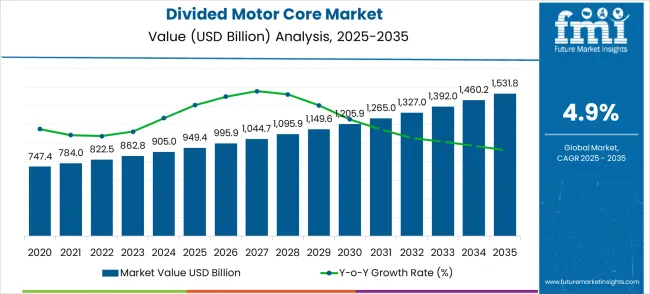

The divided motor core market is valued at USD 949.4 billion in 2025 and forecasted to reach USD 1,531.8 billion by 2035, expanding at a CAGR of 4.9%. When comparing peak and trough years, the strongest performance is seen toward the end of the forecast period, with the market rising from USD 1,460.2 billion in 2034 to USD 1,531.8 billion in 2035, representing a YoY increase of approximately 4.9%.

In contrast, the slowest growth occurs in the initial years, particularly between 2025 and 2026, during which the market expands from USD 949.4 billion to USD 995.9 billion, translating to approximately 4.9% growth, albeit with less momentum in absolute dollar terms. This comparative view highlights a consistent and stable trajectory, rather than extreme volatility, with incremental gains each year resulting in a cumulative expansion of over USD 582 billion across the decade. The global divided motor core market is valued at USD 949.4 billion in 2025. It is slated to reach USD 1,531.8 billion by 2035, recording an absolute increase of USD 582.4 billion over the forecast period. This translates into a total growth of 61.4%, with the market forecast to expand at a compound annual growth rate (CAGR) of 4.9% between 2025 and 2035.

The overall market size is expected to grow by nearly 1.61 times during the same period, supported by increasing demand for electric motor efficiency, growing adoption of electric vehicles in automotive manufacturing, and rising consumer preference for high-performance motor components across various industrial and automotive applications.

A segment-level comparison would reveal that traction motor cores, widely used in electric vehicles, likely outperform traditional induction motor cores. The higher energy efficiency demands, coupled with electrification policies, give traction motor cores a sharper growth curve compared to industrial motor cores. While the industrial segment grows steadily, it is more exposed to cyclical investment trends in manufacturing and heavy industries. On the other hand, appliance motor cores maintain moderate expansion due to stable consumer demand for household electronics. This segment-wise differentiation highlights that while the CAGR is 4.9%, sub-segments tied directly to electric mobility and renewable integration may experience CAGR levels closer to 6%–7%, outpacing the market average.

Between 2025 and 2030, the divided motor core market is projected to expand from USD 949.4 billion to USD 1,198.7 billion, resulting in a value increase of USD 249.3 billion, which represents 42.8% of the total forecast growth for the decade. This phase of development will be shaped by increasing electric vehicle production, rising adoption of energy-efficient motor technologies, and growing demand for precision motor components in automotive powertrains and industrial machinery applications. Manufacturers are expanding their capabilities in divided motor cores to address the growing demand for lightweight motor designs and enhanced electromagnetic efficiency.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 949.4 billion |

| Forecast Value in (2035F) | USD 1,531.8 billion |

| Forecast CAGR (2025 to 2035) | 4.9% |

Regional comparison further enriches the analysis. Asia-Pacific, led by China, is expected to remain the largest growth driver due to large-scale EV manufacturing, industrial automation, and renewable energy projects. Europe contributes strongly through policy-driven electric vehicle adoption, with Germany and France accelerating demand for high-performance motor cores. North America, led by the United States, grows at a steadier pace, benefiting from automotive electrification programs but limited somewhat by slower industrial equipment replacement cycles. The emerging markets in South America and the Middle East showcase slower yet stable adoption, reflecting lower industrial penetration and delayed EV adoption. These geographical trends reveal significant differences in YoY contributions to overall global growth.

The market shows a balanced comparative landscape, with the best years concentrated toward 2033–2035 when EV adoption peaks and global electrification policies intensify, while the relatively weaker years are the earlier ones, where incremental growth builds the foundation. Sub-segments linked to EV traction and regions like Asia-Pacific and Europe emerge as outperformers, while mature industrial segments and slower-developing regions deliver steadier but less dynamic contributions. This comparative analysis focus on how growth is not evenly distributed across segments and geographies but converges into a global CAGR of 4.9%.From 2030 to 2035, the market is forecast to grow from USD 1,198.7 billion to USD 1,531.8 billion, adding another USD 333.1 billion, which constitutes 57.2% of the overall ten-year expansion. This period is expected to be characterized by the expansion of block-type motor stator core technologies and advanced magnetic material integration, the development of premium high-efficiency motor core solutions, and enhanced manufacturing precision capabilities. The growing adoption of electric powertrains and renewable energy systems will drive demand for divided motor cores with superior magnetic properties and improved energy conversion efficiency characteristics.

Between 2020 and 2025, the divided motor core market experienced steady growth, driven by increasing demand for electric motor efficiency and growing recognition of divided motor cores as essential components for high-performance electric motors with superior electromagnetic properties and manufacturing precision. The market developed as automotive and industrial manufacturers recognized the potential for divided motor cores to improve motor efficiency while reducing manufacturing complexity and enhancing electromagnetic performance. Technological advancement in magnetic materials and precision manufacturing began emphasizing the critical importance of maintaining electromagnetic efficiency and structural integrity in advanced motor applications.

Market expansion is being supported by the increasing global demand for electric motor efficiency and the corresponding need for advanced motor components that can provide superior electromagnetic performance and manufacturing precision while maintaining structural integrity across various automotive and industrial motor applications. Modern motor manufacturers are increasingly focused on implementing core solutions that can enhance magnetic flux efficiency, reduce energy losses, and provide consistent performance in demanding electromagnetic environments. Divided motor cores' proven ability to deliver superior electromagnetic properties, enhanced manufacturing flexibility, and versatile application compatibility make them essential components for contemporary electric motor and powertrain solutions.

The growing emphasis focus on electric vehicle adoption and energy efficiency is driving demand for divided motor cores that can support high-performance motor designs, enable compact packaging solutions, and provide reliable performance in automotive and industrial applications with minimal electromagnetic losses. Motor manufacturing processors' preference for components that combine electromagnetic efficiency with manufacturing precision and cost-effectiveness is creating opportunities for innovative divided motor core implementations. The rising influence of electrification trends and sustainable green manufacturing is also contributing to increased adoption of motor cores that can provide advanced electromagnetic solutions without compromising structural reliability or manufacturing efficiency.

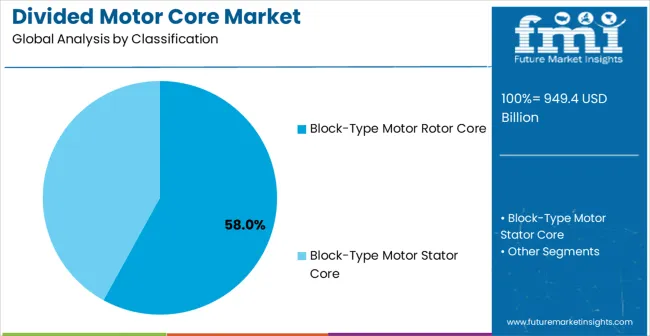

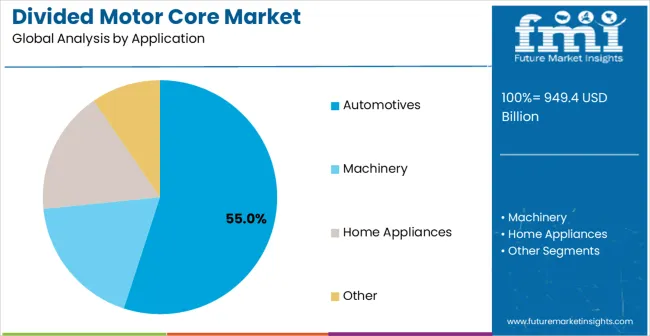

The market is segmented by classification, application, and region. By classification, the market is divided into block-type motor rotor core, block-type motor stator core, and other. Based on application, the market is categorized into automotive, machinery, home appliances, and other. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa.

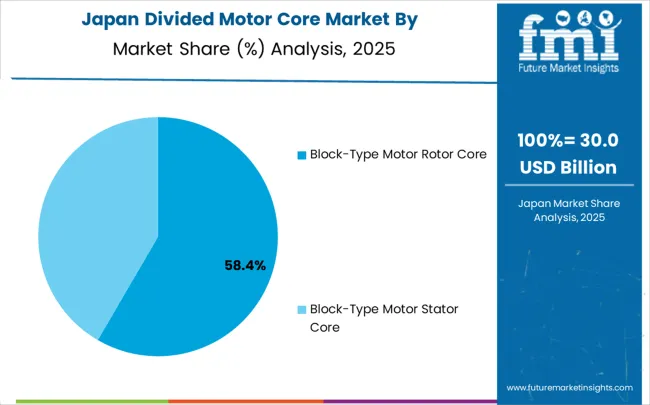

The block-type motor rotor core segment is projected to account for 58.0% of the divided motor core market in 2025, reaffirming its position as the leading classification category. Motor manufacturers increasingly utilize block-type motor rotor cores for their superior electromagnetic efficiency, proven structural integrity, and convenience in high-performance motor applications across electric vehicles, industrial machinery, and power generation systems. Block-type rotor core technology's established magnetic properties and consistent electromagnetic output directly address the manufacturing requirements for reliable motor performance and operational efficiency in demanding motor applications.

This classification segment forms the foundation of modern electric motor operations, as it represents the core type with the greatest electromagnetic optimization and established market demand across multiple motor categories and application requirements. Motor manufacturer investments in enhanced block-type rotor core technologies and magnetic material systems continue to strengthen adoption among motor producers. With manufacturers prioritizing consistent electromagnetic performance and proven structural reliability, block-type motor rotor cores align with both efficiency objectives and manufacturing requirements, making them the central component of comprehensive electric motor strategies.

Automotive applications are projected to represent 55.0% of divided motor core demand in 2025, underscoring highlighting their critical role as the primary application market for advanced motor components in electric vehicle powertrains and automotive motor systems. Automotive manufacturers prefer divided motor cores for their exceptional electromagnetic efficiency, superior performance characteristics, and ability to meet stringent automotive requirements while enhancing vehicle electrification and improving energy efficiency. Positioned as essential components for modern automotive electrification, divided motor cores offer both performance advantages and manufacturing benefits.

The segment is supported by continuous growth in electric vehicle production and the growing availability of specialized motor technologies that enable premium powertrain performance with enhanced efficiency and improved electromagnetic characteristics. Additionally The , automotive manufacturers are investing in advanced motor component systems to support high-performance electric vehicles and regulatory compliance for demanding automotive standards. As vehicle electrification becomes more widespread and performance requirements increase, automotive applications will continue to dominate the end-user market while supporting advanced motor technology utilization and electrification innovation strategies.

The divided motor core market is advancing steadily due to increasing demand for electric motor efficiency and growing adoption of advanced electromagnetic technologies that provide enhanced motor performance and superior energy conversion across diverse automotive and industrial motor applications. However, the market faces challenges, including raw material cost fluctuations, manufacturing complexity considerations, and the need for specialized production technology investments. Innovation in magnetic materials and precision manufacturing continues to influence product development and market expansion patterns.

The growing adoption of block-type motor stator core configurations and enhanced magnetic material formulations is enabling motor component manufacturers to produce premium divided motor cores with superior electromagnetic properties, enhanced efficiency characteristics, and advanced performance capabilities. Advanced magnetic systems provide improved motor performance while allowing more efficient electromagnetic conversion and consistent output across various motor applications and operating conditions. Manufacturers are increasingly recognizing the competitive advantages of advanced magnetic capabilities for product differentiation and premium market positioning in demanding motor segments.

Modern divided motor core producers are incorporating precision manufacturing technologies and advanced quality control systems to enhance electromagnetic consistency, improve structural accuracy, and ensure consistent performance delivery to motor manufacturers and automotive companies. These technologies improve manufacturing reliability while enabling new applications, including compact motor designs and high-efficiency power conversion. Advanced manufacturing integration also allows manufacturers to support premium positioning and operational excellence beyond traditional motor core production capabilities.

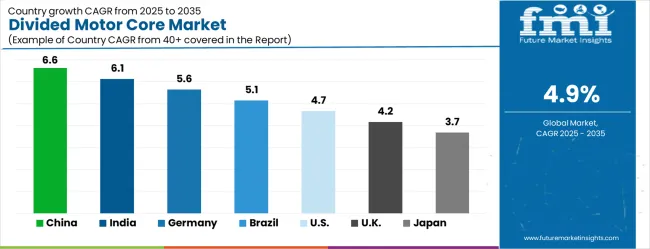

| Country | CAGR (2025-2035) |

|---|---|

| China | 6.6% |

| India | 6.1% |

| Germany | 5.6% |

| Brazil | 5.1% |

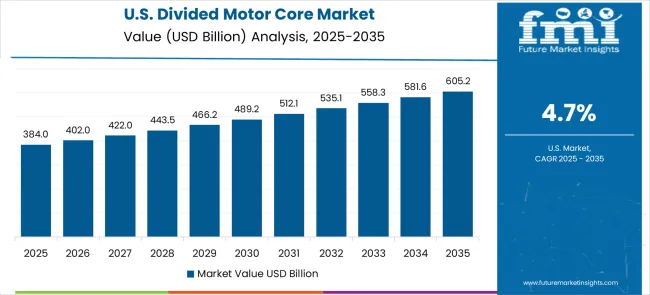

| USA | 4.7% |

| UK | 4.2% |

| Japan | 3.7% |

The global market is expected to record a CAGR of 4.9% between 2025 and 2035, driven by advancements in electric motor efficiency and rising adoption of energy-saving technologies across industrial and automotive applications. China leads with a 6.6% growth rate, supported by large-scale electric vehicle production and extensive manufacturing capacity. India follows at 6.1%, where demand is supported by industrial automation and increasing adoption of EV components. Germany shows a CAGR of 5.6%, reflecting its strong engineering base and high-quality motor component production. Brazil expands at 5.1%, influenced by industrial modernization and a shift toward energy-efficient equipment. The United States is expected to see 4.7% growth, supported by replacement demand and integration into advanced motor technologies. The United Kingdom at 4.2% and Japan at 3.7% demonstrate steady but slower adoption due to mature industrial markets.The divided motor core market is experiencing steady growth globally, with China leading at a 6.6% CAGR through 2035, driven by the expanding electric vehicle industry, growing motor manufacturing capacity, and significant investment in electromagnetic component infrastructure development. India follows at 6.1%, supported by large-scale automotive manufacturing expansion, emerging electric vehicle facilities, and growing domestic demand for motor components and electromagnetic materials. Germany shows growth at 5.6%, emphasizing technological innovation and premium automotive component development. Brazil records 5.1%, focusing on automotive industry expansion and motor manufacturing modernization. The USA demonstrates 4.7% growth, prioritizing electric vehicle technologies and high-performance motor solutions. The UK exhibits 4.2% growth, emphasizing automotive capabilities and quality motor component adoption. Japan shows 3.7% growth, supported by precision motor manufacturing excellence and advanced electromagnetic technology innovation.

The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

China is expected to grow at a CAGR of 6.6% between 2025 and 2035, supported by its dominance in electric vehicle production, renewable energy systems, and industrial automation. Divided motor cores are gaining traction due to their higher efficiency, lower eddy current loss, and improved power density in high-performance motors. Leading Chinese manufacturers are integrating advanced lamination techniques and high-grade electrical steel to improve efficiency in EV motors and wind turbines. Government incentives for electrification of transport and investments in renewable power infrastructure are driving consumption. Strategic partnerships between local producers and global technology firms are ensuring design innovation and better material quality, enhancing China’s position in the global supply chain.

India is projected to grow at a CAGR of 6.1% from 2025 to 2035, fueled by the rapid expansion of its automotive, renewable, and industrial motor sectors. Divided motor cores are increasingly used in EVs, energy-efficient motors, and power generation systems due to their improved magnetic performance and reduced energy losses. Indian manufacturers are investing in precision stamping technology and lamination processes to enhance product quality. Government incentives under FAME II and production-linked incentives for EV and component manufacturing are accelerating demand. The integration of divided motor cores into agricultural equipment and railways further widens application areas. International collaborations and joint ventures are enabling Indian producers to access advanced core design and high-grade electrical steel.

Germany is forecasted to expand at a CAGR of 5.6% through 2035, driven by its leadership in automotive innovation, renewable energy, and industrial machinery. Divided motor cores are integral in high-efficiency motors used in EVs, robotics, and wind turbines. German manufacturers emphasize advanced lamination techniques, recyclable materials, and compliance with EU energy efficiency standards. The strong presence of premium automakers and component suppliers supports the adoption of divided motor cores with superior magnetic properties. Expansion of wind and solar power installations further stimulates demand. Research collaborations with universities and material science institutions are enabling continuous innovation in electrical steel technology and core assembly design, reinforcing Germany’s position as a premium market.

Brazil is projected to grow at a CAGR of 5.1% between 2025 and 2035, with rising demand in electric mobility, industrial motors, and renewable energy. Divided motor cores are gaining attention due to their reduced energy loss, making them suitable for cost-sensitive markets where efficiency is valued. Local manufacturers are gradually adopting advanced lamination and stamping technologies, though imports continue to meet a significant portion of demand. Brazil’s hydropower dominance is being complemented by growth in wind and solar installations, creating new opportunities for high-efficiency motor cores. Government support for EV adoption and industrial modernization initiatives is also stimulating demand. International suppliers are forming partnerships with local firms to strengthen the supply chain and improve technology access.

The United States is expected to grow at a CAGR of 4.7% from 2025 to 2035, supported by rising adoption of EVs, robotics, and renewable power systems. Divided motor cores are being integrated into energy-efficient motors to meet federal regulations. Leading USA manufacturers are adopting precision stamping and automation in lamination assembly to improve production efficiency. Demand is further strengthened by investments in EV battery plants and expansion of renewable energy capacity. The strong presence of aerospace, defense, and industrial automation companies also contributes to wider application of advanced motor cores. Collaborations with electrical steel suppliers and research institutions are ensuring innovation in design and material strength.

The United Kingdom is estimated to grow at a CAGR of 4.2% between 2025 and 2035, supported by demand from automotive electrification, renewable energy expansion, and industrial modernization. Divided motor cores are gaining preference for their efficiency and reduced heat loss in high-performance motors. British manufacturers are focusing on partnerships with European electrical steel suppliers to ensure quality consistency. Government initiatives for EV adoption and wind power expansion in offshore projects are creating new growth avenues. The market is also influenced by demand from small-scale industrial automation and robotics. Technological collaboration with academic institutions is enabling development of advanced designs to meet EU and international efficiency standards despite trade-related challenges post-Brexit.

Japan is projected to grow at a CAGR of 3.7% through 2035, with demand driven by EVs, robotics, and renewable energy integration. Divided motor cores are increasingly utilized in compact, high-efficiency motors suitable for advanced robotics and electric vehicles. Japanese firms emphasize precision engineering, lightweight designs, and advanced lamination processes to improve efficiency. The automotive sector continues to lead adoption, with strong contributions from hybrid and electric vehicle production. Robotics in manufacturing and consumer electronics also supports demand. Strategic collaborations with global steel manufacturers and R&D initiatives in material science ensure continuous improvement in motor performance. The market remains shaped by Japan’s focus on energy efficiency and advanced manufacturing technology.

Revenue from divided motor cores in China is projected to exhibit strong growth with a CAGR of 6.6% through 2035, driven by expanding electric vehicle manufacturing infrastructure and rapidly growing motor production capacity supported by government electrification initiatives. The country's abundant automotive manufacturing capacity and increasing investment in electromagnetic technology are creating substantial demand for advanced motor components. Major automotive companies and motor manufacturers are establishing comprehensive motor core capabilities to serve both domestic and international markets.

Government support for electric vehicle development and motor technology expansion is driving demand for divided motor core technologies throughout major automotive regions and manufacturing centers. Strong electric vehicle sector growth and an expanding network of motor manufacturing facilities are supporting the rapid adoption of electromagnetic components among manufacturers seeking enhanced motor efficiency and automotive competitiveness.

Revenue from divided motor cores in India is expanding at a CAGR of 6.1%, supported by the country's growing automotive manufacturing capacity, emerging electric vehicle facilities, and increasing domestic demand for advanced motor technologies and electromagnetic components. The country's developing automotive supply chain and growing motor industry are driving demand for sophisticated core capabilities. International technology providers and domestic manufacturers are establishing extensive production and distribution capabilities to address the growing demand for divided motor core products.

Rising automotive manufacturing industry development and expanding electric vehicle deployment patterns are creating opportunities for motor core adoption across automotive manufacturers, component suppliers, and electromagnetic equipment facilities in major industrial areas. Growing government focus on automotive modernization and electric vehicle promotion is driving adoption of advanced motor technologies among manufacturing enterprises seeking enhanced product performance and market competitiveness.

Revenue from divided motor cores in Germany is expanding at a CAGR of 5.6%, supported by the country's advanced automotive industry, strong emphasis on technological innovation, and robust demand for high-performance motor solutions among quality-focused manufacturers. The nation's mature automotive manufacturing sector and high adoption of precision motor technologies are driving sophisticated electromagnetic capabilities throughout the automotive chain. Leading manufacturers and technology providers are investing extensively in premium motor component development and advanced electromagnetic methods to serve both domestic and export markets.

Rising manufacturer preference for high-efficiency motors and advanced electromagnetic performance is creating demand for sophisticated divided motor core systems among automotive manufacturers seeking enhanced vehicle performance and energy optimization. Strong technological expertise and growing emphasis on automotive excellence are supporting adoption of premium motor components across electric vehicle manufacturing and precision motor applications in major automotive centers.

Revenue from divided motor cores in Brazil is growing at a CAGR of 5.1%, driven by expanding automotive manufacturing infrastructure, increasing motor industry modernization patterns, and growing investment in electromagnetic technology development. The country's developing automotive resources and modernization of manufacturing facilities are supporting demand for advanced motor technologies across major production regions. Automotive companies and motor manufacturers are establishing comprehensive capabilities to serve both domestic automotive centers and emerging electric vehicle markets.

Government initiatives promoting automotive industry development and electric vehicle adoption are driving adoption of modern motor systems including divided motor cores and advanced electromagnetic methods. Rising demand for efficient automotive technologies in manufacturing areas is supporting market expansion, while robust automotive sector growth provides opportunities for motor component adoption throughout the country's manufacturing facilities.

Revenue from divided motor cores in the USA is expanding at a CAGR of 4.7%, supported by the country's advanced automotive industry, emphasis on high-performance motor supply, and strong demand for sophisticated electric vehicle solutions among technology-focused companies. The USA's established motor manufacturing sector and automotive expertise are supporting investment in advanced motor core capabilities throughout major automotive centers. Industry leaders are establishing comprehensive quality management systems to serve both domestic and export markets with premium motor component solutions.

Innovations in motor technologies including enhanced electromagnetic systems and advanced manufacturing methods are creating demand for superior motor performance and advanced automotive capability among quality-focused manufacturers. Growing technological advancement and rising demand for high-performance electric vehicles are driving adoption of sophisticated divided motor cores across automotive manufacturing and motor component applications throughout the country.

Revenue from divided motor cores in the UK is growing at a CAGR of 4.2%, driven by the country's automotive industry, emphasis on quality motor adoption, and strong demand for high-performance electromagnetic solutions among established manufacturers. The UK's mature automotive sector and focus on technology excellence are supporting investment in advanced motor core capabilities throughout major automotive centers. Automotive companies are establishing comprehensive motor component systems to serve both domestic and international markets with quality electromagnetic solutions.

Advanced automotive expertise and established motor manufacturing capabilities are creating opportunities for premium motor component adoption and enhanced automotive performance among quality-focused manufacturers throughout major automotive regions. Growing emphasis on automotive innovation and electric vehicle advancement is driving adoption of divided motor core systems across automotive manufacturing and precision motor applications throughout the country.

Revenue from divided motor cores in Japan is expanding at a CAGR of 3.7%, supported by the country's focus on precision manufacturing excellence, advanced motor applications, and strong preference for high-quality electromagnetic solutions. Japan's sophisticated automotive industry and emphasis on motor precision are driving demand for advanced motor technologies including premium electromagnetic cores and high-performance manufacturing methods. Leading manufacturers are investing in specialized capabilities to serve motor component production, automotive manufacturing, and precision electromagnetic applications with premium motor offerings.

Regional specialization in precision manufacturing and advanced technology development is creating opportunities for premium motor positioning and distinctive product development throughout major manufacturing regions. Strong emphasis on manufacturing quality combined with advanced motor requirements is driving adoption of motor technologies that deliver exceptional electromagnetic performance while meeting contemporary automotive excellence needs.

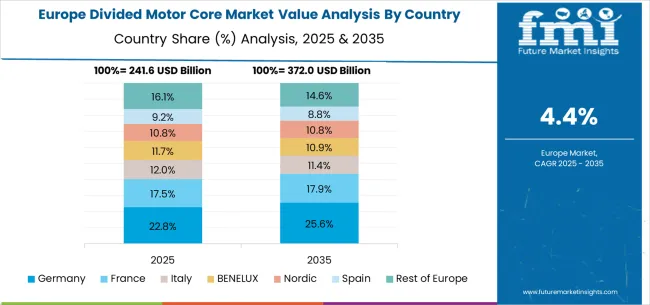

The divided motor core market in Europe is projected to grow from USD 208.9 billion in 2025 to USD 337.0 billion by 2035, registering a CAGR of 4.9% over the forecast period. Germany is expected to maintain its leadership position with a 24.0% market share in 2025, declining slightly to 23.5% by 2035, supported by its strong automotive industry, advanced motor manufacturing facilities, and comprehensive electromagnetic component supply network serving major European markets.

France follows with an 18.0% share in 2025, projected to reach 18.3% by 2035, driven by robust demand for divided motor cores in automotive manufacturing, industrial machinery, and motor component production, combined with established automotive traditions incorporating advanced electromagnetic technologies. The United Kingdom holds a 16.0% share in 2025, expected to decrease to 15.7% by 2035, supported by strong automotive sector demand but facing challenges from competitive pressures and market restructuring. Italy commands a 14.5% share in 2025, projected to reach 14.7% by 2035, while Spain accounts for 12.0% in 2025, expected to reach 12.2% by 2035. The Netherlands maintains a 4.0% share in 2025, growing to 4.2% by 2035. The Rest of Europe region, including Nordic countries, Eastern Europe, Portugal, Belgium, Switzerland, and Austria, is anticipated to gain momentum, expanding its collective share from 11.5% to 11.4% by 2035, attributed to increasing adoption of electric vehicle technologies in Nordic countries and growing automotive manufacturing activities across Eastern European markets implementing electrification modernization programs.

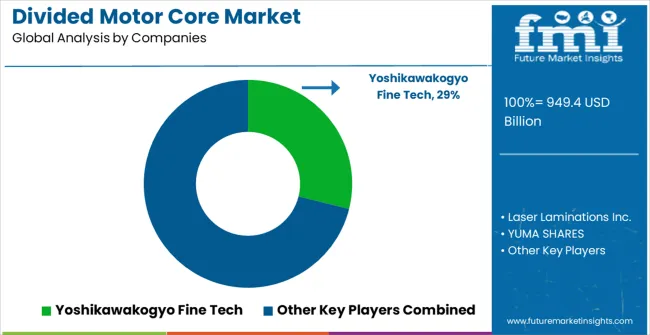

The market is characterized by strong competition between established manufacturers and specialized regional players, each focusing on efficiency, precision, and cost optimization. Yoshikawakogyo Fine Tech stands out with advanced engineering expertise in high-performance laminations, supplying precision-cut cores that improve motor efficiency and thermal stability. Its reputation for delivering consistent quality allows it to serve automotive and industrial motor applications where durability and reduced energy loss are critical. Laser Laminations Inc. holds a competitive edge through its specialized laser-cutting technology, enabling the production of intricate core designs with minimal material waste. The firm targets clients that demand flexibility in custom designs and rapid prototyping, strengthening its position in niche but high-value segments.

YUMA SHARES and Dongguan Webo drive competition through large-scale manufacturing capacity and cost-effective production methods, catering to consumer appliances and mid-tier motor applications. These firms emphasize operational efficiency and scalability, offering reliable supply to industries requiring volume-driven solutions. Zhejiang Yuhui Electronics builds its advantage by integrating divided core technology with advanced electronics compatibility, appealing to sectors where compact motor performance is a necessity. Hongda, differentiates itself by focusing on affordability and adaptability in design, appealing to smaller manufacturers seeking dependable yet budget-conscious motor core solutions.

Across the market, competition is shaped by rising demand for motors with higher efficiency ratings and lower electromagnetic losses. Manufacturers highlight attributes such as lamination precision, reduced eddy current, and extended motor lifespan in their brochures to secure customer confidence. While global leaders focus on innovation and energy optimization, regional players sustain market share by balancing cost competitiveness with technical adaptability, resulting in a fragmented yet strategically evolving competitive landscape.The divided motor core market is characterized by competition among established electromagnetic component manufacturers, specialized motor core suppliers, and integrated automotive component providers. Companies are investing in advanced electromagnetic technology research, magnetic material optimization, precision manufacturing development, and comprehensive product portfolios to deliver consistent, high-quality, and cost-effective divided motor core solutions. Innovation in magnetic materials, manufacturing precision, and electromagnetic efficiency is central to strengthening market position and competitive advantage.

Yoshikawakogyo Fine Tech leads the market with a strong market share, offering comprehensive electromagnetic solutions with a focus on automotive applications and advanced motor core systems. Laser Laminations Inc. provides specialized motor component capabilities with an emphasis on precision manufacturing and electromagnetic efficiency. YUMA SHARES delivers innovative motor core solutions with a focus on automotive and industrial markets and product versatility. Dongguan Webo specializes in electromagnetic manufacturing and advanced motor core solutions for Asian markets. Zhejiang Yuhui Electronics focuses on motor technology and integrated electromagnetic operations. Hongda offers specialized divided motor core products with emphasis on manufacturing applications and quality assurance.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 949.4 bBillion |

| Classification | Block-Type Motor Rotor Core, Block-Type Motor Stator Core, Other |

| Application | Automotive, Machinery, Home Appliances, Other |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Yoshikawakogyo Fine Tech, Laser Laminations Inc., YUMA SHARES, Dongguan Webo, Zhejiang Yuhui Electronics, and Hongda |

| Additional Attributes | Dollar sales by classification and application category, regional demand trends, competitive landscape, technological advancements in electromagnetic systems, magnetic material innovation, manufacturing development, and efficiency optimization |

North America

Europe

East Asia

South Asia & Pacific

Latin America

Middle East & Africa

The global divided motor core market is estimated to be valued at USD 949.4 billion in 2025.

The market size for the divided motor core market is projected to reach USD 1,531.8 billion by 2035.

The divided motor core market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in divided motor core market are block-type motor rotor core and block-type motor stator core.

In terms of application, automotives segment to command 55.0% share in the divided motor core market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Motor Bearing Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Fuel Hoses Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Drive Chain Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Wheels Market Size and Share Forecast Outlook 2025 to 2035

Motorized Ring Main Unit Market Size and Share Forecast Outlook 2025 to 2035

Motorhome Market Size and Share Forecast Outlook 2025 to 2035

Motor Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Airbag Jacket Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Helmet Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Diagnostic Scan Tools Market Size and Share Forecast Outlook 2025 to 2035

Motorized Prosthesis Market Size and Share Forecast Outlook 2025 to 2035

Motorized Pool Tube Market Size and Share Forecast Outlook 2025 to 2035

Motor Generator Set Market Size, Growth, and Forecast 2025 to 2035

Motorized Decoiler Machine Market Growth - Trends & Forecast 2025 to 2035

Motorcycle Chain Market Analysis - Size, Share, and Forecast 2025 to 2035

Motor Protector Market Size, Growth, and Forecast for 2025 to 2035

Motorcycle Suspension System Market Growth - Trends & Forecast 2025 to 2035

Motor Control IC Market by Type, Industry, and Region – Growth, Trends, and Forecast through 2025 to 2035

Motorcycle Lead Acid Battery Market - Trends & Forecast 2025 to 2035

Motor Winding Repair Service Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA