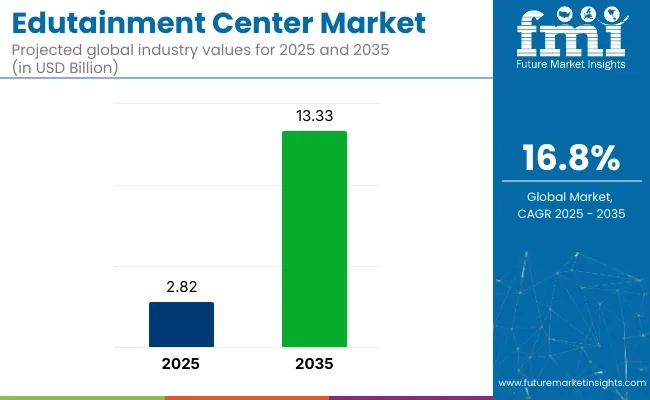

The global edutainment center market is worth USD 2.82 billion in 2025 and is set to reach USD 13.33 billion by 2035, which shows a CAGR of 16.8% during the forecast period. This substantial growth is being driven by rising demand for immersive, interactive learning experiences that blend education and entertainment.

Edutainment centers are becoming popular destinations for children, families, and schools, offering gamified learning, STEM-based activities, digital simulations, and role-playing environments. With increasing emphasis on experiential education, especially for early childhood and K-12 age groups, these centers are being integrated into malls, museums, and community hubs to encourage hands-on learning and skill development beyond traditional classrooms.

Advancements in technology are significantly enhancing the appeal and functionality of edutainment spaces. The incorporation of virtual reality (VR), augmented reality (AR), robotics, and AI-powered learning modules is transforming static exhibits into dynamic, personalized learning journeys.

Operators are designing theme-based zones around science, space, ecology, engineering, and career exploration to attract wider age groups and foster cognitive, social, and emotional learning.

The rise of smart cities, higher parental spending on extracurricular learning, and partnerships between educational brands and entertainment companies are accelerating investment in these hybrid venues. Additionally, mobile-enabled ticketing, app-based interactivity, and digital progress tracking are improving visitor engagement and retention.

Regulatory support for experiential learning and public-private investments in informal education infrastructure are strengthening the market outlook. Government programs focused on early childhood development, digital literacy, and STEM education are encouraging partnerships with edutainment providers.

In regions such as the Middle East, Southeast Asia, and Latin America, rapid urbanization and tourism are also contributing to the rise of large-scale edutainment centers in shopping and cultural districts. As education systems evolve to prioritize creativity, collaboration, and critical thinking, the edutainment center market is expected to flourish, offering multisensory environments that align with modern learning standards and family entertainment trends.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 2.82 billion |

| Industry Value (2035F) | USD 13.33 billion |

| CAGR (2025 to 2035) | 16.8% |

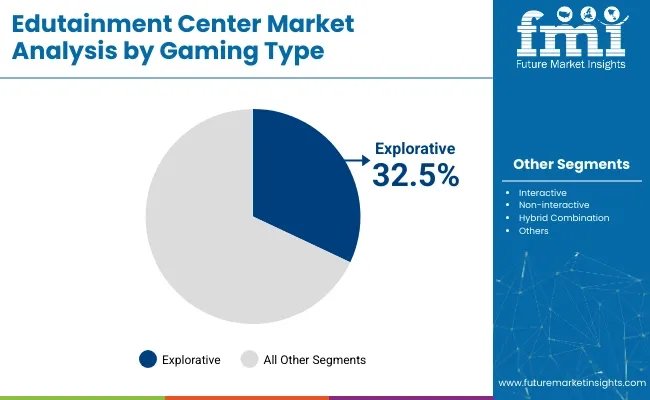

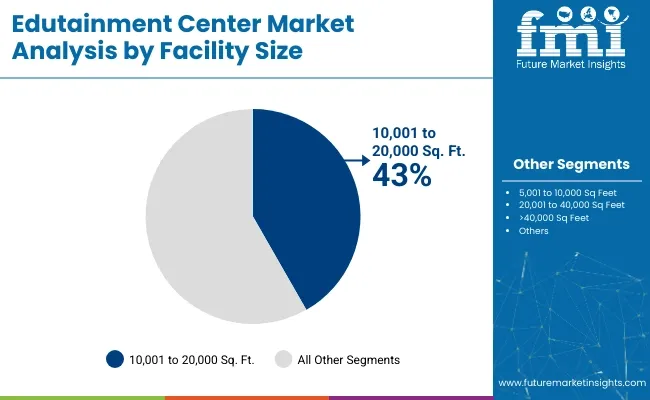

The market is segmented based on gaming type, facility size, revenue source, visitor demographics, and region. By gaming type, the market is divided into interactive, non-interactive, explorative, and hybrid combination formats. In terms of facility size, it is segmented into 5,001 to 10,000 sq. ft., 10,001 to 20,000 sq. ft., 20,001 to 40,000 sq. ft., and 40,000 sq. ft.

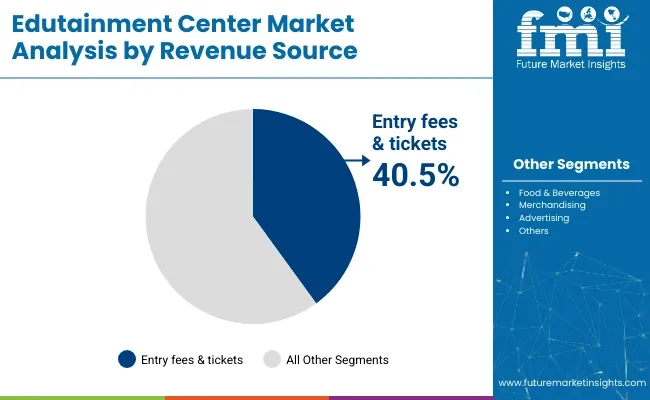

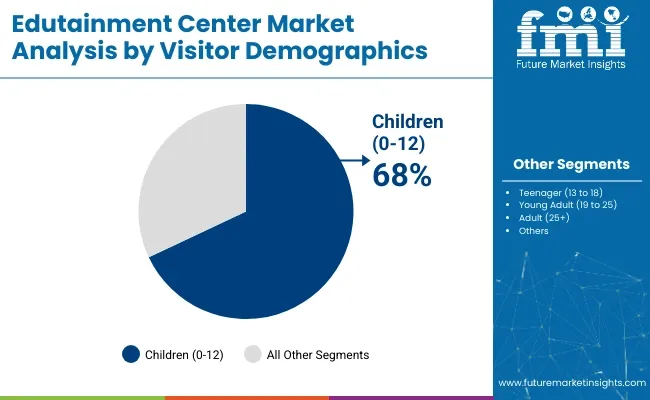

Based on revenue source, the market is categorized into entry fees & tickets, food & beverages, merchandising, and others (sponsorship & advertising, event hosting, educational workshops, and membership programs). By visitor demographics, it is segmented into children (0-12), teenagers (13-18), young adults (19-25), and adults (25+). Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East and Africa.

The explorative gaming type is projected to lead the edutainment center market with a 32.5% share in 2025. These games emphasize hands-on, interactive experiences that appeal to diverse learning styles and are increasingly aligned with modern pedagogical trends. Explorative gaming creates environments where children learn through discovery and experimentation, blending fun with cognitive development.

Parents and educators prefer these formats as they promote problem-solving, creativity, and critical thinking without rigid academic pressure. This segment is particularly popular among children aged 6 to 12, making it a key attraction in school visits and weekend family outings. Edutainment centers such as KidZania and LEGO Discovery Center continue to expand explorative experiences by integrating role-playing simulations and real-life vocational tasks.

Moreover, customized learning paths and gamified content within these centers are improving learning retention, reinforcing the appeal of explorative formats. This approach also encourages longer stay duration and repeat visits, which boost overall revenue per customer. Technological integration, including AR and gesture-based interfaces, is further enhancing engagement.

As demand grows for curriculum-aligned, skill-based recreation, explorative gaming remains the preferred choice for operators seeking both educational value and immersive visitor experiences, especially in urban and tier-1 city markets across North America, Europe, and Asia-Pacific. The interactive segment occupies 20% share.

| Gaming Type | Share (2025) |

|---|---|

| Explorative | 32.5% |

| Interactive | 20% |

Entry fees and tickets are projected to remain the leading revenue source in the edutainment center market, holding a 40.5% share in 2025. This model allows operators to generate upfront capital to fund infrastructure, immersive design, and high-quality educational content. Admission pricing helps create a premium brand perception, with centers often marketed as “learning destinations” rather than standard entertainment venues.

Parents associate paid entry with structured, value-driven experiences, making this revenue stream vital for brand trust and customer loyalty. Facilities offering tiered ticketing such as general admission, fast-track access, and bundled learning experiences witness higher monetization opportunities per visitor.

Centers like National Geographic Ultimate Explorer and Mattel Play! have adopted flexible pricing based on activity zones and age groups, enabling better revenue optimization. While other sources such as merchandising, food and beverages, and corporate sponsorships are growing, entry fees remain central to operational strategy.

With increased demand for thematic, curriculum-based play environments and school trip tie-ins, reliance on ticket revenue is expected to stay strong. As more centers introduce loyalty programs and membership-based pricing models, recurring revenue from entry fees is becoming a foundation for long-term financial stability and visitor retention. The food & beverages segment holds 28% share.

| Revenue Source | Share (2025) |

|---|---|

| Entry fees & tickets | 40.5% |

| Food & Beverages | 28% |

The 10,001 to 20,000 sq. ft. facility size segment is projected to grow at the highest CAGR of 6.7% from 2025 to 2035. This segment holds 43% share. This size range offers an optimal blend of space efficiency, activity diversity, and cost-effectiveness for operators, making it ideal for suburban malls, urban centers, and satellite cities.

Mid-sized facilities are large enough to accommodate multiple interactive zones, such as science labs, robotics workshops, and role-playing arenas, yet small enough to remain flexible in terms of layout and operations. These centers are well-suited for partnerships with schools and local education boards for curriculum-aligned field trips and weekend learning programs.

Operators benefit from lower real estate and maintenance costs compared to mega facilities, while still attracting high footfall with compact, high-engagement environments. Brands like KidZania Mini and FutureLand have launched scalable formats in this category, targeting Tier 2 and Tier 3 cities with rising disposable income.

Moreover, the modular setup of mid-sized facilities allows easy relocation and expansion, improving investment viability. As the edutainment industry shifts toward hybrid learning and experiential education, the 10,001 to 20,000 sq. ft. segment is poised for sustained growth, especially in emerging markets across Asia and the Middle East. The 20,001 to 40,000 Sq. Ft. segment occupies 22% share.

| Facility Size | Share (2025) |

|---|---|

| 10,001 to 20,000 Sq. Ft. | 43% |

| 20,001 to 40,000 Sq. Ft. | 22% |

The children segment, representing visitors aged 0 to 12, is projected to witness the fastest growth in the edutainment center market, expanding at a CAGR of 7.2% from 2025 to 2035. This segment occupies 68% share. This age group forms the core consumer base for edutainment venues globally, with operators designing immersive and interactive learning zones specifically tailored to their cognitive development and attention spans.

Activities such as role-playing, hands-on science experiments, creative arts, and storytelling are central to these centers, offering a balance of entertainment and structured learning. The growing importance of experiential education and play-based pedagogies is pushing schools and parents alike to prioritize such environments as an extension of classroom learning.

In response, edutainment chains like Imagicaa, KidZania, and Fun City are expanding age-specific zones, offering STEM-based modules and early-learning workshops. Parents’ rising interest in screen-free engagement options is also boosting demand for physical, interactive environments that promote teamwork and motor skill development.

Moreover, government and private school partnerships in regions like the Middle East and Asia-Pacific are increasing weekday traffic through institutional tie-ups. As urbanization and dual-income households rise, edutainment centers that cater to younger children are becoming a staple in both shopping malls and standalone formats, ensuring strong future growth for the segment. The teenager (13-18) segment holds 21% share.

| Visitor Demographics | Share (2025) |

|---|---|

| Children (0-12) | 68% |

| Teenager (13-18) | 21% |

Edutainment Centers Strategically Leverage Gamification Trends for Improved Consumer Retention

Edutainment centers increasingly employ gamification strategies to improve user engagement and information acquisition. By integrating game design ideas into instructional materials, these centers use the intrinsic motivation and reward systems found in games to produce a more engaging and interactive edutainment environment.

This targeted use of gamification increases customer happiness and retention by enhancing the perceived value of the educational offerings and encouraging a sense of accomplishment and active engagement.

Market Players Explore Introducing FinTech Simulations for Early Education of Children

Introducing a fun learning experience that models scenarios related to financial technology is a progressive business potential. To develop interactive simulations that educate kids about digital payments, budgeting, and the fundamentals of financial technology, edutainment centers can work with FinTech specialists.

This well-considered approach aligns with the rising significance of technology and financial education. By providing FinTech simulations, centers set themselves apart as leaders in educating kids about the digital financial world and draw in parents who value their kids' practical financial education.

Integration of STEAM Education Witness a Surge in the Market

Edutainment centers are responding to the global need for STEAM education by seamlessly incorporating Science, Technology, Engineering, Arts, and Mathematics principles into their programs. This smart approach capitalizes on the growing need for digital capabilities.

By establishing themselves as providers of complete STEAM education, these innovative edutainment centers address the changing needs of parents and educational institutions, matching their offers with the current emphasis on skill sets required for future job responsibilities.

| Metrics | Values |

|---|---|

| Edutainment Center Market Size (2020) | USD 1.28 billion |

| Edutainment Center Market Size (2024) | USD 2.1 billion |

| Edutainment Center Market (CAGR 2020 to 2024) | 13% |

The edutainment center market size expanded at a 13% CAGR from 2020 to 2024. The global trend toward skill-based education is impacting the growth of edutainment centers. Increasingly, more parents are realizing how important it is to provide their kids with real-world skills and traditional academic knowledge.

Edutainment centers capitalize on this need for a more all-encompassing approach to education by offering programs emphasizing abilities like robotics, coding, and critical thinking.

The market for entertainment centers is growing largely due to urbanization and shifting consumer preferences. Edutainment centers offer handy options for giving kids educational and play-based learning activities in metropolitan locations, where parents usually have hectic work schedules.

A demand for concentrated, high-quality experiences in a regulated and secure setting has emerged due to people's hectic lifestyles. Entertainment centers are always coming up with new ways to offer material. The creation of captivating and varied initiatives, such as multimedia material, interactive displays, and workshops with themes, are attracting a wider viewership. The products are kept interesting and enticing for kids and their parents due to the dynamic and developing character of the material.

In the coming years, edutainment centers will probably be able to reach a larger audience outside their physical presence as strong digital learning platforms continue to develop. Families will benefit from the flexibility and accessibility of hybrid models, including virtual and in-person components, particularly in light of our increasingly linked global society.

Adult education and lifelong learning programs are potential offerings that edutainment centers should look at. Acknowledging the trend toward continual learning, centers have the potential to serve parents, teachers, and anybody looking for a distinctive and fulfilling educational experience.

Personalized learning strategies are being adopted by entertainment centers progressively. These centers personalize educational experiences and material to each student's preferences and learning style via artificial intelligence and data analytics.

Sustainability and environmental education are becoming prominent topics in edutainment centers. Concerns about ecological sustainability and climate change are widespread, and this movement aligns with them.

A growing trend in education is using hybrid learning models that blend digital and physical experiences. Edutainment centers utilize interactive applications, virtual experiences, and internet platforms to expand learning beyond physical locations.

Strategic alliances between edutainment centers and the IT, entertainment, and healthcare sectors are emerging. Collaborations with entertainment organizations improve narrative and engagement, while partnerships with digital businesses deliver cutting-edge tools and experiences.

Diversity and inclusiveness are becoming increasingly important to edutainment facilities. An inclusive atmosphere is produced by programs and materials showcasing diverse cultures, ethnicities, and skill levels.

Seizing the chance to incorporate instructive gaming experiences, edutainment centers can capitalize on the growing popularity of e-sports and gaming.

With the focus on holistic education rising, edutainment centers have a chance to provide more than just traditional courses. Parental preferences for all-encompassing educational experiences are aligned with programs that emphasize character development, well-being, and soft skills.

Accepting cutting-edge technology like AI, customized learning programs, and virtual reality in the classroom presents opportunities.

There are chances to create and apply cutting-edge learning models, such as online learning environments, hybrid learning strategies, and subscription-based services.

For edutainment centers, venturing into outdoor adventure education presents an exclusive potential. Providing an alternative to indoor activities, wilderness camps, nature excursions, and outdoor skill-building programs satisfies the growing need for experiential learning in natural environments.

There can be a risk associated with the growing popularity of home-based learning programs like homeschooling and learning pods. The challenge for edutainment centers is to deliver value that goes above and beyond what can be accomplished with individualized, at-home learning strategies.

As educational institutions depend increasingly on digital platforms, they are vulnerable to security and privacy risks pertaining to data. If not sufficiently handled, issues regarding the gathering and safeguarding of children's personal information can result in legal troubles and reputational harm.

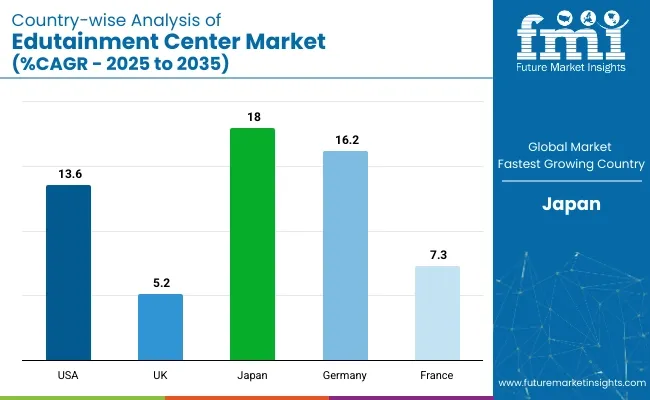

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| USA | 13.6% |

| UK | 5.2% |

| Japan | 18.0% |

| Germany | 16.2% |

| France | 7.3% |

The USA edutainment center market is estimated to grow at a 13.6% CAGR during the study period. This growth is driven by increasing investments in educational infrastructure, with both government and private sectors recognizing the value of interactive learning environments.

For instance, the USA Department of Education has allocated grants to develop instructional digital media aimed at preschoolers and early elementary students. Additionally, the rise of digital learning platforms and gamified educational tools has transformed traditional learning methods, making education more engaging and accessible.

Technologies like augmented reality (AR) and virtual reality (VR) are being integrated into edutainment centers, offering immersive learning experiences that attract tech-savvy families.

The UK edutainment center market is estimated to grow at a 5.2% CAGR during the study period. This growth is driven by a cultural shift towards experiential learning, where parents and educators seek innovative ways to engage children in educational activities. Edutainment centers in the UK are capitalizing on this trend by offering interactive exhibits and workshops that promote learning through play.

The emphasis on STEM (Science, Technology, Engineering, and Mathematics) education has also led to the development of programs that encourage problem-solving and critical thinking skills among young learners. Furthermore, the integration of digital technologies into these centers enhances the learning experience, making it more appealing to the tech-savvy generation.

The Japanese edutainment center market is estimated to grow at a 18.0% CAGR during the study period. This growth is driven by Japan's strong emphasis on education and innovation. The country's rich cultural heritage and technological advancements have led to the creation of edutainment centers that blend traditional learning with modern technology.

These centers offer interactive exhibits that teach children about science, history, and art in an engaging manner. The popularity of kawaii culture, characterized by cute and appealing designs, is also influencing the development of edutainment centers, making them more attractive to young audiences.

The German edutainment center market is estimated to grow at a 16.2% CAGR during the study period. This growth is driven by Germany's commitment to education and technological innovation. The country is leveraging Industry 4.0 technologies, such as the Internet of Things (IoT) and automation, to create smart learning environments within edutainment centers.

These technologies enable personalized learning experiences and efficient management of educational resources. Additionally, Germany's focus on sustainability has led to the development of eco-friendly edutainment centers that promote environmental awareness among young learners.

The French edutainment center market is estimated to grow at a 7.3% CAGR during the study period. This growth is driven by a growing recognition of the importance of early childhood education and the need for innovative learning methods. Edutainment centers in France are offering programs that combine education with entertainment, fostering creativity and critical thinking skills among children.

The integration of digital tools and interactive technologies enhances the learning experience, making it more engaging and effective. Moreover, the emphasis on cultural heritage and the arts in French education is reflected in the design and offerings of these centers, providing children with a well-rounded educational experience.

A constant engagement of strategic positioning, innovation, and market differentiation marks the competitive environment of the edutainment center market. Key businesses in this market always strive to create distinct value propositions that adapt to changing customer wants.

Differentiation usually rests on the quality of instructional material, technology integration, and the capacity to create immersive and memorable experiences for visitors.

| Attribute | Details |

|---|---|

| Current Total Market Size (2025) | USD 2.82 billion |

| Projected Market Size (2035) | USD 13.33 billion |

| CAGR (2025 to 2035) | 16.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | USD billion for value |

| By Gaming Type | Interactive, Non-interactive, Explorative, Hybrid Combination |

| By Facility Size | 5,001 to 10,000 Sq. Ft., 10,001 to 20,000 Sq. Ft., 20,001 to 40,000 Sq. Ft., Above 40,000 Sq. Ft. |

| By Revenue Source | Entry Fees & Tickets, Food & Beverages, Merchandising, Others (Sponsorship & Advertising, Event Hosting, Educational Workshops, Membership Programs) |

| By Visitor Demographics | Children (0-12), Teenagers (13-18), Young Adults (19-25), Adults (25+) |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, Middle East and Africa |

| Countries Covered | United States, Germany, Japan, China, Australia |

| Key Players | Kidzania, Legoland Discovery Center, Kindercity, Plabo, Pororo Park, Curiocity, Totter’s Otterville, Mattel Play Town, Little Explorers, Kidz Holding S.A.L |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis |

The global market is projected to grow from USD 2.82 billion in 2025 to USD 13.33 billion by 2035, expanding at a robust CAGR of 16.8% during the forecast period.

The explorative gaming type segment is expected to lead the market with 32.5% share in 2025, driven by its hands-on learning approach and ability to enhance creativity, cognitive skills, and critical thinking in children.

Entry fees and tickets are forecasted to dominate with 40.5% market share in 2025, as tiered pricing models and premium experiential learning formats drive higher monetization and customer loyalty.

Children aged 0-12 are projected to be the fastest-growing demographic, expanding at a CAGR of 7.2% from 2025 to 2035, supported by growing demand for structured play-based learning and school tie-ins.

Key players include KidZania, Legoland Discovery Center, Kindercity, Plabo, Pororo Park, Curiocity, Totter’s Otterville, Mattel Play Town, Little Explorers, and Kidz Holding S.A.L, focusing on immersive learning themes and digital engagement.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Value (US$ Million) Forecast by Gaming Type, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Facility Size, 2019 to 2034

Table 4: Global Market Value (US$ Million) Forecast by Revenue Source , 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by Visitor Demographics, 2019 to 2034

Table 6: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 7: North America Market Value (US$ Million) Forecast by Gaming Type, 2019 to 2034

Table 8: North America Market Value (US$ Million) Forecast by Facility Size, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Revenue Source , 2019 to 2034

Table 10: North America Market Value (US$ Million) Forecast by Visitor Demographics, 2019 to 2034

Table 11: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 12: Latin America Market Value (US$ Million) Forecast by Gaming Type, 2019 to 2034

Table 13: Latin America Market Value (US$ Million) Forecast by Facility Size, 2019 to 2034

Table 14: Latin America Market Value (US$ Million) Forecast by Revenue Source , 2019 to 2034

Table 15: Latin America Market Value (US$ Million) Forecast by Visitor Demographics, 2019 to 2034

Table 16: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 17: Western Europe Market Value (US$ Million) Forecast by Gaming Type, 2019 to 2034

Table 18: Western Europe Market Value (US$ Million) Forecast by Facility Size, 2019 to 2034

Table 19: Western Europe Market Value (US$ Million) Forecast by Revenue Source , 2019 to 2034

Table 20: Western Europe Market Value (US$ Million) Forecast by Visitor Demographics, 2019 to 2034

Table 21: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 22: Eastern Europe Market Value (US$ Million) Forecast by Gaming Type, 2019 to 2034

Table 23: Eastern Europe Market Value (US$ Million) Forecast by Facility Size, 2019 to 2034

Table 24: Eastern Europe Market Value (US$ Million) Forecast by Revenue Source , 2019 to 2034

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Visitor Demographics, 2019 to 2034

Table 26: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 27: South Asia and Pacific Market Value (US$ Million) Forecast by Gaming Type, 2019 to 2034

Table 28: South Asia and Pacific Market Value (US$ Million) Forecast by Facility Size, 2019 to 2034

Table 29: South Asia and Pacific Market Value (US$ Million) Forecast by Revenue Source , 2019 to 2034

Table 30: South Asia and Pacific Market Value (US$ Million) Forecast by Visitor Demographics, 2019 to 2034

Table 31: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 32: East Asia Market Value (US$ Million) Forecast by Gaming Type, 2019 to 2034

Table 33: East Asia Market Value (US$ Million) Forecast by Facility Size, 2019 to 2034

Table 34: East Asia Market Value (US$ Million) Forecast by Revenue Source , 2019 to 2034

Table 35: East Asia Market Value (US$ Million) Forecast by Visitor Demographics, 2019 to 2034

Table 36: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 37: Middle East and Africa Market Value (US$ Million) Forecast by Gaming Type, 2019 to 2034

Table 38: Middle East and Africa Market Value (US$ Million) Forecast by Facility Size, 2019 to 2034

Table 39: Middle East and Africa Market Value (US$ Million) Forecast by Revenue Source , 2019 to 2034

Table 40: Middle East and Africa Market Value (US$ Million) Forecast by Visitor Demographics, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Gaming Type, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Facility Size, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Revenue Source , 2024 to 2034

Figure 4: Global Market Value (US$ Million) by Visitor Demographics, 2024 to 2034

Figure 5: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 9: Global Market Value (US$ Million) Analysis by Gaming Type, 2019 to 2034

Figure 10: Global Market Value Share (%) and BPS Analysis by Gaming Type, 2024 to 2034

Figure 11: Global Market Y-o-Y Growth (%) Projections by Gaming Type, 2024 to 2034

Figure 12: Global Market Value (US$ Million) Analysis by Facility Size, 2019 to 2034

Figure 13: Global Market Value Share (%) and BPS Analysis by Facility Size, 2024 to 2034

Figure 14: Global Market Y-o-Y Growth (%) Projections by Facility Size, 2024 to 2034

Figure 15: Global Market Value (US$ Million) Analysis by Revenue Source , 2019 to 2034

Figure 16: Global Market Value Share (%) and BPS Analysis by Revenue Source , 2024 to 2034

Figure 17: Global Market Y-o-Y Growth (%) Projections by Revenue Source , 2024 to 2034

Figure 18: Global Market Value (US$ Million) Analysis by Visitor Demographics, 2019 to 2034

Figure 19: Global Market Value Share (%) and BPS Analysis by Visitor Demographics, 2024 to 2034

Figure 20: Global Market Y-o-Y Growth (%) Projections by Visitor Demographics, 2024 to 2034

Figure 21: Global Market Attractiveness by Gaming Type, 2024 to 2034

Figure 22: Global Market Attractiveness by Facility Size, 2024 to 2034

Figure 23: Global Market Attractiveness by Revenue Source , 2024 to 2034

Figure 24: Global Market Attractiveness by Visitor Demographics, 2024 to 2034

Figure 25: Global Market Attractiveness by Region, 2024 to 2034

Figure 26: North America Market Value (US$ Million) by Gaming Type, 2024 to 2034

Figure 27: North America Market Value (US$ Million) by Facility Size, 2024 to 2034

Figure 28: North America Market Value (US$ Million) by Revenue Source , 2024 to 2034

Figure 29: North America Market Value (US$ Million) by Visitor Demographics, 2024 to 2034

Figure 30: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 31: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 32: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 33: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 34: North America Market Value (US$ Million) Analysis by Gaming Type, 2019 to 2034

Figure 35: North America Market Value Share (%) and BPS Analysis by Gaming Type, 2024 to 2034

Figure 36: North America Market Y-o-Y Growth (%) Projections by Gaming Type, 2024 to 2034

Figure 37: North America Market Value (US$ Million) Analysis by Facility Size, 2019 to 2034

Figure 38: North America Market Value Share (%) and BPS Analysis by Facility Size, 2024 to 2034

Figure 39: North America Market Y-o-Y Growth (%) Projections by Facility Size, 2024 to 2034

Figure 40: North America Market Value (US$ Million) Analysis by Revenue Source , 2019 to 2034

Figure 41: North America Market Value Share (%) and BPS Analysis by Revenue Source , 2024 to 2034

Figure 42: North America Market Y-o-Y Growth (%) Projections by Revenue Source , 2024 to 2034

Figure 43: North America Market Value (US$ Million) Analysis by Visitor Demographics, 2019 to 2034

Figure 44: North America Market Value Share (%) and BPS Analysis by Visitor Demographics, 2024 to 2034

Figure 45: North America Market Y-o-Y Growth (%) Projections by Visitor Demographics, 2024 to 2034

Figure 46: North America Market Attractiveness by Gaming Type, 2024 to 2034

Figure 47: North America Market Attractiveness by Facility Size, 2024 to 2034

Figure 48: North America Market Attractiveness by Revenue Source , 2024 to 2034

Figure 49: North America Market Attractiveness by Visitor Demographics, 2024 to 2034

Figure 50: North America Market Attractiveness by Country, 2024 to 2034

Figure 51: Latin America Market Value (US$ Million) by Gaming Type, 2024 to 2034

Figure 52: Latin America Market Value (US$ Million) by Facility Size, 2024 to 2034

Figure 53: Latin America Market Value (US$ Million) by Revenue Source , 2024 to 2034

Figure 54: Latin America Market Value (US$ Million) by Visitor Demographics, 2024 to 2034

Figure 55: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 56: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 57: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 58: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 59: Latin America Market Value (US$ Million) Analysis by Gaming Type, 2019 to 2034

Figure 60: Latin America Market Value Share (%) and BPS Analysis by Gaming Type, 2024 to 2034

Figure 61: Latin America Market Y-o-Y Growth (%) Projections by Gaming Type, 2024 to 2034

Figure 62: Latin America Market Value (US$ Million) Analysis by Facility Size, 2019 to 2034

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Facility Size, 2024 to 2034

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Facility Size, 2024 to 2034

Figure 65: Latin America Market Value (US$ Million) Analysis by Revenue Source , 2019 to 2034

Figure 66: Latin America Market Value Share (%) and BPS Analysis by Revenue Source , 2024 to 2034

Figure 67: Latin America Market Y-o-Y Growth (%) Projections by Revenue Source , 2024 to 2034

Figure 68: Latin America Market Value (US$ Million) Analysis by Visitor Demographics, 2019 to 2034

Figure 69: Latin America Market Value Share (%) and BPS Analysis by Visitor Demographics, 2024 to 2034

Figure 70: Latin America Market Y-o-Y Growth (%) Projections by Visitor Demographics, 2024 to 2034

Figure 71: Latin America Market Attractiveness by Gaming Type, 2024 to 2034

Figure 72: Latin America Market Attractiveness by Facility Size, 2024 to 2034

Figure 73: Latin America Market Attractiveness by Revenue Source , 2024 to 2034

Figure 74: Latin America Market Attractiveness by Visitor Demographics, 2024 to 2034

Figure 75: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 76: Western Europe Market Value (US$ Million) by Gaming Type, 2024 to 2034

Figure 77: Western Europe Market Value (US$ Million) by Facility Size, 2024 to 2034

Figure 78: Western Europe Market Value (US$ Million) by Revenue Source , 2024 to 2034

Figure 79: Western Europe Market Value (US$ Million) by Visitor Demographics, 2024 to 2034

Figure 80: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 81: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 82: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 83: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 84: Western Europe Market Value (US$ Million) Analysis by Gaming Type, 2019 to 2034

Figure 85: Western Europe Market Value Share (%) and BPS Analysis by Gaming Type, 2024 to 2034

Figure 86: Western Europe Market Y-o-Y Growth (%) Projections by Gaming Type, 2024 to 2034

Figure 87: Western Europe Market Value (US$ Million) Analysis by Facility Size, 2019 to 2034

Figure 88: Western Europe Market Value Share (%) and BPS Analysis by Facility Size, 2024 to 2034

Figure 89: Western Europe Market Y-o-Y Growth (%) Projections by Facility Size, 2024 to 2034

Figure 90: Western Europe Market Value (US$ Million) Analysis by Revenue Source , 2019 to 2034

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Revenue Source , 2024 to 2034

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Revenue Source , 2024 to 2034

Figure 93: Western Europe Market Value (US$ Million) Analysis by Visitor Demographics, 2019 to 2034

Figure 94: Western Europe Market Value Share (%) and BPS Analysis by Visitor Demographics, 2024 to 2034

Figure 95: Western Europe Market Y-o-Y Growth (%) Projections by Visitor Demographics, 2024 to 2034

Figure 96: Western Europe Market Attractiveness by Gaming Type, 2024 to 2034

Figure 97: Western Europe Market Attractiveness by Facility Size, 2024 to 2034

Figure 98: Western Europe Market Attractiveness by Revenue Source , 2024 to 2034

Figure 99: Western Europe Market Attractiveness by Visitor Demographics, 2024 to 2034

Figure 100: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 101: Eastern Europe Market Value (US$ Million) by Gaming Type, 2024 to 2034

Figure 102: Eastern Europe Market Value (US$ Million) by Facility Size, 2024 to 2034

Figure 103: Eastern Europe Market Value (US$ Million) by Revenue Source , 2024 to 2034

Figure 104: Eastern Europe Market Value (US$ Million) by Visitor Demographics, 2024 to 2034

Figure 105: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 106: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Gaming Type, 2019 to 2034

Figure 110: Eastern Europe Market Value Share (%) and BPS Analysis by Gaming Type, 2024 to 2034

Figure 111: Eastern Europe Market Y-o-Y Growth (%) Projections by Gaming Type, 2024 to 2034

Figure 112: Eastern Europe Market Value (US$ Million) Analysis by Facility Size, 2019 to 2034

Figure 113: Eastern Europe Market Value Share (%) and BPS Analysis by Facility Size, 2024 to 2034

Figure 114: Eastern Europe Market Y-o-Y Growth (%) Projections by Facility Size, 2024 to 2034

Figure 115: Eastern Europe Market Value (US$ Million) Analysis by Revenue Source , 2019 to 2034

Figure 116: Eastern Europe Market Value Share (%) and BPS Analysis by Revenue Source , 2024 to 2034

Figure 117: Eastern Europe Market Y-o-Y Growth (%) Projections by Revenue Source , 2024 to 2034

Figure 118: Eastern Europe Market Value (US$ Million) Analysis by Visitor Demographics, 2019 to 2034

Figure 119: Eastern Europe Market Value Share (%) and BPS Analysis by Visitor Demographics, 2024 to 2034

Figure 120: Eastern Europe Market Y-o-Y Growth (%) Projections by Visitor Demographics, 2024 to 2034

Figure 121: Eastern Europe Market Attractiveness by Gaming Type, 2024 to 2034

Figure 122: Eastern Europe Market Attractiveness by Facility Size, 2024 to 2034

Figure 123: Eastern Europe Market Attractiveness by Revenue Source , 2024 to 2034

Figure 124: Eastern Europe Market Attractiveness by Visitor Demographics, 2024 to 2034

Figure 125: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 126: South Asia and Pacific Market Value (US$ Million) by Gaming Type, 2024 to 2034

Figure 127: South Asia and Pacific Market Value (US$ Million) by Facility Size, 2024 to 2034

Figure 128: South Asia and Pacific Market Value (US$ Million) by Revenue Source , 2024 to 2034

Figure 129: South Asia and Pacific Market Value (US$ Million) by Visitor Demographics, 2024 to 2034

Figure 130: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 131: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 132: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 133: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 134: South Asia and Pacific Market Value (US$ Million) Analysis by Gaming Type, 2019 to 2034

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Gaming Type, 2024 to 2034

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Gaming Type, 2024 to 2034

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Facility Size, 2019 to 2034

Figure 138: South Asia and Pacific Market Value Share (%) and BPS Analysis by Facility Size, 2024 to 2034

Figure 139: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Facility Size, 2024 to 2034

Figure 140: South Asia and Pacific Market Value (US$ Million) Analysis by Revenue Source , 2019 to 2034

Figure 141: South Asia and Pacific Market Value Share (%) and BPS Analysis by Revenue Source , 2024 to 2034

Figure 142: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Revenue Source , 2024 to 2034

Figure 143: South Asia and Pacific Market Value (US$ Million) Analysis by Visitor Demographics, 2019 to 2034

Figure 144: South Asia and Pacific Market Value Share (%) and BPS Analysis by Visitor Demographics, 2024 to 2034

Figure 145: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Visitor Demographics, 2024 to 2034

Figure 146: South Asia and Pacific Market Attractiveness by Gaming Type, 2024 to 2034

Figure 147: South Asia and Pacific Market Attractiveness by Facility Size, 2024 to 2034

Figure 148: South Asia and Pacific Market Attractiveness by Revenue Source , 2024 to 2034

Figure 149: South Asia and Pacific Market Attractiveness by Visitor Demographics, 2024 to 2034

Figure 150: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 151: East Asia Market Value (US$ Million) by Gaming Type, 2024 to 2034

Figure 152: East Asia Market Value (US$ Million) by Facility Size, 2024 to 2034

Figure 153: East Asia Market Value (US$ Million) by Revenue Source , 2024 to 2034

Figure 154: East Asia Market Value (US$ Million) by Visitor Demographics, 2024 to 2034

Figure 155: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 156: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 157: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 158: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 159: East Asia Market Value (US$ Million) Analysis by Gaming Type, 2019 to 2034

Figure 160: East Asia Market Value Share (%) and BPS Analysis by Gaming Type, 2024 to 2034

Figure 161: East Asia Market Y-o-Y Growth (%) Projections by Gaming Type, 2024 to 2034

Figure 162: East Asia Market Value (US$ Million) Analysis by Facility Size, 2019 to 2034

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Facility Size, 2024 to 2034

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Facility Size, 2024 to 2034

Figure 165: East Asia Market Value (US$ Million) Analysis by Revenue Source , 2019 to 2034

Figure 166: East Asia Market Value Share (%) and BPS Analysis by Revenue Source , 2024 to 2034

Figure 167: East Asia Market Y-o-Y Growth (%) Projections by Revenue Source , 2024 to 2034

Figure 168: East Asia Market Value (US$ Million) Analysis by Visitor Demographics, 2019 to 2034

Figure 169: East Asia Market Value Share (%) and BPS Analysis by Visitor Demographics, 2024 to 2034

Figure 170: East Asia Market Y-o-Y Growth (%) Projections by Visitor Demographics, 2024 to 2034

Figure 171: East Asia Market Attractiveness by Gaming Type, 2024 to 2034

Figure 172: East Asia Market Attractiveness by Facility Size, 2024 to 2034

Figure 173: East Asia Market Attractiveness by Revenue Source , 2024 to 2034

Figure 174: East Asia Market Attractiveness by Visitor Demographics, 2024 to 2034

Figure 175: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 176: Middle East and Africa Market Value (US$ Million) by Gaming Type, 2024 to 2034

Figure 177: Middle East and Africa Market Value (US$ Million) by Facility Size, 2024 to 2034

Figure 178: Middle East and Africa Market Value (US$ Million) by Revenue Source , 2024 to 2034

Figure 179: Middle East and Africa Market Value (US$ Million) by Visitor Demographics, 2024 to 2034

Figure 180: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 182: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 183: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 184: Middle East and Africa Market Value (US$ Million) Analysis by Gaming Type, 2019 to 2034

Figure 185: Middle East and Africa Market Value Share (%) and BPS Analysis by Gaming Type, 2024 to 2034

Figure 186: Middle East and Africa Market Y-o-Y Growth (%) Projections by Gaming Type, 2024 to 2034

Figure 187: Middle East and Africa Market Value (US$ Million) Analysis by Facility Size, 2019 to 2034

Figure 188: Middle East and Africa Market Value Share (%) and BPS Analysis by Facility Size, 2024 to 2034

Figure 189: Middle East and Africa Market Y-o-Y Growth (%) Projections by Facility Size, 2024 to 2034

Figure 190: Middle East and Africa Market Value (US$ Million) Analysis by Revenue Source , 2019 to 2034

Figure 191: Middle East and Africa Market Value Share (%) and BPS Analysis by Revenue Source , 2024 to 2034

Figure 192: Middle East and Africa Market Y-o-Y Growth (%) Projections by Revenue Source , 2024 to 2034

Figure 193: Middle East and Africa Market Value (US$ Million) Analysis by Visitor Demographics, 2019 to 2034

Figure 194: Middle East and Africa Market Value Share (%) and BPS Analysis by Visitor Demographics, 2024 to 2034

Figure 195: Middle East and Africa Market Y-o-Y Growth (%) Projections by Visitor Demographics, 2024 to 2034

Figure 196: Middle East and Africa Market Attractiveness by Gaming Type, 2024 to 2034

Figure 197: Middle East and Africa Market Attractiveness by Facility Size, 2024 to 2034

Figure 198: Middle East and Africa Market Attractiveness by Revenue Source , 2024 to 2034

Figure 199: Middle East and Africa Market Attractiveness by Visitor Demographics, 2024 to 2034

Figure 200: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Edutainment Center Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Edutainment Center Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Edutainment Center Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Edutainment Market Trends – Growth & Forecast 2024-2034

Center-less Grinding Machines Market Size and Share Forecast Outlook 2025 to 2035

Center Sealed Pouch Packaging Market Size and Share Forecast Outlook 2025 to 2035

Center Seal Pouch Making Machine Market

Datacenter Infrastructure Services Market Size and Share Forecast Outlook 2025 to 2035

Datacenter Grid Interface Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Data Center Automatic Transfer Switches and Switchgears Market Size and Share Forecast Outlook 2025 to 2035

Data Center Power Management Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Data Center Power Management Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Data Center Liquid Cooling Market Size and Share Forecast Outlook 2025 to 2035

Data Center RFID Market Size and Share Forecast Outlook 2025 to 2035

Data Center Accelerator Market Size and Share Forecast Outlook 2025 to 2035

Data Center Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Data Center Refrigerant Market Size and Share Forecast Outlook 2025 to 2035

Data Center Fire Detection And Suppression Market Size and Share Forecast Outlook 2025 to 2035

Data Center Security Market Size and Share Forecast Outlook 2025 to 2035

Data Center Construction Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA