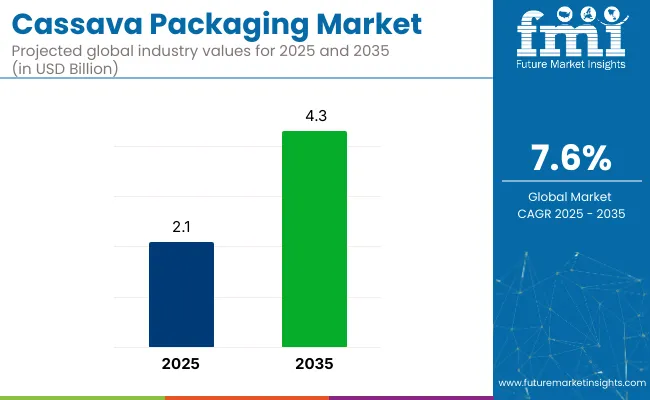

The global cassava packaging market is projected to grow from USD 2.1 billion in 2025 to USD 4.3 billion by 2035, expanding at a CAGR of 7.6% over the forecast period. Sales in 2024 were recorded at USD 260.4 million, indicating strong baseline momentum as global demand for sustainable packaging accelerates.

| Metric | Value |

|---|---|

| Estimated Size (2025E) | USD 2.1 billion |

| Projected Value (2035F) | USD 4.3 billion |

| CAGR (2025 to 2035) | 7.6% |

This growth is primarily driven by increasing international efforts to phase out petroleum-based plastics and transition toward eco-friendly, biodegradable alternatives. Cassava starch-based materials extracted from the root of the cassava plant are rapidly gaining traction as cost-effective, compostable, and home-disposable packaging solutions.

These materials are especially valued for their low carbon footprint, soil biodegradability, and ability to decompose in both industrial and domestic composting systems. Their utility spans multiple sectors, including foodservice, grocery retail, agriculture, and the rapidly expanding e-commerce packaging ecosystem.

Governments and environmental regulatory bodies across countries such as Indonesia, India, Thailand, and key regions within the European Union have actively promoted cassava-based packaging through plastic bans, financial incentives, and green packaging certifications. These developments collectively contribute to the accelerated commercialization of cassava-derived biopolymers in global packaging markets.

Recent innovations in cassava packaging have focused heavily on enhancing both performance and versatility, making these materials viable for a wider array of applications. One of the major technological breakthroughs has been the integration of multi-layer barrier coatings, which significantly improve moisture resistance and extend shelf life an essential requirement for fresh produce and refrigerated goods.

Additionally, the formulation of PLA-free compostable blends has gained popularity, eliminating dependence on corn-based polymers and enabling fully starch-derived material compositions. Innovations such as hydrophilic surface treatments are also being used to enhance durability in humid and moist environments, expanding cassava film applications in cold chain logistics.

Engineers are now developing cassava packaging films with oxygen resistance, microwave compatibility, and low-temperature endurance, ensuring usability for both frozen and ready-to-eat meal categories. Furthermore, bio-ink-compatible surfaces now allow brands to implement high-quality graphics and QR-enabled traceability features, strengthening consumer engagement, anti-counterfeit measures, and supply chain transparency. These advancements position cassava-based packaging as a front-runner in the next generation of smart, sustainable, and high-performance packaging materials.

The Asia-Pacific region continues to dominate the cassava packaging market, underpinned by abundant cassava cultivation, low-cost manufacturing, and rising environmental awareness. Countries like Indonesia, Thailand, and Vietnam not only lead in cassava crop production but also benefit from favorable policy frameworks banning single-use plastics.

As a result, a robust local ecosystem of cassava film manufacturers, R&D labs, and packaging startups has emerged, propelling the region’s leadership in both innovation and supply chain capacity. Meanwhile, Europe and North America are establishing themselves as critical demand hubs, particularly in sectors like organic retail, institutional foodservice, and eco-conscious hospitality chains.

High environmental compliance standards in countries such as France and Germany, combined with localized zero-waste initiatives in California, Oregon, and Washington, are compelling businesses to shift toward home-compostable solutions. With composting infrastructure expanding and consumer preference leaning toward natural-origin materials, cassava-based packaging is well-positioned to capitalize on transcontinental demand, regulatory momentum, and global decarbonization targets.

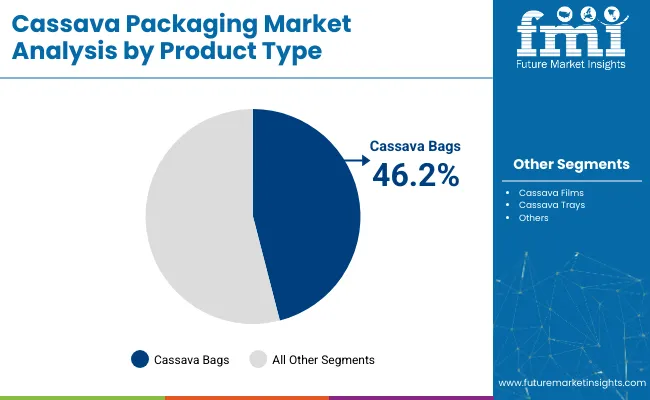

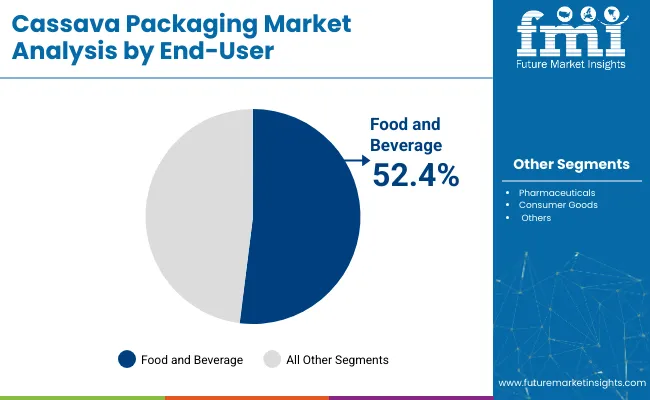

The market has been segmented based on product type, end-user industry, and region. By product type, cassava films, cassava bags, cassava trays, and other variants have been introduced to cater to sustainable packaging needs across primary, secondary, and tertiary packaging formats.

These biodegradable options provide low-carbon, compostable alternatives to petroleum-based plastics. End-user industry segmentation includes food and beverage, pharmaceuticals, consumer goods, and others representing growing interest from environmentally conscious industries aiming to reduce plastic waste and align with circular packaging goals.

Regional segmentation includes North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa to reflect regulatory landscapes, bio economy initiatives, and manufacturing capabilities that influence cassava-based packaging adoption across developed and emerging economies.

The cassava bags segment is projected to dominate the product type category with a 46.2% share in 2025, driven by increasing global demand for biodegradable alternatives to conventional plastic bags. Derived from tapioca starch, cassava-based bags are 100% compostable, non-toxic, and dissolve completely in hot water, making them ideal for short-life packaging in both food and retail sectors.

These bags are increasingly used in supermarkets, convenience stores, takeaways, and e-commerce packaging, replacing polyethylene and polypropylene-based single-use carry bags. Governments and municipalities in Southeast Asia, Latin America, and parts of Africa have endorsed cassava bags as part of national policies to ban or restrict petroleum-based plastics, further fueling their adoption.

In addition to regulatory tailwinds, cassava bags are lightweight, printable, and offer decent tensile strength and moisture resistance, which appeals to both brand owners and eco-conscious consumers. Producers are also innovating by blending cassava starch with natural resins and fibers to enhance flexibility and cost efficiency. As zero-waste retail formats and biodegradable packaging mandates proliferate globally, cassava bags are emerging as the most scalable and commercially viable format in the cassava packaging ecosystem.

The food and beverage segment is forecasted to hold the largest share of 52.4% in the cassava packaging market by 2025, supported by rising demand for clean-label, biodegradable packaging across fresh produce, snacks, beverages, and takeaway items.

Brands in this sector are actively replacing plastic wraps, liners, and pouches with compostable cassava-based alternatives in response to growing pressure from both regulators and environmentally aware consumers. Cassava packaging is increasingly being used for fresh food wrapping, bakery items, single-serve pouches, and dry snack bags. It provides a breathable, low-impact barrier that preserves product freshness while decomposing completely in natural environments without leaving toxic residues.

Sustainable sourcing certifications, plastic tax regulations, and food contact safety compliance have further driven its appeal. Fast food outlets, organic grocers, and beverage manufacturers are leveraging cassava-based solutions as part of ESG commitments and brand storytelling around planet-positive packaging.

The food and beverage industry’s massive packaging volume, combined with its heightened visibility in the public sustainability discourse, positions this segment as the principal driver of cassava packaging demand. With advancements in moisture barrier and printability, cassava packaging is also making inroads into ready-to-eat meals and specialty drink formats, cementing its dominance in the market.

High Production Costs, Limited Industrial-Scale Manufacturing, and Performance Constraints

High production costs for the extraction and processing of biopolymers from cassava hinder the growth of cassava packaging market. They are also much more expensive and less scalable than traditional plastic packaging, since cassava-based alternatives require specialized equipment and enzymatic treatment to create.

For one, the market growth is restrained by lack of industrial-grade manufacturing plants for cassava-based packaging, especially in regions that do not grow it in large amounts. Performance limitations is another challenge, cassava-based materials may not be as durable, moisture-resistant, and heat resistant as traditional plastics, necessitating further production of bio-based polymer to strengthen its structure.

Growth in Eco-Friendly Packaging, Government Support for Plastic-Free Policies, and Biodegradable Innovations

Though there are challenges over the coming years, the cassava packaging market is poised with high growth potential due to the growing consumer awareness for sustainable alternatives, global single-use plastic bags, and technological advancements in bio-degradable material. The cassava-based solutions for eco-friendly packaging are gaining ground through various governments' commitments in this area - needing new solutions for food packaging, shopping bags, e-commerce packaging, and disposable containers.

Ongoing R&D for biodegradable film coatings, water resistant biopolymers, and AI optimized packaging design is furthering the strength, shelf life, and versatility of cassava packaging, making it increasingly competitive across diverse industries including food and beverage, healthcare, and retail.

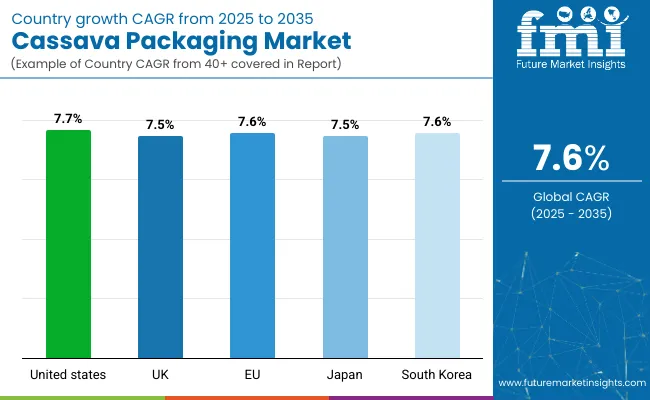

The USA cassava packaging market is anticipated to expand at a significant rate, owing to rise in consumer demand towards sustainable & biodegradable alternative of plastic packaging. Government regulations around single-use plastics alongside corporate sustainability initiatives are driving cassava-based packaging into retail, food service and e-commerce. Besides that, biopolymer tech evolution is further improving the durability and performance of cassava packaging solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.7% |

The demand for cassava packaging is on the rise in the UK as both businesses and consumers move towards sustainable alternatives of traditional plastic packaging. Soaring needs for biodegradable packaging options include rigid implementation of environmental policies such as plastic packaging tax and extended producer responsibility (EPR) regulations. Trends such as the increasing movement towards circular economy principles are also aiding market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 7.5% |

The market for cassava packaging is booming across the European Union owing to strict policies against plastic single-use products and for green packaging material. The shift towards compostable and biodegradable packaging solutions in businesses is further driven by the EU’s Green Deal and the circular economy action plan. Moreover, increasing consumer awareness regarding environmental sustainability is driving the demand for cassava-based packaging in the food, beverage, and consumer goods industries.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 7.6% |

The Japan cassava packaging market is developing steadily as the country strengthens its commitment to reduce plastic waste and promoting biodegradable alternatives. The market is being aided by bio solution manufacturing innovations and measurable customer demand for sustainable materials in food packaging and retail. The growth of the industry is also being aided by government initiatives that help promote eco-friendly substitutes for petroleum-based plastics.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.5% |

Biodegradable packaging solutions, which help in reducing the environmental impact, are gaining momentum with businesses and consumers alike in South Korea leading to the growth of cassava packaging market in the region. The adoption is being driven by government policies to eliminate plastic waste and increase the use of sustainable materials in packaging. Growing eco-conscious consumers and sustainable e-commerce packaging solution providers are another factors propelling the market demand.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.7% |

The demand for packaging materials made of cassava is surging owing to the growing trend of eco-friendly, biodegradable, and plastic-free packaging across extension of the market worldwide. Things like AI-powered material engineering, water-soluble cassava-based bioplastics, and sustainable packaging innovations are being studied to improve durability, ensure decomposition efficiency, and increase production scale.

Biodegradable packaging manufacturers, sustainable raw material developers, and compostable product suppliers are part of the market whose innovations range from the development of cassava-starch polymers to AI-driven quality control and regulatory-compliant green packaging solutions.

The overall market size for cassava packaging market was USD 2.1 billion in 2025.

Cassava packaging market is expected to reach USD 4.3 billion in 2035.

The demand for Cassava Bags is expected to rise due to increasing environmental concerns, growing regulations on plastic usage, and rising consumer preference for biodegradable and sustainable packaging solutions.

The top 5 countries which drives the development of cassava packaging market are USA, UK, Europe Union, Japan and South Korea.

Containers & Clamshells and Ready-to-Eat Meals to command significant share over the assessment period.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cassava Bags Market Growth – Demand & Forecast 2025 to 2035

Cassava Flour Market Trends – Size, Share & Forecast 2025-2035

Packaging Supply Market Size and Share Forecast Outlook 2025 to 2035

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Size and Share Forecast Outlook 2025 to 2035

Packaging Jar Market Forecast and Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Packaging Burst Strength Test Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tapes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

Packaging Labels Market Size and Share Forecast Outlook 2025 to 2035

Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Packaging Resins Market Size and Share Forecast Outlook 2025 to 2035

Packaging Inspection Systems Market Size and Share Forecast Outlook 2025 to 2035

Packaging Design And Simulation Technology Market Size and Share Forecast Outlook 2025 to 2035

Packaging Suction Cups Market Size and Share Forecast Outlook 2025 to 2035

Packaging Straps and Buckles Market Size and Share Forecast Outlook 2025 to 2035

Packaging Coating Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA