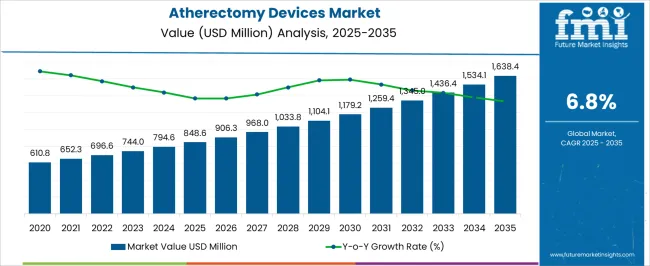

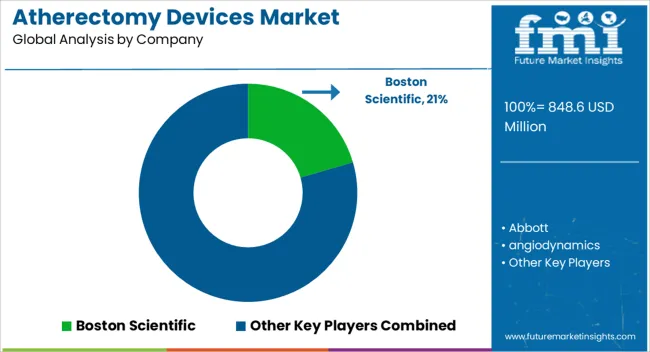

The Atherectomy Devices Market is estimated to be valued at USD 848.6 million in 2025 and is projected to reach USD 1638.4 million by 2035, registering a compound annual growth rate (CAGR) of 6.8% over the forecast period. Between 2020 and 2030, the market value rises from USD 610.8 million to around USD 1,033.8 million, reflecting consistent growth driven by increasing prevalence of cardiovascular diseases, rising geriatric population, and advancements in minimally invasive surgical procedures.

This initial phase benefits from growing awareness among healthcare professionals regarding the advantages of atherectomy devices in treating peripheral arterial diseases and coronary artery diseases. Technological innovations enhancing device precision, safety, and efficacy contribute to market expansion. Additionally, the rising number of catheterization laboratories and favorable reimbursement policies further support adoption.

From 2030 to 2035, the market accelerates from USD 1,104.1 million to USD 1,638.4 million, propelled by ongoing research and development efforts aimed at improving device functionality and patient outcomes. Expansion in emerging economies, driven by increasing healthcare infrastructure investments and rising disposable incomes, also contributes to market growth. Overall, the atherectomy devices market is positioned for robust and sustained growth through 2035, fueled by technological advancements, increasing disease burden, and growing demand for minimally invasive treatment options.

| Metric | Value |

|---|---|

| Atherectomy Devices Market Estimated Value in (2025 E) | USD 848.6 million |

| Atherectomy Devices Market Forecast Value in (2035 F) | USD 1638.4 million |

| Forecast CAGR (2025 to 2035) | 6.8% |

The atherectomy devices market is witnessing consistent growth, driven by a rising global incidence of peripheral artery disease (PAD), an expanding aging population, and technological advancements in minimally invasive vascular treatment options. Increasing clinical preference for plaque removal devices over traditional angioplasty in complex lesion scenarios is reshaping interventional strategies.

Healthcare systems are also experiencing growing demand for revascularization procedures due to lifestyle-associated vascular conditions such as diabetes and smoking. Enhanced reimbursement frameworks, coupled with clinical guidelines encouraging early PAD detection and intervention, have contributed to market expansion.

Furthermore, integration of real-time imaging and device miniaturization is enabling safer, more precise plaque excision, improving procedural outcomes and recovery times. Looking ahead, ongoing R&D investment in multi-modality systems and the emergence of robotic-assisted atherectomy tools are anticipated to open new pathways for device innovation and broader clinical adoption.

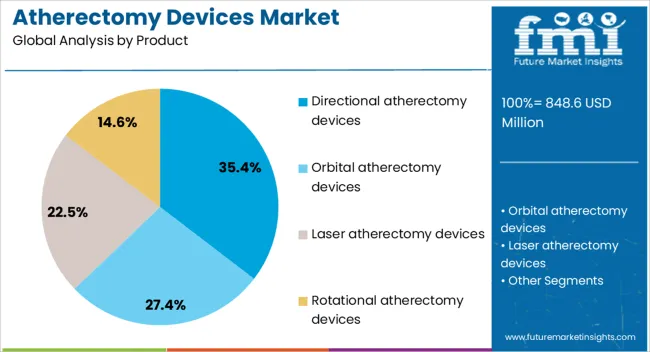

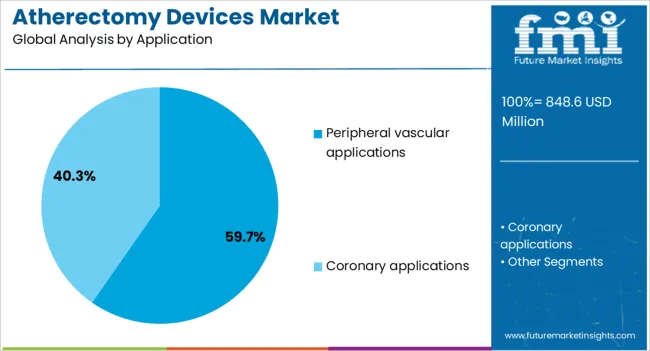

The atherectomy devices market is segmented by product, application, end use, and geographic regions. By product, the atherectomy devices market is divided into Directional atherectomy devices, Orbital atherectomy devices, Laser atherectomy devices, and Rotational atherectomy devices. In terms of application, the atherectomy devices market is classified into Peripheral vascular applications and Coronary applications.

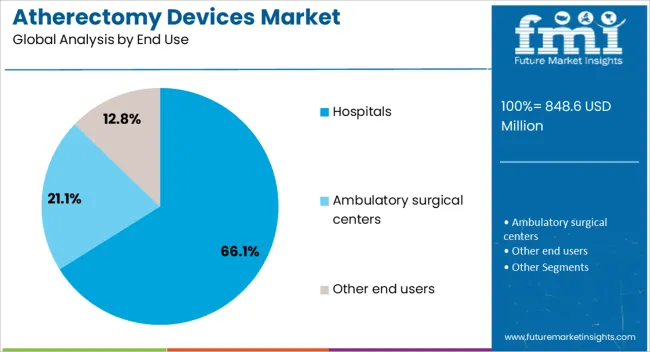

Based on the end use of the atherectomy devices market, it is segmented into Hospitals, Ambulatory surgical centers, and Other end users. Regionally, the atherectomy devices industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Directional atherectomy devices are anticipated to account for 35.40% of total market revenue in 2025, making them the leading product type. This dominance is being attributed to their ability to selectively excise atheromatous plaque while preserving healthy vessel walls, reducing procedural complications and restenosis risk.

Directional systems are favored in treating eccentric lesions and calcified arteries, particularly in lower limb vascular beds. Their compatibility with guidewires and real-time visualization technologies has improved procedural precision in complex PAD cases.

Increasing operator confidence, combined with consistent clinical trial data supporting efficacy and safety, has further accelerated adoption. As hospitals and ambulatory centers prioritize device versatility and lesion-specific customization, directional atherectomy continues to lead based on its technical advantages and therapeutic outcomes.

Peripheral vascular applications are projected to hold 59.70% of total market share by 2025, emerging as the dominant use case for atherectomy devices. This leadership is driven by the high prevalence of PAD, especially among aging and diabetic populations, and the need for effective endovascular intervention in femoral, popliteal, and below-the-knee arteries.

Clinical limitations of balloon angioplasty and stenting in treating long, calcified, or restenotic lesions have elevated the role of atherectomy in peripheral treatment protocols. Favorable reimbursement policies and evolving clinical practice guidelines are supporting increased procedural volumes.

Device innovations enabling plaque debulking with minimal thermal or mechanical trauma are further reinforcing the use of atherectomy as a frontline solution in limb salvage and PAD management strategies.

Hospitals are expected to contribute 66.10% of overall revenue in the atherectomy devices market by 2025, positioning them as the leading end-use environment. Their leadership stems from their capacity to perform complex vascular interventions with access to multidisciplinary teams and advanced imaging support.

Hospitals continue to serve as primary sites for PAD diagnosis, staging, and treatment particularly for patients with comorbidities or advanced disease stages. The presence of interventional radiology and cardiology units enhances procedural flexibility and case throughput.

In addition, hospitals often act as early adopters of emerging atherectomy technologies, benefiting from vendor training programs, clinical research collaboration, and capital equipment budgets. As health systems integrate value-based care models, emphasis on shorter hospital stays, better outcomes, and reduced readmission rates is further supporting hospital-based adoption of atherectomy devices.

The atherectomy devices market is driven by the increasing prevalence of cardiovascular diseases, the shift toward minimally invasive procedures, advancements in technology, and challenges related to costs and regulatory approval. Continued innovation and adoption are expected to sustain market growth.

The growing prevalence of cardiovascular diseases (CVDs), particularly in aging populations, is a key driver for the atherectomy devices market. As more individuals develop peripheral artery disease (PAD) and coronary artery disease (CAD), there is a heightened need for effective treatment options. Atherectomy devices provide minimally invasive alternatives for plaque removal, which can reduce complications and improve recovery time. With CVDs remaining a leading cause of death worldwide, the demand for these devices is anticipated to increase. Healthcare systems are recognizing the benefits of early diagnosis and intervention, further boosting the market for atherectomy devices. The focus on improving patient outcomes in cardiovascular care continues to drive market growth.

The trend toward minimally invasive procedures is a significant dynamic driving the atherectomy devices market. Compared to traditional surgeries, atherectomy devices offer advantages such as smaller incisions, shorter recovery times, and reduced hospital stays. This shift is particularly evident in the treatment of PAD and CAD, where patients seek options that minimize risks and allow for faster return to daily activities. The efficiency and precision of atherectomy procedures have led to wider adoption, particularly in outpatient settings. As healthcare providers and patients increasingly prioritize faster, less invasive options, the demand for atherectomy devices is expected to continue growing, contributing to the market's expansion.

Advancements in atherectomy device technology play a vital role in expanding the market. The introduction of new features, such as enhanced safety mechanisms and improved precision in plaque removal, has made atherectomy devices more effective and reliable. Different types of atherectomy devices, including rotational, laser, and directional options, cater to specific patient needs, making them valuable tools for cardiovascular procedures. These improvements lead to better clinical outcomes, such as reduced procedural complications and enhanced recovery rates. As innovation in device design continues, it is likely that atherectomy devices will become even more integral to treating complex vascular conditions, thereby driving the market forward.

Despite the growing demand for atherectomy devices, the market faces challenges related to regulatory approvals and high treatment costs. Regulatory bodies, such as the FDA, require rigorous testing and documentation before new devices can be approved for clinical use, which can slow down market growth.The high cost of atherectomy devices and associated procedures may limit their adoption, particularly in price-sensitive regions. Although reimbursement policies are improving, cost concerns remain an obstacle for many healthcare providers, especially in emerging markets. Addressing these challenges will be crucial for the continued growth of the atherectomy devices market in the coming years.

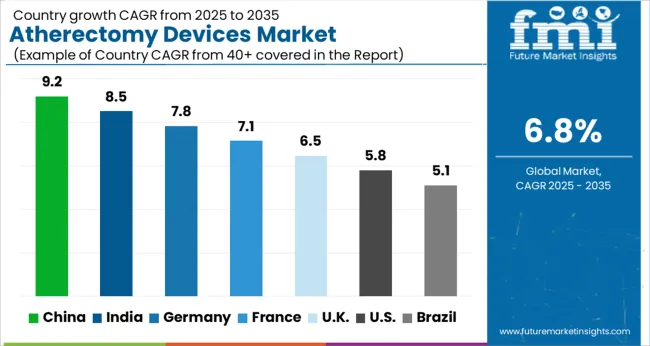

The atherectomy devices market is projected to grow globally at a CAGR of 6.8% from 2025 to 2035, driven by increasing prevalence of cardiovascular diseases, advancements in medical technologies, and the growing adoption of minimally invasive procedures. China leads with a CAGR of 9.2%, supported by a rapidly aging population, rising cardiovascular conditions, and the country's significant healthcare infrastructure improvements. India follows with a CAGR of 8.5%, driven by a growing burden of cardiovascular diseases, increasing healthcare investments, and the adoption of advanced medical devices in hospitals and clinics.

France grows at 7.1%, benefiting from rising demand for cardiovascular procedures, ongoing innovations in atherectomy devices, and the increasing use of minimally invasive surgeries. The United Kingdom achieves a CAGR of 6.5%, supported by the growing focus on heart health and the adoption of advanced treatment technologies, while the United States records a CAGR of 5.8%, driven by the continuous advancement of atherectomy devices and rising healthcare awareness. This growth trajectory highlights the increasing demand for atherectomy devices, supported by advancements in medical technology, rising awareness of cardiovascular diseases, and the growing preference for minimally invasive treatments worldwide.

The UK’s atherectomy devices market grew at a CAGR of 5.1% from 2020 to 2024 and is projected to rise to 6.5% during 2025-2035. The earlier growth was driven by an increase in cardiovascular diseases, growing awareness of minimally invasive procedures, and advancements in atherectomy technologies. However, as demand for more efficient and precise cardiovascular treatments rises, the market is expected to experience an accelerated growth rate. The shift towards advanced atherectomy devices that offer less risk and faster recovery times will drive further adoption. Increasing healthcare investments and the rise of personalized medicine will contribute to this growth. As technology evolves, providing more accurate and effective treatment options, the market for atherectomy devices in the UK is expected to increase substantially.

China’s atherectomy devices market is projected to grow at a CAGR of 9.2% during 2025-2035, well above the global CAGR of 6.8%. The market grew at a CAGR of 7.8% from 2020 to 2024, driven by China’s large aging population, high prevalence of cardiovascular diseases, and rapidly improving healthcare infrastructure. In the coming decade, market growth will be fueled by increased demand for advanced cardiovascular treatment solutions, expanding access to healthcare services, and rising disposable incomes. Moreover, as China continues to focus on developing its medical technologies and increasing investments in healthcare, demand for minimally invasive treatments and atherectomy devices will continue to rise.

India’s atherectomy devices market is expected to grow at a CAGR of 8.5% during 2025-2035, surpassing the global average of 6.8%. The market grew at a CAGR of 7.2% during 2020-2024, supported by rising cardiovascular diseases, expanding healthcare access, and increased awareness of advanced medical treatments. The market is expected to experience accelerated growth in the next decade due to ongoing healthcare reforms, a rising middle class, and a greater shift towards high-tech medical treatments. Additionally, the increasing preference for minimally invasive surgeries and advanced cardiovascular treatments will drive the adoption of atherectomy devices in India.

France’s atherectomy devices market is projected to grow at a CAGR of 7.1% during 2025-2035. The market grew at a CAGR of 5.9% from 2020 to 2024, driven by increased demand for minimally invasive cardiovascular treatments and rising investments in healthcare innovation. In the coming decade, growth will be fueled by the continued shift toward advanced and precise medical procedures, an aging population, and increasing cardiovascular disease rates. As France continues to focus on providing high-quality healthcare services and advanced treatment options, the demand for atherectomy devices will grow significantly, driven by both public and private healthcare investments.

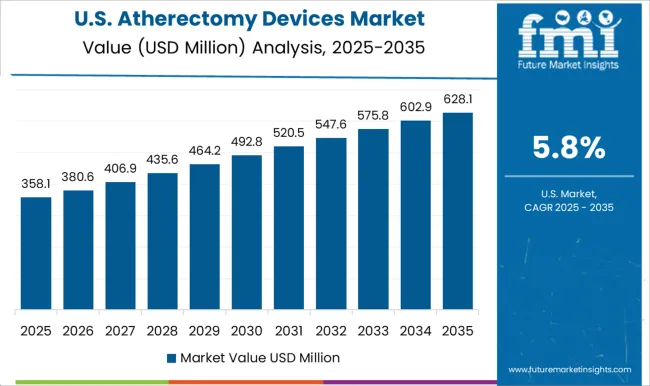

The USA atherectomy devices market is projected to grow at a CAGR of 5.8% during 2025-2035. The market grew at a CAGR of 5.1% from 2020 to 2024, driven by the increasing prevalence of cardiovascular diseases, rising awareness about minimally invasive treatments, and technological innovations in medical devices. The expected growth in the coming decade will be fueled by the USA’s continuous advancements in healthcare technology, growing patient demand for advanced treatments, and rising investments in medical research. Additionally, increasing healthcare access, along with the expansion of healthcare infrastructure, will contribute to the growing adoption of atherectomy devices in the USA

The Atherectomy Devices Market is shaped by key players such as Boston Scientific, Abbott, and Medtronic, who lead the competition with their advanced medical device offerings, focusing on performance, reliability, and precision. Boston Scientific is renowned for its cutting-edge atherectomy devices, such as the Diamondback 360° System, which offers effective plaque removal for peripheral artery disease (PAD) and coronary artery disease (CAD).

Abbott excels with its coronary atherectomy systems, providing integrated solutions for complex vascular procedures. Medtronic, with its robust portfolio of atherectomy products, offers technologies designed to improve clinical outcomes and reduce recovery times for patients undergoing vascular treatments. Other prominent players like Cardiovascular Systems, Terumo, and Cordis specialize in offering a range of atherectomy devices tailored for specific patient needs.

Cardiovascular Systems focuses on its orbital atherectomy technology, which provides superior plaque removal with minimal vessel damage. Terumo and Cordis provide complementary vascular technologies, expanding the options available for minimally invasive procedures. Companies such as Avinger, BIOMERICS, and Rex Medical are gaining traction in niche markets, offering specialized atherectomy devices that cater to unique medical requirements. These players emphasize product efficacy, patient safety, and ease of use in their device offerings.

Companies like Nipro, B. Braun, and Angiodynamics are also making strides with their innovative atherectomy devices, contributing to the growing demand for minimally invasive vascular procedures. Their offerings focus on improving clinical outcomes, enhancing patient comfort, and optimizing the treatment process. As the market for atherectomy devices continues to expand, these companies, along with key market leaders, remain at the forefront of driving innovation and offering advanced solutions for vascular interventions.

Manufacturers are integrating atherectomy devices with other cardiovascular technologies like stent deployment systems and balloon angioplasty to create comprehensive solutions for vascular intervention procedures. The integration of atherectomy with intravascular ultrasound (IVUS) and optical coherence tomography (OCT) is providing real-time guidance for better decision-making and more accurate plaque removal, ensuring better procedural outcomes.

| Item | Value |

|---|---|

| Quantitative Units | USD 848.6 Million |

| Product | Directional atherectomy devices, Orbital atherectomy devices, Laser atherectomy devices, and Rotational atherectomy devices |

| Application | Peripheral vascular applications and Coronary applications |

| End Use | Hospitals, Ambulatory surgical centers, and Other end users |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Boston Scientific, Abbott, angiodynamics, AVINGER, B. Braun, BD (Becton, Dickinson and Company), BIOMERICS, Cardinal Health, Cardiovascular Systems, Cordis, Philips, Medtronic, Nipro, Rex Medical, and TERUMO |

| Additional Attributes | Dollar sales trends, market share of leading players, growth drivers in cardiovascular care, demand across regions, technological advancements, regulatory impact, and future forecasts for PAD and CAD treatments. |

The global atherectomy devices market is estimated to be valued at USD 848.6 million in 2025.

The market size for the atherectomy devices market is projected to reach USD 1,638.4 million by 2035.

The atherectomy devices market is expected to grow at a 6.8% CAGR between 2025 and 2035.

The key product types in atherectomy devices market are directional atherectomy devices, orbital atherectomy devices, laser atherectomy devices and rotational atherectomy devices.

In terms of application, peripheral vascular applications segment to command 59.7% share in the atherectomy devices market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

FBAR Devices Market

Snare devices Market

C-Arms Devices Market Size and Share Forecast Outlook 2025 to 2035

Timing Devices Market Analysis - Size, Growth, & Forecast Outlook 2025 to 2035

Spinal Devices Market Size and Share Forecast Outlook 2025 to 2035

Hearing Devices 3D Printing Market Size and Share Forecast Outlook 2025 to 2035

Medical Devices Market Size and Share Forecast Outlook 2025 to 2035

Network Devices Market Size and Share Forecast Outlook 2025 to 2035

Medical Devices Secondary Packaging Market Analysis by Material and Application Through 2035

Hearable Devices Market Size and Share Forecast Outlook 2025 to 2035

Lab Chip Devices Market Size and Share Forecast Outlook 2025 to 2035

Orthotic Devices, Casts and Splints Market Size and Share Forecast Outlook 2025 to 2035

Lacrimal Devices Market Size, Trends, and Forecast 2025 to 2035

Global Ablation Devices Market Trends - Growth, Innovations & Forecast 2025 to 2035

Orthotic Devices, Splints & Orthopedic Braces Market Analysis - Trends & Forecast 2024 to 2034

Ear Tube Devices Market

Pathology Devices Market Size and Share Forecast Outlook 2025 to 2035

Neurotech Devices Market Size and Share Forecast Outlook 2025 to 2035

Skin Care Devices Market Analysis - Trends & Forecast 2025 to 2035

Strapping Devices Market Trends - Size, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA