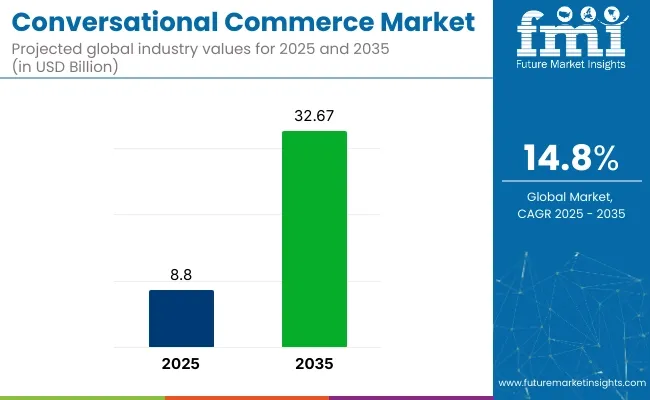

The conversational commerce market is estimated to generate a market size of USD 8.80 billion in 2025 and is expected to reach USD 32.67 billion by 2035, reflecting a compound annual growth rate (CAGR) of 14.8% during the forecast period.

Conversational commerce, which refers to the use of messaging apps, chatbots, and other conversational interfaces to facilitate online shopping and customer service, is transforming the way businesses engage with consumers. The growth of this market is primarily driven by the increasing use of artificial intelligence (AI) and machine learning (ML) technologies, the rise of messaging platforms, and the growing consumer preference for personalized shopping experiences.

One of the key drivers of this market’s growth is the increasing adoption of chatbots and messaging apps by businesses to enhance customer engagement. These tools enable real-time communication with consumers, offering personalized recommendations, instant responses to inquiries, and seamless purchasing experiences. As customers demand faster, more efficient, and personalized services, conversational commerce provides an ideal solution for businesses looking to improve customer satisfaction and increase conversion rates.

Recent developments in the conversational commerce market include the integration of advanced AI and natural language processing (NLP) technologies into chatbots and virtual assistants. These innovations are enhancing the ability of businesses to understand and respond to customer queries in a more human-like and intuitive manner.

| Attribute | Value |

|---|---|

| Market Size in 2025 | USD 8.80 billion |

| Market Size in 2035 | USD 32.67 billion |

| CAGR (2025 to 2035) | 14.8% |

Furthermore, the integration of payment systems and order management capabilities within messaging platforms is streamlining the purchasing process, allowing consumers to make purchases directly within the chat interface, which further boosts the market’s growth.

On September 14, 2023, Vonage introduced its Conversational Commerce solution for Salesforce Marketing Cloud. This integration enables businesses to engage customers and facilitate transactions via WhatsApp, leveraging AI-driven bots and live agents. The solution aims to enhance personalized marketing campaigns and streamline customer interactions across various channels. This was officially announced in the company's press release.

As the market continues to expand, ongoing advancements in AI, NLP, and payment technologies will further enhance the capabilities of conversational commerce platforms. This will enable businesses to provide a more seamless, personalized, and efficient shopping experience, fueling further growth in the market.

Leading companies in conversational commerce are integrating AI, natural language processing (NLP), machine learning, and omnichannel communication to enhance customer engagement, personalize shopping experiences, and streamline sales processes. These innovations cater to retail, banking, telecom, and service industries.

LivePerson:

LivePerson uses AI-powered chatbots and messaging platforms that enable brands to interact with customers across multiple channels in real-time. Their conversational AI supports personalized recommendations, automated customer support, and seamless handoffs to human agents.

Salesforce (Einstein AI):

Salesforce integrates its Einstein AI into its Commerce Cloud and Service Cloud platforms, delivering smart chatbots and predictive analytics. Their solutions help businesses automate conversations, offer personalized product suggestions, and improve customer journey management.

Google (Dialogflow):

Google’s Dialogflow provides powerful NLP and voice recognition capabilities for building conversational agents. It supports omnichannel deployment, enabling brands to create interactive chatbots and voice assistants for sales, support, and marketing.

IBM Watson Assistant:

IBM Watson Assistant leverages advanced AI to build sophisticated virtual assistants capable of understanding complex queries and providing contextual responses. It’s widely used in banking, healthcare, and retail for conversational commerce applications.

Zendesk (Answer Bot):

Zendesk’s Answer Bot employs machine learning to automatically resolve customer inquiries through chat, email, and messaging platforms. It integrates with sales and support workflows, enhancing conversational commerce by reducing response times and boosting customer satisfaction.

Twilio (Autopilot):

Twilio’s Autopilot platform offers customizable conversational AI bots that handle customer interactions across SMS, voice, and messaging apps. It empowers businesses to automate lead generation, customer support, and transactional conversations.

Shopify (Kit):

Shopify’s Kit is a virtual marketing assistant that uses AI to help merchants manage their online stores through conversational interfaces, offering personalized marketing recommendations, advertising automation, and customer engagement tools.

The below table presents the expected CAGR for the global Conversational Commerce market over several semi-annual periods spanning from 2025 to 2035. This assessment outlines changes in the Conversational Commerce industry and identify revenue trends, offering key decision makers an understanding about market performance throughout the year.

H1 represents first half of the year from January to June, H2 spans from July to December, which is the second half. In the first half H1 of the year from 2024 to 2034, the business is predicted to surge at a CAGR of 13.9%, followed by a slightly higher growth rate of 14.4% in the second half H2 of the same decade.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 13.9% |

| H2 (2024 to 2034) | 14.4% |

| H1 (2025 to 2035) | 14.6% |

| H2 (2025 to 2035) | 15.2% |

Moving into the subsequent period, from H1 2024 to H2 2034, the CAGR is projected to decrease slightly to 14.6% in the first half and remain higher at 15.2% in the second half. In the first half H1 the market witnessed an increase of 70 BPS while in the second half H2, the market witnessed an increase of 80 BPS.

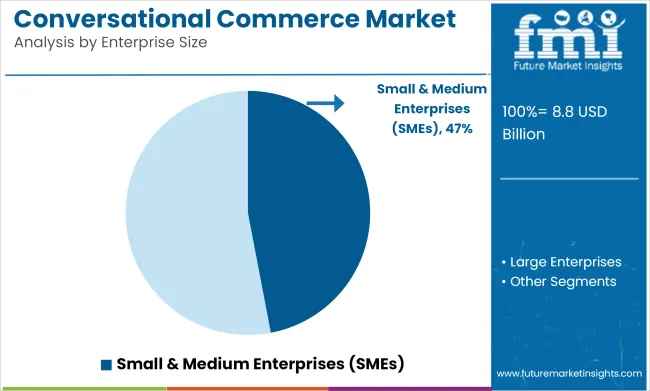

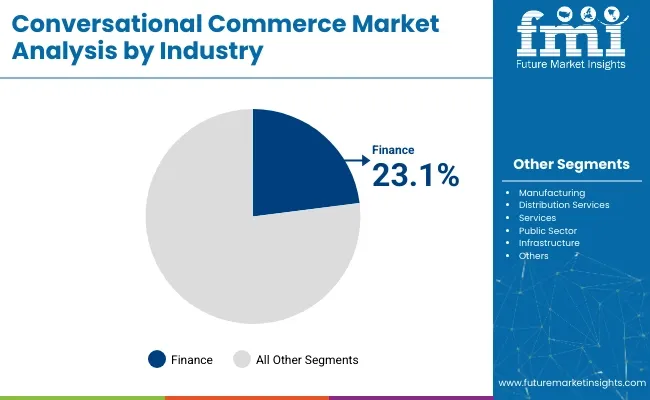

The global conversational commerce market is gaining momentum from 2025 to 2035, driven by the rising integration of AI chatbots, messaging apps, and voice assistants across industries. In 2025, SMEs are projected to capture 47.0% of the enterprise size segment, while the finance industry is expected to hold 23.1% of the industry segment. Key players include Twilio, LivePerson, and Salesforce.

The SMEs segment is expected to account for 47.0% of the enterprise size segment in 2025. Small and medium-sized enterprises are increasingly embracing conversational commerce to compete with larger businesses by enhancing customer engagement, streamlining support, and improving conversion rates. With limited budgets, SMEs find value in scalable, plug-and-play chatbot and messaging solutions that offer 24/7 customer service without requiring large IT investments.

Providers like Twilio and Zendesk are targeting this segment with AI-powered APIs, no-code interfaces, and integrated CRM tools that automate lead generation, appointment scheduling, and sales transactions. WhatsApp Business, Meta Messenger, and Google Business Messages are also seeing increased SME adoption due to their ubiquity and affordability.

Additionally, the rise of omnichannel retail and mobile commerce is pushing SMEs to leverage conversational tools for personalized shopping experiences. As digital transformation accelerates across developing markets, the SME segment is set to maintain strong momentum, fueled by rising internet penetration and growing demand for agile, customer-first digital solutions.

The finance industry is projected to hold 23.1% of the industry segment market share in 2025. Conversational commerce is playing a pivotal role in transforming financial services by enabling secure, real-time customer interactions across chat, voice, and messaging platforms. Banks, fintechs, and insurance companies are leveraging AI chatbots and virtual assistants to offer account updates, fraud alerts, payment reminders, and even financial advice.

Companies like LivePerson and Salesforce are leading the charge with enterprise-grade platforms tailored for financial institutions, ensuring compliance, data security, and seamless integration with core banking systems. Use cases are expanding to include biometric verification, conversational loan applications, and AI-driven investment suggestions, offering customers frictionless and personalized financial journeys.

The growing preference for self-service banking and round-the-clock availability is further accelerating the use of conversational tools in the sector. As trust, convenience, and automation become central to financial experiences, the finance industry’s investment in conversational commerce is set to deepen significantly over the coming decade.

Rising adoption of AI-driven chatbots and voice assistants for customer engagement

AI-driven chatbots and voice assistants have evolved as key aspects in driving customer engagement within the conversational commerce industry. These technologies are being utilized by businesses to deliver immediate, tailored responses, enhancing customer satisfaction and operational efficiency. According to a recent report, the global chatbot market was valued at USD 5.1 billion in 2023 and is expected to reach USD 36.3 billion by 2032, at a compound annual growth rate (CAGR) of 24.4%.

The growth is driven by increased automatic customer support demand and major progresses in AI technology. For example, Wendy’s will begin using AI technology to take orders at 500 to 600 of its drive-thrus by the end of 2025, with the goal of improving the speed and accuracy of service.

In the same vein, also expanding is SoundHound AI whose voice technology has reached more than 10,000 restaurants, recently signing a partnership with Torchy's Tacos to bring in voice AI across the establishment's 130 locations to optimize order management for efficient service. Such trends highlight just how critical AI-powered conversational solutions have become in contemporary customer engagement playbooks.

Integration of AI and machine learning for enhanced personalization

AI and machine learning are enabling the personalization of customer experiences like never before. These technologies use data analytics to process and analyze large amounts of data, allowing businesses to customize their responses and recommendations based on individual consumer preferences, thus improving the user experience in general.

According to a recent study, 70% of brands say they are already using artificial intelligence to communicate with customers, from personalized product recommendations to customized support interactions. It's not just in retail; banking, law, medicine, and other industries are using AI tools to communicate with customers and deliver services. Professionals, for instance, are using generative AI tools to write emails and reports, making processes easier and the client relationship more human.

Rising need for secure and compliant conversational platforms in regulated industries

The conversational AI being adopted across industry verticals, compliance and security have never been more critical, particularly in regulated industries like healthcare and finance. It is vital to ensure sensitive information is protected and standards are maintained to avoid adverse effects in terms of customer trust and regulatory standards.

In the United States, standards established in the Health Insurance Portability and Accountability Act (HIPAA) impose strict safeguards for patient health data. It is possible for a conversational AI to work on a secure and HIPPA-compliant platform for storage and transmission of PHI, thus helping an organization protect valuable patient health data.

In a similar vein, the Executive Order on Improving the Nation's Cybersecurity underscores the importance of ramming up cybersecurity and software supply chain integrity; this naturally extends to the secure development and deployment of AI technologies.

High Operational Costs for Real-Time Scalability in Conversational Commerce

AI Chatbots, voice assistants, and real-time messaging systems are a core part of optimizing conversational commerce. But, such real-time high-volume interaction needs strong cloud infrastructure, resulting in high operational costs. Organizations need to invest in scalable cloud computing solutions, capable of managing peak traffic times seamlessly, without latency issues.

Needless to say, the demand for near-instantaneous response times and non-stop service puts immense strain on businesses to efficiently implement high-powered servers, AI-driven data analytics, and storage solutions, resulting in a mounting bill.

Moreover, there are also cloud infrastructure costs on account of the continuous training and real-time processing capabilities that AI models driving conversational commerce will have to possess. With customer engagement expanding across various platforms, companies are required to ensure that third-party integrations with such things as messaging apps, payment gateways and CRM systems, will be seamless. This results in increased expenditure on software personnel and API maintenance, data synchronization in real time.

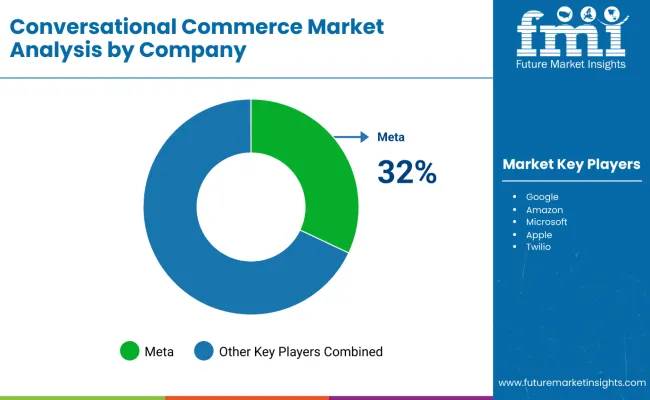

The Tier 1 vendors, including giant technology companies and major conversational AI vendors, own around 45% to 50% of the market. They are introducing thousands of new users to their own platform and ecosystems, which today include sophisticated AI features, natural language capabilities, unified e-commerce offerings, etc.

Mid-sized vendors that have built dedicated conversational commerce solutions comprise Tier 2, 15% to 20% of the market. Such vendors tend to target niche markets or specific industries, offering custom services that cater to unique business requirements. They offer flexible and customized solutions that enable them to successfully cater to a wide array of clients.

Tier 3 vendors represent the remaining 25% to 30% of the market and include smaller companies or startups exploring the conversational commerce market. The smaller market share than its competitors but helps drive innovation in the industry with new technologies and approaches. Their nimbleness allows them to respond rapidly to rising trends, fulfilling the ever-evolving needs of both consumers and enterprises.

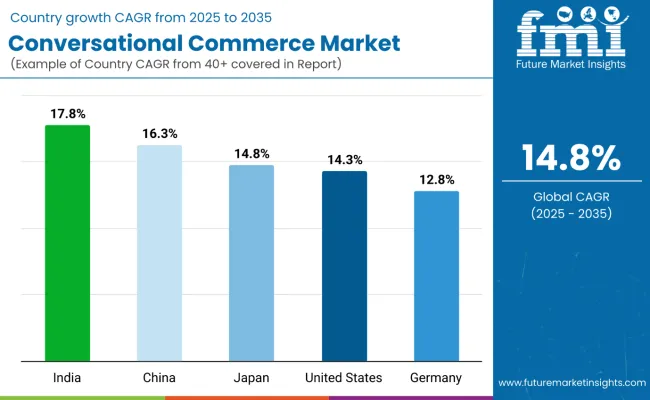

The section highlights the CAGRs of countries experiencing growth in the Conversational Commerce market, along with the latest advancements contributing to overall market development. Based on current estimates China, India and USA are expected to see steady growth during the forecast period.

| Countries | CAGR from 2025 to 2035 |

|---|---|

| India | 17.8% |

| China | 16.3% |

| Germany | 12.8% |

| Japan | 14.8% |

| United States | 14.3% |

With 121 languages, India's diverse linguistic makeup naturally poses a challenge for businesses who want to target a wide consumer base. As such, Indian companies are rapidly implementing multilingual AI chatbots to communicate with this heterogeneous audience. These sophisticated systems enable multi-regional language interactions improving customer engagement and satisfaction.

Movements to engender this technological revolution have the full support of the Indian government in the form of Bhashini, an AI-driven linguistic translation Programme that aims to create open-source datasets in the language of the local populace. Not only does this facilitate AI tool creation, it allows digital services to be available to the non-English speaking population across the country.

Employing such multilingual AI chatbots can empower businesses to tailor their products and services to consumers from diverse linguistic backgrounds while widening their market scope and promoting inclusivity in the digital economy. India is anticipated to see substantial growth at a CAGR 17.8% from 2025 to 2035 in the Conversational Commerce market.

AI-powered solutions are rapidly being integrated into customer engagement strategies in the USA. A recent article examines how federal agencies are leveraging artificial intelligence to improve citizen services and be more efficient and accessible. For example, legislative, judicial and executive agencies are using AI to transform contact centers to respond to the public more quickly and efficiently.

Such government-backed AI technologies will not only save time and money for the state but also serve as an example for private companies to follow. Businesses can provide personalized interactions, serving on-demand responses to customer inquiries and getting ahead of consumer needs through the implementation of customer engagement tools powered by artificial intelligence, resulting in higher levels of customer satisfaction and loyalty. USA Conversational Commerce market is anticipated to grow at a CAGR 14.3% during this period.

The surge of smart phone users in China provides a perfect environment for the propagation of AI conversation platforms. Smartphones are prevalent: consumers have the ability to use digital services and communicate with businesses on multiple channels, such as through AI chatbots and voice assistants. The transformative potential of artificial intelligence has not gone unnoticed by the Chinese government, which is actively fostering international collaboration to advance AI technology.

This stance not only cultivates what is being innovated in the land but also serves to facilitate the creation of high-level exchanges in line with the growing needs of the Chinese people. China is anticipated to see substantial growth in the Conversational Commerce market significantly holds dominant share of 63.2% in 2025.

The market for Conversational Commerce is driven by need and rapid development in AI, NLP and cloud-based solutions. Companies are working on improving the capabilities of chatbots, incorporating generative AI applications and improving omnichannel engagement. There is intense competition in delivering not only secure, scalable, personalized customer interactions. Innovation and compliance remain key driver of competitiveness.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 8.80 billion |

| Projected Market Size (2035) | USD 32.67 billion |

| CAGR (2025 to 2035) | 14.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value and million users for volume |

| Solutions Analyzed (Segment 1) | Software, Services |

| Enterprise Sizes Analyzed (Segment 2) | Small & Medium Enterprises (SMEs), Large Enterprises |

| Industries Analyzed (Segment 3) | Finance, Manufacturing, Distribution Services, Services, Public Sector, Infrastructure |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

| Key Players influencing the Conversational Commerce Market | Meta, Google, Amazon, Microsoft, Apple, Twilio, Vonage, Haptik, LivePerson, Sinch |

| Additional Attributes | CAGR trends by enterprise size (SMEs vs large), Growth in financial sector chatbot deployment, Role of GenAI in conversational solutions, Demand for omnichannel CX platforms, Government support for digital transformation of SMEs, Customer engagement strategies through AI automation |

In terms of solution, the segment is divided into software and services.

In terms of enterprise size, the segment is segregated into Small & Medium Enterprises (SMEs) and Large Enterprises.

In terms of industry, the segment is segregated into Finance, Manufacturing, Distribution Services, Services, Public Sector, Infrastructure.

A regional analysis has been carried out in key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East and Africa (MEA), and Europe.

The Global Conversational Commerce industry is projected to witness CAGR of 12.3% between 2025 and 2035.

The Global Conversational Commerce industry stood at USD 8.80 billion in 2025.

The Global Conversational Commerce industry is anticipated to reach USD 32.67 billion.

South Asia & Pacific is set to record the highest CAGR of 16.9% in the assessment period.

The key players operating in the Global Conversational Commerce Industry Meta, Google, Amazon, Microsoft, Apple, Twilio, Vonage, Haptik, LivePerson, Sinch.

Table 1: Global Market Value (USD Million) Forecast by Region, 2020 to 2035

Table 2: Global Market Value (USD Million) Forecast by Component, 2020 to 2035

Table 3: Global Market Value (USD Million) Forecast by Type, 2020 to 2035

Table 4: Global Market Value (USD Million) Forecast by Deployment Mode, 2020 to 2035

Table 5: Global Market Value (USD Million) Forecast by Enterprise Size, 2020 to 2035

Table 6: Global Market Value (USD Million) Forecast by Business Function, 2020 to 2035

Table 7: Global Market Value (USD Million) Forecast by Industry, 2020 to 2035

Table 8: North America Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 9: North America Market Value (USD Million) Forecast by Component, 2020 to 2035

Table 10: North America Market Value (USD Million) Forecast by Type, 2020 to 2035

Table 11: North America Market Value (USD Million) Forecast by Deployment Mode, 2020 to 2035

Table 12: North America Market Value (USD Million) Forecast by Enterprise Size, 2020 to 2035

Table 13: North America Market Value (USD Million) Forecast by Business Function, 2020 to 2035

Table 14: North America Market Value (USD Million) Forecast by Industry, 2020 to 2035

Table 15: Latin America Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 16: Latin America Market Value (USD Million) Forecast by Component, 2020 to 2035

Table 17: Latin America Market Value (USD Million) Forecast by Type, 2020 to 2035

Table 18: Latin America Market Value (USD Million) Forecast by Deployment Mode, 2020 to 2035

Table 19: Latin America Market Value (USD Million) Forecast by Enterprise Size, 2020 to 2035

Table 20: Latin America Market Value (USD Million) Forecast by Business Function, 2020 to 2035

Table 21: Latin America Market Value (USD Million) Forecast by Industry, 2020 to 2035

Table 22: Western Europe Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 23: Western Europe Market Value (USD Million) Forecast by Component, 2020 to 2035

Table 24: Western Europe Market Value (USD Million) Forecast by Type, 2020 to 2035

Table 25: Western Europe Market Value (USD Million) Forecast by Deployment Mode, 2020 to 2035

Table 26: Western Europe Market Value (USD Million) Forecast by Enterprise Size, 2020 to 2035

Table 27: Western Europe Market Value (USD Million) Forecast by Business Function, 2020 to 2035

Table 28: Western Europe Market Value (USD Million) Forecast by Industry, 2020 to 2035

Table 29: Eastern Europe Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 30: Eastern Europe Market Value (USD Million) Forecast by Component, 2020 to 2035

Table 31: Eastern Europe Market Value (USD Million) Forecast by Type, 2020 to 2035

Table 32: Eastern Europe Market Value (USD Million) Forecast by Deployment Mode, 2020 to 2035

Table 33: Eastern Europe Market Value (USD Million) Forecast by Enterprise Size, 2020 to 2035

Table 34: Eastern Europe Market Value (USD Million) Forecast by Business Function, 2020 to 2035

Table 35: Eastern Europe Market Value (USD Million) Forecast by Industry, 2020 to 2035

Table 36: South Asia and Pacific Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 37: South Asia and Pacific Market Value (USD Million) Forecast by Component, 2020 to 2035

Table 38: South Asia and Pacific Market Value (USD Million) Forecast by Type, 2020 to 2035

Table 39: South Asia and Pacific Market Value (USD Million) Forecast by Deployment Mode, 2020 to 2035

Table 40: South Asia and Pacific Market Value (USD Million) Forecast by Enterprise Size, 2020 to 2035

Table 41: South Asia and Pacific Market Value (USD Million) Forecast by Business Function, 2020 to 2035

Table 42: South Asia and Pacific Market Value (USD Million) Forecast by Industry, 2020 to 2035

Table 43: East Asia Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 44: East Asia Market Value (USD Million) Forecast by Component, 2020 to 2035

Table 45: East Asia Market Value (USD Million) Forecast by Type, 2020 to 2035

Table 46: East Asia Market Value (USD Million) Forecast by Deployment Mode, 2020 to 2035

Table 47: East Asia Market Value (USD Million) Forecast by Enterprise Size, 2020 to 2035

Table 48: East Asia Market Value (USD Million) Forecast by Business Function, 2020 to 2035

Table 49: East Asia Market Value (USD Million) Forecast by Industry, 2020 to 2035

Table 50: Middle East and Africa Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 51: Middle East and Africa Market Value (USD Million) Forecast by Component, 2020 to 2035

Table 52: Middle East and Africa Market Value (USD Million) Forecast by Type, 2020 to 2035

Table 53: Middle East and Africa Market Value (USD Million) Forecast by Deployment Mode, 2020 to 2035

Table 54: Middle East and Africa Market Value (USD Million) Forecast by Enterprise Size, 2020 to 2035

Table 55: Middle East and Africa Market Value (USD Million) Forecast by Business Function, 2020 to 2035

Table 56: Middle East and Africa Market Value (USD Million) Forecast by Industry, 2020 to 2035

Figure 1: Global Market Value (USD Million) by Component, 2025 to 2035

Figure 2: Global Market Value (USD Million) by Type, 2025 to 2035

Figure 3: Global Market Value (USD Million) by Deployment Mode, 2025 to 2035

Figure 4: Global Market Value (USD Million) by Enterprise Size, 2025 to 2035

Figure 5: Global Market Value (USD Million) by Business Function, 2025 to 2035

Figure 6: Global Market Value (USD Million) by Industry, 2025 to 2035

Figure 7: Global Market Value (USD Million) by Region, 2025 to 2035

Figure 8: Global Market Value (USD Million) Analysis by Region, 2020 to 2035

Figure 9: Global Market Value Share (%) and BPS Analysis by Region, 2025 to 2035

Figure 10: Global Market Y-o-Y Growth (%) Projections by Region, 2025 to 2035

Figure 11: Global Market Value (USD Million) Analysis by Component, 2020 to 2035

Figure 12: Global Market Value Share (%) and BPS Analysis by Component, 2025 to 2035

Figure 13: Global Market Y-o-Y Growth (%) Projections by Component, 2025 to 2035

Figure 14: Global Market Value (USD Million) Analysis by Type, 2020 to 2035

Figure 15: Global Market Value Share (%) and BPS Analysis by Type, 2025 to 2035

Figure 16: Global Market Y-o-Y Growth (%) Projections by Type, 2025 to 2035

Figure 17: Global Market Value (USD Million) Analysis by Deployment Mode, 2020 to 2035

Figure 18: Global Market Value Share (%) and BPS Analysis by Deployment Mode, 2025 to 2035

Figure 19: Global Market Y-o-Y Growth (%) Projections by Deployment Mode, 2025 to 2035

Figure 20: Global Market Value (USD Million) Analysis by Enterprise Size, 2020 to 2035

Figure 21: Global Market Value Share (%) and BPS Analysis by Enterprise Size, 2025 to 2035

Figure 22: Global Market Y-o-Y Growth (%) Projections by Enterprise Size, 2025 to 2035

Figure 23: Global Market Value (USD Million) Analysis by Business Function, 2020 to 2035

Figure 24: Global Market Value Share (%) and BPS Analysis by Business Function, 2025 to 2035

Figure 25: Global Market Y-o-Y Growth (%) Projections by Business Function, 2025 to 2035

Figure 26: Global Market Value (USD Million) Analysis by Industry, 2020 to 2035

Figure 27: Global Market Value Share (%) and BPS Analysis by Industry, 2025 to 2035

Figure 28: Global Market Y-o-Y Growth (%) Projections by Industry, 2025 to 2035

Figure 29: Global Market Attractiveness by Component, 2025 to 2035

Figure 30: Global Market Attractiveness by Type, 2025 to 2035

Figure 31: Global Market Attractiveness by Deployment Mode, 2025 to 2035

Figure 32: Global Market Attractiveness by Enterprise Size, 2025 to 2035

Figure 33: Global Market Attractiveness by Business Function, 2025 to 2035

Figure 34: Global Market Attractiveness by Industry, 2025 to 2035

Figure 35: Global Market Attractiveness by Region, 2025 to 2035

Figure 36: North America Market Value (USD Million) by Component, 2025 to 2035

Figure 37: North America Market Value (USD Million) by Type, 2025 to 2035

Figure 38: North America Market Value (USD Million) by Deployment Mode, 2025 to 2035

Figure 39: North America Market Value (USD Million) by Enterprise Size, 2025 to 2035

Figure 40: North America Market Value (USD Million) by Business Function, 2025 to 2035

Figure 41: North America Market Value (USD Million) by Industry, 2025 to 2035

Figure 42: North America Market Value (USD Million) by Country, 2025 to 2035

Figure 43: North America Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 44: North America Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 45: North America Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 46: North America Market Value (USD Million) Analysis by Component, 2020 to 2035

Figure 47: North America Market Value Share (%) and BPS Analysis by Component, 2025 to 2035

Figure 48: North America Market Y-o-Y Growth (%) Projections by Component, 2025 to 2035

Figure 49: North America Market Value (USD Million) Analysis by Type, 2020 to 2035

Figure 50: North America Market Value Share (%) and BPS Analysis by Type, 2025 to 2035

Figure 51: North America Market Y-o-Y Growth (%) Projections by Type, 2025 to 2035

Figure 52: North America Market Value (USD Million) Analysis by Deployment Mode, 2020 to 2035

Figure 53: North America Market Value Share (%) and BPS Analysis by Deployment Mode, 2025 to 2035

Figure 54: North America Market Y-o-Y Growth (%) Projections by Deployment Mode, 2025 to 2035

Figure 55: North America Market Value (USD Million) Analysis by Enterprise Size, 2020 to 2035

Figure 56: North America Market Value Share (%) and BPS Analysis by Enterprise Size, 2025 to 2035

Figure 57: North America Market Y-o-Y Growth (%) Projections by Enterprise Size, 2025 to 2035

Figure 58: North America Market Value (USD Million) Analysis by Business Function, 2020 to 2035

Figure 59: North America Market Value Share (%) and BPS Analysis by Business Function, 2025 to 2035

Figure 60: North America Market Y-o-Y Growth (%) Projections by Business Function, 2025 to 2035

Figure 61: North America Market Value (USD Million) Analysis by Industry, 2020 to 2035

Figure 62: North America Market Value Share (%) and BPS Analysis by Industry, 2025 to 2035

Figure 63: North America Market Y-o-Y Growth (%) Projections by Industry, 2025 to 2035

Figure 64: North America Market Attractiveness by Component, 2025 to 2035

Figure 65: North America Market Attractiveness by Type, 2025 to 2035

Figure 66: North America Market Attractiveness by Deployment Mode, 2025 to 2035

Figure 67: North America Market Attractiveness by Enterprise Size, 2025 to 2035

Figure 68: North America Market Attractiveness by Business Function, 2025 to 2035

Figure 69: North America Market Attractiveness by Industry, 2025 to 2035

Figure 70: North America Market Attractiveness by Country, 2025 to 2035

Figure 71: Latin America Market Value (USD Million) by Component, 2025 to 2035

Figure 72: Latin America Market Value (USD Million) by Type, 2025 to 2035

Figure 73: Latin America Market Value (USD Million) by Deployment Mode, 2025 to 2035

Figure 74: Latin America Market Value (USD Million) by Enterprise Size, 2025 to 2035

Figure 75: Latin America Market Value (USD Million) by Business Function, 2025 to 2035

Figure 76: Latin America Market Value (USD Million) by Industry, 2025 to 2035

Figure 77: Latin America Market Value (USD Million) by Country, 2025 to 2035

Figure 78: Latin America Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 79: Latin America Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 80: Latin America Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 81: Latin America Market Value (USD Million) Analysis by Component, 2020 to 2035

Figure 82: Latin America Market Value Share (%) and BPS Analysis by Component, 2025 to 2035

Figure 83: Latin America Market Y-o-Y Growth (%) Projections by Component, 2025 to 2035

Figure 84: Latin America Market Value (USD Million) Analysis by Type, 2020 to 2035

Figure 85: Latin America Market Value Share (%) and BPS Analysis by Type, 2025 to 2035

Figure 86: Latin America Market Y-o-Y Growth (%) Projections by Type, 2025 to 2035

Figure 87: Latin America Market Value (USD Million) Analysis by Deployment Mode, 2020 to 2035

Figure 88: Latin America Market Value Share (%) and BPS Analysis by Deployment Mode, 2025 to 2035

Figure 89: Latin America Market Y-o-Y Growth (%) Projections by Deployment Mode, 2025 to 2035

Figure 90: Latin America Market Value (USD Million) Analysis by Enterprise Size, 2020 to 2035

Figure 91: Latin America Market Value Share (%) and BPS Analysis by Enterprise Size, 2025 to 2035

Figure 92: Latin America Market Y-o-Y Growth (%) Projections by Enterprise Size, 2025 to 2035

Figure 93: Latin America Market Value (USD Million) Analysis by Business Function, 2020 to 2035

Figure 94: Latin America Market Value Share (%) and BPS Analysis by Business Function, 2025 to 2035

Figure 95: Latin America Market Y-o-Y Growth (%) Projections by Business Function, 2025 to 2035

Figure 96: Latin America Market Value (USD Million) Analysis by Industry, 2020 to 2035

Figure 97: Latin America Market Value Share (%) and BPS Analysis by Industry, 2025 to 2035

Figure 98: Latin America Market Y-o-Y Growth (%) Projections by Industry, 2025 to 2035

Figure 99: Latin America Market Attractiveness by Component, 2025 to 2035

Figure 100: Latin America Market Attractiveness by Type, 2025 to 2035

Figure 101: Latin America Market Attractiveness by Deployment Mode, 2025 to 2035

Figure 102: Latin America Market Attractiveness by Enterprise Size, 2025 to 2035

Figure 103: Latin America Market Attractiveness by Business Function, 2025 to 2035

Figure 104: Latin America Market Attractiveness by Industry, 2025 to 2035

Figure 105: Latin America Market Attractiveness by Country, 2025 to 2035

Figure 106: Western Europe Market Value (USD Million) by Component, 2025 to 2035

Figure 107: Western Europe Market Value (USD Million) by Type, 2025 to 2035

Figure 108: Western Europe Market Value (USD Million) by Deployment Mode, 2025 to 2035

Figure 109: Western Europe Market Value (USD Million) by Enterprise Size, 2025 to 2035

Figure 110: Western Europe Market Value (USD Million) by Business Function, 2025 to 2035

Figure 111: Western Europe Market Value (USD Million) by Industry, 2025 to 2035

Figure 112: Western Europe Market Value (USD Million) by Country, 2025 to 2035

Figure 113: Western Europe Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 116: Western Europe Market Value (USD Million) Analysis by Component, 2020 to 2035

Figure 117: Western Europe Market Value Share (%) and BPS Analysis by Component, 2025 to 2035

Figure 118: Western Europe Market Y-o-Y Growth (%) Projections by Component, 2025 to 2035

Figure 119: Western Europe Market Value (USD Million) Analysis by Type, 2020 to 2035

Figure 120: Western Europe Market Value Share (%) and BPS Analysis by Type, 2025 to 2035

Figure 121: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2025 to 2035

Figure 122: Western Europe Market Value (USD Million) Analysis by Deployment Mode, 2020 to 2035

Figure 123: Western Europe Market Value Share (%) and BPS Analysis by Deployment Mode, 2025 to 2035

Figure 124: Western Europe Market Y-o-Y Growth (%) Projections by Deployment Mode, 2025 to 2035

Figure 125: Western Europe Market Value (USD Million) Analysis by Enterprise Size, 2020 to 2035

Figure 126: Western Europe Market Value Share (%) and BPS Analysis by Enterprise Size, 2025 to 2035

Figure 127: Western Europe Market Y-o-Y Growth (%) Projections by Enterprise Size, 2025 to 2035

Figure 128: Western Europe Market Value (USD Million) Analysis by Business Function, 2020 to 2035

Figure 129: Western Europe Market Value Share (%) and BPS Analysis by Business Function, 2025 to 2035

Figure 130: Western Europe Market Y-o-Y Growth (%) Projections by Business Function, 2025 to 2035

Figure 131: Western Europe Market Value (USD Million) Analysis by Industry, 2020 to 2035

Figure 132: Western Europe Market Value Share (%) and BPS Analysis by Industry, 2025 to 2035

Figure 133: Western Europe Market Y-o-Y Growth (%) Projections by Industry, 2025 to 2035

Figure 134: Western Europe Market Attractiveness by Component, 2025 to 2035

Figure 135: Western Europe Market Attractiveness by Type, 2025 to 2035

Figure 136: Western Europe Market Attractiveness by Deployment Mode, 2025 to 2035

Figure 137: Western Europe Market Attractiveness by Enterprise Size, 2025 to 2035

Figure 138: Western Europe Market Attractiveness by Business Function, 2025 to 2035

Figure 139: Western Europe Market Attractiveness by Industry, 2025 to 2035

Figure 140: Western Europe Market Attractiveness by Country, 2025 to 2035

Figure 141: Eastern Europe Market Value (USD Million) by Component, 2025 to 2035

Figure 142: Eastern Europe Market Value (USD Million) by Type, 2025 to 2035

Figure 143: Eastern Europe Market Value (USD Million) by Deployment Mode, 2025 to 2035

Figure 144: Eastern Europe Market Value (USD Million) by Enterprise Size, 2025 to 2035

Figure 145: Eastern Europe Market Value (USD Million) by Business Function, 2025 to 2035

Figure 146: Eastern Europe Market Value (USD Million) by Industry, 2025 to 2035

Figure 147: Eastern Europe Market Value (USD Million) by Country, 2025 to 2035

Figure 148: Eastern Europe Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 149: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 150: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 151: Eastern Europe Market Value (USD Million) Analysis by Component, 2020 to 2035

Figure 152: Eastern Europe Market Value Share (%) and BPS Analysis by Component, 2025 to 2035

Figure 153: Eastern Europe Market Y-o-Y Growth (%) Projections by Component, 2025 to 2035

Figure 154: Eastern Europe Market Value (USD Million) Analysis by Type, 2020 to 2035

Figure 155: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2025 to 2035

Figure 156: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2025 to 2035

Figure 157: Eastern Europe Market Value (USD Million) Analysis by Deployment Mode, 2020 to 2035

Figure 158: Eastern Europe Market Value Share (%) and BPS Analysis by Deployment Mode, 2025 to 2035

Figure 159: Eastern Europe Market Y-o-Y Growth (%) Projections by Deployment Mode, 2025 to 2035

Figure 160: Eastern Europe Market Value (USD Million) Analysis by Enterprise Size, 2020 to 2035

Figure 161: Eastern Europe Market Value Share (%) and BPS Analysis by Enterprise Size, 2025 to 2035

Figure 162: Eastern Europe Market Y-o-Y Growth (%) Projections by Enterprise Size, 2025 to 2035

Figure 163: Eastern Europe Market Value (USD Million) Analysis by Business Function, 2020 to 2035

Figure 164: Eastern Europe Market Value Share (%) and BPS Analysis by Business Function, 2025 to 2035

Figure 165: Eastern Europe Market Y-o-Y Growth (%) Projections by Business Function, 2025 to 2035

Figure 166: Eastern Europe Market Value (USD Million) Analysis by Industry, 2020 to 2035

Figure 167: Eastern Europe Market Value Share (%) and BPS Analysis by Industry, 2025 to 2035

Figure 168: Eastern Europe Market Y-o-Y Growth (%) Projections by Industry, 2025 to 2035

Figure 169: Eastern Europe Market Attractiveness by Component, 2025 to 2035

Figure 170: Eastern Europe Market Attractiveness by Type, 2025 to 2035

Figure 171: Eastern Europe Market Attractiveness by Deployment Mode, 2025 to 2035

Figure 172: Eastern Europe Market Attractiveness by Enterprise Size, 2025 to 2035

Figure 173: Eastern Europe Market Attractiveness by Business Function, 2025 to 2035

Figure 174: Eastern Europe Market Attractiveness by Industry, 2025 to 2035

Figure 175: Eastern Europe Market Attractiveness by Country, 2025 to 2035

Figure 176: South Asia and Pacific Market Value (USD Million) by Component, 2025 to 2035

Figure 177: South Asia and Pacific Market Value (USD Million) by Type, 2025 to 2035

Figure 178: South Asia and Pacific Market Value (USD Million) by Deployment Mode, 2025 to 2035

Figure 179: South Asia and Pacific Market Value (USD Million) by Enterprise Size, 2025 to 2035

Figure 180: South Asia and Pacific Market Value (USD Million) by Business Function, 2025 to 2035

Figure 181: South Asia and Pacific Market Value (USD Million) by Industry, 2025 to 2035

Figure 182: South Asia and Pacific Market Value (USD Million) by Country, 2025 to 2035

Figure 183: South Asia and Pacific Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 184: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 185: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 186: South Asia and Pacific Market Value (USD Million) Analysis by Component, 2020 to 2035

Figure 187: South Asia and Pacific Market Value Share (%) and BPS Analysis by Component, 2025 to 2035

Figure 188: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Component, 2025 to 2035

Figure 189: South Asia and Pacific Market Value (USD Million) Analysis by Type, 2020 to 2035

Figure 190: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2025 to 2035

Figure 191: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2025 to 2035

Figure 192: South Asia and Pacific Market Value (USD Million) Analysis by Deployment Mode, 2020 to 2035

Figure 193: South Asia and Pacific Market Value Share (%) and BPS Analysis by Deployment Mode, 2025 to 2035

Figure 194: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Deployment Mode, 2025 to 2035

Figure 195: South Asia and Pacific Market Value (USD Million) Analysis by Enterprise Size, 2020 to 2035

Figure 196: South Asia and Pacific Market Value Share (%) and BPS Analysis by Enterprise Size, 2025 to 2035

Figure 197: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Enterprise Size, 2025 to 2035

Figure 198: South Asia and Pacific Market Value (USD Million) Analysis by Business Function, 2020 to 2035

Figure 199: South Asia and Pacific Market Value Share (%) and BPS Analysis by Business Function, 2025 to 2035

Figure 200: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Business Function, 2025 to 2035

Figure 201: South Asia and Pacific Market Value (USD Million) Analysis by Industry, 2020 to 2035

Figure 202: South Asia and Pacific Market Value Share (%) and BPS Analysis by Industry, 2025 to 2035

Figure 203: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Industry, 2025 to 2035

Figure 204: South Asia and Pacific Market Attractiveness by Component, 2025 to 2035

Figure 205: South Asia and Pacific Market Attractiveness by Type, 2025 to 2035

Figure 206: South Asia and Pacific Market Attractiveness by Deployment Mode, 2025 to 2035

Figure 207: South Asia and Pacific Market Attractiveness by Enterprise Size, 2025 to 2035

Figure 208: South Asia and Pacific Market Attractiveness by Business Function, 2025 to 2035

Figure 209: South Asia and Pacific Market Attractiveness by Industry, 2025 to 2035

Figure 210: South Asia and Pacific Market Attractiveness by Country, 2025 to 2035

Figure 211: East Asia Market Value (USD Million) by Component, 2025 to 2035

Figure 212: East Asia Market Value (USD Million) by Type, 2025 to 2035

Figure 213: East Asia Market Value (USD Million) by Deployment Mode, 2025 to 2035

Figure 214: East Asia Market Value (USD Million) by Enterprise Size, 2025 to 2035

Figure 215: East Asia Market Value (USD Million) by Business Function, 2025 to 2035

Figure 216: East Asia Market Value (USD Million) by Industry, 2025 to 2035

Figure 217: East Asia Market Value (USD Million) by Country, 2025 to 2035

Figure 218: East Asia Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 219: East Asia Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 220: East Asia Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 221: East Asia Market Value (USD Million) Analysis by Component, 2020 to 2035

Figure 222: East Asia Market Value Share (%) and BPS Analysis by Component, 2025 to 2035

Figure 223: East Asia Market Y-o-Y Growth (%) Projections by Component, 2025 to 2035

Figure 224: East Asia Market Value (USD Million) Analysis by Type, 2020 to 2035

Figure 225: East Asia Market Value Share (%) and BPS Analysis by Type, 2025 to 2035

Figure 226: East Asia Market Y-o-Y Growth (%) Projections by Type, 2025 to 2035

Figure 227: East Asia Market Value (USD Million) Analysis by Deployment Mode, 2020 to 2035

Figure 228: East Asia Market Value Share (%) and BPS Analysis by Deployment Mode, 2025 to 2035

Figure 229: East Asia Market Y-o-Y Growth (%) Projections by Deployment Mode, 2025 to 2035

Figure 230: East Asia Market Value (USD Million) Analysis by Enterprise Size, 2020 to 2035

Figure 231: East Asia Market Value Share (%) and BPS Analysis by Enterprise Size, 2025 to 2035

Figure 232: East Asia Market Y-o-Y Growth (%) Projections by Enterprise Size, 2025 to 2035

Figure 233: East Asia Market Value (USD Million) Analysis by Business Function, 2020 to 2035

Figure 234: East Asia Market Value Share (%) and BPS Analysis by Business Function, 2025 to 2035

Figure 235: East Asia Market Y-o-Y Growth (%) Projections by Business Function, 2025 to 2035

Figure 236: East Asia Market Value (USD Million) Analysis by Industry, 2020 to 2035

Figure 237: East Asia Market Value Share (%) and BPS Analysis by Industry, 2025 to 2035

Figure 238: East Asia Market Y-o-Y Growth (%) Projections by Industry, 2025 to 2035

Figure 239: East Asia Market Attractiveness by Component, 2025 to 2035

Figure 240: East Asia Market Attractiveness by Type, 2025 to 2035

Figure 241: East Asia Market Attractiveness by Deployment Mode, 2025 to 2035

Figure 242: East Asia Market Attractiveness by Enterprise Size, 2025 to 2035

Figure 243: East Asia Market Attractiveness by Business Function, 2025 to 2035

Figure 244: East Asia Market Attractiveness by Industry, 2025 to 2035

Figure 245: East Asia Market Attractiveness by Country, 2025 to 2035

Figure 246: Middle East and Africa Market Value (USD Million) by Component, 2025 to 2035

Figure 247: Middle East and Africa Market Value (USD Million) by Type, 2025 to 2035

Figure 248: Middle East and Africa Market Value (USD Million) by Deployment Mode, 2025 to 2035

Figure 249: Middle East and Africa Market Value (USD Million) by Enterprise Size, 2025 to 2035

Figure 250: Middle East and Africa Market Value (USD Million) by Business Function, 2025 to 2035

Figure 251: Middle East and Africa Market Value (USD Million) by Industry, 2025 to 2035

Figure 252: Middle East and Africa Market Value (USD Million) by Country, 2025 to 2035

Figure 253: Middle East and Africa Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 254: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 255: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 256: Middle East and Africa Market Value (USD Million) Analysis by Component, 2020 to 2035

Figure 257: Middle East and Africa Market Value Share (%) and BPS Analysis by Component, 2025 to 2035

Figure 258: Middle East and Africa Market Y-o-Y Growth (%) Projections by Component, 2025 to 2035

Figure 259: Middle East and Africa Market Value (USD Million) Analysis by Type, 2020 to 2035

Figure 260: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2025 to 2035

Figure 261: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2025 to 2035

Figure 262: Middle East and Africa Market Value (USD Million) Analysis by Deployment Mode, 2020 to 2035

Figure 263: Middle East and Africa Market Value Share (%) and BPS Analysis by Deployment Mode, 2025 to 2035

Figure 264: Middle East and Africa Market Y-o-Y Growth (%) Projections by Deployment Mode, 2025 to 2035

Figure 265: Middle East and Africa Market Value (USD Million) Analysis by Enterprise Size, 2020 to 2035

Figure 266: Middle East and Africa Market Value Share (%) and BPS Analysis by Enterprise Size, 2025 to 2035

Figure 267: Middle East and Africa Market Y-o-Y Growth (%) Projections by Enterprise Size, 2025 to 2035

Figure 268: Middle East and Africa Market Value (USD Million) Analysis by Business Function, 2020 to 2035

Figure 269: Middle East and Africa Market Value Share (%) and BPS Analysis by Business Function, 2025 to 2035

Figure 270: Middle East and Africa Market Y-o-Y Growth (%) Projections by Business Function, 2025 to 2035

Figure 271: Middle East and Africa Market Value (USD Million) Analysis by Industry, 2020 to 2035

Figure 272: Middle East and Africa Market Value Share (%) and BPS Analysis by Industry, 2025 to 2035

Figure 273: Middle East and Africa Market Y-o-Y Growth (%) Projections by Industry, 2025 to 2035

Figure 274: Middle East and Africa Market Attractiveness by Component, 2025 to 2035

Figure 275: Middle East and Africa Market Attractiveness by Type, 2025 to 2035

Figure 276: Middle East and Africa Market Attractiveness by Deployment Mode, 2025 to 2035

Figure 277: Middle East and Africa Market Attractiveness by Enterprise Size, 2025 to 2035

Figure 278: Middle East and Africa Market Attractiveness by Business Function, 2025 to 2035

Figure 279: Middle East and Africa Market Attractiveness by Industry, 2025 to 2035

Figure 280: Middle East and Africa Market Attractiveness by Country, 2025 to 2035

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Conversational AI in Healthcare Market Size and Share Forecast Outlook 2025 to 2035

Conversational Marketing Software Market Size and Share Forecast Outlook 2025 to 2035

Conversational AI Market Size and Share Forecast Outlook 2025 to 2035

Commerce Cloud Market

Europe Ecommerce Paper Bags Market Analysis – Trends & Forecast 2024-2034

Ecommerce Software & Platform Market – Trends & Forecast 2034

E-Commerce Packaging Market Forecast Outlook 2025 to 2035

E-commerce Platform Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Q-Commerce Last-Mile Thermal Packs & Reverse Logistics Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

E Commerce Flexible Packaging Market Size and Share Forecast Outlook 2025 to 2035

E Commerce Logistics Market Analysis – Trends, Growth & Forecast 2025 to 2035

E-commerce Market

Voice Commerce Services Market Analysis - Size, and Share, Forecast Outlook 2025 to 2035

Social Commerce Market Size and Share Forecast Outlook 2025 to 2035

Digital Commerce Market Insights - Growth & Demand 2025 to 2035

Digital Commerce Platform Market Analysis - Size, Share, and Forecast 2025 to 2035

Retail E-Commerce Packaging Market Size and Share Forecast Outlook 2025 to 2035

Apparel Re-commerce Market Size and Share Forecast Outlook 2025 to 2035

UK Digital Commerce Market Report – Demand, Growth & Industry Outlook 2025-2035

USA Digital Commerce Market Growth – Innovations, Trends & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA