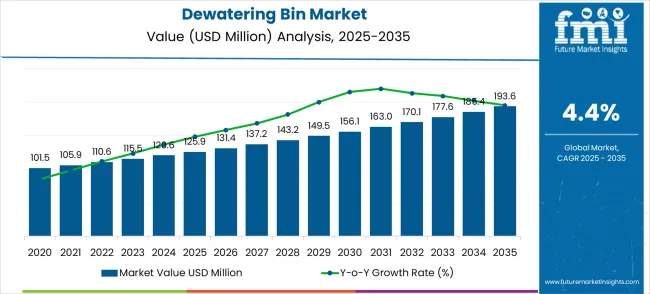

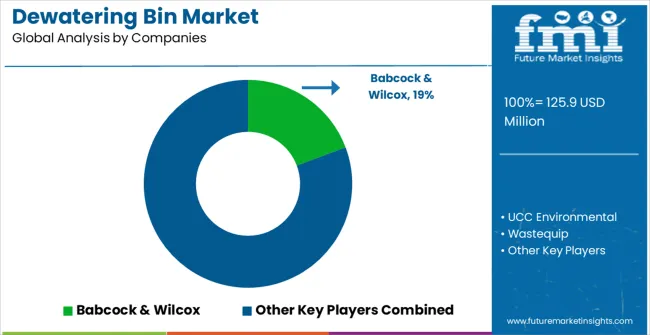

The global dewatering bin market is valued at USD 125.9 million in 2025 and is expected to reach USD 193.6 million by 2035, reflecting a CAGR of 4.4%. Growth contribution across this period is primarily driven by increasing demand from wastewater treatment, food processing, and industrial applications where efficient moisture removal is critical. In the early phase from 2025 to 2028, contributions are concentrated in regions with expanding municipal infrastructure and growing industrial output. Manufacturers offering high-capacity, durable, and energy-efficient dewatering bins secure larger market shares, while technological enhancements such as automated discharge and corrosion-resistant designs reinforce adoption. During this stage, growth is amplified by operational efficiency gains and regulatory requirements for improved waste and water management.

From 2029 to 2035, the growth contribution becomes more balanced as markets in developed regions approach maturity and emerging regions expand adoption. Innovations in modular designs, compact systems, and integration with advanced waste treatment technologies support incremental gains. Collaboration between equipment suppliers and large-scale industrial users further strengthens market penetration and steady value creation.

By 2035, the market is expected to record an absolute increase of USD 67.7 million, indicating consistent expansion over the decade. The growth contribution index analysis highlights how early momentum driven by infrastructure development transitions into steady growth supported by technological innovation and broader adoption, ensuring long-term stability and progressive market accumulation in the global dewatering bin sector.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 125.9 million |

| Forecast Value in (2035F) | USD 193.6 million |

| Forecast CAGR (2025 to 2035) | 4.4% |

The dewatering bin market is segmented into construction and civil engineering at 37%, mining and mineral processing at 26%, industrial wastewater treatment at 17%, food and beverage processing at 11%, and municipal services at 9%. Construction dominates due to extensive use in excavation, trenching, and foundation work where water removal is essential. Mining and mineral facilities utilize dewatering bins for slurry management and efficient solid-liquid separation. Industrial wastewater plants apply them to handle sludge volumes more effectively. Food and beverage industries benefit from water recycling and by-product management. Municipal services use bins for stormwater control and sludge reduction, ensuring efficient waste handling and compliance with local regulations.

Trends in the dewatering bin market highlight the adoption of modular and stackable designs to maximize space usage and simplify logistics. Manufacturers are advancing with lightweight, corrosion-resistant, and automated systems to improve durability and reduce manual labor. Growing uptake in construction, mining, and industrial facilities reflects the need for cost-effective sludge and water control solutions.

Integration of smart monitoring tools and IoT-enabled systems is enhancing operational efficiency by tracking fill levels, water recovery, and disposal cycles. Collaborations between equipment suppliers and utility providers are leading to customized solutions. The rising demand for efficient sludge management and adherence to regulations continues to drive global adoption across multiple industries.

Market expansion is being supported by the increasing global demand for efficient waste management solutions and the corresponding need for reliable dewatering systems that can handle diverse waste streams while maintaining consistent performance across various industrial applications. Modern industrial facilities are increasingly focused on implementing waste treatment solutions that can reduce disposal costs, minimize environmental impact, and provide consistent quality in processed waste discharge. Dewatering bins' proven ability to deliver efficient solid-liquid separation, reduced waste volume, and versatile operational capabilities make them essential equipment for contemporary industrial waste management and processing solutions.

The growing focus on environmental compliance and green manufacturing practices is driving demand for dewatering bins that can support regulatory requirements, reduce waste disposal costs, and enable efficient resource recovery from industrial waste streams. Industrial processors' preference for equipment that combines operational efficiency with environmental benefits and cost-effectiveness is creating opportunities for innovative dewatering implementations. The rising influence of circular economy principles and resource recovery demands is also contributing to the increased adoption of dewatering bins, which can provide efficient separation solutions without excessive energy consumption or maintenance requirements.

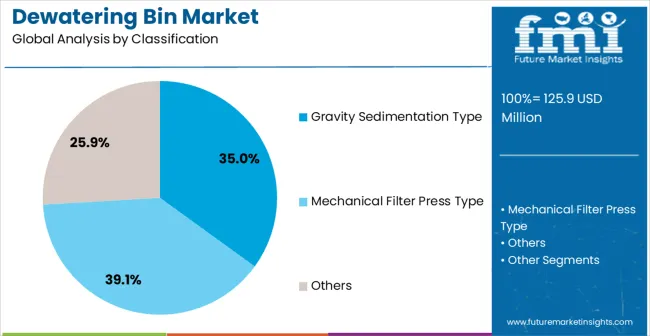

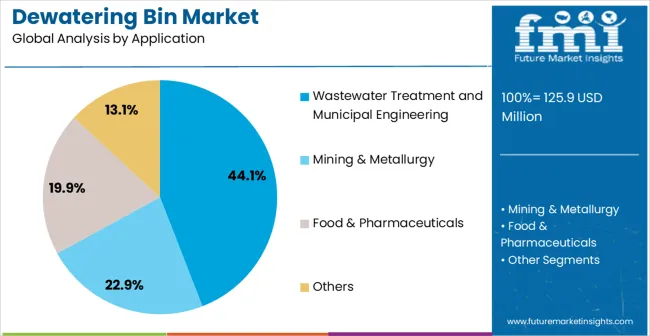

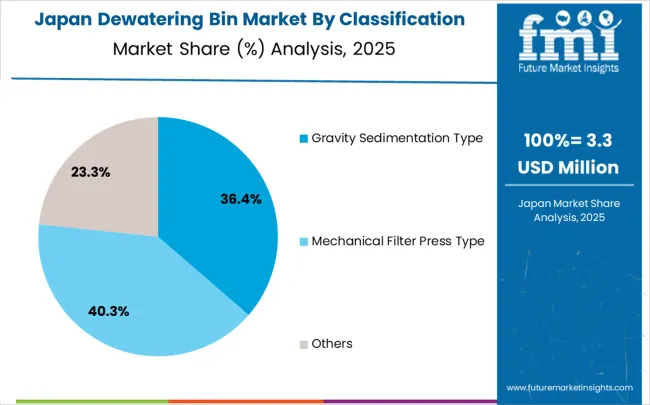

The dewatering bin market is experiencing steady growth, driven by increasing demand for efficient sludge and liquid-solid separation systems across industries. Gravity sedimentation type bins dominate the technology segment with a 35% market share, while mechanical filter press types and other technologies account for the remainder. In terms of application, wastewater treatment and municipal engineering lead with a 44.1% share, followed by mining and metallurgy, food and pharmaceuticals, and other industrial applications. These segments represent the primary opportunities for investment, reflecting widespread adoption and consistent demand for reliable dewatering solutions across key industrial sectors.

Gravity sedimentation type dewatering bins hold a 35% share of the technology segment, making them the most commonly used solution. They are favored for wastewater treatment, municipal sludge handling, and low to medium solids content separation due to their simplicity and cost-effectiveness. Key manufacturers include Alfa Laval, Veolia, ANDRITZ, and GEA Group. Gravity sedimentation bins offer low energy consumption and minimal maintenance requirements, which makes them particularly attractive for municipal and industrial wastewater treatment plants. Their reliability and ease of operation contribute to continued preference among operators in sectors seeking efficient, low-cost dewatering solutions.

Wastewater treatment and municipal engineering applications account for 44.1% of the market, representing the largest segment. Dewatering bins in this segment are used to process municipal sludge, industrial effluent, and other liquid-solid waste, improving operational efficiency and environmental compliance. Leading manufacturers such as Alfa Laval, Veolia, ANDRITZ, and GEA Group provide solutions designed for high reliability and ease of integration into existing treatment systems. The segment’s growth is driven by expanding municipal infrastructure, increasing regulatory standards for wastewater management, and the need for efficient waste handling, making it the primary focus for investment.

The dewatering bin market is expanding as industries seek efficient waste management solutions. These bins separate liquids from solids, reducing waste volume and simplifying disposal. Construction and mining sectors are major contributors, producing slurry and wastewater that require safe handling. Improvements in bin design and materials have enhanced durability and performance, making them more reliable for industrial applications. The ability to maintain cleaner work environments, reduce operational hazards, and support regulatory compliance reinforces demand. Combined with increasing industrial activity globally, these factors are driving steady growth for dewatering bin solutions. Companies are investing in improved designs and manufacturing processes to meet evolving industrial requirements while ensuring effective, safe, and environmentally responsible waste handling.

Despite the growth potential, the dewatering bin market faces significant challenges. High acquisition costs make these systems less accessible for smaller organizations or budget-constrained facilities. Operational requirements, including regular maintenance and proper handling, add to total ownership expenses. Skilled personnel are often needed to ensure correct use, which can increase labor costs. Performance may vary depending on the type and consistency of waste, sometimes requiring customized solutions that further increase investment. Urban or space-limited environments can restrict installation options. Limited awareness of advanced waste management practices in some regions can also slow adoption. These factors collectively hinder broader implementation, even as demand from large industrial operators and high-volume facilities continues to increase, highlighting the need for cost-effective and user-friendly solutions.

Market trends show increasing adoption of automation and green practices. Dewatering bins are being equipped with sensors and monitoring features that allow efficient operation, reduce manual labor, and prevent overflow or spillage. Manufacturers are focusing on environmentally conscious designs using durable, recyclable materials. Customization is growing in response to diverse industrial needs, with bins tailored to handle specific waste types, volumes, and operational conditions. Companies are exploring modular and portable designs to improve installation flexibility and space utilization. The trend toward cleaner, safer, and more efficient industrial processes is guiding innovation.

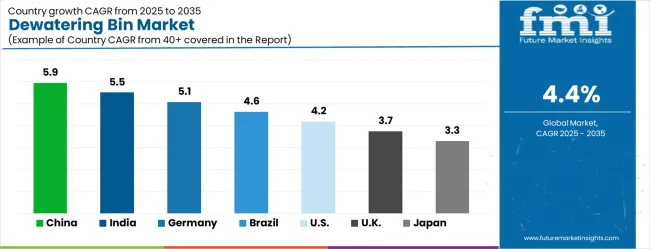

The global dewatering bin sector is expected to expand at a CAGR of 4.4% from 2025 to 2035, corresponding to a multiplication factor of 1.44 over the period. China leads at 5.9% (1.76x), 1.5 points above the global average, supported by growing industrial activities and enhanced waste processing infrastructure. India follows at 5.5% (1.71x), 1.1 points above global growth, fueled by urban development and modernization of municipal waste systems, both part of BRICS along with Brazil, which grows at 4.6% (1.56x), slightly above the global rate due to expanding waste management projects. Germany records 5.1% (1.65x), 0.7 points higher than the global average, reflecting advanced waste handling facilities. The USA grows at 4.2% (1.52x), slightly below the global pace, while the UK at 3.7% (1.44x) and Japan at 3.3% (1.38x) lag behind. ASEAN and Oceania are adopting these solutions at 4-5% (1.44-1.56x), driven by rising urban waste management initiatives.

| Country | CAGR (2025-2035) |

|---|---|

| China | 5.9% |

| India | 5.5% |

| Germany | 5.1% |

| Brazil | 4.6% |

| USA | 4.2% |

| UK | 3.7% |

| Japan | 3.3% |

The report covers an in-depth analysis of 40+ countries, Top-performing countries are highlighted below.

China accounts for 5.9% of the global Dewatering Bin market with CAGR projected at 5.9% from 2025 to 2035, above the global rate of 4.4%. Demand is supported by rapid expansion of industrial wastewater treatment, large-scale municipal waste operations, and heavy construction activity. International players such as Veolia and GEA Group are strengthening their presence through partnerships with domestic firms to deliver high-capacity, automated systems. Eastern and southern provinces dominate installations due to industrial concentration. Demand for modular bins is increasing as facilities prioritize compact designs for ease of handling. Strong government focus on efficient effluent management continues to drive purchases.

India contributes 5.5% to the global market with 5.5% CAGR expected through 2035. Expansion is linked to municipal wastewater facilities, industrial plants, and expanding infrastructure projects. Metropolitan hubs including Mumbai, Delhi, and Bangalore lead adoption. Suppliers such as GEA Group and Veolia are introducing bins with automated solid-liquid separation, reducing manual intervention in large treatment plants. Growing adoption in textile, chemical, and food industries adds to demand. Compact, multifunctional bins are gaining preference due to space constraints in urban facilities. Government-backed water management initiatives and investments in industrial effluent treatment are further strengthening adoption.

Germany represents 5.1% of the global Dewatering Bin market with 5.1% CAGR. Adoption is strongest in industrial wastewater plants, municipal operations, and manufacturing sectors requiring efficient sludge management. Regions such as North Rhine-Westphalia and Bavaria dominate installations due to heavy industrial activity. Companies like GEA Group and Veolia are supplying advanced automated bins that integrate with recycling systems. Food and chemical industries are particularly strong adopters, requiring high-capacity dewatering equipment for compliance with EU standards. Automated designs also reduce reliance on labor while improving accuracy in separation processes.

Brazil accounts for 4.6% of the global market, recording CAGR of 4.6%. Market adoption is highest in wastewater facilities, municipal programs, and food processing operations. São Paulo and Rio de Janeiro are leading centers of installation, representing more than half of the demand. International suppliers such as Veolia and GEA Group are adapting equipment for local climate and infrastructure. Applications include wastewater recycling, bioenergy, and industrial sludge treatment. Modular bin systems with automation help facilities cut handling costs and optimize workflows. Regulatory focus on effluent control is expected to steady demand.

The United States holds 4.2% share of the global market with CAGR at 4.2%. Adoption is concentrated in municipal wastewater plants, industrial sites, and construction-related projects. States such as California, Texas, and New York lead usage due to dense urban and industrial activity. Suppliers including Veolia and GEA Group are delivering high-capacity, automated bins designed for efficient solid-liquid separation. Growing investments in water reuse and environmental compliance are supporting steady adoption. Compact and modular designs are gaining traction as enterprises focus on reducing operational space while improving waste handling performance.

The United Kingdom makes up 3.7% of the global market with CAGR at 3.7%. Demand is concentrated in municipal wastewater centers, industrial plants, and recycling facilities. London, Manchester, and Birmingham dominate installations owing to large urban populations and manufacturing activity. GEA Group and Veolia are supplying modular bins with improved solid-liquid separation and automation. Food, paper, and chemical processing sectors rely on dewatering systems to comply with strict waste guidelines. Compact models are increasingly preferred to manage space in high-density facilities.

Japan accounts for 3.3% of the global Dewatering Bin market with CAGR at 3.3%, below the global average. Installations are concentrated in Tokyo, Osaka, and Nagoya, which account for half of total demand. International players like Veolia and GEA Group provide compact, high-efficiency bins designed for dense urban environments. Adoption is driven by wastewater treatment plants, municipal facilities, and industrial processing operations. Automated bin systems are replacing older models, cutting labor requirements and improving accuracy in separation. Compact units are increasingly chosen due to limited space in urban laboratories and treatment centers.

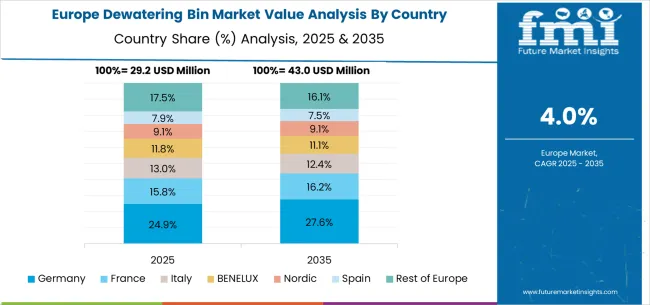

The dewatering bin market in Europe is projected to grow from USD 29.2 million in 2025 to USD 44.8 million by 2035, registering a CAGR of 4.3% over the forecast period. Germany is expected to maintain its leadership position with a 31.5% market share in 2025, moderating slightly to 31.2% by 2035, supported by its strong industrial base, advanced waste treatment infrastructure, and comprehensive environmental compliance requirements serving major European markets.

The United Kingdom follows with a 22.5% share in 2025, projected to reach 22.7% by 2035, driven by robust industrial facility upgrades, municipal infrastructure modernization, and established waste treatment systems across manufacturing and municipal sectors. France holds a 17.8% share in 2025, rising to 18.0% by 2035, supported by industrial development. Italy records 11.5% in 2025, inching to 11.6% by 2035, with growth underpinned by industrial modernization and increasing adoption of advanced waste treatment technologies. Spain contributes 8.2% in 2025, moving to 8.3% by 2035, supported by expanding industrial activities and municipal infrastructure development. The Netherlands maintains a 3.1% share in 2025, growing to 3.2% by 2035. The Rest of Europe region, including Nordic countries, Eastern Europe, Belgium, Switzerland, and Austria, is anticipated to gain momentum, expanding its collective share from 5.4% to 5.0% by 2035, attributed to increasing adoption of advanced waste treatment solutions in Nordic countries and growing industrial activities across Eastern European markets implementing environmental compliance programs.

The dewatering bin market is defined by engineering performance, compliance demands, and cost efficiency. Key companies include Babcock & Wilcox, UCC Environmental, Wastequip, Ironclad Environmental, ParkUSA under ParkProcess, Con-Fab, Spectrum Water Technology, DumpsterLiners, Morrow Water Technologies, and E-Pak Manufacturing. Competition is shaped by durability of bins, adaptability to multiple site conditions, and the ability to handle high solids content without leakage. Buyers evaluate bins not only on strength but also on ease of maintenance and disposal logistics. Product value is tied to reliability in drainage and long service life.

UCC Environmental promotes bins designed with wear-resistant plates, center dewatering elements, and fast discharge features. Spectrum Water Technology presents transport-ready bins optimized for solids retention with minimal manual handling. Babcock & Wilcox highlights heavy-duty designs suitable for industrial applications, while ParkProcess offers skid-mounted units for flexible deployment. Con-Fab and E-Pak Manufacturing focus on rugged fabrication with customizable dimensions. DumpsterLiners and Morrow Water Technologies differentiate by providing accessories and support solutions tailored to waste transport.

Capacity ranges are presented in cubic yards, steel gauges are listed to underline durability, and drainage performance is detailed with perforation ratios. Gate mechanisms, lifting configurations, and corrosion-resistant coatings are positioned as critical selection points. Customers are shown maintenance steps, liner compatibility, and safe unloading procedures. Manufacturers present their products as engineered for operational savings, reduced downtime, and compliance with discharge rules. Competition relies on innovation in bin geometry, structural reinforcement, and service programs. Distinct positioning is maintained through product reliability, adaptability, and after-sales support, rather than simple price competition.

Dewatering bins represent a specialized solid-liquid separation segment within industrial waste management and municipal engineering, projected to grow from USD 125.9 million in 2025 to USD 193.6 million by 2035 at a 4.4% CAGR. These gravity sedimentation and mechanical filter press systems enable efficient dewatering operations across wastewater treatment and municipal engineering (44.1% market share), mining and metallurgy, and food and pharmaceutical processing applications. Market expansion is driven by increasing environmental regulations, growing industrial waste management requirements, rising demand for cost-effective waste treatment solutions, and expanding municipal infrastructure development requiring reliable solid-liquid separation technologies.

How Environmental Regulatory Authorities Could Strengthen Waste Management Standards and Compliance?

How Municipal Engineering Organizations Could Advance Infrastructure Standards and Operational Excellence?

How Equipment Manufacturers Could Drive Innovation and Competitive Advantage?

How Industrial Facility Operators Could Optimize Waste Management and Operational Efficiency?

How Engineering Consultants and System Integrators Could Enable Comprehensive Solutions?

How Investors and Financial Enablers Could Support Market Development and Infrastructure Growth?

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 125.9 million |

| Technology Type | Gravity Sedimentation Type, Mechanical Filter Press Type, Others |

| Application | Wastewater Treatment and Municipal Engineering, Mining & Metallurgy, Food & Pharmaceuticals, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Babcock & Wilcox, UCC Environmental, Wastequip, Ironclad Environmental, ParkUSA (ParkProcess), Con-Fab, Spectrum Water Technology, DumpsterLiners, Morrow Water Technologies, and E-Pak Manufacturing |

| Additional Attributes | Dollar sales by technology type and application category, regional demand trends, competitive landscape, technological advancements in dewatering systems, automation innovation, energy efficiency development, and operational optimization |

The global dewatering bin market is estimated to be valued at USD 125.9 million in 2025.

The market size for the dewatering bin market is projected to reach USD 193.6 million by 2035.

The dewatering bin market is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types in dewatering bin market are gravity sedimentation type, mechanical filter press type and others.

In terms of application, wastewater treatment and municipal engineering segment to command 44.1% share in the dewatering bin market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Binary Drivers Market Size and Share Forecast Outlook 2025 to 2035

Dewatering Pump Market Size and Share Forecast Outlook 2025 to 2035

Binary High Pressure Gradient Liquid Chromatography System Market Size and Share Forecast Outlook 2025 to 2035

Binders Market Size and Share Forecast Outlook 2025 to 2035

Dewatering Liner Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Binder's Board Market Size and Share Forecast Outlook 2025 to 2035

Dewatering Box Market Size and Share Forecast Outlook 2025 to 2035

Binoculars and Mounting Solutions Market Growth - Trends & Forecast 2025 to 2035

Market Share Breakdown of Dewatering Pump Manufacturers

Binder Clip Market Trends & Industry Growth Forecast 2024-2034

Binder Jet Market

Cabin Air Heater Market Size and Share Forecast Outlook 2025 to 2035

Combined Reaming Drills Market Size and Share Forecast Outlook 2025 to 2035

Combined Charging System Market Size and Share Forecast Outlook 2025 to 2035

Turbine Oils Market Size and Share Forecast Outlook 2025 to 2035

Combination Kinase Inhibitor Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Combination Antihypertensive Agents Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Combined Cycle Gas Turbine Market Size and Share Forecast Outlook 2025 to 2035

Turbine Blade Material Market Size and Share Forecast Outlook 2025 to 2035

Combined Cycle Power Plant Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA