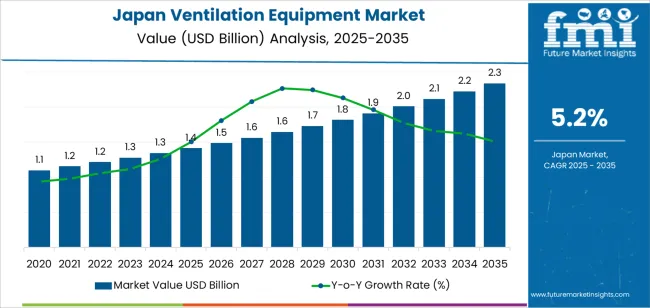

The demand for ventilation equipment in Japan is projected to grow from USD 1.4 billion in 2025 to USD 2.3 billion by 2035, reflecting a CAGR of 5.2%. Ventilation systems, which play a key role in maintaining indoor air quality and energy efficiency across both residential and commercial buildings, are increasingly important in the context of Japan's growing focus on sustainability and healthier living environments. As urbanization continues and the demand for energy-efficient buildings increases, ventilation systems are being integrated into new and existing structures to meet stringent environmental regulations and improve occupant comfort. Moreover, the energy-saving potential of advanced ventilation systems, particularly those equipped with heat recovery and air purification technologies, is becoming an attractive solution for commercial and industrial sectors.

The market for ventilation equipment will continue to be shaped by government initiatives aimed at improving indoor air quality and reducing carbon emissions in building systems. The shift toward smart buildings and green building certifications will further drive demand for advanced ventilation solutions. Additionally, as climate change and environmental concerns heighten, more consumers and businesses are prioritizing the use of sustainable and energy-efficient technologies in building designs, contributing to a robust long-term growth outlook for the ventilation equipment market in Japan.

From 2025 to 2030, the demand for ventilation equipment in Japan will grow from USD 1.4 billion to USD 1.8 billion, adding USD 0.4 billion in value. This period will see steady growth, driven by the continued demand for energy-efficient systems and health-focused solutions in residential and commercial buildings. The market will experience early-stage growth, with new technologies such as smart ventilation systems and air purification devices becoming increasingly mainstream. As these innovations are integrated into the design of new buildings, growth will be sustained by regulatory requirements and increased consumer awareness of the importance of indoor air quality. However, this phase will also mark the beginning of market saturation, as the adoption of basic ventilation systems becomes widespread across various sectors.

From 2030 to 2035, the market will grow from USD 1.8 billion to USD 2.3 billion, contributing an additional USD 0.5 billion in value. During this phase, growth will moderate, as the market approaches a more mature stage. While demand for advanced ventilation systems will continue, the market will begin to exhibit signs of saturation as a larger proportion of the market shifts toward replacement and system upgrades rather than initial installations. The introduction of new technologies and innovative solutions, such as integrated smart systems and advanced filtration technologies, will help sustain growth, but the overall pace of expansion will slow as most buildings and infrastructure in Japan adopt basic ventilation solutions. The market will experience incremental improvements in demand, driven by retrofit projects and technological advancements that provide enhanced efficiency and sustainability.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 1.4 billion |

| Industry Forecast Value (2035) | USD 2.3 billion |

| Industry Forecast CAGR (2025-2035) | 5.2% |

Demand for ventilation equipment in Japan is rising as building owners, manufacturers and public sector entities aim to improve indoor air quality, reduce energy consumption and comply with stricter environmental regulations. In 2024 the factory ventilation systems segment alone was valued at approximately USD 337.2 million. Forecasts suggest this segment could reach around USD 970.3 million by 2033, representing a compound annual growth rate (CAGR) near 12.5%. The primary drivers include government policy targets for carbon neutrality by 2050, the Energy Conservation Act and rising operational costs for large scale facilities.

Ventilation equipment demand is also supported by construction activity in commercial, industrial and residential sectors. New builds, retrofits and smart building installations favour advanced systems with features like variable speed fans, demand controlled ventilation and IoT enabled monitoring. The data centre and electronics manufacturing sectors in Japan contribute significantly, given their strict requirements for airflow control and thermal management. Key constraints include the high upfront cost of sophisticated ventilation systems, space and infrastructure limitations in urban environments and the challenge of integrating new equipment with legacy HVAC systems. Still, the combination of regulatory momentum, industrial demand and technology innovation suggests continued growth in Japan’s ventilation equipment market.

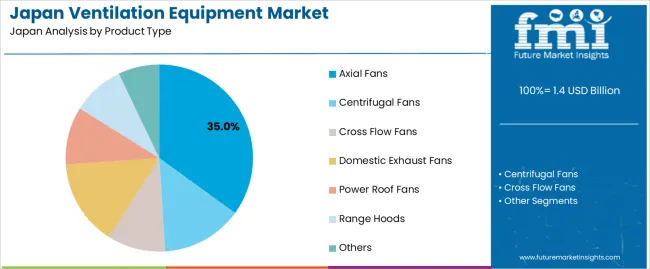

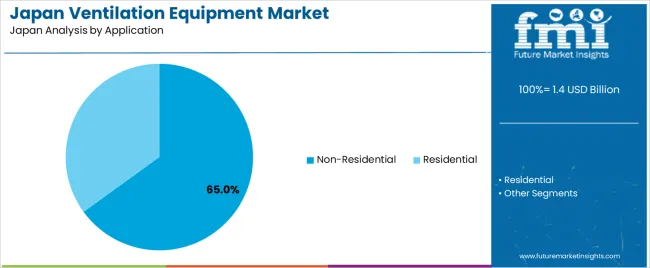

The demand for ventilation equipment in Japan is primarily driven by product type and application. The leading product type is axial fans, which capture 35% of the market share, while non-residential applications dominate, accounting for 65% of the demand. Ventilation equipment plays a crucial role in maintaining air quality, temperature control, and energy efficiency across various sectors, with applications ranging from industrial buildings to residential spaces.

Axial fans lead the market for ventilation equipment in Japan, holding 35% of the demand. Axial fans are commonly used in ventilation systems due to their efficiency in moving large volumes of air at relatively low pressure. These fans are widely used in both industrial and commercial settings, where large-scale air movement is required.

The demand for axial fans is driven by their versatility, ease of installation, and cost-effectiveness. They are often used in applications such as HVAC systems, industrial exhausts, and air circulation in large spaces. Their ability to provide efficient airflow makes them an ideal choice for environments requiring continuous ventilation. As industries prioritize energy efficiency and better air quality, axial fans are expected to remain the dominant product type in Japan’s ventilation equipment market.

Non-residential applications are the largest segment for ventilation equipment in Japan, capturing 65% of the demand. Non-residential buildings, such as commercial offices, factories, and healthcare facilities, require advanced ventilation systems to maintain air quality and meet building regulations. These systems are critical for ensuring the health and comfort of occupants, particularly in large or enclosed spaces.

The demand from non-residential applications is driven by the need for efficient air circulation and temperature regulation in environments with high foot traffic or specialized air quality needs. As businesses and industries continue to focus on improving worker health and optimizing energy use, the demand for ventilation equipment in commercial and industrial settings is expected to remain strong. This segment is likely to continue leading the market as sustainability and indoor air quality become more central to building design and operation in Japan.

What Are the Primary Growth Drivers for Ventilation Equipment Demand in Japan?

Several drivers support growth. First, stricter environmental laws and corporate ESG commitments are prompting facility managers to upgrade HVACsystems and install advanced ventilation to comply with Japan’s “CarbonNeutrality by 2050” agenda. Second, rising demand for smart manufacturing and Industry 4.0 facilities in sectors such as electronics and automotive is increasing demand for mechanical and hybrid ventilation systems with realtime monitoring capabilities. Third, high energy costs and labour constraints are making energyrecovery ventilation and demandcontrolledventilation solutions more attractive for industrial facilities. Fourth, accelerated facilityrenovation efforts across commercial buildings and data centres are creating new opportunities for modern ventilation equipment.

What Are the Key Restraints Affecting Ventilation Equipment Demand in Japan?

Despite favourable conditions, several constraints apply. Investment in ventilation systems often comes with significant capital cost and long payback periods when energy savings are modest, deterring some buyers. Many existing buildings in Japan require complex retrofitting which increases disruption, specialised labour requirements and delivery delay. Supplychain disruptions particularly for advanced control systems, sensors and filters—can increase leadtimes and drive costs. In some cases, older facilities or smaller firms may postpone investment until regulation mandates force upgrades, limiting shortterm market penetration.

What Are the Key Trends Shaping Ventilation Equipment Demand in Japan?

Important trends include the growing use of IoTenabled ventilation systems that monitor airflow, indoorair quality, occupancy and performance, enabling predictive maintenance and efficiency improvement. Another trend is the shift toward heatrecovery ventilation and hybrid systems combining natural and mechanical exchange to meet both comfort and energyreduction goals. There is also increased demand for ventilation in tighttolerance environments such as semiconductor fabs and pharmaceutical production, which require specialised filters and controlledflow systems. Finally, modularisation and prefabricated ventilation units are gaining traction, reducing installation time and disruption in retrofit projects.

The demand for ventilation equipment in Japan is primarily driven by factors such as the need for better air quality, increasing awareness about environmental health, and regulations surrounding indoor air standards. Ventilation systems are crucial for ensuring optimal air circulation and minimizing exposure to pollutants, which is especially important in densely populated urban areas and industries requiring controlled environments. With Japan's focus on sustainability, energy efficiency, and public health, there has been a rising adoption of advanced ventilation systems in residential, commercial, and industrial sectors.

Additionally, the demand for ventilation equipment is influenced by Japan's aging population, where improved indoor air quality becomes more critical for health and well-being. The growth of smart homes, environmental regulations, and a greater focus on energy-efficient and eco-friendly solutions are further contributing to the growth of the ventilation equipment market across Japan.

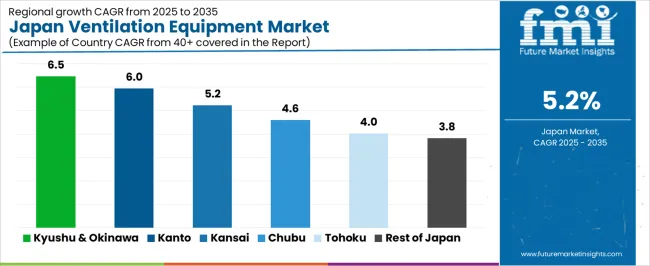

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 6.5% |

| Kanto | 6% |

| Kinki | 5.2% |

| Chubu | 4.6% |

| Tohoku | 4% |

| Rest of Japan | 3.8% |

Kyushu & Okinawa leads the demand for ventilation equipment in Japan with a CAGR of 6.5%. This growth is largely driven by the region’s focus on improving indoor air quality in both residential and commercial buildings. With the ongoing environmental initiatives and growing awareness about health impacts caused by poor air quality, demand for advanced ventilation systems is increasing in this region. Okinawa, with its subtropical climate and tourism-driven economy, also drives the need for efficient ventilation systems in hotels, resorts, and public spaces.

Additionally, the rise in construction and renovation activities across Kyushu & Okinawa, particularly in urban areas, has further fueled the demand for modern ventilation solutions. As businesses and homeowners seek energy-efficient and sustainable ventilation systems, the region is poised to continue experiencing strong demand.

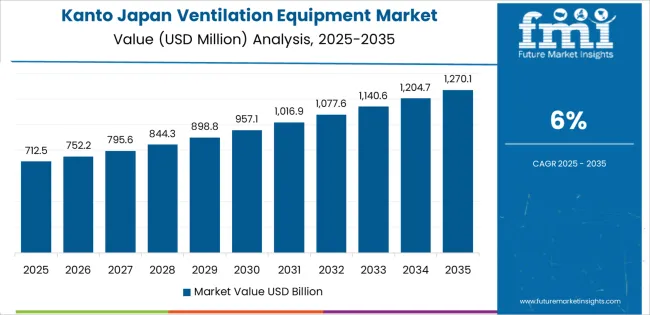

Kanto shows strong demand for ventilation equipment with a CAGR of 6.0%. As Japan’s largest economic hub, Kanto, which includes Tokyo and its surrounding areas, is home to a high concentration of commercial buildings, residential complexes, and industrial facilities that require advanced ventilation systems to meet air quality standards. The region's emphasis on energy-efficient and environmentally friendly solutions, driven by both consumer demand and governmental regulations, contributes to the rising adoption of ventilation equipment.

The growing concern about indoor air quality, particularly in densely populated urban areas where pollution levels are higher, has spurred demand for efficient and smart ventilation systems. Kanto's robust infrastructure and technological advancements further support the expansion of the ventilation equipment market in the region.

Kinki, with a CAGR of 5.2%, shows steady demand for ventilation equipment. The region, home to cities like Osaka and Kyoto, has a strong industrial and commercial base, particularly in the manufacturing and service sectors. As industries in Kinki continue to expand and modernize, the need for efficient ventilation solutions in factories, offices, and residential buildings increases.

Kinki's commitment to improving air quality, combined with growing urbanization and environmental regulations, further drives the market for ventilation equipment. While growth in Kinki is steady compared to Kyushu & Okinawa and Kanto, it is sustained by a solid demand from both industrial sectors and residential construction.

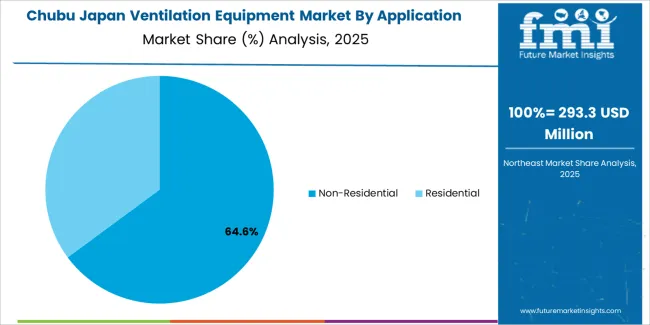

Chubu shows moderate growth in the demand for ventilation equipment with a CAGR of 4.6%. The region, known for its strong manufacturing and automotive industries, is increasingly adopting energy-efficient and eco-friendly solutions to meet both regulatory standards and consumer preferences. As industries in Chubu invest in modernizing their facilities, the demand for ventilation systems, particularly in factories and warehouses, is growing.

The region’s focus on sustainability and environmental protection is helping drive the adoption of advanced ventilation systems. With growing concerns over air quality and energy efficiency, businesses and homeowners in Chubu are increasingly turning to modern ventilation equipment to improve comfort and reduce energy consumption.

Tohoku, with a CAGR of 4.0%, and the Rest of Japan, with a CAGR of 3.8%, show slower growth in the demand for ventilation equipment compared to other regions. These regions are more rural and less industrialized, with lower concentrations of commercial buildings and large-scale residential developments. However, the demand for ventilation systems in Tohoku and the Rest of Japan is steadily increasing, driven by the need to meet national air quality standards and the growing focus on sustainability.

In these regions, the adoption of ventilation systems is slower but gradually increasing as construction activities rise and businesses become more aware of the importance of energy-efficient solutions. As environmental regulations and consumer awareness of air quality continue to grow, demand in these areas is expected to increase, though at a more moderate pace compared to more urbanized regions.

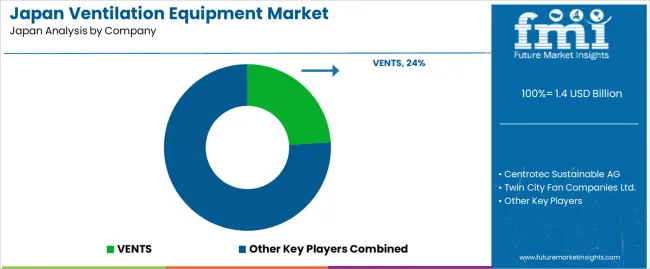

The ventilation equipment industry in Japan is expanding as the country increases efforts to improve indoor air quality, reduce energy consumption, and meet stricter building regulations. Industry data show Japan’s HVAC market is projected to grow at a compound annual growth rate (CAGR) of about 8.9 % between 2025 and 2032. Key firms in the local ventilation segment include VENTS (with approximately 24 % market share), Centrotec Sustainable AG, Twin City Fan Companies Ltd., Nortek Incorporated, Soler & Palau Group, and Zibo Lihua Co. Ltd. VENTS is cited as a company with more than 25 years of development and broad international export reach.

Competition in Japan’s ventilation equipment industry is driven by technological innovation, energy efficiency, and local service capabilities. Manufacturers focus on products that reduce power consumption and enable smart control of airflow and heat recovery. Some firms offer ventilation units that integrate EC (electronically commutated) motors or IoT-enabled controls. Another competitive dimension is compliance with Japanese energy conservation standards and local building codes. Suppliers are also emphasizing delivery, maintenance support, and compatibility with Japanese installation practices. Marketing materials typically highlight airflow performance, noise levels, power draw, and installation ease. By aligning their product portfolios with Japan’s demand for reliable, efficient, and code compliant ventilation systems, these companies aim to maintain or increase their presence in the Japanese ventilation equipment market.

| Items | Details |

|---|---|

| Quantitative Units | USD Billion |

| Regions Covered | Japan |

| Product Type | Axial Fans, Centrifugal Fans, Cross Flow Fans, Domestic Exhaust Fans, Power Roof Fans, Range Hoods, Others |

| Application | Non-Residential, Residential |

| Key Companies Profiled | VENTS, Centrotec Sustainable AG, Twin City Fan Companies Ltd., Nortek Incorporated, Soler & Palau Group, Zibo Lihua Co. Ltd. |

| Additional Attributes | The market analysis includes dollar sales by product type, application, and company categories. It also covers regional demand trends in Japan, driven by the growing need for efficient and energy-saving ventilation systems in residential and non-residential buildings. The competitive landscape highlights key manufacturers focusing on innovations in fan designs, noise reduction technologies, and energy-efficient systems. Trends in the increasing adoption of ventilation solutions for improving indoor air quality, particularly in residential and commercial spaces, are explored, along with advancements in product performance and sustainability. |

The demand for ventilation equipment in japan is estimated to be valued at USD 1.4 billion in 2025.

The market size for the ventilation equipment in japan is projected to reach USD 2.3 billion by 2035.

The demand for ventilation equipment in japan is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in ventilation equipment in japan are axial fans , centrifugal fans, cross flow fans, domestic exhaust fans, power roof fans, range hoods and others.

In terms of application, non-residential segment is expected to command 65.0% share in the ventilation equipment in japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ventilation Equipment Market Growth - Trends & Forecast 2025 to 2035

Japan Tennis Equipment Market Analysis - Size, Share, and Forecast 2025 to 2035

Japan Drain Cleaning Equipment Market Report – Trends, Demand & Outlook 2025-2035

Japan Compact Construction Equipment Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Aircraft Ground Support Equipment Market Analysis & Forecast by Equipment, Ownership, Power, Application, and Region Through 2025 to 2035

Demand for Ventilation Equipment in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Advanced Driver Assistance System (ADAS) Testing Equipment in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Equipment Management Software Market Size and Share Forecast Outlook 2025 to 2035

Equipment cases market Size and Share Forecast Outlook 2025 to 2035

Japan Probiotic Yogurt Market is segmented by product type, source type, nature type, flavor type, fat content, sales channel and key city/province through 2025 to 2035.

japan Tortilla Market - Growth, Trends and Forecast from 2025 to 2035

Japan Cosmetics ODM Market Analysis - Size, Share & Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA