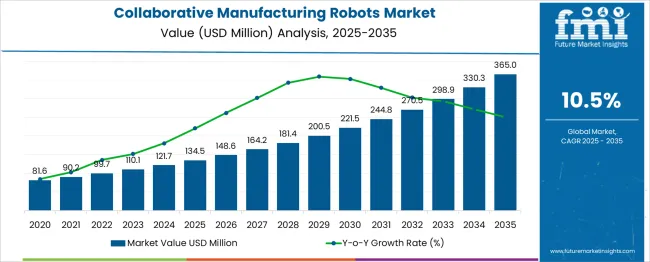

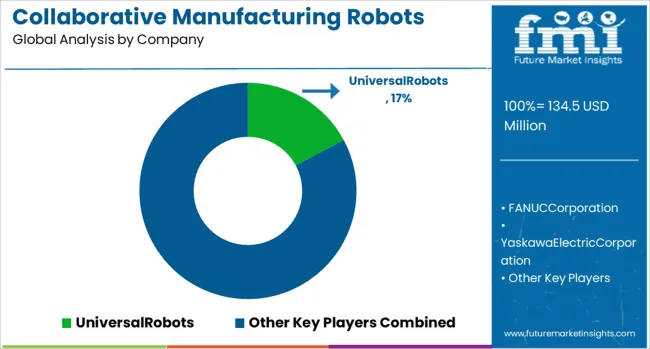

The Collaborative Manufacturing Robots Market is estimated to be valued at USD 134.5 million in 2025 and is projected to reach USD 365.0 million by 2035, registering a compound annual growth rate (CAGR) of 10.5% over the forecast period. This rapid expansion indicates a strong shift towards automation and smart manufacturing processes where humans and robots work side by side. The absolute dollar opportunity, representing the incremental market growth over the 15-year period, amounts to USD 283.4 million. This substantial increase highlights significant potential for manufacturers and technology providers to tap into rising demand across diverse industries seeking efficiency and flexibility in production. Between 2020 and 2025, the market grows from USD 81.6 million to USD 134.5 million, marking a foundational phase supported by early adoption and pilot projects in key manufacturing sectors. The subsequent decade from 2025 to 2035 offers even greater growth potential, with the market expanding by USD 230.5 million to reach USD 365.0 million. This surge is driven by increasing integration of robotics in small and medium enterprises, advancements in robot capabilities, and growing emphasis on collaborative human-robot workflows. Overall, the market presents a dynamic growth landscape with wide-ranging opportunities over the next decade and a half.

| Metric | Value |

|---|---|

| Collaborative Manufacturing Robots Market Estimated Value in (2025 E) | USD 134.5 million |

| Collaborative Manufacturing Robots Market Forecast Value in (2035 F) | USD 365.0 million |

| Forecast CAGR (2025 to 2035) | 10.5% |

The collaborative manufacturing robots market is witnessing robust growth as industries across the globe increasingly adopt flexible automation to address labor shortages, rising production complexity, and demand for mass customization. The shift toward human-robot collaboration has been accelerated by improvements in force-limiting technologies, advanced sensors, and intuitive programming interfaces that ensure safety without compromising efficiency.

Collaborative robots are being deployed across various manufacturing settings to perform tasks such as machine tending, assembly, and quality inspection, reducing cycle times while enhancing workplace safety. Integration with Industry 4.0 frameworks, cloud platforms, and AI-enabled edge controllers has further expanded the scope of application, making them vital assets in smart manufacturing ecosystems.

The ability of these robots to operate alongside human workers without physical barriers is streamlining workflows, particularly in small and medium enterprises. Regulatory standards supporting safe automation, combined with declining sensor and actuator costs, are expected to further support market expansion, with strong growth anticipated across electronics, automotive, and metal fabrication sectors.

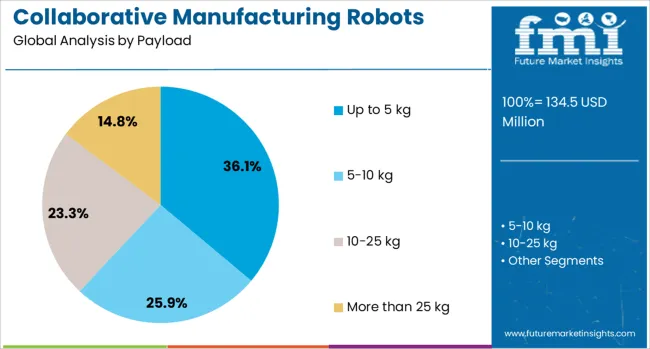

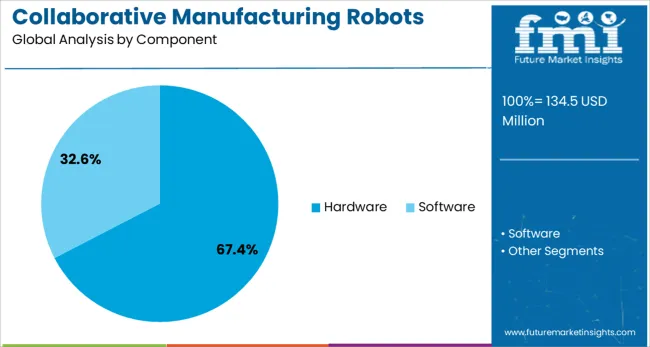

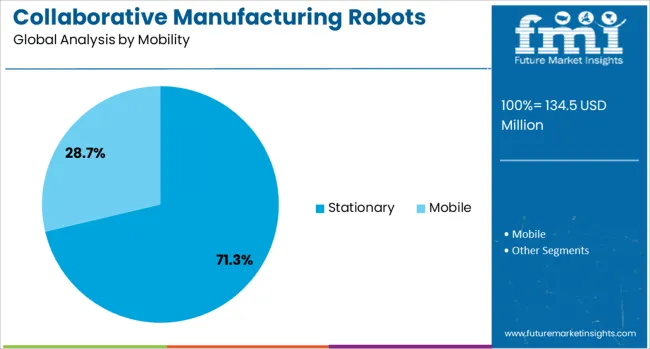

The collaborative manufacturing robots market is segmented by payload, component, mobility, end-use, application, and geographic region. By payload, the collaborative manufacturing robots market is divided into up to 5 kg, 5-10 kg, 10-25 kg, and more than 25 kg. In terms of components, the collaborative manufacturing robots market is classified into Hardware and Software. Based on mobility, the collaborative manufacturing robots market is segmented into Stationary and Mobile. By end use, the collaborative manufacturing robots market is segmented into large enterprises and small and medium enterprises (SMEs). By application, the collaborative manufacturing robots market is segmented into Material handling, Assembling & dissembling, Welding & soldering, Dispensing, processing, and others. Regionally, the collaborative manufacturing robots industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The up to 5 kg payload segment is projected to account for 36.1% of the total revenue share in the collaborative manufacturing robots market in 2025, making it the leading payload category. This dominance is being driven by the high demand for lightweight, compact collaborative robots that can perform repetitive or precision tasks in tight workspaces.

The segment’s growth has been supported by applications in electronics assembly, quality inspection, and small parts handling, where minimal payload capacity is required but high repeatability and flexibility are essential. These robots are being favored for their lower cost of ownership, ease of deployment, and minimal infrastructure requirements.

Enhanced integration with machine vision systems and plug-and-play programming features has also encouraged adoption in smaller factories and decentralized production lines. Their ability to safely interact with human workers without the need for safety cages has enabled greater floor space efficiency and simplified redeployment, reinforcing their role in agile manufacturing systems.

The hardware segment is expected to represent 67.4% of the overall revenue share in the collaborative manufacturing robots market in 2025. This leading position is supported by the increasing investment in actuators, sensors, controllers, robotic arms, and end-effectors that form the physical foundation of collaborative robotic systems. The demand for high-performance components that ensure safety, accuracy, and repeatability in shared workspaces has been a key driver of segment growth.

The integration of force-torque sensors, servo motors, and embedded safety systems into hardware modules has significantly improved the real-time responsiveness of collaborative robots. Component innovation focusing on miniaturization, modularity, and energy efficiency has further strengthened adoption across both high-volume production lines and low-volume custom manufacturing.

As manufacturers seek enhanced uptime and reduced maintenance, the development of durable, IP-rated hardware for harsh industrial environments is becoming a priority. Continued hardware advancements are expected to play a pivotal role in enabling next-generation collaborative robot capabilities across diverse industrial applications.

The stationary segment is anticipated to contribute 71.3% of the total revenue share in the collaborative manufacturing robots market in 2025. The strong performance of this segment is influenced by the widespread use of fixed robotic systems in assembly lines, inspection stations, and machine tending applications where positional stability and repetitive task accuracy are critical. Stationary collaborative robots are preferred in scenarios that require consistent cycle times, precise alignment, and fixed point operations.

Their integration into traditional manufacturing layouts allows for minimal disruption while enhancing operational productivity and worker safety. The segment has benefited from improvements in base-mounted robotic arms, real-time force feedback, and vision-assisted alignment systems, all of which are essential in static collaborative tasks.

Reduced infrastructure costs and simplified programming have made stationary configurations more accessible to small and medium-sized enterprises. As production environments move toward lean and just-in-time methodologies, stationary collaborative robots are expected to remain fundamental to process efficiency and throughput optimization.

The collaborative manufacturing robots market is expanding as industries adopt automation solutions that allow safe human-robot interaction on factory floors. These robots assist with assembly, material handling, quality inspection, and packaging tasks, enhancing productivity without extensive safety barriers. Increasing demand for flexible manufacturing, labor cost management, and precision drives market growth. Adoption is strongest in automotive, electronics, and consumer goods sectors across North America, Europe, and Asia-Pacific, supported by advances in robotics and control systems.

Collaborative robots differ in payload capacity, reach, speed, and precision, influencing their suitability for specific manufacturing tasks. Some models excel in delicate assembly, while others handle heavier components or repetitive motions. Integration with existing production lines and compatibility with various end-effectors affect deployment ease. Differences in sensor technologies and force feedback enable safer human interaction and improved task adaptability. Vendors offering customizable solutions and scalable systems gain favor by addressing diverse operational requirements across small and large manufacturers.

Progress in robot programming interfaces, machine learning integration, and cloud connectivity allows easier setup, real-time monitoring, and predictive maintenance. User-friendly software platforms enable operators with limited coding skills to configure robots quickly, reducing downtime. Connectivity with enterprise resource planning (ERP) and manufacturing execution systems (MES) supports workflow optimization and data-driven decision-making. Improved cybersecurity measures protect communication networks and operational data from unauthorized access. These developments increase robot utilization rates and support Industry 4.0 initiatives.

Sectors such as automotive, electronics, pharmaceuticals, and food processing increasingly deploy collaborative robots to improve efficiency, maintain quality standards, and enhance worker safety. Small and medium-sized enterprises (SMEs) benefit from the lower cost and flexibility of collaborative robots compared to traditional industrial robots. Demand for robots capable of working alongside humans in confined spaces and performing varied tasks supports market diversification. Expansion into emerging economies is driven by rising labor costs and efforts to modernize manufacturing infrastructure.

Compliance with international and regional safety standards governs the design and deployment of collaborative robots to ensure safe interaction with human workers. Certification requirements may extend product development timelines and costs. Initial investment costs, including robot hardware, integration, and training, can be a barrier for some manufacturers, especially SMEs. Ongoing maintenance and software updates contribute to operational expenses. Vendors providing comprehensive training, flexible financing options, and after-sales support strengthen market presence. Balancing safety, affordability, and performance remains a key focus for stakeholders.

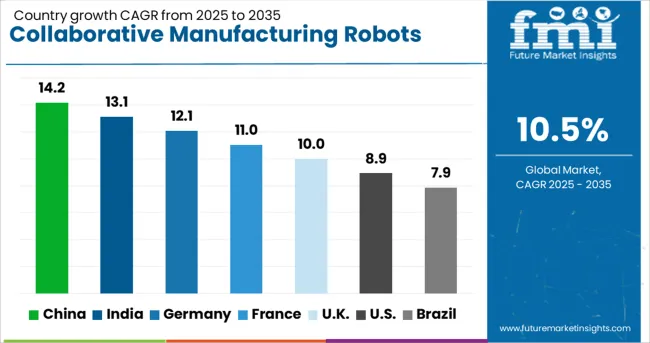

| Country | CAGR |

|---|---|

| China | 14.2% |

| India | 13.1% |

| Germany | 12.1% |

| France | 11.0% |

| UK | 10.0% |

| USA | 8.9% |

| Brazil | 7.9% |

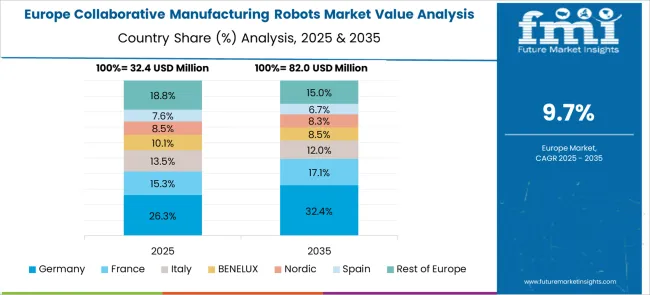

The global collaborative manufacturing robots market is growing at a 10.5% CAGR, driven by increasing automation needs across various industries. Among BRICS nations, China leads with 14.2% growth, supported by large-scale manufacturing infrastructure and government support. India follows at 13.1%, fueled by rising adoption in small and medium enterprises. In the OECD region, Germany records 12.1% growth, reflecting strong industrial robotics expertise and demand for precision automation. The United Kingdom grows at 10.0%, driven by investments in advanced manufacturing systems. The United States, a mature market, shows 8.9% growth, shaped by industry standards and integration with existing production lines. These countries collectively influence market trends through production capacity, regulatory frameworks, and industry demand. This report includes insights on 40+ countries; the top countries are shown here for reference.

China leads the collaborative manufacturing robots market with a 14.2% growth rate, driven by expanding industrial automation and manufacturing modernization. Compared to India, China’s large-scale production facilities increasingly adopt robots to improve efficiency, reduce labor costs, and enhance precision. Government incentives and investment in smart factories accelerate market expansion. Local robotics manufacturers are innovating with advanced sensors and AI integration to meet diverse industrial needs. The rise of electronics, automotive, and consumer goods sectors fuels demand for collaborative robots capable of safe human-machine interaction in factory settings.

Collaborative manufacturing robots market in India grows at 13.1%, supported by rising manufacturing output and increasing focus on automation. Compared to Germany, India’s market expansion is driven by small and medium enterprises adopting robots for repetitive and precise tasks. Growing awareness about workplace safety and productivity gains propels robot adoption. Government initiatives promoting Make in India also encourage robotics investments. The automotive and electronics industries serve as key growth segments, while local companies and global suppliers compete to offer cost-effective solutions. Training programs and technology partnerships help address skill gaps in robotics use.

Collaborative manufacturing robots market in Germany advances at 12.1%, supported by a strong industrial base and emphasis on precision manufacturing. Compared to the UK, German manufacturers prioritize integration of robotics in automotive and machinery sectors for enhanced production accuracy. The demand is driven by skilled labor shortage and the need for flexible manufacturing systems. High quality standards and industrial safety regulations promote the use of collaborative robots capable of safe interaction with humans. Research and development investments by robotics companies further strengthen market position.

The United Kingdom collaborative manufacturing robots market grows at 10.0%, driven by growing interest in automation to improve manufacturing competitiveness. Compared to the USA, the UK market focuses more on small and medium enterprises seeking affordable and adaptable robotic solutions. Robotics help reduce labor shortages and increase output in electronics and food processing industries. Government support through grants and innovation hubs fosters market growth. Increasing awareness of human-robot collaboration benefits leads to gradual adoption, especially in urban manufacturing centers.

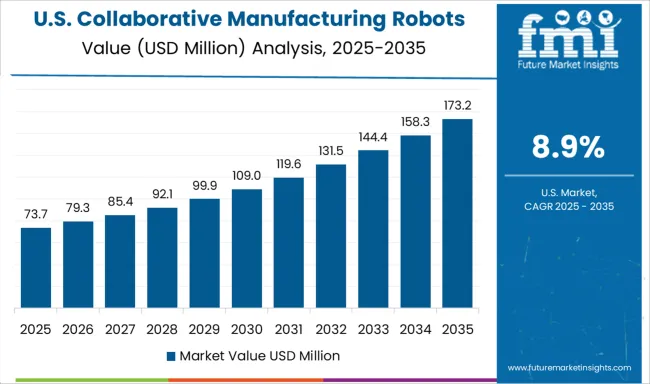

The United States collaborative manufacturing robots market expands at 8.9%, supported by advanced technology adoption and robust industrial infrastructure. Compared to China, growth is steady but moderated by diverse industry preferences and larger labor availability. Collaborative robots gain popularity in electronics, automotive, and logistics sectors for tasks requiring precision and flexibility. Manufacturers emphasize safety features and easy programming to attract small and large enterprises. Increasing integration of AI and machine learning further enhances robot capabilities. Online sales channels and after-sales support contribute to market growth.

Dominant players such as Universal Robots, ABB, FANUC, and KUKA lead with advanced modular robots, high-precision arms, and intuitive programming interfaces that reduce deployment time and increase factory productivity. Key players, such as Techman Robot, Denso, and Yaskawa Motoman, focus on specialized applications, including assembly, packaging, pick-and-place, and quality inspection, with embedded sensors for real-time human-robot interaction and safety compliance. Emerging players such as Doosan Robotics, AUBO Robotics, and Omron are expanding through innovation in lightweight arms, AI-driven motion control, and cloud-enabled fleet management solutions.

Historically, strategies centered on global expansion through partnerships with system integrators, establishing regional training centers, and offering modular robots compatible with existing industrial setups. Forecast strategies indicate a shift toward multi-robot collaborative cells, integration with IoT and factory automation platforms, and AI-enabled adaptive learning for optimized task execution. Differentiation levers include payload capacity, precision, ease of deployment, compatibility with existing manufacturing infrastructure, and cybersecurity features. Growth opportunities exist in electronics, automotive, pharmaceuticals, food and beverage, and SMEs seeking affordable automation solutions. Strategic alliances with software providers, industrial integrators, and component manufacturers are leveraged to accelerate adoption, enhance human-robot collaboration safety, and penetrate emerging markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 134.5 Million |

| Payload | Up to 5 kg, 5-10 kg, 10-25 kg, and More than 25 kg |

| Component | Hardware and Software |

| Mobility | Stationary and Mobile |

| End Use | Large enterprises and Small & medium enterprises (SME) |

| Application | Material handling, Assembling & dissembling, Welding & soldering, Dispensing, Processing, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | UniversalRobots, FANUCCorporation, YaskawaElectricCorporation, KUKARobotics, ABBRobotics, DoosanRobotics, TechmanRobot, StäubliRobotics, AUBORobotics, and RethinkRobotics |

| Additional Attributes | Dollar sales in the Collaborative Manufacturing Robots Market vary by payload capacity (light, medium, heavy), application (assembly, welding, packaging, inspection), industry (automotive, electronics, pharmaceuticals), and region (North America, Europe, Asia-Pacific). Growth is driven by automation adoption, workforce safety focus, and demand for flexible manufacturing solutions. |

The global collaborative manufacturing robots market is estimated to be valued at USD 134.5 million in 2025.

The market size for the collaborative manufacturing robots market is projected to reach USD 365.0 million by 2035.

The collaborative manufacturing robots market is expected to grow at a 10.5% CAGR between 2025 and 2035.

The key product types in collaborative manufacturing robots market are up to 5 kg, 5-10 kg, 10-25 kg and more than 25 kg.

In terms of component, hardware segment to command 67.4% share in the collaborative manufacturing robots market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Collaborative Authoring Tools Market Size and Share Forecast Outlook 2025 to 2035

Collaborative Customer Interfaces Market Analysis and Forecast 2025 to 2035, By Deployment Type, Type of User, End Use, and Region

Collaborative Robots Market Size and Share Forecast Outlook 2025 to 2035

Social Software As A Collaborative ERP Tool Market

Manufacturing Scale Electrostatic Precipitator Market Size and Share Forecast Outlook 2025 to 2035

Manufacturing Logistics Market Size and Share Forecast Outlook 2025 to 2035

Manufacturing Execution Systems (MES) Market Analysis - Growth, Demand & Forecast 2025 to 2035

Manufacturing Test Systems Market

Manufacturing Analytics Market

Wafer Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Micro Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Glass Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

India Manufacturing Execution System Market – Industry 4.0 & Smart Factories

IoT in Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

Battery Manufacturing Machines Market

In Space Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

Additive Manufacturing With Metal Powders Market Size and Share Forecast Outlook 2025 to 2035

Additive Manufacturing and Material Market Trends - Growth & Forecast 2025 to 2035

Mining Remanufacturing Component Market Growth – Trends & Forecast 2024-2034

Satellite Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA