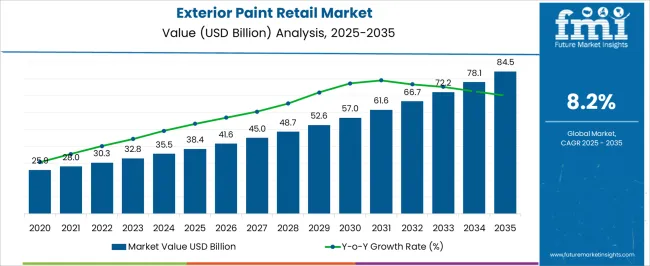

The exterior paint retail market is estimated to be valued at USD 38.4 billion in 2025 and is projected to reach USD 84.5 billion by 2035, registering a compound annual growth rate (CAGR) of 8.2% over the forecast period. Early growth from 2025 to 2029 shows strong year-over-year expansion as the market rises from USD 38.4 to USD 45.0 billion, reflecting high consumer demand, increased construction activity, and product innovation across finishes and weather-resistant formulations.

Between 2030 and 2032, the pace moderates as values move from USD 48.7 to USD 61.6 billion, signaling that large-scale adoption and competitive pricing begin to limit outsized gains. Beyond 2033, growth slows further, moving steadily to USD 84.5 billion in 2035, marking a saturation stage where incremental expansion is less dependent on volume and more tied to premiumization and replacement cycles. The saturation point is shaped by a combination of widespread adoption, mature distribution channels, and brand consolidation, creating fewer opportunities for disruptive volume growth. Companies are expected to rely on differentiated offerings such as UV-resistant coatings, eco-friendly formulas, and extended durability to capture consumer preference. While the trajectory remains positive, the market’s expansion curve clearly bends toward stabilization, reflecting the balance between mature demand and emerging niches.

| Metric | Value |

|---|---|

| Exterior Paint Retail Market Estimated Value in (2025 E) | USD 38.4 billion |

| Exterior Paint Retail Market Forecast Value in (2035 F) | USD 84.5 billion |

| Forecast CAGR (2025 to 2035) | 8.2% |

The exterior paint retail market is supported by several parent markets that together shape its demand and expansion across residential, commercial, and industrial applications. The paints and coatings market plays the most dominant role, with exterior paints accounting for nearly 25-30% of the share. As a critical sub-segment of paints and coatings, exterior paints are widely used to provide protective and decorative finishes for buildings, infrastructure, and outdoor structures. The construction and building materials market contributes around 18-20% to the exterior paint retail segment. The demand is strongly tied to ongoing residential, commercial, and industrial projects where exterior coatings are required for durability, weather resistance, and overall aesthetics, making it a crucial driver of retail sales.

The retail and distribution market accounts for approximately 12-15% of the share, as exterior paints are primarily distributed through hardware stores, paint specialty outlets, and large home improvement centers. These channels make exterior paints accessible to both contractors and consumers. The home improvement market further supports the retail sector, contributing about 10-12%. Renovations, remodeling projects, and the growing do-it-yourself (DIY) trend encourage consumers to purchase exterior paints for upgrading and maintaining their properties, directly boosting retail demand.

The Exterior Paint Retail Market is experiencing sustained expansion, supported by rising construction activity, renovation projects, and growing consumer awareness regarding long-term protection and aesthetic enhancement of building exteriors. A shift toward environmentally responsible and high-performance products is shaping the market, with increasing preference for low-VOC, weather-resistant, and durable coatings. Rapid urbanization, coupled with infrastructure development in emerging economies, has further boosted retail demand.

Innovation in color technology, surface adhesion, and protective features has allowed manufacturers to meet both functional and decorative needs. Retail channels have benefited from strong brand competition, expanded product assortments, and improved consumer guidance at point-of-sale, enhancing purchase confidence. The integration of digital color visualization tools and e-commerce platforms is also influencing buying patterns.

As climate-related challenges demand more resilient materials, products that combine sustainability with superior performance are expected to dominate retail shelves Strategic collaborations between paint manufacturers and retail distributors continue to ensure wide market coverage and steady future growth.

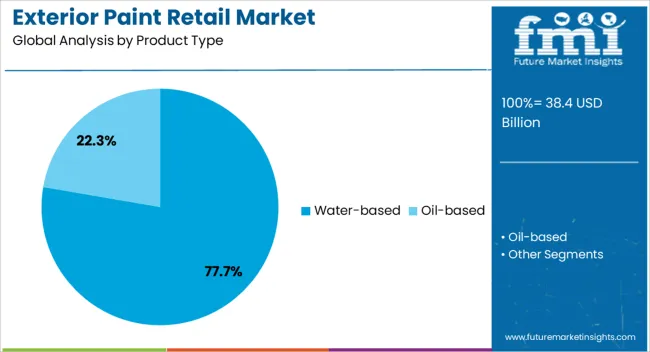

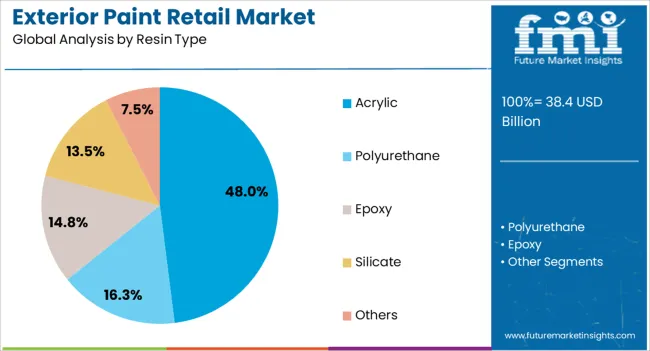

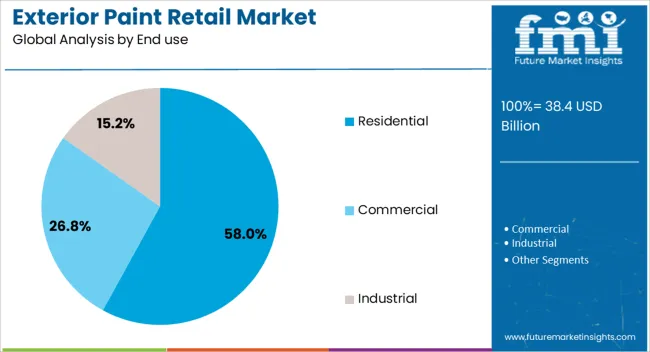

The exterior paint retail market is segmented by product type, resin type, end use, and geographic regions. By product type, exterior paint retail market is divided into Water-based and Oil-based. In terms of resin type, exterior paint retail market is classified into Acrylic, Polyurethane, Epoxy, Silicate, and Others. Based on end use, exterior paint retail market is segmented into Residential, Commercial, and Industrial. Regionally, the exterior paint retail industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The water-based segment is projected to account for 77.70% of the Exterior Paint Retail Market revenue share in 2025, making it the leading product type. This dominance has been attributed to its eco-friendly formulation, low odor, and reduced volatile organic compound content, which meet increasingly stringent environmental regulations. The segment has benefited from advancements in water-based paint technology, enabling superior adhesion, weather resistance, and color retention.

Consumer preference has shifted toward products that provide both aesthetic appeal and ease of application, and water-based paints deliver on these expectations while ensuring faster drying times. Retail adoption has been reinforced by growing awareness of indoor and outdoor air quality, influencing consumer choice toward safer coating solutions.

Additionally, compatibility with various exterior substrates and improved durability in harsh climates have positioned water-based paints as the preferred option for residential and commercial projects. The combination of environmental benefits, performance enhancements, and regulatory compliance has solidified this segment’s leadership in the market.

The acrylic segment is expected to hold 48% of the Exterior Paint Retail Market revenue share in 2025, emerging as the dominant resin type. Its leadership has been reinforced by the versatility and durability of acrylic formulations, which deliver superior color retention, UV resistance, and protection against moisture and cracking. Acrylic resins have been widely adopted in exterior applications due to their ability to withstand fluctuating weather conditions without compromising performance.

The segment has also gained from continuous improvements in resin chemistry, which have enhanced adhesion and finish quality while allowing for a broader range of color options. Retailers have favored acrylic-based paints for their extended shelf life, ease of application, and consumer satisfaction rates.

In addition, growing demand for high-performance, low-maintenance coatings in both urban and rural areas has sustained the segment’s growth. As consumer focus remains on long-term value and exterior durability, acrylic resins are set to retain their dominant position in the market.

The residential segment is projected to capture 58% of the Exterior Paint Retail Market revenue share in 2025, making it the leading end-use category. Its dominance is driven by steady growth in new housing developments, renovation projects, and homeowner investments in exterior aesthetics and property protection. Rising disposable incomes and lifestyle upgrades have encouraged greater spending on premium paint finishes that enhance curb appeal and longevity.

The segment’s growth has also been reinforced by the adoption of sustainable and low-maintenance coating solutions that meet modern environmental and performance standards. Retail channels catering to the residential sector have expanded product offerings, color ranges, and professional advisory services to attract a broad consumer base.

Seasonal repainting trends, coupled with marketing campaigns emphasizing home value enhancement, have further propelled demand. With the integration of smart color selection tools and tailored paint packages for specific climates, the residential category is positioned to maintain its leading role in the market.

The exterior paint retail sector is on a robust growth path, propelled by rising construction activities and an uptick in home renovation projects across both developed and emerging regions. Consumers and contractors alike are fueling demand for high-performance coatings that balance aesthetics, UV protection, weather resistance, and durability. Retailers are adapting by stocking formulations like acrylic-based paints and waterborne emulsions that align with preferences for low-odor and fast-drying options. Growth is particularly strong in expanding homeownership areas and regions undergoing urban development, where the demand for both new builds and repainting cycles continues to rise.

High volatility in raw material costs, especially for pigments, resins, and additives, continues to strain manufacturer margins and retail pricing strategies. The regulatory environment has become more complex, with stringent building codes and stricter VOC limits requiring frequent adjustments to paint formulations and labels. For retail businesses, staying compliant means investing in updated packaging and thorough documentation, adding operational burdens. Supply chain disruptions, whether due to logistics challenges or trade shifts, further complicate inventory management and result in delayed product availability. In some markets, new competitors offering deeply discounted products are applying pressure on established brands, squeezing profitability and forcing strategic reevaluations. Together, these pressures pose significant hurdles to consistent market performance and long-term planning.

The market is being driven by several intersecting forces: the boom in home improvements, growing consumer interest in DIY projects, and increased demand for weather-resistant paint solutions. As consumers spend more on enhancing curb appeal and maintaining exterior assets, demand continues to climb. Innovations like self-cleaning, heat-reflective, and mold-resistant coatings offer new appeal to homeowners looking for long-lasting and low-maintenance finishes. Retailers are responding with expanded product lines, improved in-store services, and digital tools like virtual color previews to enhance the shopping experience. In emerging economies, infrastructure development and housing growth are also helping to fuel the market. Altogether, these dynamics are elevating demand for exterior paints that blend performance, convenience, and ease of use.

Strong opportunities are emerging in several areas. The rising appeal of digitally printed and personalized packaging enables paint brands to offer tailored color selections and limited-edition collections an increasingly popular trend among style-conscious consumers. Retailers serving emerging markets are seeing expanding business thanks to urbanization and rising disposable incomes, particularly in Asia-Pacific and Latin America. Demand for protective coatings in coastal and harsh-weather regions opens doors for advanced formulations like UV-stable and salt-resistant paints. Companies providing modular packaging solutions such as smaller paint cans and easy-to-transport options gain traction where space or logistics are constraints. E-commerce platforms offering convenient delivery and live virtual assistance are further widening market reach beyond traditional brick-and-mortar channels.

Digital color-selection tools, such as augmented reality for home visualization, are enriching customer experiences and helping close sales. Paints with enhanced functional properties like rapid drying, microbicidal resistance, and temperature reflectance are drawing interest from both consumers and commercial users. The growing focus on packaging reusability and refill systems is gaining traction among eco-minded shoppers. Retailers are also enhancing omnichannel strategies, combining online platforms with in-store services, like custom tinting and DIY tutorials, to serve both professional users and hobbyists better. Additionally, the deployment of mobile tinting units and express services is appealing to those seeking quick, on-site paint solutions.

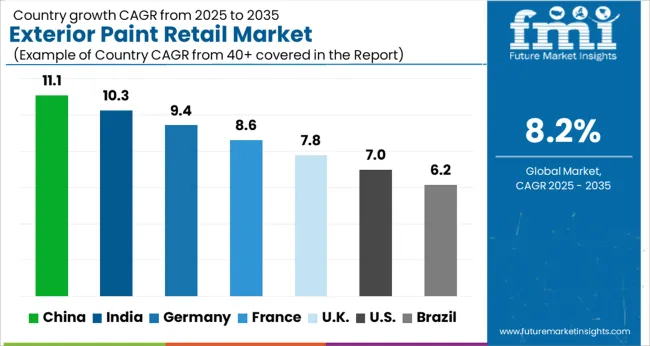

| Countries | CAGR |

|---|---|

| China | 11.1% |

| India | 10.3% |

| Germany | 9.4% |

| France | 8.6% |

| UK | 7.8% |

| USA | 7.0% |

| Brazil | 6.2% |

The global exterior paint retail market is projected to grow at a CAGR of 8.2% from 2025 to 2035. China leads with a growth rate of 11.1%, followed by India at 10.3% and France at 8.6%. The United Kingdom and the United States post more moderate growth at 7.8% and 7.0%, respectively. The market is being fueled by robust demand for decorative and durable exterior paints, expanding retail channels, and increasing consumer focus on aesthetics and long-term building maintenance. DIY culture, seasonal repainting trends, and the rise of online retail platforms are further boosting growth across all major region The analysis spans over 40+ countries, with the leading markets shown below.

China is expected to dominate the exterior paint retail market with a CAGR of 11.1% between 2025 and 2035. The demand is driven by rapid growth in construction activities across both residential and commercial sectors. Rising disposable incomes and urban development projects are fueling increased spending on decorative paints, particularly in exterior applications. The retail landscape in China is also undergoing transformation, with e-commerce platforms and specialized paint outlets providing easy access to a wide range of premium paint products. International and domestic brands are investing heavily in marketing campaigns, product innovation, and distribution networks to capture the growing demand.

The exterior paint retail market in India is projected to grow at a CAGR of 10.3% from 2025 to 2035. The country is witnessing strong demand from rising infrastructure development, housing projects, and modernization of urban centers. Increased disposable incomes and changing lifestyle preferences are encouraging consumers to invest in decorative paints with enhanced durability and aesthetic appeal. Organized retail networks and online platforms are making branded paints more accessible to both urban and semi-urban customers. Seasonal repainting demand during festive and wedding periods also adds to the retail market’s strength.

France is expected to grow at a CAGR of 8.6% in the exterior paint retail market from 2025 to 2035. The demand is primarily driven by the renovation and refurbishment of existing buildings alongside steady new construction activity. French consumers value quality and aesthetics, which supports the demand for premium exterior paint solutions. The strong presence of DIY culture in France is also boosting sales through retail outlets as homeowners increasingly take on repainting projects themselves. Retailers are enhancing customer engagement by offering personalized color selection tools and in-store digital services. The market also benefits from government-backed initiatives that encourage the modernization of building exteriors, indirectly supporting retail paint sales.

The United Kingdom’s exterior paint retail market is forecasted to grow at a CAGR of 7.8% from 2025 to 2035. Rising demand for decorative and protective paints in both residential and commercial buildings is shaping the market outlook. Home improvement trends, spurred by changing consumer preferences, are creating strong demand for premium quality paints. The retail environment is evolving, with paint specialty stores and e-commerce platforms offering competitive pricing and wide product variety. Seasonal promotions and bundled offers by retailers are encouraging higher sales volumes. The trend of do-it-yourself projects among households continues to boost the sales of exterior paints through retail channels.

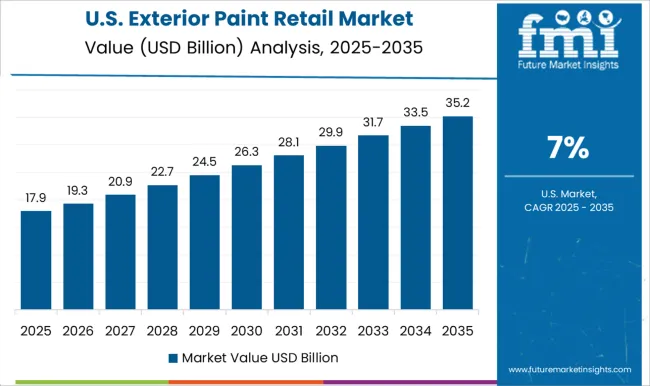

The USA exterior paint retail market is projected to expand at a CAGR of 7.0% from 2025 to 2035. Demand is supported by residential construction, commercial development, and the growing trend of renovation and remodeling projects. Consumers are showing increased preference for high-performance paints that provide durability and weather resistance, fueling retail sales. Major retail chains and home improvement stores dominate the distribution landscape, while online platforms are becoming an important channel for reaching broader audiences. Competitive pricing strategies and product innovation by leading brands also play a significant role in driving retail market growth. Seasonal repainting cycles and homeowner associations’ standards contribute to steady and recurring demand.

Competition in the exterior paint retail market is intense, with leading players differentiating through distribution strength, product innovation, and regional dominance. The Sherwin-Williams Company secures market presence through its expansive retail network and professional contractor channels, offering exterior coatings that emphasize weather resistance, UV protection, and long-lasting finish. PPG Industries competes with a broad portfolio spanning decorative and industrial coatings, leveraging advanced formulations tailored to specific climates and applications.

AkzoNobel showcases premium exterior paints under well-known brands, emphasizing color durability and high performance across various surfaces. Nippon Paint positions itself with technology-driven exterior solutions that emphasize ease of application and adaptability to regional conditions. Asian Paints maintains a strong footprint in fast-growing markets, combining affordability with consistent quality, making it a preferred choice in both urban and semi-urban areas. Strategic focus among these companies rests on expanding retail accessibility, strengthening partnerships with contractors, and scaling premium product lines. Sherwin-Williams invests in brand extensions and high-performance product categories to consolidate leadership.

PPG emphasizes R&D to deliver coatings engineered for energy efficiency and enhanced durability. AkzoNobel reinforces premium branding while expanding in high-growth geographies. Nippon Paint advances with localized product strategies and investments in eco-compliant formulations. Asian Paints pursues volume growth supported by a robust distribution network and targeted marketing across diverse customer segments. Product brochures underline clear strengths: Sherwin-Williams showcases exterior paints with fade resistance and protective finishes, PPG emphasizes weatherproof coatings with broad color ranges, AkzoNobel highlights premium decorative paints, Nippon Paint presents specialized exterior solutions for varied climates, and Asian Paints details value-driven yet high-quality finishes that appeal to mass consumers.

| Item | Value |

|---|---|

| Quantitative Units | USD 38.4 Billion |

| Product Type | Water-based and Oil-based |

| Resin Type | Acrylic, Polyurethane, Epoxy, Silicate, and Others |

| End use | Residential, Commercial, and Industrial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | The Sherwin-Williams Co., PPG Industries, AkzoNobel, Nippon Paint, Asian Paints, and Others |

| Additional Attributes | Dollar sales by product type (latex, acrylic, enamel), finish (matte, gloss, satin), and packaging size (small, medium, large). Demand dynamics are driven by urban construction activity, DIY trends, and consumer preference for durable and weather-resistant coatings. Regional trends indicate strong growth in North America, Europe, and Asia-Pacific, supported by retail expansion, promotional initiatives, and the increasing popularity of premium and eco-friendly exterior paints. |

The global exterior paint retail market is estimated to be valued at USD 38.4 billion in 2025.

The market size for the exterior paint retail market is projected to reach USD 84.5 billion by 2035.

The exterior paint retail market is expected to grow at a 8.2% CAGR between 2025 and 2035.

The key product types in exterior paint retail market are water-based and oil-based.

In terms of resin type, acrylic segment to command 48.0% share in the exterior paint retail market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Exterior Polyurethane Varnish Market Size and Share Forecast Outlook 2025 to 2035

Exterior Insulation and Finish Systems (EIFS) Market Analysis by Product Type, Insulation Material, End User, and Region through 2035

Aircraft Exterior Lighting Market Growth - Trends & Forecast 2025 to 2035

Demand for Exterior Polyurethane Varnish in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Exterior Polyurethane Varnish in UK Size and Share Forecast Outlook 2025 to 2035

Automotive Exterior Trim Parts Market Growth - Trends & Forecast 2025 to 2035

Automotive Decorative Exterior Trim Market Size and Share Forecast Outlook 2025 to 2035

Paint Cans Market Size and Share Forecast Outlook 2025 to 2035

Painting Robots Market Size and Share Forecast Outlook 2025 to 2035

Paint Curing Lamp Market Size and Share Forecast Outlook 2025 to 2035

Paint Booth Market Size and Share Forecast Outlook 2025 to 2035

Painting Tool Market Size and Share Forecast Outlook 2025 to 2035

Paint Rollers Market Size and Share Forecast Outlook 2025 to 2035

Paint Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Paint Tester Market Size and Share Forecast Outlook 2025 to 2035

Paint Knife Market Size and Share Forecast Outlook 2025 to 2035

Paint Buckets Market Size, Share & Forecast 2025 to 2035

Paint Mixing Market Analysis - Size, Share, and Forecast Outlook for 2025-2035

Market Share Insights of Paint Can Manufacturers

Market Share Breakdown of Paint Protection Film Manufacturers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA