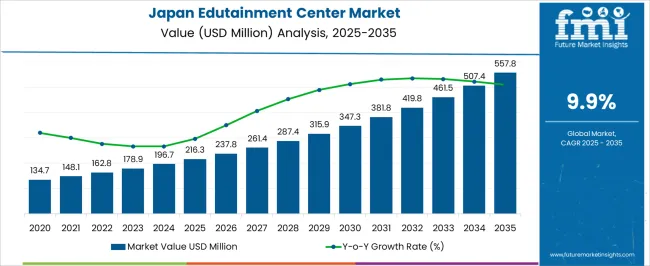

The Edutainment Center Industry Analysis in Japan is estimated to be valued at USD 216.3 million in 2025 and is projected to reach USD 557.8 million by 2035, registering a compound annual growth rate (CAGR) of 9.9% over the forecast period.

| Metric | Value |

|---|---|

| Edutainment Center Industry Analysis in Japan Estimated Value in (2025 E) | USD 216.3 million |

| Edutainment Center Industry Analysis in Japan Forecast Value in (2035 F) | USD 557.8 million |

| Forecast CAGR (2025 to 2035) | 9.9% |

The edutainment center industry in Japan is experiencing sustained growth. Rising demand for interactive and educational recreational experiences, increasing household expenditure on leisure activities, and the integration of technology-driven entertainment solutions are driving market expansion.

Current dynamics are characterized by the proliferation of family-oriented and child-centric facilities, regulatory frameworks supporting safety and accessibility, and heightened awareness of experiential learning benefits. The future outlook is shaped by urban development, expansion of commercial complexes, and strategic investments in advanced gaming and learning technologies.

Growth rationale is underpinned by the ability of operators to deliver immersive, technology-enabled experiences, consistent consumer interest in combining education with recreation, and the scalability of facility operations to meet both regional and metropolitan demand Enhanced operational efficiency, coupled with marketing initiatives targeting diverse visitor segments, is expected to support revenue growth and sustained industry relevance over the forecast period.

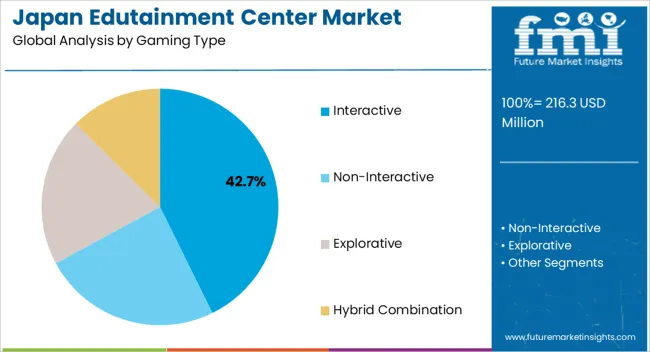

The interactive gaming segment, representing 42.70% of the gaming type category, has been leading due to its ability to engage visitors through immersive, participatory experiences. Its adoption has been supported by technological advancements in virtual reality, motion-sensing devices, and interactive exhibits, which enhance engagement and learning outcomes.

Visitor retention has been strengthened by gamified educational content and hands-on activity stations. Facility operators have leveraged this segment to differentiate offerings and drive repeat visits.

Investment in staff training, content updates, and maintenance has further ensured consistent quality and safety Strategic partnerships with technology providers and educational content developers are expected to sustain growth and reinforce the segment’s competitive position in the Japanese edutainment market.

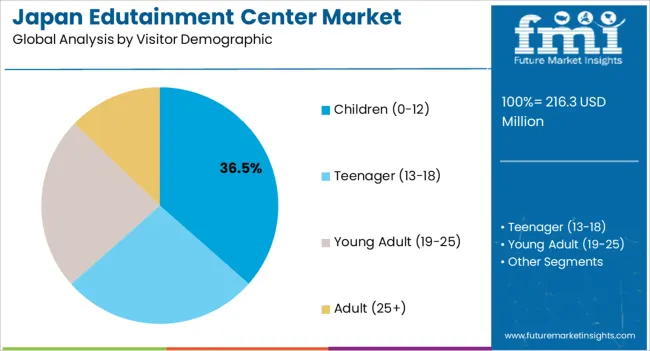

The children (0-12) demographic segment, accounting for 36.50% of the visitor category, has maintained prominence due to parental preference for safe, educational, and entertaining environments. Demand has been supported by structured programming, age-appropriate interactive zones, and specialized learning modules.

Marketing efforts targeting families, school groups, and community programs have enhanced engagement and visitation frequency. Operational planning, including staff-to-child ratios and safety protocols, has contributed to a positive experience and reinforced repeat visitation.

Ongoing enhancements in attraction design, content diversity, and educational alignment are expected to sustain market share and position the segment as a central driver of overall industry growth.

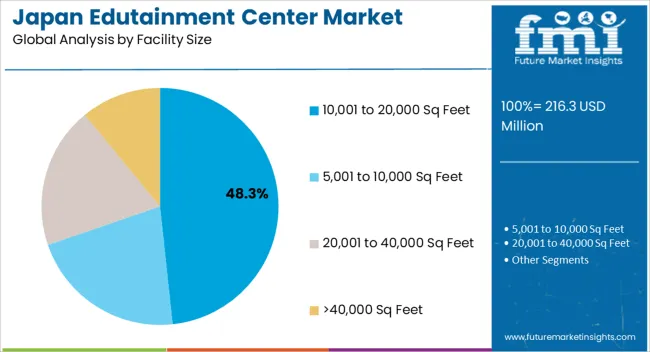

The 10,001 to 20,000 square feet facility segment, holding 48.30% of the facility size category, has emerged as the leading configuration due to its ability to balance operational efficiency with capacity for diverse attractions. Adoption has been facilitated by design flexibility, optimized visitor flow, and accommodation of multiple gaming zones and educational stations.

Revenue optimization has been achieved through scalable admission pricing, event hosting, and ancillary services. Maintenance and operational management protocols have been structured to ensure safety, accessibility, and visitor satisfaction.

Continued focus on modular layouts, space utilization efficiency, and integration of new attractions is expected to maintain the segment’s market share and support growth across urban and suburban locations in Japan.

Interactive experiences are preferred by consumers in Japan when it comes to edutainment center. For 2025, these experiences are expected to account for 36.5% of the industry share by gaming type.

Interactive experiences aim to involve children in actual learning. The rise of AR and VR tech is further enhancing the capability of interactive experiences. Thus, edutainment centers are increasingly offering such experiences to capture the attention of consumers.

| Demand for Edutainment Center in Japan Based on Gaming Type | Interactive |

|---|---|

| Industry Share in 2025 | 36.5% |

Teenagers are flocking to edutainment center in Japan. For 2025, teenagers (13-18) are anticipated to be the leading visitor demographic, with an expected 40.2% of the industry share.

Teenagers have active imaginations but are still at the studying age. Thus, edutainment centers are proving to be the perfect gateway for teenagers in Japan to stay engaged while still participating in education. Teenagers are enamored by the diverse experiences in edutainment centers compared to the monotony in schools.

| Demand for Edutainment Center in Japan Based on Visitor Demographic | Teenager (13-18) |

|---|---|

| Industry Share in 2025 | 40.2% |

Japan-based industry players are balancing tradition with technology in edutainment centers. Modern technology is blending with Japan's arts to keep the culture alive through edutainment center in Japan.

Japan, being at the forefront of technology, has integrated cutting-edge technology into edutainment centers. Thus, the face of edutainment in Japan is constantly evolving, and these centers are investing in innovative experiences.

Recent Developments Observed in Edutainment Center in Japan

| Attribute | Details |

|---|---|

| Estimated Industry Size in 2025 | USD 216.3 million |

| Projected Industry Size by 2035 | USD 557.8 million |

| Anticipated CAGR between 2025 to 2035 | 9.9% CAGR |

| Historical Analysis of Demand for Edutainment Center in Japan | 2020 to 2025 |

| Demand Forecast for Edutainment Center in Japan | 2025 to 2035 |

| Report Coverage | Industry Size, Industry Trends, Key Insights for Edutainment Center in Japan, Insights on Global Players and Leading Industry Strategy in Japan, Ecosystem Analysis of Local and Regional Japan Providers |

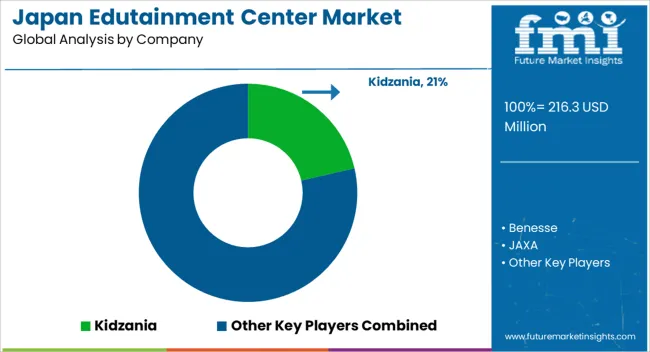

| Key Companies Profiled | Benesse; JAXA; Kodomo Miraikan; Kidzania; LEGOLAND; Nintendo; Studio Ghibli |

| Key Cities Analyzed | Kanto, Chubu, Kinki, Kyushu & Okinawa, Tohoku, Rest of Japan |

The global edutainment center industry analysis in Japan is estimated to be valued at USD 216.3 million in 2025.

The market size for the edutainment center industry analysis in Japan is projected to reach USD 557.8 million by 2035.

The edutainment center industry analysis in Japan is expected to grow at a 9.9% CAGR between 2025 and 2035.

The key product types in edutainment center industry analysis in Japan are interactive, non-interactive, explorative and hybrid combination.

In terms of visitor demographic, children (0-12) segment to command 36.5% share in the edutainment center industry analysis in Japan in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA