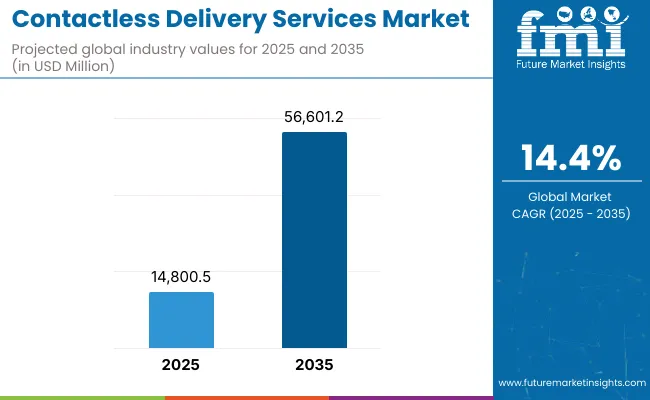

The Contactless Delivery Services Market is expected to record a valuation of USD 14,800.5 million in 2025 and USD 56,601.2 million in 2035, with an increase of USD 41,800.7 million, which equals a growth of 193% over the decade. The overall expansion represents a CAGR of 14.4% and a 2X+ increase in market size.

Contactless Delivery Services Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value in 2025E | USD 14,800.5 million |

| Market Forecast Value in 2035F | USD 56,601.2 million |

| Forecast CAGR (2025 to 2035) | 14.4% |

During the first five-year period from 2025 to 2030, the market increases from USD 14,800.5 million to USD 28,943.5 million, adding USD 14,143 million, which accounts for 34% of the total decade growth. This phase records steady adoption in food & grocery delivery, e-commerce parcels, and healthcare logistics, driven by the need for speed, safety, and automation. Autonomous vehicles dominate this period, contributing 42% of market value (USD 6,216 million in 2025), supported by early adoption in structured urban and highway routes.

The second half from 2030 to 2035 contributes USD 27,657.7 million, equal to 66% of total growth, as the market jumps from USD 28,943.5 million to USD 56,601.2 million. This acceleration is powered by widespread deployment of drone fleets, AI-driven logistics, and robotics-enabled last-mile delivery across smart cities. Drone and hybrid delivery modes together capture a rising share above 57% by 2035, while B2C service models retain dominance with 69% share (USD 10,064 million in 2025). Platform-driven models and cloud-based analytics add recurring revenue streams, increasing digital and AI-enabled services as a core value driver by the end of the decade

From 2020 to 2024, the Contactless Delivery Services Market transitioned from pilot-stage trials to large-scale deployments, laying the groundwork for rapid expansion. During this period, the competitive landscape was dominated by autonomous vehicle and drone technology developers, with global leaders such as Amazon, JD Logistics, and DHL focusing on logistics automation and e-commerce integration. Competitive differentiation relied on delivery speed, operational efficiency, and pilot-scale coverage, while subscription or platform services had limited traction and represented less than 10% of overall revenues.

Demand for contactless delivery solutions will expand to USD 14.8 billion in 2025, and the revenue mix will shift significantly as digital platforms and service-based models gain momentum. Traditional logistics leaders face rising competition from tech-driven players offering AI-powered routing, drone logistics platforms, and integrated app-based ecosystems. Major incumbents are pivoting to hybrid models, combining autonomous fleets with platform-driven digital services to stay competitive. Meanwhile, emerging entrants specializing in AI optimization, AR/VR-enabled tracking, and mobile-first ecosystems are gaining share. The competitive advantage is shifting away from infrastructure alone toward integrated ecosystems, scalability, and recurring digital revenues.

The rapid growth of contactless delivery services is being fueled by their integration into major e-commerce ecosystems, particularly in Asia and North America. Platforms like Amazon, JD Logistics, and Cainiao are embedding autonomous vehicles and drone deliveries directly into checkout options, offering faster, guaranteed fulfillment windows. This integration shifts consumer expectations from days to hours, creating strong demand pull. The ecosystem lock-in effect ensures recurring adoption, making autonomous delivery a strategic revenue driver.

Market growth is also propelled by proactive regulatory frameworks that enable large-scale drone and autonomous vehicle delivery pilots. Countries like China, India, and the UK are implementing favorable airspace policies, corridor testing zones, and subsidies for robotics-driven last-mile logistics. This structured rollout accelerates technology validation and commercialization, while reducing entry barriers for startups. As regulations evolve into permanent frameworks, the market gains stability and scalability, allowing operators to transition from pilots to profitable operations.

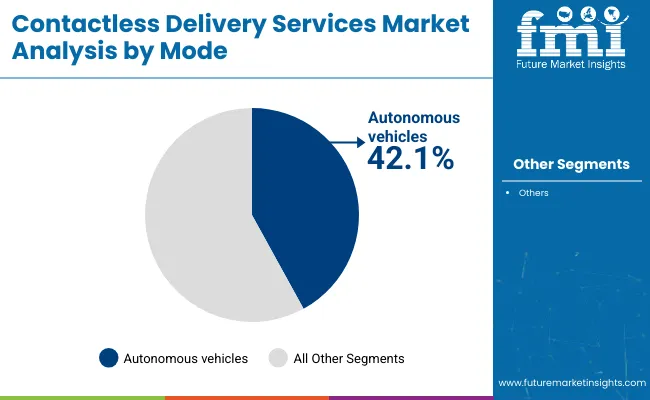

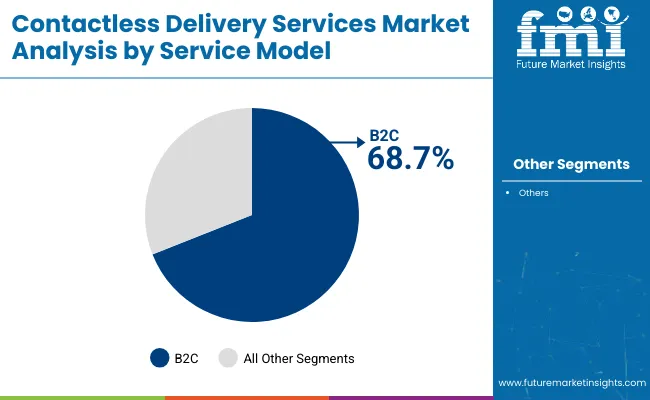

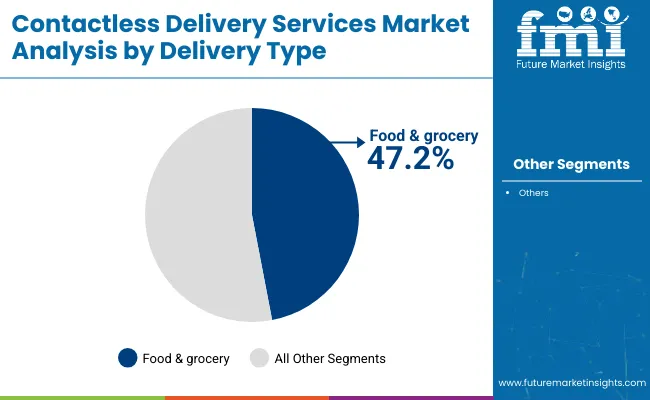

The Contactless Delivery Services Market is segmented by mode, delivery type, service model, and region. By mode, the market covers autonomous vehicles, drones, smart lockers, and robot couriers, with autonomous vehicles accounting for 42% of global value in 2025. By delivery type, segmentation includes food & grocery, parcel & e-commerce, and healthcare/pharma, with food and grocery commanding 47% share in 2025. In terms of service model, the market is divided into B2C, B2B, and hybrid, with B2C dominating at 69% in 2025. Regionally, the market spans North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, with Asia-Pacific particularly China and India emerging as the fastest-growing regions due to rapid urbanization, regulatory support for drones, and expanding e-commerce adoption.

| Mode | Value Share% 2025 |

|---|---|

| Autonomous vehicles | 42.1% |

| Others | 57.9% |

The autonomous vehicles segment is projected to contribute 42.1% of the Contactless Delivery Services Market revenue in 2025, establishing itself as a leading mode of delivery. This dominance is driven by strong adoption in structured urban and highway delivery networks, where reliability and route optimization are critical. Logistics companies and e-commerce platforms are investing heavily in autonomous fleets to ensure cost efficiency and operational scalability.

Growth in this segment is also supported by continuous advancements in navigation systems, AI-powered traffic management, and vehicle-to-infrastructure connectivity, which improve efficiency and safety. As demand for faster and contactless last-mile delivery rises, autonomous vehicles are increasingly positioned as a backbone solution, particularly for high-volume parcel and e-commerce logistics.

| Service Model | Value Share% 2025 |

|---|---|

| B2C | 68.7% |

| Others | 31.3% |

The B2C segment is forecasted to hold 68.7% of the market share in 2025, led by its widespread application in food, grocery, and parcel delivery. Consumers prefer direct-to-door contactless options that ensure convenience, safety, and faster turnaround times. This dominance is further reinforced by the rapid integration of delivery apps, loyalty programs, and mobile payment systems, which make subscription-based or one-time deliveries seamless.

The segment’s growth is also supported by e-commerce giants and food delivery platforms investing heavily in autonomous vehicles, drones, and robotic couriers to cater to rising urban demand. As consumer lifestyles shift toward instant and on-demand fulfillment, the B2C model is expected to remain the cornerstone of the contactless delivery services market.

| Delivery Type | Value Share% 2025 |

|---|---|

| Food & grocery | 47.2% |

| Others | 52.8% |

The food & grocery segment is projected to account for 47.2% of the Contactless Delivery Services Market revenue in 2025, establishing itself as one of the leading delivery types. This dominance is driven by the sharp rise in on-demand meal delivery, online grocery shopping, and hyperlocal fulfillment models, where speed and convenience are critical.

Food and grocery deliveries are well-suited to drones, autonomous vehicles, and robot couriers, which can optimize last-mile efficiency and reduce reliance on human drivers. Additionally, integration with subscription-based grocery apps and restaurant aggregators has enhanced customer stickiness and recurring revenue streams. Given the balance of high-frequency demand, consumer convenience, and digital integration, food & grocery delivery is expected to remain the cornerstone of the contactless delivery services market through 2035.

Integration of Contactless Delivery into E-Commerce Platforms

The market is expanding rapidly as e-commerce giants like Amazon, JD Logistics, and Alibaba integrate drones, autonomous vehicles, and robot couriers into their delivery ecosystems. By embedding contactless options directly at checkout, platforms enhance speed, reliability, and convenience, reshaping consumer expectations. This integration also creates strong recurring demand, as customers increasingly prefer guaranteed, time-bound fulfillment powered by automation rather than traditional delivery channels.

Rising Adoption in Healthcare and Pharma Logistics

Healthcare and pharmaceutical deliveries are accelerating the growth of contactless services, particularly in critical and time-sensitive supply chains. Drones and autonomous systems are increasingly used for delivering vaccines, medical samples, and essential drugs to remote or congested areas. This not only improves accessibility but also reduces dependency on human handling, ensuring higher safety and reliability. Governments and NGOs are actively piloting such models, making healthcare a strong growth vertical for the market.

High Infrastructure and Regulatory Costs

The deployment of drones, autonomous vehicles, and smart lockers requires significant infrastructure investment, from charging stations to secure storage networks. Furthermore, navigating fragmented regulatory frameworks for airspace usage, road safety, and cross-border logistics creates hurdles. Smaller operators face financial and compliance barriers, slowing down scalability and limiting participation to larger players with capital strength and regulatory expertise.

Shift Toward Eco-Friendly and Sustainable Delivery Models

Sustainability is emerging as a defining trend, with companies adopting electric-powered autonomous vehicles, solar-enabled smart lockers, and drones optimized for low energy consumption. E-commerce and logistics providers are actively marketing green delivery options to attract environmentally conscious consumers. Additionally, regulatory bodies in Europe and Asia are encouraging carbon-neutral logistics, prompting operators to embed eco-efficiency into their service models. This sustainability focus is becoming a key differentiator in competitive positioning.

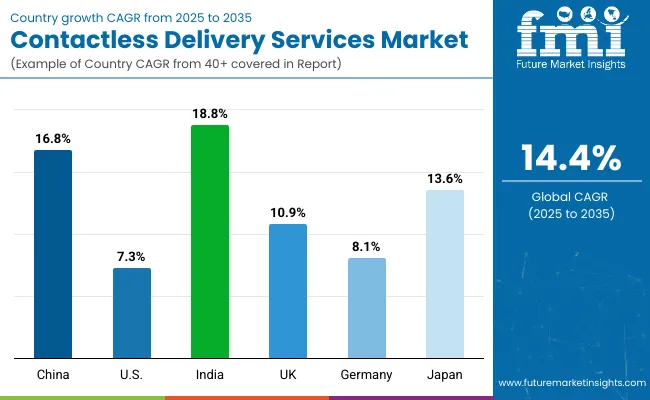

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 16.8% |

| USA | 7.3% |

| India | 18.8% |

| UK | 10.9% |

| Germany | 8.1% |

| Japan | 13.6% |

The global Contactless Delivery Services Market exhibits notable regional disparities in adoption speed, strongly influenced by e-commerce penetration, regulatory readiness, and infrastructure maturity.

Asia-Pacific emerges as the fastest-growing region, anchored by India at 18.8% CAGR and China at 16.8% CAGR. Growth is propelled by aggressive investment in drone delivery pilots, smart city programs, and government-backed policies supporting autonomous logistics. China’s rapid deployment of drone corridors and integration of contactless delivery in e-commerce platforms like JD Logistics and Alibaba further accelerate adoption. India’s trajectory reflects explosive e-commerce growth, adoption of drone delivery in healthcare and remote regions, and rising demand in tier-2 and tier-3 cities.

Europe maintains a robust growth profile, led by the UK at 10.9% and Germany at 8.1%, supported by stringent sustainability goals and regulatory approvals for autonomous vehicles and drones in last-mile logistics. European operators are leveraging green delivery solutions and integrating autonomous technologies into existing courier networks, positioning the region as a leader in sustainable logistics. North America shows steady expansion, with the USA at 7.3% CAGR, reflecting maturity in core logistics but strong adoption in high-frequency delivery markets such as food, grocery, and healthcare. Growth in the USA is more service-driven, with emphasis on app-based B2C platforms, AI-powered route optimization, and pilot programs for autonomous fleets, rather than pure infrastructure scale-up.

Japan stands out at 13.6% CAGR, where robotics-led delivery solutions are expanding in both healthcare and retail. Cultural acceptance of automation and government initiatives supporting robotics adoption reinforce its growth momentum.

| Year | USA Contactless Delivery Services Market (USD Million) |

|---|---|

| 2025 | 3432.05 |

| 2026 | 3878.76 |

| 2027 | 4383.62 |

| 2028 | 4954.19 |

| 2029 | 5599.02 |

| 2030 | 6327.78 |

| 2031 | 7151.40 |

| 2032 | 8082.23 |

| 2033 | 9134.20 |

| 2034 | 10323.11 |

| 2035 | 11666.75 |

The Contactless Delivery Services Market in the United States is projected to grow at a CAGR of 7.3% between 2025 and 2035, driven by the expansion of autonomous vehicles, drone deliveries, and robotic couriers across urban and suburban markets. Growth is fueled by strong adoption in food & grocery delivery, parcel logistics, and healthcare supply chains, where demand for speed and safety is highest.

E-commerce leaders and logistics providers are heavily investing in B2C delivery models, which accounted for 45.2% of USA value in 2025 (USD 1.55 billion). Pilot projects for autonomous fleets and drone corridors are accelerating adoption, supported by gradual regulatory approvals for unmanned deliveries. Sustainability is another growth driver, with operators incorporating electric-powered fleets and AI-based routing systems to reduce costs and carbon footprint.

The Contactless Delivery Services Market in the United Kingdom is expected to grow at a CAGR of 10.9% (2025-2035), supported by rising adoption of autonomous vehicles, drones, and smart locker networks. The country’s strong base in e-commerce and food delivery platforms is accelerating demand for reliable contactless options. The UK’s thriving motorsport and automotive innovation sector is also piloting robotic delivery systems for parts logistics and rapid fulfillment. Public institutions and retailers are investing in drone-based last-mile pilots, supported by regulatory trials and government funding for smart mobility initiatives. Sustainability-driven policies further encourage the transition to electric and eco-friendly delivery fleets.

India is witnessing rapid growth in the Contactless Delivery Services Market, which is forecast to expand at a CAGR of 18.8% through 2035. Expansion is being driven by rising e-commerce penetration, government-backed drone delivery initiatives, and the rapid adoption of mobile-first logistics platforms. Tier-2 and tier-3 cities are becoming hotspots for contactless delivery growth, supported by cost-effective autonomous solutions and increasing consumer acceptance. Healthcare and pharmaceutical sectors are also emerging as major adopters, particularly for vaccine and medical supply deliveries in remote regions. Educational and vocational programs are building a skilled workforce for robotics, drone operations, and AI-powered logistics.

The Contactless Delivery Services Market in China is expected to grow at a CAGR of 16.8% (2025-2035), the highest among leading economies. Growth momentum is driven by large-scale smart city rollouts, drone delivery corridors, and strong innovation from domestic logistics tech firms. Industrial demand for autonomous vehicles and drones is accelerating across the e-commerce and electronics supply chains, while healthcare logistics are increasingly adopting drones for urgent deliveries. Municipal governments are piloting autonomous delivery programs as part of digital twin and smart infrastructure planning. Competitive pricing and innovation by Chinese firms are enabling mass adoption across e-commerce, food delivery, and healthcare sectors, making China a global leader in contactless delivery adoption.

| Countries | 2025 Share (%) |

|---|---|

| USA | 23.2% |

| China | 11.9% |

| Japan | 6.9% |

| Germany | 15.3% |

| UK | 8.4% |

| India | 4.8% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 20.6% |

| China | 12.8% |

| Japan | 8.3% |

| Germany | 13.3% |

| UK | 7.2% |

| India | 5.9% |

The Contactless Delivery Services Market in Germany is projected to grow at a CAGR of 8.1% (2025-2035), supported by the country’s emphasis on precision logistics, automation, and sustainability mandates. German cities are piloting autonomous vehicles and drones for last-mile delivery, integrated with e-commerce and retail networks. Logistics providers are increasingly pairing robotic couriers with AI-powered route optimization to ensure real-time efficiency and compliance with urban traffic regulations.

Healthcare adoption is also rising, with drone-enabled delivery of medicines and lab samples ensuring timely access in urban and rural areas. Compliance with EU sustainability and emissions targets is further pushing adoption of electric-powered delivery fleets and eco-friendly drone operations. Germany’s strong automotive and industrial sectors are fueling innovation in autonomous logistics, positioning the country as a leader in Europe’s contactless delivery adoption.

| USA by Service Model | Value Share% 2025 |

|---|---|

| B2C | 45.2% |

| Others | 54.8% |

The Contactless Delivery Services Market in the United States is projected at USD 3,432 million in 2025, with B2C models contributing 45.2% of market share (USD 1,551 million). This highlights the growing influence of direct-to-consumer platforms, particularly in food, grocery, and parcel deliveries, where speed and convenience are key differentiators. By contrast, B2B and hybrid services dominate slightly at 54.8%, reflecting their strong adoption in logistics, healthcare supply chains, and enterprise partnerships.

Growth is further supported by the rapid integration of AI-powered route optimization, electric delivery fleets, and autonomous vehicle pilots, which strengthen both cost efficiency and sustainability. In parallel, e-commerce platforms are embedding subscription-driven contactless delivery options at checkout, ensuring recurring demand. Over the decade, the USA market will see increasing reliance on digital platforms, predictive logistics, and robotics-driven automation, positioning it as a global leader in service-based delivery innovation.

| China by Service Model | Value Share% 2025 |

|---|---|

| B2B | 65.5% |

| Others | 34.5% |

The Contactless Delivery Services Market in China is projected to be one of the fastest-growing globally, expanding at a CAGR of 16.8% (2025-2035). The market is heavily shaped by the dominance of B2B services, which account for 65.5% share in 2025 (USD 1.15 billion). This strength is driven by large-scale integration of contactless delivery in logistics, e-commerce fulfillment centers, and healthcare supply chains, where automation reduces costs and increases reliability.

Opportunities lie in China’s government-backed initiatives for smart city logistics, drone delivery corridors, and investment in autonomous vehicles. Affordable solutions from domestic players such as JD Logistics and Cainiao are enabling rapid adoption across tier-1 and tier-2 cities, while healthcare delivery of vaccines and critical medicines in rural areas is expanding the use case. With digital payments via WeChat Pay and Alipay seamlessly integrated into platforms, consumer adoption is accelerating alongside enterprise growth.

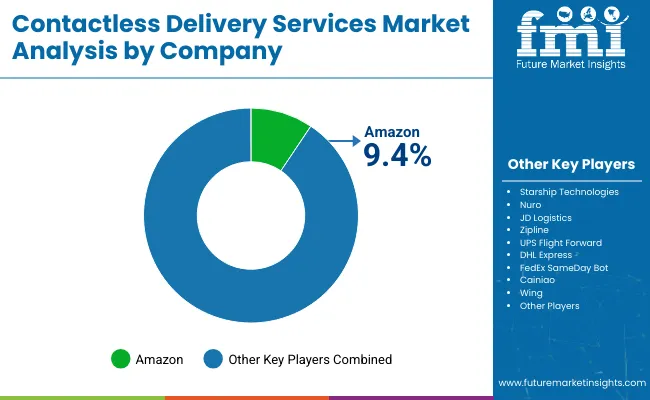

The Contactless Delivery Services Market is moderately fragmented, with global logistics leaders, mid-sized innovators, and niche-focused providers competing across different delivery modes and service models. Amazon holds the largest global share at 9.4%, leveraging its vast e-commerce ecosystem, Prime membership integration, and investment in drone and autonomous vehicle pilots to strengthen its lead. Its strategy emphasizes subscription-driven delivery, automation, and integration with app-based platforms. Mid-sized innovators such as Starship Technologies, Nuro, and Zipline are accelerating adoption with specialized solutions. Starship’s robotic couriers dominate in university and urban environments, Nuro leads in autonomous vehicle pilots for food delivery, and Zipline has pioneered drone-based healthcare logistics, especially in rural and hard-to-reach locations. These companies are carving niches by offering cost-efficient, application-specific models.

Large logistics and courier incumbents like UPS Flight Forward, DHL Express, and FedEx are adopting a hybrid approach, integrating autonomous fleets and drones into existing networks. Meanwhile, regional players such as Cainiao (Alibaba) and JD Logistics are fueling growth in Asia, focusing on scale, affordability, and smart-city alignment. Competitive differentiation is shifting away from fleet size alone toward digital ecosystems that combine AI-powered route optimization, subscription-based delivery tiers, eco-friendly fleets, and seamless integration with e-commerce checkout systems.

Key Developments in Contactless Delivery Services Market

| Item | Value |

|---|---|

| Quantitative Units | USD 14,800.5 Million |

| Mode | Autonomous vehicles, Drones, Smart lockers, Robot couriers |

| Delivery Type | Food & grocery, Parcel & e-commerce, Healthcare/pharma |

| Service Model | B2C, B2B, Hybrid |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Amazon, Starship Technologies, Nuro, JD Logistics, Zipline, UPS Flight Forward, DHL Express, FedEx SameDay Bot, Cainiao, Wing |

| Additional Attributes | Dollar sales by scanner type and end-use industry, Adoption trends in reverse engineering and quality control, Rising demand for handheld and portable 3D scanners, Sector-specific growth in aerospace, automotive, and healthcare, Software and services revenue segmentation, Integration with AR/VR and digital twin technologies, Regional trends influenced by digitization initiatives, Innovations in laser triangulation, structured light, and photogrammetry methods |

The global Contactless Delivery Services Market is estimated to be valued at USD 14,800.5 million in 2025.

The market size for the Contactless Delivery Services Market is projected to reach USD 56,601.2 million by 2035.

The Contactless Delivery Services Market is expected to grow at a 14.4% CAGR between 2025 and 2035.

The key delivery types in Contactless Delivery Services Market are Food & grocery, Parcel & e-commerce, Healthcare/pharma.

In terms of service model, B2C to command 68.7% share in the Contactless Delivery Services Market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Online Food Delivery Services Market Outlook - Growth, Demand & Forecast 2025 to 2035

Delivery Management Software Market Size and Share Forecast Outlook 2025 to 2035

Delivery Tracking Platform Market Size and Share Forecast Outlook 2025 to 2035

Contactless Biometric Technology Market by Technology, Component, Application & Region Forecast till 2035

Contactless Ticketing Market Analysis – Growth & Forecast through 2034

Contactless Ticketing ICs Market

Contactless Smart Card Market

Contactless Payment Market

Contactless Payment Terminals Market

M2M Services Market Size and Share Forecast Outlook 2025 to 2035

B2B Services Review Platforms Market Size and Share Forecast Outlook 2025 to 2035

IOL Delivery Systems Market Size and Share Forecast Outlook 2025 to 2035

Bot Services Market Size and Share Forecast Outlook 2025 to 2035

Spa Services Market Size and Share Forecast Outlook 2025 to 2035

Gas Delivery Systems Market Growth - Trends & Forecast 2025 to 2035

Drug Delivery Technology Market is segmented by route of administration, and end user from 2025 to 2035

Drug Delivery Solutions Market Insights - Growth & Forecast 2025 to 2035

Microservices Orchestration Market Growth - Trends & Forecast 2025 to 2035

VOIP Services Market Analysis - Trends, Growth & Forecast through 2034

Global AI HR Services Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA