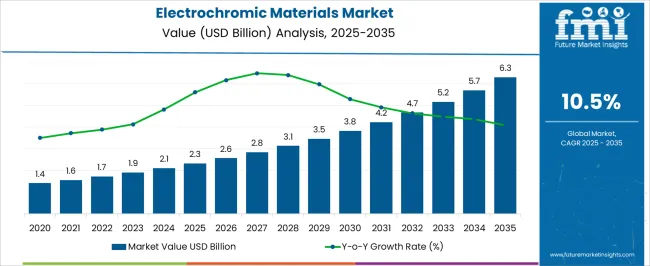

The electrochromic materials sector is expected to expand from USD 2.3 billion in 2025 to USD 6.3 billion by 2035, reflecting a CAGR of 10.5%, offering a strong absolute dollar opportunity. In 2025, the market size of USD 2.3 billion indicates substantial room for revenue growth across segments like smart glazing, displays, and automotive applications. Over the decade, this growth represents an incremental opportunity of around USD 4 billion, allowing companies to scale production, capture market share, and strengthen their position as demand steadily rises year over year. By 2035, the electrochromic materials market is estimated to reach USD 6.3 billion, translating the consistent 10.5% CAGR into a tangible absolute dollar increase of roughly USD 4 billion from 2025 levels. The yearly progression from USD 2.3 billion to USD 6.3 billion highlights a sustained growth trajectory, enabling manufacturers and investors to leverage rising adoption rates. Early market entry can secure long-term revenue streams, while incremental gains each year strengthen financial prospects across the supply chain and downstream applications.

| Metric | Value |

|---|---|

| Electrochromic Materials Market Estimated Value in (2025 E) | USD 2.3 billion |

| Electrochromic Materials Market Forecast Value in (2035 F) | USD 6.3 billion |

| Forecast CAGR (2025 to 2035) | 10.5% |

A breakpoint analysis of the electrochromic materials market highlights key stages of growth between 2025 and 2035, emphasizing periods of accelerated opportunity. The market, starting at USD 2.3 billion in 2025, reaches USD 3.5 billion by 2030, marking the first significant breakpoint where the market crosses the USD 3 billion threshold. This period represents an absolute dollar growth of USD 1.2 billion over five years, indicating early adoption and gradual penetration across building, automotive, and display applications. Companies that establish a presence during this phase can capture early contracts and position themselves for long-term expansion. The second breakpoint occurs around 2033–2035, when the market approaches USD 6.3 billion. Growth during this period accelerates due to cumulative adoption and scaling effects, adding approximately USD 2.8 billion in absolute terms from the 2030 baseline. This stage offers the largest incremental dollar opportunity within the decade, highlighting a peak in investment and production potential. Strategic alignment with high-demand segments during this window can yield maximum returns. Overall, the breakpoint analysis illustrates two critical phases: an early-stage growth window between 2025–2030 and a high-expansion phase between 2030–2035, providing clear guidance on timing investment, production capacity expansion, and market entry to optimize absolute dollar gains.

The Electrochromic Materials market is experiencing sustained growth, supported by increasing demand for energy-efficient glazing solutions and advancements in adaptive material technologies. Widespread adoption of smart glass in architectural, automotive, and consumer electronics applications is enhancing the relevance of electrochromic systems. The ability of these materials to dynamically control light transmission is being leveraged to reduce energy consumption, improve occupant comfort, and support modern aesthetic requirements.

Investments in manufacturing process optimization, along with the development of scalable and cost-effective production techniques, are expanding the accessibility of electrochromic products. Regulatory initiatives promoting green building standards and sustainable construction practices are also influencing market expansion.

As material innovations enhance durability, switching speed, and color range, electrochromic technology is becoming increasingly attractive for diverse end-use sectors The ongoing integration of these materials into smart infrastructure projects and connected systems is expected to further accelerate market adoption, ensuring a strong trajectory for future growth.

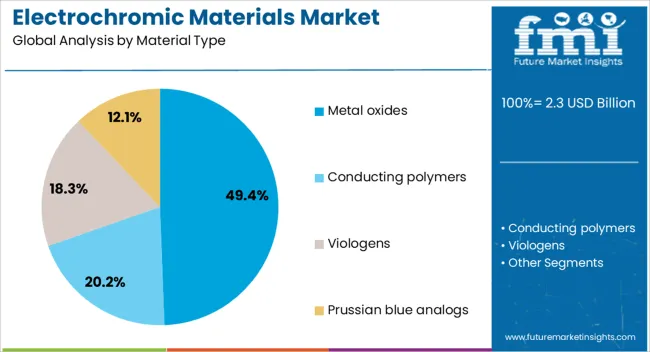

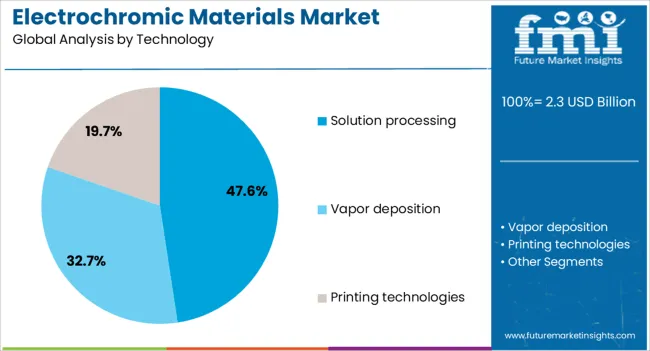

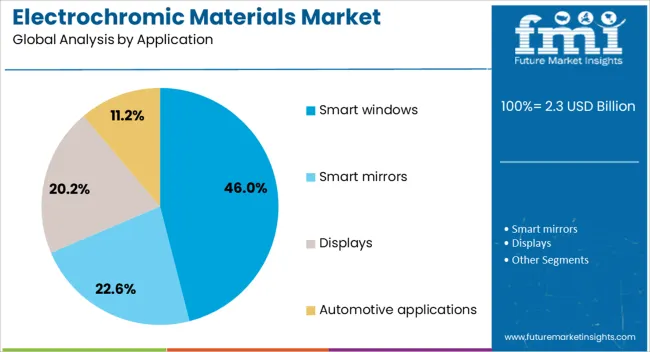

The electrochromic materials market is segmented by material type, technology, application, end use industry, and geographic regions. By material type, electrochromic materials market is divided into Metal oxides, Conducting polymers, Viologens, Prussian blue analogs, Liquid crystals, Hybrid & composite materials, and Other electrochromic materials. In terms of technology, electrochromic materials market is classified into Solution processing, Vapor deposition, Printing technologies, and Other technologies. Based on application, electrochromic materials market is segmented into Smart windows, Smart mirrors, Displays, Automotive applications, Aerospace applications, Wearable devices, Energy storage devices, and Other applications. By end use industry, electrochromic materials market is segmented into Construction & architecture, Automotive & transportation, Aerospace & defense, Electronics & displays, Marine, Healthcare & medical, and Other end-use industries. Regionally, the electrochromic materials industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The metal oxides segment is projected to hold 49.40% of the Electrochromic Materials market revenue share in 2025, positioning it as the leading material type. This dominance has been driven by the superior electrochemical stability and optical performance of metal oxides, which ensure consistent switching between transparent and opaque states over extended lifecycles.

Their compatibility with a variety of substrates and integration into large-area glazing systems has enhanced their adoption in both architectural and automotive applications. The segment has also benefited from significant advancements in thin-film deposition techniques, enabling uniform coatings that enhance energy efficiency.

The proven reliability and low maintenance requirements of metal oxide-based electrochromic layers have strengthened their appeal for commercial and residential projects As manufacturers focus on improving switching speed and coloration efficiency, metal oxides are expected to maintain their competitive edge, securing continued demand in energy-conscious markets.

The solution processing segment is anticipated to account for 47.60% of the Electrochromic Materials market revenue share in 2025, making it the leading technology. Growth in this segment has been supported by its cost-effectiveness, scalability, and suitability for large-area manufacturing. The ability to deposit electrochromic layers using solution-based techniques allows for reduced production costs and easier integration into flexible substrates.

This approach has been widely adopted by manufacturers aiming to meet the increasing demand for smart glass in high-volume applications. Enhanced process control and advancements in printable formulations have further improved product quality and uniformity.

The reduced material wastage and compatibility with roll-to-roll manufacturing make solution processing particularly attractive for large-scale projects As the industry seeks to balance performance with cost efficiency, solution processing is expected to remain a preferred technology pathway for the mass production of electrochromic devices.

The smart windows segment is expected to hold 46.00% of the Electrochromic Materials market revenue share in 2025, establishing itself as the dominant application. This leadership position has been influenced by the growing adoption of energy-efficient building designs and the increasing focus on occupant comfort and privacy.

Smart windows utilizing electrochromic materials enable dynamic control of natural light and solar heat gain, contributing to reduced reliance on artificial lighting and HVAC systems. Their integration into commercial buildings, residential projects, and transportation has been facilitated by advancements in durability, switching performance, and design versatility.

The segment’s growth has also been reinforced by supportive government policies promoting sustainable construction and the deployment of green technologies As urban development accelerates and energy regulations become more stringent, smart windows are expected to remain a key driver of electrochromic material demand.

The electrochromic materials market is expanding as industries adopt smart glass and dynamic surfaces for applications in architecture, automotive, aerospace, and consumer electronics. Electrochromic materials enable variable light transmission and color change when an electric charge is applied, improving energy efficiency, comfort, and aesthetics. Growing demand for green buildings, advanced vehicle designs, and energy-saving technologies is fueling adoption. Rapid innovation in materials such as tungsten oxide, nickel oxide, and conductive polymers is enhancing durability and switching speed. Companies integrating electrochromic solutions into windows, mirrors, and displays are capturing new opportunities as sustainability and smart technology trends gain global momentum.

The electrochromic materials market faces challenges related to high production costs, durability, and scalability. Manufacturing electrochromic devices requires specialized deposition techniques, advanced materials, and precision engineering, which increase overall costs. Limited durability under prolonged cycling or exposure to harsh environments can reduce product reliability and lifespan, especially in outdoor or automotive applications. Achieving uniform switching speed, color consistency, and optical clarity across large surfaces remains a technical hurdle. Recycling and disposal of electrochromic materials also present environmental and regulatory concerns. To overcome these challenges, manufacturers must focus on process optimization, material innovation, and large-scale production methods that lower costs while maintaining performance, reliability, and environmental compliance.

The market is trending toward smart glass integration in buildings, vehicles, and consumer products, driven by sustainability and design innovation. Electrochromic windows are gaining adoption in commercial and residential buildings to reduce heating and cooling costs while enhancing occupant comfort. Automotive manufacturers are integrating electrochromic materials in rear-view mirrors, sunroofs, and side windows for improved safety and luxury features. Advances in conductive polymers, nanostructured materials, and hybrid coatings are enhancing switching speed, color tunability, and energy efficiency. Consumer electronics and wearables are emerging as new application areas with lightweight, flexible electrochromic films. Partnerships between research institutions, glass manufacturers, and technology providers are accelerating innovation, making smart and dynamic surfaces a mainstream trend.

Electrochromic materials present significant opportunities in green building projects, automotive advancements, and aerospace applications. The construction industry is adopting electrochromic windows to support energy-efficient building certifications and reduce long-term operational costs. In the automotive sector, demand for luxury features, safety improvements, and energy efficiency is driving integration into sunroofs, windows, and mirrors. Aerospace applications, including aircraft cabin windows, benefit from electrochromic materials that reduce glare and improve passenger comfort. Emerging opportunities also lie in consumer electronics, where flexible displays and dynamic surfaces are gaining attention. Companies investing in scalable production, durable material formulations, and cross-industry partnerships can unlock substantial growth opportunities across these diverse sectors.

Market growth for electrochromic materials is restrained by regulatory hurdles, limited consumer awareness, and adoption barriers. Building codes, automotive safety standards, and certification processes vary across regions, creating complexities for manufacturers. Lack of awareness among consumers and end-users about the energy-saving benefits of electrochromic materials can slow adoption outside premium markets. High upfront installation costs further discourage widespread use in price-sensitive sectors, despite long-term savings. Competition from alternative smart glass technologies, such as liquid crystal and suspended particle devices, also limits market penetration. Until awareness campaigns, cost reductions, and regulatory alignment are achieved, adoption of electrochromic materials will remain gradual in mainstream applications.

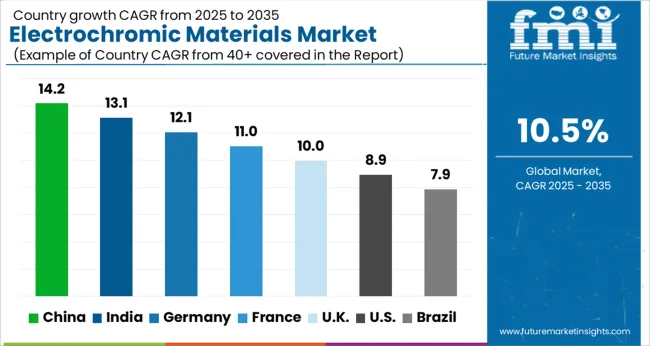

| Country | CAGR |

|---|---|

| China | 14.2% |

| India | 13.1% |

| Germany | 12.1% |

| France | 11.0% |

| UK | 10.0% |

| USA | 8.9% |

| Brazil | 7.9% |

The global electrochromic materials market is projected to grow at a CAGR of 10.5% through 2035, supported by increasing demand across smart windows, automotive, and consumer electronics applications. Among BRICS nations, China has been recorded with 14.2% growth, driven by large-scale production and deployment in smart glass and automotive applications, while India has been observed at 13.1%, supported by rising utilization in energy-efficient buildings and consumer electronics. In the OECD region, Germany has been measured at 12.1%, where production and adoption for automotive, architectural, and industrial applications have been steadily maintained. The United Kingdom has been noted at 10.0%, reflecting consistent use in smart windows and consumer electronics, while the USA has been recorded at 8.9%, with production and utilization across automotive, architectural, and electronics sectors being steadily increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The electrochromic materials market in China is expanding at a CAGR of 10.5%, driven by increasing demand in smart windows, automotive applications, and energy efficient building solutions. Manufacturers are focusing on developing high performance electrochromic coatings, films, and glass that allow adjustable transparency for light and heat control. Government initiatives promoting green building standards, energy efficiency, and carbon reduction are accelerating adoption. R&D efforts are targeting improved switching speed, durability, and optical performance. Pilot projects in commercial and residential smart buildings, automotive glazing, and facade applications demonstrate operational benefits such as energy savings and enhanced occupant comfort. Collaborations between universities, research institutes, and industrial firms are advancing material innovation and cost reduction. Rising awareness of sustainable solutions and regulatory support continue to drive steady growth in China’s electrochromic materials market.

Electrochromic materials market in India is growing at a CAGR of 10.5%, fueled by increasing construction of commercial and residential buildings and automotive glazing applications. Electrochromic films and coatings are being adopted to enhance energy efficiency, comfort, and aesthetic appeal. Manufacturers and startups are investing in advanced materials, high durability coatings, and scalable production methods. Government programs promoting energy efficient buildings, green architecture, and carbon reduction initiatives are supporting market adoption. Pilot projects in office buildings, luxury residential complexes, and automotive glazing validate practical benefits, including lower energy consumption and improved occupant comfort. Collaborations with research institutions and material science laboratories are advancing optical performance, switching speed, and cost effectiveness. Rising consumer awareness of eco-efficient solutions is expected to further accelerate growth across India’s electrochromic materials market.

Electrochromic materials market in Germany is recording a CAGR of 12.1%, supported by strong focus on energy efficient buildings, smart glazing technologies, and sustainable automotive solutions. Electrochromic coatings, films, and glass are increasingly used in commercial and residential buildings to reduce energy consumption while enhancing occupant comfort. Manufacturers are investing in high performance materials with improved switching speed, optical clarity, and long-term durability. Government incentives and building regulations promoting green construction, low energy buildings, and renewable energy integration are driving adoption. Pilot projects in office buildings, smart facades, and automotive glazing demonstrate operational benefits. Collaborations between research institutes, industrial firms, and universities are advancing R&D on materials, coatings, and production technologies. Germany’s focus on energy efficiency and sustainability continues to drive strong market growth.

The United Kingdom is experiencing a CAGR of 10.0% in the electrochromic materials market, driven by applications in smart windows, automotive glazing, and energy efficient buildings. Manufacturers are developing durable electrochromic coatings and films with improved optical performance and switching efficiency. Government initiatives promoting green building standards, energy savings, and carbon reduction are supporting market adoption. Pilot projects in commercial buildings, residential complexes, and automotive prototypes demonstrate operational benefits such as energy reduction and enhanced comfort. Collaborations between universities, research organizations, and industrial partners are enhancing material innovation, durability, and cost effectiveness. Increasing environmental awareness and demand for sustainable technologies are expected to continue driving steady growth across the UK electrochromic materials market.

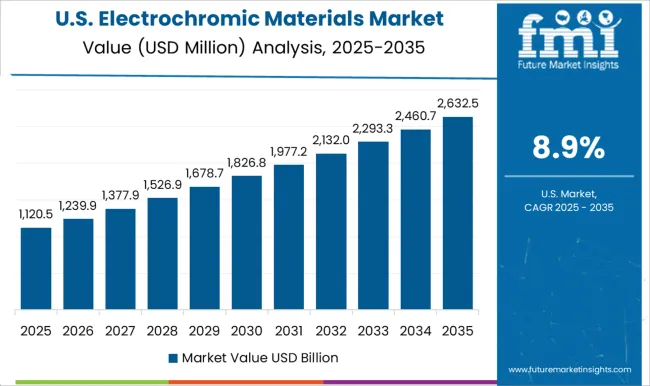

The United States electrochromic materials market is growing at a CAGR of 8.9%, supported by demand in smart glazing, energy efficient building solutions, and automotive applications. Electrochromic coatings, films, and glass are widely adopted in commercial and residential buildings to control heat and light while reducing energy consumption. Manufacturers are focusing on high durability, optical performance, and faster switching speeds. Pilot projects in office buildings, residential complexes, and automotive glazing highlight operational benefits such as energy savings and occupant comfort. Research collaborations with universities, material science institutes, and industrial firms are advancing innovative materials, production technologies, and cost reduction. Increasing regulatory pressure on energy efficiency and growing consumer preference for sustainable solutions continue to drive adoption in the USA market.

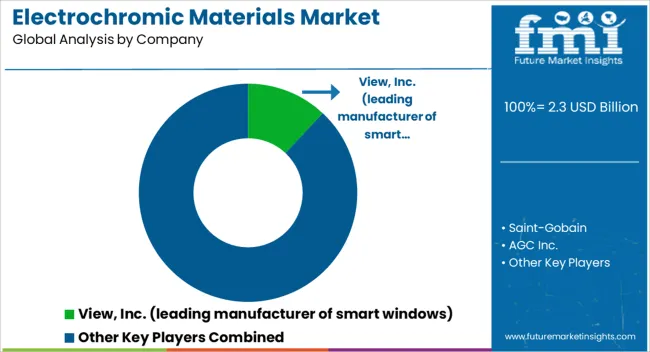

The electrochromic materials market is highly competitive, driven by manufacturers of smart windows and adaptive glazing solutions. View, Inc. is positioned as a market leader, offering integrated electrochromic glass systems for commercial and residential buildings, with products promoted for energy efficiency, glare reduction, and occupant comfort. Saint-Gobain competes with architectural and automotive glass solutions incorporating electrochromic layers, with brochures highlighting durability, clarity, and solar control. AGC Inc. emphasizes scalable manufacturing and versatile glass solutions, with technical literature showcasing energy savings and customizable tint ranges.

Gentex Corporation offers automotive-focused smart glass products, with brochures emphasizing rapid switching times, safety compliance, and integration with vehicle electronics. Guardian and Guardian Glass provide architectural glazing solutions with embedded electrochromic technology, while ChromoGenics / Chromogenics AB focuses on retrofit and modular smart window products.

Kinestral Technologies and Sage Electrochromics deliver energy-efficient glazing with customizable control systems, targeting both commercial and residential segments. Research Frontiers licenses electrochromic coatings for multiple OEM applications, while other players such as PPG, Merck, and Fuyao contribute specialty materials and coatings for smart glass integration.

| Item | Value |

|---|---|

| Quantitative Units | USD Billion |

| Material Type | Metal oxides, Conducting polymers, Viologens, Prussian blue analogs, Liquid crystals, Hybrid & composite materials, and Other electrochromic materials |

| Technology | Solution processing, Vapor deposition, Printing technologies, and Other technologies |

| Application | Smart windows, Smart mirrors, Displays, Automotive applications, Aerospace applications, Wearable devices, Energy storage devices, and Other applications |

| End Use Industry | Construction & architecture, Automotive & transportation, Aerospace & defense, Electronics & displays, Marine, Healthcare & medical, and Other end-use industries |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | View, Inc. (leading manufacturer of smart windows), Saint-Gobain, AGC Inc., Gentex Corporation, Guardian / Guardian Glass, ChromoGenics / Chromogenics AB, Kinestral Technologies, Sage Electrochromics / SAGE, Research Frontiers, and [Other listed players: PPG, Merck, Fuyao, etc.] |

| Additional Attributes | Dollar sales vary by material type, including transition metal oxides, conducting polymers, nanocrystals, and viologens; by application, such as smart windows, automotive mirrors, displays, and eyewear; by end-use industry, spanning construction, automotive, aerospace, and consumer electronics; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by demand for energy-efficient smart glass, sustainable building solutions, and advancements in electrochromic technology. |

The global electrochromic materials market is estimated to be valued at USD 2.3 billion in 2025.

The market size for the electrochromic materials market is projected to reach USD 6.3 billion by 2035.

The electrochromic materials market is expected to grow at a 10.5% CAGR between 2025 and 2035.

The key product types in electrochromic materials market are metal oxides, _tungsten oxide (wo₃), _nickel oxide (nio), _titanium dioxide (tio₂), _vanadium pentoxide (v₂o₅), _molybdenum oxide (moo₃), _other metal oxides, conducting polymers, _polyaniline (pani), _polypyrrole (ppy), _poly(3,4-ethylenedioxythiophene) (pedot), _other conducting polymers, viologens, prussian blue analogs, liquid crystals, hybrid & composite materials and other electrochromic materials.

In terms of technology, solution processing segment to command 47.6% share in the electrochromic materials market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electrochromic and Liquid Crystal Polymer Market Size and Share Forecast Outlook 2025 to 2035

Electrochromic Glass and Devices Market Growth - Trends & Forecast 2025 to 2035

Electrochromic Glass Market Analysis - Growth & Forecast 2025 to 2035

Automotive Electrochromic Rearview Modules Market Size and Share Forecast Outlook 2025 to 2035

Nanomaterials Market Insights - Size, Share & Industry Growth 2025 to 2035

Tire Materials Market Insights – Size, Trends & Forecast 2025–2035

Facade Materials Market Size and Share Forecast Outlook 2025 to 2035

Solder Materials Market Size and Share Forecast Outlook 2025 to 2035

Sheath Materials Market Size and Share Forecast Outlook 2025 to 2035

Exosuit Materials Market Size and Share Forecast Outlook 2025 to 2035

Stealth Materials and Coatings Market Size and Share Forecast Outlook 2025 to 2035

Battery Materials Recycling Market Size and Share Forecast Outlook 2025 to 2035

Battery Materials Market: Growth, Trends, and Future Opportunities

Optical Materials Market - Trends & Forecast 2025 to 2035

Circuit Materials Market Analysis based on Substrate, Conducting Material, Outer Layer, Application, and Region: Forecast for 2025 and 2035

Building Materials Market Size and Share Forecast Outlook 2025 to 2035

Recycled Materials Packaging Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Materials Market Growth - Trends & Forecast 2025 to 2035

Fluoride Materials Market

Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA