar Adisseo Co., Lallemand Animal Nutrition, Evonik Industries AG, Skretting (Nutreco N.V.), Kemin Industries, Alltech Inc., Zeus Biotech Pvt. Ltd., Biostadt India Limited |

| Additional Attributes | Dollar sales by microorganism type, form, and species; adoption trends in antibiotic-free aquaculture; strong demand in shrimp and fish farming; regulatory pressure for sustainable farming practices; integration with digital aquaculture systems; rising adoption in Asia-Pacific; innovation in strain-specific probiotics and water-quality management solutions. |

The global Aqua Probiotic is estimated to be valued at USD 480.5 million in 2025.

The market size for the Aqua Probiotic is projected to reach USD 1,180.0 million by 2035.

The Aqua Probiotic is expected to grow at a 9.4% CAGR between 2025 and 2035.

The key forms in the Aqua Probiotic Market are powder, liquid, and granules.

In terms of microorganism type, he Bacillus segment is expected to command the largest share at 38.9% in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA