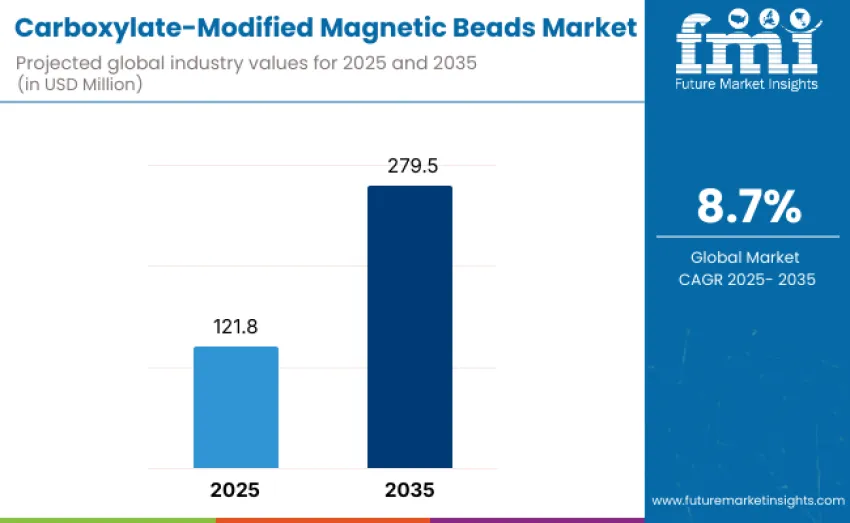

The carboxylate-modified magnetic beads market is projected to reach USD 279.5 million by 2035, recording an absolute increase of USD 157.7 million over the forecast period. Value stands at USD 121.8 million in 2025 and is set to rise at a CAGR of 8.7% during the forecast period 2025 to 2035. Size is expected to grow nearly 1.5 times during this period, driven by increasing demand for efficient biomolecular separation, nucleic acid purification, protein and antibody coupling, and immunoassay applications across research, clinical, and biopharmaceutical laboratories worldwide.

Carboxylate-modified magnetic beads are highly valued for their versatility in surface functionalization, enabling covalent attachment of biomolecules such as nucleic acids, proteins, and antibodies. This capability supports diverse applications in genomics, proteomics, molecular diagnostics, and cell biology. The beads' uniform size, high binding capacity, and reproducible performance improve assay sensitivity and workflow efficiency, making them indispensable in high-throughput and automated laboratory operations.

Technological advancements have been pivotal in shaping growth. Innovations in bead synthesis, surface chemistry, and magnetic separation systems have enhanced performance, enabling faster, more consistent, and scalable workflows. Integration with automated liquid handling systems and high-throughput screening platforms has facilitated adoption in research, pharmaceutical R&D, and clinical laboratories. These developments allow laboratories to process larger sample volumes with reduced variability, supporting growing demand for reliable and scalable biomolecular workflows.

Between 2025 and 2030, carboxylate-modified magnetic beads market is projected to expand from USD 121.8 million to USD 184.5 million, resulting in a value increase of USD 62.7 million, representing 39.8% of total forecast growth for the decade. This phase of development is expected to be driven by rising demand for high-throughput molecular biology applications, including nucleic acid and protein isolation workflows, as well as growing adoption in diagnostic, pharmaceutical, and research laboratory settings.

From 2030 to 2035, growth continues from USD 184.5 million to USD 279.5 million, adding another USD 95.0 million, constituting 60.2% of overall ten-year expansion. This half of the decade is expected to be characterized by development of highly specialized magnetic bead products, including advanced carboxylate-modified beads with enhanced binding efficiency, uniformity, and scalability for large-scale applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 121.8 million |

| Market Forecast Value (2035) | USD 279.5 million |

| Forecast CAGR (2025 to 2035) | 8.7% |

Global carboxylate-modified magnetic beads market is expanding due to growing utilization of these beads in biotechnology, diagnostics, and life sciences research. Carboxyl-functionalized beads are coated with reactive carboxyl groups, which allow stable covalent attachment of biomolecules, such as proteins, antibodies, and nucleic acids, using carbodiimide-based coupling chemistry. This feature makes them highly suitable for applications requiring specific binding and reproducibility, including immunoassays, protein purification, nucleic acid extraction, and cell isolation. Demand is being driven by increasing adoption of molecular diagnostics and genomics research.

In laboratories, carboxyl-modified magnetic beads enable efficient sample preparation workflows, reducing processing time while improving assay sensitivity and specificity. Their compatibility with automation platforms allows high-throughput operations in clinical, academic, and industrial settings, which is critical for large-scale screening, drug discovery, and translational research. Biotechnology companies have advanced development of carboxyl-modified beads by improving surface chemistries, increasing binding capacities, and producing beads with uniform particle sizes. These innovations enhance reaction kinetics, reproducibility, and stability, encouraging adoption in both research and diagnostic applications.

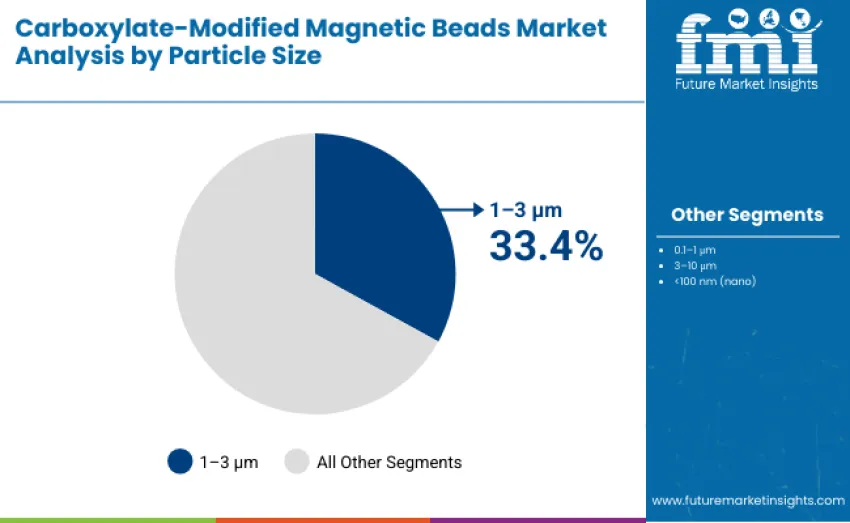

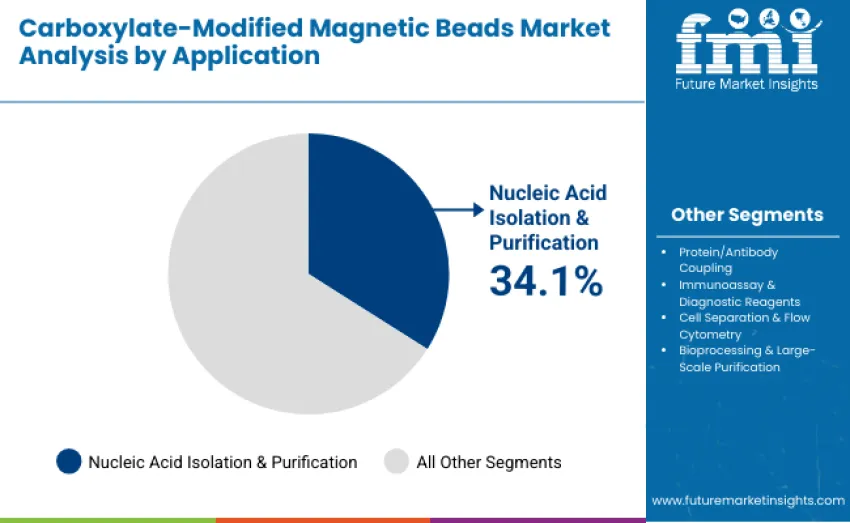

Carboxylate-modified magnetic beads market is segmented based on particle size, application, and region. By particle size, it is categorized into <100 nm (nano), 0.1-1 μm, 1-3 μm, and 3-10 μm. In terms of application, it is divided into nucleic acid isolation and purification, protein/antibody coupling, immunoassay and diagnostic reagents, cell separation and flow cytometry, and bioprocessing and large-scale purification. Regionally, it is divided into Asia Pacific, Europe, North America, Latin America, and Middle East & Africa.

The 1-3 μm particle size segment leads the carboxylate-modified magnetic beads market with 33.4% revenue in 2025, driven by its optimal surface area, strong magnetic responsiveness, and broad suitability for nucleic acid isolation, protein coupling, and immunoassays. The 0.1-1 μm segment holds 28.7%, favored for finer dispersion and higher interaction surface. The 3-10 μm segment accounts for 19.6%, preferred in large-scale purification and cell separation. Nano beads (<100 nm) capture 18.3%, used in advanced molecular assays and high-resolution diagnostic applications.

Key factors driving the dominance of the 1-3 μm segment include:

Nucleic acid isolation and purification leads with a 34.1% revenue share in 2025, driven by demand for rapid, high-purity DNA and RNA extraction in research, diagnostics, and genomics. Protein and antibody coupling follows at 23.7%, supporting therapeutic development and immunoassay workflows. Immunoassay and diagnostic reagent applications hold 21.6%, reflecting expanded biomarker testing and clinical diagnostics. Cell separation and flow cytometry account for 12.8%, driven by immunology and cellular therapy research. Bioprocessing contributes 7.8%, enabling scalable biomolecule recovery in biopharmaceutical production.

Key dynamics shaping application preferences include:

Market growth is driven by rising adoption of molecular diagnostics, high throughput research, and nucleic acid purification workflows worldwide. Increasing use of automated sample preparation systems and expansion of genomic, proteomic, and clinical testing laboratories reinforce demand. Carboxylate-modified beads are preferred for their high binding efficiency, compatibility with diverse biological matrices, and strong performance in PCR, qPCR, and next generation sequencing workflows. Growing utilization in cell isolation, protein purification, immunoprecipitation, and biomarker discovery further supports market expansion as selective binding and rapid magnetic separation become essential across research and clinical settings.

Higher costs of advanced magnetic bead formulations compared with conventional separation materials remain a primary restraint. Budget-limited laboratories may delay adoption of premium functionalized bead systems. Additional barriers include variability in bead performance across suppliers, need for specialized magnetic handling equipment, and challenges in standardizing workflows across high throughput laboratories.

Key trends include rapid expansion of automation-ready bead formats and increasing integration into microfluidic and lab-on-chip platforms. Demand for miniaturized, high efficiency bead systems is rising as laboratories shift toward scalable, automated, and rapid sample preparation workflows. Growth in precision medicine, genetic testing, and multi omics research will further advance high performance bead technologies.

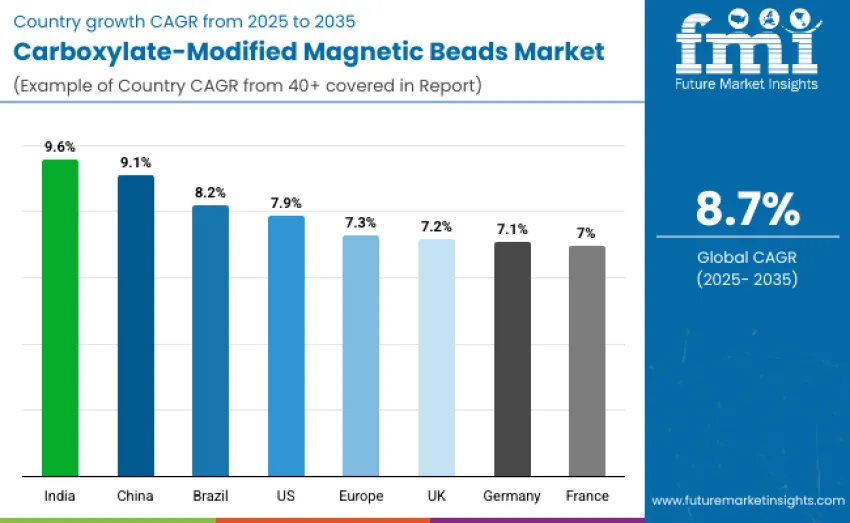

| Country/Region | CAGR (2025 to 2035) |

|---|---|

| India | 9.6% |

| China | 9.1% |

| Brazil | 8.2% |

| United States | 7.9% |

| Europe | 7.3% |

| United Kingdom | 7.2% |

| Germany | 7.1% |

| France | 7.0% |

India leads the carboxylate-modified magnetic beads market with a 9.6% CAGR, driven by expanding biotechnology research, molecular diagnostics growth, and government support for automated bead-based workflows. China follows at 9.1%, supported by major investments in high throughput genomics, proteomics, and cell separation. Brazil grows at 8.2% through increasing lab modernization and assay adoption. The USA advances at 7.9% with strong pharmaceutical and biotech infrastructures. Europe expands at 7.3%, with the UK at 7.2%, Germany at 7.1%, and France at 7.0%, supported by advanced research and diagnostic capabilities.

China’s carboxylate-modified magnetic beads market is projected to grow at a 9.1% CAGR through 2035, supported by rapid modernization of biotechnology, diagnostic, and pharmaceutical laboratories in Shanghai, Beijing, and Shenzhen. Magnetic bead platforms are widely adopted for nucleic acid extraction, protein purification, and immunoassays. The “Made in China 2025” initiative provides grants and subsidies that accelerate procurement of automated systems, while provincial biotech parks fund high throughput sample preparation platforms. Domestic manufacturing capacity has expanded, reducing reliance on imports. More than 250 laboratories had installed automated magnetic bead systems by 2024, supported by CRO standardization and strong industry-academia collaboration.

India’s carboxylate-modified magnetic beads market is projected to grow at a 9.6% CAGR through 2035, supported by rapid expansion of molecular diagnostics laboratories in Bengaluru, Mumbai, Hyderabad, and Pune. Bead-based workflows are increasingly used for nucleic acid extraction, immunoassays, and protein purification. Government programs under the National Biotechnology Development Strategy and Make in India are promoting local manufacturing and reducing import dependence. Public healthcare initiatives are driving adoption in tier-2 and tier-3 cities. More than 150 laboratories integrated magnetic bead platforms in 2024, supported by CRO partnerships, standardized protocols, and laboratory personnel training programs.

Germany’s carboxylate-modified magnetic beads market is projected to grow at a 7.1% CAGR through 2035, driven by precision-oriented laboratory workflows in biotechnology, diagnostics, and industrial research centers across Berlin, Munich, and Frankfurt. Strict compliance with European regulations and ISO accreditation ensures consistent use of high-quality beads. Academic-industry R&D collaborations support development of advanced bead variants for targeted molecular applications. Growing laboratory automation enhances workflow reproducibility and throughput. Sustainability requirements encourage adoption of environmentally efficient systems. By 2024, more than 180 laboratories had installed automated bead platforms, strengthening nationwide uptake across clinical and research environments.

Brazil’s carboxylate-modified magnetic beads market is projected to grow at an 8.2% CAGR through 2035, driven by expansion of public and private clinical laboratories in São Paulo, Rio de Janeiro, Brasília, and Porto Alegre. Government-backed modernization initiatives have funded procurement of automated bead-based systems for nucleic acid extraction, protein purification, and immunoassays. Cost-efficiency advantages over conventional separation methods support adoption in resource-constrained facilities. Improved import pathways ensure reliable reagent availability, while distributor partnerships enhance access and technical support. More than 120 hospitals and research centers adopted bead platforms by 2024, supported by standardized workflows and personnel training.

The United States carboxylate-modified magnetic beads market is projected to grow at a 7.9% CAGR through 2035, supported by extensive R&D investment across pharmaceutical, academic, and clinical laboratories in California, Massachusetts, and New York. Automated bead-based workflows are widely used for nucleic acid extraction, protein purification, and immunoassays, improving throughput and reproducibility. NIH grants fund high-throughput platform installation, while biopharmaceutical companies collaborate with suppliers to develop customized bead formulations. Over 500 laboratories had adopted automated bead systems by 2024. Compliance with FDA quality standards ensures reliability across genomics, proteomics, and drug development applications.

The UK carboxylate-modified magnetic beads market is projected to grow at a 7.2% CAGR through 2035, driven by modernization of clinical and research laboratories in London, Manchester, Bristol, and Edinburgh. Automated bead-based workflows support nucleic acid extraction, immunoassays, and protein purification, improving efficiency and reproducibility. Collaborative efforts between universities, research institutes, and local suppliers enable development of specialized bead formulations. Government support for biopharmaceutical innovation boosts adoption in public and private labs. By 2024, more than 140 laboratories had installed bead systems, aided by workforce training programs and integration with digital laboratory management systems.

Europe’s carboxylate-modified magnetic beads market is projected to grow at a 7.3% CAGR through 2035, supported by expansion of molecular diagnostics, biotechnology research, and high-throughput testing capabilities across Germany, France, the UK, the Netherlands, and the Nordics. EU-wide regulatory alignment under IVDR is accelerating adoption of analytically validated bead-based systems, ensuring reproducibility and clinical reliability. Investments through Horizon Europe and national oncology programs are strengthening multi-omics workflows in hospitals and centralized laboratories. Integration with automated extraction systems and LIMS platforms is enhancing operational efficiency, while cross-border academic-industry collaborations continue to advance bead formulations optimized for nucleic acid, protein, and immunoassay applications.

France’s carboxylate-modified magnetic beads market is projected to grow at a 7.0% CAGR through 2035, driven by modernization of molecular biology and oncology laboratories in Paris, Lyon, Marseille, and Toulouse. National research initiatives and support from agencies such as Inserm and INCa are promoting broader adoption of bead-based nucleic acid extraction, protein purification, and immunoassay workflows. ISO 15189-accredited laboratories ensure standardized processing and high-quality diagnostics. Academic-clinical partnerships advance multi-omics research, biomarker development, and method validation. Integration with automated extraction platforms and digital laboratory systems is improving throughput and reproducibility. Growing investment in precision medicine continues to reinforce nationwide bead-based testing adoption.

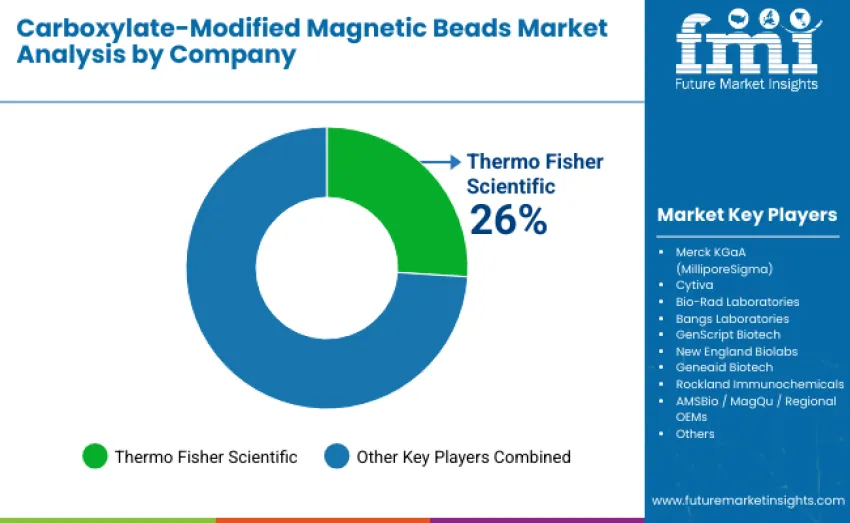

The global carboxylate-modified magnetic beads market shows moderate concentration, with 12 to 15 players competing across molecular diagnostics, research, and biopharmaceutical production workflows. The top three companies control an estimated 50% to 55% of global revenue, with Thermo Fisher Scientific leading at 26% due to its extensive magnetic bead portfolio, validated chemistries, and strong integration with automated extraction platforms. Thermo Fisher, Merck KGaA (MilliporeSigma), and Cytiva maintain dominant positions supported by robust quality control systems, intellectual property strength, and broad distribution networks. Their beads demonstrate high magnetic responsiveness, strong binding capacity, reproducible performance, and compatibility with automated sample-preparation instruments, making them preferred in genomics, proteomics, immunoassays, and clinical testing.

Challenger companies such as Bio-Rad Laboratories, Bangs Laboratories, GenScript Biotech, and New England Biolabs compete by offering customizable bead formats, specialized surface chemistries, and flexible kits designed for mid-sized laboratories and emerging multi-omics applications. These manufacturers differentiate through innovation-driven product development and tailored application support. Competitive dynamics increasingly favor companies that deliver high-quality bead performance, automation readiness, reproducible workflows, and reliable technical support. As laboratories worldwide adopt high-throughput, bead-based purification and diagnostic systems, suppliers offering robust performance and seamless workflow integration continue to strengthen their position in the global market.

| Item | Value |

|---|---|

| Quantitative Units | USD 121.8 million |

| Particle Size | 0.1 - 1 μm , 1 - 3 μm , 3 - 10 μm , <100 nm (nano) |

| Application | Nucleic Acid Isolation & Purification, Protein/Antibody Coupling, Immunoassay & Diagnostic Reagents, Cell Separation & Flow Cytometry, Bioprocessing & Large-Scale Purification |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Country Covered | USA , Brazil, China, India, Europe, Germany, France, UK |

| Key Companies Profiled | Thermo Fisher Scientific, Merck KGaA ( MilliporeSigma ), Cytiva , Bio-Rad Laboratories, Bangs Laboratories, GenScript Biotech, New England Biolabs , Geneaid Biotech, Rockland Immunochemicals , AMSBio / MagQu / regional OEMs, and others |

| Additional Attributes | Dollar sales vary by particle size and application, shaped by adoption across Asia Pacific, Europe, and North America. Competition centers on leading bead manufacturers, distribution networks, performance specifications, workflow integration, improved surface chemistry, magnetic responsiveness, and specialized high-capacity bead designs with enhanced conjugation efficiency and stability |

The global carboxylate-modified magnetic beads market is estimated to be valued at USD 121.8 million in 2025.

The carboxylate-modified magnetic beads market is projected to reach USD 279.5 million by 2035.

The carboxylate-modified magnetic beads market is expected to grow at an 8.7% CAGR between 2025 and 2035.

The key particle size segments are <100 nm, 0.1-1 μm, 1-3 μm, and 3-10 μm.

The nucleic acid isolation and purification segment is expected to lead with a 34.1% share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Magnetic Beads Market

Magnetic Absorption Data Line Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Material Magnetization and Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Coupler Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Shielding Device Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Stripe Readers Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Resonance Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Drive Pump Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Separator Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Ballast Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Sensor Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Flowmeter Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Resonance Imaging Coils Market Analysis - Size, Share, and Forecast 2025 to 2035

Magnetic Tape Market Analysis Size and Share Forecast Outlook 2025 to 2035

Magnetic Resonance Imaging (MRI) Contrast Agents Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Crack Detectors Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Materials Market Growth - Trends & Forecast 2025 to 2035

Magnetic Resonance Imaging (MRI) Market Trends - Size, Share & Forecast 2025 to 2035

Magnetic Grill Market Analysis – Trends, Growth & Forecast 2025 to 2035

Magnetic Closure Boxes Market Trends - Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA