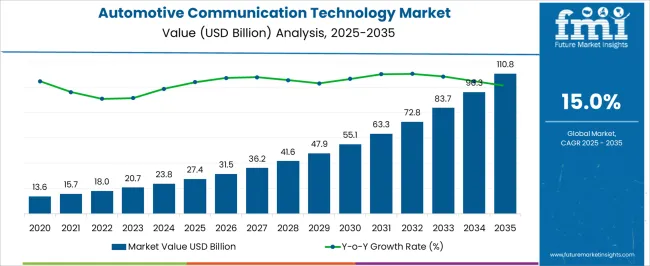

The automotive communication technology market is estimated to be valued at USD 27.4 billion in 2025 and is projected to reach USD 110.8 billion by 2035, registering a compound annual growth rate (CAGR) of 15.0% over the forecast period.

The automotive communication technology market, valued at USD 27.4 billion in 2025 and projected to reach USD 110.8 billion by 2035, is expanding at a CAGR of 15.0%. The growth trajectory reflects accelerating adoption of advanced in-vehicle networking systems, driven by rising demand for connected, autonomous, and electrified vehicles. From 2020–2024, the market increases from USD 13.6 billion to USD 23.8 billion, supported by early integration of technologies such as Controller Area Network (CAN), Local Interconnect Network (LIN), and Ethernet in automotive design.

Annual increments, including USD 15.7 billion in 2021, USD 18.0 billion in 2022, and USD 20.7 billion in 2023, highlight consistent progress as OEMs adopt secure and high-bandwidth communication protocols. Between 2025–2030, the market advances strongly from USD 27.4 billion to USD 55.1 billion, accounting for nearly half of the total projected growth. This stage is shaped by the scaling of vehicle-to-everything (V2X) communication, integration of advanced driver-assistance systems (ADAS), and growing software-defined vehicle architectures requiring fast, reliable data exchange. From 2031–2035, the market surges from USD 63.3 billion to USD 110.8 billion, contributing the remaining share of expansion. This final stage is fueled by mass deployment of autonomous fleets, rising EV adoption, and standardization of high-speed automotive Ethernet. Overall, the automotive communication technology market demonstrates a transformative growth path through 2035, propelled by digitalization, safety requirements, and the evolution of next-generation mobility ecosystems.

| Metric | Value |

|---|---|

| Automotive Communication Technology Market Estimated Value in (2025 E) | USD 27.4 billion |

| Automotive Communication Technology Market Forecast Value in (2035 F) | USD 110.8 billion |

| Forecast CAGR (2025 to 2035) | 15.0% |

The automotive communication technology market holds a notable position within the global connected vehicle and in-vehicle electronics ecosystem, capturing approximately 12–14% share of the broader automotive electronics sector, driven by the rising need for vehicle-to-everything (V2X) connectivity. Within the intelligent transportation systems and telematics domain, it accounts for nearly 10–12%, supported by increasing integration of real-time data communication for navigation, safety, and traffic management. In the larger automotive infotainment and driver-assistance ecosystem, automotive communication technology contributes around 8–10%, as demand grows for seamless vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) interactions that enhance road safety and driving efficiency. The connected mobility and fleet management segment represents close to 6–8% share, where technologies are being deployed for vehicle tracking, remote diagnostics, predictive maintenance, and autonomous vehicle support systems. Growth is fueled by increasing government mandates for connected vehicle safety features, the expansion of 5G networks, and consumer demand for advanced infotainment and driver-assistance functionalities.

Key manufacturers are focusing on embedding secure, low-latency communication modules, integrating advanced sensor networks, and ensuring compatibility with global communication standards. While challenges such as high R&D costs, interoperability issues, and cybersecurity concerns persist, automotive communication technologies are witnessing accelerated adoption due to rising investments in smart transportation infrastructure, autonomous mobility initiatives, and vehicle electrification trends. With continued development of V2X protocols, multi-network connectivity, and edge computing integration, automotive communication technology is strengthening its share as a core enabler of next-generation connected and autonomous vehicle ecosystems, enhancing both safety and user experience across global automotive markets.

The automotive communication technology market is gaining momentum due to rising demand for advanced in-vehicle connectivity, growing adoption of electric vehicles, and integration of driver-assistance systems. As OEMs shift toward software-defined vehicles, efficient communication protocols between microcontrollers, sensors, and actuators have become critical.

Regulatory mandates for vehicle safety and emissions management are further driving the adoption of robust data exchange networks. Automakers are increasingly standardizing on scalable communication architectures to enable real-time diagnostics, infotainment, and autonomous driving functionalities. The convergence of telematics, V2X systems, and over-the-air updates is set to expand the scope of embedded communication technologies across passenger and commercial fleets.

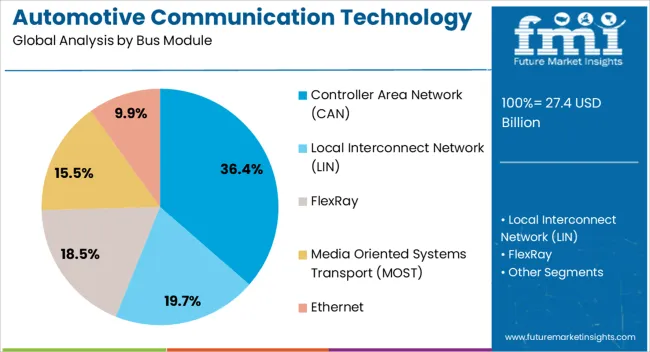

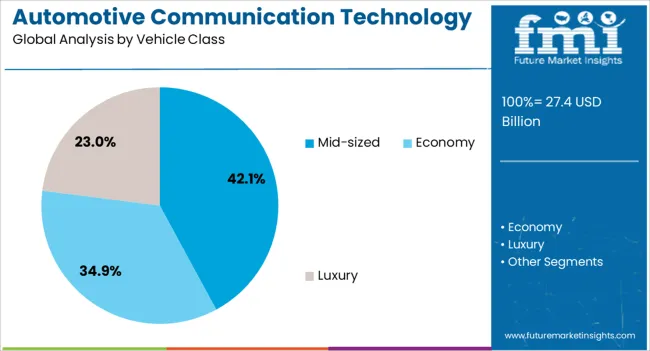

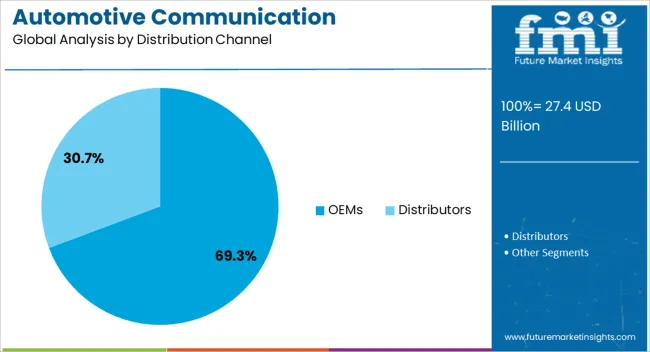

The automotive communication technology market is segmented by bus module, vehicle class, distribution channel, application, and geographic regions. By bus module, automotive communication technology market is divided into Controller Area Network (CAN), Local Interconnect Network (LIN), FlexRay, Media Oriented Systems Transport (MOST), and Ethernet. In terms of vehicle class, automotive communication technology market is classified into mid-sized, economy, and luxury. Based on distribution channel, automotive communication technology market is segmented into OEMs and distributors. By application, automotive communication technology market is segmented into safety & ADAS, powertrain, body & comfort electronics, infotainment & communication, and others (chassis, wireless, and telematics). Regionally, the automotive communication technology industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Controller Area Network (CAN) is projected to account for 36.4% of the automotive communication technology market by 2025, making it the leading bus module. This dominance is fueled by its reliability, cost-effectiveness, and long-standing integration into vehicle electronics architecture. CAN enables real-time communication between ECUs and is especially favored in applications requiring deterministic data transfer, such as engine control, airbag deployment, and braking systems. Despite the emergence of newer protocols, CAN's robustness and widespread tooling ecosystem continue to support its adoption in mid-range and entry-level vehicles. Its scalability and compatibility with existing infrastructure also contribute to its leading market position.

Mid-sized vehicles are expected to lead the market with a 42.1% share in 2025, driven by their strong production volumes and balanced feature-to-cost ratio. This segment typically integrates a variety of communication protocols to support infotainment, ADAS, and powertrain systems without the complexity or cost burden of luxury models. As OEMs target mid-segment vehicles for advanced driver-assistance upgrades and electrification, the need for high-speed and fault-tolerant communication architectures is rising. Their broad market presence in both developed and emerging economies further ensures strong demand for embedded communication technologies tailored to functional and regulatory needs.

OEMs are projected to dominate with a 69.3% share of the distribution channel by 2025, reinforcing their central role in technology integration. OEMs are increasingly embedding advanced communication technologies during manufacturing stages to meet regulatory requirements and consumer expectations around safety and connectivity. Strategic partnerships with chipset and software vendors enable seamless integration of bus systems such as CAN, LIN, and Ethernet. The emphasis on factory-fitted solutions also aligns with rising demand for warranty coverage, product reliability, and certification compliance. As OEMs accelerate R&D around connected and autonomous vehicles, their dominance in sourcing and implementing communication technology remains robust.

Automotive communication technology is central to connected vehicles, enhancing safety, efficiency, and user experience. Growth is driven by V2X adoption, ADAS integration, connected infotainment, and fleet telematics solutions.

Vehicle-to-everything (V2X) communication is being increasingly integrated into passenger and commercial vehicles to enhance safety, traffic management, and efficiency. Adoption is driven by regulatory mandates in Europe, North America, and Asia requiring collision avoidance systems, emergency vehicle notification, and intersection communication. Early deployment focuses on V2V (vehicle-to-vehicle) and V2I (vehicle-to-infrastructure) modules that transmit real-time data for proactive driver assistance. Automotive OEMs and tier-1 suppliers are investing in standardized communication protocols and low-latency networks to ensure interoperability across brands and regions. Pilot programs in smart cities and connected highways are generating data that informs system optimization and rollout strategies. As governments emphasize road safety and congestion reduction, V2X-enabled vehicles are becoming a central component of connected transportation ecosystems.

Automotive communication technologies increasingly support connected infotainment, navigation, and digital assistant functionalities, enhancing in-car user experiences. Real-time traffic updates, remote diagnostics, and cloud-based navigation platforms rely on stable communication links between vehicles and external networks. OEMs are embedding communication modules that allow seamless integration with smartphones, wearable devices, and vehicle ecosystems, enabling voice commands, live content streaming, and location-based services. Ride-hailing and fleet operators are leveraging these systems for route optimization and passenger engagement. Partnerships between automotive suppliers and telecom providers are expanding bandwidth and coverage, ensuring minimal disruption in high-density urban or remote areas. This trend underlines the dual role of communication technology in operational efficiency and driver/passenger convenience, accelerating adoption across both passenger and commercial vehicle segments.

Advanced driver-assistance systems (ADAS) depend heavily on automotive communication technologies to process sensor inputs, exchange data with nearby vehicles, and interact with infrastructure. Features such as adaptive cruise control, lane-keeping assistance, automated emergency braking, and collision avoidance are increasingly dependent on low-latency, reliable vehicle networks. Manufacturers are prioritizing secure data transmission, edge processing, and multi-network compatibility to enhance reliability under varied traffic and environmental conditions. Investments in autonomous shuttle programs, urban delivery vehicles, and semi-autonomous trucks are driving adoption in commercial applications. Regulatory testing frameworks and industry consortiums are supporting interoperability and safety validation. These factors collectively accelerate market uptake by demonstrating the critical role of communication modules in achieving higher levels of autonomy and safer road environments.

Commercial fleets, logistics operators, and ride-hailing services are increasingly relying on automotive communication technologies for real-time vehicle monitoring, predictive maintenance, and fuel efficiency optimization. Telemetry systems track vehicle location, performance, and driver behavior, allowing operators to reduce downtime and improve route efficiency. Insurance companies are leveraging connected vehicle data for usage-based policies, enhancing risk assessment and claims processing. OEMs are offering modular communication platforms that integrate with enterprise fleet management systems and third-party analytics tools. Cloud-based dashboards, automated alerts, and remote control functionalities improve operational decision-making. Adoption is particularly strong in regions with high commercial transport density, where regulatory compliance, urban mobility planning, and cost optimization incentivize integration of connected communication modules into fleet vehicles.

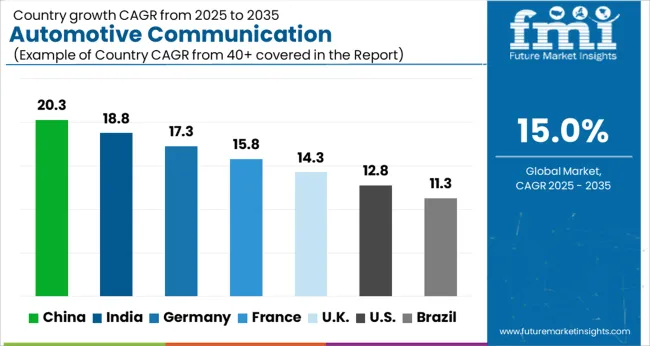

| Country | CAGR |

|---|---|

| China | 20.3% |

| India | 18.8% |

| Germany | 17.3% |

| France | 15.8% |

| UK | 14.3% |

| USA | 12.8% |

| Brazil | 11.3% |

The automotive communication technology market is projected to grow globally at a CAGR of 15.0% from 2025 to 2035, driven by rising connected vehicle adoption, V2X deployments, and expanding autonomous driving initiatives. China leads with a CAGR of 18.2%, fueled by large-scale government-backed smart transportation projects, extensive 5G network rollout, and increasing integration of connected vehicle platforms in passenger and commercial vehicles. India follows at 17.5%, supported by national vehicle safety mandates, growing telematics adoption in fleets, and corporate investment in connected mobility solutions. France posts 15.3%, with growth influenced by regulatory frameworks for vehicle connectivity, fleet modernization, and advanced driver-assistance system (ADAS) integration. The United Kingdom grows at 14.2%, emphasizing connected infotainment, urban mobility programs, and fleet management adoption. The United States records 13.1%, reflecting steady uptake in telematics, vehicle tracking solutions, and semi-autonomous vehicle deployments. This trajectory highlights Asia as the fastest-growing hub, Europe as a compliance-driven and technology-adopting region, and North America as a mature yet steadily expanding segment for automotive communication technologies.

China’s CAGR for the automotive communication technology market was 16.8% between 2020–2024 and is expected to reach 20.3% during 2025–2035, reflecting accelerated adoption of connected and autonomous vehicle platforms. Early growth was influenced by large-scale 5G network rollouts, increasing integration of V2X solutions, and government-backed smart mobility programs. Expansion in the next decade is driven by growing demand for telematics, fleet connectivity, and urban intelligent transportation systems. Automotive manufacturers and technology providers are investing heavily in vehicle-to-everything communication modules, software platforms, and smart infrastructure partnerships. China continues to dominate globally due to its scale, infrastructure support, and aggressive adoption strategies.

India’s CAGR for the automotive communication technology market stood at 16.0% between 2020–2024 and is projected to rise to 18.8% during 2025–2035, highlighting strong adoption momentum. Early growth was driven by regulatory requirements for vehicle safety, gradual introduction of telematics in commercial fleets, and pilot projects for connected vehicles in urban centers. The subsequent decade sees stronger adoption through expansion of smart city initiatives, EV and fleet modernization programs, and partnerships between automakers and telecom providers. Corporate demand for connected mobility platforms and real-time vehicle monitoring also fuels growth. India is emerging as a critical hub for automotive communication technology in Asia.

France’s CAGR for automotive communication technology was 13.7% between 2020–2024 and is expected to increase to 15.8% during 2025–2035. Early growth reflected adoption of advanced driver-assistance systems, connected infotainment, and pilot telematics programs in passenger and commercial vehicles. Regulatory compliance for vehicle safety and data-driven mobility management further influenced adoption rates. The subsequent period is characterized by expansion of smart mobility frameworks, increased OEM investment in connected vehicle platforms, and integration of V2X infrastructure in urban transport corridors. Fleet operators and urban transport authorities also drive the implementation of vehicle communication modules across commercial and public transport networks.

The UK automotive communication technology market recorded a CAGR of 12.5% between 2020–2024, which is projected to rise to 14.3% for 2025–2035. The earlier period saw gradual adoption of connected vehicle solutions, telematics, and limited V2X deployments in select commercial and urban fleets. Growth in the next decade is expected to accelerate due to increased government support for connected mobility trials, fleet electrification, and expansion of advanced driver-assistance system infrastructure. Partnerships between automotive OEMs and tech providers have strengthened adoption in public and private fleets. The UK is poised to become a significant adopter in Europe, balancing early-stage regulatory adoption with growing commercial demand.

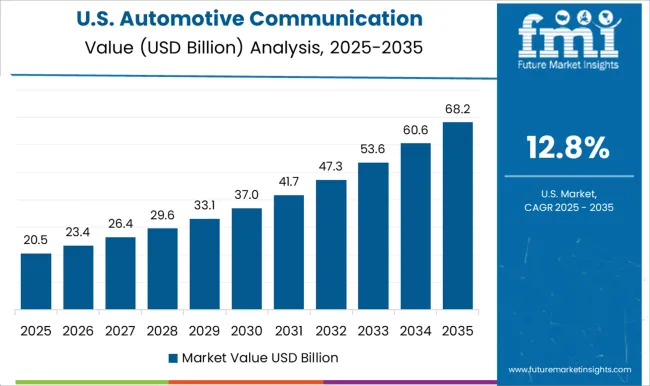

The USA CAGR for automotive communication technology stood at 11.6% during 2020–2024 and is expected to reach 12.8% between 2025–2035. Initial growth reflected adoption of telematics, in-vehicle connectivity, and pilot autonomous vehicle projects, supported by progressive state-level regulations. Expansion over the next decade is fueled by broader V2X integration, rising corporate fleet adoption, and development of connected infrastructure in smart cities. Automotive OEMs are investing in software platforms, vehicle communication modules, and partnerships with telecom companies to ensure nationwide deployment. The USA remains a mature yet steadily expanding market driven by safety regulations, fleet modernization, and technological deployment in private and commercial vehicles.

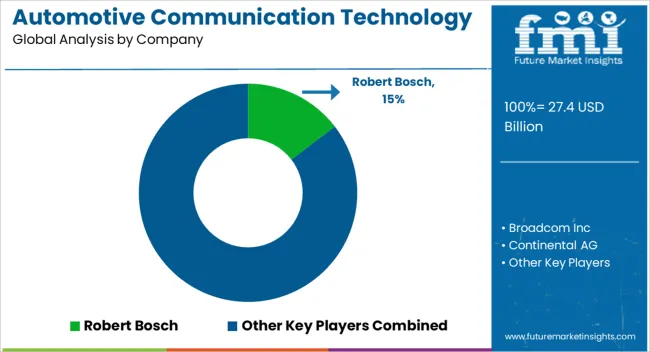

The automotive communication technology market is shaped by a mix of semiconductor leaders, automotive electronics specialists, and connectivity solution providers competing for global adoption and OEM integration. Robert Bosch maintains a strong presence by offering V2X modules, advanced driver-assistance system (ADAS) integration, and telematics solutions across global vehicle platforms. Broadcom Inc. strengthens its position through high-performance wireless communication chips, enabling faster vehicle connectivity and IoT integration for connected car ecosystems. Continental AG contributes by developing end-to-end automotive communication networks, including in-vehicle Ethernet and infotainment integration for passenger and commercial vehicles. Intel Corporation supports market growth via processing platforms and software frameworks for autonomous vehicle communication. NXP Semiconductors expands competitiveness through secure vehicle-to-everything (V2X) connectivity solutions and microcontroller platforms for ADAS and infotainment systems. Toshiba Corporation provides advanced sensor and memory technologies crucial for low-latency communication and vehicle data storage.

STMicroelectronics focuses on automotive-grade semiconductors supporting CAN, FlexRay, and Ethernet networks in connected vehicles. Denso Corporation strengthens its role through embedded telematics, vehicle networking modules, and fleet management solutions. Aptiv PLC delivers intelligent mobility platforms integrating software-defined communication systems, enhancing both passenger safety and vehicle-to-infrastructure communication. Harman International Industries emphasizes infotainment, telematics, and connected vehicle platforms tailored for premium automotive OEMs. Valeo SA leverages its expertise in ADAS and V2X solutions, supporting smart mobility initiatives and autonomous driving trials. ZF Friedrichshafen focuses on integrated chassis, safety, and communication systems that enhance vehicle stability and sensor interoperability. Lear Corporation provides wiring, connectivity, and vehicle network solutions enabling seamless in-vehicle communication.

Autoliv Inc. integrates communication-enabled safety systems for collision avoidance, supporting next-generation connected mobility. Magna International Inc. strengthens its portfolio with modular vehicle electronics and communication subsystems for multiple OEMs. Yazaki Corporation offers wiring harnesses and in-vehicle network solutions critical for telematics and ADAS deployment. Mitsubishi Electric Corporation contributes through automotive control units, infotainment modules, and secure V2X communication systems. Competition in this market is defined by semiconductor innovation, software integration, and OEM partnerships, while differentiation strategies include advanced sensor deployment, secure data communication solutions, and collaboration across automotive and telecom ecosystems.

| Item | Value |

|---|---|

| Quantitative Units | USD 27.4 billion |

| Bus Module | Controller Area Network (CAN), Local Interconnect Network (LIN), FlexRay, Media Oriented Systems Transport (MOST), and Ethernet |

| Vehicle Class | Mid-sized, Economy, and Luxury |

| Distribution Channel | OEMs and Distributors |

| Application | Safety & ADAS, Powertrain, Body & comfort electronics, Infotainment & communication, and Others (chassis, wireless, and telematics) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Robert Bosch, Broadcom Inc, Continental AG, Intel Corporation, NXP Semiconductor, Toshiba Corporation, STMicroelectronics, Denso Corporation, Aptiv PLC, Harman International Industries, Valeo SA, ZF Friedrichshafen, Lear Corporation, Autoliv Inc, Magna International Inc, Yazaki Corporation, and Mitsubishi Electric Corporation |

| Additional Attributes | Dollar sales, share, global vs regional growth, CAGR trends, top OEM adoption rates, V2X and ADAS integration, semiconductor and software demand, competitive landscape, regulatory mandates, and future connected vehicle deployment projections. |

The global automotive communication technology market is estimated to be valued at USD 27.4 billion in 2025.

The market size for the automotive communication technology market is projected to reach USD 110.8 billion by 2035.

The automotive communication technology market is expected to grow at a 15.0% CAGR between 2025 and 2035.

The key product types in automotive communication technology market are controller area network (can), local interconnect network (lin), flexray, media oriented systems transport (most) and ethernet.

In terms of vehicle class, mid-sized segment to command 42.1% share in the automotive communication technology market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Thin IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA