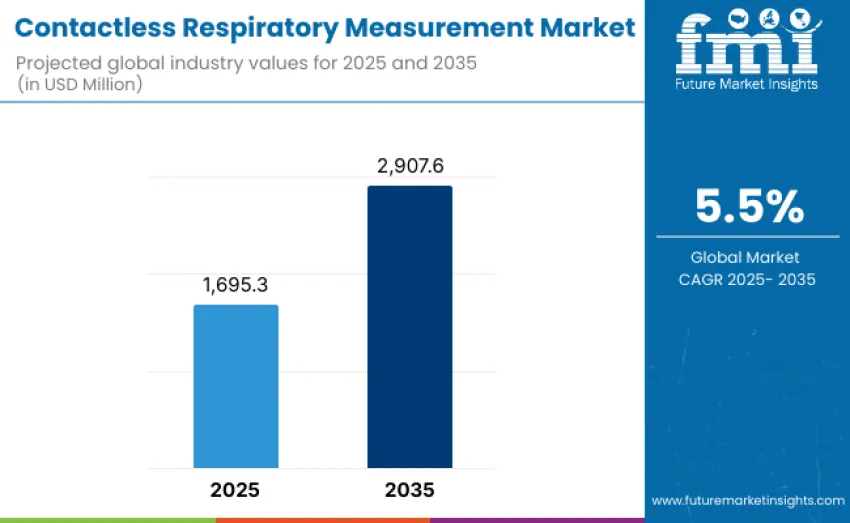

Global contactless respiratory measurement market is projected to reach USD 2,907.6 million by 2035, recording an absolute increase of USD 1,212.3 million over the forecast period. Value stands at USD 1,695.3 million in 2025 and is set to rise at a CAGR of 5.5% during the forecast period 2025 to 2035. Overall size is anticipated to grow by nearly 1.5 times, driven by rising demand for non-invasive, real-time respiratory monitoring solutions, expanding telehealth ecosystems, and growing adoption of advanced sensing technologies across healthcare, wellness, and medical research sectors.

Expansion reflects fundamental changes in clinical monitoring practices and patient management workflows, where contactless respiratory measurement systems enable healthcare professionals to obtain accurate, continuous respiratory data without direct patient contact. This evolution reduces infection risk, enhances patient comfort, and supports long-term observation in hospitals, home care, and remote monitoring settings.

Technological advancements in sensor fusion, automated signal processing, and data visualization are reshaping contactless respiratory measurement landscape. Modern solutions integrate machine learning algorithms capable of differentiating respiratory patterns, detecting abnormalities such as apnea or irregular breathing, and correlating respiratory rate fluctuations with other vital parameters. These systems offer seamless compatibility with electronic health record (EHR) platforms, telemedicine networks, and remote patient monitoring (RPM) ecosystems, supporting healthcare providers in predictive diagnosis and personalized treatment planning.

Between 2025 and 2030, contactless respiratory measurement market is projected to expand from USD 1,695.3 million to USD 2,220.2 million, resulting in a value increase of USD 524.9 million, representing 43.3% of total forecast growth for the decade. This phase of development will be driven by growing need for contact-free respiratory monitoring technologies across hospitals, long-term care facilities, and home healthcare environments. Increasing awareness of infection control, growing prevalence of chronic respiratory diseases, and acceleration of telehealth adoption will contribute significantly to expansion during this period.

From 2030 to 2035, growth continues from USD 2,220.2 million to USD 2,907.6 million, adding another USD 687.4 million, constituting 56.7% of overall ten-year expansion. This period will be characterized by widespread deployment of automated multimodal monitoring platforms capable of integrating respiratory rate measurement with other vital signs such as heart rate, oxygen saturation, and sleep patterns.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 1,695.3 million |

| Market Forecast Value (2035) | USD 2,907.6 million |

| Forecast CAGR (2025 to 2035) | 5.5% |

Contactless respiratory measurement market is expanding globally due to rising demand for non-invasive, hygienic, and continuous respiratory monitoring solutions across healthcare and wellness settings. These technologies enable clinicians to accurately track breathing patterns without the need for physical contact, reducing risk of cross-contamination and improving patient comfort, especially in intensive care units, neonatal care, and home-based monitoring environments. Growing awareness of respiratory health issues such as chronic obstructive pulmonary disease (COPD), asthma, and sleep apnea is driving adoption, as hospitals and diagnostic centers seek advanced tools capable of delivering precise, real-time respiratory data.

Technological advancements, including automated motion detection, radar-based sensors, and camera-based monitoring systems, are enhancing accuracy, enabling early detection of abnormalities, and supporting integration with telemedicine and remote patient monitoring platforms. These innovations are especially valuable in post-acute care and elderly populations where continuous, unobtrusive tracking is critical. Government initiatives promoting digital health transformation, increased healthcare spending, and growing emphasis on preventive and home-based care are fueling growth.

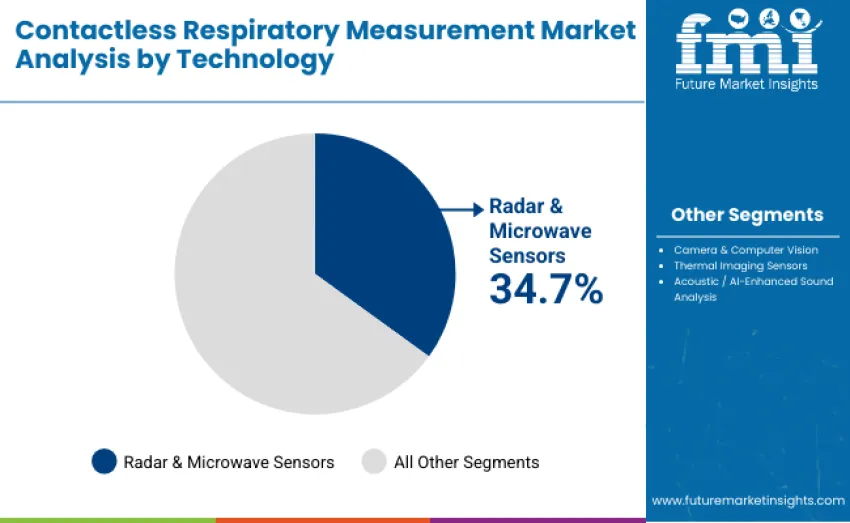

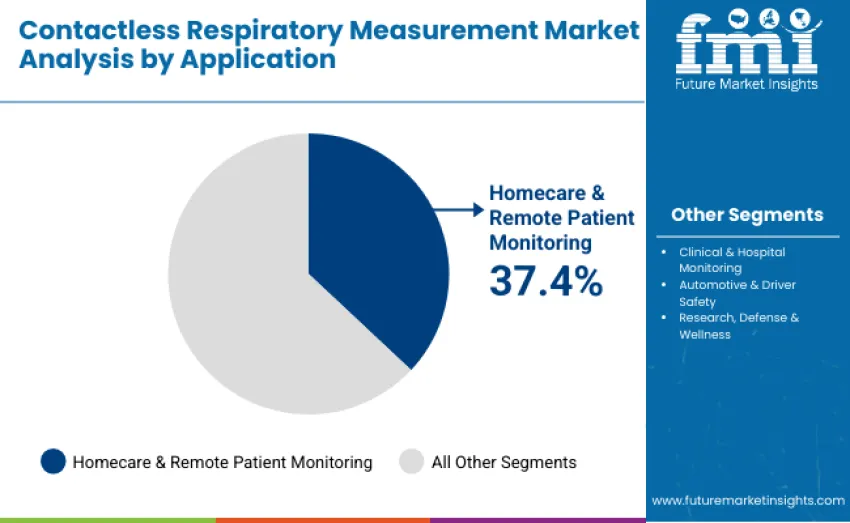

Contactless respiratory measurement market is segmented by technology, application, and region. By technology, it is divided into radar & microwave sensors, camera & computer vision, thermal imaging sensors, and acoustic/automated sound analysis. Based on application, it is categorized into clinical & hospital monitoring, homecare & remote patient monitoring, automotive & driver safety, and research, defense & wellness. Regionally, it is divided into Asia Pacific, Europe, North America, Latin America, and Middle East & Africa. Each segment demonstrates distinct growth patterns driven by clinical requirements, technology adoption rates, and healthcare infrastructure development across diverse medical environments worldwide. (118 words)

Radar and microwave sensors lead the contactless respiratory measurement market with a 34.7% share in 2025, driven by their high precision, long-range detection, and ability to deliver accurate, real-time respiratory data in clinical, homecare, automotive, and wellness environments. Camera and computer vision systems hold 29.6%, leveraging optical sensing and advanced algorithms for non-invasive monitoring in hospitals, telehealth, and research. Thermal imaging accounts for 22.1%, supporting temperature-based respiratory detection, while acoustic and automated sound analysis represents 13.6%. Radar’s reliability, non-contact capability, and environmental versatility underpin its continued leadership.

Homecare and remote patient monitoring dominate with a 37.4% share in 2025, supported by telehealth expansion, aging populations, and rising demand for continuous, contactless monitoring for chronic respiratory conditions and post-operative recovery. Clinical and hospital monitoring follows at 32.8%, driven by integration with advanced monitoring systems and EHR platforms for accurate, real-time respiratory assessment. Automotive and driver safety applications hold 16.3%, enabling alertness and fatigue detection. Research, defense, and wellness contribute 13.5%, supporting specialized monitoring needs. Growing home-based care and clinical reliability requirements shape application preferences.

Market growth is driven by three major factors. First, rising global prevalence of respiratory disorders is increasing demand for continuous, non-invasive monitoring to support early detection, reduce hospitalizations, and improve patient management. Second, infection control priorities in hospitals are accelerating adoption of contactless systems, as radar, optical, and thermal sensors eliminate the need for physical contact and improve comfort in ICU, neonatal, and surgical settings. Third, rapid telehealth expansion and growth of home-based care are boosting demand for portable, camera-based respiratory monitoring tools that enable remote tracking of breathing patterns and chronic conditions.

High acquisition and integration costs remain major barriers, as advanced radar, optical, and infrared systems require specialized hardware, calibration, and workflow integration. Environmental and motion-related signal variability can affect measurement consistency, requiring sophisticated algorithms to meet clinical accuracy standards. These limitations can slow adoption in cost-sensitive healthcare settings and prevent widespread deployment in uncontrolled environments.

Key trends include rapid adoption in Asia-Pacific, supported by government-backed healthcare innovation programs, clinical validation initiatives, and growing investment in digital health infrastructure. Advancements in imaging, radar sensing, and AI-based signal interpretation are strengthening clinical reliability. Expansion of remote monitoring, telehealth platforms, and smart home health technologies is expected to further accelerate global market growth.

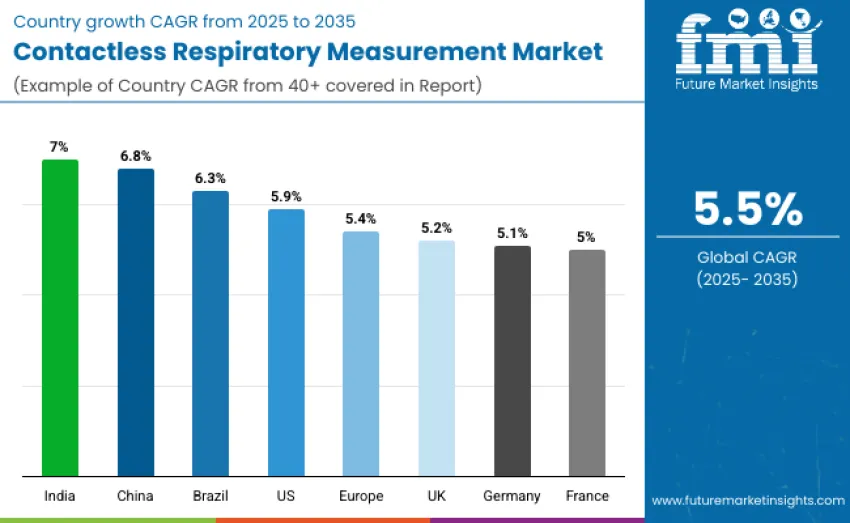

| Country/Region | CAGR (2025 to 2035) |

|---|---|

| India | 7.0% |

| China | 6.8% |

| Brazil | 6.3% |

| United States | 5.9% |

| Europe | 5.4% |

| United Kingdom | 5.2% |

| Germany | 5.1% |

| France | 5.0% |

India leads the contactless respiratory measurement market with a 7.0% CAGR, driven by digital health expansion and strong government support. China follows at 6.8%, supported by major investments in telemedicine infrastructure and domestic sensor manufacturing. Brazil grows at 6.3% as home-based monitoring adoption rises. The United States advances at 5.9% due to its mature healthcare ecosystem and strong remote monitoring networks. Europe grows at 5.4%, with the UK at 5.2%, Germany at 5.1%, and France at 5.0%, supported by precision engineering and expanding telehealth initiatives.

China’s contactless respiratory measurement market is projected to grow at a 6.8% CAGR through 2035, driven by rapid digital health expansion, telemedicine infrastructure, and domestic sensor manufacturing. Hospitals and research institutes in Beijing, Shanghai, Guangzhou, and Shenzhen are adopting radar, optical, and camera-based respiratory monitoring systems for clinical care, chronic disease management, and home-based programs. National initiatives such as Healthy China 2030 and Made in China 2025 provide subsidies for telehealth equipment and workforce training.

India’s contactless respiratory measurement market is expected to grow at a 7.0% CAGR through 2035, strengthened by Digital India initiatives, healthcare technology programs, and IT sector expansion into clinical monitoring. Adoption is rising in major hubs such as Bengaluru, Hyderabad, Mumbai, and Pune across hospitals, diagnostics labs, and telemedicine providers. National programs support remote patient care and advanced monitoring technologies. Government incentives offer training subsidies and equipment financing, while collaborations between global manufacturers, domestic suppliers, and healthcare institutions accelerate accessibility. Increasing telehealth use and digital patient management systems further reinforce nationwide adoption.

Germany’s contactless respiratory measurement market is projected to grow at a 5.1% CAGR through 2035, supported by precision engineering, strong regulatory standards, and integration of advanced monitoring systems in Berlin, Munich, Hamburg, and Frankfurt. Hospitals and ICUs are adopting radar and optical respiratory systems with structured staff training. Academic–industry collaborations enhance system validation and clinical proficiency. Integration with hospital IT, telehealth networks, and EHR platforms strengthens real-time monitoring. Reliable distributor networks ensure consistent device availability, while strict EU regulations maintain high-quality adoption across clinical, research, and homecare environments.

Brazil’s contactless respiratory measurement market is projected to grow at a 6.3% CAGR through 2035, driven by rising respiratory disease prevalence, telehealth expansion, and increasing homecare adoption. Major regions such as São Paulo, Rio de Janeiro, Brasília, and Porto Alegre are deploying contactless monitoring systems across hospitals, clinics, and home-based care. Partnerships with international distributors improve accessibility, training, and financing support. Telemedicine networks are integrating respiratory monitoring for chronic disease follow-up, while growing digital health awareness accelerates adoption.

The USA contactless respiratory measurement market is projected to grow at a 5.9% CAGR through 2035, supported by advanced healthcare infrastructure and strong telemedicine adoption. Hospitals and remote monitoring networks in New York, California, Texas, and Washington use contactless systems for chronic care, post-discharge monitoring, and ICU workflows. Integration with EHR platforms ensures accurate data capture. Established distribution networks provide broad device access and technical support. Collaborations between healthcare associations, technology providers, and manufacturers enhance product development and clinical training, reinforcing widespread adoption across hospitals, clinics, and homecare programs.

The UK’s contactless respiratory measurement market is projected to grow at a 5.2% CAGR through 2035, driven by telehealth expansion, digital health integration, and homecare monitoring initiatives. Healthcare clusters in London, Manchester, Bristol, and Edinburgh are deploying contactless systems to improve early detection and reduce readmissions. NHS-supported digital health programs facilitate standardized workflows and structured training. Partnerships between universities, hospitals, and device suppliers strengthen workforce readiness and system interoperability. Broader adoption in homecare networks and institutional settings supports national goals for remote patient management and continuous monitoring.

Europe’s contactless respiratory measurement market is projected to grow at a 5.4% CAGR through 2035, supported by widespread digital health adoption, expanding telehealth infrastructure, and strong regulatory frameworks under EU medical device standards. Healthcare systems in Germany, France, the UK, and the Nordics are integrating radar, optical, and camera-based respiratory monitoring tools into hospitals, homecare networks, and remote patient management platforms. EU-funded innovation programs and cross-border research collaborations are accelerating validation of contactless technologies. Integration with EHR systems, clinical monitoring platforms, and national telehealth networks enhances workflow efficiency and strengthens clinical adoption across Europe.

France’s contactless respiratory measurement market is projected to grow at a 5.0% CAGR through 2035, driven by modernized healthcare infrastructure, strong clinical research networks, and expanding telehealth adoption. Major centers in Paris, Lyon, Marseille, and Toulouse are implementing contactless respiratory systems for chronic disease management, early detection, and post-hospital monitoring. National digital health programs and regulatory support through HAS and ANSM facilitate deployment of validated monitoring solutions. Partnerships between academic hospitals, research institutes, and device manufacturers strengthen workforce training and technology integration. Growing emphasis on home-based care and remote monitoring accelerates nationwide adoption of advanced respiratory systems.

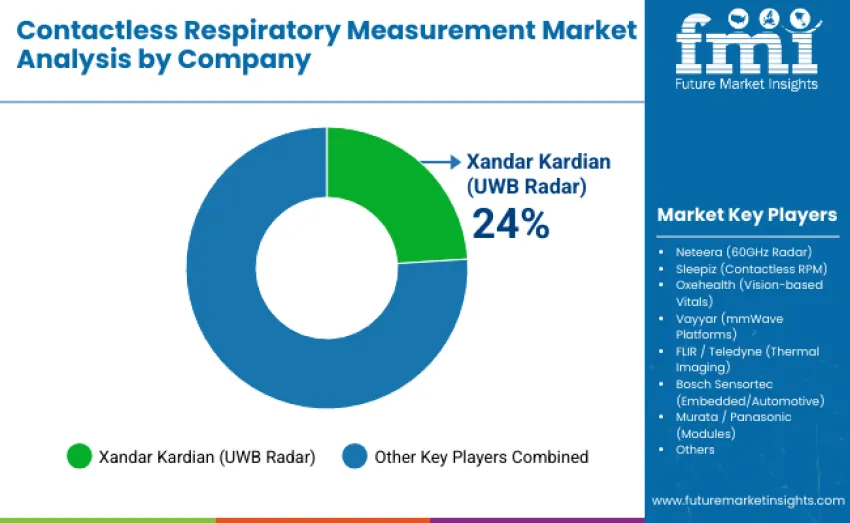

The global contactless respiratory measurement market is moderately concentrated, with 10–12 players and the top five companies controlling 55–60% of global revenue through advanced sensing platforms and strong healthcare integration capabilities. XandarKardian (UWB Radar) now leads with a significantly larger 24% share, supported by its proprietary ultra-wideband radar technology, validated clinical accuracy, and broad deployment across hospitals, long-term care centers, and home-based monitoring programs.

Alongside Xandar Kardian, key leaders such as Neteera, Sleepiz, Oxehealth, and Vayyar maintain competitive strength through extensive intellectual property portfolios, clinically validated performance, and partnerships with health systems and telehealth networks. These companies invest heavily in mmWave radar, advanced optics, computer vision analytics, and automated signal-processing algorithms to improve precision and workflow integration.

Challenger companies including FLIR/Teledyne, Bosch Sensortec, Murata/Panasonic, and Nanotronics compete by offering embedded sensing modules, thermal imaging capabilities, and specialized monitoring solutions tailored to niche applications. Emerging manufacturers in Asia-Pacific and Europe intensify competition through fast development cycles and cost-efficient deployment strategies.

Overall, market dynamics favor companies able to combine high-accuracy sensing, robust AI-driven analytics, EHR and telehealth interoperability, and strong clinical validation supporting continuous respiratory monitoring in diverse care environments.

| Item | Value |

|---|---|

| Quantitative Units | USD 1,695.3 million |

| Technology | Radar & Microwave Sensors, Camera & Computer Vision, Thermal Imaging Sensors, Acoustic/Automated Sound Analysis |

| Application | Clinical & Hospital Monitoring, Homecare & Remote Patient Monitoring, Automotive & Driver Safety, Research, Defense & Wellness |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Country Covered | USA, Brazil, China, India, Europe, Germany, France, UK |

| Key Companies Profiled | Xandar Kardian (UWB Radar), Neteera (60 GHz Radar), Sleepiz (Contactless RPM), Oxehealth (Vision-based Vitals), Vayyar ( mmWave Platforms), FLIR / Teledyne (Thermal Imaging), Bosch Sensortec (Embedded/Automotive Sensors), Murata / Panasonic (Sensing Modules), Nanotronics (Vision AI), and others |

| Additional Attributes | Dollar sales vary by technology and application, shaped by adoption across Asia Pacific, Europe, and North America. Competition centers on global and regional providers, performance specifications, HIS and telehealth integration, AI-driven signal processing, and advanced radar, optical, infrared, and mmWave systems offering higher accuracy and real-time respiratory monitoring |

The global contactless respiratory measurement market is estimated to be valued at USD 1,695.3 million in 2025.

The contactless respiratory measurement market is projected to reach USD 2,907.6 million by 2035.

The contactless respiratory measurement market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key technology types include radar & microwave sensors, camera & computer vision, thermal imaging sensors, and acoustic/automated sound analysis.

The homecare and remote patient monitoring segment is expected to lead with a 37.4% share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Respiratory Measurement Devices Market Size and Share Forecast Outlook 2025 to 2035

Respiratory Trainer Market Size and Share Forecast Outlook 2025 to 2035

Respiratory Distress Syndrome Management Market Size and Share Forecast Outlook 2025 to 2035

Contactless Delivery Services Market Size and Share Forecast Outlook 2025 to 2035

Respiratory Analysers Market Size and Share Forecast Outlook 2025 to 2035

Measurement Technology in Downstream Processing Market Size and Share Forecast Outlook 2025 to 2035

Respiratory Protective Equipment Market Size and Share Forecast Outlook 2025 to 2035

Respiratory Heaters Market Trends and Forecast 2025 to 2035

Respiratory Pathogen Testing Kits Market Insights - Growth & Forecast 2025 to 2035

Contactless Biometric Technology Market by Technology, Component, Application & Region Forecast till 2035

Respiratory Inhaler Devices Market Report – Size & Forecast 2025-2035

Understanding Market Share Trends in Respiratory Inhaler Devices

Respiratory Gating Market Analysis – Size, Share & Forecast 2025-2035

Contactless Ticketing Market Analysis – Growth & Forecast through 2034

Respiratory Device Market Insights – Growth & Forecast 2024-2034

Global Respiratory Biologics Market Analysis – Size, Share & Forecast 2024-2034

Contactless Ticketing ICs Market

Contactless Smart Card Market

Contactless Payment Terminals Market

Contactless Payment Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA