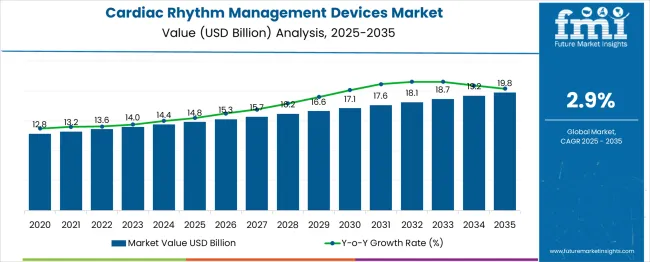

The global cardiac rhythm management devices market is estimated to reach USD 14.8 billion in 2025 and is anticipated to expand to USD 19.8 billion by 2035, registering a CAGR of 2.9% and an absolute increase of USD 5 billion over the forecast period. This market is expected to witness steady adoption of advanced implantable devices, driven by the rising prevalence of cardiovascular diseases, increasing aging populations, and growing demand for minimally invasive and remote monitoring solutions. Key segments such as pacemakers, implantable cardioverter defibrillators (ICDs), and cardiac resynchronization therapy (CRT) devices are expected to benefit from technological advancements in device miniaturization, battery longevity, and remote monitoring capabilities.

Between 2025 and 2030, the market is projected to expand from USD 14.8 billion to USD 17.1 billion, generating an incremental dollar opportunity of USD 2.3 billion, representing 46% of the total forecast growth for the next few years. This five-year growth block is expected to be shaped by increasing diagnosis and management of arrhythmias, growing adoption of leadless pacemakers, and broader penetration of CRT devices. Medical device manufacturers are anticipated to expand their portfolios with patient-centric solutions, integrating wireless monitoring systems and minimally invasive implantation procedures. Healthcare providers are likely to adopt early intervention protocols supported by evidence-based clinical studies, which will drive hospital and outpatient adoption. Additionally, regulatory approvals and reimbursement expansions in emerging markets are expected to enhance accessibility and accelerate growth during this phase.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 14.8 billion |

| Forecast Value in (2035F) | USD 19.8 billion |

| Forecast CAGR (2025 to 2035) | 2.9% |

From 2030 to 2035, the market is forecast to grow from USD 17.1 billion to USD 19.8 billion, contributing USD 2.7 billion to the total market expansion, accounting for 54% of the decade-long growth. This period is expected to witness the integration of artificial intelligence and machine learning in device monitoring, personalized cardiac therapy solutions, and telemedicine-enabled follow-up services. Growth will be supported by rising patient preference for connected health solutions, remote monitoring of device performance, and predictive analytics for arrhythmia management. Advances in biocompatible materials, smaller form-factor devices, and enhanced battery efficiency are likely to improve patient outcomes and expand indications for use. Emerging markets will continue to see increased adoption as healthcare infrastructure and cardiovascular awareness improve.

Looking at the historical phase from 2020 to 2025, the cardiac rhythm management devices market experienced steady growth, rising from approximately USD 12.5 billion to USD 14.8 billion. This early-stage expansion was influenced by the rising global burden of heart failure and atrial fibrillation, growing awareness of sudden cardiac death prevention, and increasing adoption of guideline-recommended device therapy. Hospitals and specialty cardiac centers invested in advanced electrophysiology labs and minimally invasive implantation techniques, setting the stage for long-term growth. Clinical evidence emphasizing improved survival rates and quality of life with advanced cardiac rhythm management devices further reinforced market adoption, creating a strong foundation for the 2025–2035 forecast horizon.

Market expansion is being supported by the increasing global burden of cardiovascular diseases and the corresponding demand for effective cardiac rhythm management solutions. Modern healthcare systems are increasingly focused on preventive cardiac care measures that can protect against sudden cardiac death, heart failure complications, and arrhythmia-related complications. Advanced cardiac rhythm management devices' proven efficacy in maintaining heart rhythm stability and improving patient outcomes makes them essential components in comprehensive cardiovascular treatment protocols.

The growing focus on minimally invasive cardiac procedures and remote patient monitoring is driving demand for next-generation cardiac rhythm management devices with wireless connectivity and smartphone integration. Healthcare provider preference for multifunctional devices that combine pacing, defibrillation, and cardiac resynchronization capabilities is creating opportunities for innovative device platforms. The rising influence of evidence-based medicine and clinical guidelines is also contributing to increased device adoption across different patient populations and healthcare settings.

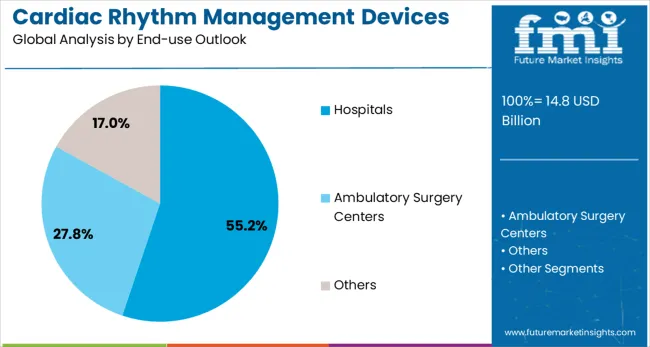

The market is segmented by product, end-use, and region. By product, the market is divided into pacemakers (conventional and leadless), defibrillators (implantable cardioverter defibrillators and external defibrillators), and cardiac resynchronization therapy (CRT-defibrillator and CRT-pacemakers). Based on end-use, the market is categorized into hospitals, ambulatory surgery centers, and others. Regionally, the market is divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

The pacemaker’s product segment is projected to account for 39% of the cardiac rhythm management devices market in 2025, reaffirming its position as the category's leading device type. Healthcare providers increasingly recognize the critical role of pacemaker therapy in treating bradycardia, heart block, and other rhythm disorders that can significantly impact patient quality of life. Advanced pacemaker technologies, including leadless designs and MRI-compatible systems, directly address clinical needs by providing reliable cardiac pacing while minimizing procedural complications and device-related infections.

This product segment forms the foundation of most cardiac rhythm management strategies, as it represents the most established and clinically validated approach to treating slow heart rhythms. Cardiologist endorsements and extensive clinical evidence continue to strengthen confidence in pacemaker therapy across diverse patient populations. With aging demographics increasing the prevalence of conduction system diseases, pacemaker therapy aligns with both curative and palliative cardiac care goals. Its broad clinical applicability across age groups ensures market dominance, making it the central growth driver of cardiac rhythm management device demand.

Hospitals are projected to represent 55% of cardiac rhythm management device demand in 2025, underscoring their role as the primary setting for cardiac device implantation and management. Healthcare institutions gravitate toward comprehensive cardiac rhythm management programs that include device implantation, follow-up care, and emergency management capabilities. Positioned as specialized cardiac care centers, hospitals offer both acute intervention services, such as emergency defibrillation, and planned therapeutic procedures, including pacemaker and CRT device implantation.

The segment is supported by the increasing complexity of cardiac rhythm management procedures, where hospitals provide essential infrastructure including cardiac catheterization laboratories, electrophysiology suites, and intensive care units. Hospitals are increasingly developing specialized cardiac device clinics that combine device implantation with long-term patient monitoring and device programming services. As healthcare systems prioritize comprehensive cardiac care delivery, hospital-based cardiac rhythm management programs will continue to dominate service provision, reinforcing their central positioning within the cardiovascular care continuum.

The cardiac rhythm management devices market is advancing steadily due to increasing cardiovascular disease prevalence and growing demand for advanced cardiac therapy solutions. The market faces challenges including device cost considerations, implantation procedure complexity, and competition from pharmaceutical cardiovascular therapies. Innovation in wireless monitoring systems and artificial intelligence integration continue to influence product development and market expansion patterns.

The growing adoption of remote monitoring technologies is enabling healthcare providers to track patient cardiac status continuously and provide timely interventions when needed. Digital health platforms offer real-time device data transmission, automatic alert systems, and comprehensive patient management tools that improve clinical outcomes while reducing healthcare costs. Telemedicine integration and mobile health applications are driving patient engagement and treatment adherence, particularly among elderly populations who benefit from reduced clinic visit requirements.

Modern cardiac rhythm management device manufacturers are incorporating artificial intelligence algorithms for predictive analytics, automatic rhythm detection, and personalized therapy optimization. These technologies improve device performance by learning patient-specific cardiac patterns while providing healthcare providers with actionable insights for treatment optimization. Advanced algorithmic approaches also enable combination devices that deliver multiple therapeutic modalities based on real-time cardiac assessment and patient condition monitoring.

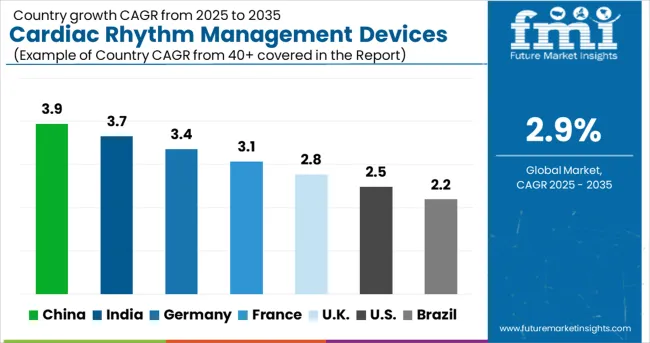

| Countries | Market Value (USD Billion) |

|---|---|

| China | 3.9% |

| India | 3.7% |

| Germany | 3.4% |

| France | 3.1% |

| UK | 2.8% |

| USA | 2.5% |

| Brazil | 2.2% |

The cardiac rhythm management devices market demonstrates significant regional variations, with China leading at USD 3.9 billion market value, driven by rapidly expanding healthcare infrastructure, increasing cardiovascular disease prevalence, and growing adoption of advanced cardiac technologies. India follows at USD 3.7 billion, supported by large patient populations, improving healthcare access, and increasing awareness of cardiac rhythm disorders. Germany shows a strong performance at USD 3.4 billion, emphasizing technological innovation and comprehensive cardiac care delivery systems. France records USD 3.1 billion, focusing on specialized cardiac electrophysiology services and device innovation. The UK demonstrates a USD 2.8 billion market value, prioritizing evidence-based cardiac care and cost-effective treatment protocols.

The report covers an in-depth analysis of 40+ countries, top-performing countries are highlighted below.

The cardiac rhythm management (CRM) devices market in China is projected to grow at a CAGR of 3.9% from 2025 to 2035, reflecting a strong upward trajectory driven by demographic and healthcare trends. An aging population and increasing prevalence of cardiovascular diseases, including arrhythmias and heart failure, are expanding the patient base for pacemakers, implantable cardioverter defibrillators (ICDs), and cardiac resynchronization therapy (CRT) devices. Investments in hospital infrastructure, specialty cardiac centers, and advanced diagnostic facilities are increasing the availability of these devices across urban and semi-urban regions. Remote patient monitoring solutions and AI-assisted diagnostics are improving clinical outcomes and patient follow-up efficiency. Government policies supporting faster approvals and domestic manufacturing are fostering innovation, while rising patient awareness of early detection and preventive care is boosting demand. Domestic and international players are competing by introducing technologically advanced devices with enhanced longevity, remote monitoring, and minimally invasive implantation techniques, strengthening market competitiveness.

India CRM devices market is expected to grow at a CAGR of 3.7% from 2025 to 2035, supported by increasing cardiovascular disease prevalence, rising awareness of heart health, and improved healthcare accessibility. Hospitals, clinics, and specialty cardiac centers are expanding adoption of pacemakers, ICDs, and CRT devices to address a growing population of patients requiring arrhythmia management and heart failure treatment. Government initiatives promoting preventive cardiac care, insurance schemes, and public-private collaborations are improving affordability and accessibility of advanced devices. Urban populations are increasingly opting for early diagnosis and high-quality cardiac treatments, driving hospitals to adopt technologically advanced devices. Imports of sophisticated international devices complement domestic offerings, while training programs for cardiac surgeons and cardiologists improve implantation success rates. Patient awareness campaigns and telemedicine integration further support adoption, making India a high-growth market for CRM technologies over the forecast period.

Germany CRM devices market is projected to grow at a CAGR of 3.4% from 2025 to 2035, supported by a strong healthcare ecosystem and advanced patient care infrastructure. Hospitals, specialized cardiac centers, and outpatient clinics are equipped with modern pacemakers, ICDs, and CRT devices, offering high levels of diagnostic and treatment precision. Comprehensive reimbursement policies and insurance coverage facilitate patient access to these advanced therapies. Germany’s medical research focus encourages continuous innovation, enabling the introduction of devices with longer battery life, improved connectivity, and remote monitoring features. The aging population significantly contributes to the growing demand for cardiac rhythm management solutions, while clinical guidelines and standardized protocols promote consistent adoption across healthcare facilities. Market competition among domestic and international manufacturers drives product differentiation, emphasizing quality, technological advancement, and patient safety. Germany is expected to remain a leading European hub for CRM adoption due to its research capabilities, regulatory support, and strong hospital network.

France CRM devices market is expected to grow at a CAGR of 3.1% from 2025 to 2035, shaped by preventive healthcare initiatives, patient-centric treatment approaches, and public-private collaboration. Hospitals, cardiac clinics, and outpatient care centers are increasingly implementing pacemakers, ICDs, and CRT devices to address rising cardiovascular disease incidence. Government programs promoting early detection and chronic disease management are driving demand for technologically advanced devices. Public-private partnerships enhance device accessibility, ensuring both urban and semi-urban populations benefit from cardiac care innovations. Focus on personalized treatment and follow-up care encourages adoption of remote monitoring and AI-assisted devices. International and domestic manufacturers are competing to offer devices with superior durability, reliability, and minimally invasive implantation features. Increasing patient awareness of heart health and preventive care is further contributing to market growth, making France a steady and competitive CRM devices market in Europe.

The UK CRM devices market is projected to grow at a CAGR of 2.8% from 2025 to 2035, supported by NHS initiatives, funding for cardiac care, and integration of digital health solutions. Hospitals and cardiac centers are expanding use of pacemakers, ICDs, and CRT devices, while telemedicine and remote monitoring platforms improve patient management and follow-up. Clinical guidelines promoting the adoption of advanced cardiac rhythm devices are enhancing standardization of care and ensuring broader patient access. NHS funding for cardiac infrastructure upgrades supports hospitals in acquiring advanced technologies. The market benefits from increasing patient awareness of preventive care and early diagnosis of arrhythmias and heart failure. Competition among domestic and international device manufacturers drives innovation in connectivity, battery longevity, and minimally invasive procedures. Expanding adoption of digital cardiac monitoring solutions further improves treatment efficiency and outcomes.

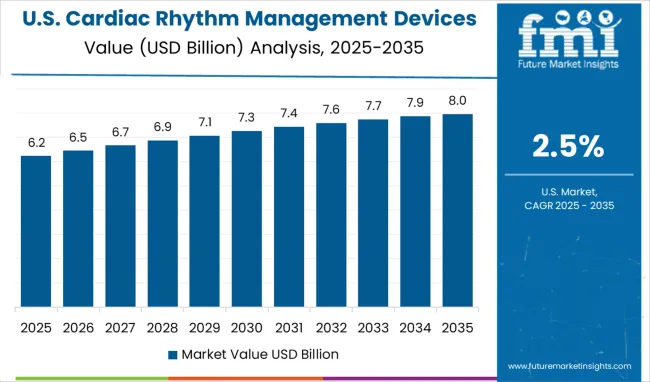

The USA CRM devices market is expected to grow at a CAGR of 2.5% from 2025 to 2035, remaining the largest globally due to high healthcare spending, advanced technology adoption, and the presence of leading manufacturers. Hospitals, outpatient clinics, and specialty cardiac centers widely deploy pacemakers, ICDs, and CRT devices. Insurance coverage and reimbursement policies facilitate patient access to expensive devices, while investments in research and development drive technological improvements in device connectivity, longevity, and minimally invasive implantation. Market competition between domestic and international players stimulates innovation and product differentiation. Increasing patient awareness of cardiovascular health, preventive care, and early diagnostics contributes to adoption growth. Remote monitoring, AI integration, and personalized therapy planning enhance treatment outcomes. The USA market continues to set benchmarks for device performance, clinical outcomes, and innovation.

Brazil CRM devices market is projected to grow at a CAGR of 2.2% from 2025 to 2035, driven by increasing healthcare infrastructure investments, growing focus on chronic disease management, and rising awareness of cardiovascular health. Hospitals and specialized cardiac centers are expanding adoption of pacemakers, ICDs, and CRT devices, while government initiatives promote access to advanced cardiac therapies in urban and semi-urban regions. Chronic disease prevalence and an aging population are expanding the patient base for CRM solutions. Public and private healthcare investments are improving device availability, distribution, and accessibility. International manufacturers are collaborating with local distributors to enhance supply chains and ensure quality standards. Patient education programs, telemedicine integration, and early diagnostic campaigns further stimulate device adoption, making Brazil a growing yet competitive market for CRM devices in Latin America.

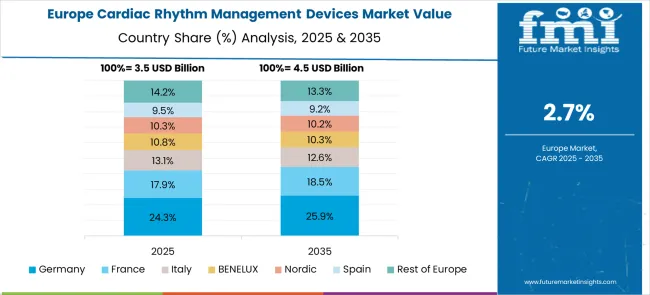

The cardiac rhythm management devices market in Europe demonstrates mature development across major economies with Germany showing strong presence through its advanced cardiac care infrastructure and comprehensive healthcare reimbursement systems, supported by leading medical device manufacturers developing innovative cardiac rhythm management solutions that address complex arrhythmia cases and heart failure management requirements. France represents a significant market driven by its established cardiovascular medicine programs and sophisticated cardiac electrophysiology services, with healthcare institutions pioneering advanced cardiac resynchronization therapy protocols and remote monitoring platforms for enhanced patient outcomes.

The UK exhibits considerable growth through its National Health Service cardiac care initiatives and evidence-based treatment protocols, with cardiac centers leading the adoption of next-generation pacemaker and defibrillator technologies for improved patient safety and clinical efficacy. Italy and Spain show expanding utilization of cardiac rhythm management devices, particularly in comprehensive heart failure management programs and sudden cardiac death prevention strategies. BENELUX countries contribute through their focus on innovative cardiac technologies and patient-centered care models, while Eastern Europe and Nordic regions display growing potential driven by healthcare infrastructure development and increasing access to advanced cardiac rhythm management therapies across diverse healthcare delivery systems.

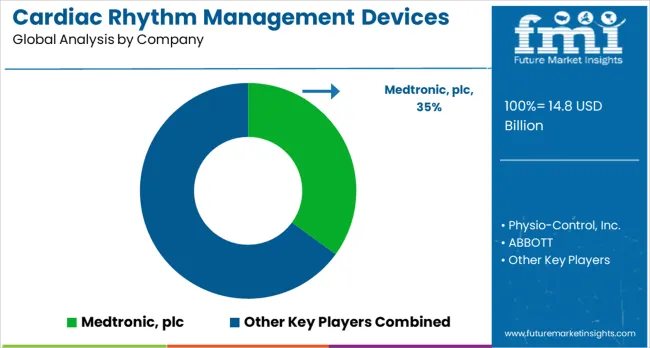

The cardiac rhythm management devices market is shaped by intense competition among established medical device manufacturers, specialized cardiac technology firms, and emerging digital health companies. Market participants prioritize innovation in device design, integration of remote monitoring systems, and development of advanced therapeutic technologies. Companies are channeling investments into clinical research programs, regulatory compliance frameworks, and physician education initiatives to ensure safe, effective, and widely accessible cardiac rhythm management solutions. Collaboration with healthcare providers, coupled with evidence-based clinical validation, has become central to strengthening product portfolios and enhancing market presence.

Medtronic, headquartered in the USA, maintains a leading position with a 35.0% global value share. Its extensive cardiac rhythm management portfolio emphasizes clinical innovation, patient outcome optimization, and integrated device ecosystems that enable both therapeutic and monitoring capabilities. Physio-Control Inc., also USA-based, specializes in emergency cardiac care solutions, emphasizing defibrillation technologies and integration with emergency medical services. ABBOTT delivers advanced cardiac device platforms designed to support minimally invasive procedures while enabling remote patient monitoring for chronic cardiac conditions. Boston Scientific Corporation develops cardiac rhythm management solutions that merge therapeutic efficacy with procedural efficiency, prioritizing physician workflow optimization and patient-centric outcomes.

European players have established strong positions as well. Biotronik, Germany, focuses on innovative cardiac devices and remote monitoring solutions, targeting premium clinical segments. Schiller and Koninklijke Philips N.V. offer comprehensive cardiac monitoring and intervention devices across diverse healthcare settings, ensuring adaptability to various patient care environments. Progetti Srl provides specialized solutions tailored for specific clinical applications, emphasizing device customization to meet niche demands. Zoll Medical Corporation and LivaNova Plc contribute targeted technologies for emergency care and specialized cardiac therapy applications, emphasizing rapid response and therapeutic precision.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 14.8 billion |

| Product | Pacemakers (Conventional, Leadless), Defibrillators (Implantable Cardioverter Defibrillators, External Defibrillators), Cardiac Resynchronization Therapy (CRT-defibrillator, CRT-pacemakers) |

| End-use | Hospitals, Ambulatory Surgery Centers, Others |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia, and 40+ countries |

| Key Companies Profiled | Medtronic, Physio-Control Inc., ABBOTT, Boston Scientific Corporation, Schiller, Koninklijke Philips N.V., Biotronik, Progetti Srl, Zoll Medical Corporation, and LivaNova Plc |

| Additional Attributes | Dollar sales by device type and technology level, regional demand trends, competitive landscape, healthcare provider preferences for conventional versus advanced technologies, integration with remote monitoring and telemedicine platforms, innovations in miniaturization, wireless connectivity, and artificial intelligence-powered diagnostic capabilities |

The global cardiac rhythm management devices market is estimated to be valued at USD 14.8 billion in 2025.

The market size for the cardiac rhythm management devices market is projected to reach USD 19.8 billion by 2035.

The cardiac rhythm management devices market is expected to grow at a 2.9% CAGR between 2025 and 2035.

The key product types in cardiac rhythm management devices market are pacemakers, _conventional, _leadless, defibrillators, _implantable cardioverter defibrillators (icd), _external defibrillator, cardiac resynchronization therapy (crt), _crt-defibrillator and _crt-pacemakers.

In terms of end-use outlook, hospitals segment to command 55.2% share in the cardiac rhythm management devices market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cardiac Monitoring And Cardiac Rhythm Management Devices Market Size and Share Forecast Outlook 2025 to 2035

Cardiac Rehabilitation Market Size and Share Forecast Outlook 2025 to 2035

Cardiac Valvulotome Market Size and Share Forecast Outlook 2025 to 2035

Cardiac Ambulatory Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Cardiac Ultrasound Systems Market - Trends & Forecast 2025 to 2035

Cardiac Biomarker Diagnostic Test Kits Market Analysis – Trends & Forecast 2025 to 2035

Cardiac Reader System Market Growth – Trends & Forecast 2019 to 2027

Cardiac Medical Device Market

Cardiac Assist Devices Market Growth – Trends & Forecast 2025 to 2035

Cardiac Surgery Devices Market Analysis – Trends & Forecast 2024-2034

Cardiac Rhythm Remote Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Cardiac Rhythm Management Market Insights - Trends & Forecast 2024 to 2034

Intracardiac Echocardiography Market Insights - Growth & Forecast 2025 to 2035

Intracardiac Imaging Market Trends – Industry Growth & Forecast 2024-2034

Mobile Cardiac Telemetry System Market Size and Share Forecast Outlook 2025 to 2035

MRI-Guided Cardiac Ablation Market Size and Share Forecast Outlook 2025 to 2035

Continuous Cardiac Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Companion Animal Cardiac Drugs Market Size and Share Forecast Outlook 2025 to 2035

Biorhythmic Skincare Actives Market Size and Share Forecast Outlook 2025 to 2035

Circadian Rhythm Sleep Disorders Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA