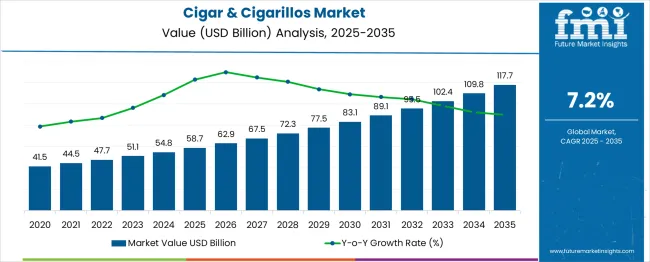

The global cigar & cigarillos market is estimated to reach USD 58.7 billion in 2025 and is anticipated to expand to USD 117.7 billion by 2035, expanding at a CAGR of 7.2% and an absolute increase of USD 58.98 billion over the forecast period. The year-on-year (YoY) growth indicates steady gains, with the market rising from USD 41.5 billion in 2020, USD 44.5 billion in 2021, USD 47.7 billion in 2022, USD 51.1 billion in 2023, USD 54.8 billion in 2024, and reaching USD 58.7 billion in 2025.

Revenues are likely to increase to USD 62.9 billion in 2026, USD 67.5 billion in 2027, USD 72.3 billion in 2028, USD 77.5 billion in 2029, and USD 83.1 billion in 2030. The latter half of the forecast period is expected to see the market further expanding to USD 89.1 billion in 2031, USD 95.5 billion in 2032, USD 102.4 billion in 2033, USD 109.8 billion in 2034, and USD 117.7 billion in 2035. This growth reflects sustained consumer demand for premium tobacco products, lifestyle-oriented smoking experiences, and expanding flavor options.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 58.7 billion |

| Forecast Value in (2035F) | USD 117.7 billion |

| Forecast CAGR (2025 to 2035) | 7.2% |

From 2030 to 2035, the market is projected to accelerate, rising from USD 83.1 billion to USD 117.7 billion, contributing an additional USD 34.6 billion to the total growth, representing nearly 60% of the decade-long expansion. This phase is anticipated to witness the integration of advanced manufacturing techniques, higher-quality tobacco leaf selection, and innovation in flavor profiles to appeal to luxury and collector-oriented segments. The growing adoption of premium smoking experiences as social and celebratory rituals is expected to reinforce market expansion. Emerging markets in Asia-Pacific and Latin America are likely to see heightened consumer interest due to increasing disposable incomes and lifestyle-driven consumption patterns.

Historical growth between 2020 and 2025 laid the foundation for the market, with revenues increasing from USD 41.5 billion to USD 58.7 billion. This early-stage expansion was driven by growing appreciation for premium cigars, rising social smoking trends, and the influence of lifestyle branding across media channels. Manufacturers responded by diversifying their portfolios with limited edition and specialty products, creating aspirational value for consumers. The combination of brand positioning, quality improvements, and increasing international demand has set the stage for sustained growth over the 2025–2035 horizon, providing ample opportunities for market participants to capture emerging revenue streams while navigating evolving regulatory and cultural dynamics.

Market expansion is being supported by the increasing consumer interest in premium smoking experiences and the corresponding demand for high-quality tobacco products with distinct flavor profiles. Modern consumers are increasingly focused on lifestyle products that can provide unique sensory experiences, social enjoyment, and status symbol positioning. The proven appeal of cigars and cigarillos in providing relaxation and social bonding makes them preferred choices in premium tobacco segments across mature markets.

The growing focus on craftsmanship and artisanal production is driving demand for premium cigars made with traditional techniques and high-grade tobacco leaves from renowned growing regions. Consumer preference for products that combine heritage craftsmanship with modern flavor innovations is creating opportunities for diverse product offerings. The rising influence of lifestyle trends and luxury positioning is also contributing to increased product adoption across different demographic segments and income levels.

The market is segmented by product outlook, flavor outlook, distribution channel outlook, and region. By product outlook, the market is divided into mass and premium categories. Based on flavor outlook, the market is categorized into flavored and unflavored variants. In terms of distribution channel outlook, the market is segmented into offline and online channels. Regionally, the market is divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

The mass segment is projected to account for 78% of the cigar & cigarillos market in 2025, reaffirming its position as the category's dominant product category. Consumers in this segment prioritize accessibility, affordability, and consistent quality over ultra-premium positioning. Mass-produced cigars and cigarillos offer reliable smoking experiences at competitive price points, making them appealing to regular smokers and casual consumers seeking enjoyable tobacco products without premium pricing.

This segment forms the foundation of market volume, as it represents the most accessible entry point for new consumers and provides consistent revenue streams for manufacturers. Established production processes and efficient distribution networks continue to strengthen market presence across diverse retail channels. With consumer demand for affordable yet quality tobacco experiences, mass products align with both value-conscious purchasing and regular consumption patterns. Its broad market appeal across demographics ensures dominance, making it the central volume driver of cigar and cigarillo demand.

Flavored variants are projected to represent 52% of cigar & cigarillos demand in 2025, underscoring their role as the preferred choice for consumers seeking enhanced smoking experiences. Consumers gravitate toward flavored products for their aromatic profiles, diverse taste options, and ability to provide more approachable entry points into cigar consumption. Positioned as innovative and appealing alternatives, flavored cigars offer both traditional tobacco satisfaction and modern sensory enhancements through various flavor infusions and aromatic treatments.

The segment is supported by the rising popularity of diverse flavor profiles, where flavored variants play a central role in product differentiation strategies. Manufacturers are increasingly combining traditional tobacco craftsmanship with innovative flavor technologies, enhancing appeal and expanding consumer base beyond traditional cigar demographics. As taste-conscious consumers prioritize sensory variety and unique experiences, flavored cigars and cigarillos will continue to dominate market preference, reinforcing their growth positioning within the premium tobacco market.

The cigar & cigarillos market is advancing steadily due to increasing consumer interest in premium tobacco experiences and growing demand for lifestyle smoking products. The market faces challenges, including regulatory restrictions, health awareness campaigns, and competition from alternative tobacco products. Innovation in flavor development and premium positioning continue to influence product development and market expansion patterns.

The cigar and cigarillos market is experiencing growth driven by increasing preference among premium consumers seeking luxury smoking experiences. High-income groups and enthusiasts are attracted to premium tobacco blends, exclusive flavors, and handcrafted products. Consumer interest in aged, limited-edition, and imported cigars has increased brand loyalty and repeat purchases. Marketing campaigns focusing on lifestyle, heritage, and craftsmanship further enhance appeal. Retailers and specialty stores are promoting premium offerings through sampling events, exclusive lounges, and subscription services.

Flavor Innovation And Product Diversification Trends Manufacturers are focusing on flavor innovation and product diversification to attract new consumers and retain existing customers. Cigarillos and cigars are now available in a variety of flavors, including fruity, spiced, and herbal options, appealing to younger adults and casual smokers. Limited-edition and seasonal variants generate excitement and encourage repeat purchases. Product diversification also includes variations in size, strength, and packaging formats, catering to different consumer preferences.

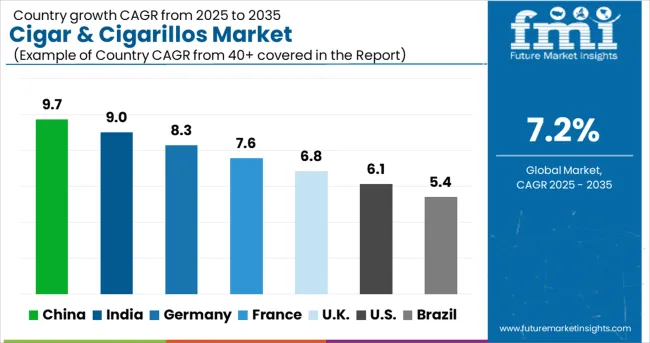

| Countries | CAGR (2025-2035) |

|---|---|

| China | 9.7% |

| India | 9% |

| Germany | 8.3% |

| France | 7.6% |

| UK | 6.8% |

| USA | 6.1% |

| Brazil | 5.4% |

The global cigar and cigarillos market is projected to grow at a CAGR of 7.0% between 2025 and 2035. China leads this expansion with a 9.7% CAGR, supported by rising disposable income, increasing premium product consumption, and growing acceptance of luxury tobacco products. India follows at 9.0%, driven by expanding urban population, cultural adoption of cigar usage, and growth in high-end retail channels. Germany shows growth at 8.3%, emphasizing premium product offerings and rising consumer awareness of cigar quality. France records 7.6%, supported by tradition in cigar consumption and increasing tourism-driven sales. The UK grows at 6.8%, focusing on lifestyle branding and high-end cigar lounges. The USA stands at 6.1%, reflecting steady demand for premium and flavored cigar lines, while Brazil follows at 5.4%, influenced by regulatory frameworks and emerging consumer trends.

The report covers an in-depth analysis of 40+ countries, top-performing countries are highlighted below.

China cigar and cigarillos market is projected to grow at a CAGR of 9.7% from 2025 to 2035, driven by rising disposable incomes, changing lifestyle habits, and increasing urban demand for premium tobacco products. The market is experiencing strong adoption in tier-1 and tier-2 cities, supported by specialty tobacco stores, lounges, and duty-free retail outlets. Imported cigars from the Caribbean and Europe are increasingly preferred by affluent consumers, while domestic manufacturers are focusing on premium product lines to capture urban demand. Social acceptance of cigar consumption in corporate and leisure environments is rising, contributing to higher sales. Marketing initiatives emphasizing luxury and lifestyle positioning are influencing consumer perception. E-commerce platforms and cross-border retail are further expanding accessibility, making cigars and cigarillos more widely available to urban and semi-urban consumers.

India cigar and cigarillos market is expected to grow at a CAGR of 9% from 2025 to 2035, fueled by a growing urban population, rising disposable incomes, and increasing interest in premium tobacco products. Imported cigars from Cuba, the Dominican Republic, and Nicaragua are gaining traction among affluent consumers. Specialty cigar lounges, tobacco clubs, and luxury retail outlets are contributing to higher visibility and accessibility. Awareness of quality and brand reputation is shaping purchasing decisions, while domestic manufacturers are focusing on premium and mid-tier products. Social and corporate occasions, gifting culture, and leisure consumption are further driving growth. Retail expansion through e-commerce platforms and high-end stores is enabling convenient access to both imported and domestic brands. Government regulations on tobacco advertising and packaging are shaping marketing strategies, encouraging sophisticated branding and experiential promotions.

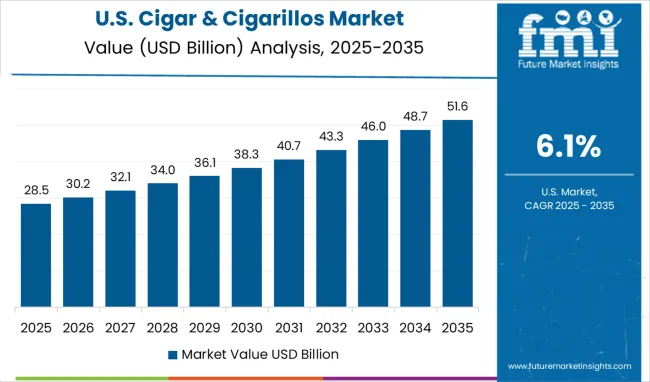

The USA cigar and cigarillos market is expected to grow at a CAGR of 6.1% during the forecast period, supported by rising consumer demand for premium tobacco products, increasing disposable incomes, and an established culture of cigar consumption. Retail presence in tobacconists, lounges, and luxury outlets, along with online platforms, is enhancing product accessibility. Imported cigars from the Caribbean and Latin America dominate the premium market, while domestic manufacturers focus on mid-tier and value segments. Social occasions, leisure, gifting, and professional events continue to drive regular consumption. Marketing strategies focus on lifestyle positioning, product quality, and brand heritage. Regulatory and taxation policies impact pricing and product positioning, prompting manufacturers to emphasize authenticity, craftsmanship, and experiential marketing to maintain consumer engagement.

Germany cigar and cigarillos market is estimated to grow at a CAGR of 8.3% from 2025 to 2035, reflecting steady adoption driven by a mature consumer base and cultural appreciation of premium tobacco products. Retail and specialty tobacco stores, lounges, and clubs are supporting consistent sales of imported and domestic cigars. Consumers are increasingly seeking high-quality products with rich flavors and authentic craftsmanship, making brand reputation and origin important purchase considerations. Social occasions, gifting, and leisure use contribute to recurring consumption. E-commerce and online specialty platforms are complementing traditional retail distribution, offering convenient access to a wide range of premium products. German consumers are also influenced by regulatory compliance, packaging quality, and authenticity certifications when making purchasing decisions, ensuring trust in imported and domestic cigar offerings.

The UK cigar and cigarillos market is projected to grow at a CAGR of 6.8% from 2025 to 2035, shaped by a combination of cultural traditions, premium product preferences, and leisure consumption trends. Specialty tobacconists, luxury retail outlets, and lounges support widespread availability, particularly for imported cigars from Cuba, the Dominican Republic, and Honduras. Consumers increasingly prioritize authenticity, flavor variety, and craftsmanship when purchasing premium cigars. Leisure consumption, gifting, and professional social occasions are driving repeat purchases. E-commerce platforms are expanding market reach, complementing traditional retail channels. Regulatory requirements, including strict labeling, packaging, and taxation, influence marketing strategies and brand positioning. Despite regulations, premium product demand continues to rise due to social, professional, and lifestyle-oriented consumption patterns.

France cigar and cigarillos market is expected to grow at a CAGR of 7.6% between 2025 and 2035, supported by urban consumers’ preference for premium and luxury tobacco products. Cigars are widely consumed during social gatherings, professional events, and leisure occasions, establishing a consistent market demand. Imported brands from Europe, the Caribbean, and Latin America dominate premium segments, while domestic players focus on mid-range offerings. Retail presence in specialty tobacconists, high-end stores, and lounges ensures accessibility to discerning consumers. Awareness of product origin, craftsmanship, and flavor profiles is shaping purchase behavior. Government regulations regarding tobacco taxation, packaging, and advertising influence brand positioning, prompting companies to emphasize premium experiences and lifestyle marketing. E-commerce expansion is also supporting access to imported and domestic products, particularly among younger urban professionals.

Brazil cigar and cigarillos market is projected to grow at a CAGR of 5.4% from 2025 to 2035, influenced by growing urban disposable incomes, leisure-driven consumption, and rising awareness of premium tobacco products. Specialty tobacconists, lounges, and high-end retail outlets are facilitating access to imported cigars, particularly from the Caribbean, while domestic producers focus on mid-range options. Social occasions, leisure use, and gifting are key drivers of consumption, and emerging middle-class segments are increasingly seeking premium products. E-commerce platforms are expanding their reach beyond major urban centers, providing convenience and variety. Regulatory frameworks, including tobacco taxation, labeling, and import policies, influence product pricing and market positioning. Despite regulatory constraints, premium and imported cigars continue to drive the market, supported by lifestyle-focused marketing and brand awareness campaigns.

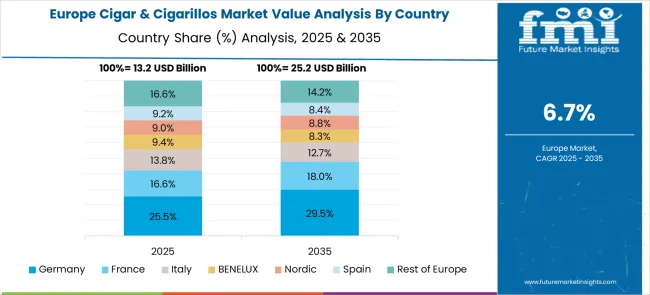

The cigar & cigarillos market in Europe demonstrates mature development across major economies with Germany showing a strong presence through its established tobacco culture and consumer appreciation for premium smoking products, supported by manufacturers leveraging traditional craftsmanship to develop high-quality cigars and cigarillos that cater to discerning smokers seeking authentic tobacco experiences and social enjoyment.

France represents a significant market driven by its luxury lifestyle heritage and sophisticated understanding of premium tobacco products, with companies pioneering artisanal cigars that combine French luxury positioning with traditional tobacco craftsmanship for enhanced smoking experiences and premium market positioning.

The UK exhibits considerable growth through its embrace of premium tobacco products and lifestyle smoking culture, with specialty retailers and premium brands leading the market for high-quality cigars and cigarillos with comprehensive consumer education about tobacco appreciation and smoking traditions. Germany shows expanding interest in premium tobacco solutions, particularly in artisanal cigar formulations targeting lifestyle consumers and social smoking experiences.

The cigar and cigarillos market is highly competitive, driven by established tobacco companies, specialty manufacturers, and emerging craft tobacco players seeking to capture market share through product differentiation and brand loyalty. Companies are focusing on advanced manufacturing technologies, premium tobacco sourcing, and luxury packaging to deliver authentic, high-quality experiences for consumers. Lifestyle-driven marketing, flavor innovation, and strategic distribution expansion have become central to strengthening product portfolios and enhancing market visibility. Attention to craftsmanship, regional preferences, and consumer trends is shaping the evolution of both premium and mass-market cigar offerings.

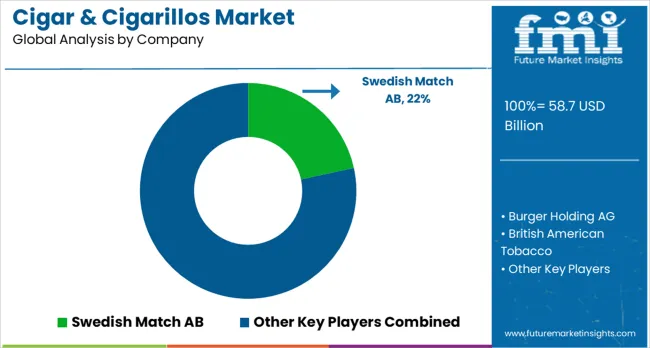

Swedish Match leads the market with a 22% global value share, offering premium cigar and cigarillo formulations that emphasize traditional craftsmanship, high-quality tobacco, and refined flavor profiles. Burger Holding AG is recognized for its comprehensive tobacco portfolio, European market leadership, and traditional manufacturing expertise that ensures product consistency. British American Tobacco leverages its globally recognized brands, focusing on product reliability and consumer satisfaction, while Gurkha Cigars positions itself within the luxury segment, sourcing premium tobacco for discerning consumers seeking exclusivity and superior smoking experiences.

Global players such as JT International SA and Imperial Brands Plc, including Habanos S.A., provide wide-ranging cigar offerings across multiple price tiers and distribution channels, catering to diverse consumer segments. Oettinger Davidoff AG emphasizes premium positioning, heritage, and artisanal tobacco craftsmanship, targeting affluent and connoisseur markets. Scandinavian Tobacco Group focuses on specialty products that align with regional preferences and traditional production methods. Philip Morris International Inc. and Swisher International Inc. address mass-market demand by offering accessible products with consistent quality, ensuring brand loyalty among mainstream consumers. Market competition continues to be driven by innovation in flavor profiles, packaging appeal, and the ability to balance premium and mass-market strategies, ensuring steady growth and sustained consumer engagement across global markets.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 58.7 billion |

| Product Outlook | Mass, Premium |

| Flavor Outlook | Flavored, Unflavored |

| Distribution Channel Outlook | Offline, Online |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia, and 40+ countries |

| Key Companies Profiled | Swedish Match, Burger Holding AG, British American Tobacco, Gurkha Cigars, JT International SA, Imperial Brands Plc (Habanos S.A.), Oettinger Davidoff AG, Scandinavian Tobacco Group, Philip Morris International Inc., and Swisher International Inc. |

| Additional Attributes | Dollar sales by tobacco type and product positioning, regional demand trends, competitive landscape, buyer preferences for flavored versus traditional products, integration with premium lifestyle positioning, innovations in flavor development, traditional manufacturing techniques, and tobacco sourcing practices |

The global cigar & cigarillos market is estimated to be valued at USD 58.7 billion in 2025.

The market size for the cigar & cigarillos market is projected to reach USD 117.7 billion by 2035.

The cigar & cigarillos market is expected to grow at a 7.2% CAGR between 2025 and 2035.

The key product types in cigar & cigarillos market are mass and premium.

In terms of flavor outlook , flavored segment to command 51.8% share in the cigar & cigarillos market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cigarette Butt Market Size and Share Forecast Outlook 2025 to 2035

Cigarette Filters Market Size and Share Forecast Outlook 2025 to 2035

Cigarette Packaging Material Market Size and Share Forecast Outlook 2025 to 2035

Cigarette Making Equipment Market Size and Share Forecast Outlook 2025 to 2035

Cigarette Inner Liner Market Size and Share Forecast Outlook 2025 to 2035

Cigarette Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Cigarette Packaging Machine Manufacturers

Global Cigarette Paper Market Analysis – Growth & Forecast 2024-2034

Premium Cigarette Market Growth – Demand & Industry Outlook to 2035

Smokeless Cigarettes Market Trends – Growth & Outlook 2025 to 2035

Automotive Cigarette Lighters Market

Disposable E-Cigarettes Market Size and Share Forecast Outlook 2025 to 2035

Flavor Capsule Cigarette Market Analysis - Size, Share, and Forecast 2025 to 2035

Flavor Capsule Cigarettes Market

Liquor Flavored Cigars Market

Demand For Flavor Capsule Cigarette Products in EU Size and Share Forecast Outlook 2025 to 2035

R & D Cloud Collaboration Market Size and Share Forecast Outlook 2025 to 2035

US & Canada Sports & Athletic Insoles Market Trends - Growth & Forecast 2024 to 2034

Gas & Dual-Fuel Injection Systems Market Size and Share Forecast Outlook 2025 to 2035

ADC & DAC In Quantum Computing Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA