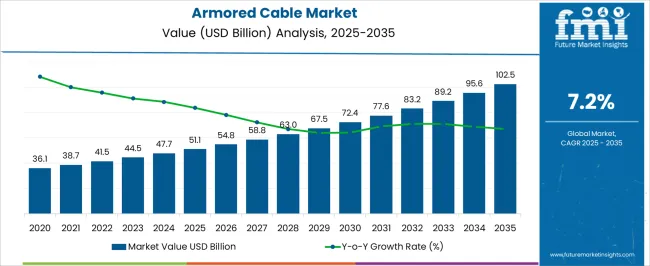

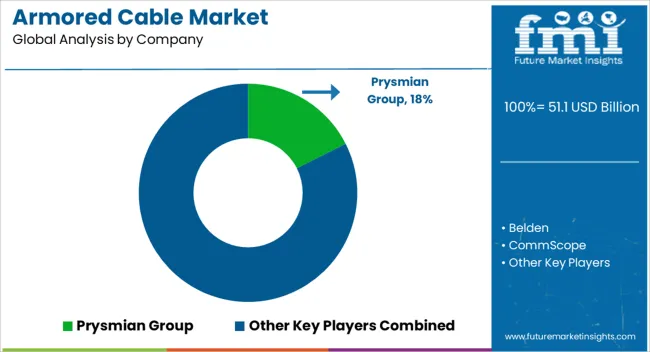

The Armored Cable Market is estimated to be valued at USD 51.1 billion in 2025 and is projected to reach USD 102.5 billion by 2035, registering a compound annual growth rate (CAGR) of 7.2% over the forecast period. Analyzing the data reveals specific breakpoints where growth acceleration or stability can be observed. Between 2025 and 2027, the market experiences moderate increases, rising from USD 51.1 billion to USD 58.8 billion.

This early phase indicates foundational growth supported by stable demand and initial adoption of armored cable technologies across sectors. From 2027 to 2030, a more pronounced growth phase occurs, with the market climbing from USD 58.8 billion to USD 67.5 billion, reflecting increased industrial investments and infrastructure upgrades. After 2030, the growth trend maintains consistent upward movement, albeit at a steadier pace, progressing to USD 102.5 billion by 2035.

The data suggest a plateau forming toward the end of the period, indicating a maturation phase where market penetration is nearing saturation. Incremental gains still add substantial value but at a slower rate compared to mid-cycle expansion. This breakpoint analysis highlights critical periods of market acceleration and stabilization.

For investors and decision-makers, understanding these phases is essential for timing investments and strategizing resource allocation to maximize returns as the Armored Cable Market evolves through its growth lifecycle.

| Metric | Value |

|---|---|

| Armored Cable Market Estimated Value in (2025 E) | USD 51.1 billion |

| Armored Cable Market Forecast Value in (2035 F) | USD 102.5 billion |

| Forecast CAGR (2025 to 2035) | 7.2% |

The armored cable market is undergoing stable expansion, supported by increased demand for high-performance, durable electrical systems across infrastructure, industrial, and energy projects. Enhanced safety protocols, higher load requirements, and the need for corrosion and moisture resistance are reinforcing the importance of armored solutions over traditional wiring systems.

Government-backed initiatives in grid modernization, renewable integration, and industrial electrification are expanding the scope of application for armored cables, particularly in extreme environments. Technological advancements in cable sheathing and insulation materials have enabled longer service life and improved performance in subsea, underground, and offshore installations.

Additionally, rising investments in oil & gas infrastructure and increased automation across energy-intensive industries are expected to create sustained demand for reliable armored cable systems. Regulatory compliance and performance certifications continue to shape procurement standards, further enhancing trust and deployment across mission-critical applications.

The armored cable market is segmented by armor type, core type, end user, and geographic regions. By armor type, the armored cable market is divided into Continuously Corrugated Welded and Interlocked. In terms of the core type, the armored cable market is classified into Multi-Core and Single Core. The end users of the armored cable market are segmented into Oil & Gas, Manufacturing, Mining, Construction, and Others. Regionally, the armored cable industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

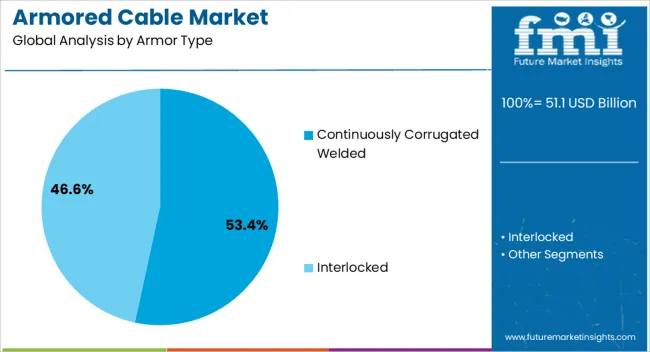

Continuously corrugated, welded armor is anticipated to account for 53.4% of total revenue in the armored cable market by 2025, making it the dominant armor type. Its leadership is driven by the superior mechanical protection and moisture barrier performance it offers in harsh environments, especially in underground and subsea installations.

The continuous design allows for enhanced crush resistance and durability while maintaining cable flexibility during deployment. This type of armor is widely preferred in energy, petrochemical, and offshore applications due to its reliability in maintaining electrical integrity under extreme pressure, temperature, and corrosive exposure.

The compatibility of this armor format with high-voltage and fiber optic systems has further expanded its adoption in complex infrastructure and utility projects where operational uptime is critical.

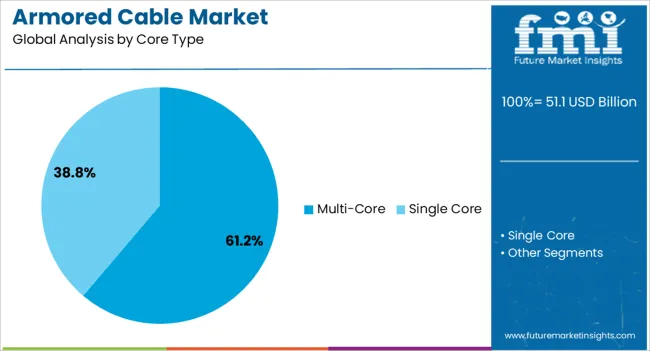

Multi-core armored cables are expected to contribute 61.2% of the overall market revenue in 2025, solidifying their position as the leading core type. This segment’s strength stems from the ability to house multiple conductors within a single shielded unit, thereby streamlining installation and reducing space and labor costs.

Multi-core cables are extensively used in applications requiring compact yet high-capacity wiring, such as control panels, industrial equipment, and building automation systems. Enhanced signal transmission, minimized electromagnetic interference, and easier routing have made them a preferred choice for integrated power and signal distribution.

Their usage aligns with the increased complexity of electrical systems in modern infrastructure, where space optimization and reliability are vital design priorities.

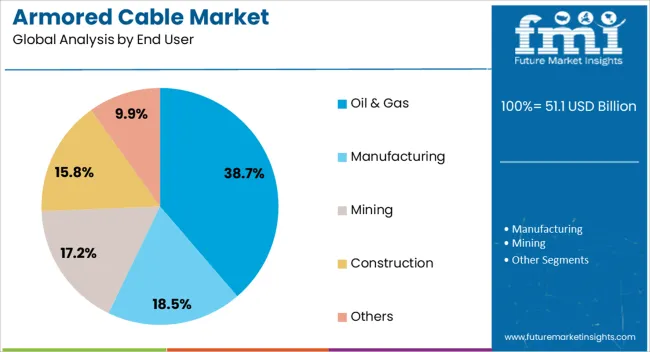

The oil & gas sector is projected to hold 38.7% of the armored cable market share in 2025, establishing it as the leading end-use industry. This dominance is attributed to the industry’s high safety standards, extreme operational conditions, and need for long-term cable performance in corrosive and explosive-prone zones.

Armored cables are critical in upstream, midstream, and downstream operations for power supply, control systems, and instrumentation. The push toward offshore exploration, deepwater drilling, and facility automation has intensified the demand for robust cable solutions capable of withstanding chemical exposure, mechanical stress, and high temperatures.

Regulatory mandates for flame-retardant and fire-resistant cabling in hazardous zones further support the widespread deployment of armored cable systems across global oil & gas infrastructures.

The market has grown steadily due to increasing demand for robust and secure electrical wiring solutions in industrial, commercial, and infrastructure projects. These cables provide mechanical protection and resistance against environmental hazards such as moisture, corrosion, and rodents, ensuring reliable power transmission and communication in harsh conditions. The expansion of power generation and distribution networks, along with rising urban development, has fueled market growth. Innovations in cable materials, including corrosion-resistant alloys and flexible armoring techniques, have improved installation ease and durability. The high installation costs and regulatory compliance requirements pose challenges.

Rapid infrastructure expansion globally, including smart grid deployments, transportation systems, and commercial buildings, drives the need for secure and durable cabling solutions. Armored cables are preferred in underground and outdoor installations where protection against physical damage and environmental exposure is critical. The growing emphasis on reliable energy transmission and data communication in urban centers further accelerates adoption. Public and private sector investments in utility modernization projects have increased demand for armored cables compliant with stringent safety and fire-resistant standards. The market benefits from large-scale electrical infrastructure upgrades, industrial automation, and digitization initiatives, all of which require dependable cable systems for uninterrupted operation.

Advancements in armor materials and cable construction techniques have elevated performance levels in challenging environments. The use of high-strength steel wires, aluminum armoring, and novel composite materials provides superior mechanical protection while reducing cable weight. Improvements in sheath materials enhance resistance to chemicals, ultraviolet radiation, and temperature fluctuations. Flexible armoring designs facilitate easier handling and installation in complex routing scenarios. Enhanced shielding technologies also minimize electromagnetic interference, ensuring signal integrity in communication cables. These innovations allow armored cables to meet diverse industry demands, from heavy industrial use to sensitive data transmission, while maintaining compliance with evolving regulatory requirements.

Compliance with safety and fire resistance standards such as IEC, NEC, and UL certifications is critical in the armored cable market. Regulatory bodies impose rigorous testing and quality assurance protocols to ensure cables perform reliably under fire, mechanical stress, and environmental hazards. These regulations protect end-users and infrastructure investments by mandating minimum performance criteria and traceability. Manufacturers invest in advanced testing facilities and certification processes to meet global standards and customer expectations. Regulations also drive innovation in fire-retardant and low-smoke zero-halogen (LSZH) cable variants. Ongoing updates to electrical codes and standards necessitate continuous product development and adaptation by industry participants.

The market faces challenges from fluctuating raw material prices, especially copper, steel, and aluminum, which significantly impact production costs. Global supply chain disruptions caused by geopolitical tensions, transportation constraints, and trade restrictions add complexity to procurement and manufacturing. These factors can lead to price volatility and longer lead times, affecting project schedules and profit margins. Manufacturers are focusing on supply chain diversification, strategic inventory management, and cost optimization initiatives to mitigate risks. Balancing quality, compliance, and cost-effectiveness remains essential for sustaining competitiveness. Investment in local production capabilities and raw material recycling is also increasing to enhance supply security and environmental sustainability.

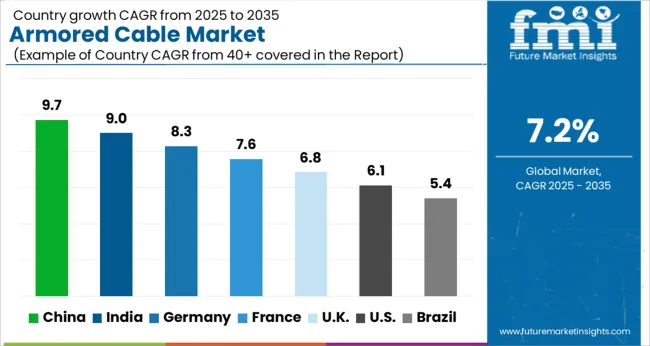

The market is projected to grow at a CAGR of 7.2% from 2025 to 2035, driven by increasing demand for durable and secure electrical wiring in industrial, commercial, and infrastructure projects. China leads with a 9.7% CAGR, supported by large-scale infrastructure development and expanding power transmission networks. India follows at 9.0%, fueled by rapid urbanization and growing industrial sectors.

Germany, growing at 8.3%, benefits from advanced manufacturing technologies and stringent safety standards. The UK, with 6.8% growth, experiences steady demand from construction and utility sectors. The USA, at 6.1%, reflects ongoing modernization of electrical grids and increasing emphasis on safety and durability. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China is projected to grow at a CAGR of 9.7% from 2025 to 2035, driven by increasing infrastructure projects and industrial automation. Domestic manufacturers have invested heavily in developing cables with enhanced fire resistance and mechanical protection suitable for high-voltage transmission and industrial applications. Companies such as Hengtong Group and Far East Cable are leading advancements with customized solutions for urban rail transit and smart grid projects. Government support for energy infrastructure modernization and expanding renewable energy installations continue to stimulate demand, positioning China as a key producer and consumer in the armored cable industry.

In India, the industry is forecasted to grow at a CAGR of 9.0% between 2025 and 2035, supported by rapid electrification initiatives and infrastructure development. Emphasis on product reliability and compliance with international safety standards has encouraged adoption in commercial and industrial segments. Manufacturers are focusing on enhancing cable flexibility and durability while maintaining cost efficiency. Expansion of metro rail networks and industrial zones has contributed significantly to market growth. Strategic partnerships with foreign technology providers have accelerated product innovation and quality improvement.

Germany is expected to grow at a CAGR of 8.3% from 2025 to 2035, driven by demand from renewable energy integration and industrial automation. Manufacturers prioritize high-quality standards, producing cables with enhanced electromagnetic shielding and chemical resistance. The automotive and manufacturing sectors are key consumers requiring specialized cable assemblies. Focus on energy-efficient production processes aligns with national environmental targets. Collaborative efforts between cable producers and system integrators have improved installation efficiency and product customization options.

The United Kingdom’s armored cable industry is projected to expand at a CAGR of 6.8% over the next decade, fueled by upgrades in power distribution networks and commercial construction. The rising demand for fire-safe and mechanically protected cables is encouraging innovation in materials and coatings. Urban redevelopment projects and industrial facility modernization contribute substantially to market growth. Suppliers are emphasizing compliance with British Standards and offering tailored solutions for diverse industrial environments. Growth in offshore wind farms also supports demand for specialized armored cable systems.

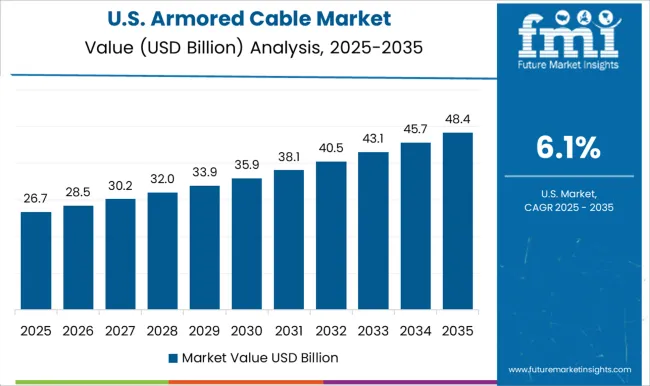

The armored cable industry in the United States is expected to grow at a CAGR of 6.1% between 2025 and 2035, supported by infrastructure modernization and expanding industrial sectors. Emphasis on safety compliance with NEC standards has increased the use of armored cables in commercial buildings and industrial facilities. Manufacturers are innovating with lightweight yet durable cables to facilitate installation and reduce labor costs. The growth of data centers and telecommunication hubs is driving demand for cables with enhanced shielding and fire resistance. Federal funding for grid resilience projects further supports market expansion.

The market is driven by leading global manufacturers supplying robust, protective cabling solutions essential for power transmission, industrial, and infrastructure projects. Prysmian Group commands a significant share with a wide portfolio of armored cables designed for high mechanical protection and resistance to environmental stress. Belden and CommScope are prominent players offering specialized cables that meet rigorous industry standards for telecommunications and data centers.

Elsewedy Electric and Fujikura focus on regional expansion and product diversification, providing cables suited for power distribution and control applications. Furukawa Electric and Helukabel emphasize advanced materials and manufacturing technologies that improve durability and flexibility. The Hellenic Group and Kabelwerk Eupen serve niche markets with customized armored cable assemblies tailored for demanding industrial environments. Lapp Group, Leoni, and LS Cable & Systems maintain strong presence through integrated supply chains and comprehensive product lines covering power, control, and instrumentation cables.

Nexans, NKT, and Polycab continue to invest in new manufacturing capacities and quality certifications to support growing infrastructure developments globally. Shawcor and Sumitomo specialize in high-performance cables with added chemical and corrosion resistance.

Technikabel, TFKable, and other regional manufacturers complement the market by offering cost-competitive solutions focused on local demand. The industry is characterized by high entry barriers, including capital-intensive production facilities, strict safety and quality certifications, complex supply chains, and long-standing relationships with end users and contractors. These factors limit new entrants and reinforce the position of established players.

| Item | Value |

|---|---|

| Quantitative Units | USD 51.1 Billion |

| Armor Type | Continuously Corrugated Welded and Interlocked |

| Core Type | Multi-Core and Single Core |

| End User | Oil & Gas, Manufacturing, Mining, Construction, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Prysmian Group, Belden, CommScope, Elsewedy Electric, Fujikura, Furukawa Electric, Helukabel, Hellenic Group, Kabelwerk Eupen, Lapp Group, Leoni, LS Cable & Systems, Nexans, NKT, Polycab, Shawcor, Sumitomo, Technikabel, and TFKable |

| Additional Attributes | Dollar sales by cable type and application sector, demand dynamics across industrial facilities, commercial buildings, and infrastructure projects, regional trends in deployment across North America, Europe, and Asia-Pacific, innovation in corrosion-resistant armoring, lightweight construction, and enhanced fire-retardant coatings, environmental impact of metal sourcing, manufacturing emissions, and end-of-life cable recycling, and emerging use cases in renewable energy grid expansions, smart building systems, and underground communication networks. |

The global armored cable market is estimated to be valued at USD 51.1 billion in 2025.

The market size for the armored cable market is projected to reach USD 102.5 billion by 2035.

The armored cable market is expected to grow at a 7.2% CAGR between 2025 and 2035.

The key product types in armored cable market are continuously corrugated welded and interlocked.

In terms of core type, multi-core segment to command 61.2% share in the armored cable market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

CCW Armored Cable Market Size and Share Forecast Outlook 2025 to 2035

Multi Core Armored Cable Market Size and Share Forecast Outlook 2025 to 2035

Single Core Armored Cable Market Size and Share Forecast Outlook 2025 to 2035

Interlocked Armored Cable Market Size and Share Forecast Outlook 2025 to 2035

Armored Vehicle Market

Cable Tray Market Size and Share Forecast Outlook 2025 to 2035

Cable Granulator Market Size and Share Forecast Outlook 2025 to 2035

Cable Distribution Cabinets Market Size and Share Forecast Outlook 2025 to 2035

Cable Accessories Market Growth - Trends & Forecast 2025 to 2035

Cable Cleaning Solutions Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cable Cleaning Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cable Material Market Growth - Trends & Forecast 2025 to 2035

Cable Fault Locator Market Size, Share, and Forecast 2025 to 2035

Cable Connectors and Adapters Market Analysis by Application, Product, Type and Region: Forecast from 2025 to 2035

Cable Cars and Ropeways Market Growth - Trends & Forecast 2025 to 2035

Cable Wrapping Tape Market

Cable Racks Market

Cable Testing Market

Cable Assemblies Market

Cable Carrier Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA