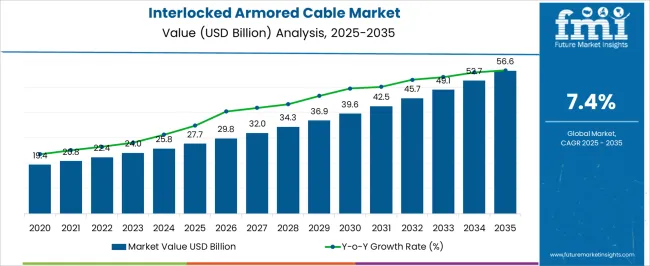

The interlocked armored cable market is estimated to be valued at USD 27.7 billion in 2025 and is projected to reach USD 56.6 billion by 2035, registering a compound annual growth rate (CAGR) of 7.4% over the forecast period. The growth rate volatility index (GRVI) highlights moderate fluctuations in the market’s growth trajectory, reflecting both acceleration in early phases and stabilization in later stages. Between 2025 and 2030, the market grows from USD 27.7 billion to USD 39.6 billion, contributing USD 11.9 billion in growth, with a CAGR of 8.1%. This acceleration is driven by increasing demand for armored cables in industries such as construction, utilities, and infrastructure, where high durability and protection against mechanical damage are crucial. The rising adoption of interlocked armored cables in high-voltage power transmission, mining, and offshore applications further contributes to this early-phase growth.

From 2030 to 2035, the market continues its upward trajectory, expanding from USD 39.6 billion to USD 56.6 billion, contributing USD 17 billion in growth, with a slightly lower CAGR of 6.3%. This deceleration is due to the market reaching maturity in more developed regions, where the demand for armored cables becomes more stable as infrastructure upgrades slow down. However, growth remains strong in emerging markets as the need for durable electrical infrastructure continues to rise. The GRVI shows a strong early-phase acceleration, followed by more stable and steady growth in the later years.

| Metric | Value |

|---|---|

| Interlocked Armored Cable Market Estimated Value in (2025 E) | USD 27.7 billion |

| Interlocked Armored Cable Market Forecast Value in (2035 F) | USD 56.6 billion |

| Forecast CAGR (2025 to 2035) | 7.4% |

The interlocked armored cable market is experiencing strong demand due to its growing use in high-risk and high-performance environments where mechanical protection, fire resistance, and flexibility are essential. Rising investments in energy infrastructure, commercial construction, and industrial expansion are propelling the market.

Regulatory emphasis on secure electrical transmission systems and cost-effective installation solutions is encouraging the adoption of interlocked armored cables in sectors that demand high durability and operational reliability. Enhanced resistance to physical damage, along with simplified installation without the need for conduit, positions these cables as a preferred choice for challenging applications.

The future outlook remains favorable as stakeholders prioritize long-lasting, low-maintenance, and safety-compliant wiring systems across diverse industries.

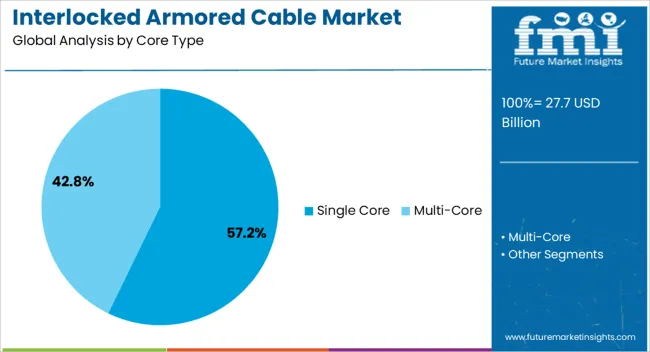

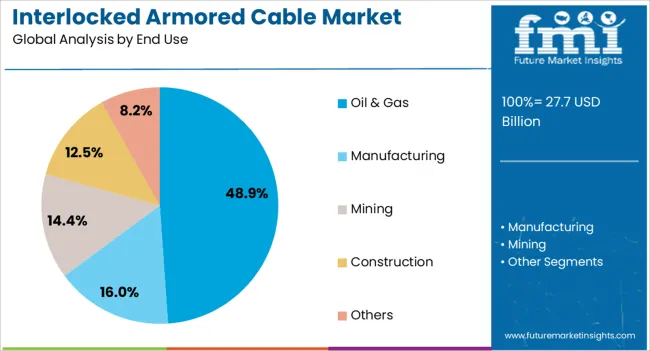

The interlocked armored cable market is segmented by core type, end use, and geographic regions. By core type of the interlocked armored cable market is divided into Single Core and Multi-Core. In terms of end use of the interlocked armored cable market is classified into Oil & Gas, Manufacturing, Mining, Construction, and Others. Regionally, the interlocked armored cable industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The single core segment is expected to represent 57.20% of total market revenue by 2025 within the core type category, making it the dominant configuration. This leadership is attributed to its suitability for power transmission applications that require robust insulation and mechanical protection in constrained environments.

Single core armored cables offer superior flexibility, ease of routing, and reduced electromagnetic interference, which are critical in large-scale industrial and infrastructure projects. Their compact size and enhanced performance in underground and hazardous environments have made them the preferred choice for high-capacity installations.

As industries seek to balance safety, cost, and efficiency, the adoption of single core configurations continues to rise steadily, reinforcing their market dominance.

The oil and gas segment is projected to account for 48.90% of the total market revenue by 2025, positioning it as the leading end use category. This growth is being driven by the critical requirement for rugged and flame-retardant cabling systems in volatile and hazardous environments.

Interlocked armored cables are widely used across exploration, drilling, and refining operations due to their high tensile strength, corrosion resistance, and ability to perform reliably under extreme temperatures and pressures. The need for uninterrupted power and communication systems across remote and offshore installations further strengthens the case for armored cabling solutions.

As global energy demand rises and upstream and downstream activities expand, the oil and gas sector remains a key contributor to the continued dominance of this segment in the interlocked armored cable market.

The interlocked armored cable market is growing due to increasing demand for durable and reliable cables in harsh environments. These cables, with a metal armor that provides mechanical protection, are essential in sectors such as construction, oil and gas, telecommunications, and utilities. They are particularly valued for their ability to withstand physical stress, environmental factors, and electromagnetic interference. As industries prioritize safety, energy efficiency, and infrastructure development, the market for interlocked armored cables is set to expand, with advancements in cable design and materials offering enhanced performance and cost-effectiveness.

The interlocked armored cable market is primarily driven by the increasing need for secure, durable electrical cables in various industries. These cables are designed to protect sensitive electrical conductors from physical damage, making them ideal for use in environments where cables are exposed to mechanical stress, chemical hazards, and extreme temperatures. The construction, oil and gas, and telecommunications sectors require robust, reliable cables to ensure continuous power supply and data transmission, especially in harsh or hazardous environments. As industries focus on reducing downtime and enhancing safety, the demand for interlocked armored cables continues to rise, driving market growth.

Despite the market’s growth, there are several challenges limiting the widespread adoption of interlocked armored cables. One key issue is the relatively high cost of these cables compared to non-armored alternatives. The added protection provided by the metal armor increases manufacturing costs, making interlocked armored cables more expensive. Additionally, the complexity of installation due to their rigid structure can make handling and installation more difficult, especially in tight spaces or complex infrastructure projects. These factors can deter small businesses or projects with limited budgets from adopting interlocked armored cables, which may slow the market's expansion in some regions.

The interlocked armored cable market presents significant opportunities driven by advancements in cable technology and the growing emphasis on energy-efficient and green construction practices. Innovations in materials, such as improved metallic armoring and enhanced insulation, are increasing the performance and cost-effectiveness of these cables. As the construction industry moves toward smarter and more energy-efficient buildings, the demand for cables that ensure electrical safety and meet regulatory standards is growing. Additionally, the expanding use of renewable energy sources, such as solar and wind, is driving the need for interlocked armored cables for safe and reliable energy transmission. These advancements are expected to create new growth opportunities, particularly in environmentally conscious construction and infrastructure projects.

A key trend in the interlocked armored cable market is the rising demand for more flexible and fire-resistant cable options. While traditional armored cables offer durability and protection, there is an increasing need for cables that are not only resistant to physical damage but also flexible and capable of withstanding fire and extreme environmental conditions. The growing focus on safety standards in various industries, including construction and manufacturing, is driving this trend. Fire-resistant interlocked armored cables, which prevent the spread of flames and protect critical systems during fires, are becoming more popular, especially in high-risk environments. This trend reflects the industry's commitment to improving safety and performance in cable technology, driving further market development.

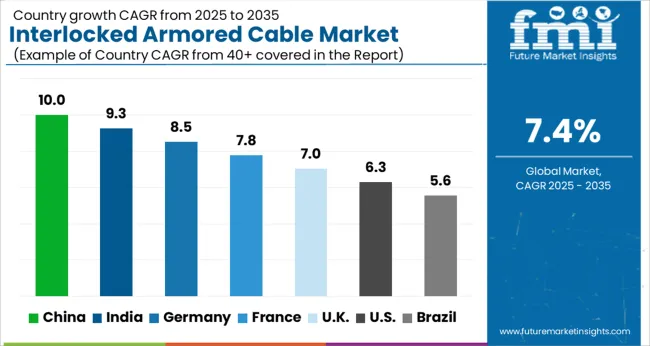

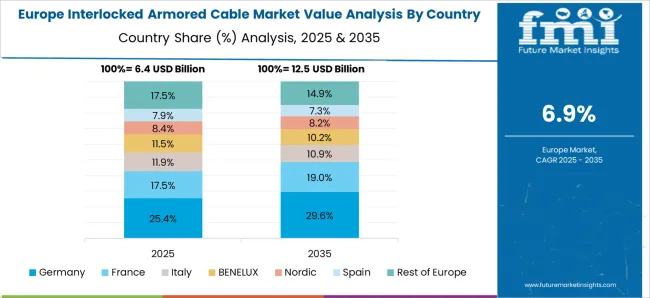

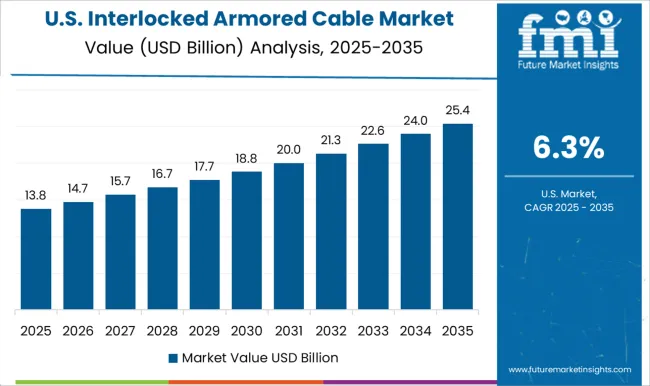

The global interlocked armored cable market is projected to grow at a global CAGR of 7.4% from 2025 to 2035. China leads the market with a growth rate of 10.0%, followed by India at 9.3%. France records a growth rate of 7.8%, while the UK shows 7.0% and the USA follows at 6.3%. The market is primarily driven by the increasing demand for robust and secure cable solutions in industries such as construction, telecommunications, and power generation. China and India are leading the growth due to rapid infrastructure development and industrialization. Developed economies like France, the UK, and the USA are witnessing steady growth driven by technological advancements and growing infrastructure needs. The analysis spans over 40+ countries, with the leading markets shown below.

The interlocked armored cable market in China is expanding at a CAGR of 10.0% through 2035, driven by the rapid urbanization, industrialization, and growing energy sector. With a high demand for durable and reliable cables in the construction, telecommunications, and power sectors, China is seeing an increasing adoption of interlocked armored cables. These cables are used in high-risk environments where safety and durability are critical, such as in industrial plants, power stations, and underground networks. China’s focus on enhancing its electrical infrastructure, including renewable energy projects, is further boosting the market for interlocked armored cables.

Demand for interlocked armored cable in India is projected to grow at a CAGR of 9.3% through 2035, supported by the country’s expanding infrastructure and industrial sectors. As India modernizes its electrical grid and increases investments in the power and construction sectors, the demand for durable and high-performance cables is rising. Interlocked armored cables are gaining popularity in applications requiring robust protection from mechanical damage, such as in industrial settings, power stations, and communication lines. The government’s push for smart cities and improved infrastructure further contributes to the adoption of armored cables across the country.

Sale of interlocked armored cable in France is expected to grow at a 7.8% CAGR, driven by the need for robust and reliable cable solutions in industries such as construction, energy, and telecommunications. The demand for interlocked armored cables is growing as the French government continues to invest in infrastructure, particularly in energy and power transmission systems. The construction sector also drives market growth as cables are needed for electrical wiring in commercial and residential buildings. France’s commitment to modernizing its electrical grid and transitioning to renewable energy sources further increases the demand for durable and secure cables.

The UK interlocked armored cable market is projected to grow at a 7.0% CAGR, supported by the country’s ongoing infrastructure development and focus on modernizing energy networks. The demand for interlocked armored cables is rising, particularly in the construction, energy, and telecommunications sectors. As the UK invests in smart grids and renewable energy projects, the need for durable and safe cables to ensure efficient power transmission is growing. With an increasing number of industrial facilities and power plants, the market for armored cables is set to grow as more sectors require secure and damage-resistant cable solutions.

The USA interlocked armored cable market is expected to grow at a 6.3% CAGR, driven by rising demand for high-performance, safe, and durable cables in energy, telecommunications, and industrial applications. The USA market benefits from continuous investments in infrastructure, including electrical grid improvements, renewable energy projects, and industrial facilities. The growth of smart cities and the ongoing expansion of the construction sector further contribute to the need for interlocked armored cables. The USA focus on safety regulations and secure electrical systems plays a key role in driving market demand for reliable cable solutions.

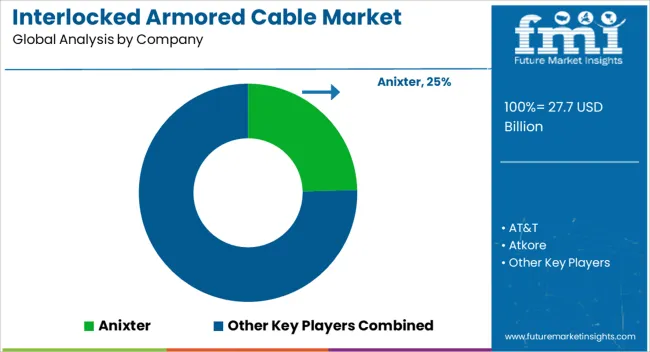

The interlocked armored cable market is driven by manufacturers and specialist distributors that supply durable cables for industrial, commercial, and utility environments. Atkore and Southwire provide aluminum interlocked armor product families for critical installations. Belden offers armored portfolios for power, data, and fiber with aluminum interlocked variants for harsh settings. The Okonite Company supplies interlocked armored power and control designs for demanding locations. Global cable makers such as Nexans, Prysmian Group, NKT, LS Cable & System, Furukawa Electric, and Sumitomo Electric support armored power and control ranges for energy and infrastructure projects. Regional leaders, including Polycab, KEI Industries, Havells, Finolex, RR Kabel, and Riyadh Cables, supply armored low and medium-voltage cables widely used in building and utility projects. Helukabel and Leoni address industrial automation and data cabling needs with armored options in selected families. Anixter and OmniCable operate as large distributors that stock and configure interlocked armor constructions for contractors and end users.

| Item | Value |

|---|---|

| Quantitative Units | USD 27.7 Billion |

| Core Type | Single Core and Multi-Core |

| End Use | Oil & Gas, Manufacturing, Mining, Construction, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Anixter; Atkore; Belden; Encore Wire; Finolex Cables Ltd.; Furukawa Electric Co., Ltd.; Havells India Ltd.; HELUKABEL; KEI Industries Ltd.; LEONI; LS Cable & System; Nexans; NKT A/S; The Okonite Company; OmniCable; Polycab India Ltd.; Prysmian Group; Riyadh Cables Group; RR Kabel Ltd.; Southwire Company, LLC; Sumitomo Electric Industries, Ltd. |

| Additional Attributes | Dollar sales by product type (single-core, multi-core, multi-conductor) and end-use segments (power distribution, industrial automation, construction, telecommunications). Demand dynamics are influenced by the growing need for durable, high-performance cables in infrastructure, industrial applications, and telecommunication systems. Regional trends show strong growth in North America, Europe, and Asia-Pacific, driven by infrastructure development and increasing demand for reliable power and communication networks. Innovation trends focus on improving cable performance in harsh environments, enhancing flexibility, and reducing installation time. Environmental considerations include improving the recyclability of cables and reducing the environmental impact of production processes. |

The global interlocked armored cable market is estimated to be valued at USD 27.7 billion in 2025.

The market size for the interlocked armored cable market is projected to reach USD 56.6 billion by 2035.

The interlocked armored cable market is expected to grow at a 7.4% CAGR between 2025 and 2035.

The key product types in interlocked armored cable market are single core and multi-core.

In terms of end use, oil & gas segment to command 48.9% share in the interlocked armored cable market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Armored Vehicle Market

Armored Cable Market Size and Share Forecast Outlook 2025 to 2035

CCW Armored Cable Market Size and Share Forecast Outlook 2025 to 2035

Multi Core Armored Cable Market Size and Share Forecast Outlook 2025 to 2035

Single Core Armored Cable Market Size and Share Forecast Outlook 2025 to 2035

Cable Line Fault Indicator Market Size and Share Forecast Outlook 2025 to 2035

Cable Tray Market Size and Share Forecast Outlook 2025 to 2035

Cable Granulator Market Size and Share Forecast Outlook 2025 to 2035

Cable Distribution Cabinets Market Size and Share Forecast Outlook 2025 to 2035

Cable Accessories Market Growth - Trends & Forecast 2025 to 2035

Cable Cleaning Solutions Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cable Cleaning Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cable Material Market Growth - Trends & Forecast 2025 to 2035

Cable Fault Locator Market Size, Share, and Forecast 2025 to 2035

Cable Connectors and Adapters Market Analysis by Application, Product, Type and Region: Forecast from 2025 to 2035

Cable Cars and Ropeways Market Growth - Trends & Forecast 2025 to 2035

Cable Wrapping Tape Market

Cable Racks Market

Cable Testing Market

Cable Assemblies Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA