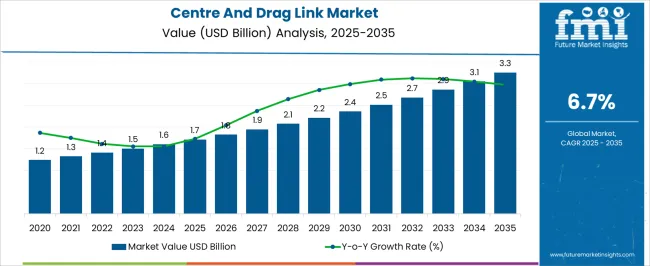

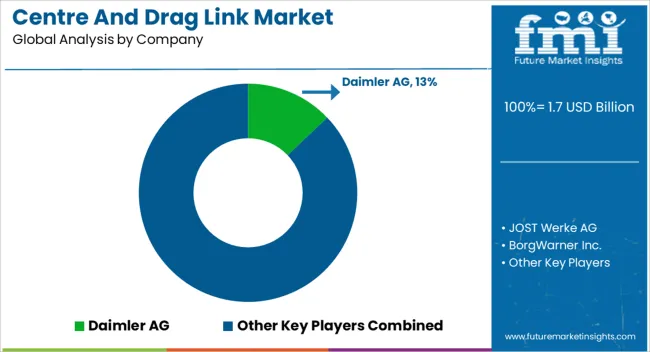

The Centre And Drag Link Market is estimated to be valued at USD 1.7 billion in 2025 and is projected to reach USD 3.3 billion by 2035, registering a compound annual growth rate (CAGR) of 6.7% over the forecast period.

| Metric | Value |

|---|---|

| Centre And Drag Link Market Estimated Value in (2025 E) | USD 1.7 billion |

| Centre And Drag Link Market Forecast Value in (2035 F) | USD 3.3 billion |

| Forecast CAGR (2025 to 2035) | 6.7% |

The centre and drag link market is experiencing steady growth, driven by rising demand for reliable steering mechanisms in commercial vehicles, heavy-duty trucks, and specialized off-road applications. Increasing vehicle production, particularly in the medium and heavy commercial vehicle segment, is creating consistent demand for strong and durable linkages that can sustain high loads and rough operating conditions.

Growing focus on driver safety and vehicle stability is influencing manufacturers to invest in advanced materials and improved designs that enhance durability and reduce wear over time. Expanding applications in construction, mining, and off-road vehicles are also contributing to the market’s expansion, as these vehicles require steering components with greater resilience.

Regulatory pressures on road safety are further strengthening the need for high-quality centre and drag link assemblies As global freight movement increases and commercial vehicle fleets expand, the market outlook remains positive, with innovations in design and material strength expected to enhance long-term growth and provide opportunities for manufacturers to capture wider industry adoption.

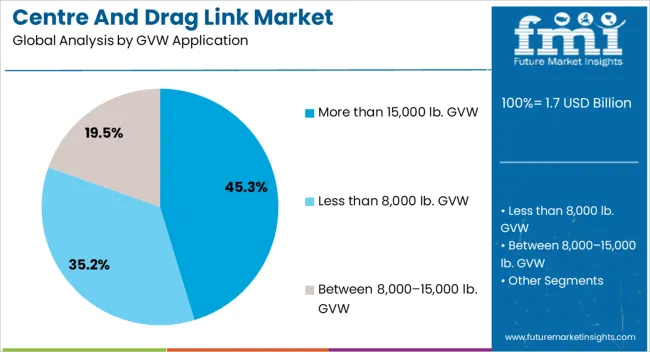

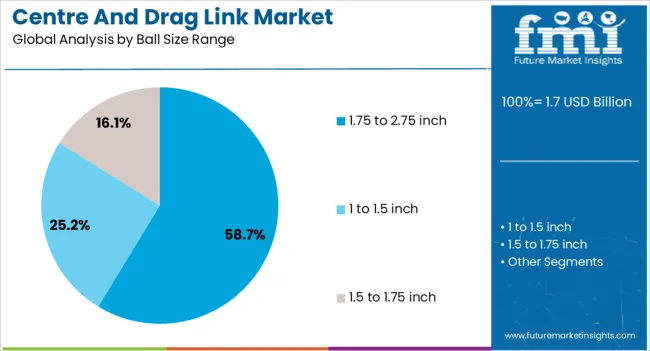

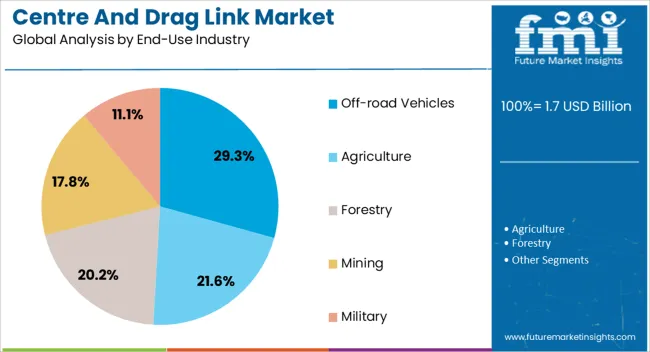

The centre and drag link market is segmented by gvw application, ball size range, end-use industry, product type, and geographic regions. By gvw application, centre and drag link market is divided into More than 15,000 lb. GVW, Less than 8,000 lb. GVW, and Between 8,000–15,000 lb. GVW. In terms of ball size range, centre and drag link market is classified into 1.75 to 2.75 inch, 1 to 1.5 inch, and 1.5 to 1.75 inch. Based on end-use industry, centre and drag link market is segmented into Off-road Vehicles, Agriculture, Forestry, Mining, and Military. By product type, centre and drag link market is segmented into Heavy-Duty Vehicle, Light-Duty Vehicle, and Medium-Duty Vehicle. Regionally, the centre and drag link industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The more than 15,000 lb. GVW application segment is projected to hold 45.3% of the centre and drag link market revenue share in 2025, making it the leading application area. This dominance is being supported by the growing production of heavy-duty trucks and buses that demand robust steering linkages capable of handling high weight and load stresses.

Vehicles operating in long-haul freight, construction, and industrial applications are placing increased emphasis on reliability, as steering component failures can lead to safety risks and costly downtime. The ability of centre and drag link assemblies in this category to withstand high torque and operational fatigue has reinforced their adoption across multiple regions.

Rising demand for advanced heavy-duty vehicles in emerging economies, combined with investments in logistics and infrastructure development, is further contributing to the segment’s growth The segment’s leadership is also being enhanced by the focus of manufacturers on providing reinforced components that meet global quality and safety standards, ensuring superior performance and longevity in demanding environments.

The 1.75 to 2.75 inch ball size range segment is anticipated to account for 58.7% of the centre and drag link market revenue share in 2025, making it the dominant ball size category. This dominance is being driven by its widespread adoption in medium and heavy-duty commercial vehicles where durability and precision are essential. The ball size range ensures effective load distribution and superior strength, reducing wear and tear while maintaining consistent steering control.

Its compatibility with multiple vehicle classes, including trucks, buses, and industrial vehicles, has made it the preferred choice among manufacturers and fleet operators. Increasing vehicle load capacities and stringent requirements for steering performance are encouraging the use of larger and more resilient ball sizes.

The segment is also benefiting from advancements in forging and machining techniques, which enhance durability and reduce failure risks As the demand for reliable and cost-efficient steering components continues to rise, this ball size range is expected to retain its leadership, supported by its proven adaptability and high-performance characteristics.

The off-road vehicles end-use industry segment is expected to capture 29.3% of the centre and drag link market revenue share in 2025, positioning it as the leading end-use industry. This leadership is being reinforced by the growing demand for vehicles in sectors such as construction, mining, agriculture, and defense, where performance under challenging terrain conditions is critical. Off-road vehicles require steering components with higher durability, shock resistance, and load-bearing capacity, which centre and drag link assemblies are well positioned to deliver.

The segment is also gaining momentum from increasing investments in large-scale infrastructure and mining projects, where specialized vehicles are deployed extensively. Rising consumer interest in recreational off-road vehicles is further contributing to demand, particularly in regions with growing adventure and sports tourism.

Manufacturers are focusing on designing reinforced and customizable steering solutions tailored for off-road conditions, ensuring superior maneuverability and safety As demand for durable and high-performance off-road vehicles continues to expand, the segment’s contribution to overall market revenue is expected to remain strong and steadily increase over the forecast period.

The centre and drag links relate to the drop and steering gearbox to the steering wheel. The rising automotive industry, along with the transformation of steering technology, is fueling the sales of centre and drag links.

The centre and drag links play a crucial role in the vehicle balancing as it wanders or pulls to the left or right once it is bad or loose, ending up as the reason why tires wear unevenly. The vehicle loses alignment once traveling down the road. Thus, the demand for centre and drag links has increased.

Heavy-duty vehicles with advanced power steering adopt the centre and drag links that are flexible with different steering technology. A rise in urbanization and industrialization have been two strong factors for the sales of centre and drag links. The engineering companies work on the strength and longer shelf life of the center and drag link.

Vendors use forged steel composition results for a better and stronger component. Advanced centre and drag links come with a bearing design that enables grease to flow through so that the friction gets reduced around the stud. This gives the centre and drags link strength and stability.

With an increasing end-user inclination towards better and more efficient vehicle components, vehicle component manufacturers need to design products meeting challenges, especially for commercial vehicles. The new supercars involve advanced machinery that further requires string response and integration between the centre and steering drag and drag, expanding the centre and steering drag link market size.

End users try to get it installed for the like-new steering response that it provides with tighter tolerances and conventional cover plate design, delivering more durability and life. Thus, people get it installed for lighter steering with an enhanced response. With the developing automotive infrastructure in emerging economies such as China and India, new outlets and brands have started producing spare parts for different automobiles, such as centre and drag links.

The producers make sure that there is 100% integration between the steering drag and track rods to provide and enhance the steering handling experience for the end users. However, alternative technology and the advent of electric vehicles have slowed down the growth of the centre and drag link market.

Center link is used for transmission of motion from inner tie rods to pitman arm on both sides of a vehicle as compared to center link, which connects to an idler arm. While driving, center link allows the driver to turn front wheels in desired direction. Center and drag link assemblies offer smooth functioning of the vehicle and result in less vibrates and wobbles, thus easy to drive.

Center and drag link assemblies are essential components of steering wheel, which is intended to maintain front wheel and front axle lineup. Center and drag link manufacturers are keen on developing products, which overcome challenges such as extreme temperatures, uneven terrain, bad ground conditions, safety and reliability.

With increasing end user inclination towards better and efficient vehicle components, the vehicle component manufacturer's need to design products meeting aforementioned challenges especially for commercial vehicle vehicles

Center and drag link market is segmented on the basis of Gross Vehicle Weight (GVW), ball size range, end use industry and product type. Based on the type of GVW applications, the market is segmented into less than 8,000 lb. GVW, between 8,000-15,000 lb. GVW, and more than 15,000 GVW.

On the basis of ball size type, the segmentation includes 1 to 1.5 inch, 1.5 to 1.75 inch and 1.75 to 2.75 inch. Center and Drag link assemblies are used across various end use industries including agriculture, forestry, off-road vehicles, mining, and military. The segmentation is also done by the product type, which majorly includes light-duty vehicle, medium-duty vehicle and heavy-duty vehicle.

Geographically, the center and drag link market is segmented into seven regions namely North America, Western Europe, Japan, Asia Pacific Excluding Japan, Middle East and Africa and Latin America. Also, Asian countries offer low-cost labour, the developed products are less expensive as compared to those manufactured in developed regions of the world.

Technological advancements in automotive industry is one of prominent factors driving the demand for development of more durable and strong products such as center and drag links. Moreover, due to fragmented nature of market, number of players in the center and drag link market has increased in recent years.

This has further led to improved product development at affordable prices, which is fuelling the market growth. In addition, growing automotive industry particularly across countries such as India and China is further expected to increase demand for steering wheel components such as center and drag link among the end-users.

Manufacturers of steering wheel system are focused on extensive research and development (R&D) in order to achieve a defined top-line growth. Apart from R&D gaining significant share in the aftermarket is a concern for manufacturers in North America.

Thus, improvement in stock keeping units (SKUs) with an aim to increase coverage of products for different vehicle models might offer surge in unit shipment sales and result in competitive pricing. Furthermore, this is predicted to lead towards enhanced product availability at affordable prices for end users particularly in North America and increase in market share of respective companies.

However, large number of suppliers does lead to increased product availability, which results in low quality and less efficiency and thus, hampering the market growth of high-end center and drag link assemblies.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

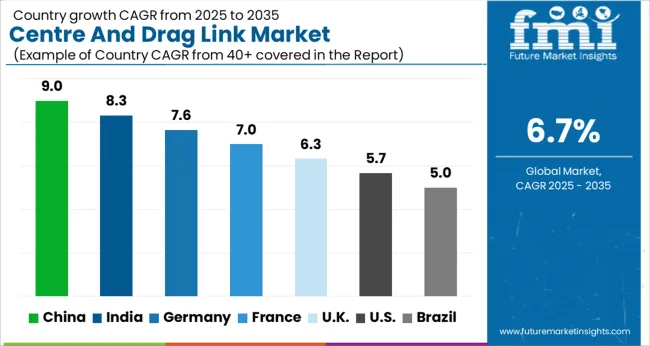

| Country | CAGR |

|---|---|

| China | 9.0% |

| India | 8.3% |

| Germany | 7.6% |

| France | 7.0% |

| UK | 6.3% |

| USA | 5.7% |

| Brazil | 5.0% |

The Centre And Drag Link Market is expected to register a CAGR of 6.7% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 9.0%, followed by India at 8.3%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 5.0%, yet still underscores a broadly positive trajectory for the global Centre And Drag Link Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 7.6%. The USA Centre And Drag Link Market is estimated to be valued at USD 599.2 million in 2025 and is anticipated to reach a valuation of USD 1.0 billion by 2035. Sales are projected to rise at a CAGR of 5.7% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 84.1 million and USD 49.4 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.7 Billion |

| GVW Application | More than 15,000 lb. GVW, Less than 8,000 lb. GVW, and Between 8,000–15,000 lb. GVW |

| Ball Size Range | 1.75 to 2.75 inch, 1 to 1.5 inch, and 1.5 to 1.75 inch |

| End-Use Industry | Off-road Vehicles, Agriculture, Forestry, Mining, and Military |

| Product Type | Heavy-Duty Vehicle, Light-Duty Vehicle, and Medium-Duty Vehicle |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Daimler AG, JOST Werke AG, BorgWarner Inc., WABCO Holdings Inc., Magna International Inc., ZF Friedrichshafen AG, Hendrickson USA, LLC, Meritor, Inc., Bendix Commercial Vehicle Systems LLC, GKN PLC, Schaeffler AG, Triumph Group, Inc., CurtissWright Corporation, Continental AG, and Raven Industries, Inc. |

The global centre and drag link market is estimated to be valued at USD 1.7 billion in 2025.

The market size for the centre and drag link market is projected to reach USD 3.3 billion by 2035.

The centre and drag link market is expected to grow at a 6.7% CAGR between 2025 and 2035.

The key product types in centre and drag link market are more than 15,000 lb. gvw, less than 8,000 lb. gvw and between 8,000–15,000 lb. gvw.

In terms of ball size range, 1.75 to 2.75 inch segment to command 58.7% share in the centre and drag link market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Centre High Mount Stop Lamps Market

IP Centrex Platforms Market

Data Centre Rack Server Market Size and Share Forecast Outlook 2025 to 2035

Data Centre Colocation Market Size and Share Forecast Outlook 2025 to 2035

Data Centre UPS Market Size and Share Forecast Outlook 2025 to 2035

Call Centre Market Analysis - Size, Share, and Forecast 2025 to 2035

Data Centre Security Market Report – Trends & Forecast 2018-2028

Security Operation Centre as a Service Market Size and Share Forecast Outlook 2025 to 2035

Family/Indoor Entertainment Centres Market Report – Forecast 2017-2027

Anderson Cascade Impactor Market Size and Share Forecast Outlook 2025 to 2035

Andersen-Tawil Syndrome Treatment Market Trends - Growth & Future Prospects 2025 to 2035

Andro Supplements Market

Handheld Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

Sandwich Panel System Market Size and Share Forecast Outlook 2025 to 2035

Hand Tools Market Size and Share Forecast Outlook 2025 to 2035

Land Survey Equipment Market Size and Share Forecast Outlook 2025 to 2035

Handloom Product Market Size and Share Forecast Outlook 2025 to 2035

Band File Sander Belts Market Size and Share Forecast Outlook 2025 to 2035

Handheld XRF Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Sand Abrasion Tester Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA