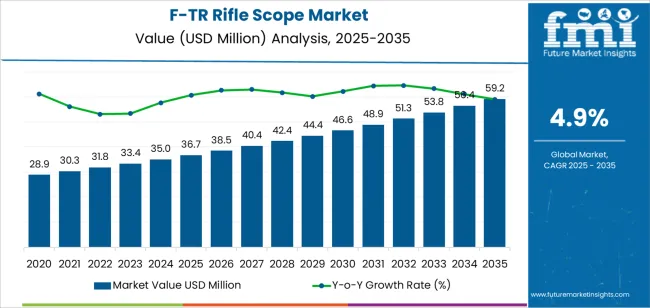

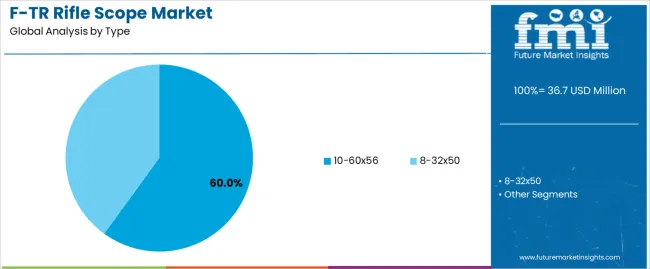

The F-TR rifle scope market is projected to reach USD 59.3 million by 2035 from USD 36.7 million in 2025 at a CAGR of 4.9%, driven by rising participation in long range shooting sports and expanding interest in precision driven F Class Target Rifle disciplines. Demand strengthens as competitive shooters, recreational users and tactical communities seek high magnification optics that deliver clarity, turret precision and consistent tracking performance across variable environments. The 10-60x56 segment maintains a leading 60% share due to its wide zoom range, large objective lens and suitability for long distance accuracy.

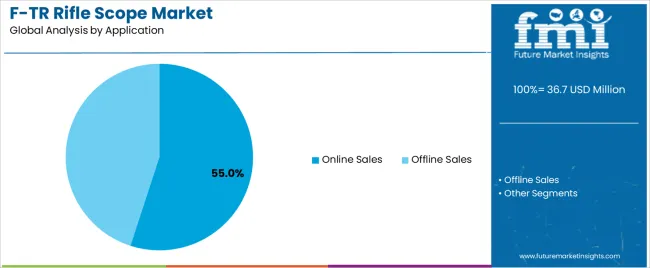

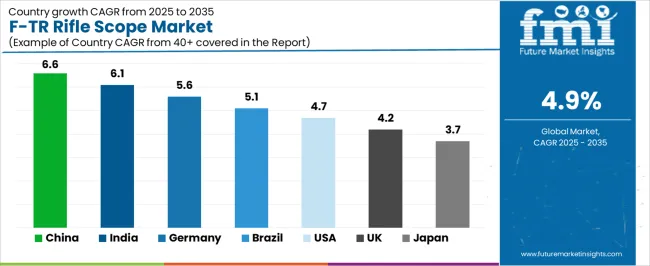

Growth is supported by advances in optical coatings, improved lens assemblies, lighter alloys and refined reticle designs that improve shooter consistency at extended ranges. Online sales dominate with a 55% share as buyers compare models, access specialist brands and source equipment not readily available in offline stores. Regional demand is lifted by China at 6.6% CAGR and India at 6.1% CAGR, while Germany, Brazil, the USA, the UK and Japan sustain stable uptake through competitive clubs and established shooting communities. Manufacturers focus on weight reduction, mechanical repeatability and enhanced optical resolution to differentiate premium offerings while mid tier brands broaden accessibility for new entrants. Constraints include high pricing of top tier optics, regulatory limits in select regions and supply chain pressures linked to precision manufacturing. Despite these challenges, demand for reliable high magnification scopes suited to long range targets ensures steady expansion through 2035, positioning the category as a durable niche within the global precision shooting equipment landscape.

Over the forecast period from 2025 to 2035, the absolute dollar opportunity for the F-TR rifle scope market is significant, with the market expected to expand by USD 22.6 million. Starting at USD 36.7 million in 2025, the market will grow steadily, reaching USD 59.3 million by 2035. This growth represents an opportunity for manufacturers to capture increasing demand for high-performance optics used in competitive shooting and recreational long-range shooting. The steady increase in interest in F-TR competitions, coupled with advancements in optical technologies and scope manufacturing, ensures continued market expansion.

The USD 22.6 million growth represents a stable opportunity for manufacturers and suppliers in the optics industry to introduce innovative products, enhance customer experience, and expand their market share. As both the competitive shooting market and consumer demand for precision shooting equipment increase, businesses in the F-TR rifle scope space will benefit from a steady revenue stream over the next decade, making it a promising market segment for sustained investment and development.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 36.7 million |

| Market Forecast Value (2035) | USD 59.3 million |

| Forecast CAGR (2025-2035) | 4.9% |

The F-TR rifle scope market is growing as interest in long range target shooting disciplines increases among civilian, competitive and military users. As shooters pursue greater accuracy at extended distances, scopes that deliver high magnification, fine reticles and robust optical performance are in higher demand. At the same time, manufacturers are introducing advanced coatings, better glass, lightweight materials and finer adjustments to meet those needs. This trend is supported by greater participation in shooting sports and shooting clubs, particularly in regions such as North America and Europe.

In addition, the rise in firearms accessory ecommerce, global brand penetration and specialist optics retail expansion are broadening the market reach for FTR scopes. The manufacturing of entrylevel and midtier models makes the category accessible to aspirational shooters, while premium models cater to professional use and competition. However, high cost of top end optics, regulatory restrictions on rifles in some countries and distribution limitations in emerging markets may restrict faster growth.

The F-TR rifle scope market is segmented by type and application. The leading type is the 10-60x56 rifle scope, which holds a 60% market share, while the online sales application segment is the dominant channel, accounting for 55% of the market. These segments are key drivers in the market, with the increasing demand for high-performance optics in long-range shooting and the growing preference for the convenience of online shopping influencing market dynamics.

The 10-60x56 rifle scope is the leading type in the F-TR rifle scope market, commanding a 60% market share. This model is favored by long-range shooters due to its high magnification range and large objective lens size, which allows for enhanced clarity and precision at extended distances. The 10-60x56 scope provides excellent light transmission, critical for shooting in low-light conditions, and is particularly popular in precision rifle competitions and tactical operations where accuracy over long ranges is paramount.

The dominance of the 10-60x56 rifle scope is also due to its versatility in various shooting environments, offering shooters a broad zoom range for both short-range adjustments and long-range targeting. As interest in precision rifle shooting and F-Class Target Rifle (F-TR) competitions grows, demand for high-quality, high-magnification scopes like the 10-60x56 is expected to continue its upward trajectory. The increasing focus on long-range accuracy and the need for optics that can provide precise adjustments in competitive shooting further cements the 10-60x56 as the preferred choice in the market.

The online sales segment leads the F-TR rifle scope market, capturing 55% of the total market share. The growth of e-commerce has made it easier for consumers to access a wide range of rifle scopes from different manufacturers, compare prices, and read customer reviews. The convenience of online shopping, along with the ability to deliver directly to customers' homes, has contributed to the rising popularity of purchasing rifle scopes online.

Additionally, the online sales segment benefits from the ability to target a broader audience, including competitive shooters, hobbyists, and professionals in remote or underserved regions where physical stores may not carry specialized optics. The increasing presence of dedicated online marketplaces for shooting equipment, along with specialized websites offering expert guidance and product recommendations, continues to drive the growth of online sales in the F-TR rifle scope market. As consumers continue to prioritize convenience and access to a wider selection of products, the online sales channel is expected to maintain its dominant position in the market.

The FTR rifle scope market is experiencing growth driven by increasing participation in long range rifle competitions and precision shooting sports. As shooters seek higher magnification and clearer optics to engage targets at extended distances, demand for specialist scopes tailored to FTR class rifles is rising. Furthermore, the expansion of shooting ranges and clubs supporting FTR events across North America and Europe enhances product uptake. On the supply side, advancements in lens coatings, reticle systems, and build materials elevate performance expectations. At the same time, high cost of premium scopes and regulatory constraints on firearms and optics in some regions pose challenges for manufacturers and end users.

What Are The Primary Growth Drivers For The FTR Rifle Scope Market?

A chief driver is the rising interest in FTR (Target Rifle) competition formats that emphasise precision at long distances and strict equipment standards. Competitors require optical equipment that delivers reliable clarity, fine reticles and robust build quality under varied external conditions. Another driver is the growing disposable income among outdoor and shooting sport enthusiasts, which extends to investment in higher tier optics. Moreover, technological innovation-such as enhanced optics, adjustable magnification, improved coatings, and integration with ballistic aids-adds value and attracts serious shooters. Finally, expansion of online retailing and global shipping makes niche products more accessible internationally, thereby aiding market growth.

What Are The Key Restraints In The FTR Rifle Scope Market?

One significant restraint is the high price point of premium FTR qualified scopes, which restricts uptake to dedicated competitive shooters or affluent hobbyists rather than casual users. Additionally, the regulatory environment across different jurisdictions complicates imports or sale of advanced optics in some regions, limiting market reach. Equipment standardisation requirements for FTR competition may reduce the pool of eligible scopes and restrict innovation adoption faster. Supply chain issues-such as specialised materials, precision manufacturing tolerances and coating processes-can increase production cost and lead times, further constraining availability and margins. Finally, the niche nature of FTR shooting means the addressable market remains smaller compared to general rifle scope markets, which may limit scale for some manufacturers.

What Are The Emerging Trends In The FTR Rifle Scope Market?

Emerging trends include a shift towards ultra high magnification scopes and refined reticle systems designed specifically for long range target applications, meeting the needs of FTR shooters. There is also growing adoption of lightweight and rugged materials (for example, aircraft grade aluminium and advanced coatings) enabling scopes to withstand competitive conditions and transport. Integration of digital features-such as data linking ballistic calculators or environmental sensors-is gaining traction, although still early in this niche segment. Additionally, manufacturers are increasingly offering custom and modular options (variable zoom ranges, interchangeable reticles, tailored mounting systems) to cater to elite users. Geographically, while North America continues to dominate, regions like Europe and parts of Asia are showing increased interest in precision rifle sports, opening new growth corridors.

The FTR rifle scope market is experiencing steady growth, driven by increasing interest in long-range shooting sports, hunting, and tactical applications. FTR (F-Class Target Rifle) scopes are specifically designed to offer precision and high performance for long-range shooters. The growing popularity of competitive shooting, rising disposable incomes, and advances in optics technology are driving demand. Countries with strong shooting sports cultures, such as China and India, are seeing significant market expansion. At the same time, developed markets like the USA and Germany continue to show steady growth as a result of military and civilian demand. This analysis provides insights into how different regions contribute to the expansion of the FTR rifle scope market and the factors influencing their growth.

| Country | CAGR (2025-2035) |

|---|---|

| China | 6.6% |

| India | 6.1% |

| Germany | 5.6% |

| Brazil | 5.1% |

| USA | 4.7% |

| United Kingdom | 4.2% |

| Japan | 3.7% |

China leads the FTR rifle scope market with a robust CAGR of 6.6%. The country's growing interest in shooting sports, particularly long-range shooting, is driving demand for high-precision rifle scopes. China’s increasing focus on sports and recreational activities, combined with rising disposable income, has resulted in a significant market for shooting accessories, including FTR rifle scopes.

The growth in China's firearms market, particularly for recreational and competitive shooting, is also a contributing factor. As shooting sports gain popularity in the country, there is a rising need for advanced optics and scopes that offer better precision and durability. With China’s growing consumer market and increasing interest in shooting sports, the demand for FTR rifle scopes is expected to continue its upward trajectory.

India is experiencing significant growth in the FTR rifle scope market, with a CAGR of 6.1%. The rise in recreational shooting, hunting, and sports shooting in India is contributing to the increasing demand for high-quality optics. As disposable incomes rise and interest in precision shooting grows, consumers are increasingly seeking advanced scopes that provide improved accuracy.

India’s increasing participation in international shooting competitions and the development of shooting ranges and clubs across the country are also driving demand for FTR rifle scopes. Additionally, the growing awareness of outdoor sports and adventure activities is fueling the market expansion. With the government and private sector investing in promoting shooting sports, India’s market for FTR rifle scopes is set to continue growing rapidly.

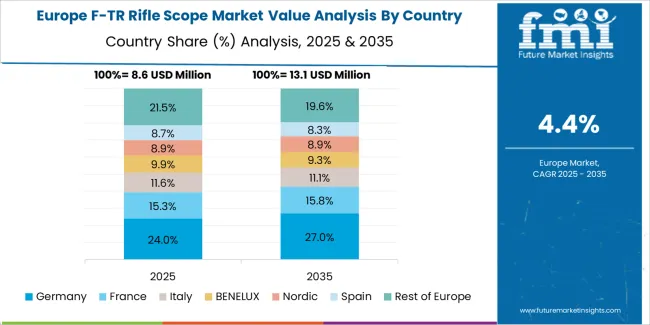

Germany’s FTR rifle scope market is projected to grow at a CAGR of 5.6%. The country has a strong tradition of competitive shooting and hunting, with an increasing number of enthusiasts and professionals looking for advanced rifle scopes. Germany’s well-established firearms and optics industries ensure a steady demand for high-quality and precision-driven products like FTR rifle scopes.

The growing popularity of long-range shooting sports and Germany’s focus on improving its shooting infrastructure contribute to the expansion of this market. Moreover, advancements in optics technology and the increasing interest in outdoor activities are further supporting demand. As shooting sports continue to thrive in Germany, the FTR rifle scope market is expected to see steady growth in the coming years.

Brazil’s FTR rifle scope market is expected to grow at a CAGR of 5.1%. The rising interest in recreational shooting, hunting, and competitive shooting is driving the demand for precision rifle scopes. As Brazil’s middle class expands and outdoor sports gain popularity, there is a growing market for high-performance rifle scopes that offer long-range shooting capabilities.

Brazil’s increasing participation in shooting sports, along with the growth of shooting clubs and ranges, is contributing to the market’s expansion. Additionally, government support for the development of sporting infrastructure is helping to create a favorable environment for the growth of shooting-related products. As more Brazilians take up shooting as a hobby or sport, the demand for FTR rifle scopes is expected to increase steadily.

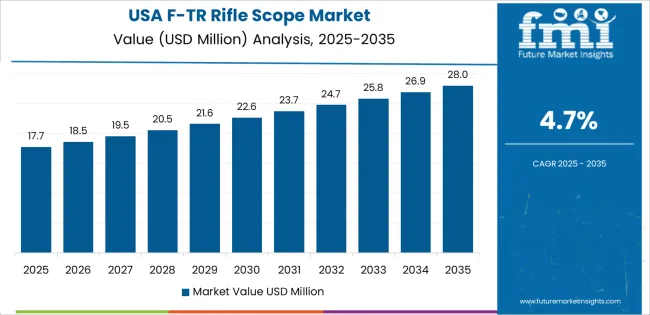

The United States has a projected CAGR of 4.7% for the FTR rifle scope market. The U.S. has a well-established shooting sports culture, with a large number of enthusiasts and professionals engaged in activities like long-range shooting and hunting. The demand for FTR rifle scopes is supported by the growing interest in precision shooting and the increasing popularity of long-range competitions.

In the U.S., advancements in rifle scope technology and the continued focus on improving the accuracy and reliability of scopes are driving the market. The country’s strong firearms industry and the large base of hunters and competitive shooters ensure steady demand for high-quality optics. As long-range shooting continues to grow in popularity, the U.S. market for FTR rifle scopes is expected to maintain a steady growth trajectory.

The FTR rifle scope market in the United Kingdom is projected to grow at a CAGR of 4.2%. The UK has a strong shooting sports culture, with increasing participation in disciplines such as long-range shooting and hunting. The demand for high-quality, precision-focused optics is driven by the need for accuracy and performance in competitive shooting events.

The UK’s emphasis on outdoor sports and activities, along with rising interest in recreational shooting, supports the growth of the FTR rifle scope market. As the country’s shooting community continues to grow, the demand for advanced scopes will continue to rise. The steady increase in sporting infrastructure and shooting clubs will further fuel market expansion.

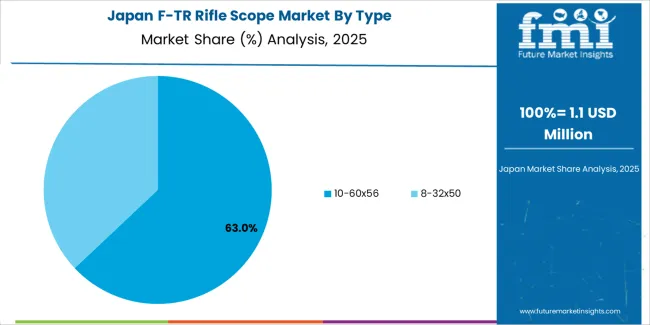

Japan’s FTR rifle scope market is expected to grow at a CAGR of 3.7%. While Japan has a smaller market compared to some other countries, the demand for high-quality optics is increasing due to the growing interest in shooting sports and hunting. The country has a strong base of precision shooters, and the demand for advanced optics to enhance shooting performance is on the rise.

Japan’s focus on improving the quality of its shooting sports infrastructure and its growing participation in international shooting competitions are contributing to the demand for FTR rifle scopes. As more individuals take up shooting as a hobby or sport, the market for precision optics in Japan is expected to continue to expand, albeit at a more moderate pace compared to larger markets.

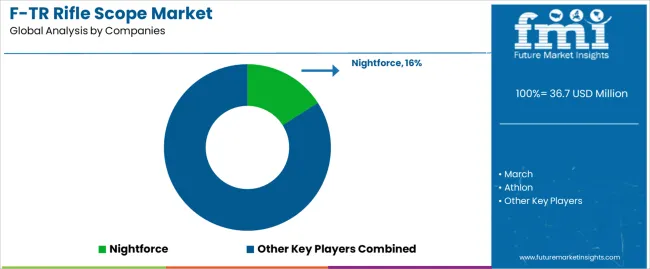

In the FTR rifle scope market, companies such as Nightforce (holding about 16% market share), March, Athlon, Sightron, Delta Optical, Kahles, Vortex, Schmidt & Bender, Trijicon, Savage, and Sightmark compete for position. The market is shaped by the demands of precision long range shooters who require high magnification, fine adjustment turrets, low weight, and durable construction. The market share figure for Nightforce reflects its strong position in the competitive optics segment. The scope builds (weight, optics quality, turret precision) become a differentiator. Some companies emphasise ultralight designs for FTR rules compliance, while others focus on extreme glass quality and turret performance for longer range work.

Product brochures are used as a key tool to convey these differentiators. One brochure may highlight optics transmission percentages, mechanical repeatability of turrets, weight per unit, and compatibility with FTR rigs. Another may focus on cost effective models, broad zoom ranges, and value driven pricing aimed at shooters entering the discipline. The brochure layout often presents magnification range, reticle options, click value (MOA or MIL), and product weight. Some present side by side comparisons of models or track endorsements by F Class shooters. The strategic message in brochures is crafted to address either high end competitive shooters or value conscious sport shooters. By aligning brochure content with target customer segments, companies aim to position their scopes as the right choice under the FTR rule set.

| Items | Details |

|---|---|

| Quantitative Units | USD Million |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Type | 10-60x56, 8-32x50 |

| Application | Online Sales, Offline Sales |

| Key Companies Profiled | Nightforce, March, Athlon, Sightron, Delta Optical, Kahles, Vortex, Schmidt & Bender, Trijicon, Savage, Sightmark |

| Additional Attributes | The market analysis includes dollar sales by type and application categories. It also covers regional adoption trends across major markets such as Asia Pacific, Europe, and North America. The competitive landscape focuses on key manufacturers in the F-TR rifle scope market, with innovations in magnification ranges and scope technologies. Trends in online and offline sales channels are explored, along with the growing demand for high-performance rifle scopes in competitive shooting and hunting markets. |

The global F-TR rifle scope market is estimated to be valued at USD 36.7 million in 2025.

The market size for the F-TR rifle scope market is projected to reach USD 59.2 million by 2035.

The F-TR rifle scope market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in F-TR rifle scope market are 10-60x56 and 8-32x50.

In terms of application, online sales segment to command 55.0% share in the F-TR rifle scope market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

F-Open Match Rifle Scope Market Size and Share Forecast Outlook 2025 to 2035

Full-Bore F-Class Rifle Scope Market Size and Share Forecast Outlook 2025 to 2035

Otoscope Market Size and Share Forecast Outlook 2025 to 2035

Endoscope Protective Barrier Covers Market Size and Share Forecast Outlook 2025 to 2035

Endoscope Reprocessing Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Borescope Market Size and Share Forecast Outlook 2025 to 2035

Endoscope Procedure Kits Market Size and Share Forecast Outlook 2025 to 2035

Telescope Box Market Size and Share Forecast Outlook 2025 to 2035

Endoscope Detergents And Disinfectants Market Size and Share Forecast Outlook 2025 to 2035

Endoscope Reprocessing Device Market – Trends & Forecast 2025-2035

Endoscope Tracking Solutions Market

Borescope Inspection Camera Market

Endoscope Leak Detection Device Market

Microscope Digital Camera Market Size and Share Forecast Outlook 2025 to 2035

Stethoscope Hygiene Devices Market Size and Share Forecast Outlook 2025 to 2035

Stethoscope Market – Growth, Demand & Forecast 2025 to 2035

Stroboscope Market

F-Open Scope Market Size and Share Forecast Outlook 2025 to 2035

Anomaloscope Market Size and Share Forecast Outlook 2025 to 2035

Oscilloscope Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA