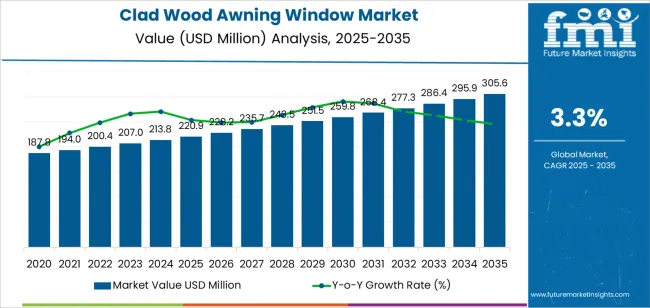

The global clad wood awning window market is valued at USD 220.9 million in 2025. It is slated to reach USD 305.7 million by 2035, recording an absolute increase of USD 224.9 million over the forecast period. This translates into a total growth of 278.5%, with the market forecast to expand at a compound annual growth rate (CAGR) of 3.3% between 2025 and 2035. The overall market size is expected to grow by nearly 3.8X during the same period, supported by increasing demand for energy-efficient window solutions across residential construction, growing adoption of clad wood awning windows in premium home renovation and commercial building applications, and rising emphasis on weather resistance and architectural aesthetics across residential, commercial, and institutional building sectors.

Between 2025 and 2030, the clad wood awning window market is projected to expand from USD 220.9 million to USD 130.8 million, resulting in a value increase of USD 50.0 million, which represents 22.2% of the total forecast growth for the decade. This phase of development will be shaped by increasing residential construction quality standards and energy efficiency requirements, rising adoption of premium window systems in home renovation projects, and growing demand for durable exterior cladding solutions in commercial building applications. Window manufacturers and building product suppliers are expanding their clad wood awning window capabilities to address the growing demand for weather-resistant and aesthetically appealing window solutions that ensure building performance and occupant comfort.

From 2030 to 2035, the market is forecast to grow from USD 130.8 million to USD 305.7 million, adding another USD 174.9 million, which constitutes 77.8% of the overall ten-year expansion. This period is expected to be characterized by the expansion of green building certification programs requiring high-performance window systems, the development of advanced cladding materials and thermal break technologies, and the growth of specialized applications for coastal construction and extreme weather environments. The growing adoption of sustainable building practices and lifecycle cost analysis will drive demand for clad wood awning windows with enhanced durability features and environmental performance credentials.

Between 2020 and 2025, the clad wood awning window market experienced steady growth, driven by increasing residential building quality standards and growing recognition of clad wood awning windows as essential components for enhancing building envelope performance and architectural character across residential and commercial construction applications. The market developed as architects and builders recognized the potential for clad wood awning window technology to combine natural wood aesthetics with low-maintenance exterior durability, improve ventilation control, and support energy efficiency objectives while meeting stringent weather resistance requirements. Technological advancement in cladding materials and weather sealing began emphasizing the importance of maintaining thermal performance and moisture protection in challenging climate conditions.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 220.9 million |

| Forecast Value in (2035F) | USD 305.7 million |

| Forecast CAGR (2025 to 2035) | 3.3% |

Market expansion is being supported by the increasing global demand for premium window solutions driven by residential renovation activity and growing homeowner preference for low-maintenance building products, alongside the corresponding need for advanced window systems that can enhance energy efficiency, enable weather-protected ventilation, and maintain architectural authenticity across residential construction, commercial building, and institutional facility applications. Builders and homeowners are increasingly focused on implementing clad wood awning window solutions that can improve building envelope performance, reduce maintenance requirements, and provide consistent weather resistance in diverse climate conditions.

The growing emphasis on energy efficiency and sustainable building practices is driving demand for clad wood awning windows that can support green building certification, enable natural ventilation strategies, and ensure comprehensive thermal performance. Architects' preference for window products that combine interior wood aesthetics with exterior durability and operational functionality is creating opportunities for innovative clad wood awning window implementations. The rising influence of coastal construction requirements and extreme weather preparedness is also contributing to increased adoption of clad wood awning windows that can provide superior weather resistance without compromising design flexibility or natural material character.

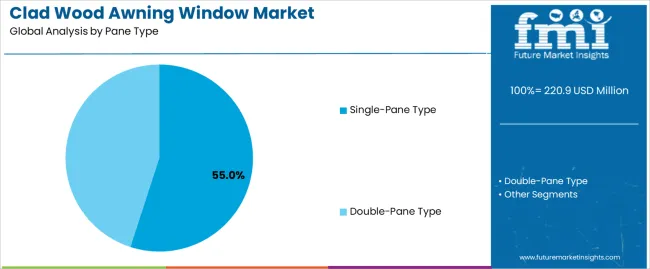

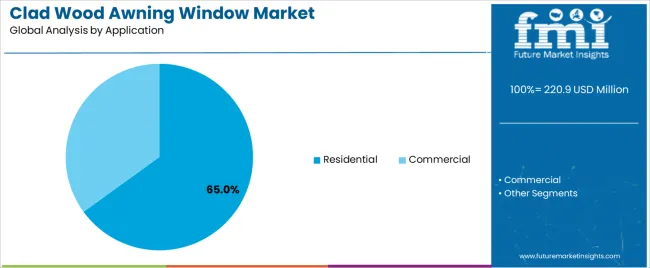

The market is segmented by pane type, application, and region. By pane type, the market is divided into single-pane type and double-pane type. Based on application, the market is categorized into residential and commercial. Regionally, the market is divided into East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, and Eastern Europe.

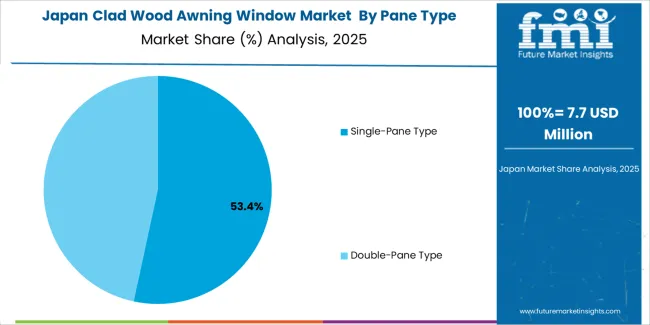

The single-pane type segment is projected to maintain its leading position in the clad wood awning window market in 2025, reaffirming its role as the preferred pane configuration for cost-effective residential applications and climate-appropriate building solutions. Builders and homeowners increasingly utilize single-pane clad wood awning windows for their superior affordability characteristics, excellent ventilation capabilities, and proven effectiveness in mild climate applications while maintaining aesthetic appeal. Single-pane window technology's proven effectiveness and application versatility directly address the industry requirements for accessible premium window solutions and budget-conscious renovation projects across diverse residential construction environments and moderate climate regions.

This pane type segment forms the foundation of entry-level premium window offerings, as it represents the configuration with the greatest contribution to market accessibility and established presence record across multiple residential applications and construction segments. Residential construction investments in quality building products continue to strengthen adoption among builders and renovation contractors. With project requirements demanding cost-effectiveness and natural wood aesthetics, single-pane clad wood awning windows align with both budget objectives and design requirements, making them the central component of comprehensive residential window strategies.

The residential application segment is projected to represent the 65% market share of clad wood awning window demand in 2025, underscoring its role as the primary driver for clad wood awning window adoption across single-family home construction, residential renovation projects, and custom home building operations. Homeowners prefer clad wood awning windows for residential applications due to their exceptional aesthetic appeal, maintenance-free exterior performance, and ability to provide ventilation during light rain while supporting energy efficiency and architectural character. Positioned as premium building products for residential construction, clad wood awning windows offer both interior beauty advantages and exterior durability benefits.

The segment is supported by continuous innovation in residential window technology and the growing availability of customizable window configurations that enable superior design integration with enhanced weather performance and reduced lifecycle costs. Homeowners are investing in comprehensive premium window programs to support increasingly demanding aesthetic preferences and energy efficiency requirements. As residential construction quality standards advance and homeowner expectations increase, the residential application will continue to dominate the market while supporting premium window utilization and building performance optimization strategies.

The clad wood awning window market is advancing steadily due to increasing demand for premium residential building products driven by renovation market growth and growing adoption of low-maintenance exterior materials that require specialized window systems providing enhanced durability characteristics and aesthetic benefits across residential construction, commercial building, and institutional facility applications. However, the market faces challenges, including high product costs compared to vinyl or aluminum alternatives, competition from composite window materials and fiberglass frames, and installation requirements related to proper flashing and weather barrier integration. Innovation in cladding material technologies and thermal performance enhancement continues to influence product development and market expansion patterns.

The growing residential renovation sector is driving demand for specialized window replacement solutions that address homeowner requirements including enhanced curb appeal, improved energy efficiency, and reduced maintenance obligations for exterior building components. Residential renovation projects require premium clad wood awning window configurations that deliver superior aesthetic quality across multiple design parameters while maintaining cost-effectiveness and installation efficiency. Homeowners are increasingly recognizing the value advantages of clad wood awning window integration for home improvement and property value enhancement, creating opportunities for innovative window designs specifically engineered for renovation market applications.

Modern clad wood awning window manufacturers are incorporating advanced cladding materials and thermal break technologies to enhance weather resistance, improve thermal performance, and support comprehensive energy efficiency objectives through optimized frame construction and insulated glazing systems. Leading companies are developing windows with aluminum-clad exteriors, implementing fiberglass cladding options, and advancing frame designs that minimize thermal bridging and maximize insulation value. These technologies improve building performance while enabling new market opportunities, including coastal construction applications, extreme weather installations, and high-performance building envelopes. Advanced material integration also allows manufacturers to support comprehensive durability objectives and market differentiation beyond traditional window performance attributes.

The expansion of coastal construction and hurricane-prone region development is driving demand for clad wood awning windows with impact-resistant glazing and reinforced frame systems capable of withstanding extreme wind loads and debris impact. These specialized applications require engineered window configurations with stringent structural specifications that exceed standard residential requirements, creating premium market segments with differentiated value propositions. Manufacturers are investing in impact-testing capabilities and structural engineering programs to serve emerging coastal construction applications while supporting innovation in storm-resistant housing, coastal residential development, and climate-adapted building design sectors.

| Country | CAGR (2025-2035) |

|---|---|

| China | 4.5% |

| India | 4.1% |

| Germany | 3.8% |

| Brazil | 3.5% |

| USA | 3.1% |

| UK | 2.8% |

| Japan | 2.5% |

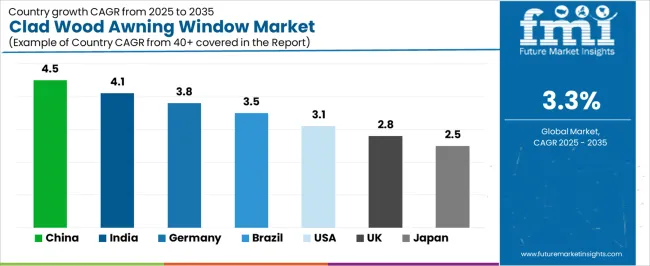

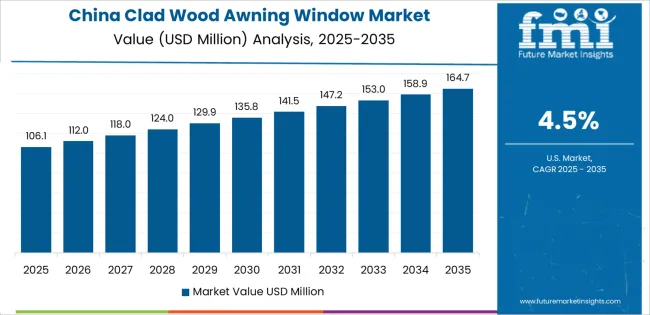

The clad wood awning window market is experiencing solid growth globally, with China leading at a 4.5% CAGR through 2035, driven by expanding premium residential construction, growing middle-class housing demand, and increasing adoption of Western-style window products across urban development projects. India follows at 4.1%, supported by growing premium housing segment, expanding commercial construction activity, and rising awareness of energy-efficient building products. Germany shows growth at 3.8%, emphasizing energy efficiency standards, renovation market activity, and premium building product demand. Brazil demonstrates 3.5% growth, supported by expanding upper-income residential construction, growing renovation market, and increasing quality building material adoption. The United States records 3.1%, focusing on residential renovation activity, coastal construction requirements, and premium home improvement demand. The United Kingdom exhibits 2.8% growth, emphasizing residential renovation market and heritage building restoration. Japan shows 2.5% growth, supported by quality housing construction and natural material aesthetics preferences.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

Revenue from clad wood awning windows in China is projected to exhibit exceptional growth with a CAGR of 4.5% through 2035, driven by expanding premium residential construction and rapidly growing middle-class housing demand supported by urbanization programs and rising living standards. The country's massive residential construction scale and increasing preference for Western-style building products are creating substantial demand for clad wood awning window solutions. Major window manufacturers and building product suppliers are establishing comprehensive production capabilities to serve both domestic markets and export opportunities.

Revenue from clad wood awning windows in India is expanding at a CAGR of 4.1%, supported by growing premium housing segment development, expanding commercial construction activity, and increasing awareness of energy-efficient building products across residential and commercial sectors. The country's developing premium construction market and rising quality standards are driving adoption of advanced window products throughout urban development projects. Leading window suppliers and building product distributors are establishing distribution and service capabilities to address growing domestic demand.

Revenue from clad wood awning windows in Germany is expanding at a CAGR of 3.8%, supported by the country's emphasis on energy efficiency standards, active renovation market activity, and strong demand for premium building products. The nation's building performance requirements and quality construction culture are driving demand for high-specification clad wood awning window solutions. Leading window manufacturers and building product suppliers are investing extensively in energy-efficient window technologies and renovation-focused product lines.

Revenue from clad wood awning windows in Brazil is expanding at a CAGR of 3.5%, supported by expanding upper-income residential construction, growing renovation market activity, and increasing quality building material adoption across premium housing segments. The nation's developing premium construction sector and rising construction standards are driving demand for advanced window product solutions. Building product distributors and window suppliers are investing in market development and product availability to serve growing demand.

Revenue from clad wood awning windows in the United States is expanding at a CAGR of 3.1%, supported by the country's active residential renovation market, coastal construction requirements, and strong demand for premium home improvement products. The nation's comprehensive residential renovation sector and coastal housing development are driving demand for high-performance clad wood awning window solutions. Window manufacturers and building product retailers are investing in product innovation and distribution capabilities to serve both renovation and new construction markets.

Revenue from clad wood awning windows in the United Kingdom is expanding at a CAGR of 2.8%, driven by the country's active residential renovation market, heritage building restoration requirements, and quality building product preferences. UK's renovation-focused construction sector and conservation standards are driving demand for appropriate clad wood awning window solutions. Window suppliers and building restoration specialists are establishing comprehensive programs for residential window replacement and heritage-appropriate products.

Revenue from clad wood awning windows in Japan is expanding at a CAGR of 2.5%, supported by the country's emphasis on quality housing construction, natural material aesthetics preferences, and strong commitment to building performance and durability. Japan's quality-conscious construction culture and natural material appreciation are driving demand for premium clad wood awning window products. Window manufacturers and residential construction companies are investing in specialized capabilities for quality window applications.

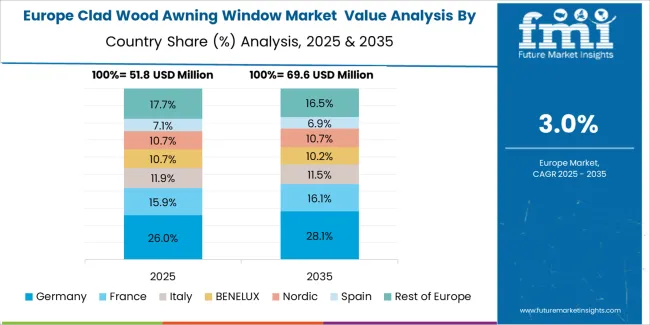

The clad wood awning window market in Europe is projected to grow from USD 17.9 million in 2025 to USD 67.8 million by 2035, registering a CAGR of 3.3% over the forecast period. Germany is expected to maintain leadership with a 29.3% market share in 2025, moderating to 28.6% by 2035, supported by energy efficiency standards, renovation market activity, and strong premium building product demand.

The United Kingdom follows with 20.4% in 2025, projected at 19.8% by 2035, driven by residential renovation activity, heritage building restoration, and quality window product preferences. France holds 16.7% in 2025, reaching 17.1% by 2035 on the back of residential construction quality standards and renovation market growth. Italy commands 13.2% in 2025, rising slightly to 13.5% by 2035, while Spain accounts for 9.8% in 2025, reaching 10.2% by 2035 aided by coastal residential development and premium housing construction. The Netherlands maintains 5.9% in 2025, up to 6.1% by 2035 due to energy-efficient construction requirements and quality housing standards. The Rest of Europe region, including Nordics, Central & Eastern Europe, and other markets, is anticipated to hold 4.7% in 2025 and 4.7% by 2035, reflecting steady advancement in premium building product adoption and residential construction quality standards.

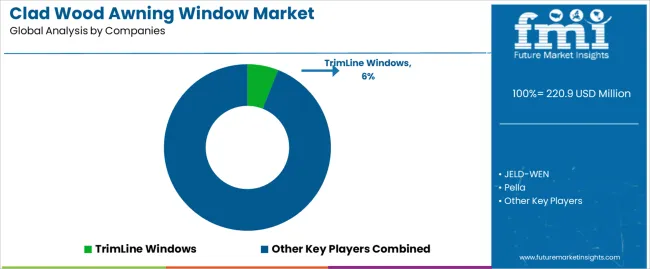

The clad wood awning window market is characterized by competition among established window manufacturers, specialty building product companies, and regional window fabricators. Companies are investing in cladding material development, thermal performance innovation, product customization expansion, and weather resistance enhancement to deliver high-quality, durable, and aesthetically appealing clad wood awning window solutions. Innovation in aluminum cladding technologies, fiberglass composite materials, and advanced weather sealing systems is central to strengthening market position and competitive advantage.

TrimLine Windows maintains market presence, offering clad wood window solutions with focus on residential applications and customizable designs. JELD-WEN provides comprehensive window and door products with emphasis on residential and commercial markets, featuring diverse material options and energy-efficient designs. Pella delivers premium window solutions focusing on innovation and architectural versatility. Sun Windows offers residential window products with emphasis on quality and value. Lepage provides window solutions for residential applications. Andersen Windows emphasizes premium residential window products with strong brand recognition and comprehensive product lines. Ply Gem offers building products including window systems for residential construction. Kolbe provides high-end architectural window solutions for custom projects.

Additional manufacturers including Loewen Windows, Hurd, Lincoln Windows, Sierra Pacific, and Caiframe contribute to market diversity with specialized product offerings serving specific architectural requirements and regional markets.

Clad wood awning windows represent a specialized building product segment within residential and commercial construction applications, projected to grow from USD 220.9 million in 2025 to USD 305.7 million by 2035 at a 3.3% CAGR. These premium window systems—primarily single-pane and double-pane configurations for building applications—serve as essential building envelope components in residential construction, commercial building projects, and renovation applications where enhanced aesthetic quality, weather resistance, and low-maintenance performance are essential. Market expansion is driven by increasing residential renovation activity, growing premium housing construction, expanding energy efficiency requirements, and rising demand for durable building products across residential, commercial, and institutional building sectors.

How Building Code Authorities Could Strengthen Product Standards and Performance Requirements?

How Industry Associations Could Advance Product Standards and Market Development?

How Clad Wood Awning Window Manufacturers Could Drive Innovation and Market Leadership?

How Builders and Contractors Could Optimize Product Selection and Installation Quality?

How Research Institutions Could Enable Technology Advancement?

How Investors and Financial Enablers Could Support Market Growth and Innovation Enhancement?

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 220.9 million |

| Pane Type | Single-Pane Type, Double-Pane Type |

| Application | Residential, Commercial |

| Regions Covered | East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, and 40+ countries |

| Key Companies Profiled | TrimLine Windows, JELD-WEN, Pella, Sun Windows, Lepage, Andersen Windows, Ply Gem, Kolbe |

| Additional Attributes | Dollar sales by pane type and application category, regional demand trends, competitive landscape, technological advancements in cladding materials and thermal performance, weather resistance development, design innovation, and building envelope integration optimization |

The global clad wood awning window market is estimated to be valued at USD 220.9 million in 2025.

The market size for the clad wood awning window market is projected to reach USD 305.6 million by 2035.

The clad wood awning window market is expected to grow at a 3.3% CAGR between 2025 and 2035.

The key product types in clad wood awning window market are single-pane type and double-pane type.

In terms of application, residential segment to command 65.0% share in the clad wood awning window market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Clad Pipe Market Size and Share Forecast Outlook 2025 to 2035

Key Players & Market Share in Clad Pipe Industry

Platycladus Orientalis Leaf Extract Market Size and Share Forecast Outlook 2025 to 2035

Laser Cladding Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Cladding Market Size and Share Forecast Outlook 2025 to 2035

Rainscreen Cladding Market Growth - Trends & Forecast 2025 to 2035

Solid Aluminium Cladding Panel Market Size and Share Forecast Outlook 2025 to 2035

High Power Double-Clad Fiber Bragg Grating Market Size and Share Forecast Outlook 2025 to 2035

Cobalt Based Laser Cladding Powder Market Size and Share Forecast Outlook 2025 to 2035

High Frequency High Speed Copper Clad Laminate CCL Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

Woodcore Access Floor Market Size and Share Forecast Outlook 2025 to 2035

Woodworm Treatment Service Market Size and Share Forecast Outlook 2025 to 2035

Wood Plastic Composite Market Size and Share Forecast and Outlook 2025 to 2035

Wooden Pallet Rental Service Market Size and Share Forecast Outlook 2025 to 2035

Wood Recycling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Woodfree Paper Market Size and Share Forecast Outlook 2025 to 2035

Wooden Crate Market Forecast and Outlook 2025 to 2035

Wood-Polymer Bottle Molders Market Size and Share Forecast Outlook 2025 to 2035

Woodworking CNC Tools Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA