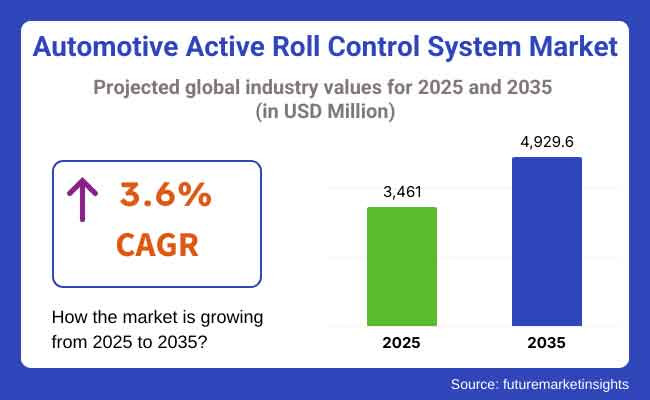

The automotive active roll control system market is set to rise from USD 3,461 Million in 2025 to USD 4,929.6 Million by 2035, showing an annual growth of 3.6%. Quick changes in electricity, growing need for fancy and high-performance cars, and new tech in mechatronics and electronic control units (ECUs) will push this growth.

The automotive active roll control system market will achieve steady growth during the forecast period 2025 to 2035, as increasing consumer demands towards advanced safety, greater ride comfort & enhanced vehicle handling will set in the market.

These systems improve driving stability by reducing body roll through sharp turns and uneven terrain. For most SUVs and sports cars, their implementation would be practically crucial to ensuring dynamics control and comfort for passengers, both performance and market competitive.

Over the forecast period, North America is anticipated to be the leading automotive active roll control system marketas the region possesses a substantial automotive manufacturing base with significant investment in advanced chassis and vehicle safety technologies.

And especially in the USA, there is growing demand for more comfortable luxury SUVs, or electric vehicles and now sports cars with better ride handling properties. To appeal to a population of consumers who are not only more comfort-oriented but are also keen for performance, automakers are improving vehicle stability and control.

OEMs are also striking technological partnerships with Tier-1 suppliers to expedite the incorporation of active roll control systems. In addition, government organizations such as the National Highway Traffic Safety Administration (NHTSA) are endorsing active safety systems that, in turn, are projected to benefit the growth of the market.

Europe is a mature and innovation-oriented market, as indicated by the high penetration of automotive brands and the luxury and high-performance segment. Active roll control is implemented in many countries such as Germany, the UK, France, and Sweden.

The same goes for electro-mechanical roll control systems that German manufacturers are introducing for their electric and hybrid models again, allowing for greater customizability and ride optimization. The EU’s stricter than ever safety and emissions standards create an added incentive to use driving dynamics and efficiency enhancement systems.

The regional market will also be driven by the growing demand for active roll control technologies owing to the rising penetration of advanced chassis systems as the market share of plug-in hybrids and battery electric vehicles increases significantly.

Asia-Pacific is set to grow fastest in automotive active roll control system market during this time. This is due to more cars being made, new tech, and people knowing more in China, Japan, South Korea, and India. China leads in making electric cars. Car makers add new roll systems to electric and top cars to stay ahead.

Japan and South Korea keep pushing car tech forward. Big names like Toyota, Nissan, Hyundai, and Kia are working on better ride control. India is seeing more safe and top cars which drives up the need for active roll, mainly in city cars and electric ones.

Challenge

High System Costs and Complex Integration

High cost of active roll control components constituted a major restraining force in the automotive active roll control system market. These costs can be prohibitive in mass market or economy vehicle segments, leading adoption to mostly premium and high-end vehicles. Moreover, complicated electronic and mechanical integration with existing vehicle platforms requires cutting-edge engineering know-how, increasing production and maintenance costs.

Opportunity

Integration with Electric and Autonomous Vehicle Platforms

As the global automotive industry revolutionizes to focus on electrification and autonomous driving, the demand for accurate control of vehicles and the pursuit of an ideal ride comfort have reached new heights.

This trend represents a great opportunity for the active roll control systems to be integrated into EVs, as well as autonomous vehicles, as it helps enhancing the vehicle stability, passenger comfort, safety, etc. OEMs and Tier-1 suppliers that are developing modular and software-driven chassis technologies will likely drive the next wave of innovation in this area.

The automotive active roll control system marketgrew at a compound annual growth rate during 2020 to 2024, mainly because of an increasing preference for vehicle safety, ride comfort and performance. New advanced hydraulic and electromechanical roll control technologies helped automakers improve handling and boost stability in premium and high-performance vehicles by minimizing body roll around corners.

Between 2025 to 2035, the automotive active roll control system market will develop at a faster pace due to the features such as AI-based control systems incorporation, enhanced vehicle electrification, and compliance with tighter global safety standards.

OEMs must leverage responsive, energy-efficient roll control technologies that deliver smooth handling and overall passenger comfort due to increasing demand for electric and autonomous vehicles. Future growth can also be driven through the development of lightweight roll control modules, advanced predictive analytics through machine learning, and seamless integration with ADAS platforms, bringing a transformational shift in automotive chassis technology.

Market Shifts: 2020 to 2024 vs. 2025 to 2035

| Key Dimensions | 2020 to 2024 |

|---|---|

| Technology Adoption | Hydraulic and electromechanical systems in high-end vehicles |

| Vehicle Integration | Focus on luxury SUVs and sports cars |

| Consumer Demand | Ride comfort and high-speed stability |

| Regulatory Compliance | Regional safety initiatives |

| Energy Efficiency | Standard performance metrics |

| Market Penetration | Concentrated in developed economies |

| ADAS Integration | Minimal linkage to advanced driver aids |

| System Cost | High cost limiting broader adoption |

| Aftermarket Solutions | Limited retrofitting options |

| Sustainability | Initial efforts at eco-friendly materials |

| Key Dimensions | 2025 to 2035 |

|---|---|

| Technology Adoption | AI-powered, self-adaptive systems in mainstream EVs and AVs |

| Vehicle Integration | Expanded integration in EVs, hybrids, and mid-range models |

| Consumer Demand | Personalized ride dynamics and predictive vehicle control |

| Regulatory Compliance | Global mandates for stability-enhancing systems |

| Energy Efficiency | Lightweight, low-energy modules optimized for electric powertrains |

| Market Penetration | Wider presence in Asia-Pacific and Latin America |

| ADAS Integration | Full integration with ADAS and autonomous driving systems |

| System Cost | Cost-optimized designs enabling scalability across segments |

| Aftermarket Solutions | Rise in aftermarket kits and upgrades |

| Sustainability | Focus on recyclable materials and green manufacturing practices |

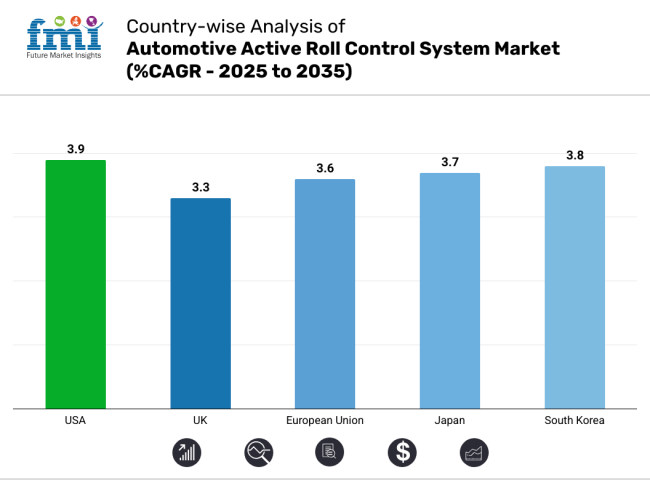

The automotive active roll control system marketis seeing growth in the USA because more people want safer cars. Also, more electric and hybrid cars are on the roads. Government rules set by groups like the National Highway Traffic Safety Administration (NHTSA) are pushing for safer cars and more use of ARC systems, especially in SUVs and high-end cars.

Key trends include more ARC systems in fast and fancy cars, tie-ins with ADAS tech, and investments in new tech for roll control. Big car companies and top suppliers in the USA are helping this growth and sparking new ideas.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 3.9% |

The automotive active roll control system marketin the UK is growing as car makers answer calls for better driving feel and safety. The UK's push for electric cars, helped by rules from the Vehicle Certification Agency (VCA) and Euro NCAP standards, helps the use of ARC systems grow.

Trends in the market show using ARC systems in electric cars to boost cornering, more demand for electronic roll stabilization, and car makers' focus on giving top ride quality. Teamwork between UK R&D centers and car parts suppliers is also boosting new ideas in this area.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.3% |

The automotive active roll control system marketin the EU is seeing big growth. New car safety laws are tough. More cars are using electric power. People want cars that drive well. Rules from the EU and Euro NCAP make car controls better.

Germany, France, and Sweden help a lot. These places make many cars. They like electric and hybrid cars with these systems. They work on light, smart roll controls. Fancy driving is a hit.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 3.6% |

Japan's automotive active roll control system marketgrows due to top car makers like Toyota, Nissan, and Honda. They keep putting money into car safety, electric cars, and better tech. The Ministry of Land, Infrastructure, Transport, and Tourism (MLIT) sets car safety rules, aiding ARC system use.

Hot trends show more active roll stabilization in hybrid and electric cars. There's a push for fuel efficiency with lighter frames and new electromechanical ARC systems. Japan's strong car supply chain helps the market grow even more.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.7% |

South Korea's automotive active roll control system marketis growing fast. The government is pushing to make cars safer and better. Groups like the Ministry of Trade, Industry, and Energy (MOTIE) and the Korea Automobile Testing & Research Institute (KATRI) support using new car control tech.

Now, more SUVs and EVs from big companies like Hyundai and Kia have ARC systems. Parts makers and research centers work together on smart chasses. People also want cars that are more stable and comfy to ride in.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.8% |

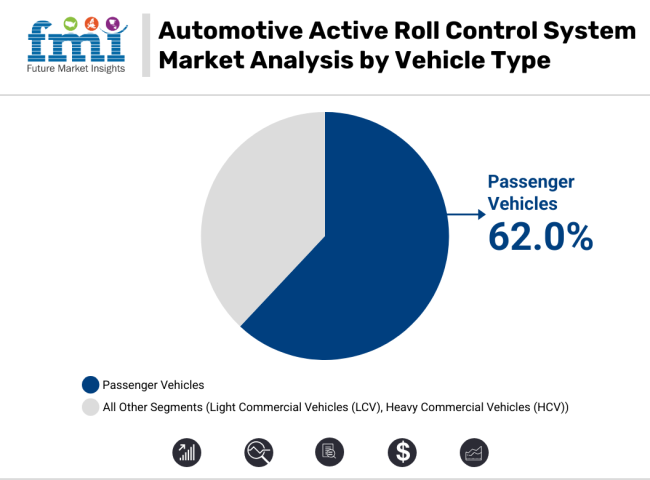

The automotive active roll control system market is gaining traction as automobile manufacturers are focusing on easier driving, vehicle dynamics, and passenger safety. In contrast, conventional anti-roll systems minimize body roll in curves and when steering sharply, enhancing both handling performance and ride comfort. An increase in demand for luxury cars, SUVs, and commercial fleets that require enhanced stability and safety drive the market.

Passenger vehicle market holds the majority of share with high-end sedans and sport utility vehicles being the leading segment due to enhanced suspension systems and electronic stability control features. As consumer expectations for premium driving experiences and improved rollover protection have grown, it has mounted pressure on adopting active roll control system across this segment.

Active roll control is particularly important for center-of-gravity balance in electric and hybrid passenger cars meaning even heavier battery packs need not detract from driving dynamics. This trend is indicative of even more growth in the EV segment throughout the world.

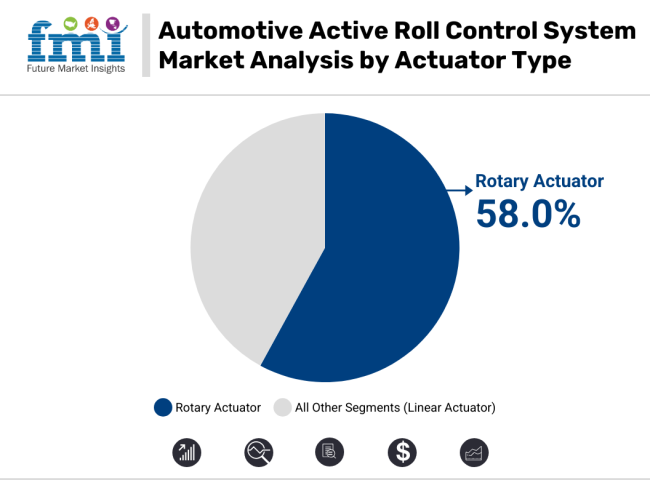

Compact and powerful energy delivery for precise torque modifications make rotary actuators the dominant drive technology in active roll control concepts. The actuators allow adjustments to body control in real-time, a key to high-speed driving and rough terrain.

They are applied across luxury passenger cars and performance-oriented vehicles, where dynamic cornering control is a key differentiator. Electromechanical rotary actuators innovations further support this segment by adopting fewer hydraulic components, whilst benefiting integration with ADAS and active suspension modules.

The automotive active roll control system marketis growing fast. More people want better car stability, safety, and comfort. ARC systems cut body roll when turning, helping control the car and lowering rollover risk. This goes with the global need for better safety. Combining ARC with advanced driver help systems (ADAS) lets the car react to road changes quickly, improving how it drives.

With more electric cars on the roads, ARC systems fit well because electric cars' electronic setups make it easy. Luxury and performance car makers use ARC systems to make their cars stand out. New tech means ARC systems are getting better and quicker. As cities grow and people want smoother, smarter driving, ARC systems are key for modern cars, fitting both high-end and regular models with gas and electric engines.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Continental AG | 18-22% |

| Robert Bosch GmbH | 15-19% |

| ZF Friedrichshafen AG | 12-16% |

| Schaeffler AG | 10-14% |

| Tenneco Inc. | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Continental AG | In 2024, a new ARC system was shown. It had adaptive suspension tech to make car fun to drive and comfy. |

| Robert Bosch GmbH | In 2025, a next-gen ARC system came out with real-time data. It made cars safer and easier to handle. |

| ZF Friedrichshafen AG | In 2024, an electric ARC system was created for EVs. It saved energy and cut down on weight. |

| Schaeffler AG | In 2025, modular ARC systems were released. They fit many car types and could be easily customized. |

| Tenneco Inc. | In 2024, displayed an ARC system with advanced damping tech. It gave better roll control and improved ride quality. |

Key Company Insights

Continental AG (18-22%)

Continental leads the market with innovative ARC solutions that integrate seamlessly with existing vehicle architectures, enhancing both performance and safety.

Robert Bosch GmbH (15-19%)

Bosch focuses on developing ARC systems with advanced sensors and control algorithms, aiming to provide precise roll stabilization across diverse driving conditions.

ZF Friedrichshafen AG (12-16%)

ZF emphasizes the development of electric ARC systems tailored for EVs, contributing to improved handling and energy efficiency.

Schaeffler AG (10-14%)

Schaeffler offers modular ARC solutions that can be customized for different vehicle types, providing flexibility to automotive manufacturers.

Tenneco Inc. (6-10%)

Tenneco integrates advanced damping technologies into its ARC systems, focusing on enhancing ride comfort and vehicle stability.

Other Key Players (30-40% Combined)

Several other companies contribute significantly to the ARC market:

The overall market size for the automotive active roll control system market was USD 3,461 Million in 2025.

The automotive active roll control system market is expected to reach USD 4,929.6 Million in 2035.

Increasing emphasis on vehicle safety and ride comfort, rising demand for premium and high-performance vehicles, advancements in electronic control systems, and growing regulatory pressure to enhance vehicle stability are key drivers fueling market growth.

The USA, Germany, China, Japan, and South Korea are key contributors.

The hydraulic active roll control segment is expected to lead due to its high efficiency in maintaining vehicle stability and minimizing body roll during cornering.

Table 1: Global Market Value (US$ Mn) Forecast by Region, 2017-2032

Table 2: Global Market Volume (Units) Forecast by Region, 2017-2032

Table 3: Global Market Value (US$ Mn) Forecast by Actuator Type, 2017-2032

Table 4: Global Market Volume (Units) Forecast by Actuator Type, 2017-2032

Table 5: Global Market Value (US$ Mn) Forecast by Vehicle Type, 2017-2032

Table 6: Global Market Volume (Units) Forecast by Vehicle Type, 2017-2032

Table 7: Global Market Value (US$ Mn) Forecast by Distribution Channel, 2017-2032

Table 8: Global Market Volume (Units) Forecast by Distribution Channel, 2017-2032

Table 9: North America Market Value (US$ Mn) Forecast by Country, 2017-2032

Table 10: North America Market Volume (Units) Forecast by Country, 2017-2032

Table 11: North America Market Value (US$ Mn) Forecast by Actuator Type, 2017-2032

Table 12: North America Market Volume (Units) Forecast by Actuator Type, 2017-2032

Table 13: North America Market Value (US$ Mn) Forecast by Vehicle Type, 2017-2032

Table 14: North America Market Volume (Units) Forecast by Vehicle Type, 2017-2032

Table 15: North America Market Value (US$ Mn) Forecast by Distribution Channel, 2017-2032

Table 16: North America Market Volume (Units) Forecast by Distribution Channel, 2017-2032

Table 17: Latin America Market Value (US$ Mn) Forecast by Country, 2017-2032

Table 18: Latin America Market Volume (Units) Forecast by Country, 2017-2032

Table 19: Latin America Market Value (US$ Mn) Forecast by Actuator Type, 2017-2032

Table 20: Latin America Market Volume (Units) Forecast by Actuator Type, 2017-2032

Table 21: Latin America Market Value (US$ Mn) Forecast by Vehicle Type, 2017-2032

Table 22: Latin America Market Volume (Units) Forecast by Vehicle Type, 2017-2032

Table 23: Latin America Market Value (US$ Mn) Forecast by Distribution Channel, 2017-2032

Table 24: Latin America Market Volume (Units) Forecast by Distribution Channel, 2017-2032

Table 25: Europe Market Value (US$ Mn) Forecast by Country, 2017-2032

Table 26: Europe Market Volume (Units) Forecast by Country, 2017-2032

Table 27: Europe Market Value (US$ Mn) Forecast by Actuator Type, 2017-2032

Table 28: Europe Market Volume (Units) Forecast by Actuator Type, 2017-2032

Table 29: Europe Market Value (US$ Mn) Forecast by Vehicle Type, 2017-2032

Table 30: Europe Market Volume (Units) Forecast by Vehicle Type, 2017-2032

Table 31: Europe Market Value (US$ Mn) Forecast by Distribution Channel, 2017-2032

Table 32: Europe Market Volume (Units) Forecast by Distribution Channel, 2017-2032

Table 33: Asia Pacific Market Value (US$ Mn) Forecast by Country, 2017-2032

Table 34: Asia Pacific Market Volume (Units) Forecast by Country, 2017-2032

Table 35: Asia Pacific Market Value (US$ Mn) Forecast by Actuator Type, 2017-2032

Table 36: Asia Pacific Market Volume (Units) Forecast by Actuator Type, 2017-2032

Table 37: Asia Pacific Market Value (US$ Mn) Forecast by Vehicle Type, 2017-2032

Table 38: Asia Pacific Market Volume (Units) Forecast by Vehicle Type, 2017-2032

Table 39: Asia Pacific Market Value (US$ Mn) Forecast by Distribution Channel, 2017-2032

Table 40: Asia Pacific Market Volume (Units) Forecast by Distribution Channel, 2017-2032

Table 41: Middle East and Africa Market Value (US$ Mn) Forecast by Country, 2017-2032

Table 42: Middle East and Africa Market Volume (Units) Forecast by Country, 2017-2032

Table 43: Middle East and Africa Market Value (US$ Mn) Forecast by Actuator Type, 2017-2032

Table 44: Middle East and Africa Market Volume (Units) Forecast by Actuator Type, 2017-2032

Table 45: Middle East and Africa Market Value (US$ Mn) Forecast by Vehicle Type, 2017-2032

Table 46: Middle East and Africa Market Volume (Units) Forecast by Vehicle Type, 2017-2032

Table 47: Middle East and Africa Market Value (US$ Mn) Forecast by Distribution Channel, 2017-2032

Table 48: Middle East and Africa Market Volume (Units) Forecast by Distribution Channel, 2017-2032

Figure 1: Global Market Value (US$ Mn) by Actuator Type, 2022-2032

Figure 2: Global Market Value (US$ Mn) by Vehicle Type, 2022-2032

Figure 3: Global Market Value (US$ Mn) by Distribution Channel, 2022-2032

Figure 4: Global Market Value (US$ Mn) by Region, 2022-2032

Figure 5: Global Market Value (US$ Mn) Analysis by Region, 2017-2032

Figure 6: Global Market Volume (Units) Analysis by Region, 2017-2032

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2022-2032

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2022-2032

Figure 9: Global Market Value (US$ Mn) Analysis by Actuator Type, 2017-2032

Figure 10: Global Market Volume (Units) Analysis by Actuator Type, 2017-2032

Figure 11: Global Market Value Share (%) and BPS Analysis by Actuator Type, 2022-2032

Figure 12: Global Market Y-o-Y Growth (%) Projections by Actuator Type, 2022-2032

Figure 13: Global Market Value (US$ Mn) Analysis by Vehicle Type, 2017-2032

Figure 14: Global Market Volume (Units) Analysis by Vehicle Type, 2017-2032

Figure 15: Global Market Value Share (%) and BPS Analysis by Vehicle Type, 2022-2032

Figure 16: Global Market Y-o-Y Growth (%) Projections by Vehicle Type, 2022-2032

Figure 17: Global Market Value (US$ Mn) Analysis by Distribution Channel, 2017-2032

Figure 18: Global Market Volume (Units) Analysis by Distribution Channel, 2017-2032

Figure 19: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2022-2032

Figure 20: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2022-2032

Figure 21: Global Market Attractiveness by Actuator Type, 2022-2032

Figure 22: Global Market Attractiveness by Vehicle Type, 2022-2032

Figure 23: Global Market Attractiveness by Distribution Channel, 2022-2032

Figure 24: Global Market Attractiveness by Region, 2022-2032

Figure 25: North America Market Value (US$ Mn) by Actuator Type, 2022-2032

Figure 26: North America Market Value (US$ Mn) by Vehicle Type, 2022-2032

Figure 27: North America Market Value (US$ Mn) by Distribution Channel, 2022-2032

Figure 28: North America Market Value (US$ Mn) by Country, 2022-2032

Figure 29: North America Market Value (US$ Mn) Analysis by Country, 2017-2032

Figure 30: North America Market Volume (Units) Analysis by Country, 2017-2032

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 33: North America Market Value (US$ Mn) Analysis by Actuator Type, 2017-2032

Figure 34: North America Market Volume (Units) Analysis by Actuator Type, 2017-2032

Figure 35: North America Market Value Share (%) and BPS Analysis by Actuator Type, 2022-2032

Figure 36: North America Market Y-o-Y Growth (%) Projections by Actuator Type, 2022-2032

Figure 37: North America Market Value (US$ Mn) Analysis by Vehicle Type, 2017-2032

Figure 38: North America Market Volume (Units) Analysis by Vehicle Type, 2017-2032

Figure 39: North America Market Value Share (%) and BPS Analysis by Vehicle Type, 2022-2032

Figure 40: North America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2022-2032

Figure 41: North America Market Value (US$ Mn) Analysis by Distribution Channel, 2017-2032

Figure 42: North America Market Volume (Units) Analysis by Distribution Channel, 2017-2032

Figure 43: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2022-2032

Figure 44: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2022-2032

Figure 45: North America Market Attractiveness by Actuator Type, 2022-2032

Figure 46: North America Market Attractiveness by Vehicle Type, 2022-2032

Figure 47: North America Market Attractiveness by Distribution Channel, 2022-2032

Figure 48: North America Market Attractiveness by Country, 2022-2032

Figure 49: Latin America Market Value (US$ Mn) by Actuator Type, 2022-2032

Figure 50: Latin America Market Value (US$ Mn) by Vehicle Type, 2022-2032

Figure 51: Latin America Market Value (US$ Mn) by Distribution Channel, 2022-2032

Figure 52: Latin America Market Value (US$ Mn) by Country, 2022-2032

Figure 53: Latin America Market Value (US$ Mn) Analysis by Country, 2017-2032

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2017-2032

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 57: Latin America Market Value (US$ Mn) Analysis by Actuator Type, 2017-2032

Figure 58: Latin America Market Volume (Units) Analysis by Actuator Type, 2017-2032

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Actuator Type, 2022-2032

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Actuator Type, 2022-2032

Figure 61: Latin America Market Value (US$ Mn) Analysis by Vehicle Type, 2017-2032

Figure 62: Latin America Market Volume (Units) Analysis by Vehicle Type, 2017-2032

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Vehicle Type, 2022-2032

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2022-2032

Figure 65: Latin America Market Value (US$ Mn) Analysis by Distribution Channel, 2017-2032

Figure 66: Latin America Market Volume (Units) Analysis by Distribution Channel, 2017-2032

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2022-2032

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2022-2032

Figure 69: Latin America Market Attractiveness by Actuator Type, 2022-2032

Figure 70: Latin America Market Attractiveness by Vehicle Type, 2022-2032

Figure 71: Latin America Market Attractiveness by Distribution Channel, 2022-2032

Figure 72: Latin America Market Attractiveness by Country, 2022-2032

Figure 73: Europe Market Value (US$ Mn) by Actuator Type, 2022-2032

Figure 74: Europe Market Value (US$ Mn) by Vehicle Type, 2022-2032

Figure 75: Europe Market Value (US$ Mn) by Distribution Channel, 2022-2032

Figure 76: Europe Market Value (US$ Mn) by Country, 2022-2032

Figure 77: Europe Market Value (US$ Mn) Analysis by Country, 2017-2032

Figure 78: Europe Market Volume (Units) Analysis by Country, 2017-2032

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 81: Europe Market Value (US$ Mn) Analysis by Actuator Type, 2017-2032

Figure 82: Europe Market Volume (Units) Analysis by Actuator Type, 2017-2032

Figure 83: Europe Market Value Share (%) and BPS Analysis by Actuator Type, 2022-2032

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Actuator Type, 2022-2032

Figure 85: Europe Market Value (US$ Mn) Analysis by Vehicle Type, 2017-2032

Figure 86: Europe Market Volume (Units) Analysis by Vehicle Type, 2017-2032

Figure 87: Europe Market Value Share (%) and BPS Analysis by Vehicle Type, 2022-2032

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Vehicle Type, 2022-2032

Figure 89: Europe Market Value (US$ Mn) Analysis by Distribution Channel, 2017-2032

Figure 90: Europe Market Volume (Units) Analysis by Distribution Channel, 2017-2032

Figure 91: Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2022-2032

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2022-2032

Figure 93: Europe Market Attractiveness by Actuator Type, 2022-2032

Figure 94: Europe Market Attractiveness by Vehicle Type, 2022-2032

Figure 95: Europe Market Attractiveness by Distribution Channel, 2022-2032

Figure 96: Europe Market Attractiveness by Country, 2022-2032

Figure 97: Asia Pacific Market Value (US$ Mn) by Actuator Type, 2022-2032

Figure 98: Asia Pacific Market Value (US$ Mn) by Vehicle Type, 2022-2032

Figure 99: Asia Pacific Market Value (US$ Mn) by Distribution Channel, 2022-2032

Figure 100: Asia Pacific Market Value (US$ Mn) by Country, 2022-2032

Figure 101: Asia Pacific Market Value (US$ Mn) Analysis by Country, 2017-2032

Figure 102: Asia Pacific Market Volume (Units) Analysis by Country, 2017-2032

Figure 103: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 104: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 105: Asia Pacific Market Value (US$ Mn) Analysis by Actuator Type, 2017-2032

Figure 106: Asia Pacific Market Volume (Units) Analysis by Actuator Type, 2017-2032

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Actuator Type, 2022-2032

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Actuator Type, 2022-2032

Figure 109: Asia Pacific Market Value (US$ Mn) Analysis by Vehicle Type, 2017-2032

Figure 110: Asia Pacific Market Volume (Units) Analysis by Vehicle Type, 2017-2032

Figure 111: Asia Pacific Market Value Share (%) and BPS Analysis by Vehicle Type, 2022-2032

Figure 112: Asia Pacific Market Y-o-Y Growth (%) Projections by Vehicle Type, 2022-2032

Figure 113: Asia Pacific Market Value (US$ Mn) Analysis by Distribution Channel, 2017-2032

Figure 114: Asia Pacific Market Volume (Units) Analysis by Distribution Channel, 2017-2032

Figure 115: Asia Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2022-2032

Figure 116: Asia Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2022-2032

Figure 117: Asia Pacific Market Attractiveness by Actuator Type, 2022-2032

Figure 118: Asia Pacific Market Attractiveness by Vehicle Type, 2022-2032

Figure 119: Asia Pacific Market Attractiveness by Distribution Channel, 2022-2032

Figure 120: Asia Pacific Market Attractiveness by Country, 2022-2032

Figure 121: Middle East and Africa Market Value (US$ Mn) by Actuator Type, 2022-2032

Figure 122: Middle East and Africa Market Value (US$ Mn) by Vehicle Type, 2022-2032

Figure 123: Middle East and Africa Market Value (US$ Mn) by Distribution Channel, 2022-2032

Figure 124: Middle East and Africa Market Value (US$ Mn) by Country, 2022-2032

Figure 125: Middle East and Africa Market Value (US$ Mn) Analysis by Country, 2017-2032

Figure 126: Middle East and Africa Market Volume (Units) Analysis by Country, 2017-2032

Figure 127: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 128: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 129: Middle East and Africa Market Value (US$ Mn) Analysis by Actuator Type, 2017-2032

Figure 130: Middle East and Africa Market Volume (Units) Analysis by Actuator Type, 2017-2032

Figure 131: Middle East and Africa Market Value Share (%) and BPS Analysis by Actuator Type, 2022-2032

Figure 132: Middle East and Africa Market Y-o-Y Growth (%) Projections by Actuator Type, 2022-2032

Figure 133: Middle East and Africa Market Value (US$ Mn) Analysis by Vehicle Type, 2017-2032

Figure 134: Middle East and Africa Market Volume (Units) Analysis by Vehicle Type, 2017-2032

Figure 135: Middle East and Africa Market Value Share (%) and BPS Analysis by Vehicle Type, 2022-2032

Figure 136: Middle East and Africa Market Y-o-Y Growth (%) Projections by Vehicle Type, 2022-2032

Figure 137: Middle East and Africa Market Value (US$ Mn) Analysis by Distribution Channel, 2017-2032

Figure 138: Middle East and Africa Market Volume (Units) Analysis by Distribution Channel, 2017-2032

Figure 139: Middle East and Africa Market Value Share (%) and BPS Analysis by Distribution Channel, 2022-2032

Figure 140: Middle East and Africa Market Y-o-Y Growth (%) Projections by Distribution Channel, 2022-2032

Figure 141: Middle East and Africa Market Attractiveness by Actuator Type, 2022-2032

Figure 142: Middle East and Africa Market Attractiveness by Vehicle Type, 2022-2032

Figure 143: Middle East and Africa Market Attractiveness by Distribution Channel, 2022-2032

Figure 144: Middle East and Africa Market Attractiveness by Country, 2022-2032

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive Thin IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hydrogen Leak Detection Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hybrid IGBTs Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Extraction Hose Reels Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA