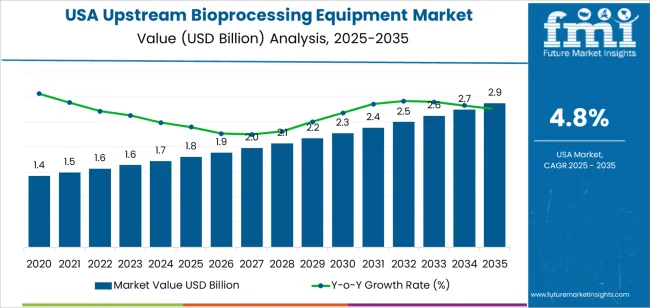

The USA upstream bioprocessing equipment demand is valued at USD 1.8 billion in 2025 and is expected to reach USD 2.9 billion by 2035, supported by a CAGR of 4.8%. Demand is shaped by expanded biopharmaceutical production, increased adoption of single-use systems, and broader utilisation of controlled bioreactor technologies. Growth reflects sustained investment in recombinant protein development, monoclonal antibody programmes, and cell-based therapeutics that rely on reproducible upstream workflows. Rising emphasis on contamination control and scalable production platforms also influences equipment selection across industrial bioprocessing facilities.

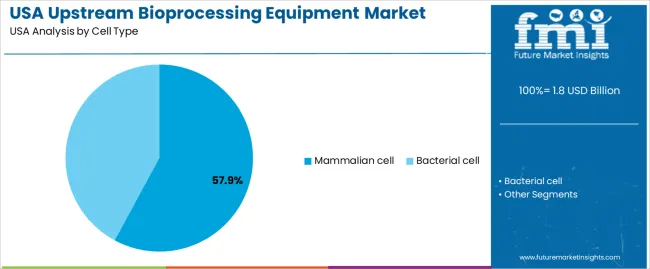

Mammalian cells represent the leading cell type due to their suitability for complex protein expression and regulatory compatibility with therapeutic manufacturing. Their continued use in antibody production, vaccine development, and advanced biologics reinforces equipment upgrades involving automation, monitoring, and precision-control modules.

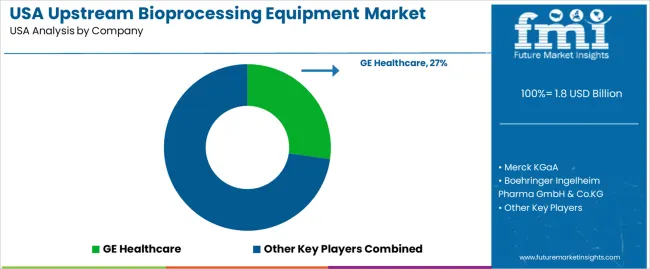

The West, South, and Northeast record strong demand owing to their concentration of biotechnology clusters, contract development and manufacturing organisations, and academic research centres engaged in large-scale bioprocessing. These regions maintain dense supplier networks and ongoing infrastructure expansion that supports equipment procurement for both pilot and commercial operations. GE Healthcare, Merck KGaA, Boehringer Ingelheim Pharma, Thermo Fisher Scientific, BiOZEEN, and Katalyst Bio Engineering are the principal suppliers. These firms provide bioreactors, filtration systems, media-preparation units, and upstream automation tools that support cell-culture expansion, process stabilisation, and quality-assurance functions.

The growth-contribution index indicates that biopharmaceutical manufacturers will supply the largest share of incremental expansion between 2025 and 2029. Increased demand for single-use bioreactors, advanced mixing systems, and high-efficiency filtration units will support early contributions, particularly across facilities expanding monoclonal-antibody and recombinant-protein production. Consistent investment in cell-culture media optimisation and upstream intensification will reinforce this phase.

From 2030 to 2035, contributions broaden across contract-development and manufacturing organisations (CDMOs), regional biotech firms, and research-focused institutions. Growth during this period will be shaped by replacement cycles for stainless-steel systems, adoption of automated control platforms, and integration of real-time process-analytics tools. While procurement becomes more predictable, steady utilisation of mammalian-cell and microbial-fermentation equipment continues to drive incremental gains. The contribution profile reflects a mature production-infrastructure segment in which early growth is led by large-scale biologics facilities, followed by sustained contributions from CDMOs and mid-sized developers as upstream capacity and process-control requirements expand across the United States.

| Metric | Value |

|---|---|

| USA Upstream Bioprocessing Equipment Sales Value (2025) | USD 1.8 billion |

| USA Upstream Bioprocessing Equipment Forecast Value (2035) | USD 2.9 billion |

| USA Upstream Bioprocessing Equipment Forecast CAGR (2025 to 2035) | 4.8% |

Demand for upstream bioprocessing equipment in the USA is rising as biopharmaceutical manufacturers, contract development and manufacturing organisations (CDMOs), and biotech start-ups invest in cell-culture, fermentation and process-intensification technologies. The booming pipeline of monoclonal antibodies, cell-and-gene therapies and vaccine manufacturing requires advanced bioreactors, single-use systems and ancillary equipment that support flexible and scalable production. Growing focus on reducing time-to-market and improving process efficiency drives adoption of modular systems, disposables and digital monitoring tools tailored for upstream workflows.

Regulatory initiatives that encourage domestic biomanufacturing, capacity expansion and resilience of supply chains further boost equipment procurement in the USA. Constraints include high capital and consumable costs associated with advanced upstream systems, challenges in technology transfer from research to commercial scale, and shortages of highly skilled process engineers capable of managing sophisticated equipment platforms. Some firms may delay investment until clear return-on-investment models are established.

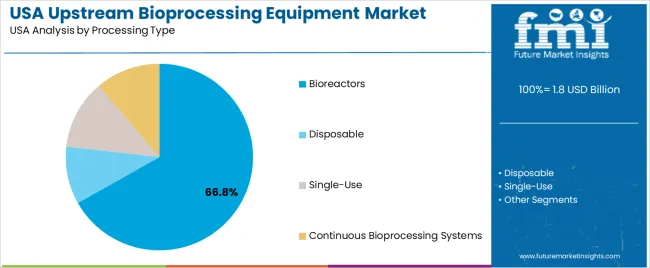

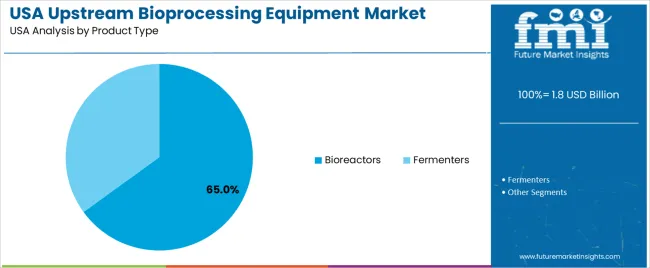

Demand for upstream bioprocessing equipment in the United States reflects production needs across biologics, vaccines, cell-based therapies, and microbial-derived products. Cell-type distribution is shaped by product complexity, protein-expression pathways, and regulatory requirements. Processing-type preferences reflect facility design, batch volumes, disposable adoption, and continuous-processing deployment. Product-type distribution highlights the tools used for cell cultivation and microbial fermentation across research, pilot, and commercial manufacturing stages.

Mammalian cells hold 57.9% of national demand and represent the leading cell-type group in USA upstream bioprocessing. Their ability to express complex recombinant proteins, monoclonal antibodies, and viral vectors makes them central to biologics manufacturing. These cells support post-translational modifications required in therapeutic proteins and gene-therapy materials. Bacterial cells represent 42.1%, supporting high-volume, rapid-growth fermentation used for enzymes, plasmids, and select recombinant proteins. Cell-type distribution reflects the differing biological outputs produced by mammalian and bacterial systems, where therapeutic protein complexity and regulatory pathways determine cultivation requirements.

Key drivers and attributes:

Bioreactors hold 66.8% of national demand and form the dominant processing-type category. These systems support controlled cultivation through automated monitoring, agitation, gassing, and temperature regulation suitable for mammalian and microbial growth. Single-use systems represent 12.0%, offering flexibility and reduced cleaning requirements for multiproduct facilities. Continuous bioprocessing systems account for 11.2%, enabling steady-state production used in advanced biologics manufacturing. Disposable options represent 10.0%, supporting small-batch and pilot-scale activities. Processing-type distribution reflects facility scale, contamination-control needs, and workflow optimisation requirements across modern biomanufacturing operations.

Key drivers and attributes:

Bioreactors represent 65.0% of national demand and serve as the primary equipment type in upstream bioprocessing. They support mammalian and microbial growth under controlled conditions, enabling scale-up from research to large-volume production. Fermenters account for 35.0%, serving bacterial and yeast-based processes requiring high-intensity aeration and agitation. Their use is common in enzyme, plasmid, and microbial-derived product manufacturing. Product-type distribution reflects the balance between mammalian-cell biologics, which rely heavily on bioreactors, and microbial production, which depends on fermenter design optimised for rapid cell expansion and high biomass output.

Key drivers and attributes:

In the United States, demand for upstream bioprocessing equipment is growing as biopharmaceutical companies expand development pipelines and scale manufacturing of biologics, monoclonal antibodies, viral vectors and cell therapies. The need for faster time to industry drives investment in bioreactors, cell culture systems, perfusion platforms and related support equipment that offer flexibility and scalability. Single use technologies appeal to manufacturers because they reduce cleaning validation requirements, lower cross contamination risks and support rapid changeovers between products. Strong R and D activity and an established biomanufacturing ecosystem further reinforce demand for advanced upstream systems.

Upstream bioprocessing equipment involves significant capital expenditure for installation, automation and validation which can slow new facility investments. Companies must comply with strict manufacturing and regulatory standards that extend project timelines and increase operational cost. Supply chain challenges related to single use components, specialised sensors and high grade materials can delay equipment delivery and reduce flexibility. Smaller biotechnology firms or contract manufacturers may postpone large scale equipment purchases until product pipelines or funding conditions stabilise.

Manufacturers are developing modular upstream systems that allow facilities to expand capacity without full site reconstruction which improves operational agility. Continuous and intensified processing methods such as high cell density cultures and perfusion systems are gaining momentum in the United States and fuel demand for next generation upstream equipment. Contract development and manufacturing organisations are investing in flexible and scalable production lines to support multiple clients which further increases purchases of upstream bioprocessing systems across the country.

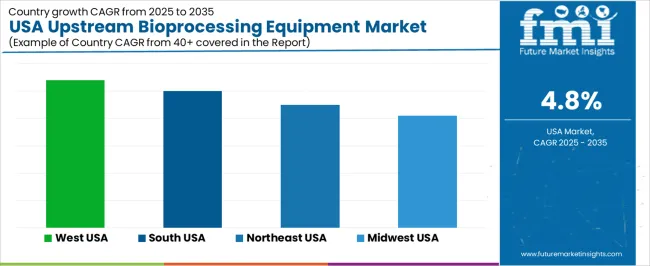

Demand for upstream bioprocessing equipment in the USA is rising through 2035 as biopharma companies, CDMOs, research institutes, and precision-fermentation firms expand capacity for cell-culture production, microbial fermentation, and recombinant protein development. Upstream equipment, including bioreactors, single-use systems, media-preparation units, and process-monitoring tools, supports early-stage production, scale-up, and continuous-processing workflows. Growth differs by region based on the density of biomanufacturing facilities, R&D clusters, and investment levels in cell-culture and fermentation infrastructure. The West leads at 5.4% CAGR, followed by the South (5.0%), the Northeast (4.5%), and the Midwest (4.1%).

| Region | CAGR (2025-2035) |

|---|---|

| West | 5.4% |

| South | 5.0% |

| Northeast | 4.5% |

| Midwest | 4.1% |

The West grows at 5.4% CAGR, supported by strong bioprocessing expansion in California and Washington. Companies operating in these states use upstream equipment for cell-culture intensification, precision fermentation, and early clinical manufacturing. Single-use bioreactors and modular upstream suites are widely adopted due to their flexibility, reduced cleaning needs, and streamlined changeover times. Research universities and biotechnology accelerators rely on benchtop bioreactors and automated media-preparation systems to support early-stage discovery and preclinical development. CDMOs in the region expand microbial and mammalian-cell capabilities, increasing the need for scalable upstream reactors and digital process-monitoring tools.

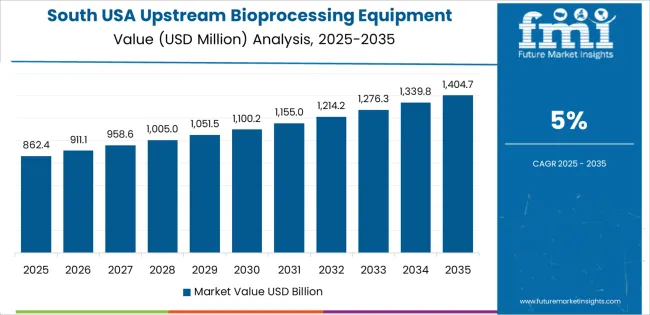

The South grows at 5.0% CAGR, supported by expanding bioprocessing corridors in Texas, North Carolina, Georgia, and Florida. CDMOs install new upstream suites to support mammalian-cell production, gene-therapy intermediates, and microbial fermentation. Universities and biotechnology parks use pilot-scale and lab-scale reactors to expand translational research and technology-transfer programs. State-level incentives attract new biomanufacturing investments, encouraging adoption of automated seed-train equipment and digitally monitored single-use reactor systems. Regional facilities often prioritize flexible upstream production to support diversified clinical projects.

The Northeast grows at 4.5% CAGR, reflecting mature biopharma hubs in Massachusetts, New York, and Pennsylvania. Facilities emphasize process optimization, upgrading existing upstream suites rather than pursuing large capacity increases. Companies adopt advanced sensors, inline analytics, and automated control platforms to improve yield consistency and reduce variability. Pilot-scale and clinical-scale upstream systems support development pipelines, especially in monoclonal antibodies, gene-therapy intermediates, and recombinant proteins. Established biomanufacturing sites maintain stable but incremental equipment purchases to modernize existing reactors.

The Midwest grows at 4.1% CAGR, reflecting lower levels of large-scale upstream expansion. Regional investment often centers on downstream purification, analytical testing, and quality-control facilities rather than reactor scale-out. Universities and technology centers maintain modest upstream usage for research and pilot programs. Some biomanufacturing sites integrate single-use upstream systems to support small-batch or specialty production. While upstream demand is slower than in coastal regions, industrial biotechnology and fermentation activities in Illinois and Minnesota provide stable baseline equipment needs.

Demand for upstream bioprocessing equipment in the USA is shaped by a concentrated group of global bioprocess-technology suppliers supporting cell-culture expansion, media preparation, fermentation, and pilot- to commercial-scale biologics production. GE Healthcare holds the leading position with an estimated 27.2% share, supported by established single-use and stainless-steel bioreactor platforms, controlled process-automation systems, and long-term integration with USA biopharmaceutical manufacturers. Its position is reinforced by predictable scalability and consistent equipment reliability across clinical and commercial operations.

Merck KGaA and Thermo Fisher Scientific follow as major participants, providing upstream systems that include single-use bioreactors, mixers, controllers, and media-handling technologies suited to monoclonal antibodies, vaccines, and cell- and gene-therapy production. Their strengths include dependable sensor accuracy, validated process-control frameworks, and comprehensive support for GMP operations. Boehringer Ingelheim Pharma GmbH & Co. KG contributes additional capability through internal large-scale bioprocessing infrastructure that shapes equipment-performance standards across the USA biologics sector. Emerging engineering firms such as BiOZEEN and Katalyst Bio Engineering maintain roles in modular upstream systems and training-focused equipment, supporting flexible facility designs and capacity expansion among small and mid-sized biomanufacturers.

Competition across this segment centers on scalability, process-control stability, batch reproducibility, single-use reliability, contamination-risk reduction, and compliance with USA regulatory expectations. Demand continues to rise as biologics pipelines expand, production shifts toward flexible single-use systems, and USA developers increase investment in high-efficiency upstream platforms that support rapid scale-up and consistent cell-culture performance.

| Items | Values |

|---|---|

| Quantitative Units | USD billion |

| Cell Type | Mammalian Cell, Bacterial Cell |

| Processing Type | Bioreactors, Disposable, Single-Use, Continuous Bioprocessing Systems |

| Product Type | Bioreactors, Fermenters |

| End User | Biopharmaceutical Manufacturing Companies, Research Organizations |

| Regions Covered | West, Midwest, South, Northeast |

| Key Companies Profiled | GE Healthcare, Merck KGaA, Boehringer Ingelheim Pharma GmbH & Co. KG, Thermo Fisher Scientific, BiOZEEN, Katalyst Bio Engineering |

| Additional Attributes | Dollar sales by cell type, processing type, product type, and end user categories; regional adoption trends across West, Midwest, South, and Northeast; competitive landscape of upstream bioprocess equipment providers; advancements in single-use technology, scalable bioreactors, continuous bioprocessing, and microbial/mammalian culture systems; integration with biologics production, vaccine manufacturing, and research-scale fermentation in the USA. |

The global demand for upstream bioprocessing equipment in USA is estimated to be valued at USD 1.8 billion in 2025.

The market size for the demand for upstream bioprocessing equipment in USA is projected to reach USD 2.9 billion by 2035.

The demand for upstream bioprocessing equipment in USA is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in demand for upstream bioprocessing equipment in USA are mammalian cell and bacterial cell.

In terms of processing type, bioreactors segment to command 66.8% share in the demand for upstream bioprocessing equipment in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Upstream Bioprocessing Equipment Market - Growth, Trends & Forecast 2025 to 2035

USA Hunting Equipment & Accessories Market Trends, Growth and Forecast 2025 to 2035

USA Food Service Equipment Market Insights – Demand, Size & Industry Trends 2025–2035

USA Drain Cleaning Equipment Market Analysis – Size, Share & Trends 2025-2035

Bioprocessing Analytics Equipment Market Size and Share Forecast Outlook 2025 to 2035

USA Compact Construction Equipment Market Trends – Growth, Demand & Forecast 2025–2035

Demand for Ventilation Equipment in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automated Test Equipment in USA Size and Share Forecast Outlook 2025 to 2035

Demand for 4-Inch SiC Laser Annealing Equipment in the USA Size and Share Forecast Outlook 2025 to 2035

Demand for Magnetic Material Magnetization and Testing Equipment in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Advanced Driver Assistance System (ADAS) Testing Equipment in USA Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA