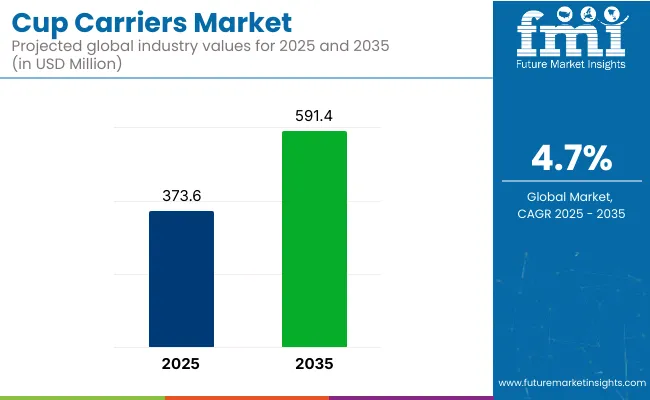

The cup carriers market is projected to grow from USD 373.6 million in 2025 to USD 591.4 million by 2035, registering a CAGR of 4.7% during the forecast period. Sales in 2024 reached USD 356.8 million, reflecting a steady increase in demand across various regions. This growth has been attributed to the rising need for convenient and sustainable beverage packaging solutions. The increasing adoption of cup carriers for their ease of use and eco-friendly properties has further propelled the market's expansion.

| Metric | Value |

| Market Size (2025E) | USD 373.6 Million |

| Market Value (2035F) | USD 591.4 Million |

| CAGR (2025 to 2035) | 4.7% |

In December 2024, Novolex® and Pactiv Evergreen Inc., announced today they have entered into a definitive agreement to combine, creating a leading manufacturer in food, beverage and specialty packaging products. “This transaction reflects the continuation of our long-term growth strategy to create the industry’s most innovative, sustainable and customer-focused company,” said Stan Bikulege, Chairman and CEO of Novolex. “Pactiv Evergreen’s strong product portfolio, along with their talented team, will complement and add significant depth to Novolex’s diverse packaging solutions.

Our companies share a dedication to customer success, a steadfast entrepreneurial spirit and have aligned values of integrity, collaboration and excellence. Our commitment to employees is unwavering in making this a best-in-class, high growth platform. We’re excited to continue our growth journey and are confident this combination will strengthen the future of food and beverage packaging.”

Manufacturers have been focusing on developing carriers that are biodegradable, derived from renewable resources, and offer excellent durability. Innovations include the integration of advanced materials, ergonomic designs, and the use of natural additives to enhance carrier performance.

These advancements align with global sustainability goals and regulatory requirements, making cup carriers an attractive option for environmentally conscious consumers. Additionally, the development of automated manufacturing processes has enhanced efficiency and consistency in production, further driving market growth.

The cup carriers market is poised for significant growth, driven by increasing demand in on-the-go beverage consumption, convenience packaging, and sustainable solutions. Companies investing in eco-friendly materials, innovative designs, and efficient production processes are expected to gain a competitive edge.

As global beverage consumption continues to rise and environmental regulations become more stringent, the adoption of cup carriers is anticipated to increase, offering cost-effective and eco-friendly solutions for packaging. Furthermore, the integration of smart technologies and automation in packaging applications is expected to enhance operational efficiency and meet the evolving needs of various industries.

The market is segmented based on material, carrying capacity, end use, and region. By material, the market is categorized into plastic, paper, wood, and molded pulp. In terms of carrying capacity, the market includes single cup holders, 2 to 4 cup holders, and those designed to hold more than 4 cups.

By end use, the market is segmented into foodservice-covering quick service restaurants, hotels, and cafes-along with institutional and household applications. Regionally, the market is analyzed across North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Oceania, and the Middle East and Africa.

Molded pulp cup carriers with 18.5% share are projected to grow at a CAGR of 6.3% from 2025 to 2035, as their environmental benefits, cushioning strength, and low-cost production have been increasingly prioritized in the beverage takeaway and delivery industries.

Produced from recycled paper and agricultural waste, molded pulp has been widely adopted for its biodegradability, composability, and ability to support sustainable packaging mandates across retail and foodservice channels.

The ability of molded pulp to absorb condensation, hold multiple cup sizes securely, and provide thermal insulation without requiring coatings has positioned it as an ideal alternative to plastic-based cup carriers. In addition, structural rigidity and nestability have improved transport efficiency and reduced storage space in cafes, QSRs, and convenience outlets.

Minimal energy input during production, along with compatibility with digital and in-mold labeling technologies, has allowed molded pulp carriers to align with both brand aesthetics and green procurement policies. As legislative pressure to eliminate single-use plastics increases globally, molded pulp is expected to remain the material of choice for beverage cup transport solutions.

The food & beverages industry with 78.2% share is expected to grow at a CAGR of 6.7% from 2025 to 2035, as the expansion of coffee chains, fast food outlets, and beverage-focused retail has driven consistent demand for durable and sustainable cup carriers.

Multi-cup holders have been used to transport hot and cold drinks, including coffees, smoothies, sodas, and shakes-especially in dine-out, drive-thru, and delivery settings.

With increasing demand for convenience and portability, cup carriers have been supplied in bulk across cafés, delivery aggregators, restaurants, and vending setups. Integrated carrier designs with handles and compartments for branding or condiments have supported functionality and marketing appeal in high-traffic environments.

Sustainability-conscious consumers have also influenced the industry’s shift toward biodegradable carrier options, accelerating demand for molded pulp and paperboard variants. As beverage-on-the-go formats continue to rise across urban and suburban markets, the dominance of the food & beverages segment is expected to persist-supported by operational utility, hygiene standards, and packaging innovation.

Environmental Regulations and High Production Costs

Balancing cost with sustainability compliance is one of the biggest challenges facing the Cup Carriers Market. The plastic-based packaging restrictions by governing authorities across different geographies oblige manufacturers to spend money on sustainable packaging material such as recycled paper, bagasse, and molded pulp, increasing production expenditure.

In addition, logistics and warehouse problems for bulk cup carriers impair transportation efficiency and cost for drink retailers. Innovation costs in the form of ergonomic, heat-enduring, and reusable designs also impact profit and pricing strategies.

Growth in Custom-Printed and Smart Packaging Solutions

Even with challenges, the Cup Carriers Market holds substantial growth potential. The popularity of custom-branded cup carriers with QR codes, augmented reality (AR) promotion, and digital loyalty schemes is boosting customer engagement and brand recognition.

Growing use of lightweight, collapsible, and reusable cup holder containers in sustainable cafés, shared workspaces, and company catering is compelling demand for minimal and versatile formats. Furthermore, antimicrobial and spill-proof finishes are enhancing convenience and hygiene with health-aware drinking packaging.

The development of e-commerce packaging solutions for online drink orders is increasing the application of intelligent cup carriers with temperature-insensitive insulation, anti-leak properties, and reusable carrying handles. Developments in biodegradable and edible packaging options are also on the rise, in line with international sustainability trends.

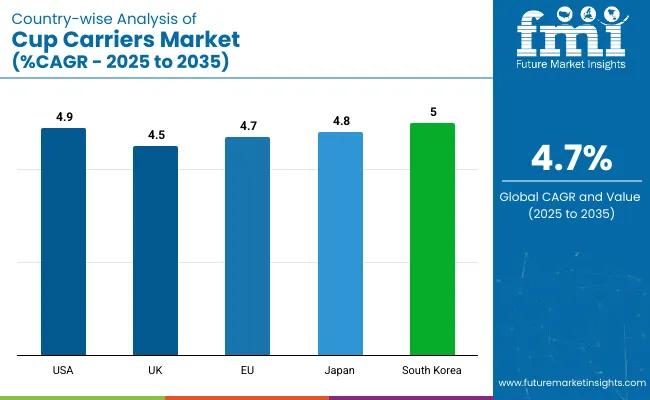

The demand for single cup carriers in United States is growing, driven by the need for convenience beverages, an increasing market of green packaging materials, as well as chain restaurants Quick (QSRs) and coffee shops. In a bid to minimize the use of plastics, the US Environmental Protection Agency (EPA) promotes biodegradable and recyclable cup carriers.

The rise in reusable cup carriers has spurred innovation. In the field of foodservice there is also a trend towards packaging with less environmental impact, as pulp molded or corrugated board cups come onto the scene and biodegradable carry trays now come under serious consideration.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.9% |

In the United Kingdom, demand for cup carriers is increasing. Locally, it is driven by government regulations on single-use plastics, consumer demand for sustainable packaging, and the recent switch from paper pulp to compostable materials. Both in the UK itself and abroad, the Environment Agency promotes voluntary conservation movements. Restaurants and other food service businesses are expected to adopt eco-friendly alternatives as the standard.

In addition to standing in line at coffeehouses, the growing popularity of take-away services and food delivery platforms has generated demand for sturdy, heat-resistant, and ergonomic cup carriers. Furthermore, the trend of custom-branded reusable cup holders is catching on in the drink retail industry.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.5% |

The European Cup Carriers Market is now growing steadily thanks to strict EU rules against verbal littering as well as the adoption of fiber based packaging. But that is not all: demand for sustainable foodservice equipment is also rising. The Circular Economy Action Plan and European Green Deal are both pushing the switch over to cups that can be recycled or composted.

In Germany, France and the Netherlands, sustainable packaging industry innovation is being driven forward by biodegradable molded pulp cup carriers and kraft paper ones. Major coffee chains and catering providers have already started using such packaging in the form of trays to hold cups the very instant they arrive out of an industrial dishwasher. Another trend is for programs like zero-waste or deposit return schemes which are increasing the use of reusable cup holder solutions.

| Rigion | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.7% |

As Japan's cities discover a love for coffee and consumers become increasingly interested in convenience and beauty, there is opportunity for local government too. In an effort to reduce the amount of plastic damage inflicted on our lives by lids that dissolve you tongue, recently both China and Japan have been promoting recyclable or compostable packaging technologies.

Japanese drinks companies are targeting compact, stackable, and ergonomically designed cup-carrier designs that add valued convenience for consumers picking up a beverage from takeaway outlets and vending machines. Furthermore, the arrival of moisture-resistant paper-based carriers is improving their robustness as well as usability.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.8% |

The South Korean Cup Carriers Market is experiencing robust growth, driven by the growth of premium coffee shop chains, rising government regulations on sustainable packaging, and growing online food delivery service expansion. The South Korean Ministry of Environment is enforcing plastic reduction goals, triggering demand for biodegradable and paper-based cup carriers.

The rise in contactless pickup operations and delivery-led coffee chains is driving the demand for durable, spill-proof, and personalized cup carriers. Besides, technological advances in foldable carrier formats and smart packaging are also making consumer life easier.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.0% |

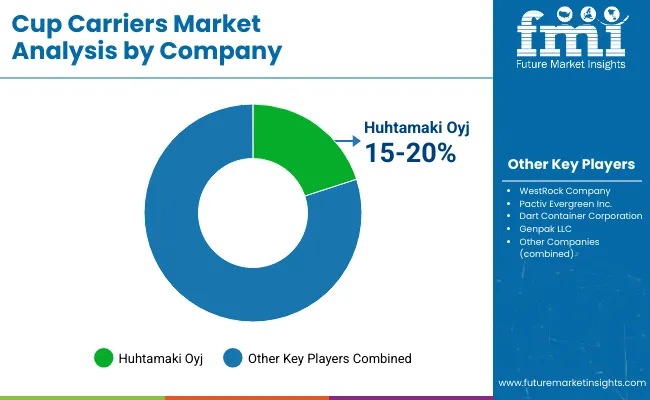

The Cup Carriers Market is growing due to increasing demand for on-the-go beverage consumption, sustainable packaging solutions, and rising trends in food delivery services. The market is driven by growth in the quick-service restaurant (QSR) sector, eco-friendly material innovations, and increasing adoption of recyclable and biodegradable packaging. Companies focus on molded fiber, paperboard, and reusable plastic cup carriers to enhance durability, convenience, and sustainability.

The market includes leading packaging manufacturers, foodservice supply companies, and eco-friendly packaging innovators, each contributing to innovations in lightweight, customizable, and stackable carrier designs.

Other Key Players

Several packaging manufacturers, sustainable material innovators, and custom packaging firms contribute to advancements in cup carrier strength, recyclability, and design efficiency. These include:

The overall market size for the Cup Carriers Market was USD 373.6 Million in 2025.

The Cup Carriers Market is expected to reach USD 591.4 Million in 2035.

Rising demand for takeaway beverages, increasing focus on sustainable and biodegradable packaging, and growth in quick-service restaurants (QSRs) will drive market growth.

The USA, China, Germany, India, and the UK are key contributors.

Molded fiber cup carriers are expected to dominate due to their eco-friendliness, durability, and increasing preference for sustainable packaging solutions.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cupcake Box Market Size and Share Forecast Outlook 2025 to 2035

Cup Filling Machines Market Forecast and Outlook 2025 to 2035

Cupcake Liner Market Size and Share Forecast Outlook 2025 to 2035

Cupcake Containers Market Size and Share Forecast Outlook 2025 to 2035

Cupcake Wrappers Market Size and Share Forecast Outlook 2025 to 2035

Cup Holder Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Cup Fill and Seal Machine Market by Automation Level from 2025 to 2035

Cup Sleeves Market Growth - Demand, Trends & Forecast 2025 to 2035

Industry Share Analysis for Cup Fill and Seal Machine Companies

Market Share Breakdown of Cup Carrier Packaging Suppliers

Competitive Landscape of Cupcake Wrappers Manufacturers

Industry Share Analysis for Cupric Chloride Companies

Cupuacu Butter Market – Growth, Beauty Benefits & Market Demand

Cupcake Tray Machines Market

Cup Filler Market

Occupancy Sensor Market Size and Share Forecast Outlook 2025 to 2035

PLA Cup Market Forecast and Outlook 2025 to 2035

PET Cup Market Trends & Industry Growth Forecast 2024-2034

Foam Cups Market Size and Share Forecast Outlook 2025 to 2035

Deli Cup Market Analysis – Trends & Growth 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA