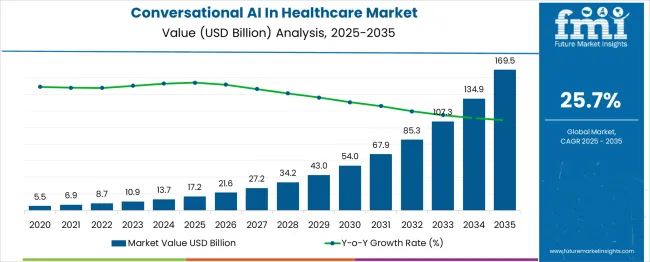

The conversational AI in healthcare market was valued at USD 17.2 billion in 2025, is forecast to reach USD 169.5 billion by 2035, registering a CAGR of 25.7%. This growth trajectory results in an absolute dollar opportunity of USD 152.3 billion over the assessment period. The sizeable expansion indicates accelerated adoption of high efficiency boiler systems as food manufacturers aim to streamline production and manage energy consumption effectively. Such large-scale value creation suggests a transformative shift in processing infrastructure, with revenue gains supported by technological advancements, stricter operational standards, and the need for reliable heat generation within food industry applications.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 17.2 billion |

| Forecast Value in (2035F) | USD 169.5 billion |

| Forecast CAGR (2025 to 2035) | 25.7% |

The market has been experiencing a steady expansion, with consistent adoption of intelligent systems designed to improve patient engagement and streamline clinical workflows. Over the past few years, integration of AI-driven chatbots, voice assistants, and automated patient interaction platforms has gained momentum due to their ability to reduce administrative burdens and provide 24/7 support. From 2025 onward, the market is projected to maintain an upward trajectory as healthcare providers increasingly prioritize digital transformation. This growth is further reinforced by rising demand for virtual health assistants in appointment scheduling, symptom checking, remote patient monitoring, and medication management. Strong investments in healthcare IT infrastructure and the increasing use of AI in telehealth consultations are also creating favorable conditions for the long-term expansion of this market.

Looking at the 10-year period ahead, the market is forecast to show robust long-term growth rather than stagnation or decline. The compound annual growth rate is expected to remain strong, supported by ongoing advancements in natural language processing, machine learning, and generative AI capabilities. While concerns around data privacy, integration complexity, and compliance with healthcare regulations may present challenges, the overall trajectory suggests sustained market development. With a growing focus on cost efficiency and improved patient experience, conversational AI adoption is set to expand steadily, making the market a clear long-term growth sector.

Market expansion is being supported by the increasing demand for automated patient engagement solutions and the corresponding need for intelligent healthcare communication systems. Modern healthcare providers are increasingly focused on leveraging AI technologies that can enhance patient experience, reduce administrative burden, and improve clinical outcomes through personalized care delivery. Conversational AI's proven effectiveness in handling routine inquiries, providing medical information, and supporting clinical decision-making makes it an essential component in digital health transformation strategies.

The growing focuses on patient-centered care and personalized medicine is driving demand for AI solutions that can understand natural language, process medical data, and provide contextually relevant responses. Healthcare organizations' preference for scalable solutions that combine multiple AI capabilities including speech recognition, natural language processing, and machine learning is creating opportunities for comprehensive conversational AI platforms. The rising influence of value-based care models and regulatory support for AI adoption in healthcare is also contributing to increased technology implementation across different healthcare settings and specialties.

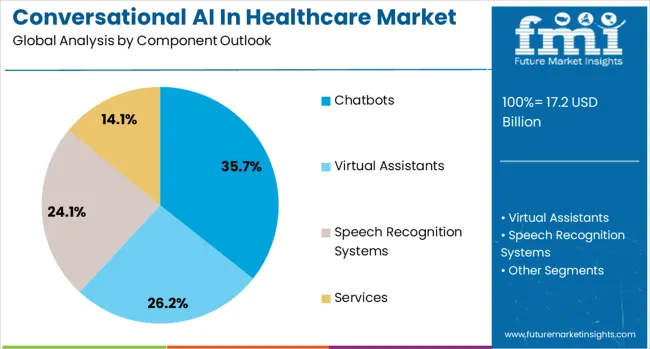

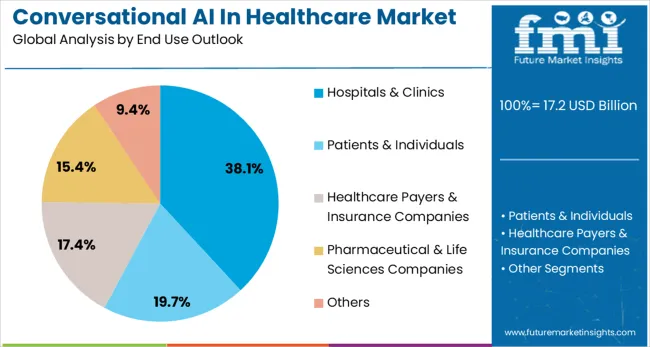

The market is segmented by component, technology outlook, application outlook, end use, and region. By component, the market is divided into chatbots, virtual assistants, speech recognition systems, and services. Based on technology outlook, the market is categorized into speech recognition & generation, natural language processing (NLP) & understanding (NLU), machine learning & deep learning models, large language models (LLMs) & generative AI, and dialogue management & orchestration. In terms of application outlook, the market is segmented into patient engagement & support, mental health support & therapy bots, medical diagnosis & clinical decision support, remote patient monitoring, telemedicine & virtual consultations, administrative & workflow automation, pharmaceutical & drug information assistance, and medical training & education. By end use, the market is classified into hospitals & clinics, patients & individuals, healthcare payers & insurance companies, pharmaceutical & life sciences companies, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

The chatbots component is projected to account for 35.7% of the conversational AI in healthcare market in 2025, establishing its position as the most widely adopted conversational AI solution in healthcare settings. Healthcare organizations increasingly recognize chatbots' effectiveness in handling routine patient inquiries, appointment scheduling, medication reminders, and basic health information provision. These AI-powered systems provide 24/7 availability, reduce staff workload, and improve patient satisfaction through immediate response capabilities.

This component forms the foundation of most healthcare communication strategies, as it represents the most accessible and cost-effective entry point for implementing conversational AI technology. Clinical validation and successful deployment cases continue to strengthen healthcare providers' confidence in chatbot solutions. With increasing patient expectations for digital health services and growing need for scalable patient support systems, chatbots align with both operational efficiency and patient experience goals. Their broad applicability across different healthcare specialties and patient demographics ensures market dominance, making them the primary driver of conversational AI adoption in healthcare organizations.

Speech recognition & generation technology is projected to represent 30.8% of conversational AI in healthcare demand in 2025, highlighting its critical role in enabling natural, hands-free interactions between healthcare providers and AI systems. Healthcare professionals value speech-enabled solutions for their ability to integrate seamlessly into clinical workflows, allowing for efficient documentation, voice-activated system navigation, and real-time information retrieval during patient consultations.

The segment benefits from continuous improvements in accuracy, multilingual support, and medical terminology recognition capabilities. Healthcare organizations are increasingly adopting speech-enabled AI solutions to reduce documentation burden on clinicians, improve data capture efficiency, and enhance overall productivity. The technology's ability to process complex medical terminology and maintain high accuracy in noisy clinical environments makes it particularly valuable for hospitals and medical practices seeking to optimize their operational efficiency while maintaining quality patient care standards.

The patient engagement & support application is forecasted to contribute 29.5% of the conversational AI in healthcare market in 2025, reflecting the growing importance of patient-centered care delivery and continuous health management. Healthcare providers recognize that effective patient engagement directly impacts treatment adherence, health outcomes, and overall care quality. Conversational AI solutions enable personalized patient interactions, proactive health monitoring, and timely intervention capabilities that support better health management.

This application segment addresses critical healthcare challenges including patient education, medication compliance, appointment scheduling, and post-discharge follow-up care. The growing focus on preventive care and chronic disease management creates significant opportunities for AI-powered patient engagement solutions. Healthcare organizations are investing in conversational AI platforms that can deliver personalized health recommendations, monitor patient symptoms, and provide immediate support for health-related questions, positioning patient engagement as a fundamental component of modern healthcare delivery strategies.

The hospitals & clinics end-use segment is projected to represent 38.1% of conversational AI in healthcare market demand in 2025, underscoring their role as primary adopters of AI-powered communication and automation technologies. These healthcare facilities face significant operational challenges including high patient volumes, complex administrative processes, and the need for efficient clinical workflows. Conversational AI solutions provide scalable solutions for patient triage, appointment management, clinical documentation, and staff support services.

Large healthcare institutions have the resources and technical infrastructure necessary to implement comprehensive conversational AI platforms, making them ideal early adopters of advanced AI technologies. The segment benefits from growing recognition of AI's potential to improve operational efficiency, reduce costs, and enhance patient care quality. As hospitals and clinics continue to face staffing challenges and increasing patient expectations, conversational AI represents a strategic technology investment that addresses multiple operational pain points while supporting improved patient outcomes and satisfaction levels.

The conversational AI in healthcare market is advancing rapidly due to increasing healthcare digitization, growing demand for automated patient engagement solutions, and rising adoption of AI-powered clinical decision support systems. The market faces challenges including data privacy concerns, integration complexity with existing healthcare systems, and regulatory compliance requirements. Innovation in natural language processing capabilities and healthcare-specific AI model development continue to influence product advancement and market expansion patterns.

The growing adoption of telemedicine platforms is creating significant opportunities for conversational AI integration to enhance virtual care delivery and patient interaction capabilities. Remote patient monitoring solutions require intelligent communication systems that can process patient data, provide automated feedback, and alert healthcare providers about critical health changes. Conversational AI technologies enable seamless integration between monitoring devices, patient communication channels, and clinical management systems, supporting comprehensive remote care delivery.

Healthcare organizations are increasingly implementing advanced AI technologies including large language models and generative AI to enhance conversational capabilities and clinical decision support. These technologies enable more sophisticated natural language understanding, medical knowledge processing, and personalized patient interaction capabilities. Advanced AI models can process complex medical literature, provide evidence-based recommendations, and support healthcare professionals in making informed clinical decisions through intelligent dialogue systems.

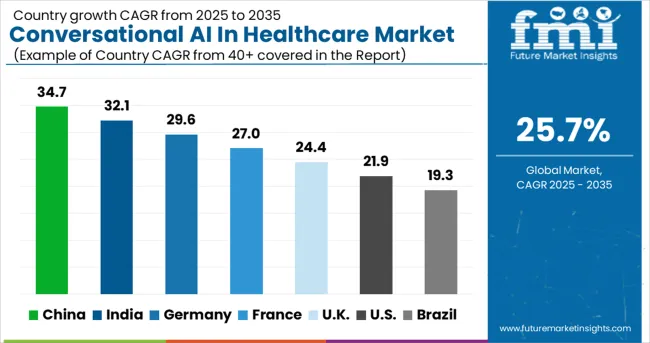

| Country | CAGR (2025-2035) |

|---|---|

| China | 34.7% |

| India | 32.1% |

| Germany | 29.6% |

| France | 27.0% |

| UK | 24.4% |

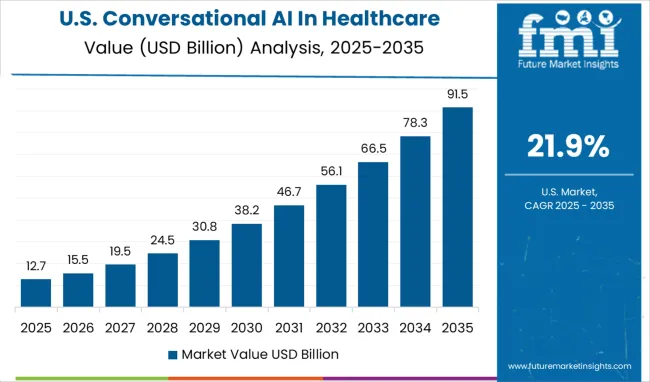

| USA | 21.9% |

The global conversational AI in healthcare market is anticipated to grow at a CAGR of 25.7% from 2025 to 2035. China leads with a CAGR of 34.7%, supported by large-scale investments in AI-driven healthcare infrastructure and rapid adoption of virtual assistants. India follows at 32.1%, driven by expanding telemedicine services and the growing need for AI-based patient engagement solutions. Germany records 29.6% growth, reflecting advancements in precision healthcare and integration of AI in diagnostics. France is projected at 27.0%, supported by digital transformation in patient management. The UK grows at 24.4% with strong use of AI triage systems, while the USA expands at 21.9% through adoption of virtual health assistants and AI-enabled chronic care management.

The report covers an in-depth analysis of 40+ countries, top-performing countries are highlighted below.

China is projected to record the highest CAGR of 34.7% between 2025 and 2035, supported by government backed digital health reforms and rapid integration of AI technology across hospitals. Conversational AI is being implemented to address physician shortages and expand healthcare access in rural regions. Chinese technology leaders have developed AI assistants optimized for Mandarin and regional dialects, enhancing inclusivity in healthcare delivery. Smart hospital programs backed by national policy have prioritized AI enabled patient interaction systems, while cross border collaborations with international firms have expanded clinical capabilities. With heavy investment in healthcare digitization and data infrastructure, conversational AI is expected to play a central role in strengthening telemedicine and hospital management platforms in China throughout the forecast period.

India will witness a CAGR of 32.1% from 2025 to 2035 in conversational AI healthcare, supported by rapid digital adoption and expansion of telemedicine platforms. Hospitals and startups have adopted AI powered assistants to manage scheduling, symptom checks, and follow up care. Government initiatives under the digital health mission have created opportunities for AI vendors to scale across urban and rural facilities. IT service firms have expanded investments in healthcare AI, integrating chatbots into electronic health records and insurance systems. A fast growing startup ecosystem has developed multilingual conversational AI tools, ensuring patient accessibility across India’s diverse languages. With strong policy push and private sector innovation, conversational AI is being positioned as a central pillar for strengthening healthcare efficiency in India.

Germany is forecasted to grow at a CAGR of 29.6% between 2025 and 2035, supported by regulatory clarity and high healthcare spending. Hospitals have accelerated the use of AI powered assistants for outpatient management, enabling reduced administrative burden and quicker communication. Pharmaceutical companies have utilized conversational AI to improve patient education and adherence to therapies. Compliance with GDPR has shaped product deployment strategies, pushing vendors to design highly secure systems. Collaborations between domestic health technology companies and global AI leaders have accelerated innovation, particularly in clinical decision support. As electronic health record integration progresses, conversational AI is expected to play a central role in improving efficiency across German healthcare infrastructure.

France is projected to expand at a CAGR of 27.0% from 2025 to 2035, with hospitals adopting conversational AI to manage patient intake, support chronic disease monitoring, and provide multilingual care. Health insurers have introduced AI bots to streamline claim handling and improve response times. The government’s focus on AI sovereignty has encouraged local startups to develop healthcare specific natural language solutions. International players have entered through collaborations with public and private providers, accelerating adoption across hospitals. Limited pilots have already demonstrated improved patient communication, and funding allocations under the national AI strategy are expected to strengthen deployment further. With an focus on both local innovation and global partnerships, France is building a robust ecosystem for conversational AI in healthcare.

The United Kingdom will grow at a CAGR of 24.4% between 2025 and 2035, supported by NHS digital initiatives and private sector adoption. Conversational AI has been deployed to reduce patient wait times through triage systems, appointment scheduling, and mental health support. NHS trusts have prioritized AI assistants for reminders and consultations, while private providers have used chatbots to strengthen customer experience. Vendors have partnered with IT integrators to ensure system compatibility across care networks. Regulatory frameworks have been enforced to protect patient data, requiring compliance with GDPR standards. The market outlook remains positive as conversational AI becomes central to integrated care pathways and population health management across the UK.

Conversational AI in healthcare within the United States is set to expand at a CAGR of 21.9% from 2025 to 2035, driven by large scale digital health investments and patient engagement initiatives. Hospitals have increasingly adopted AI powered assistants for managing electronic health records and reducing clinician workload, while insurers have prioritized AI chatbots for claim support and customer communication. Vendors have shaped competition through partnerships between technology giants and hospital networks, enabling ambient intelligence and real time clinical documentation. Strict regulatory oversight has defined product development, ensuring compliance with HIPAA and other standards. Adoption of conversational AI is being accelerated as patient centric models become a priority, enabling reduced wait times, virtual triage, and improved chronic disease management across overstretched health facilities in the country.

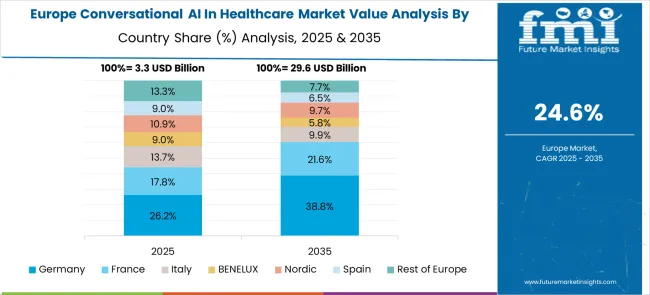

The market in Europe demonstrates strong development across major healthcare systems with Germany showing significant presence through its advanced healthcare infrastructure and focuses on digital health innovation, supported by healthcare institutions leveraging AI technologies to improve patient care efficiency and clinical workflow optimization. France represents a substantial market driven by its comprehensive healthcare system and government initiatives promoting digital health transformation, with organizations implementing conversational AI solutions for patient engagement and administrative automation.

The UK exhibits considerable growth through its National Health Service digital initiatives and focus on AI-powered healthcare solutions, with healthcare providers implementing conversational AI systems for patient triage, appointment scheduling, and clinical decision support. Italy and Spain show expanding adoption of AI technologies in healthcare settings, particularly in patient communication and telemedicine applications. BENELUX countries contribute through their advanced healthcare technology infrastructure and focuses on patient-centered digital health solutions, while Eastern Europe and Nordic regions display growing potential driven by increasing healthcare digitization and expanding access to AI-powered patient engagement platforms.

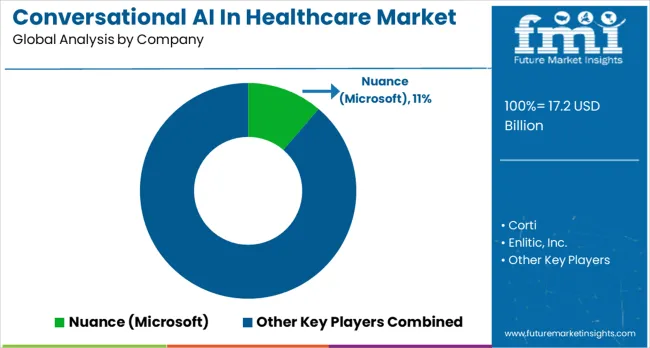

The conversational AI in healthcare market has been shaped by technology giants, AI-driven startups, and healthcare-focused innovators, competing on accuracy, integration, and patient engagement. Nuance (Microsoft), IBM, Google, and NVIDIA have concentrated on large-scale AI infrastructure, natural language processing, and deep learning models that enhance clinical documentation, patient communication, and diagnostic support. Their strategies focuses scalability, data security, and compliance with healthcare regulations. Corti, Enlitic, and Oncora Medical have targeted specialized applications, including real-time emergency support, radiology interpretation, and oncology workflows, positioning themselves as niche leaders.

UST, Authenticx, Hyro, and Notable have differentiated through workflow automation and virtual assistants designed to reduce provider burden and streamline patient interactions. Mediktor and Babylon Health have advanced symptom-checking platforms and patient triage systems, focusing on accessible healthcare delivery. Rasa Technologies, Fireflies, and Abridge AI, Inc. have built strong positions with conversational frameworks, transcription tools, and medical note automation. Product brochures highlight features such as multilingual capability, HIPAA compliance, integration with electronic health records, and AI models trained on diverse clinical datasets.

Competition revolves around trust, adaptability, and clinical validation. Nuance and IBM emphasize proven deployments across hospitals and health systems, while NVIDIA and Google position their platforms as foundational AI engines powering multiple healthcare applications. Startups highlight agility, domain-specific AI, and affordability. Brochures consistently present value through reduced administrative workload, improved diagnostic accuracy, and enhanced patient experiences. The market has evolved into a landscape where transparency, accuracy, and seamless integration into healthcare ecosystems define customer preference, with product literature serving as a primary tool to project technical credibility and practical impact.

| Items | Values |

| Quantitative Units (2025) | USD 17.2 billion |

| Component | Chatbots, Virtual Assistants, Speech Recognition Systems, Services |

| Technology Outlook | Speech Recognition & Generation, Natural Language Processing & Understanding, Machine Learning & Deep Learning, Large Language Models & Generative AI, Dialogue Management & Orchestration |

| Application Outlook | Patient Engagement & Support, Mental Health Support & Therapy Bots, Medical Diagnosis & Clinical Decision Support, Remote Patient Monitoring, Telemedicine & Virtual Consultations, Administrative & Workflow Automation, Pharmaceutical & Drug Information Assistance, Medical Training & Education |

| End Use | Hospitals & Clinics, Patients & Individuals, Healthcare Payers & Insurance Companies, Pharmaceutical & Life Sciences Companies, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Nuance (Microsoft), Corti, Enlitic Inc., IBM, UST, Authenticx, LivePerson, Hyro, Oncora Medical, NVIDIA Corporation |

| Additional Attributes | Market sizing by AI model complexity and deployment type, regional adoption patterns, competitive landscape analysis, healthcare provider preferences for cloud versus on-premise solutions, integration with electronic health records, clinical validation requirements, and innovations in healthcare-specific natural language processing |

The global conversational ai in healthcare market is estimated to be valued at USD 17.2 billion in 2025.

The market size for the conversational ai in healthcare market is projected to reach USD 169.5 billion by 2035.

The conversational ai in healthcare market is expected to grow at a 25.7% CAGR between 2025 and 2035.

The key product types in conversational ai in healthcare market are chatbots, virtual assistants, speech recognition systems and services.

In terms of technology outlook , speech recognition & generation segment to command 30.8% share in the conversational ai in healthcare market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Healthcare Air Purifier Market Size and Share Forecast Outlook 2025 to 2035

Healthcare AI Computer Vision Market Size and Share Forecast Outlook 2025 to 2035

Conversational AI Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Cold Chain Logistics Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Regulatory Affairs Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

AI Code Assistant Market Size and Share Forecast Outlook 2025 to 2035

AI-Based Data Observability Software Market Size and Share Forecast Outlook 2025 to 2035

Air Fryer Paper Liners Market Size and Share Forecast Outlook 2025 to 2035

Air Struts Market Size and Share Forecast Outlook 2025 to 2035

AI-powered Wealth Management Solution Market Size and Share Forecast Outlook 2025 to 2035

Airless Paint Spray System Market Size and Share Forecast Outlook 2025 to 2035

AI Powered Software Testing Tool Market Size and Share Forecast Outlook 2025 to 2035

AI Document Generator Market Size and Share Forecast Outlook 2025 to 2035

AI in Fintech Market Size and Share Forecast Outlook 2025 to 2035

Air Caster Skids System Market Size and Share Forecast Outlook 2025 to 2035

AI-Driven HD Mapping Market Size and Share Forecast Outlook 2025 to 2035

AI Platform Market Size and Share Forecast Outlook 2025 to 2035

AI-powered Spinal Surgery Market Size and Share Forecast Outlook 2025 to 2035

AI-Powered Sleep Technologies Market Size and Share Forecast Outlook 2025 to 2035

AI-Powered Gait & Mobility Analytics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA