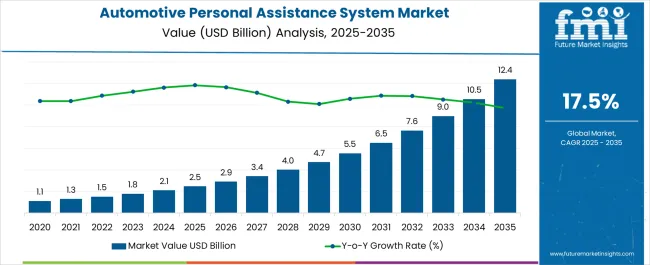

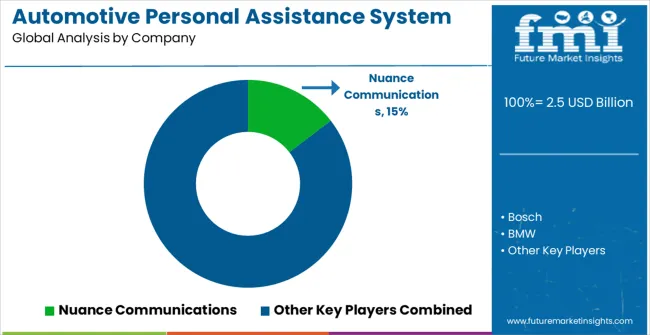

The Automotive Personal Assistance System Market is estimated to be valued at USD 2.5 billion in 2025 and is projected to reach USD 12.4 billion by 2035, registering a compound annual growth rate (CAGR) of 17.5% over the forecast period.

| Metric | Value |

|---|---|

| Automotive Personal Assistance System Market Estimated Value in (2025 E) | USD 2.5 billion |

| Automotive Personal Assistance System Market Forecast Value in (2035 F) | USD 12.4 billion |

| Forecast CAGR (2025 to 2035) | 17.5% |

The Automotive Personal Assistance System market is witnessing significant growth, driven by increasing demand for advanced driver assistance and in-vehicle connectivity solutions across passenger and commercial vehicles. The adoption of these systems is being supported by technological advancements in artificial intelligence, machine learning, voice recognition, and sensor integration, enabling vehicles to provide real-time navigation, safety alerts, and personalized assistance. Growing consumer preference for enhanced driving comfort, safety, and convenience is further fueling market expansion.

OEMs are increasingly integrating intelligent assistance systems into new vehicle models to meet evolving regulatory safety standards and to differentiate products in competitive markets. Rising investments in connected vehicle infrastructure and the increasing deployment of infotainment and telematics solutions are supporting adoption.

As automotive manufacturers focus on next-generation mobility solutions and smart vehicle ecosystems, the market for personal assistance systems is poised for long-term growth The continuous enhancement of system functionalities, improved user experience, and integration with broader vehicle ecosystems are expected to drive sustained demand in the coming years.

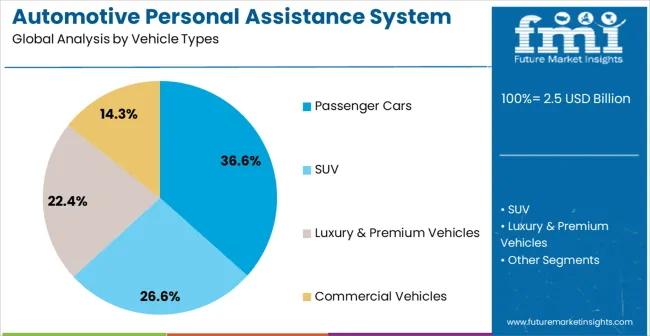

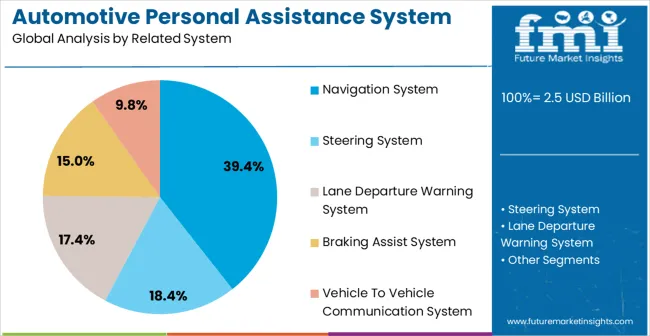

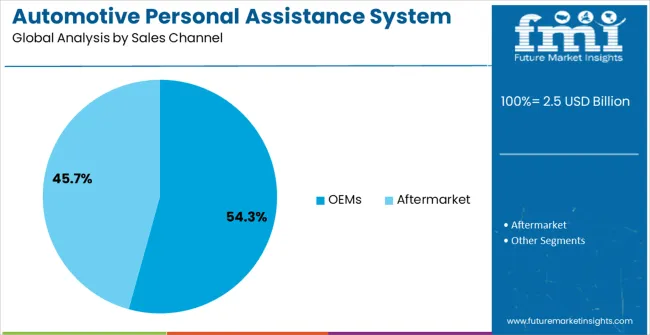

The automotive personal assistance system market is segmented by vehicle types, related system, sales channel, and geographic regions. By vehicle types, automotive personal assistance system market is divided into Passenger Cars, SUV, Luxury & Premium Vehicles, and Commercial Vehicles. In terms of related system, automotive personal assistance system market is classified into Navigation System, Steering System, Lane Departure Warning System, Braking Assist System, and Vehicle To Vehicle Communication System. Based on sales channel, automotive personal assistance system market is segmented into OEMs and Aftermarket. Regionally, the automotive personal assistance system industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The passenger cars segment is projected to hold 36.6% of the market revenue in 2025, establishing it as the leading vehicle type. Growth is being driven by rising consumer expectations for enhanced safety, convenience, and in-vehicle intelligence in passenger vehicles. Automotive personal assistance systems, including navigation, driver monitoring, and collision avoidance features, are increasingly becoming standard offerings in mid-range and premium passenger cars.

Integration of AI-driven analytics and voice-controlled interfaces allows for personalized driver experiences and improved operational safety. The widespread availability of connected vehicle technologies and infotainment systems has reinforced adoption in passenger cars. Manufacturers are leveraging these systems to comply with safety regulations, enhance customer satisfaction, and differentiate vehicle models in competitive markets.

Continuous innovation in sensor technology, human-machine interface design, and predictive analytics further strengthens market growth As demand for intelligent and connected mobility solutions grows, passenger cars are expected to remain the largest vehicle type segment in the Automotive Personal Assistance System market.

The navigation system segment is anticipated to account for 39.4% of the market revenue in 2025, making it the leading system type. Its growth is being driven by the increasing need for real-time route guidance, traffic updates, and location-based services in modern vehicles. Advanced GPS, AI-based route optimization, and integration with other in-vehicle assistance systems improve driving efficiency and enhance the user experience.

Navigation systems also support integration with connected vehicle platforms, telematics, and infotainment services, which enhances their utility for both drivers and fleet operators. The ability to provide predictive routing, fuel-efficient paths, and safety alerts has strengthened adoption among passenger car owners and commercial operators alike.

Increasing adoption of electric vehicles, smart city infrastructure, and autonomous driving technologies further supports the growth of navigation systems as a core component of personal assistance solutions Continuous innovation and software-based updates are expected to maintain the navigation system segment as the leading related system in the market.

The OEMs sales channel segment is projected to hold 54.3% of the market revenue in 2025, establishing it as the dominant distribution channel. Growth in this segment is being driven by automotive manufacturers increasingly offering pre-installed personal assistance systems in new vehicles as part of standard or optional packages. OEM integration ensures seamless compatibility with vehicle electronics, safety systems, and infotainment platforms, which enhances user experience and reliability.

The direct installation of these systems by OEMs reduces integration complexity and post-sale installation costs, increasing adoption among consumers. Collaboration between OEMs and technology providers has facilitated continuous upgrades and feature enhancements via over-the-air updates.

Consumer preference for factory-installed solutions that are fully compatible with vehicle electronics further reinforces the OEM sales channel As manufacturers focus on providing value-added features and ensuring compliance with safety regulations, the OEM channel is expected to maintain its market leadership, driving adoption of automotive personal assistance systems across passenger and commercial vehicles.

Fundamentally society today desire for safe and effective mobility at low economic and ecological costs. However, its technical implementation varies among societies, based on their degree of development and possible evolutionary roadmap for automotive personal assistance system. Vehicles have emerged as systems based on optimal sensors such as Lidar sensor, Radar sensor, Ultrasonic sensor and Infrared sensor, however automated and supportive traffic still remains a visualization of the future, transitional step towards that goal can be understood through system that mitigate or avoid collision in particular driving situations.

Automotive personal assistance system (APAS) is developed to enhanced vehicle system safety and better driving. Some component of this technology included image processors, Lidar sensors, system- on- a chip processors and vehicle cameras. Moreover, there are some adaptive systems such as Autobraking system, Blind spot warning system, Braking assistance system, Forward collision warning system, Lane departure warning system, Rear cross traffic warning system and infraction warning system related to automotive personal assistance system.

Over the next few decades, the market will witness increased penetration of automotive personal vehicle assistant systems by OEMs, this technology segment will grow with high growth rate in automotive electronics segments. The market is anticipated to be regularized by regulations, government has passed a vehicular safety system standards such IEEE (Institute of Electrical and Electronics Engineers) 2025 for image sensor quality and communication etiquettes such as Vehicle Information API (Application Programming Interface).

Furthermore, the technology has given the opportunity to consumer to connect to their tablet and smartphone to vehicle infotainment system. Platforms such as Apple’s Carplay and Googles’ Android Auto are used broadly by auto OEMs in in their infotainment system to permit drivers to connect their smartphone to the car hardware. This escalation in consumer shift will enhance growth in the global automotive personal assistance system market in forecast period.

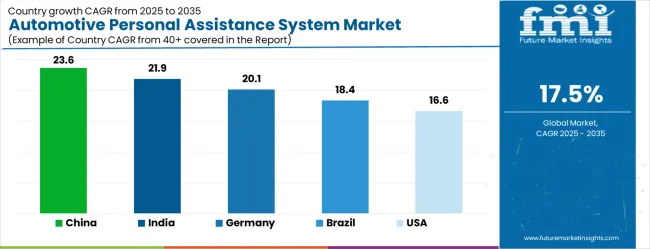

| Country | CAGR |

|---|---|

| China | 23.6% |

| India | 21.9% |

| Germany | 20.1% |

| Brazil | 18.4% |

| USA | 16.6% |

| UK | 14.9% |

| Japan | 13.1% |

The Automotive Personal Assistance System Market is expected to register a CAGR of 17.5% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 23.6%, followed by India at 21.9%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 13.1%, yet still underscores a broadly positive trajectory for the global Automotive Personal Assistance System Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 20.1%. The USA Automotive Personal Assistance System Market is estimated to be valued at USD 894.2 million in 2025 and is anticipated to reach a valuation of USD 894.2 million by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 132.0 million and USD 82.0 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.5 Billion |

| Vehicle Types | Passenger Cars, SUV, Luxury & Premium Vehicles, and Commercial Vehicles |

| Related System | Navigation System, Steering System, Lane Departure Warning System, Braking Assist System, and Vehicle To Vehicle Communication System |

| Sales Channel | OEMs and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Nuance Communications, Bosch, BMW, Tata Motors, Alpine Electronics, Continental AG, Voicebox Technologies, Audi, Wipro, Mobileye (Intel), and Flex |

The global automotive personal assistance system market is estimated to be valued at USD 2.5 billion in 2025.

The market size for the automotive personal assistance system market is projected to reach USD 12.4 billion by 2035.

The automotive personal assistance system market is expected to grow at a 17.5% CAGR between 2025 and 2035.

The key product types in automotive personal assistance system market are passenger cars, suv, luxury & premium vehicles and commercial vehicles.

In terms of related system, navigation system segment to command 39.4% share in the automotive personal assistance system market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Personal Navigation Systems Market Size and Share Forecast Outlook 2025 to 2035

ADAS Market Growth - Trends & Forecast 2025 to 2035

Automotive Brake System Market Growth - Trends & Forecast 2025 to 2035

Automotive Brake System & Components Market Growth - Trends & Forecast 2025 to 2035

Automotive Piston System Market Growth - Trends & Forecast 2025 to 2035

Automotive Washer System Market Trends - Growth & Forecast 2025 to 2035

Automotive Seating Systems Market Analysis - Size, Share & Forecast 2025 to 2035

Automotive Exhaust Systems Market Trends - Growth & Forecast 2025 to 2035

Automotive Starting System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Ignition Systems Market Size and Share Forecast Outlook 2025 to 2035

Automotive Steering System Market Growth - Trends & Forecast 2025 to 2035

Automotive Embedded System Market Growth - Trends & Forecast 2024 to 2034

Automotive Defogger System Market

Smart Personal Assistance Devices Market Size and Share Forecast Outlook 2025 to 2035

Automotive Platooning System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Gear Shift System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Navigation System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Automotive Suspension System Market Growth - Trends & Forecast 2025 to 2035

Automotive Night Vision System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA