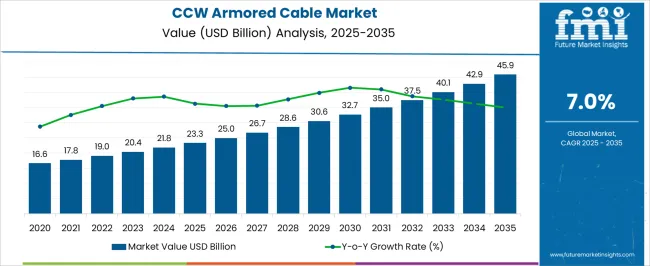

The CCW armored cable market is estimated to be valued at USD 23.3 billion in 2025 and is projected to reach USD 45.9 billion by 2035, registering a compound annual growth rate (CAGR) of 7.0% over the forecast period. Asia-Pacific is poised to dominate the market due to sustained investments in power distribution, industrial construction, and urban infrastructure expansion. The rapid industrialization, coupled with increasing electricity demand in countries such as China, India, and Southeast Asian economies, accelerates the adoption of armored cable solutions for enhanced safety, reliability, and durability in high-voltage and hazardous environments.

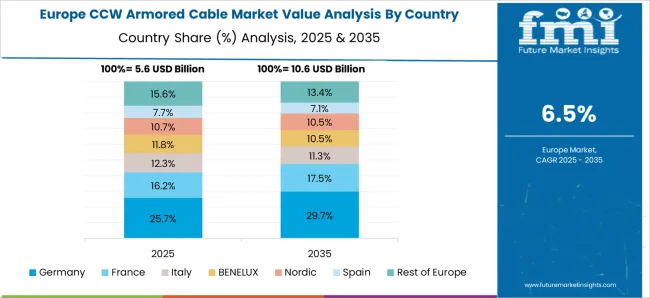

Europe demonstrates moderate growth driven by the replacement and upgrade of aging infrastructure, alongside stringent regulatory mandates for electrical safety and fire-resistant cabling. The region’s focus on energy efficiency, smart grids, and industrial modernization supports steady demand, though overall market expansion remains tempered by relatively saturated infrastructure networks and slower urban expansion rates. North America exhibits steady but comparatively slower growth, as the market is largely mature, with significant penetration of armored cables in industrial and commercial sectors already established.

Investments in grid modernization, renewable energy integration, and industrial upgrades contribute to incremental demand increases. Over the forecast period, Asia-Pacific’s share is expected to rise sharply relative to Europe and North America, reflecting higher growth momentum driven by industrialization, urban expansion, and large-scale electrification projects, highlighting the pronounced regional disparity in CCW armored cable adoption and market value expansion.

| Metric | Value |

|---|---|

| CCW Armored Cable Market Estimated Value in (2025 E) | USD 23.3 billion |

| CCW Armored Cable Market Forecast Value in (2035 F) | USD 45.9 billion |

| Forecast CAGR (2025 to 2035) | 7.0% |

The CCW armored cable market represents a specialized segment within the global electrical and power transmission industry, emphasizing safety, durability, and reliable power distribution. Within the broader power and electrical cabling sector, it accounts for about 4.3%, driven by adoption in industrial, commercial, and residential applications requiring mechanical protection and environmental resistance. In the armored and protective cable segment, its share is approximately 5.1%, reflecting demand for fire-resistant, moisture-proof, and rodent-resistant solutions.

Across the power distribution and infrastructure market, it holds around 3.7%, supporting high-voltage, low-voltage, and control applications. Within the industrial electrical solutions category, it represents 3.4%, highlighting use in factories, oil and gas, and heavy engineering facilities. In the overall electrical safety and infrastructure ecosystem, the market contributes about 3.0%, emphasizing reliability, compliance, and long-term operational efficiency. Recent developments in the CCW armored cable market have focused on material enhancement, installation efficiency, and compliance with electrical safety standards. Groundbreaking trends include the use of advanced polymer sheaths, lightweight metal armoring, and high-temperature resistant insulation for enhanced durability.

Key players are collaborating with construction, industrial, and energy companies to offer customized cable solutions for demanding applications. Adoption of pre-terminated and flexible designs is gaining traction for faster deployment and reduced downtime. The integration with smart monitoring systems and predictive maintenance solutions is emerging to ensure operational reliability and minimize failures.

The CCW armored cable market is growing steadily as industries increasingly demand robust and reliable electrical cabling solutions capable of withstanding harsh operating environments. Continuous corrugated welded (CCW) armored cables are gaining traction due to their superior mechanical protection, fire resistance, and EMI shielding, making them highly suitable for mission-critical installations.

As infrastructure modernization accelerates across sectors such as oil & gas, power generation, and transportation, the adoption of CCW cables is being driven by their compliance with stringent safety standards and installation efficiency. Market growth is further reinforced by expanding investments in energy and industrial automation, where secure and long-lasting cable systems are a prerequisite.

Rising emphasis on operational safety, infrastructure durability, and reduced downtime is expected to support sustained demand for CCW armored cable solutions in both developed and emerging markets

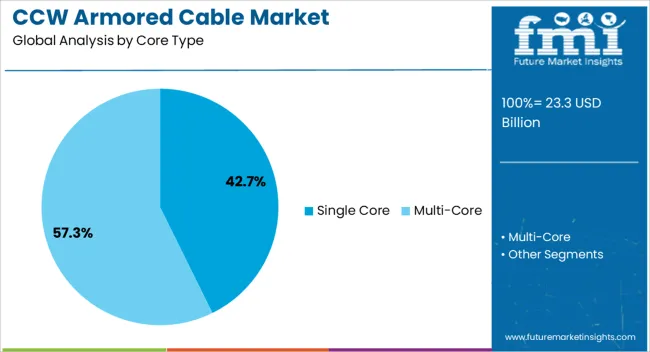

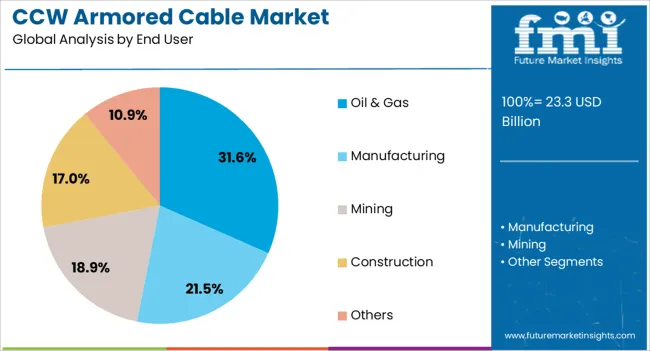

The CCW armored cable market is segmented by core type, end user, and geographic regions. By core type, the CCW armored cable market is divided into single-core and Multi-Core. In terms of end users, the CCW armored cable market is classified into oil and gas, Manufacturing, Mining, Construction, and Others. Regionally, the CCW armored cable industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The single core segment accounts for 42.7% of the CCW armored cable market share, underscoring its widespread application in high-voltage and controlled distribution systems. These cables are preferred for their simplicity, space efficiency, and suitability for power transmission in industrial and utility environments.

Single core CCW cables are extensively used in environments requiring clear phase separation, reduced cross-talk, and enhanced thermal performance. Their structural strength and resistance to physical and chemical stressors make them ideal for underground and hazardous locations.

Increasing infrastructure development projects, particularly in the energy and heavy engineering sectors, are driving consistent demand for single-core configurations. As industries prioritize system safety, current handling capacity, and ease of routing in confined installations, the single core segment is expected to retain its leading position across global installations.

The oil & gas segment leads the CCW armored cable market by end user with a 31.6% share, driven by the sector’s high dependency on reliable, durable, and secure electrical infrastructure in challenging operational environments. From offshore rigs to downstream refineries, CCW cables are essential for ensuring a continuous power supply, signal integrity, and protection against mechanical damage, moisture, and corrosive substances.

The sector’s stringent safety standards and exposure to explosive atmospheres necessitate the use of cables that meet rigorous fire and mechanical codes, reinforcing the relevance of CCW solutions. With global exploration and production activities rebounding and major operators investing in digitalization and automation, demand for robust cabling systems is expected to rise.

The segment’s growth will remain strong as oil & gas companies continue to prioritize system reliability, personnel safety, and compliance across upstream, midstream, and downstream operations.

The market has experienced significant growth due to increasing demand for high-performance electrical infrastructure across industrial, commercial, and utility sectors. CCW (Copper-Clad Aluminum Wire) armored cables are preferred for their robustness, flexibility, and enhanced electrical conductivity, offering reliable power transmission while withstanding mechanical stress and harsh environmental conditions. Adoption has been driven by expanding construction activities, renewable energy projects, and the need for durable wiring solutions in industrial and commercial applications. Manufacturers are focusing on innovations in fire-resistant, moisture-resistant, and lightweight armored cable solutions to meet evolving regulatory and operational standards.

CCW armored cables are widely deployed in industrial and commercial facilities to ensure reliable power distribution and operational safety. Their enhanced mechanical strength and resistance to environmental hazards make them suitable for factories, warehouses, and large-scale commercial buildings. In addition, armored construction minimizes the risk of physical damage, ensuring consistent energy supply to critical equipment and systems. Growing industrialization in emerging economies, coupled with modernization of commercial electrical infrastructure in developed regions, has expanded the market potential. The adoption of advanced cable management systems and integration with automated monitoring tools has further increased operational efficiency. With rising investments in construction and industrial automation, CCW armored cables have become essential components in reliable power distribution frameworks.

CCW armored cables are increasingly utilized in renewable energy projects, including solar, wind, and hydroelectric installations. Their ability to carry high-voltage power over long distances with minimal losses, combined with enhanced durability, supports efficient energy transmission from generation sites to distribution networks. In addition, smart grid deployment has accelerated the demand for cables that can withstand dynamic loads, environmental extremes, and frequent handling during installation. Armored cables with improved fire resistance, UV stability, and chemical tolerance are preferred for grid modernization initiatives. Manufacturers are developing solutions tailored for renewable energy and smart grid applications, enhancing reliability, operational safety, and long-term performance of electrical networks.

Technological advancements in CCW armored cable design, material composition, and manufacturing processes have enhanced product performance and reliability. Innovations include lightweight conductor materials, improved insulation and sheath compounds, and fire-retardant coatings that increase safety and operational lifespan. Integration with monitoring systems enables real-time diagnostics, reducing maintenance costs and downtime. Customization options, such as flexible designs for complex installations and enhanced shielding for electromagnetic interference mitigation, have expanded the application scope. Continuous research and development efforts are driving performance improvements, ensuring that CCW armored cables meet stringent industry standards and support emerging power distribution needs across industrial, commercial, and utility sectors.

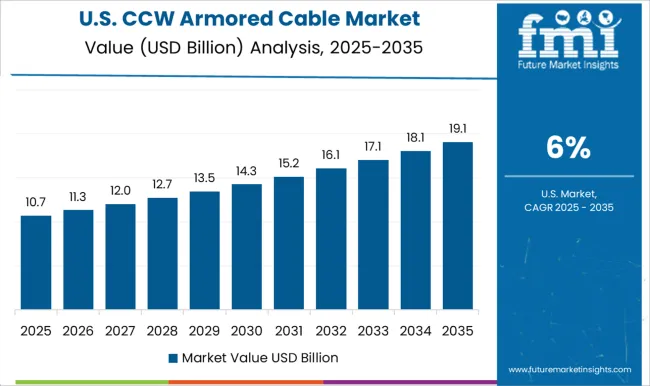

North America and Europe lead the CCW armored cable market due to well-established electrical infrastructure, stringent safety regulations, and advanced industrial sectors. Asia Pacific is emerging as a high-growth region, driven by rapid urbanization, infrastructure expansion, and industrial development.

Market participants focus on product innovation, strategic partnerships, and expanding production capabilities to meet the diverse demands of various regions. Pricing strategies, quality differentiation, and adherence to environmental and safety standards shape competitive dynamics. The increasing emphasis on reliable energy transmission, modernization of electrical networks, and growth in the industrial and renewable energy sectors continue to propel the global adoption of CCW armored cables.

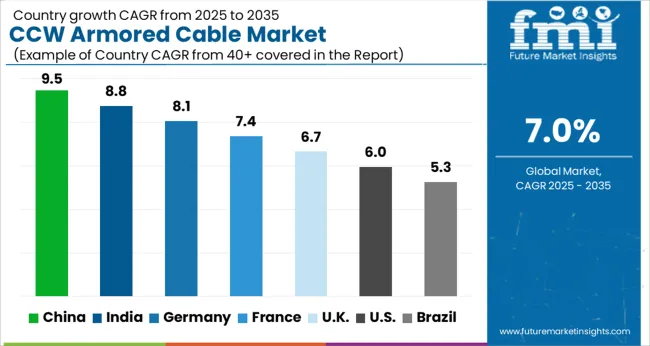

| Country | CAGR |

|---|---|

| China | 9.5% |

| India | 8.8% |

| Germany | 8.1% |

| France | 7.4% |

| UK | 6.7% |

| USA | 6.0% |

| Brazil | 5.3% |

The market is expected to expand at a CAGR of 7.0% from 2025 to 2035, driven by increasing infrastructure investments and industrial electrification projects. China leads with 9.5%, fueled by large-scale construction activities and robust manufacturing capabilities. India follows at 8.8%, supported by rising energy distribution and industrial expansion. Germany records 8.1%, reflecting strong demand for high-quality and reliable cable solutions. The UK registers 6.7%, with growth attributed to modernization of electrical networks, while the USA stands at 6.0%, driven by steady industrial and commercial developments. These regions exemplify global growth trends and innovation in armored cable technologies. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is experiencing a CAGR of 9.5%, driven by extensive industrial and infrastructure development requiring robust power distribution systems. Adoption is high in manufacturing facilities, commercial complexes, and urban infrastructure projects where protection against mechanical stress and environmental factors is critical. Domestic manufacturers focus on high-quality armored cables with advanced insulation materials and enhanced safety features. Collaboration with international suppliers and standardization initiatives supports large-scale deployment across energy, construction, and industrial sectors.

India is projected to grow at a CAGR of 8.8%, driven by the need for reliable and durable power transmission in industrial parks, commercial buildings, and metro infrastructure. Armored cables are preferred in regions with high environmental exposure and mechanical stress. Local manufacturers are focusing on high-capacity, low-loss cable solutions to support energy efficiency. Integration with smart grid initiatives and urban electrification projects accelerates adoption across power and industrial segments.

Germany is growing at a CAGR of 8.1%, supported by industrial manufacturing, renewable energy projects, and stringent electrical safety standards. The market emphasizes medium- and high-voltage armored cables for industrial plants, renewable installations, and urban infrastructure. Manufacturers focus on advanced insulation, fire-retardant properties, and compliance with European Union standards. Collaboration with construction and power utilities ensures efficient supply and integration in industrial applications.

The United Kingdom is projected to grow at a CAGR of 6.7%, influenced by the expansion of urban infrastructure, industrial upgrades, and energy distribution networks. Armored cables are widely used in commercial, industrial, and municipal installations due to enhanced durability and safety. Companies are emphasizing product standardization, reliability, and compliance with UK electrical codes to ensure secure energy transmission.

The United States is expanding at a CAGR of 6.0%, supported by industrial modernization, energy transmission projects, and growing adoption in commercial and urban infrastructure. Armored cables are preferred in high-voltage transmission, manufacturing plants, and regions with extreme environmental conditions. Manufacturers focus on quality, durability, and compliance with UL standards to ensure safety and reliability. Strategic partnerships with utility companies and industrial contractors strengthen market penetration.

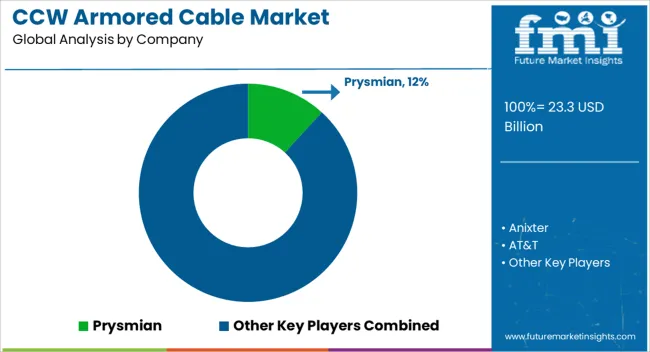

The market is characterized by a mix of global cable manufacturers, regional leaders, and specialized players focusing on industrial, commercial, and utility applications. Prysmian, Nexans, Southwire, and Belden dominate the international segment, offering high-quality armored cable solutions with emphasis on safety standards, durability, and long-term reliability. Their competitive advantage stems from extensive R&D, large-scale production capabilities, and a global distribution network catering to energy, infrastructure, and telecommunication sectors. Regional manufacturers such as Finolex, Havells, KEI Industries, Polycab, and RR Kabel target growing demand in emerging markets, emphasizing cost-effective solutions, localized support, and compliance with regional standards.

These players leverage proximity to customers and strong domestic sales networks to strengthen market penetration. Specialized international and niche players including Furukawa Electric, Leoni Cables, LS Cable & System, Helukabel, and Omni Cables compete through innovation in cable technology, corrosion-resistant armor, and application-specific solutions for critical infrastructure. The market is increasingly influenced by stringent electrical safety regulations, renewable energy integration, and urban infrastructure projects, with competition focusing on product reliability, technical support, and strategic alliances across industrial and utility sectors.

| Item | Value |

|---|---|

| Quantitative Units | USD 23.3 Billion |

| Core Type | Single Core and Multi-Core |

| End User | Oil & Gas, Manufacturing, Mining, Construction, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Prysmian, Anixter, AT&T, Atkore, Belden, Finolex, Furukawa Electric, Havells, Helukabel, KEI Industries, Leoni Cables, LS Cable & System, Nexans, NKT, Okonite, Omni Cables, Polycab, Riyadh Cables, RR Kabel, Southwire, and Sumitomo Electric |

| Additional Attributes | Dollar sales by cable type and application, demand dynamics across residential, commercial, and industrial electrical systems, regional trends in fire-resistant and armored cable adoption, innovation in insulation materials, mechanical protection, and installation efficiency, environmental impact of material production and disposal, and emerging use cases in critical infrastructure, hazardous environments, and high-reliability power distribution. |

The global ccw armored cable market is estimated to be valued at USD 23.3 billion in 2025.

The market size for the ccw armored cable market is projected to reach USD 45.9 billion by 2035.

The ccw armored cable market is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types in ccw armored cable market are single core and multi-core.

In terms of end user, oil & gas segment to command 31.6% share in the ccw armored cable market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Armored Vehicle Market

Armored Cable Market Size and Share Forecast Outlook 2025 to 2035

Multi Core Armored Cable Market Size and Share Forecast Outlook 2025 to 2035

Single Core Armored Cable Market Size and Share Forecast Outlook 2025 to 2035

Interlocked Armored Cable Market Size and Share Forecast Outlook 2025 to 2035

Cable Line Fault Indicator Market Size and Share Forecast Outlook 2025 to 2035

Cable Tray Market Size and Share Forecast Outlook 2025 to 2035

Cable Granulator Market Size and Share Forecast Outlook 2025 to 2035

Cable Distribution Cabinets Market Size and Share Forecast Outlook 2025 to 2035

Cable Accessories Market Growth - Trends & Forecast 2025 to 2035

Cable Cleaning Solutions Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cable Cleaning Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cable Material Market Growth - Trends & Forecast 2025 to 2035

Cable Fault Locator Market Size, Share, and Forecast 2025 to 2035

Cable Connectors and Adapters Market Analysis by Application, Product, Type and Region: Forecast from 2025 to 2035

Cable Cars and Ropeways Market Growth - Trends & Forecast 2025 to 2035

Cable Wrapping Tape Market

Cable Racks Market

Cable Testing Market

Cable Assemblies Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA