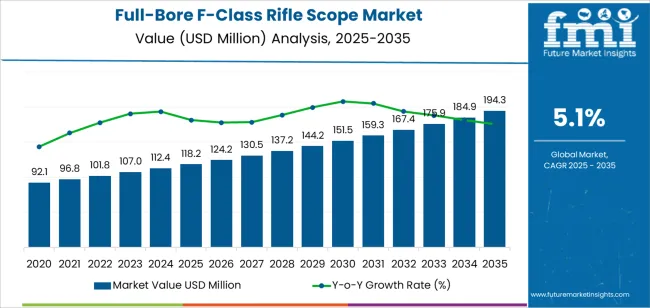

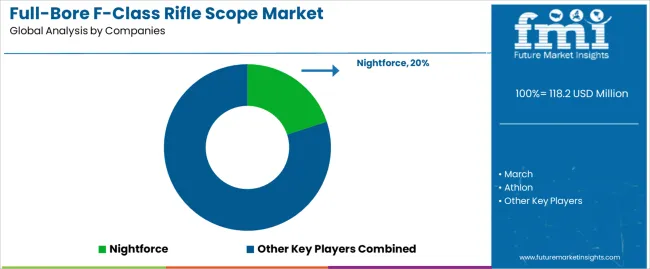

The full bore F-Class rifle scope market is projected to reach USD 194.3 million by 2035 from USD 118.2 million in 2025 at a CAGR of 5.1%, supported by rising interest in long range precision shooting and steady procurement of advanced optics for defense and law enforcement training programs. Demand strengthens as competitive shooters seek scopes that maintain optical clarity, turret accuracy and repeatable mechanical tracking at extended distances. The 10-60x56 category remains the dominant type due to its broad magnification range, high light transmission and stable performance on heavy barrel rifles used in full bore settings.

Manufacturers invest in refined glass formulations, improved coating treatments, tactile elevation systems and sealed housings that support consistent aiming reference through long match durations. Offline retail remains the primary purchasing route due to the need for hands on inspection, while online channels expand through specialist retailers offering access to global brands. Constraints include high prices for premium models, regulatory differences across countries and the specialist nature of full bore competition that concentrates demand within a skilled user group. Even so, technical upgrades in turret design, parallax control and digital ready features contribute to stable long term demand. Growth remains reinforced by organized match calendars, coaching programs and a rising community of shooters adopting full bore disciplines.

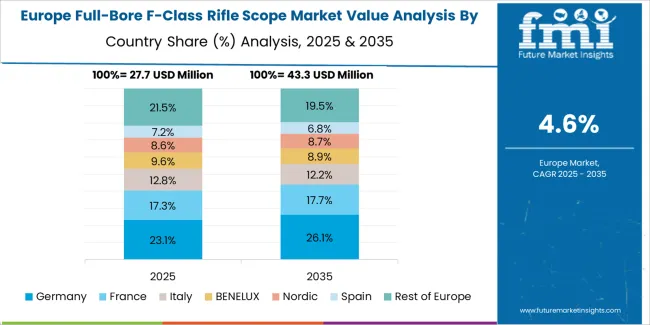

Asia Pacific leads market growth, supported by expanding civilian shooting sports and increasing defense modernization in China and India. Europe and North America maintain steady demand through established precision shooting communities and advanced optical manufacturing. Key industry participants include Nightforce, March, Athlon, Sightron, Delta Optical, Kahles, Vortex, Schmidt & Bender, Trijicon, Savage, and Sightmark, focusing on optical innovation, precision engineering, and rugged design.

Peak-to-trough analysis indicates moderate cyclical growth influenced by competitive shooting trends, defense procurement patterns, and consumer spending in the precision optics segment. Between 2025 and 2028, the market will experience its first growth peak as demand rises from sports shooting associations and defense training programs emphasizing high-accuracy optical systems. Product innovation in lens coating, reticle design, and optical clarity will further strengthen early momentum.

A mild trough is expected between 2029 and 2031 due to market saturation in developed regions and cyclical reductions in government and defense-related equipment budgets. The impact will be limited as the civilian marksmanship and long-range shooting communities continue to generate steady replacement demand. Post-2031, renewed growth will emerge as advanced scope models featuring improved light transmission and digital adjustment systems gain adoption. The overall peak-to-trough pattern reflects a stable, cyclic market characterized by moderate fluctuations and long-term resilience supported by technological enhancements and steady participation in precision shooting disciplines.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 118.2 million |

| Market Forecast Value (2035) | USD 194.3 million |

| Forecast CAGR (2025-2035) | 5.1% |

The Full-Bore F-Class rifle scope market is growing as competitive long-range shooters demand precision optics with high magnification and reliable resolution. Optical developments improve light transmission, minimize chromatic aberration and preserve contrast at extreme distances. Users prefer reticles with fine subtensions and reference marks that support holdover and windage estimation without calculator aids. Repeatable turret mechanisms and crisp zero stops reduce setup time and increase confidence across multiple ranges and weather conditions. Manufacturers integrate robust mechanical designs and sealed assemblies to withstand recoil and environmental exposure in field use.

Rising interest in precision rifle sports and organized matches increases demand for purpose-built scopes tailored to Full-Bore requirements. Growth is supported by accessory ecosystems such as high-quality mounts, elevation blocks and ballistic calculators that enhance system performance. High manufacturing costs, exacting quality control and niche user volumes constrain rapid price declines and broad consumer adoption. Training and shooter skill development remain critical for utilising advanced optical capabilities, which limits uptake among casual marksmen. Demand reflects technical progression in optics combined with sustained participation in long-range shooting disciplines.

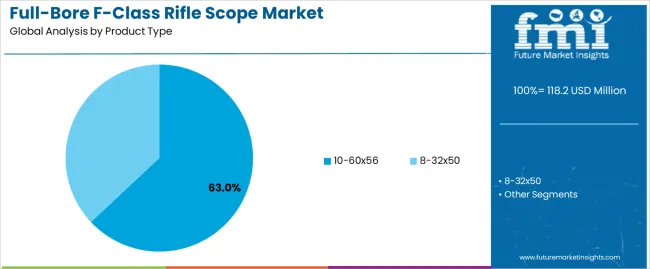

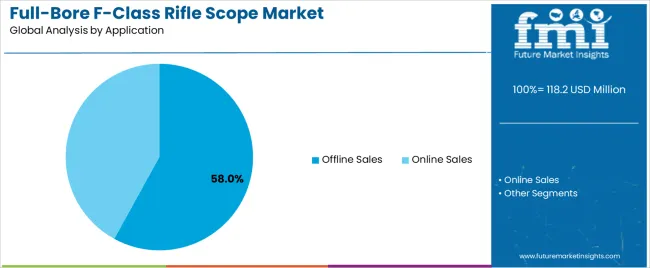

The Full-Bore F-Class rifle scope market is segmented by product type and application. By product type, the market is divided into 10–60×56 and 8–32×50 rifle scopes. Based on application, it is categorized into online sales and offline sales channels. Regionally, the market is divided into Asia Pacific, Europe, North America, and other key regions.

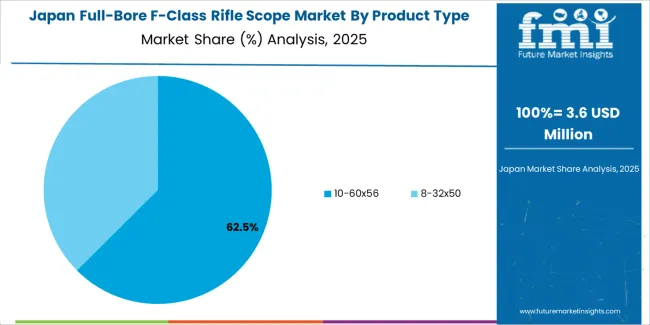

The 10–60×56 segment holds the leading position in the full-bore F-class rifle scope market, representing an estimated 63.0% of total market share in 2025. This high-magnification optic is favored by competitive shooters and precision marksmen due to its extended zoom range, superior optical clarity, and enhanced light transmission. The larger 56 mm objective lens provides a broader field of view and better performance in low-light conditions, making it suitable for long-range precision targeting common in F-class shooting competitions.

The segment’s dominance is driven by its compatibility with heavy-barrel rifles and advanced optical systems that support high tracking accuracy and repeatable adjustments. These scopes often feature side-focus parallax control, fine reticle options, and durable construction designed for consistent performance under competition stress. The 8–32×50 category, estimated at 37.0%, remains relevant for shooters prioritizing balance, lighter weight, and cost efficiency. It is widely used in mid-range precision shooting, training, and field applications.

Key factors supporting the 10–60×56 segment include:

The offline sales segment accounts for approximately 58.0% of the full-bore F-class rifle scope market in 2025. Physical retail distribution channels, including firearm dealers, sporting goods stores, and authorized optics retailers, remain the primary purchasing route due to the need for product inspection, consultation, and post-sale support. Professional shooters and firearm enthusiasts often prefer in-store purchasing to evaluate optical clarity, mechanical precision, and compatibility with rifle platforms before acquisition.

The online sales segment, estimated at 42.0%, is expanding steadily through specialized e-commerce platforms offering product comparisons, technical details, and access to international brands. The growth of online firearm accessory distribution is supported by improvements in digital retail logistics and increasing consumer confidence in verified online optics sellers.

Primary dynamics driving demand from the offline sales segment include:

Rising long-range shooting participation, precision-rifle competitions, and demand for ballistic performance drive market growth.

The Full-Bore F-Class rifle scope market expands as competitive long-range shooting gains participation worldwide and event standards demand high-precision optics. Shooters and teams seek scopes with superior resolution, repeatable tracking and fine elevation adjustment to achieve consistent groupings at 600 to 1,000 yards. Advances in optical glass, multi-coating technologies and precision turrets support tighter tolerances and improved light transmission for low-angle, low-light engagement. Growth in professional precision training, military marksmanship programs and premium hunting segments further increase demand for robust, high-magnification F-class scopes that integrate with ballistic-calculation workflows.

Regulatory constraints, premium pricing and narrow specialist demand restrict broader adoption.

Strict firearms regulations, import controls and varying optics export policies create market entry barriers and complicate cross-border distribution. High unit prices for fully featured F-class scopes, combined with specialised mounting and calibration costs, limit purchases to serious competitors and affluent enthusiasts. The addressable market remains niche compared with general hunting and tactical optics, which reduces volume economics and slows supply expansion. Some end users favour electronic sighting systems or lower-cost alternatives for multi-purpose use, which constrains market scale for dedicated full-bore competition scopes.

Integration of digital ballistics, customisation, and lightweight materials define near-term trends.

Manufacturers are embedding digital reticle options, ballistic-compensation platforms and wireless telemetry to streamline range zeroing and wind-hold calculations. Demand for modular scope designs and user configurable reticles supports personalised competition setups and rapid field adaptation. Lightweight alloys, carbon components and advanced lens formulations reduce system mass without sacrificing optical performance for long matches. E-commerce and direct-to-consumer sales channels enable specialist vendors to reach international shooting communities and provide bespoke turrets, parallax assemblies and service calibration, reinforcing the market’s premium, performance-driven orientation.

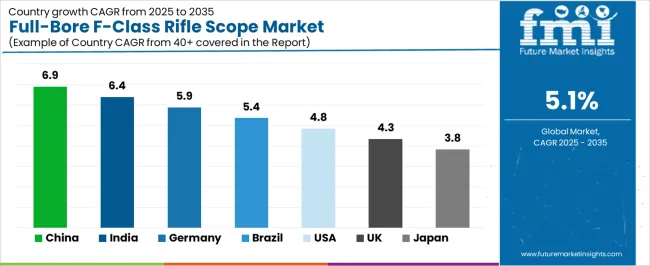

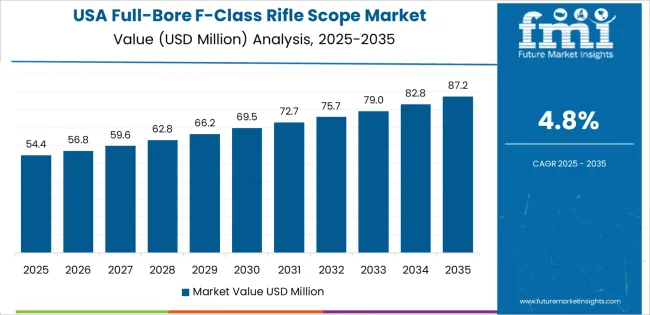

The global full-bore F-Class rifle scope market is expanding through 2035, driven by precision shooting sports, competition growth, and optics technology improvements. China leads with a 6.9% CAGR, followed by India at 6.4%, reflecting rising competitive shooting participation and local optics manufacturing. Germany records 5.9%, supported by precision engineering and sports shooting tradition. Brazil posts 5.4%, backed by growing long-range rifle clubs and importation of premium optics. The United States grows at 4.8%, sustained by established F-Class communities and product innovation. The United Kingdom (4.3%) and Japan (3.8%) show steady adoption through regulated sporting channels and specialist retailers.

| Country | CAGR (%) |

|---|---|

| China | 6.9 |

| India | 6.4 |

| Germany | 5.9 |

| Brazil | 5.4 |

| USA | 4.8 |

| UK | 4.3 |

| Japan | 3.8 |

China’s market grows at 6.9% CAGR, supported by expanding precision shooting clubs and competitive programs. Domestic optics manufacturers are improving glass quality and turret accuracy for long-range disciplines. Sports shooting interest among civilian and military-affiliated clubs is increasing training facility demand. Import substitution policies encourage local assembly of high-performance scopes for national match use. Regional competitions stimulate aftermarket accessories and wind-reading instrumentation purchases. Collaboration between optics firms and ballistics coaches enhances product fit for F-Class requirements. Growth concentrates in coastal manufacturing hubs and provincial shooting associations organizing formal match calendars.

Key Market Factors:

India’s market grows at 6.4% CAGR, driven by rising interest in long-range target shooting and organized competitions. Private shooting ranges and national federation events are increasing demand for precision optics and range accessories. Domestic dealers import established European and American scope brands for premium segments. Local gunsmiths and training academies advise on scope selection and ballistic calibration for team entry. Government licensing reforms and shooting sport promotion programs have improved competitive pipeline growth. Regional clubs in northern and central states are emerging as focal points for product trials and community adoption.

Key Market Factors:

Germany’s market grows at 5.9% CAGR, supported by long-standing precision optics traditions and engineering excellence. Local manufacturers specialize in turrets, reticles, and low-dispersion glass for accurate long-range performance. Shooting clubs and national championships maintain steady demand for competition-grade scopes and mounts. Integration between optics firms and ballistic software providers supports matched turret calibration. Regulatory clarity for sporting firearms ensures stable retail and after-sales service channels. Export activity also supports domestic capacity, with manufacturers supplying specialized components to international brands.

Key Market Factors:

Brazil’s market grows at 5.4% CAGR, supported by increasing participation in long-range shooting and private firing ranges. Imports of established scope brands supply the premium competition segment. Local distributors and retailers provide sighting services and elevation turret calibration for humid tropical conditions. Growth is concentrated in states with active sporting clubs and hunting traditions transitioning to target disciplines. Training academies and match organizers promote technical workshops on wind reading and holdover techniques. Government policy on firearm sport governance stabilizes market access for registered competitors.

Key Market Factors:

The United States grows at 4.8% CAGR, driven by an extensive competitive shooting community and established retail networks. Domestic and international optical brands supply scopes optimized for F-Class windage and elevation demands. Long-range coaching programs and match circuits generate continual demand for precise reticles and fine-tuned turrets. Aftermarket support for mounting systems, parallax adjustment, and custom reticle milling strengthens product ecosystems. Regulatory frameworks for sporting firearms maintain stable sales channels through licensed retailers and clubs. Innovation in zero-stop mechanisms and low-dispersion glass supports premium product migrations.

Key Market Factors:

The United Kingdom’s market grows at 4.3% CAGR, supported by historic target shooting traditions and regulated club structures. National governing bodies coordinate match standards that influence scope specification and performance expectations. British retailers and specialist gunsmiths provide custom mounting and elevation indexing services. Demand centers on competition-proven scopes offering repeatable turret clicks and clear long-range imaging. Export of British match expertise and coaching services enhances domestic product selection. Licensing and range safety protocols contribute to predictable procurement by clubs and competitive teams.

Key Market Factors:

Japan’s market grows at 3.8% CAGR, reflecting steady adoption within tightly regulated sporting channels and specialist retailers. Long-range rifle disciplines are supported by dedicated clubs and precision shooting academies. Importers supply compact competition scopes adapted for local match rules and range distances. High standards for manufacturing quality encourage demand for durable optical coatings and reliable mechanical adjustments. Coaching and ballistic consultancy services aid shooters in equipment selection and zeroing procedures. Market growth focuses on a niche community pursuing international match participation and technical refinement.

Key Market Factors:

The full-bore F-Class rifle scope market is moderately concentrated, with around twelve specialist manufacturers globally. Nightforce leads the segment with an estimated 20.0% global market share, supported by focused precision optics and established competitive shooting adoption. Schmidt & Bender and Kahles follow as key competitors, offering mechanical repeatability and high-resolution reticle options. March and Vortex target distinct user groups by combining extended magnification, turret fidelity, and durability testing protocols.

Competition centers on optical clarity, turret precision, and long-range ballistic compensation rather than price alone. Product differentiation arises from reticle design, parallax control mechanisms, and zero-stop turret engineering for repeatable shot placement. Manufacturers emphasize ruggedization, nitrogen purging, and coating technologies to ensure reliability under varied field conditions. Aftermarket support and dealer networks contribute to market access and sustained replacement optics revenue streams.

Regional suppliers in Asia supply cost-competitive assemblies that pressure pricing in entry-level segments and regional sales channels. R&D focus on weight reduction, optical glass formulation, and turret tactile feedback guides future product roadmaps. Market dynamics favor suppliers who combine precision optical engineering with consistent quality assurance and responsive service. Competitive positioning increasingly depends on validated ballistic data and integrated mount compatibility across platforms. Adoption in competitive shooting and military precision units will maintain demand for high-specification scopes over the forecast period.

| Items | Values |

|---|---|

| Quantitative Units | USD million |

| Product Type | 10-60x56, 8-32x50 |

| Application | Online Sales, Offline Sales |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Countries Covered | India, China, USA, Germany, South Korea, Japan, Italy, and 40+ countries |

| Key Companies Profiled | Nightforce, March, Athlon, Sightron, Delta Optical, Kahles, Vortex, Schmidt & Bender, Trijicon, Savage, Sightmark |

| Additional Attributes | Dollar sales by product type and application categories; regional adoption trends across Asia Pacific, Europe, and North America; competitive landscape of precision optics and rifle scope manufacturers; advancements in high-magnification, full-bore shooting optics; integration with competitive shooting, tactical training, and hunting applications. |

The global full-bore F-Class rifle scope market is estimated to be valued at USD 118.2 million in 2025.

The market size for the full-bore F-Class rifle scope market is projected to reach USD 194.3 million by 2035.

The full-bore F-Class rifle scope market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in full-bore F-Class rifle scope market are 10-60x56 and 8-32x50.

In terms of application, offline sales segment to command 58.0% share in the full-bore F-Class rifle scope market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Otoscope Market Size and Share Forecast Outlook 2025 to 2035

Endoscope Protective Barrier Covers Market Size and Share Forecast Outlook 2025 to 2035

Endoscope Reprocessing Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Borescope Market Size and Share Forecast Outlook 2025 to 2035

Endoscope Procedure Kits Market Size and Share Forecast Outlook 2025 to 2035

Telescope Box Market Size and Share Forecast Outlook 2025 to 2035

Endoscope Detergents And Disinfectants Market Size and Share Forecast Outlook 2025 to 2035

Endoscope Reprocessing Device Market – Trends & Forecast 2025-2035

Endoscope Tracking Solutions Market

Borescope Inspection Camera Market

Endoscope Leak Detection Device Market

Microscope Digital Camera Market Size and Share Forecast Outlook 2025 to 2035

Stethoscope Hygiene Devices Market Size and Share Forecast Outlook 2025 to 2035

Stethoscope Market – Growth, Demand & Forecast 2025 to 2035

Stroboscope Market

F-Open Scope Market Size and Share Forecast Outlook 2025 to 2035

Anomaloscope Market Size and Share Forecast Outlook 2025 to 2035

Oscilloscope Market Size and Share Forecast Outlook 2025 to 2035

Duodenoscope Market Size and Share Forecast Outlook 2025 to 2035

Bronchoscopes Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA