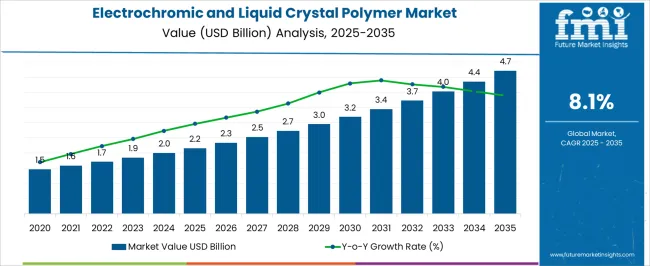

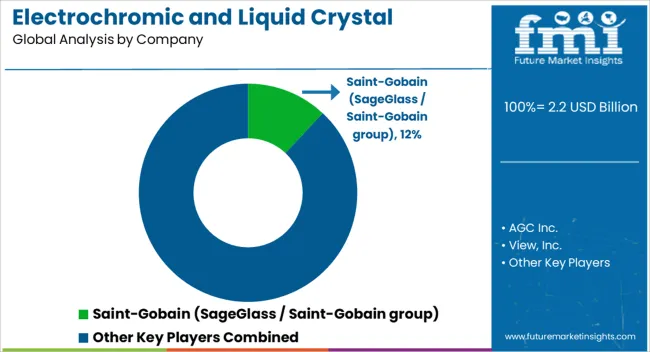

The electrochromic and liquid crystal polymer market is estimated to be valued at USD 2.2 billion in 2025 and is projected to reach USD 4.7 billion by 2035, registering a compound annual growth rate (CAGR) of 8.1% over the forecast period.

Between 2021 and 2025, the market rises from USD 1.5 billion to USD 2.2 billion, reflecting steady early-stage adoption. Annual increments indicate gradual acceleration, with values reaching USD 1.6 billion in 2022, USD 1.7 billion in 2023, USD 1.9 billion in 2024, and USD 2.0 billion immediately before attaining USD 2.2 billion in 2025. This period highlights initial breakpoints where adoption gains are sensitive to product availability, manufacturing scale-up, and cost reductions in polymer synthesis. From 2026 to 2030, the market continues its upward trajectory, expanding from USD 2.2 billion to USD 3.2 billion. Incremental values increase to USD 2.3 billion in 2026, USD 2.5 billion in 2027, USD 2.7 billion in 2028, USD 3.0 billion in 2029, and USD 3.2 billion in 2030.

Breakpoint analysis during this period shows that key inflection points occur when new applications, such as smart windows, flexible displays, and adaptive optical devices, gain traction, leading to sudden spikes in adoption and revenue. Between 2031 and 2035, growth strengthens further, rising from USD 3.4 billion to USD 4.7 billion. Values progress to USD 3.4 billion in 2031, USD 3.7 billion in 2032, USD 4.0 billion in 2033, USD 4.4 billion in 2034, and USD 4.7 billion in 2035.

| Metric | Value |

|---|---|

| Electrochromic and Liquid Crystal Polymer Market Estimated Value in (2025 E) | USD 2.2 billion |

| Electrochromic and Liquid Crystal Polymer Market Forecast Value in (2035 F) | USD 4.7 billion |

| Forecast CAGR (2025 to 2035) | 8.1% |

The electrochromic and liquid crystal polymer market is supported by several parent markets that collectively drive its demand and adoption across industries requiring advanced material performance. The advanced materials market holds a strong influence, with electrochromic coatings and liquid crystal polymers (LCPs) making up nearly 12-15% of this segment. Their high strength, optical control, and chemical resistance position them as premium engineered materials. The electronics and display market contributes around 15-18%, as electrochromic materials are increasingly used in smart displays and adaptive windows, while LCPs are widely deployed in high-frequency connectors, printed circuit boards, and 5G communication systems.

The automotive components market accounts for nearly 10-12% of the demand, where electrochromic applications include smart rearview mirrors, adaptive sunroofs, and windows, while LCPs are chosen for electrical sensors and high-temperature resistant parts. The aerospace and defense materials market represents about 8-10%, with both electrochromics and LCPs applied in radar systems, cockpit displays, antenna substrates, and smart windows where durability and precision are essential. Finally, the construction and architectural materials market contributes approximately 7-9%, as electrochromic glass is integrated into smart facades and building windows, while LCP-based components support structural electronics.

The market is undergoing notable expansion, supported by technological advancements, energy efficiency demands, and increasing integration into high-performance applications. Electrochromic technology is gaining momentum due to its capacity to modulate light and heat transmission, offering significant benefits for energy conservation and user comfort.

Liquid crystal polymers are being adopted for their exceptional strength-to-weight ratio, heat resistance, and dimensional stability, which makes them suitable for complex engineering and electronic applications. Regulatory emphasis on sustainability and energy efficiency, coupled with the need for innovative materials in sectors such as construction, automotive, and electronics, is shaping the market trajectory.

The transition toward smart and adaptive materials is creating opportunities for product innovation and cross-industry collaborations With ongoing research and the expansion of manufacturing capabilities, both electrochromic and liquid crystal polymer technologies are expected to see broad-based adoption, driving consistent growth in global markets.

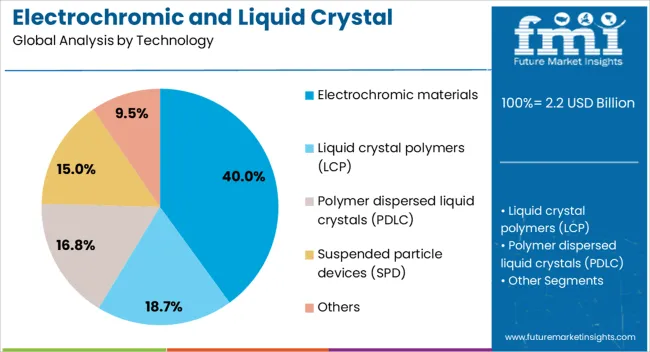

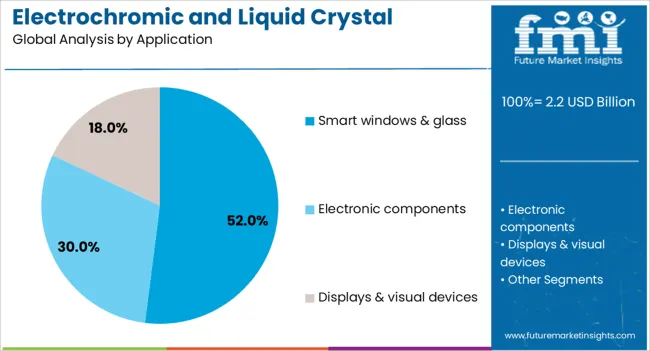

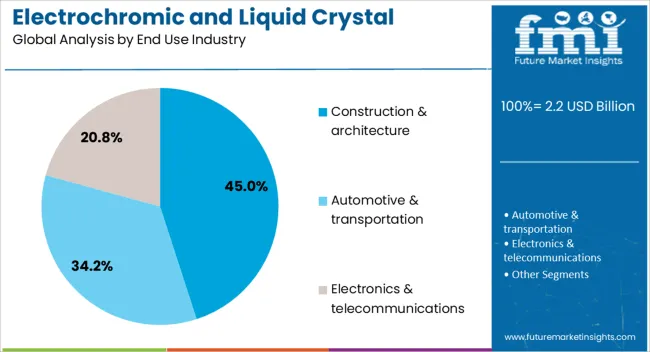

The electrochromic and liquid crystal polymer market is segmented by technology, application, end use industry, and geographic regions. By technology, electrochromic and liquid crystal polymer market is divided into electrochromic materials, liquid crystal polymers (LCP), polymer dispersed liquid crystals (PDLC), suspended particle devices (SPD), and others. In terms of application, electrochromic and liquid crystal polymer market is classified into smart windows & glass, electronic components, displays & visual devices, automotive components, medical devices & equipment, aerospace & defense applications, and other. Based on end use industry, electrochromic and liquid crystal polymer market is segmented into construction & architecture, automotive & transportation, electronics & telecommunications, aerospace & defense, healthcare & medical, energy & power generation, and others. Regionally, the electrochromic and liquid crystal polymer industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The electrochromic materials segment is projected to hold 40% of the electrochromic and liquid crystal polymer market revenue share in 2025, making it the dominant technology. Growth in this segment has been driven by the rising demand for energy-efficient and adaptive glazing solutions in various sectors. Electrochromic materials are valued for their ability to change optical properties in response to electrical signals, enabling dynamic control of light and heat transmission. This capability supports applications where comfort, privacy, and energy savings are prioritized. The materials have been increasingly utilized in architectural projects, transportation, and high-end consumer electronics, where performance and aesthetics converge. Advancements in manufacturing processes have reduced costs and improved product durability, further supporting adoption The integration of smart control systems has enhanced the appeal of electrochromic technologies, making them a strategic choice for forward-looking infrastructure and product designs that aim to combine functionality with sustainability.

The smart windows and glass segment is anticipated to account for 52% of the market revenue share in 2025, positioning it as the leading application. The growth of this segment has been supported by heightened interest in intelligent building solutions that improve energy efficiency and occupant comfort. Smart windows and glass allow for real-time adjustment of transparency, helping to regulate indoor temperatures and reduce reliance on artificial lighting and climate control systems. Their adoption has been accelerated by green building certifications and regulatory incentives aimed at reducing carbon footprints. In commercial and residential construction, these solutions are valued for both their functional and aesthetic benefits, enhancing the user experience while contributing to operational savings Integration with automation systems has expanded their use in modern architecture, while advances in electrochromic and liquid crystal technologies have improved response times, durability, and design flexibility, ensuring sustained demand.

The construction and architecture segment is expected to hold 45% of the market revenue share in 2025, making it the dominant end use industry. Growth in this segment has been fueled by the increasing adoption of energy-efficient building materials and the global shift toward sustainable construction practices. Electrochromic and liquid crystal polymer technologies are being deployed to create adaptive façades, smart glazing systems, and high-performance structural elements that meet stringent environmental standards. The demand for materials that can contribute to energy savings, thermal comfort, and modern design aesthetics has reinforced their role in this industry. In both new construction and retrofit projects, these materials are being specified to achieve better energy ratings and compliance with evolving building codes Ongoing urbanization, infrastructure investments, and the integration of smart building technologies are expected to further expand the use of these materials, securing their position as a preferred choice in contemporary architecture.

Electrochromic materials enable dynamic light control, while liquid crystal polymers provide heat resistance, strength, and miniaturization advantages. High production costs, raw material volatility, and technical integration challenges remain key hurdles. Opportunities are growing in smart windows, automotive systems, and advanced electronic components, supported by collaborative R&D. With innovations in hybrid coatings, thin films, and new polymer formulations, these materials are becoming essential enablers of high-performance applications across multiple industries.

Electrochromic materials are increasingly adopted in smart windows, automotive glass, and display technologies, offering dynamic light control and energy efficiency. At the same time, liquid crystal polymers are gaining traction in electronics and automotive sectors for their heat resistance, strength, and dimensional stability. Consumer electronics manufacturers are incorporating liquid crystal polymers into connectors and flexible circuits, while aerospace and defense industries value their lightweight and durable nature. The combination of smart visual control and superior mechanical performance has positioned these materials as critical enablers of modern applications. Rising adoption across automotive interiors, architectural glass, advanced electronics, and aerospace equipment reflects their ability to meet diverse performance requirements and highlights their growing role in shaping next-generation technologies.

Manufacturing electrochromic devices requires complex deposition processes and advanced coatings that elevate expenses and limit scalability. Liquid crystal polymers, though versatile, involve high material costs due to specialized synthesis and processing. Maintaining consistency in quality and performance is also difficult, as small variations during production can impact durability and optical properties. Limited supply chains for key raw materials add further volatility, creating uncertainties for manufacturers. Integration challenges remain, particularly in retrofitting electrochromic materials into existing building structures or adapting polymers into highly miniaturized electronic components. Regulatory compliance regarding safety, chemical usage, and material standards further raises costs. These barriers hinder broader adoption, particularly in price-sensitive markets, while confining usage primarily to high-value sectors where performance gains outweigh affordability concerns.

The stadium lighting market offers numerous growth opportunities with the increasing adoption of smart lighting systems and advanced control features. Smart lighting allows for adaptive lighting, where lighting levels can be adjusted based on specific needs, such as event type, training, or maintenance schedules. These systems also help improve energy efficiency by minimizing unnecessary power use during non-event hours. Additionally, integrating lighting control with other stadium management systems enables better coordination and operation. These advancements provide stadium operators with greater flexibility, efficiency, and control over their lighting systems, contributing to the market’s growth.

Advances in nanostructuring, hybrid coatings, and thin-film technologies are enhancing the optical and mechanical properties of electrochromic materials. Similarly, the development of next-generation liquid crystal polymers with improved processability and adaptability is expanding their usability in advanced manufacturing. Industry collaborations between electronics manufacturers, automotive suppliers, and material science companies are accelerating the commercialization of new solutions. Pilot projects in smart buildings and connected vehicles are also driving visibility, encouraging broader market acceptance. Regional markets are showing varied adoption patterns, with North America and Europe investing heavily in research, while Asia Pacific strengthens its presence in large-scale production. The interplay of innovation, partnerships, and end-user demand is redefining the competitive landscape, positioning these materials as cornerstones of future-ready applications.

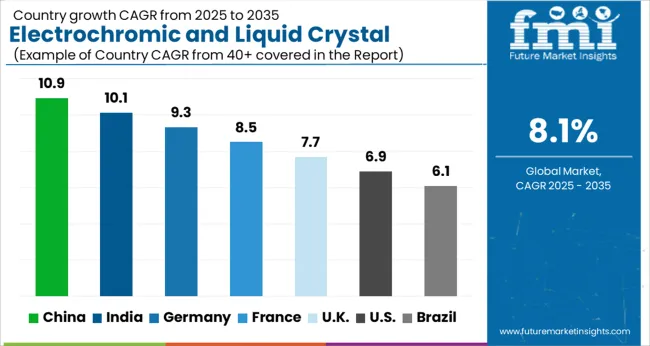

| Country | CAGR |

|---|---|

| China | 10.9% |

| India | 10.1% |

| Germany | 9.3% |

| France | 8.5% |

| UK | 7.7% |

| USA | 6.9% |

| Brazil | 6.1% |

The electrochromic and liquid crystal polymer market is projected to expand at a global CAGR of 8.1% from 2025 to 2035. China leads with 10.9%, followed by India at 10.1% and Germany at 9.3%, while the United Kingdom records 7.7% and the United States trails at 6.9%. China and India show the strongest growth premiums of +2.8% and +2.0% above the baseline, supported by electronics manufacturing, 5G adoption, and smart infrastructure growth. Germany retains a strong position with industrial and automotive integration, while the UK and USA contribute steady gains through specialty applications in healthcare, defense, and advanced communication. The analysis spans over 40+ countries, with the leading markets shown below.

China is projected to expand at a CAGR of 10.9% between 2025 and 2035, leading the global electrochromic and liquid crystal polymer market. The country’s rapid advancements in electronics, display technologies, and smart materials are fueling demand for high-performance polymers. Electrochromic materials are being increasingly integrated into architectural glass, smart windows, and automotive applications, reflecting China’s strong focus on energy-efficient infrastructure and mobility solutions. Liquid crystal polymers (LCPs) are gaining traction in electronics manufacturing, especially in connectors, flexible circuits, and high-frequency communication devices. With China being a hub for 5G deployment, semiconductors, and consumer electronics, demand for LCPs is expected to accelerate further.

India is expected to grow at a CAGR of 10.1% from 2025 to 2035 in the electrochromic and liquid crystal polymer market. The expansion is supported by the country’s growing automotive sector, which is adopting electrochromic glass and components for modern vehicles. Construction growth and increasing use of smart infrastructure are also contributing to higher demand for electrochromic applications in architectural glass and commercial projects. On the other hand, the expanding electronics and telecommunications sector is driving usage of LCPs in connectors, flexible circuits, and high-performance components. India’s manufacturing initiatives, combined with foreign investments, are establishing a strong ecosystem for polymer and electronics production.

Germany is projected to expand at a CAGR of 9.3% during 2025–2035, driven by its advanced industrial ecosystem and innovation-led economy. The German automotive industry, one of the largest in the world, is a significant consumer of electrochromic materials used in sunroofs, windows, and display technologies. Construction activities focused on high-performance building solutions are also boosting adoption of electrochromic glass in architectural applications. On the polymer side, liquid crystal polymers are being extensively utilized in electronics, healthcare equipment, and aerospace applications, where high thermal stability and precision are critical. With a growing emphasis on advanced connectivity and industrial applications, Germany is expected to remain one of the top European contributors to global growth.

The United Kingdom is expected to record a CAGR of 7.7% from 2025 to 2035, supported by steady adoption of advanced materials in construction, automotive, and consumer electronics. The UK’s construction sector is increasingly adopting electrochromic glass in commercial buildings and offices to improve comfort and efficiency. Automotive manufacturers are gradually incorporating electrochromic technologies into premium vehicles, driving new opportunities. In parallel, liquid crystal polymers are witnessing increased adoption in electronics, telecommunications, and medical equipment. Growth in fiber optics and advanced communication networks is also creating additional demand. Research institutions and universities are actively collaborating with companies to develop high-performance materials, further enhancing innovation capacity.

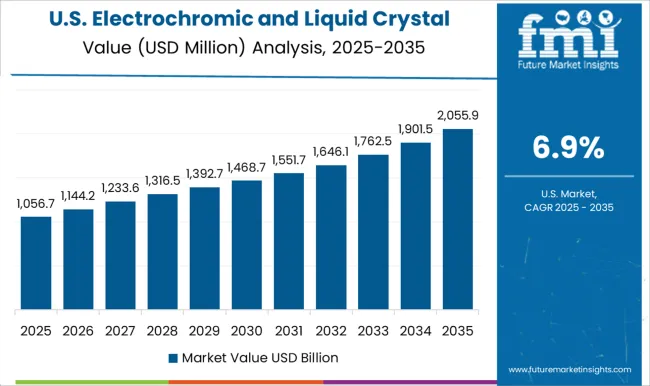

The United States is projected to grow at a CAGR of 6.9% from 2025 to 2035, with defense, aerospace, automotive, and electronics as major contributors. Electrochromic applications are gaining adoption in smart windows for commercial and residential projects, as well as in premium vehicles. The aerospace and defense sectors are utilizing advanced optical technologies based on electrochromic materials for specialized applications. On the polymer side, liquid crystal polymers are being widely applied in semiconductor packaging, healthcare devices, and high-frequency communication equipment. USA-based manufacturers are at the forefront of innovation, investing heavily in R&D for next-generation materials with greater durability and performance.

In the electrochromic and liquid crystal polymer market, competition is anchored in two distinct but converging material segments: dynamic glazing and high-performance polymers. Saint-Gobain, through SageGlass, leads in electrochromic glass solutions for architectural applications, offering smart glazing that modulates light and heat transmission for energy efficiency and occupant comfort. AGC Inc. competes with Halio and other electrochromic technologies, emphasizing integration into large-scale construction projects and partnerships with developers. View, Inc. positions itself with electrochromic glass tailored to commercial and institutional buildings, promoting connected, sensor-driven functionality.

Gentex Corporation dominates the automotive segment with electrochromic rearview mirrors and dimmable windows, expanding into aerospace for cabin shading systems. Corning Incorporated contributes through specialty glass technologies that enhance optical quality and durability, often complementing electro-optic applications. Research Frontiers and other SPD providers differentiate with suspended particle device films, focusing on fast-switching smart glass for automotive, aviation, and specialty sectors. In liquid crystal polymers (LCPs), Celanese Corporation delivers engineered LCP resins used in high-frequency electronics, automotive components, and medical devices, offering thermal stability and low dielectric properties. Toray, Polyplastics, and Kuraray compete with a wide range of LCP grades tailored for miniaturized connectors, 5G infrastructure, and lightweight electronic assemblies, emphasizing consistent performance and scalability.

Strategies across both segments highlight product innovation, application-specific targeting, and global partnerships. Electrochromic players emphasize integration into smart building and transportation ecosystems, while LCP suppliers prioritize electronics miniaturization, telecommunications, and automotive electrification. Product brochures reflect this divide: SageGlass and View highlight dynamic glazing for buildings; Gentex emphasizes auto-dimming mirrors and aerospace windows; SPD providers present switchable films; Celanese, Toray, Polyplastics, and Kuraray showcase LCP resins and compounds designed for electronic connectors, antennas, and medical devices. Together, these portfolios underline the dual growth trajectory of advanced smart glass and high-performance polymers in emerging applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.2 billion |

| Technology | Electrochromic materials, Liquid crystal polymers (LCP), Polymer dispersed liquid crystals (PDLC), Suspended particle devices (SPD), and Others |

| Application | Smart windows & glass, Electronic components, Displays & visual devices, Automotive components, Medical devices & equipment, Aerospace & defense applications, and Other |

| End Use Industry | Construction & architecture, Automotive & transportation, Electronics & telecommunications, Aerospace & defense, Healthcare & medical, Energy & power generation, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Saint-Gobain (SageGlass / Saint-Gobain group), AGC Inc., View, Inc., Gentex Corporation, Corning Incorporated, Research Frontiers / SPD providers, Celanese Corporation (LCP materials), Toray / Polyplastics / Kuraray (LCP suppliers), and Other regional / niche players |

| Additional Attributes | Dollar sales by product type (electrochromic glass, LCP sheets, LCP compounds), application (architectural, automotive, electronics, aerospace), and form factor (films, sheets, components). Demand is driven by energy efficiency, adaptive optical control, and high-performance material requirements. Regional trends indicate growth in North America, Europe, and Asia-Pacific, supported by smart building adoption, automotive electrification, and advanced electronics manufacturing. |

The global electrochromic and liquid crystal polymer market is estimated to be valued at USD 2.2 billion in 2025.

The market size for the electrochromic and liquid crystal polymer market is projected to reach USD 4.7 billion by 2035.

The electrochromic and liquid crystal polymer market is expected to grow at a 8.1% CAGR between 2025 and 2035.

The key product types in electrochromic and liquid crystal polymer market are electrochromic materials, inorganic electrochromic materials, and others.

In terms of application, smart windows & glass segment to command 52.0% share in the electrochromic and liquid crystal polymer market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electrochromic Materials Market Size and Share Forecast Outlook 2025 to 2035

Electrochromic Glass Market Analysis - Growth & Forecast 2025 to 2035

Electrochromic Glass and Devices Market Growth - Trends & Forecast 2025 to 2035

Automotive Electrochromic Rearview Modules Market Size and Share Forecast Outlook 2025 to 2035

Android Automotive OS (AAOS) Market Size and Share Forecast Outlook 2025 to 2035

Anderson Cascade Impactor Market Size and Share Forecast Outlook 2025 to 2035

Andersen-Tawil Syndrome Treatment Market Trends - Growth & Future Prospects 2025 to 2035

Andro Supplements Market

Handheld Ultrasound Scanner Market Size and Share Forecast Outlook 2025 to 2035

Handheld Tagging Gun Market Forecast and Outlook 2025 to 2035

Handheld Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

Sandwich Panel System Market Size and Share Forecast Outlook 2025 to 2035

Hand Tools Market Size and Share Forecast Outlook 2025 to 2035

Land Survey Equipment Market Size and Share Forecast Outlook 2025 to 2035

Handloom Product Market Size and Share Forecast Outlook 2025 to 2035

Band File Sander Belts Market Size and Share Forecast Outlook 2025 to 2035

Handheld XRF Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Sand Abrasion Tester Market Size and Share Forecast Outlook 2025 to 2035

Sand Testing Equipments Market Size and Share Forecast Outlook 2025 to 2035

Landscape Lighting Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA