The barium nitrate market is estimated to be valued at USD 3.9 billion in 2025 and is projected to reach USD 6.2 billion by 2035, registering a compound annual growth rate (CAGR) of 4.8% over the forecast period. The barium nitrate market demonstrates a clear transition across the adoption lifecycle, reflecting gradual but steady growth supported by demand in pyrotechnics, defense, and specialty chemicals. During the early adoption phase from 2020 to 2024, the market value increased from USD 3.1 billion to USD 3.7 billion, driven primarily by niche applications in fireworks, explosives, and oxidizing agents. At this stage, adoption was limited to traditional end-users, with growth supported by technological stability and regulatory oversight.

The scaling phase begins in 2025 when the market reaches USD 3.9 billion and continues through 2030 as the industry expands to USD 4.7 billion. This period is marked by broader adoption across defense and commercial applications, along with growth in emerging economies where pyrotechnics and chemical intermediates are in demand. Improved production methods, increased safety compliance, and a wider supplier base contribute to stronger adoption and competitive dynamics.

The consolidation phase unfolds between 2030 and 2035, with the market climbing steadily to USD 6.2 billion. Growth begins to stabilize as the market matures, with key players focusing on efficiency, cost optimization, and diversification of applications. Smaller competitors may exit or merge, while leading companies strengthen their market share through long-term contracts and strategic innovations.

| Metric | Value |

|---|---|

| Barium Nitrate Market Estimated Value in (2025 E) | USD 3.9 billion |

| Barium Nitrate Market Forecast Value in (2035 F) | USD 6.2 billion |

| Forecast CAGR (2025 to 2035) | 4.8% |

The barium nitrate market is experiencing consistent growth driven by its critical role as an oxidizing agent in applications requiring high thermal stability and precise reactivity. The material's chemical characteristics, including its ability to produce vibrant green flames and high-temperature oxygen release, have positioned it as a valuable component in pyrotechnics, military-grade explosives, and specialized glass manufacturing.

As global regulatory frameworks tighten around emissions and chemical safety, the demand for high-purity formulations has increased, particularly in sectors where precision and reliability are essential. The market is also benefiting from rising investments in military modernization programs and aerospace-grade energetic materials, where barium nitrate is used in initiators, detonators, and tracer compounds.

Additionally, innovations in automated fireworks manufacturing and the transition to eco-friendly oxidizers have provided new avenues for substitution and process optimization. The market is expected to benefit from ongoing collaborations between chemical producers and defense contractors aiming to enhance product performance while ensuring regulatory compliance and sustainability.

The barium nitrate market is segmented by purity, application, end-use industry, and geographic regions. By purity, barium nitrate market is divided into >99, <98%, and 98% to 99.0%. In terms of application, barium nitrate market is classified into Fireworks, Glass/ Ceramics, Detonators, Tracer bullets, Vacuum tube production, Explosives, Primers, Pyrotechnics, and Others. Based on end-use industry, barium nitrate market is segmented into Defense and Military, Optical Industry, and Chemicals. Regionally, the barium nitrate industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The greater than 99 percent purity segment is projected to contribute 47.6% of the total revenue share in the Barium Nitrate market in 2025. This segment's prominence is being driven by stringent quality requirements across defense, pyrotechnics, and specialty chemicals manufacturing. High-purity barium nitrate is essential in applications where chemical stability, low moisture content, and consistent particle size are critical to functional performance.

Its superior combustion efficiency and minimal residue formation have made it the preferred choice for precision-engineered applications such as signal flares, tracer bullets, and high-end fireworks. The shift toward safety-regulated production environments has further supported demand for purer grades, enabling predictable reactivity and batch consistency.

Manufacturers have prioritized this purity level to align with global standards for military-grade compositions and industrial certifications, reinforcing its dominance. The ability to support automated handling and minimal contamination risks has positioned this subsegment as essential in regulated environments requiring high-output efficiency and formulation accuracy.

The fireworks application segment is expected to account for 39.2% of the Barium Nitrate market’s revenue share in 2025. The demand in this segment is being propelled by the compound’s role in producing intense green flame coloration and its contribution to enhancing burn rate and brightness in pyrotechnic displays. Its oxidizing properties have made it indispensable in manufacturing aerial shells, fountains, and Roman candles where precise ignition and color performance are required.

Increased consumer spending on festival fireworks and large-scale event displays has fueled consistent demand, particularly in countries with strong cultural traditions linked to pyrotechnics. Technological advancements in computerized fireworks choreography and safety-enhanced formulations have enabled the wider adoption of barium nitrate due to its thermal reliability and ease of integration in multi-effect compositions.

Regulatory shifts encouraging cleaner-burning and low-smoke materials have also favored its use over other traditional oxidizers. The segment continues to benefit from seasonal demand patterns, professional show integration, and increased urban entertainment activities.

The defense and military end-use industry is forecast to dominate the Barium Nitrate market with a 51.3% revenue share in 2025. This leadership is being sustained by the compound’s critical application in various energetic formulations including detonators, ignition devices, tracer rounds, and delay compositions. Military modernization efforts and the expansion of strategic reserves have necessitated the procurement of stable and high-performing oxidizers like barium nitrate.

The material's reliability under extreme environmental conditions and its compatibility with metals and fuel binders have made it an essential component in the design of advanced munitions. Increased global defense budgets, coupled with the demand for localized sourcing of critical raw materials, have intensified focus on the compound's production and strategic stockpiling.

Additionally, collaborative research between defense agencies and chemical manufacturers has advanced the development of next-generation energetic materials, where barium nitrate plays a pivotal role. The ability to meet precise formulation standards and its long shelf life continue to make it indispensable in mission-critical defense applications.

The barium nitrate market is expanding steadily, driven by its wide use in pyrotechnics, military applications, and specialty glass manufacturing. This chemical compound is valued for producing green flames in fireworks, its oxidizing properties in explosives, and its role in producing precision glass for optics and electronics. Growth is influenced by rising demand from the defense sector, steady consumption in the fireworks industry, and niche uses in vacuum tube and ceramic manufacturing. Asia-Pacific dominates due to high fireworks production, while North America and Europe emphasize defense applications and regulated specialty glass markets. Environmental concerns and safety regulations restrain growth, but opportunities exist in advanced glass technology and eco-friendly pyrotechnics. Competitive differentiation focuses on production efficiency, safety compliance, and securing long-term supply contracts with defense and industrial clients.

One of the strongest growth drivers for the barium nitrate market is its application in military explosives, propellants, and pyrotechnics. Militaries worldwide rely on barium nitrate for producing flares, signal devices, tracer bullets, and other defense-related pyrotechnics that require controlled ignition and visibility. Its oxidizing properties make it indispensable in explosive formulations. Similarly, the fireworks industry uses barium nitrate extensively for generating vivid green colors, especially in Asia-Pacific, where large-scale cultural events and festivals drive consumption. The seasonal demand for fireworks in China and India significantly boosts production, while defense procurement ensures steady year-round usage. With increasing defense budgets and continuous demand for festive displays, barium nitrate consumption is expected to grow, although it remains tied to regulatory oversight concerning safety and handling practices in both military and commercial use cases.

Barium nitrate’s widespread use is tempered by strict safety and environmental regulations. As a toxic oxidizing agent, it poses risks to human health and ecosystems if mishandled, prompting regulatory restrictions on its use and transport. Stringent rules in North America and Europe limit its application in consumer fireworks and enforce compliance with hazardous chemical management standards. Manufacturers must invest heavily in safety infrastructure, waste management, and employee training to meet compliance requirements. Additionally, growing global awareness of environmental sustainability is pressuring the fireworks industry to adopt eco-friendly alternatives, which could constrain future demand. While defense applications remain less affected, suppliers targeting commercial segments must innovate toward safer, less polluting formulations to retain market share. Until industry-wide sustainable solutions emerge, regulatory pressures will continue to restrain growth and add complexity to global supply chains.

Beyond pyrotechnics, barium nitrate holds significant potential in high-value applications such as precision glass, ceramics, and electronics. Its ability to increase refractive index and mechanical strength makes it useful in producing optical glass, fiber optics, and lenses for cameras and defense optics. In ceramics, it enhances thermal resistance and electrical properties, supporting applications in capacitors and advanced insulators. With rising demand for consumer electronics, renewable energy technologies, and high-performance defense optics, these specialty applications are expanding. Companies investing in refining barium nitrate purity levels and aligning with technological advances in glass and ceramic manufacturing can capture premium market opportunities. Furthermore, collaborations with research institutions to develop novel formulations and advanced composites open new growth avenues, diversifying revenue streams beyond the traditional pyrotechnics segment and reducing dependency on seasonal or defense-driven demand cycles.

The barium nitrate market faces challenges from raw material sourcing, supply stability, and intense competition among global and regional players. Production depends on access to barium carbonate and nitric acid, with fluctuations in raw material availability directly affecting pricing and output. Geopolitical tensions and transportation disruptions further complicate global supply chains. Established manufacturers with integrated operations and proximity to raw material sources gain a cost and reliability advantage. The competitive landscape is characterized by a mix of large international players focusing on defense contracts and smaller regional suppliers catering to fireworks markets. Differentiation is achieved through adherence to safety standards, production efficiency, and reliability of supply. Companies adopting sustainable sourcing strategies, advanced manufacturing processes, and long-term defense or industrial contracts are best positioned to maintain competitiveness in a constrained and highly regulated market.

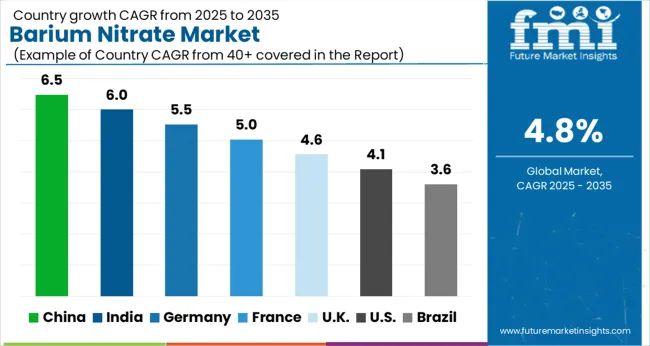

| Country | CAGR |

|---|---|

| China | 6.5% |

| India | 6.0% |

| Germany | 5.5% |

| France | 5.0% |

| UK | 4.6% |

| USA | 4.1% |

| Brazil | 3.6% |

The global barium nitrate market is projected to grow at a CAGR of 4.8% through 2035, supported by increasing demand across pyrotechnics, glass, and specialty chemical applications. Among BRICS nations, China has been recorded with 6.5% growth, driven by large-scale production and usage in fireworks and industrial chemicals, while India has been observed at 6.0%, supported by expanding applications in pyrotechnics and manufacturing. In the OECD region, Germany has been measured at 5.5%, where production and deployment for glass and specialty uses have been steadily maintained. The United Kingdom has been noted at 4.6%, reflecting stable demand in pyrotechnic and industrial applications, while the USA has been recorded at 4.1%, with production and utilization across chemicals and specialty products being gradually expanded. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The barium nitrate market in China is growing at a CAGR of 6.5%, supported by strong demand from the fireworks, defense, and pyrotechnics industries. Barium nitrate is widely used in the production of green-colored fireworks, explosives, and signaling devices, which remain in high demand during festivals, celebrations, and military applications. The country’s robust manufacturing base and large-scale fireworks production facilities make China the leading global supplier of barium nitrate-based products. In addition, increasing investments in defense applications and the use of barium nitrate in detonators, flares, and propellants further contribute to market growth. Rising urbanization and cultural traditions involving large-scale fireworks displays also drive demand. However, environmental and health concerns related to barium compounds are encouraging research into safer and eco-friendly alternatives, though traditional use remains dominant.

Barium nitrate market in India is expanding at a CAGR of 6.0%, fueled by its extensive application in fireworks, signaling devices, and defense equipment. The country is one of the largest consumers of fireworks globally, particularly during cultural and religious festivals, which drives steady demand. The defense sector also plays a crucial role, with barium nitrate being a key ingredient in explosives, propellants, and tracer rounds. Growing industrial activity and the availability of raw materials further support market expansion. At the same time, environmental regulations and concerns about the health hazards of barium compounds are pushing the industry toward safer formulations and controlled use. India’s dual demand from civilian celebrations and defense modernization ensures sustained growth of the barium nitrate market over the forecast period.

The barium nitrate market in Germany is growing at a CAGR of 5.5%, supported by applications in defense, pyrotechnics, and specialized chemical industries. While environmental regulations in the European Union restrict the uncontrolled use of hazardous chemicals, controlled demand persists in defense applications, particularly for flares, tracer rounds, and propellants. In addition, Germany’s precision chemical manufacturing industry utilizes barium nitrate in small-scale specialty applications, supporting niche demand. Technological advancements and strict quality standards drive adoption in regulated markets. However, the overall growth of the market is moderated by strict environmental guidelines that limit widespread civilian use in fireworks and pyrotechnics. Germany’s focus on sustainable and safe chemical practices ensures that the barium nitrate market grows in compliance with safety standards.

The barium nitrate market in the United Kingdom is expanding at a CAGR of 4.6%, primarily driven by defense-related applications and limited pyrotechnics use. While civilian demand for fireworks is relatively lower compared to Asian markets, defense industries continue to rely on barium nitrate for producing tracer rounds, explosives, and signaling devices. Environmental and regulatory constraints in the UK limit its use in consumer fireworks, resulting in a more defense-centric market structure. Research into alternative chemicals and eco-friendly substitutes is ongoing, reflecting the UK’s focus on sustainable solutions. Nonetheless, niche applications in specialty chemicals and limited pyrotechnics ensure steady but controlled demand. The defense sector’s modernization and focus on advanced ammunition technologies support consistent growth of the barium nitrate market.

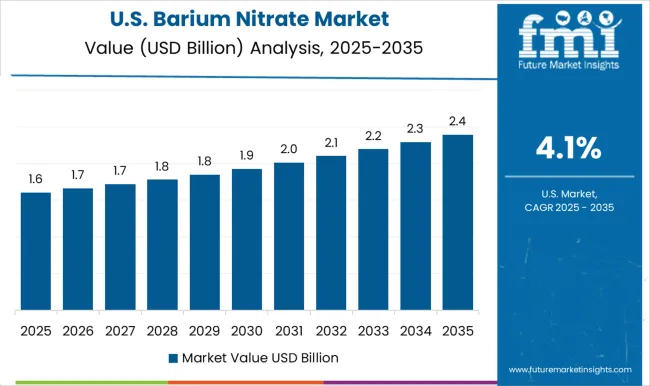

The barium nitrate market in the United States is growing at a CAGR of 4.1%, with demand concentrated in defense, aerospace, and specialized industrial applications. The compound is used in tracer ammunition, flares, and explosives for military purposes, supporting steady consumption. Unlike Asian markets, fireworks and civilian pyrotechnics applications are relatively limited due to regulatory restrictions and environmental concerns. However, strong defense spending and continued investment in modernizing ammunition and explosives ensure consistent demand. The USA chemical industry also utilizes barium nitrate in controlled processes, though strict environmental regulations govern its use. Increasing emphasis on safer, more environmentally friendly alternatives is shaping R&D efforts, but traditional demand in defense ensures the market’s stability over the forecast period.

The barium nitrate market is primarily driven by its applications in pyrotechnics, explosives, specialty glass, and military-grade products. Known for its strong oxidizing properties, barium nitrate is widely used in fireworks for producing green coloration, in detonators, and as a component in ceramic and glass industries. Demand continues to rise due to growth in defense and entertainment sectors. Solvay S.A. is one of the most established players, offering high-purity barium nitrate solutions for industrial and defense applications.

Merck KGaA provides laboratory-grade and specialty chemical forms of barium nitrate, catering to research and development needs. Sigma-Aldrich Corporation (part of Merck Group) also supplies laboratory-scale barium nitrate for scientific and industrial experimentation.

Sakai Chemical Industry Co. Ltd. and Nippon Chemical Industries, both based in Japan, are major contributors to the Asian market, focusing on high-quality chemical formulations for pyrotechnics and industrial use. Barium Chemicals Co. Ltd. plays a vital role in supplying bulk chemicals across multiple industries. Basstech International LLC is involved in the distribution of specialty chemicals, including barium nitrate, to diverse end-use markets.

Angene International Limited specializes in fine chemicals and intermediates, offering tailored chemical solutions to global customers.Together, these companies support the global barium nitrate market by ensuring a steady supply chain, maintaining product purity standards, and innovating applications across defense, glassmaking, and research industries.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.9 Billion |

| Purity | >99, <98%, and 98% to 99.0% |

| Application | Fireworks, Glass/ Ceramics, Detonators, Tracer bullets, Vacuum tube production, Explosives, Primers, Pyrotechnics, and Others |

| End-Use Industry | Defense and Military, Optical Industry, and Chemicals |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | SolvayS.A., MerckKGaA, SigmaAldrichCorporation, SakaiChemicalIndustryCo.Ltd., NipponChemicalIndustries, BariumChemicalsCo.Ltd., BasstechInternationalLLC, and AngeneInternationalLimited. |

| Additional Attributes | Dollar sales vary by grade, including industrial grade, optical grade, and military grade barium nitrate; by application, such as pyrotechnics and fireworks, military/defense applications, glass and ceramics, vacuum tube manufacturing, and specialty chemicals; by end-use industry, spanning defense, entertainment, electronics, and construction; by region, led by Asia-Pacific, North America, and Europe. Growth is driven by rising demand in fireworks and pyrotechnics, increasing use in defense for signal flares and propellants, expanding glass and ceramic production, and ongoing research into advanced materials and specialty chemical applications. |

The global barium nitrate market is estimated to be valued at USD 3.9 billion in 2025.

The market size for the barium nitrate market is projected to reach USD 6.2 billion by 2035.

The barium nitrate market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in barium nitrate market are >99, <98% and 98% to 99.0%.

In terms of application, fireworks segment to command 39.2% share in the barium nitrate market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Barium Chloride Market Size and Share Forecast Outlook 2025 to 2035

Barium Fluoride Market Size and Share Forecast Outlook 2025 to 2035

Barium Titanate Market Size and Share Forecast Outlook 2025 to 2035

Barium Carbonate Market Size and Share Forecast Outlook 2025 to 2035

Barium Sulfate Market Analysis - Size, Share & Forecast 2025 to 2035

Rare-earth Barium Copper Oxide (REBCO) Wire Market Size and Share Forecast Outlook 2025 to 2035

Precipitated Barium Sulphate Market Growth – Trends & Forecast 2025 to 2035

Nitrate-Free Bacon Market

Sodium Nitrate Market Trends & Outlook 2025 to 2035

Silver Nitrate Market - Trends & Forecast 2025 to 2035

Nickel Nitrate Hexahydrate Market

Ammonium Nitrate Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Nitrate Nonahydrate Market

Lanthanum Nitrate Market

Strontium Nitrate Market

Calcium Ammonium Nitrate Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA