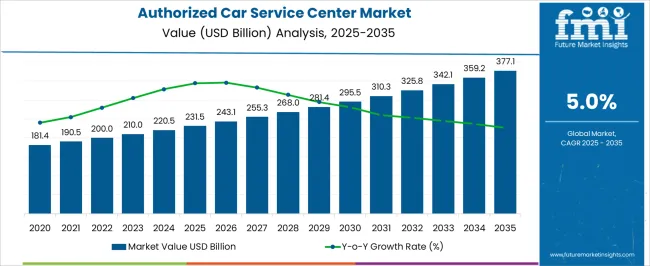

The Authorized Car Service Center Market is estimated to be valued at USD 231.5 billion in 2025 and is projected to reach USD 377.1 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period. The initial five years from 2020 to 2025 reveal a significant growth phase, with the market rising from USD 87.5 billion to USD 190.5 billion, contributing nearly 35.5% of the total increase. This period’s momentum is fueled by rising global vehicle sales, an expanding vehicle parc demanding frequent maintenance and repairs, and increasing consumer trust in authorized service centers.

The phase is also supported by the integration of advanced technologies in service operations, enhanced customer experience initiatives, and a growing preference for genuine parts and warranty-backed services. Market values steadily progress with USD 181.4 billion in 2023 and USD 200.0 billion in 2024, underscoring a consistent growth trend. From 2026 to 2035, the market accelerates substantially, adding USD 154.1 billion or 64.5% of total growth. This surge is driven by the proliferation of connected car technologies and the rising complexity of automotive systems requiring specialized servicing expertise. Expansion in emerging markets and the shift towards electric and hybrid vehicles introduce new service demands such as battery maintenance and software diagnostics.

The adoption of digital tools including online booking, predictive maintenance, and customer relationship management boosts operational efficiencies and customer loyalty. Tightening vehicle safety and emission regulations foster regular service cycles, ensuring continuous market activity. This market is poised for sustained and dynamic growth through 2035, propelled by evolving automotive technologies, increasing vehicle ownership, and a pronounced consumer preference for certified, high-quality service solutions.

| Metric | Value |

|---|---|

| Authorized Car Service Center Market Estimated Value in (2025E) | USD 231.5 billion |

| Authorized Car Service Center Market Forecast Value in (2035F) | USD 377.1 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

The authorized car service center market is gaining momentum due to rising consumer demand for reliable, warranty-protected servicing and the growing complexity of modern automotive systems. Automakers are increasingly investing in aftersales networks to build brand loyalty, ensure part authenticity, and maintain software-integrated components that require specialized expertise.

The proliferation of connected cars and EVs is further solidifying the importance of certified diagnostics and OEM-grade infrastructure. Customer preference is shifting toward preventive maintenance models and digitally integrated service scheduling, which is being facilitated by manufacturer-supported platforms.

Additionally, regulatory emphasis on emission control and safety compliance is reinforcing the role of authorized centers in ensuring up-to-date service records and quality assurance. Looking ahead, the expansion of vehicle subscription models and extended warranties is expected to boost periodic maintenance volumes, especially through certified networks.

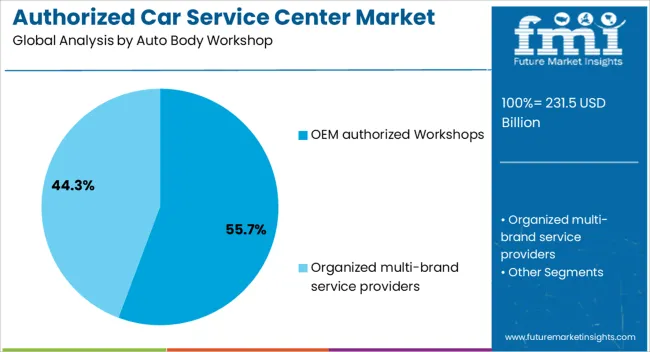

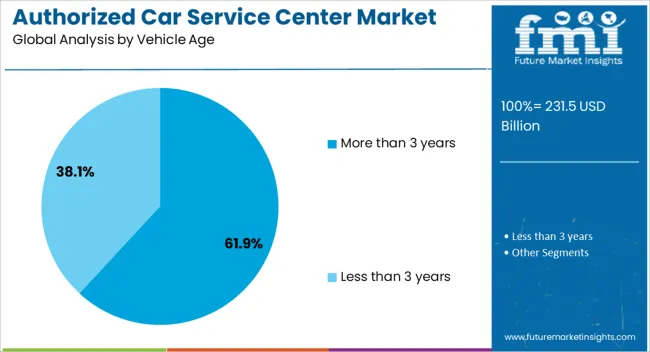

The authorized car service center market is segmented by auto body workshop, service vehicle age, and geographic regions. By auto body workshop, the authorized car service center market is divided into OEM authorized Workshops and Organized multi-brand service providers. The authorized car service center market is classified into Engine, Transmission, Brakes, Suspension, Electrical, Body, Tire, and Belts & Accessories. Based on vehicle age, the authorized car service center market is segmented into More than 3 years and less than 3 years. Regionally, the authorized car service center industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

OEM-authorized workshops are expected to capture 55.70% of the market revenue by 2025, making them the leading format in the auto body workshop segment. Their dominance is being reinforced by the increasing electronic sophistication of modern vehicles, which requires specialized tools, software access, and brand-specific expertise only available through OEM-certified channels.

These workshops are better positioned to handle vehicle recalls, diagnostics, and firmware updates while offering consumers peace of mind through warranty retention. With rising customer focus on genuine parts, extended service packages, and transparent pricing models, OEM workshops have become the preferred choice for owners seeking brand-standard repair and maintenance.

Additionally, their integration with automaker CRM systems allows for proactive service reminders and loyalty-based engagement.

Engine service is projected to represent 18.40% of the overall service revenue in 2025, ranking it as a core area of focus in authorized centers. This segment’s significance stems from the need for precision in engine diagnostics, fuel system optimization, and emissions control-all of which require manufacturer-approved procedures and skilled technicians.

Increasing fuel efficiency demands, tightening pollution norms, and growing consumer expectations for performance longevity have all contributed to elevated demand for engine-related servicing. Technological complexity, such as turbocharging, hybrid systems, and electronic fuel injection, further necessitates the controlled environment and resources found in OEM-linked centers.

Preventive engine maintenance is also being prioritized in newer maintenance packages, driving consistent revenue streams within this category.

Vehicles aged more than 3 years are projected to account for 61.90% of the market revenue in 2025, positioning them as the primary service group. This share is being driven by the expansion of the second-hand vehicle market, extended ownership cycles, and affordability-based purchase behavior in emerging economies.

As vehicles move beyond the standard warranty period, consumers tend to seek structured servicing from authorized centers to retain residual value, ensure safety, and avoid high-cost repairs in the future. OEMs are increasingly offering service extension programs and loyalty incentives to retain customers in this vehicle age bracket.

Furthermore, regulatory mandates for periodic fitness tests and emission checks are incentivizing owners to adhere to certified servicing practices, especially beyond the initial 36-month lifecycle.

Authorized car service centers are strengthening their market position through brand trust, digital platforms, EV servicing expertise, and targeted customer retention programs. These dynamics ensure resilience and revenue stability in the evolving automotive aftermarket.

Authorized car service centers benefit from the trust and assurance offered by brand certification, which ensures that vehicles are serviced to manufacturer specifications. Consumers value the use of genuine parts, specialized diagnostic tools, and technicians trained by the original equipment manufacturer. This enhances the perceived reliability and performance of the vehicle while protecting its resale value. The growing complexity of automotive systems, including hybrid and electric drivetrains, reinforces reliance on brand-approved facilities. Warranty-linked servicing policies further strengthen the customer’s inclination toward authorized centers, reducing the likelihood of switching to independent workshops. This trust-driven preference supports consistent revenue streams and strengthens brand loyalty across both premium and mass-market segments.

Digitalization has become a key driver for improving customer experience and operational efficiency in authorized car service centers. Features such as online service booking, real-time service status updates, and predictive maintenance alerts are increasingly integrated into service operations. This technology adoption enables better communication between the customer and service advisors, improving transparency and reducing turnaround time. Connected service platforms also allow manufacturers to track performance trends, recall requirements, and customer satisfaction metrics more effectively. The convenience of digital scheduling combined with accurate cost estimates encourages repeat visits. This integration also creates opportunities for cross-selling accessories, extended warranties, and subscription-based maintenance packages to a loyal customer base.

As electric and hybrid vehicle adoption rises, authorized service centers are investing in specialized equipment, safety protocols, and technician training to meet these evolving needs. The servicing of high-voltage battery systems, regenerative braking components, and advanced thermal management systems requires certified expertise that is often exclusive to authorized facilities. This creates a competitive advantage over general repair shops, which may lack the tools or skills for such work. Partnerships with OEMs to develop service readiness for upcoming electric models further strengthen market positioning. This focus on future-ready service capabilities not only drives new revenue streams but also secures long-term relevance in a shifting automotive landscape.

Customer loyalty programs, extended service contracts, and bundled maintenance packages are central to the retention strategies of authorized car service centers. These offerings encourage repeat visits by providing predictable servicing costs, priority appointments, and added benefits such as roadside assistance. Personalized follow-ups, seasonal check-up campaigns, and targeted offers based on vehicle usage patterns help maintain customer engagement. The ability to combine technical excellence with tailored aftersales benefits enhances perceived value. Strong customer relationships fostered through these programs reduce attrition to independent repair facilities, supporting consistent workshop utilization and higher lifetime service revenue per customer across different vehicle ownership cycles.

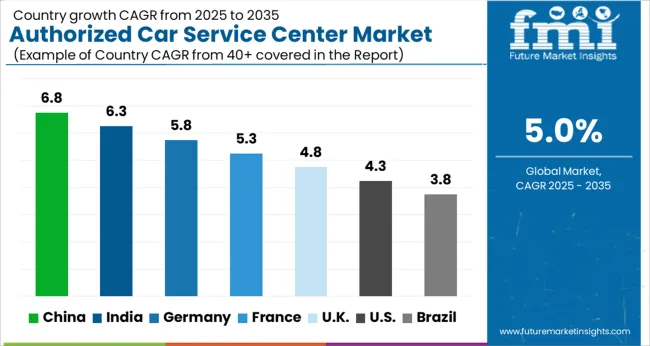

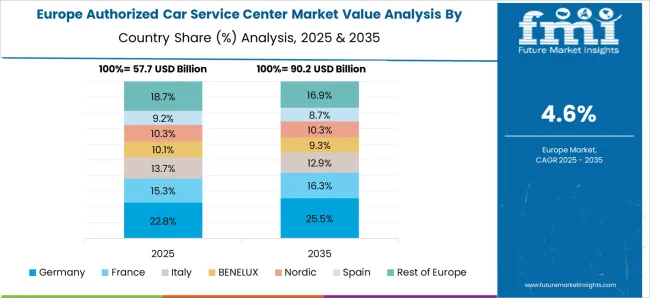

The authorized car service center market is projected to grow globally at a CAGR of 5.0% from 2025 to 2035, with China leading at 7%, driven by strong automotive sales, increasing consumer preference for authorized service providers, and expanding automotive service networks. India follows at 6%, fueled by a growing middle class, increased vehicle ownership, and the rising demand for after-sales services. France records a steady 5%, supported by regulatory frameworks promoting high-quality service standards in the automotive sector. The UK also sees 5% growth, shaped by the increasing demand for maintenance services as consumers prioritize vehicle longevity and performance. The USA maintains a moderate 4% CAGR, driven by the growing trend of extended vehicle warranties and the importance of dealer service centers for vehicle upkeep.

The CAGR for the UK Authorized Car Service Center market is projected at 4.0% during the 2020–2024 period, driven by steady demand for high-quality services and warranty protection. However, for the 2025–2035 period, the growth rate is expected to rise slightly to 5%. This acceleration can be attributed to increasing vehicle complexity, especially with the introduction of electric vehicles (EVs) and connected car technologies that require specialized service. The growing adoption of digital vehicle diagnostics, along with enhanced consumer focus on safety and emissions standards, will further drive demand for authorized service centers in the coming years.

China is projected to experience a 7% CAGR for 2025–2035, indicating robust market growth. The early years (2020–2024) saw rapid expansion, driven by rising vehicle ownership and increased demand for certified maintenance. Future growth will be fueled by the expanding market for electric and hybrid vehicles, which require specialized servicing and diagnostics. The government's continued push for green energy solutions and the automotive industry's digitalization will further support growth, making authorized service centers a critical component of the automotive maintenance infrastructure in China.

India is projected to see a 6% CAGR for the 2025–2035 period, following steady growth during 2020–2024. The market’s expansion has been driven by increased vehicle sales and rising middle-class consumption. With the country’s growing preference for electric vehicles and the shift toward high-tech car models, the demand for specialized authorized service centers is expected to grow significantly in the coming years. As vehicle technologies evolve, the need for sophisticated diagnostics and repair services will boost demand for authorized service providers.

France’s CAGR for the 2025–2035 period is expected to be 5%, reflecting steady market growth. The increase in electric and hybrid vehicles, combined with stricter emission standards and growing consumer awareness of vehicle safety, will drive the demand for authorized car service centers. The market grew at a moderate pace during the 2020–2024 period, but future growth will be fueled by the increasing complexity of modern vehicles and the government’s strong push for greener and more sustainable transportation.

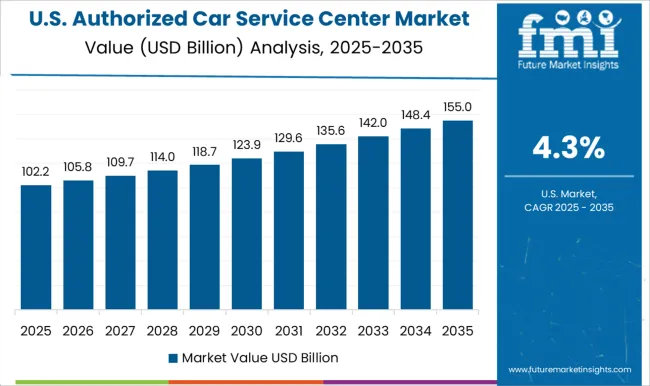

The CAGR for the United States market between 2025 and 2035 is expected to be 4%, reflecting slower growth compared to other countries. The USA market has already matured, with widespread adoption of authorized service centers for warranty and safety purposes. However, growth will continue at a moderate pace, driven by the rising complexity of modern vehicles, including the growing number of electric vehicles and connected cars. As more consumers adopt these technologies, the demand for specialized service and advanced diagnostics will increase, albeit at a slower pace than emerging markets.

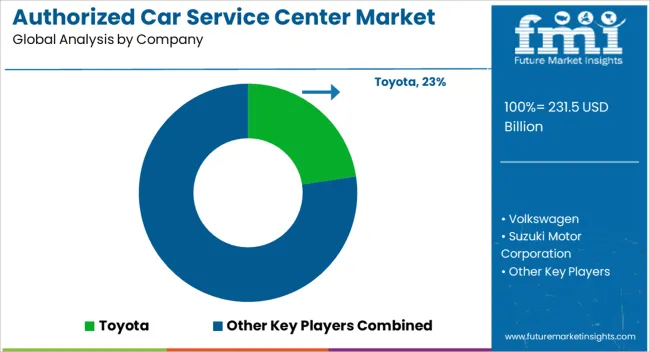

The authorized car service center market is shaped by the presence of leading global automakers and automotive technology providers such as Toyota, Volkswagen, Suzuki Motor Corporation, and Robert Bosch GmbH. Toyota focuses on enhancing customer retention through advanced service facilities, genuine parts supply, and integrated digital booking systems across its global network. Volkswagen emphasizes aftersales excellence by expanding certified service points, adopting connected diagnostics, and offering comprehensive maintenance packages tailored to each model line. Suzuki Motor Corporation strengthens its competitive standing through accessible service plans, dealer-led customer engagement, and cost-effective maintenance for compact and mid-sized vehicles. Robert Bosch GmbH, a key technology and parts supplier, supports authorized centers with high-precision diagnostic equipment, software solutions, and OEM-approved components that ensure service quality and compliance. Differentiation strategies center on technician training programs, expanded coverage for hybrid and electric vehicles, and personalized aftersales offerings. Partnerships between OEMs and technology providers are enabling faster service turnaround, enhanced predictive maintenance capabilities, and increased workshop efficiency. Future growth is expected to come from strengthening digital touchpoints, broadening certified parts availability, and integrating advanced vehicle health monitoring to meet evolving customer expectations in the aftermarket service space.

To retain customers and provide more convenience, authorized service centers are offering prepaid service packages and subscription-based maintenance plans. These packages often include routine maintenance like oil changes, tire rotations, and inspections, providing customers with predictable costs and ensuring they return for regular maintenance, fostering long-term relationships.

| Item | Value |

|---|---|

| Quantitative Units | USD 231.5 Billion |

| Auto Body Workshop | OEM authorized Workshops and Organized multi-brand service providers |

| Service | Engine, Transmission, Brakes, Suspension, Electrical, Body, Tire, and Belts & Accessories |

| Vehicle Age | More than 3 years and Less than 3 years |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Toyota, Volkswagen, Suzuki Motor Corporation, and Robert Bosch GmbH |

| Additional Attributes | Dollar sales, share, service demand by vehicle type, regional growth trends, customer retention rates, competitive benchmarking, pricing models, technology adoption in diagnostics, regulatory compliance, aftermarket expansion opportunities. |

The global authorized car service center market is estimated to be valued at USD 231.5 billion in 2025.

The market size for the authorized car service center market is projected to reach USD 377.1 billion by 2035.

The authorized car service center market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in authorized car service center market are oem authorized workshops and organized multi-brand service providers.

In terms of service, engine segment to command 18.4% share in the authorized car service center market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Car Rental Service Market Trends - Growth & Forecast 2024 to 2034

Car Washing Service Market Size and Share Forecast Outlook 2025 to 2035

Carpool As A Service Market Size and Share Forecast Outlook 2025 to 2035

The Car Detailing Services Market is segmented by service type and region from 2025 to 2035.

Home Care Services Market Size, Growth, and Forecast 2025 to 2035

Plant Care Services Market Size and Share Forecast Outlook 2025 to 2035

Carbohydrates Testing Services Market - Size, Share, and Forecast Outlook 2025 to 2035

Car Breakdown Recovery Service Market Size and Share Forecast Outlook 2025 to 2035

USA Home Care Services Market Trends – Growth, Demand & Analysis 2025-2035

Healthcare Contact Center Solution Market Size and Share Forecast Outlook 2025 to 2035

Geriatric Care Services Market Size and Share Forecast Outlook 2025 to 2035

Contact Center as a Service Market Trends - Growth & Forecast through 2034

The Carpet & Upholstery Cleaning Services Market is segmented by service type and application from 2025 to 2035.

Canada Home Care Services Market Analysis – Size, Share & Trends 2025-2035

Datacenter Infrastructure Services Market Size and Share Forecast Outlook 2025 to 2035

Germany Home Care Services Market Insights – Size, Trends & Forecast 2025-2035

Airline A-la-carte Services Market Analysis by Product Type, Carrier Type and Region from 2025 to 2035

Subscription Carwash Services Market Size and Share Forecast Outlook 2025 to 2035

Senior In-Home Care Services Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Analytical Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA