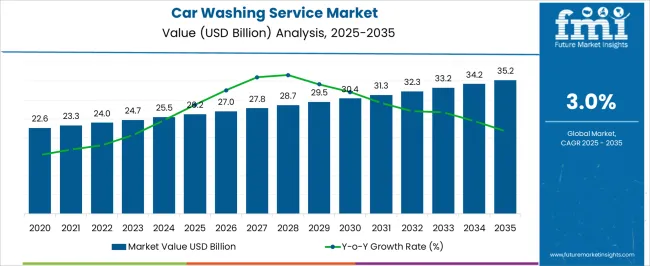

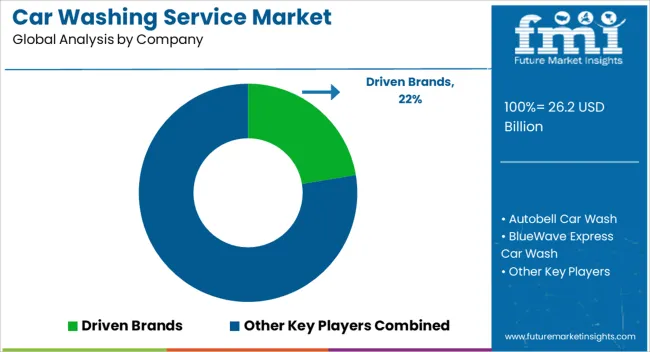

The car washing service market, valued at USD 26.2 billion in 2025 and projected to reach USD 35.2 billion by 2035 at a CAGR of 3.0%, demonstrates a cost structure heavily influenced by labor, utilities, consumables, equipment maintenance, and real estate. Labor expenses represent the largest share since car washing is service-intensive, requiring trained personnel for manual and automated operations. Water and electricity consumption add recurring operational costs, with efficiency improvements sought to reduce expenses.

Consumables such as detergents, wax, and cleaning agents are another vital component, with premium products adding to per-service costs but enabling differentiation. The value chain begins with equipment suppliers who provide washing systems, vacuums, and chemical formulations. Service operators form the core, integrating manual, self-service, and automated wash formats. Distribution channels range from standalone car wash centers to integrated services at fuel stations and dealerships, expanding accessibility. End-users consist of individual vehicle owners and commercial fleets, with fleets offering recurring revenue opportunities.

Upstream, partnerships with chemical suppliers and machine manufacturers help optimize costs and ensure operational reliability. Downstream, customer engagement through subscription models and digital booking platforms enhances value delivery. The cost-structure and value-chain highlight a low-margin, volume-driven industry where operational efficiency and service differentiation are essential for sustaining profitability.

| Metric | Value |

|---|---|

| Car Washing Service Market Estimated Value in (2025 E) | USD 26.2 billion |

| Car Washing Service Market Forecast Value in (2035 F) | USD 35.2 billion |

| Forecast CAGR (2025 to 2035) | 3.0% |

The car washing service market represents a growing segment within the global automotive aftermarket and vehicle care industry, emphasizing convenience, maintenance, and aesthetic value. Within the broader automotive aftermarket services sector, it accounts for about 5.7%, supported by steady demand from personal and commercial vehicle owners. In the professional cleaning and detailing services segment, it holds nearly 5.0%, reflecting the importance of exterior and interior upkeep. Across the urban mobility and vehicle lifestyle services market, the share is 4.4%, highlighting increasing reliance on professional cleaning solutions. Within the eco-friendly waterless and automated car wash systems category, it represents 3.9%, indicating a shift toward resource-efficient methods.

In the fleet maintenance and logistics vehicle care sector, it secures 3.5%, emphasizing the role of car washing in operational efficiency and brand image. Recent developments in this market have focused on automation, eco-friendly practices, and customer convenience. Innovations include touchless wash systems, water recycling units, and biodegradable cleaning agents designed to minimize environmental impact. Key players are collaborating with technology firms to introduce mobile booking apps, subscription-based services, and contactless payment solutions. Adoption of on-demand mobile car wash services, robotic cleaning systems, and AI-driven customer management tools is gaining traction to enhance efficiency and consumer experience. Additionally, franchising models, strategic partnerships with fuel stations, and integration with automotive service centers are being deployed to expand market reach. These trends demonstrate how technology, convenience, and sustainability-linked practices are shaping the market.

The market is witnessing steady expansion, driven by evolving consumer preferences and technological integration within the automotive care industry. The shift toward convenient and efficient service delivery is shaping the current landscape, while the increasing adoption of automated and eco-friendly washing solutions supports future growth prospects.

Factors such as rising vehicle ownership, urbanization, and increased disposable income are contributing to the expanding customer base for car wash services. Investment in digital payment infrastructure and the growing emphasis on contactless transactions are further enhancing customer experience.

Additionally, regulatory support for water conservation and environmental standards is encouraging the adoption of modern, sustainable car washing technologies. As consumers continue to prioritize speed, convenience, and quality, the market is expected to evolve through the integration of cashless payment options and automated tunnel washing systems, offering scalable and user-friendly solutions.

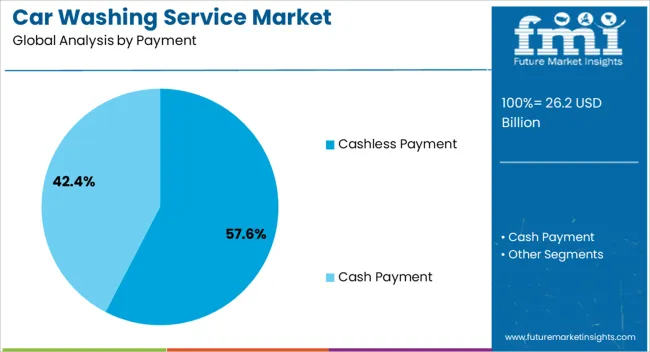

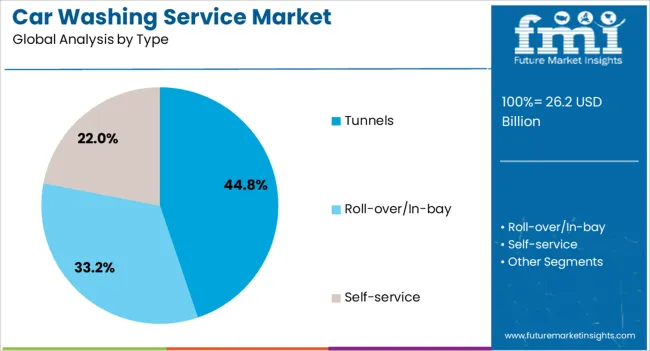

The car washing service market is segmented by payment, type, and geographic regions. By payment, car washing service market is divided into Cashless Payment and Cash Payment. In terms of type, car washing service market is classified into Tunnels, Roll-over/In-bay, and Self-service. Regionally, the car washing service industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Cashless Payment methods are expected to hold 57.6% of the Car Washing Service market revenue share in 2025, establishing this segment as the dominant payment type. This growth has been supported by increasing consumer preference for digital and contactless transactions, which provide speed, safety, and ease of use. The widespread availability of mobile wallets, card payments, and app-based services has facilitated adoption among urban customers seeking convenience and security.

Service providers have leveraged cashless payment systems to streamline operations, reduce handling costs, and enhance customer satisfaction. The rising penetration of smartphones and improving internet infrastructure have further accelerated cashless transactions within car washing services.

Moreover, the pandemic has acted as a catalyst, encouraging contactless payments to minimize physical contact Moving forward, innovations in payment technology and seamless integration with loyalty programs and subscription models are expected to sustain the dominance of this segment.

The Tunnel segment is anticipated to account for 44.8% of the Car Washing Service market revenue share in 2025, positioning it as the leading service type. This segment’s growth is being driven by the demand for fast, automated washing solutions capable of servicing a high volume of vehicles with consistent quality. Tunnel car washes offer advantages such as water efficiency, reduced labor costs, and minimal wait times, making them attractive for both customers and operators.

The scalability and modular nature of tunnel systems allow service providers to customize offerings based on location and demand. Increasing urban congestion and the need for quick service have also contributed to tunnel washing’s appeal. Furthermore, advancements in soft-touch technology and chemical formulations have improved cleaning effectiveness while protecting vehicle finishes.

The integration of tunnel car washes with digital payment and subscription systems is enhancing customer convenience and operational efficiency. The tunnel segment is expected to remain a key growth driver due to its ability to combine speed, quality, and sustainability.

The market has been shaped by the growing emphasis on vehicle care, convenience, and demand for professional cleaning solutions. Car owners are increasingly preferring professional services over manual washing due to time efficiency, advanced cleaning technologies, and enhanced quality outcomes.

Automated facilities, eco-friendly washing techniques, and subscription-based service models have strengthened the market landscape. Rising vehicle ownership across urban and semi-urban regions has ensured a steady customer base for both full-service stations and on-demand mobile car washing providers. The industry is being transformed through technology integration, environmental considerations, and innovative business models.

The rising number of passenger and commercial vehicles worldwide has been one of the primary drivers of the car washing service market. Growing car ownership among households and fleet expansion across businesses have created a steady demand for regular cleaning and detailing services. Vehicle owners prefer professional services for thorough washing, polishing, and interior cleaning that extend the life and appearance of automobiles.

Premium services, including waxing and paint protection, are increasingly sought by customers looking to preserve resale value. The consistent rise in vehicle registrations across both emerging and developed markets continues to create robust opportunities for car wash operators globally.

Automation has significantly impacted the car washing service market, making high-volume cleaning more efficient and accessible. Tunnel wash systems, in-bay automatics, and self-service stations have reduced waiting times and improved customer convenience. These facilities are increasingly equipped with modern water recycling technologies and energy-efficient systems that ensure sustainability. Automated stations also support subscription-based models where customers receive unlimited washes for a fixed fee, promoting recurring revenue for service providers. The expansion of these facilities in both urban and highway locations has made professional car washing accessible to a wider customer base, improving penetration across multiple regions.

On-demand mobile car washing has emerged as a transformative trend, offering convenience to customers at their homes or workplaces. Service providers equipped with portable cleaning kits, waterless solutions, and mobile apps allow users to schedule appointments with ease. This model reduces the need for customers to visit fixed facilities, making it particularly attractive in urban areas with high traffic and limited time availability. Start-ups and established operators are investing in app-based platforms to streamline bookings, payments, and service tracking. Mobile washing not only caters to individual customers but also serves fleet operators seeking scheduled vehicle maintenance.

Environmental concerns related to water consumption and chemical waste have influenced the car washing service market significantly. Traditional washing methods consume large amounts of water, while improper disposal of cleaning agents contributes to pollution. As a result, service providers are adopting eco-friendly practices such as water recycling, biodegradable detergents, and waterless car washing solutions. Governments in several regions have introduced stricter regulations on water usage and waste management, encouraging industry players to invest in sustainable technologies. Green certifications and eco-branded services are being marketed to environmentally conscious consumers, shaping competitive positioning within the industry and reinforcing customer loyalty.

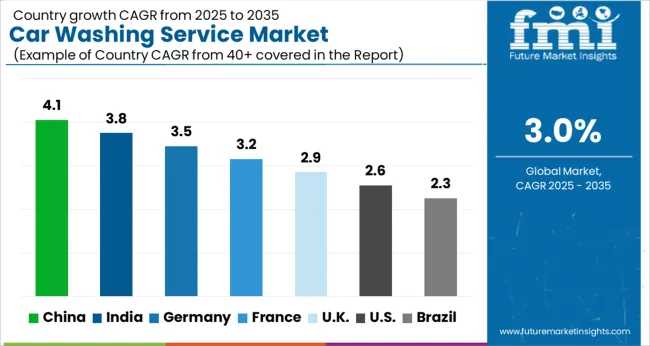

| Country | CAGR |

|---|---|

| China | 4.1% |

| India | 3.8% |

| Germany | 3.5% |

| France | 3.2% |

| UK | 2.9% |

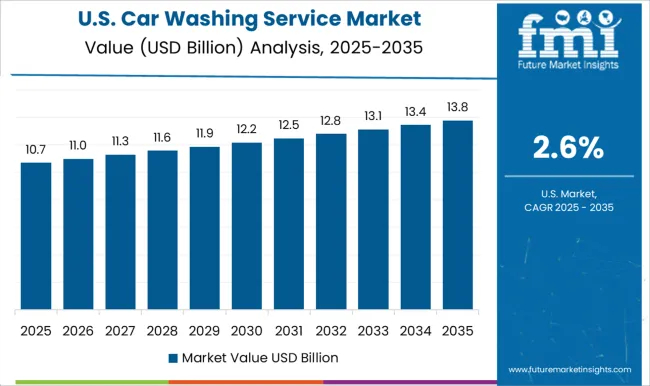

| USA | 2.6% |

| Brazil | 2.3% |

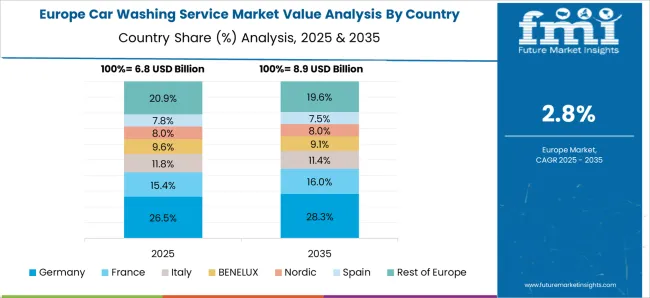

The market is projected to expand at a CAGR of 3.0% between 2025 and 2035, influenced by growing vehicle ownership, rising awareness of vehicle maintenance, and a shift toward automated washing solutions. India registered 3.8, backed by increasing car sales and the growth of organized washing chains. Germany accounted for 3.5, supported by demand for eco-friendly wash systems and premium services. China led the market with 4.1, reflecting its large automotive base and expanding service networks. The United Kingdom posted 2.9, driven by rising adoption of water-efficient systems, while the United States recorded 2.6, supported by the popularity of subscription-based washing models. These regional variations highlight distinct consumer preferences and technological advancements shaping the industry. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is expected to progress with a CAGR of 4.1%, supported by growing vehicle ownership, increasing service standardization, and rapid expansion of automated washing facilities. Demand is driven by busy urban lifestyles, which have influenced adoption of subscription based car cleaning models. Local operators are investing in tunnel and touchless wash technologies, while foreign companies collaborate with domestic chains to capture the premium segment. The market also benefits from digital platforms that allow app based booking and payment, creating convenience for customers.

India is projected to witness steady growth at a CAGR of 3.8%, with increasing reliance on organized service providers over informal cleaning practices. Rising ownership of passenger vehicles has contributed significantly to expanding demand. The emergence of mobile car washing services, often booked through digital platforms, has created a cost effective and accessible alternative for customers. Investment by domestic chains in water efficient technologies and eco-friendly cleaning agents has also gained traction. Imports of high pressure washing equipment continue to support capacity expansion.

Germany is forecast to expand at a CAGR of 3.5%, supported by strong consumer preference for professional car care, especially automated and self-service washing stations. The market is dominated by established players offering subscription models with value added services like waxing and detailing. Investment in advanced equipment has played a role in maintaining high service quality standards. Domestic operators emphasize compliance with environmental regulations, leading to the adoption of water recycling and biodegradable cleaning solutions, which further strengthens market confidence.

The United Kingdom is anticipated to register a CAGR of 2.9%, with growth supported by the presence of both traditional hand wash stations and advanced automated service chains. Increasing adoption of drive through wash facilities has accelerated the pace of organized expansion. Customers continue to favor convenience, driving demand for app based car wash booking and home service models. Market participants are also investing in ecofriendly products and energy efficient machinery to strengthen their customer base and improve competitiveness in a fragmented landscape.

The United States is expected to grow at a CAGR of 2.6%, with demand sustained by the expansion of large car wash chains, preference for unlimited monthly plans, and increasing penetration of express tunnel facilities. Domestic operators focus on rapid service delivery combined with loyalty programs to retain customers. Automated systems dominate the market, though demand for detailing and premium hand wash services remains strong in select regions. Market consolidation is also visible as leading companies expand through acquisitions to enhance their geographical footprint.

The market is highly fragmented, with competition driven by regional dominance, service innovation, and scalability. Driven Brands leads the landscape through its extensive network of car care service brands, offering both automated and self-service models across multiple regions. Companies such as Quick Quack Car Wash, Crew Car Wash, and BlueWave Express Car Wash are recognized for their rapid expansion strategies and strong focus on express exterior services supported by subscription-based revenue models. Hoffman Car Wash and Autobell Car Wash compete by blending convenience with customer-focused services, often expanding through family-owned operations and community presence.

Clean Freak Car Wash and Magic Hands Car Wash differentiate themselves with value-driven offerings, frequent wash plans, and eco-friendly practices to capture environmentally conscious customers. Competition is increasingly shaped by automation, water recycling technology, and subscription-based unlimited wash programs. Players investing in advanced equipment, digital loyalty platforms, and regional expansion are strengthening their position in this service-driven market.

| Item | Value |

|---|---|

| Quantitative Units | USD 26.2 Billion |

| Payment | Cashless Payment and Cash Payment |

| Type | Tunnels, Roll-over/In-bay, and Self-service |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Driven Brands, Autobell Car Wash, BlueWave Express Car Wash, Clean Freak Car Wash, Crew Car Wash, Hoffman Car Wash, Magic Hands Car Wash, and Quick Quack Car Wash |

| Additional Attributes | Dollar sales by service type and application, demand dynamics across residential, commercial, and fleet segments, regional trends in professional car care adoption, innovation in waterless washing, automation, and eco-friendly cleaning solutions, environmental impact of water consumption and chemical discharge, and emerging use cases in subscription-based services, mobile car wash units, and smart service platforms. |

The global car washing service market is estimated to be valued at USD 26.2 billion in 2025.

The market size for the car washing service market is projected to reach USD 35.2 billion by 2035.

The car washing service market is expected to grow at a 3.0% CAGR between 2025 and 2035.

The key product types in car washing service market are cashless payment and cash payment.

In terms of type, tunnels segment to command 44.8% share in the car washing service market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Car OS Market Size and Share Forecast Outlook 2025 to 2035

Caramel Malt Market Size and Share Forecast Outlook 2025 to 2035

Carbon Capture and Sequestration Market Forecast Outlook 2025 to 2035

Cardiac Rehabilitation Market Size and Share Forecast Outlook 2025 to 2035

Carbon Dioxide Incubators Market Size and Share Forecast Outlook 2025 to 2035

Carboxymethyl Tamarind Gum (CMT) Market Size and Share Forecast Outlook 2025 to 2035

Car Cover Market Size and Share Forecast Outlook 2025 to 2035

Cardiology Information System Market Size and Share Forecast Outlook 2025 to 2035

Cardiopulmonary Functional Testing Platform Market Size and Share Forecast Outlook 2025 to 2035

Carbon Enhanced Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Car Bushing Market Size and Share Forecast Outlook 2025 to 2035

Carbon-negative Cement Market Size and Share Forecast Outlook 2025 to 2035

Card Printer Ribbon Market Size and Share Forecast Outlook 2025 to 2035

Carbon Tetrabromide Market Size and Share Forecast Outlook 2025 to 2035

Carbon Steel Market Size and Share Forecast Outlook 2025 to 2035

Carpet Spot Remover Market Size and Share Forecast Outlook 2025 to 2035

Cardiovascular CT Systems Market Size and Share Forecast Outlook 2025 to 2035

Carbon Brush Market Size and Share Forecast Outlook 2025 to 2035

Carpet and Rug Market Size and Share Forecast Outlook 2025 to 2035

Carbon Offset Platform Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA