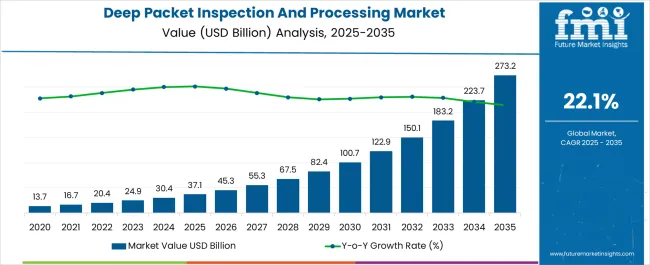

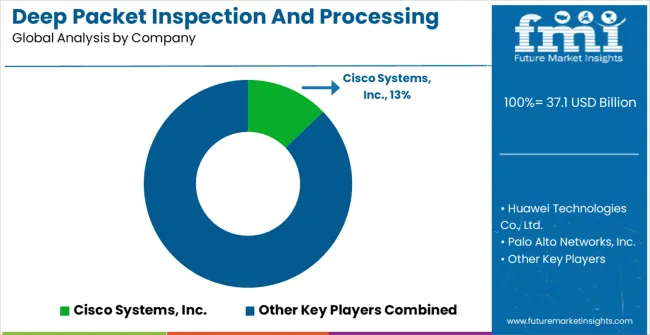

The Deep Packet Inspection And Processing Market is estimated to be valued at USD 37.1 billion in 2025 and is projected to reach USD 273.2 billion by 2035, registering a compound annual growth rate (CAGR) of 22.1% over the forecast period.

| Metric | Value |

|---|---|

| Deep Packet Inspection And Processing Market Estimated Value in (2025 E) | USD 37.1 billion |

| Deep Packet Inspection And Processing Market Forecast Value in (2035 F) | USD 273.2 billion |

| Forecast CAGR (2025 to 2035) | 22.1% |

The Deep Packet Inspection and Processing market is gaining significant traction as enterprises and service providers strengthen their cybersecurity infrastructure and enhance network performance. The rising frequency of sophisticated cyber threats, data breaches, and advanced malware has amplified the demand for robust network monitoring and packet inspection capabilities.

Deep packet inspection allows organizations to identify, analyze, and manage data traffic at a granular level, enabling more effective control of applications, enhanced quality of service, and improved compliance with security regulations. The growing adoption of cloud computing, IoT devices, and 5G networks has created an increased need for real-time traffic analysis to ensure data integrity and reduce risks of unauthorized access.

Governments and enterprises alike are investing heavily in packet inspection technologies to meet evolving security mandates, while vendors are integrating AI-driven analytics and automation to improve efficiency and reduce operational complexities With heightened emphasis on protecting sensitive data and ensuring reliable connectivity, the market is expected to grow steadily, supported by rapid advancements in analytics-driven security solutions and scalable processing architectures.

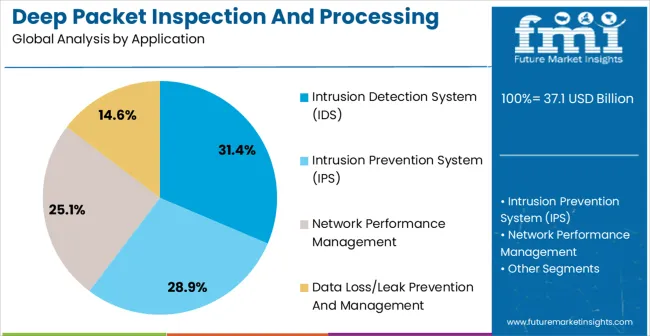

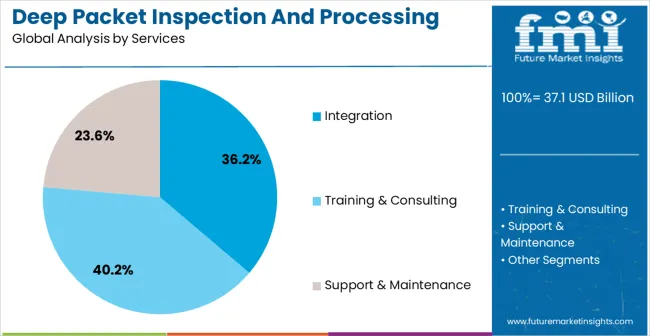

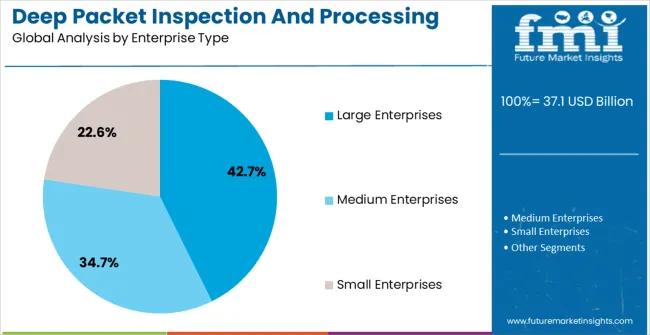

The deep packet inspection and processing market is segmented by application, services, enterprise type, end user, and geographic regions. By application, deep packet inspection and processing market is divided into Intrusion Detection System (IDS), Intrusion Prevention System (IPS), Network Performance Management, and Data Loss/Leak Prevention And Management. In terms of services, deep packet inspection and processing market is classified into Integration, Training & Consulting, and Support & Maintenance. Based on enterprise type, deep packet inspection and processing market is segmented into Large Enterprises, Medium Enterprises, and Small Enterprises. By end user, deep packet inspection and processing market is segmented into IT & Telecom, BFSI, Government And Defense, Medical & Healthcare, and Retail And Others. Regionally, the deep packet inspection and processing industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The intrusion detection system application segment is expected to account for 31.4% of the market revenue in 2025, making it the leading application area. Growth in this segment is being driven by the rising need to identify malicious traffic patterns, unauthorized access attempts, and evolving cyber threats in real time. IDS leverages deep packet inspection capabilities to monitor network activity and detect anomalies that indicate potential security breaches.

Organizations are increasingly adopting IDS solutions to enhance their incident response strategies and reduce the impact of data breaches. Integration with security information and event management systems further strengthens operational efficiency by enabling unified threat visibility and faster remediation.

Continuous improvements in machine learning and AI are enhancing the accuracy of intrusion detection, reducing false positives, and improving threat detection speed With organizations facing heightened regulatory scrutiny and escalating risks of cyberattacks, the IDS segment is expected to retain its leadership position, supported by growing investments in proactive security measures across industries.

The integration services segment is projected to hold 36.2% of the market revenue share in 2025, positioning it as the dominant services category. This growth is being driven by the increasing complexity of deploying deep packet inspection systems across diverse IT infrastructures. Integration services ensure that these solutions function seamlessly with existing security tools, enterprise applications, and cloud platforms.

Service providers play a key role in configuring, customizing, and optimizing packet inspection systems to meet specific enterprise requirements, reducing implementation risks and ensuring maximum performance. The growing demand for multi-layered security frameworks has made integration services critical for enterprises aiming to enhance interoperability and scalability. Furthermore, the expansion of hybrid and multi-cloud environments requires specialized integration expertise to maintain consistent security across distributed networks.

With cyber threats continuing to evolve, organizations are relying on service providers for end-to-end integration that maximizes the effectiveness of deep packet inspection technologies This reliance is expected to sustain the strong position of integration services in the market over the coming years.

The large enterprises segment is anticipated to account for 42.7% of the market revenue in 2025, establishing itself as the leading enterprise type. This dominance is being driven by the extensive data volumes and high-value digital assets managed by large organizations, which make them prime targets for sophisticated cyberattacks. Large enterprises are increasingly investing in deep packet inspection solutions to protect critical infrastructure, ensure compliance with stringent data protection regulations, and support complex IT environments.

These enterprises benefit from economies of scale in deploying advanced packet inspection systems that offer enhanced traffic analysis, improved anomaly detection, and robust incident response. Integration with big data analytics and AI-driven platforms further strengthens their ability to identify threats proactively and maintain operational continuity.

The growing adoption of cloud services and geographically distributed networks has increased the importance of advanced inspection technologies in securing communication channels As large organizations continue to expand globally and digitalize core operations, their reliance on deep packet inspection and processing technologies is expected to remain strong, reinforcing their leadership in the market.

The demand for advanced security equipment to scan data streams for malicious content presents significant challenges to network security vendors. Security equipment, overwhelmed by the data rates of modern age networks, is more likely to miss attacks, leading to increased risks of security breaches.

Deep packet inspection and processing is a type of data processing technique that looks in detail at the contents of the data being sent, and re-routes it accordingly.

Typical applications of deep packet inspection (DPI) include validate the proper and error free operation of network protocols, identification of anomalies such as network fraud, viruses, spam, security threats, routing and service level agreements, and network data mining.

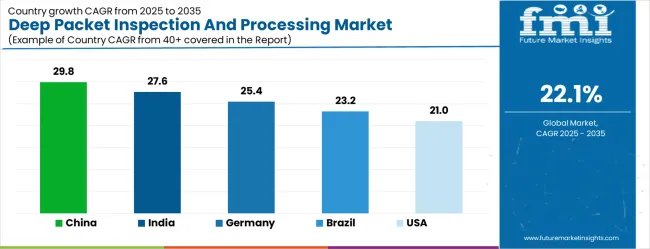

| Country | CAGR |

|---|---|

| China | 29.8% |

| India | 27.6% |

| Germany | 25.4% |

| Brazil | 23.2% |

| USA | 21.0% |

| UK | 18.8% |

| Japan | 16.6% |

The Deep Packet Inspection And Processing Market is expected to register a CAGR of 22.1% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 29.8%, followed by India at 27.6%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 16.6%, yet still underscores a broadly positive trajectory for the global Deep Packet Inspection And Processing Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 25.4%. The USA Deep Packet Inspection And Processing Market is estimated to be valued at USD 12.7 billion in 2025 and is anticipated to reach a valuation of USD 12.7 billion by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 1.7 billion and USD 1.2 billion respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 37.1 Billion |

| Application | Intrusion Detection System (IDS), Intrusion Prevention System (IPS), Network Performance Management, and Data Loss/Leak Prevention And Management |

| Services | Integration, Training & Consulting, and Support & Maintenance |

| Enterprise Type | Large Enterprises, Medium Enterprises, and Small Enterprises |

| End User | IT & Telecom, BFSI, Government And Defense, Medical & Healthcare, and Retail And Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Cisco Systems, Inc., Huawei Technologies Co., Ltd., Palo Alto Networks, Inc., Fortinet, Inc., Juniper Networks, Inc., Check Point Software Technologies Ltd., Symantec Corporation (Broadcom Inc.), BAE Systems, Allot Ltd., Blue Coat Systems, Inc. (Symantec), NetScout Systems, Inc., Sandvine Corporation, Viavi Solutions Inc., SolarWinds Worldwide, LLC, and Qosmos (Enea) |

The global deep packet inspection and processing market is estimated to be valued at USD 37.1 billion in 2025.

The market size for the deep packet inspection and processing market is projected to reach USD 273.2 billion by 2035.

The deep packet inspection and processing market is expected to grow at a 22.1% CAGR between 2025 and 2035.

The key product types in deep packet inspection and processing market are intrusion detection system (ids), intrusion prevention system (ips), network performance management and data loss/leak prevention and management.

In terms of services, integration segment to command 36.2% share in the deep packet inspection and processing market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sand Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Inspection and Inventory Labels Market Size and Share Forecast Outlook 2025 to 2035

Examining Market Share Trends in Inspection and Inventory Labels

Demand for Hydro-processing Catalysts in Japan Size and Share Forecast Outlook 2025 to 2035

Drone Inspection and Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Inspection Drone in Oil and Gas Market Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Deep Groove Ball Bearings in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Upstream Bioprocessing Equipment in USA Size and Share Forecast Outlook 2025 to 2035

Thin Wafer Processing and Dicing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Deep Depth Subsea Umbilicals, Risers and Flowlines Market Size and Share Forecast Outlook 2025 to 2035

Soil Testing, Inspection, and Certification Market Growth – Forecast 2017-2027

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Dialyzer Reprocessing Machines and Concentrates Market Size and Share Forecast Outlook 2025 to 2035

Aggregate Mining And Mineral Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Textile Testing, Inspection, and Certification (TIC) Market Insights - Growth & Forecast 2025 to 2035

Single-use Bioprocessing Probes and Sensors Market - Growth & Trends 2024 to 2034

Semiconductor Metrology and Inspection Market Size and Share Forecast Outlook 2025 to 2035

NDT and Inspection Market Growth – Trends & Forecast 2024-2034

Heterogeneous Mobile Processing and Computing Market Size and Share Forecast Outlook 2025 to 2035

Environment Testing, Inspection and Certification Market Report – Demand, Growth & Industry Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA