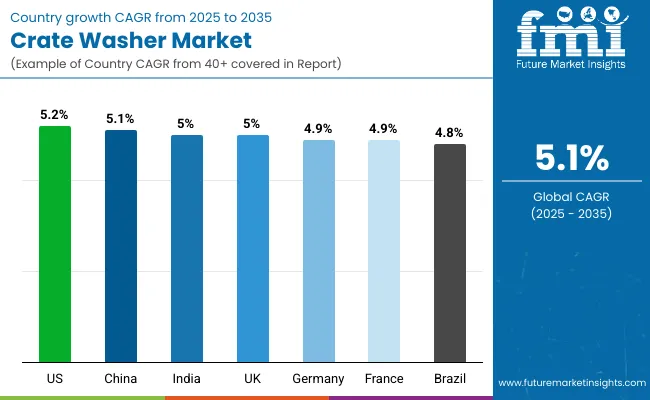

The crate washer market will expand from USD 2.8 billion in 2025 to USD 4.6 billion by 2035, advancing at a CAGR of 5.1%. Growth is driven by rising hygiene standards, automation in food and dairy facilities, and stringent cleaning regulations. Tunnel-type machines dominate due to high throughput and consistency, supporting large-scale operations.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 2.8 billion |

| Industry Value (2035F) | USD 4.6 billion |

| CAGR (2025 to 2035) | 5.1% |

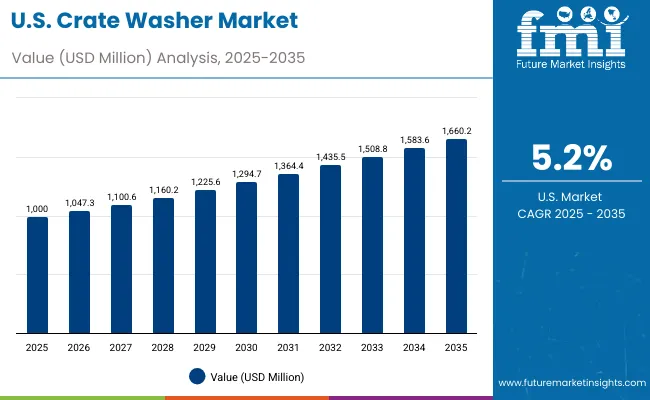

Between 2025 and 2030, the market will add USD 0.8 billion, mainly from food and beverage processing. From 2030 to 2035, an additional USD 1 billion will come from meat and dairy facilities adopting fully automated washers. Asia-Pacific will lead expansion, supported by industrial modernization and export-focused manufacturing.

From 2020 to 2024, crate washers gained steady traction as hygiene automation became mandatory in food and beverage industries. Manufacturers prioritized water efficiency and heat recovery systems. Tunnel and multi-tank washers became standard across meat and dairy facilities. Europe and Asia led adoption, supported by food safety regulations and exports.

By 2035, the market will reach USD 4.6 billion, registering a CAGR of 5.1%. Fully automated washers will dominate, driven by labour cost reduction and standardization in cleaning cycles. Asia-Pacific will lead growth, with India, China, and South Korea modernizing facilities. Food and dairy industries will anchor demand globally.

The crate washer market is expanding as hygiene, automation, and sustainability become industry priorities. Food, beverage, and dairy processors are upgrading to automated washers to meet strict safety standards and efficiency goals.

Manufacturers are innovating in energy recovery, water recycling, and automated control systems. Regulations such as HACCP compliance boost adoption. Expansion in food exports and central kitchens reinforces demand for large-scale tunnel washers.

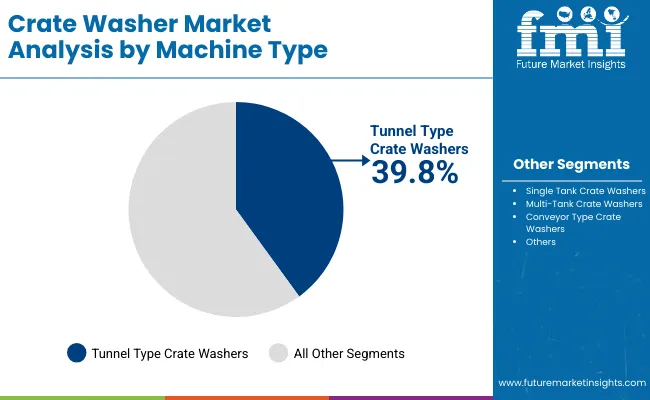

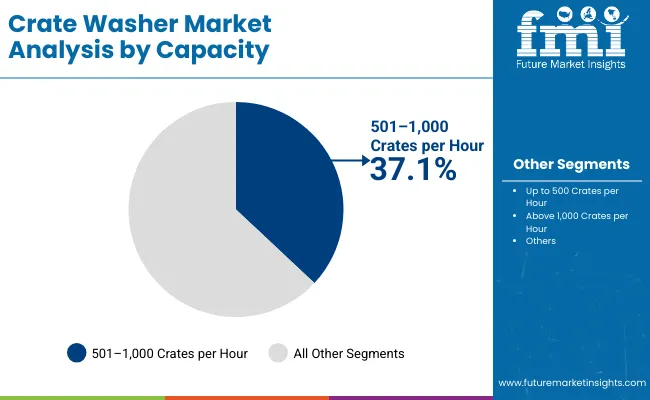

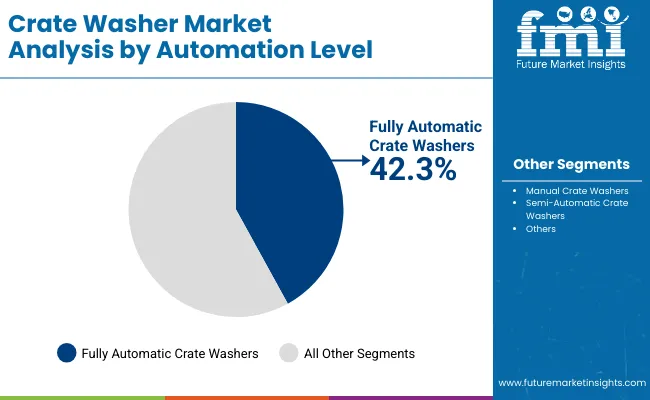

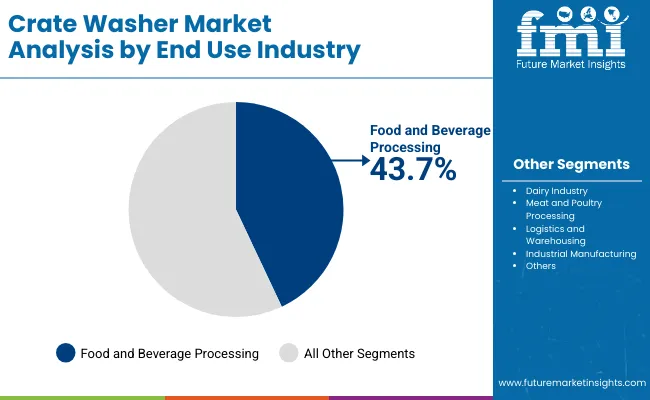

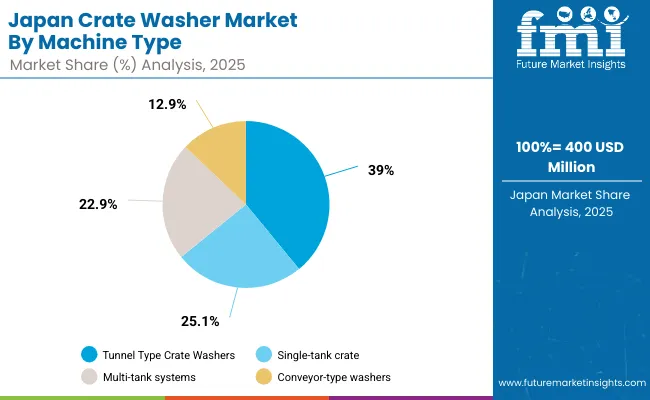

The crate washer market is segmented by machine type, capacity, automation level, end-use industry, and region. Machine types include tunnel-type, single-tank, multi-tank, and conveyor-type washers. Capacities range from up to 500 to above 1,000 crates per hour. Automation levels include fully automatic, manual, and semi-automatic washers. End-use industries span food and beverages, dairy, meat, logistics, and manufacturing across all regions.

Tunnel-type washers will hold a 39.8% share in 2025, driven by industrial-scale throughput and consistent cleaning performance. Their closed-loop designs improve water conservation and cycle control.

Adoption will grow in food, dairy, and logistics industries seeking cost-effective, hygienic cleaning. Tunnel washers will remain preferred for automated lines through 2035, offering optimal productivity and reliability.

This capacity segment will account for 37.1% share in 2025, supported by its balance of throughput and energy efficiency. It suits mid- to large-scale facilities.

Future adoption will rise as dairy and beverage plants automate medium-capacity systems. Customizable washing cycles will enhance flexibility across sectors.

Fully automatic washers will capture 42.3% share in 2025 due to rising automation. Their programmable controls ensure hygiene consistency and labor efficiency.

By 2035, their adoption will expand with Industry 4.0 integration, real-time diagnostics, and smart control systems. Automatic washers will remain standard in modern plants.

Food and beverage processing will hold 43.7% share in 2025, dominating due to strict sanitation norms and automation investment.

By 2035, this segment will expand with rising processed food output. Dairy and meat sectors will reinforce consistent demand globally.

Adoption is driven by rising hygiene standards, automation in food facilities, and strict cleaning norms. Labor shortages and sustainability mandates promote automated washers with water-saving and energy-efficient systems.

High installation and maintenance costs hinder smaller producers. Complex cleaning setups and downtime management challenges restrain widespread use in low-output facilities.

Automation and digitization create growth potential in emerging economies. Compact modular washers and heat recovery systems enable adoption across mid-scale industries.

Integration of IoT-enabled monitoring, AI-assisted cleaning optimization, and water recycling is trending. Manufacturers focus on low-chemical and quick-dry technologies to improve operational efficiency.

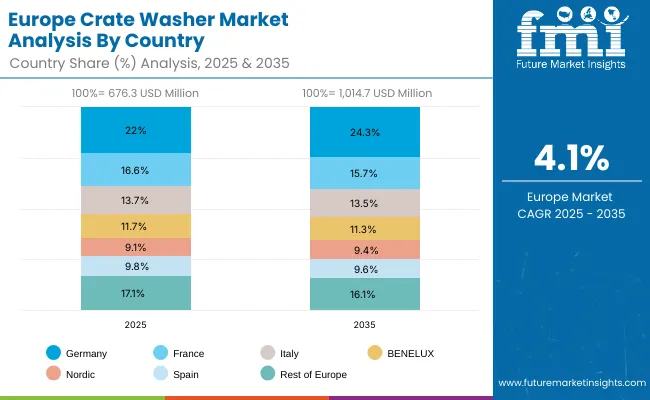

The global crate washer market is expanding as industries elevate hygiene and operational efficiency standards. Asia-Pacific leads growth through rapid food processing modernization and automation integration, while Europe focuses on sustainability, energy recovery, and regulatory compliance. North America emphasizes food safety and water conservation, driving innovation in recycling systems and smart monitoring. Increasing demand for eco-efficient, automated washing systems across food, beverage, and logistics sectors is defining the market’s next growth phase.

The USA market will grow at a CAGR of 5.2% from 2025 to 2035, driven by dairy, beverage, and food processing facilities upgrading to automated washers. Rising emphasis on water efficiency and sanitation compliance is boosting adoption of closed loop washing systems. The integration of smart monitoring, recycling, and energy-efficient components is reducing operational costs. The country’s focus on maintaining FDA and USDA hygiene standards continues to propel market expansion.

Germany will expand at a CAGR of 4.9%, supported by strict EU food safety and hygiene regulations. Energy recovery and water optimization technologies are central to new installations. Meat and dairy processors are investing in automated washers that minimize contamination risks and operational downtime. Germany’s advanced manufacturing ecosystem and sustainability mandates ensure steady demand for high-performance, energy-efficient washing equipment.

The UK market will grow at a CAGR of 5.0%, supported by automation in dairy, beverage, and logistics sectors. The country’s rising dairy exports are fuelling demand for efficient cleaning systems. Manufacturers are adopting smart washers that reduce water consumption and enhance traceability. Sustainability-driven investments and labour-saving automation are key factors sustaining market growth in the UK’s industrial washing segment.

China will grow at a CAGR of 5.1%, driven by large-scale meat processing and expanding logistics operations. Rapid industrial automation is supporting widespread adoption of crate washers to maintain hygiene and product quality. Domestic manufacturers are developing cost-efficient washers integrated with smart control systems. The country’s focus on upgrading food safety and cold-chain logistics is strengthening demand across urban and export-driven facilities.

India will grow at a CAGR of 5.0%, led by modernization in dairy, food processing, and export-oriented facilities. Government sanitation programs and food industry reforms are driving adoption of automated washing systems. Increasing export of processed foods and dairy products is boosting compliance-focused investments. Affordable automation and water-efficient washers are gaining traction across both large and mid-scale facilities.

Japan will grow at a CAGR of 5.5%, emphasizing compact and energy-efficient washers suitable for limited-space industrial setups. The country’s strong focus on hygiene reforms and technological advancement is spurring innovation. Manufacturers are adopting fully automated systems with water recycling and self-cleaning features. Sustainability-focused packaging and food sectors continue to anchor demand for precision-engineered washing equipment.

South Korea will lead with a CAGR of 5.6%, driven by automation in dairy, logistics, and beverage industries. The country’s rapid adoption of smart factory infrastructure supports the integration of IoT-based monitoring in washing systems. High-quality standards for food exports and distribution efficiency are strengthening market momentum. Manufacturers are focusing on reliability, digital control, and eco-performance in advanced crate washer solutions.

Japan’s crate washer market, valued at USD 400 million in 2025, is dominated by tunnel-type crate washers with a 39.0% share, driven by large-scale automation and consistent throughput. Single-tank crate washers account for 25.1%, catering to small and medium processing units seeking operational simplicity. Multi-tank systems hold 22.9%, ensuring enhanced hygiene for food and beverage applications. Conveyor-type washers represent 12.9%, integrated into logistics and industrial setups. Japan’s market reflects high mechanization and hygiene compliance, supported by food-grade stainless-steel design standards. Continuous equipment modernization, energy-efficient operation, and compliance with HACCP protocols drive the market’s steady technological advancement trajectory.

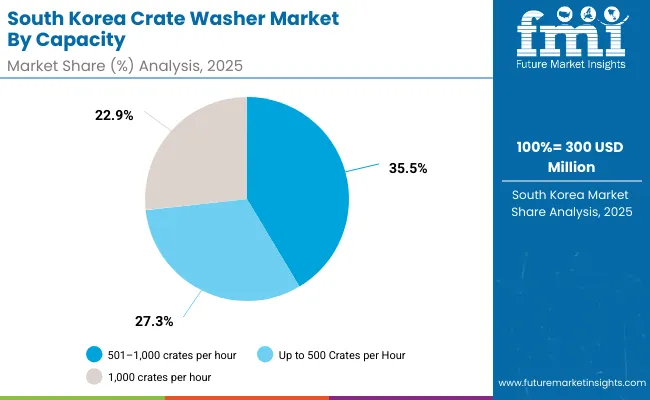

South Korea’s crate washer market, valued at USD 300 million in 2025, is led by systems handling 501-1,000 crates per hour with a 35.5% share, emphasizing mid-scale industrial efficiency. Models with up to 500 crates per hour account for 27.3%, favored by regional dairies and small-scale processors. Systems exceeding 1,000 crates per hour hold 22.9%, primarily used in beverage and large meat plants. South Korea’s market demonstrates strong industrial hygiene alignment under government-backed food safety programs. Compact automation, space-efficient installations, and reduced water consumption are shaping technology demand. Rising exports of processed foods and high urban production density sustain adoption.

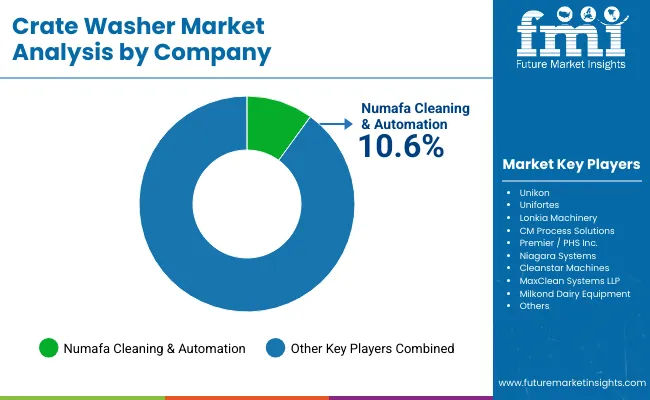

The market is moderately fragmented, featuring key players Numafa Cleaning & Automation, Unikon, Unifortes, Lonkia Machinery, CM Process Solutions, Premier/PHS Inc., Niagara Systems, Cleanstar Machines, MaxClean Systems LLP, and Milkond Dairy Equipment. These firms emphasize automation, modular design, and water efficiency.

Numafa and Unikon lead in Europe with advanced automated washers. Unifortes and Lonkia dominate in Asia-Pacific with scalable solutions. CM Process Solutions and MaxClean Systems innovate in energy recovery and sensor-based control. Competition centers on hygiene automation, cost efficiency, and regulatory compliance.

Key Developments of Crate Washer Market

| Item | Value |

|---|---|

| Quantitative Units | USD 2.8 Billion |

| By Machine Type | Tunnel, Single Tank, Multi-Tank, Conveyor Type |

| By Capacity | Up to 500, 501-1,000, Above 1,000 Crates per Hour |

| By Automation Level | Fully Automatic, Manual, Semi-Automatic |

| By End-Use Industry | Food & Beverage, Dairy, Meat & Poultry, Logistics, Industrial Manufacturing |

| Key Companies Profiled | Numafa Cleaning & Automation, Unikon, Unifortes, Lonkia Machinery, CM Process Solutions, Premier/PHS Inc., Niagara Systems, Cleanstar Machines, MaxClean Systems LLP, Milkond Dairy Equipment |

| Additional Attributes | Growth driven by hygiene automation, water efficiency, and food industry modernization. |

The market will be valued at USD 2.8 billion in 2025.

The market will reach USD 4.6 billion by 2035.

The market will grow at a CAGR of 5.1% during 2025-2035.

Tunnel-type crate washers will lead with a 39.8% share in 2025.

Fully automatic crate washers will dominate with a 42.3% share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Crate Handling Systems Market Size and Share Forecast Outlook 2025 to 2035

Crates Market Report - Industry Trends & Demand Forecast 2025 to 2035

Crates And Pallets Packaging Market

HDPE Crate Market Forecast and Outlook 2025 to 2035

Metal Crates Market

Wooden Crate Market Forecast and Outlook 2025 to 2035

Market Share Insights of Wooden Crate Providers

Plastic Crates Market Size and Share Forecast Outlook 2025 to 2035

Reusable Crate Welding Lines Market Size and Share Forecast Outlook 2025 to 2035

Beverage Crate Market Analysis – Size, Share, & Forecast Outlook 2025 to 2035

Competitive Overview of Beverage Crate Market Share

Cardboard Crates Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Cardboard Crates Manufacturers

Folding Plastic Crates Market

Returnable Plastic Crate Market Size and Share Forecast Outlook 2025 to 2035

Dishwasher Market Size and Share Forecast Outlook 2025 to 2035

Dishwasher Tablets Market Size and Share Forecast Outlook 2025 to 2035

Dry Washer Market Insights - Demand, Size & Industry Trends 2025 to 2035

Glass Washer Market Analysis Based on Product Type, Application, Automation, Driven Type and Regions 2025 to 2035

Spray Washer Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA