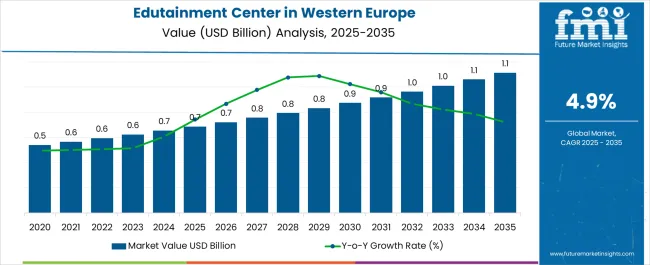

The Edutainment Center Industry Analysis in Western Europe is estimated to be valued at USD 0.7 billion in 2025 and is projected to reach USD 1.1 billion by 2035, registering a compound annual growth rate (CAGR) of 4.9% over the forecast period.

| Metric | Value |

|---|---|

| Edutainment Center Industry Analysis in Western Europe Estimated Value in (2025 E) | USD 0.7 billion |

| Edutainment Center Industry Analysis in Western Europe Forecast Value in (2035 F) | USD 1.1 billion |

| Forecast CAGR (2025 to 2035) | 4.9% |

The edutainment center industry in Western Europe is expanding steadily, supported by rising consumer interest in immersive learning experiences, growing demand for family-oriented leisure activities, and increased investments in themed entertainment facilities. Current market dynamics reflect a balance between educational enrichment and recreational appeal, where operators are integrating digital technologies and interactive platforms to enhance visitor engagement.

Urbanization and higher disposable incomes are contributing to the development of larger, more sophisticated centers, while supportive government initiatives in culture, tourism, and education are reinforcing industry growth. The future outlook is characterized by the integration of gamification, augmented reality, and virtual learning tools, all of which are expected to raise participation levels and spending per visitor.

Growth rationale is centered on the sustained appeal of experiential learning, the ability of operators to diversify revenue models, and the expansion of innovative formats that cater to both children and adults, ensuring the industry’s resilience and long-term expansion across Western Europe.

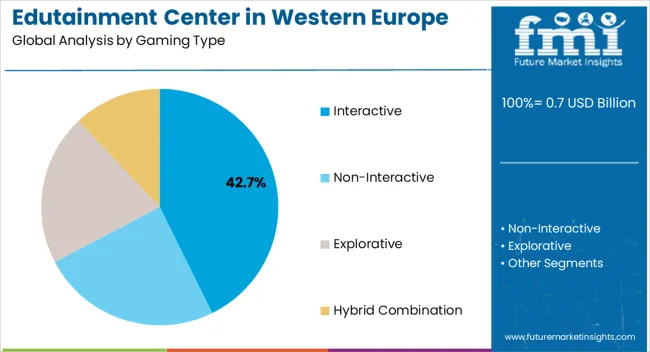

The interactive gaming type segment, holding 42.70% of the category, has emerged as the leading format due to its strong alignment with experiential learning trends and the ability to engage visitors through participatory and technology-driven activities. Its dominance has been reinforced by the widespread appeal of gamified education models, which blend entertainment with skill development.

Operators are increasingly deploying advanced gaming interfaces, immersive simulations, and adaptive challenges that cater to different age groups and learning needs. Market adoption has also been supported by the integration of interactive content into school programs and corporate training initiatives, which has boosted institutional partnerships.

With continued focus on creating personalized and socially engaging experiences, the interactive segment is expected to maintain leadership and drive higher footfall across edutainment centers in Western Europe.

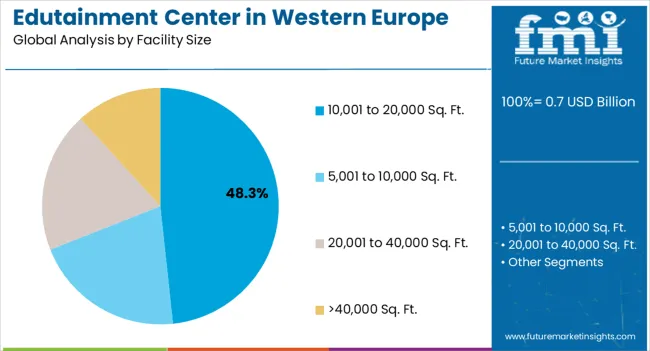

The 10,001 to 20,000 sq. ft. facility size segment, accounting for 48.30% of the category, has established dominance owing to its balance between capacity, operational efficiency, and visitor experience.

These mid-sized facilities have been favored for their ability to accommodate diverse attractions while maintaining manageable overheads. Their size allows operators to integrate multiple zones such as gaming, learning, and food services within a cohesive environment, enhancing customer satisfaction. Accessibility in urban and suburban locations has further supported segment growth, as these facilities fit well within commercial real estate parameters.

Market resilience has been driven by the adaptability of such centers to host both small and medium-scale events, creating recurring revenue streams Future expansion of this segment is expected to benefit from modular design innovations and flexible layouts that maximize space utilization while improving return on investment.

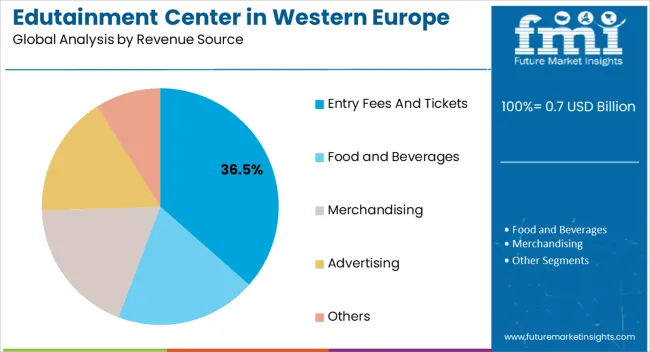

The entry fees and tickets segment, representing 36.50% of the revenue source category, has remained the leading contributor due to its straightforward monetization model and consistency in generating predictable cash flow. Operators have leveraged pricing strategies such as tiered passes, bundled packages, and loyalty programs to enhance ticket-based revenues.

The segment’s share has been sustained by steady visitor demand for accessible, one-time payment options that offer value-for-money experiences. Market confidence has been reinforced by the transparency of ticket pricing and its alignment with consumer spending habits in family and group entertainment.

With the increasing adoption of digital booking platforms and dynamic pricing models, entry fee revenues are being optimized to capture peak demand periods This approach is expected to strengthen the segment’s role as the primary revenue driver, even as centers diversify into secondary income streams such as merchandising and food services.

| Country | Italy |

|---|---|

| Forecast CAGR % (2025 to 2035) | 6.1% |

Investment in edutainment center is increasing in Italy. Our analysts have estimated the country to expand at a CAGR of 6.1% through 2035. Following factors are increasing curiosity for edutainment center in Italy:

| Country | Netherlands |

|---|---|

| Forecast CAGR % (2025 to 2035) | 5.8% |

The growth rate of edutainment center industry in the Netherlands is projected to be 5.8% through 2035. Factors below are pushing revenues from edutainment center in the country:

| Country | France |

|---|---|

| Forecast CAGR % (2025 to 2035) | 5.4% |

The edutainment center industry in France is projected to expand at a CAGR of 5.4% through 2035. Growth in these center in the country is being driven by:

| Country | United Kingdom |

|---|---|

| Forecast CAGR % (2025 to 2035) | 4.2% |

Development in edutainment center industry in the United Kingdom is being driven at a CAGR of 4.2% through 2035. The industry is strengthened by:

| Country | Germany |

|---|---|

| Forecast CAGR % (2025 to 2035) | 3.4% |

The Germany edutainment center industry is expected to expand at a CAGR of 3.4% through 2035. Following factors are contributing to the industry’s growth:

| Leading Gaming Type | Interactive |

|---|---|

| Value Share % (2025) | 36.50% |

The interactive gaming segment is projected to acquire a value share of 36.50% in 2025. The segment's growth hinges on the rising popularity of experiential learning. These platforms entice users from all age groups to gain hands-on experience. Additionally, this center provides an opportunity to enjoyably learn different topics.

Parents and education providers prefer interactive gaming experiences for their children due to the enriching and stimulating environment they offer. Additionally, investors in edutainment center are showing interest in the latest technologies to elevate user engagement and immersion.

| Leading Visitor Demographics | Teenager (13-18) |

|---|---|

| Value Share % (2025) | 40.20% |

The teenager segment, according to our analysts' estimations, is projected to account for a value share of 40.20% in 2025. This kind of center is particularly beneficial for the overall growth and understanding of different subjects among teenagers. As a result, education providers frequently organize field trips to edutainment center.

Multiple benefits of visiting these center can be attributed to the growth of this segment. These benefits include improved social skills, creative problem-solving, gaining confidence, and learning to work as a team player.

Regional players in the edutainment center industry are strategizing to position themselves well in Western Europe. Key focus areas include research and development and investments in futuristic technologies. Players are further expanding their offerings with the inclusion of different attractions and activities. This move is projected to result in repeat visitors and a larger audience base.

Edutainment center is partnering with schools and different organizations to facilitate field trips and educational programs. Additionally, they are building a strong online presence by constructing engaging and informative websites and social media handles, thus aiming for increased reach to potential visitors.

Detailed Profiles of Leading Vendors of Edutainment Center in Western Europe

| Name | Particulars |

|---|---|

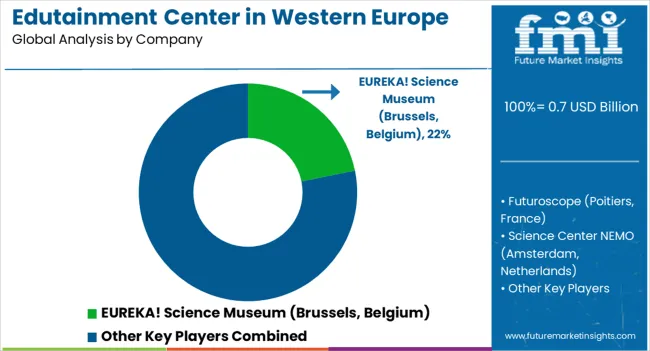

| EUREKA! Science Museum (Brussels, Belgium) | The museum offers multiple interactive exhibits and activities that increase visitors' grasp regarding science and technology. It attracts families, tourists, and school groups. |

| Futuroscope (Poitiers, France) | This theme park is popular in Europe. It includes multiple attractions, rides, and events that are rooted in science fiction and technology. It is open from March to November. |

| Attribute | Details |

|---|---|

| Estimated Industry Size in 2025 | USD 0.7 billion |

| Projected Industry Size by 2035 | USD 1.1 billion |

| Anticipated CAGR between 2025 to 2035 | 4.9% CAGR |

| Historical Analysis of Demand for Edutainment Center in Western Europe | 2020 to 2025 |

| Demand Forecast for Edutainment Center in Western Europe | 2025 to 2035 |

| Report Coverage of Edutainment Center in Western Europe | Industry Size, Industry Trends, Analysis of Key Factors Influencing Edutainment Center Adoption in Western Europe, Insights on Western Europe Players and their Industry Strategy in Western Europe, Ecosystem Analysis of Local and Regional Western Europe Providers |

| Key Vendors Profiled for Edutainment Center in Western Europe | EUREKA! Science Museum (Brussels, Belgium); Futuroscope (Poitiers, France); Science Center NEMO (Amsterdam, Netherlands); Kidzania; Spaceport (Bremen, Germany); Others |

The global edutainment center industry analysis in Western Europe is estimated to be valued at USD 0.7 billion in 2025.

The market size for the edutainment center industry analysis in Western Europe is projected to reach USD 1.1 billion by 2035.

The edutainment center industry analysis in Western Europe is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in edutainment center industry analysis in Western Europe are interactive, non-interactive, explorative and hybrid combination.

In terms of facility size, 10,001 to 20,000 sq. ft. segment to command 48.3% share in the edutainment center industry analysis in Western Europe in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Edutainment Market Trends – Growth & Forecast 2024-2034

Edutainment Center Market Outlook - Size, Share & Forecast 2025 to 2035

Edutainment Center Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Edutainment Center Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Center-less Grinding Machines Market Size and Share Forecast Outlook 2025 to 2035

Center Seal Pouch Making Machine Market

Center Sealed Pouch Packaging Market Size and Share Forecast Outlook 2025 to 2035

Datacenter Infrastructure Services Market Size and Share Forecast Outlook 2025 to 2035

Datacenter Grid Interface Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Data Center Market Forecast and Outlook 2025 to 2035

Data Center Automatic Transfer Switches and Switchgears Market Size and Share Forecast Outlook 2025 to 2035

Data Center RFID Market Size and Share Forecast Outlook 2025 to 2035

Data Center Accelerator Market Size and Share Forecast Outlook 2025 to 2035

Data Center Refrigerant Market Size and Share Forecast Outlook 2025 to 2035

Data Center Fire Detection And Suppression Market Size and Share Forecast Outlook 2025 to 2035

Data Center Security Market Size and Share Forecast Outlook 2025 to 2035

Data Center Construction Market Size and Share Forecast Outlook 2025 to 2035

Data Center Substation Market Size and Share Forecast Outlook 2025 to 2035

Data Center GPU Market Size and Share Forecast Outlook 2025 to 2035

Data Center Power Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA