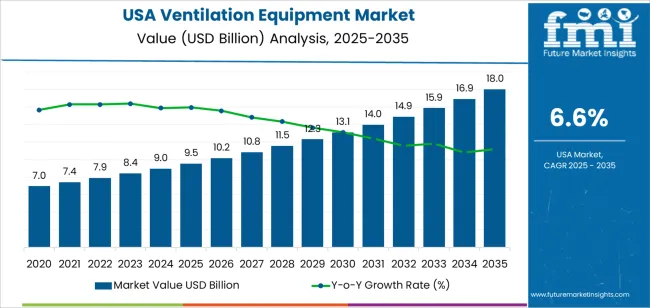

The demand for ventilation equipment in USA is valued at USD 9.5 billion in 2025 and is projected to reach USD 18.0 billion by 2035, reflecting a compound annual growth rate of 6.6%. Growth is shaped by rising requirements for efficient air movement systems across residential, commercial and industrial settings. As buildings adopt improved airflow designs and indoor air quality standards tighten, demand increases for fans, blowers, duct systems and integrated ventilation units. The shift toward energy-efficient equipment, supported by ongoing renovation cycles and broader construction activity, contributes to consistent adoption. Expanding use of controlled ventilation in healthcare, food processing, manufacturing and logistics facilities further reinforces steady demand throughout the forecast window, supported by advancements in performance and noise control features.

The growth curve shows a clear upward trajectory, beginning at USD 7.0 billion in earlier years and advancing to USD 9.5 billion in 2025 before rising steadily toward USD 18.0 billion by 2035. Annual values progress predictably, moving from USD 10.2 billion in 2026 to USD 10.8 billion in 2027 and continuing through USD 13.1 billion in 2031 and USD 15.9 billion in 2033. The shape of the curve indicates stable, incremental growth rather than abrupt shifts, driven by recurring replacement needs and expanding use of mechanical ventilation across infrastructure projects. As equipment designs improve in durability and airflow efficiency, adoption continues to widen, supporting sustained increases across USA’s ventilation equipment landscape.

Demand in USA for ventilation equipment is forecast to rise from USD 9.5 billion in 2025 to USD 18.0 billion by 2035, reflecting a compound annual growth rate (CAGR) of approximately 6.6%. Beginning at USD 7.0 billion in 2020, demand steadily increases through USD 9.0 billion in 2024 and reaches USD 9.5 billion in 2025. From 2025 to 2030 the value continues upward to around USD 13.1 billion, then progresses toward USD 18.0 billion by 2035. Growth is driven by heightened concerns about indoor air quality, increased construction and renovation of commercial and residential buildings, and stricter regulatory standards for ventilation efficacy and energy efficiency.

Over this period the uplift in value USD 8.5 billion between 2025 and 2035 is supported by both volume growth and higher specification equipment. In earlier years, growth is predominantly volume led as more buildings and retrofit projects adopt ventilation solutions. In later years, value growth contributes increasingly as equipment evolves incorporating smart monitoring, energy recovery technology and integration into building automation systems. Suppliers that focus on advanced features and lower energy operation will capture stronger segments of the forecasted USD 18.0 billion demand.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 9.5 billion |

| Forecast Value (2035) | USD 18.0 billion |

| Forecast CAGR (2025 to 2035) | 6.6% |

The demand for ventilation equipment in USA is rising as industry stakeholders increasingly place importance on indoor air quality (IAQ) across residential, commercial, industrial, and healthcare environments. Enhanced awareness of airborne contaminants, allergens, and pathogens has motivated building owners to install and upgrade ventilation systems. In residential settings, the need for proper air exchange in sealed, energy-efficient homes supports installation of heat recovery ventilators (HRVs) and energy-recovery ventilators (ERVs). In commercial and industrial facilities, regulatory and code requirements around ventilation, occupant comfort, and workplace safety foster equipment replacement and retrofitting.

The construction of new buildings and the renovation of older infrastructure provide further growth impetus in USA. Regulations and building standards emphasise energy-efficient systems with lower emissions and operational cost, encouraging the use of modern ventilation units that meet these requirements. Industrial sectors such as manufacturing, data centres, and food processing demand specialised ventilation systems to control heat, humidity, and contaminants, which pushes procurement of high-capacity equipment. While capital budgets, supply-chain constraints, and material cost inflation present challenges, the overall trajectory points toward sustained growth in the USA ventilation equipment sector.

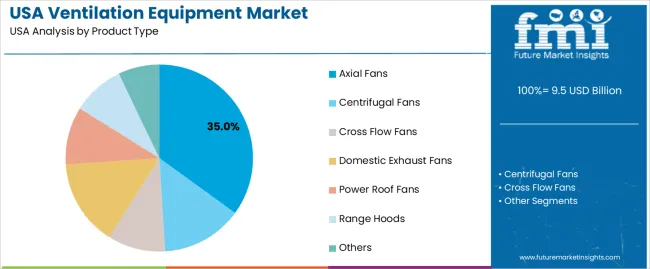

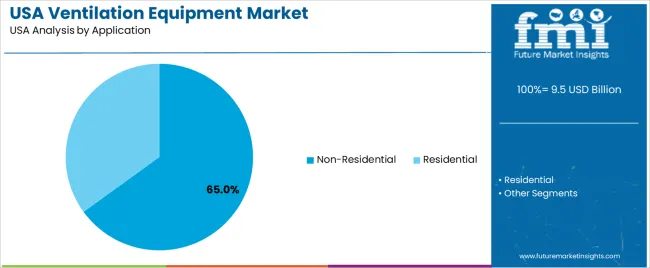

The demand for ventilation equipment in USA is shaped by a broad range of product types and the applications that depend on consistent air movement. Product types such as axial fans, centrifugal fans, cross flow fans, domestic exhaust fans, power roof fans, range hoods and other systems address different airflow volumes and installation settings. Applications span non-residential and residential buildings, where ventilation supports indoor air quality, temperature stability and equipment protection. As industries and households focus on reliable airflow solutions for comfort and operational needs, the combination of varied equipment formats and broad application use influences overall adoption across the country.

Axial fans account for 35% of total demand for ventilation equipment in USA. Their leading position reflects widespread use in systems requiring high airflow rates with relatively low energy consumption. Many industrial sites, warehouses and commercial facilities rely on axial fans for general ventilation, cooling and air exchange. Their simple construction, compact form and straightforward installation make them suitable for large and small spaces. These characteristics support frequent selection across projects seeking dependable airflow without complex ductwork or specialized fittings. Their adaptability to wall, window or duct configurations further reinforces adoption across varied sectors.

Demand for axial fans is also supported by their performance in environments that require steady movement of large air volumes. Facilities that manage heat loads or airborne particulates often rely on axial designs because they deliver consistent output with minimal maintenance. Their predictable operation suits routine ventilation schedules in manufacturing, storage and processing settings. As commercial and industrial buildings prioritize stable airflow for worker comfort and equipment safety, axial fans continue to serve as a core product type within USA ventilation solutions.

Non-residential applications account for 65.0% of total demand for ventilation equipment in USA. This leading share reflects significant ventilation needs across commercial buildings, factories, warehouses, healthcare facilities and educational institutions. These environments depend on ventilation systems to maintain air quality, manage heat loads and support compliance with building standards. Large interior spaces commonly require high-capacity systems that ensure stable airflow throughout extended operating hours. This consistent need shapes strong reliance on dedicated ventilation equipment across non-residential settings. Many projects incorporate equipment upgrades during renovations or system replacements, which further increases demand in this segment.

Demand from non-residential buildings also grows as facilities modernize mechanical systems to support improved indoor conditions and energy management. Ventilation plays an important role in maintaining safe environments for workers and visitors, making reliable equipment essential for daily operations. Equipment selection often focuses on durability, straightforward maintenance and compatibility with existing infrastructure. These factors guide the continued use of ventilation systems across diverse commercial and industrial environments. As building operations evolve, non-residential applications remain the primary driver of ventilation equipment demand in USA.

Demand for ventilation equipment in the USA is being boosted by greater focus on indoor air quality (IAQ), stricter energy efficiency and building-code requirements, and growth in retrofit activity across residential, commercial and industrial sectors. Ventilation units such as fans, air-handling units and recovery ventilators are increasingly used to manage air circulation, humidity, and pollutant control. At the same time, higher upfront costs, complex installation in older buildings and supply-chain constraints for components can limit quick uptake. These factors together determine the pace and scale of equipment adoption in the United States.

In the United States, heightened awareness of air quality risks in homes, offices and schools has increased demand for ventilation solutions that remove stale or contaminated air and bring fresh outdoor air indoors. Regulatory frameworks from bodies such as American Society of Heating, Refrigerating and Air-Conditioning Engineers (ASHRAE) and energy-performance requirements under federal and state programmes encourage the use of more advanced ventilation equipment. These pressures compel manufacturers and building owners to invest in units that offer both performance and compliance. As a result, demand rises for upgraded systems across new and existing buildings in the USA.

Key opportunities in the USA lie in retrofit projects of older buildings, construction of data centres, healthcare facilities, and workshops that require clean or controlled environments. The growth of e-commerce and data-driven operations increases the need for specialised ventilation in high-heat, high-density facilities. Residential retrofit markets in regions with extreme climates and new standards for ventilation also present significant potential. Suppliers who offer modular, energy-efficient or smart-connected ventilation equipment are well-positioned to capture these growth paths in the United States.

Several obstacles moderate the rate of adoption in the USA ventilation equipment market. Upfront capital costs and operational disruption during installation, especially in retrofit scenarios, act as deterrents. Many older buildings pose integration challenges such as inadequate ductwork or space constraints. In addition, economic uncertainties, rising interest rates and slower construction activity can reduce demand for new installations. These constraints mean that although interest is strong, market growth may remain selective rather than uniform across all building types in the USA.

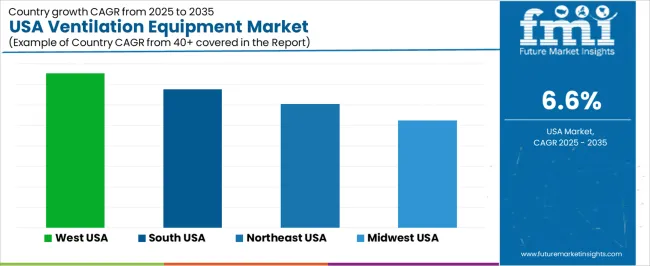

| Region | CAGR (%) |

|---|---|

| West | 7.5% |

| South | 6.8% |

| Northeast | 6.0% |

| Midwest | 5.2% |

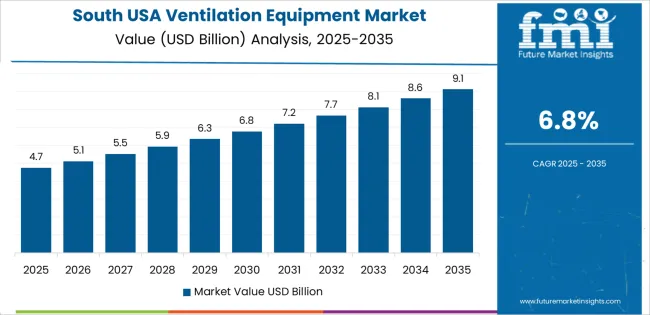

Demand for ventilation equipment in the USA is rising across all regions, with the West leading at 7.5%. Growth in this region reflects steady construction activity, heightened interest in indoor air quality, and strong adoption of energy-efficient ventilation systems across residential and commercial buildings. The South follows at 6.8%, supported by warm climates that increase year-round HVAC use and expanding construction across urban and suburban areas. The Northeast records 6.0%, shaped by older building stock and ongoing replacement of outdated ventilation units. The Midwest grows at 5.2%, where manufacturing facilities and residential renovations drive steady demand. Together, these regions show consistent interest in ventilation solutions as buildings adapt to airflow and comfort needs.

West USA is projected to grow at a CAGR of 7.5% through 2035 in demand for ventilation equipment. California and neighboring states are increasingly adopting HVAC systems, industrial fans, and air circulation devices across commercial, residential, and industrial applications. Rising construction activities, urban development, and building regulations focused on indoor air quality drive adoption. Manufacturers are providing energy-efficient, durable, and high-capacity ventilation solutions. The growth of offices, warehouses, and residential complexes, combined with health and safety regulations, ensures steady demand for ventilation equipment across West USA urban and suburban regions.

South USA is projected to grow at a CAGR of 6.8% through 2035 in demand for ventilation equipment. Urban and suburban centers, including Houston, Miami, and Atlanta, are increasingly installing HVAC systems, industrial fans, and air management devices in commercial and residential facilities. Rising awareness of indoor air quality, health standards, and energy efficiency drives adoption. Manufacturers provide durable, efficient, and scalable ventilation solutions. Construction, commercial building expansion, and industrial operations further support adoption. Regional distributors and suppliers ensure wide availability. These factors contribute to steady growth in ventilation equipment demand across southern states.

Northeast USA is projected to grow at a CAGR of 6.0% through 2035 in demand for ventilation equipment. Cities including New York, Boston, and Philadelphia increasingly install HVAC systems, ventilation fans, and air circulation solutions in commercial, residential, and institutional buildings. Rising health, safety, and energy efficiency requirements drive adoption. Manufacturers provide advanced, durable, and scalable ventilation products. Urban population density, commercial expansion, and building regulations focused on air quality ensure steady growth. Distribution networks and supplier infrastructure support accessibility. The combination of industrial, institutional, and residential applications sustains demand for ventilation equipment across Northeast USA.

Midwest USA is projected to grow at a CAGR of 5.2% through 2035 in demand for ventilation equipment. Urban centers, including Chicago, Detroit, and Minneapolis, are installing HVAC systems, industrial fans, and air circulation solutions in commercial, residential, and industrial facilities. Rising awareness of indoor air quality, regulatory compliance, and energy-efficient designs drives adoption. Manufacturers provide durable, high-performance, and scalable ventilation equipment. Growth in construction, manufacturing facilities, and office spaces ensures steady adoption. Retailers and distributors expand product availability. These factors support continued growth in ventilation equipment demand across the Midwest USA region.

The demand for ventilation equipment in the USA is driven by increasing emphasis on indoor air quality, regulatory mandates for energy efficiency and growth in residential, commercial and industrial construction. Concerns over poor indoor air quality-linked to health, productivity and occupant comfort-prompt organisations to upgrade ventilation systems. At the same time, stricter building codes, energy-recovery requirements and smart-building trends encourage specifying advanced ventilation solutions. Growth in data centres, manufacturing facilities and clean-room applications further drives demand for high-performance ventilation fans, air-handling units and energy-recovery systems. Taken together, these factors create sustained growth opportunities for ventilation equipment suppliers in the USA market.

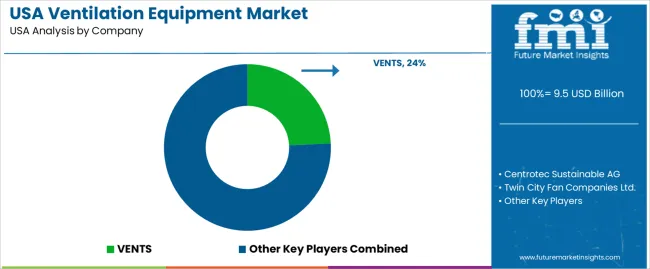

Key companies active in the USA ventilation-equipment segment include VENTS, Centrotec Sustainable AG, Twin City Fan Companies Ltd., Nortek Incorporated, Soler & Palau Group and Zibo Lihua Co. Ltd. These firms provide a wide range of products from axial and centrifugal fans to complete ventilation systems and energy-recovery ventilators serving residential, commercial and industrial end-users. Their competitive edge lies in engineering performance, energy efficiency, product lifecycle value and channel reach in the USA market. Through innovation and tailored solutions for USA regulatory and application requirements, these companies are influential in how ventilation-equipment demand evolves.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Product Type | Axial Fans, Centrifugal Fans, Cross Flow Fans, Domestic Exhaust Fans, Power Roof Fans, Range Hoods, Others |

| Application | Non-Residential, Residential |

| Region | Northeast, West, Midwest, South |

| Countries Covered | USA |

| Key Companies Profiled | VENTS, Centrotec Sustainable AG, Twin City Fan Companies Ltd., Nortek Incorporated, Soler & Palau Group, Zibo Lihua Co. Ltd. |

| Additional Attributes | Dollar by sales by product type, application, and region; regional CAGR and growth trends; adoption by commercial, industrial, and residential sectors; replacement cycles and retrofit demand; energy efficiency and compliance with ASHRAE and local building codes; integration with HVAC systems; smart ventilation and monitoring features; noise control and airflow performance; product lifespan and maintenance requirements; channel distribution including direct sales, distributors, and online suppliers; innovation in modular and scalable solutions. |

The global demand for ventilation equipment in USA is estimated to be valued at USD 9.5 billion in 2025.

The market size for the demand for ventilation equipment in USA is projected to reach USD 18.0 billion by 2035.

The demand for ventilation equipment in USA is expected to grow at a 6.6% CAGR between 2025 and 2035.

The key product types in demand for ventilation equipment in USA are axial fans , centrifugal fans, cross flow fans, domestic exhaust fans, power roof fans, range hoods and others.

In terms of application, non-residential segment to command 65.0% share in the demand for ventilation equipment in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

USA Hunting Equipment & Accessories Market Trends, Growth and Forecast 2025 to 2035

Ventilation Equipment Market Growth - Trends & Forecast 2025 to 2035

USA Food Service Equipment Market Insights – Demand, Size & Industry Trends 2025–2035

USA Drain Cleaning Equipment Market Analysis – Size, Share & Trends 2025-2035

USA Compact Construction Equipment Market Trends – Growth, Demand & Forecast 2025–2035

Demand for Ventilation Equipment in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Automated Test Equipment in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Upstream Bioprocessing Equipment in USA Size and Share Forecast Outlook 2025 to 2035

Demand for 4-Inch SiC Laser Annealing Equipment in the USA Size and Share Forecast Outlook 2025 to 2035

Demand for Magnetic Material Magnetization and Testing Equipment in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Advanced Driver Assistance System (ADAS) Testing Equipment in USA Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA